Professional Documents

Culture Documents

Backflushing and Jit

Backflushing and Jit

Uploaded by

Reign TambasacanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Backflushing and Jit

Backflushing and Jit

Uploaded by

Reign TambasacanCopyright:

Available Formats

lOMoARcPSD|12356766

Backflushing and JIT

Accounting (University of Mindanao)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Reign Tambasacan (reign.tambasacan@gmail.com)

lOMoARcPSD|12356766

Just-in-Time and Backflushing 1

Chapter 10

JUST-IN-TIME AND BACKFLUSHING

PROBLEMS

PROBLEM

1.

Cost Savings From Smaller Inventory. Automated Assembly Company maintains a WIP inventory at each

of 15 work stations, and the average size of the inventory is 200 units per station. The physical flow of units

into and out of each WIP location is first-in, first-out. The total number of instances in which some work

station goes out of its control limits is expected to be 100 during the coming year. In 80% of these instances,

the out-of-control condition is expected to be discovered immediately by the operator at that station; in the

other 20% of these instances, a defect will enter 10% of the units produced. These defective units enter

WIP between stations, where they will be discovered by the next station's operator. Every out-of-control

condition is corrected as soon as it is discovered. The average cost of a unit in WIP is $40, and the average

loss from an out-of-control condition is $20 per defective unit produced. The annual cost of carrying WIP is

33% of the cost of the inventory.

Management plans to reduce the number of units held at every work station by 50%. The rate of

final output will be unchanged, and no other changes will be made in the system.

Required:

(1) Calculate the expected carrying cost savings from the change planned by the management.

(2) Calculate the expected savings in cost of defects if the changes are implemented.

SOLUTION

(1) Carrying cost savings = 33% x reduction in average cost of WIP

= 33% x 50% x past average cost of WIP

= .33 x .5 x (15 x 200 x $40)

= $19,800

(2) Savings in cost of defects = $20 x reduction in the number of defective units

= $20 x (50% x 200 x 10%) x (.20 x 100)

= $20 x 10 x 20

= $4,000

PROBLEM

2.

Inventory Size, Velocity, and Lead Time. Probtype Incorporated requires an average lead time of 45 days

on customer orders that require parts not kept in stock. When such a customer order is received, the parts

order is placed with a vendor immediately by telephone, and the parts are received in an average of 21 days.

The parts are inspected and put into production an average of three days after receipt. The average time

Downloaded by Reign Tambasacan (reign.tambasacan@gmail.com)

lOMoARcPSD|12356766

2 Chapter 10

spent in production is 16 days. After production is completed, the order goes through final inspection in two

days and arrives at the customer's site after an additional three days, on average.

Management plans to leave the rate of final output unchanged, induce vendors to reduce their total

lead time by one-third, and reduce the average size of WIP to one-fourth of its present level.

Required: Assuming management's plans are implemented successfully, calculate the average lead time on

customer orders that require parts not kept in stock.

SOLUTION

The average lead time will be 26 days, calculated as follows:

Reduction of vendor lead time = 1/3 x 21 days = 7 days

Reduction of time in WIP= 3/4 of present time in WIP

= 3/4 x 16 days

= 12 days

New lead time = present lead time - reductions

= 45 days - (7 days + 12 days)

= 26 days

PROBLEM

3.

Comparison of Process Costing and Backflushing; Unit Cost Calculations. BF Company had 35 units in

process, 50% converted, at the beginning of a recent, typical month; the conversion cost component of this

beginning inventory was $525. There were 40 units in process, 50% converted, at the end of the month.

During the month, 5,000 units were completed and transferred to finished goods, and conversion costs of

$250,000 were incurred.

Required:

(1) Carrying calculations to three decimal places, find the conversion cost per unit for the month:

(a) by the average cost method as used in process costing.

(b) by dividing the total conversion cost incurred during the month by the number of units

completed during the month (do not calculate equivalent units).

(c) by dividing the total conversion cost incurred during the month by the number of units started

during the month.

(2) Using the three unit costs from Requirement (1), calculate three amounts for the total conversion cost

of the ending inventory of work in process to the nearest dollar.

(3) In light of the results of Requirement (2), which of the three methods of calculating unit conversion

cost would you recommend for the purpose of inventory costing, 1(a), 1(b), or 1(c)? Why?

Downloaded by Reign Tambasacan (reign.tambasacan@gmail.com)

lOMoARcPSD|12356766

Just-in-Time and Backflushing 3

SOLUTION

(1) (a) Equivalent production = 5,000 + (.50 x 40) = 5,020 units

$250,525

= $49.905 per unit

5,020

$250,000

(b) = $50 per unit

5,000

(c) Units started = 5,000 + 40 - 35 = 5,005

$250,000

= $49.950 per unit

5,005

(2) 40 x .50 x 49.905 = 998

40 x .50 x 50.000 = 1,000

40 x .50 x 49.950 = 999

(3) Considering that the results of Requirement (2) were within two dollars of each other, then method

1(b) would be recommended because of its ease and simplicity.

PROBLEM

4.

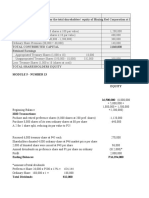

Backflush Costing With a Finished Goods Account. The LanFat Manufacturing Company uses a Raw and

In Process (RIP) inventory account and expenses all conversion costs to the cost of goods sold account. At

the end of each month, all inventories are counted, their conversion cost components are estimated, and

inventory account balances are adjusted accordingly. Raw material cost is backflushed from RIP to

Finished Goods. The following information is for the month of August:

Beginning balance for RIP account, including $4,800 of conversion cost...................................... $ 43,500

Raw materials received on credit........................................................................................................ 680,000

Ending RIP inventory per physical count, including $5,300 conversion

cost estimate.................................................................................................................................... 47,200

Required: Prepare all journal entries involving the RIP account.

Downloaded by Reign Tambasacan (reign.tambasacan@gmail.com)

lOMoARcPSD|12356766

4 Chapter 10

SOLUTION

Journal entries involving the RIP account are:

Raw and In Process.................................................................................................... 680,000

Accounts Payable................................................................................................. 680,000

This is a summary entry for all receipts of raw materials during the period. As direct materials are used, no

entry is needed, because they remain a part of RIP.

Finished Goods............................................................................................................ 676,800

Raw and In Process............................................................................................. 676,800

This entry backflushes material cost from RIP to Finished Goods. This is a postdeduction. The calculation

is:

Material in August 1 RIP balance............................................................................ $ 38,700

Material received during August.............................................................................. 680,000

$ 718,700

Material in August 31 RIP, per physical count....................................................... 41,900

Amount to be backflushed......................................................................................... $ 676,800

Raw and In Process.................................................................................................... 500

Cost of Goods Sold............................................................................................... 500

Conversion cost in RIP is adjusted from the $4,800 of August 1 to the $5,300 estimate at August 31. The

offsetting entry is made to Cost of Goods Sold, where all conversion costs were charged during August.

PROBLEM

5.

Backflush Costing With No Finished Goods Account. The ATM Manufacturing Company produces only for

customer order, and most work is shipped within twenty-four hours of the receipt of an order. ATM uses a

Raw and In Process (RIP) inventory account and expenses all conversion costs to the cost of goods sold

account. At the end of each month, inventory is counted, its conversion cost component is estimated, and

the RIP account balance is adjusted accordingly. Raw material cost is backflushed from RIP to Cost of

Goods Sold. The following information is for the month of June:

Beginning balance of RIP account, including $900 of conversion cost........................................... $ 8,500

Raw materials received on credit........................................................................................................ 187,000

Ending RIP inventory per physical count, including $1,100 conversion

cost estimate.................................................................................................................................... 7,900

Required: Prepare all journal entries involving the RIP account.

Downloaded by Reign Tambasacan (reign.tambasacan@gmail.com)

lOMoARcPSD|12356766

Just-in-Time and Backflushing 5

SOLUTION

Journal entries involving the RIP account are:

Raw and In Process.................................................................................................... 187,000

Accounts Payable................................................................................................. 187,000

This is a summary entry for all receipts of raw materials during the period. As direct materials are used, no

entry is needed because they remain a part of RIP.

Cost of Goods Sold...................................................................................................... 187,800

Raw and In Process............................................................................................. 187,800

This entry backflushes material cost from RIP to Cost of Goods Sold. This is a postdeduction. The

calculation is:

Material in June 1 RIP balance................................................................................ $ 7,600

Material received during June.................................................................................. 187,000

$ 194,600

Material in June 30 RIP, per physical count........................................................... 6,800

Amount to be backflushed......................................................................................... $ 187,800

Raw and In Process.................................................................................................... 200

Cost of Goods Sold............................................................................................... 200

Conversion cost in RIP is adjusted from the $900 of June 1 to the $1,100 estimate at June 30. The offsetting

entry is made to Cost of Goods Sold, where all conversion costs were charged during June.

PROBLEM

6.

Backflush Costing; Entries in RIP and Finished Goods. The Clifton Manufacturing Company has a cycle

time of 1.5 days, uses a Raw and In Process (RIP) account, and charges all conversion costs to Cost of Goods

Sold. At the end of each month, all inventories are counted, their conversion cost components are estimated,

and inventory account balances are adjusted. Raw material cost is backflushed from RIP to Finished

Goods. The following information is for May:

Beginning balance of RIP account, including $600 of conversion cost........................................... $ 5,500

Beginning balance of finished goods account, including $2,000 of

conversion cost............................................................................................................................... 6,000

Raw materials received on credit........................................................................................................ 173,000

Ending RIP inventory per physical count, including $850 conversion

cost estimate.................................................................................................................................... 6,200

Ending finished goods inventory per physical count, including $1,550

conversion cost estimate................................................................................................................ 4,900

Required: Prepare all the journal entries that involve the RIP account and/or the finished goods account.

Downloaded by Reign Tambasacan (reign.tambasacan@gmail.com)

lOMoARcPSD|12356766

6 Chapter 10

SOLUTION

Raw and In Process.................................................................................................... 173,000

Accounts Payable................................................................................................. 173,000

Finished Goods............................................................................................................ 172,550

Raw and In Process............................................................................................. 172,550

To backflush material cost from RIP to Finished Goods. This is a postdeduction. The calculation is:

Material in May 1 RIP balance................................................................................. $ 4,900

Material received during May.................................................................................. 173,000

$ 177,900

Material in May 31 RIP, per physical count........................................................... 5,350

Amount to be backflushed......................................................................................... $ 172,550

Cost of Goods Sold...................................................................................................... 173,200

Finished Goods..................................................................................................... 173,200

To backflush material cost from Finished Goods to Cost of Goods Sold. This is a postdeduction. The

calculation is:

Material in May 1 finished goods............................................................................. $ 4,000

Material backflushed from RIP................................................................................ 172,550

$ 176,550

Material in May 31 finished goods, per physical count......................................... 3,350

Amount to be backflushed......................................................................................... $ 173,200

Cost of Goods Sold...................................................................................................... 200

Raw and In Process.................................................................................................... 250

Finished Goods..................................................................................................... 450

Conversion cost in RIP is adjusted from $600 of May 1 to the $850 estimate at May 31. Conversion cost in

Finished Goods is adjusted from the $2,000 at May 1 to the $1,550 estimate at May 31.

Downloaded by Reign Tambasacan (reign.tambasacan@gmail.com)

You might also like

- Cost Accounting Progress AssignmentsDocument6 pagesCost Accounting Progress AssignmentsWesleyNo ratings yet

- MANAGERIAL FINANCE AssignmentDocument2 pagesMANAGERIAL FINANCE Assignmentfahim zamanNo ratings yet

- CompreDocument53 pagesCompreGEr JrvillaruEl0% (3)

- Ec Declaration of Conformity: QAS60 PDS 400 V 50 HZDocument6 pagesEc Declaration of Conformity: QAS60 PDS 400 V 50 HZFernando Morales PachonNo ratings yet

- Just-in-Time and Backflushing 1Document6 pagesJust-in-Time and Backflushing 1Claudette ClementeNo ratings yet

- Chapter 5 Just in Time and Backflush AccountingDocument11 pagesChapter 5 Just in Time and Backflush AccountingSteffany RoqueNo ratings yet

- Muhammad Asghar SAP ID #7448 Answer # 01Document16 pagesMuhammad Asghar SAP ID #7448 Answer # 01Muhammad AsgharNo ratings yet

- Green Handwritten Course Syllabus Education PresentationDocument24 pagesGreen Handwritten Course Syllabus Education PresentationCamela Jane Dela PeñaNo ratings yet

- Solutions Additional ExercisesDocument87 pagesSolutions Additional Exercisesapi-3767414No ratings yet

- CH 10 SMDocument17 pagesCH 10 SMNafisah MambuayNo ratings yet

- Mock 2Document16 pagesMock 2happywintNo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Opm58 - Exam (Dec 2015) - AnswersDocument11 pagesOpm58 - Exam (Dec 2015) - AnswersHammadNo ratings yet

- CH 10 SMDocument17 pagesCH 10 SMapi-267019092No ratings yet

- Man Acc 2Document11 pagesMan Acc 2KathleneGabrielAzasHaoNo ratings yet

- Question - Parallel Quiz - Final Term - Cost Accounting 22 - 23Document6 pagesQuestion - Parallel Quiz - Final Term - Cost Accounting 22 - 23Gistima Putra JavandaNo ratings yet

- OSCM NumericalsDocument29 pagesOSCM NumericalsADITYA SINGHNo ratings yet

- Discussion QuestionsDocument17 pagesDiscussion QuestionsSriRahayuNo ratings yet

- Jimma University Construction Economics (CEGN 6108)Document7 pagesJimma University Construction Economics (CEGN 6108)TesfuNo ratings yet

- Mubtasin Rahman Efty 1831291630 ACT202 Midterm Fall 2021Document6 pagesMubtasin Rahman Efty 1831291630 ACT202 Midterm Fall 2021Jannatul Ferdousi Prity 1911654630No ratings yet

- CosthuliDocument7 pagesCosthulikmarisseeNo ratings yet

- Afin317 FPD 1 2020 1Document8 pagesAfin317 FPD 1 2020 1Daniel Daka100% (1)

- 1709528091limiting Factor Decision MakingDocument5 pages1709528091limiting Factor Decision Makingevanperera101No ratings yet

- 2016 Mock PDFDocument16 pages2016 Mock PDFNghia Tuan NghiaNo ratings yet

- Corpuz, Aily-Bsbafm2-2-Final Practice ProblemDocument7 pagesCorpuz, Aily-Bsbafm2-2-Final Practice ProblemAily CorpuzNo ratings yet

- Paper8 SolutionDocument25 pagesPaper8 SolutionHeba_Al_KhozaeNo ratings yet

- Brealey 5CE Ch09 SolutionsDocument27 pagesBrealey 5CE Ch09 SolutionsToby Tobes TobezNo ratings yet

- Chaper 78Document4 pagesChaper 78Nyan Lynn HtunNo ratings yet

- CA Final Costing Guideline Answers May 2015Document12 pagesCA Final Costing Guideline Answers May 2015jonnajon92-1No ratings yet

- Chapter 10 Process CostingDocument31 pagesChapter 10 Process CostingKrizel Dixie ParraNo ratings yet

- Process-Analysis-II (Compatibility Mode)Document19 pagesProcess-Analysis-II (Compatibility Mode)Jerry LeeNo ratings yet

- Activity Based CostingproblemsDocument6 pagesActivity Based CostingproblemsDebarpan HaldarNo ratings yet

- BFIN525 - Chapter 11 - Problems & AKDocument10 pagesBFIN525 - Chapter 11 - Problems & AKmohamad yazbeckNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (26)

- ActivityDocument3 pagesActivityPoy TañedoNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- Activity Based Costing Spring 2023 With ThoeryDocument12 pagesActivity Based Costing Spring 2023 With ThoeryHafsah AnwarNo ratings yet

- Ma1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockDocument9 pagesMa1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockMino MinaNo ratings yet

- W2 - Concepts and ApplicationsDocument13 pagesW2 - Concepts and ApplicationsKim Yến100% (1)

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- 201B Exam 2 PrepDocument9 pages201B Exam 2 PrepChanel NguyenNo ratings yet

- UntitledfgddDocument7 pagesUntitledfgddBabawale KehindeNo ratings yet

- CH #12Document5 pagesCH #12BWB DONALDNo ratings yet

- DAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDocument3 pagesDAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDavidNo ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- CB2011 (Home Assignment) RevDocument3 pagesCB2011 (Home Assignment) RevStephanie LeungNo ratings yet

- Sugested May 2019 Group 2Document86 pagesSugested May 2019 Group 2priyanka jainNo ratings yet

- Cost Suggested Answer May 19Document28 pagesCost Suggested Answer May 19Saurabh sharmaNo ratings yet

- Ma 2 AccaDocument18 pagesMa 2 AccaRielleo Leo67% (3)

- ACC4206 Topic 2 Tutorial Q1 - Q5Document3 pagesACC4206 Topic 2 Tutorial Q1 - Q5natlyhNo ratings yet

- Model Test Paper Problem1 (A)Document15 pagesModel Test Paper Problem1 (A)HibibiNo ratings yet

- Manacc Assignment 14-3: Make or Buy A ComponentDocument7 pagesManacc Assignment 14-3: Make or Buy A ComponentCuster CoNo ratings yet

- Assignment 2 Dac 314 2024Document10 pagesAssignment 2 Dac 314 2024rachaelmercNo ratings yet

- ACC103 Assign Sem 1, 2020 PDFDocument9 pagesACC103 Assign Sem 1, 2020 PDFWSLee0% (1)

- Saage SG Fma RevisionDocument21 pagesSaage SG Fma RevisionNurul Shafina HassanNo ratings yet

- Practical Guide To Production Planning & Control [Revised Edition]From EverandPractical Guide To Production Planning & Control [Revised Edition]Rating: 1 out of 5 stars1/5 (1)

- Contracts Case 13 Manotok Realty v. IACDocument2 pagesContracts Case 13 Manotok Realty v. IACReign TambasacanNo ratings yet

- Share Based Payments-ExercisesDocument6 pagesShare Based Payments-ExercisesReign TambasacanNo ratings yet

- SWDocument1 pageSWReign TambasacanNo ratings yet

- IA2 Exercise 8Document8 pagesIA2 Exercise 8Reign TambasacanNo ratings yet

- SW 1stDocument2 pagesSW 1stReign TambasacanNo ratings yet

- Module 5 Exercises 3 and 13Document3 pagesModule 5 Exercises 3 and 13Reign TambasacanNo ratings yet

- Business TradeDocument2 pagesBusiness TradeReign TambasacanNo ratings yet

- Practice Exercises AP NPDocument5 pagesPractice Exercises AP NPReign TambasacanNo ratings yet

- Practice Exercises AP NPDocument5 pagesPractice Exercises AP NPReign TambasacanNo ratings yet

- Kinds of Obligations - CasesDocument6 pagesKinds of Obligations - CasesReign TambasacanNo ratings yet

- 9037HG32LZ20: Product DatasheetDocument2 pages9037HG32LZ20: Product DatasheetNarcisse AhiantaNo ratings yet

- Cloud Native Applications in A Telco WorldDocument22 pagesCloud Native Applications in A Telco WorldmarimcuriNo ratings yet

- Secret Behind The SecretDocument4 pagesSecret Behind The Secret9continentsNo ratings yet

- Acrylic SecretsDocument92 pagesAcrylic SecretsMihaela Toma100% (2)

- GECG Curriculum - Biomedical EngineeringDocument52 pagesGECG Curriculum - Biomedical Engineeringdhruv7887No ratings yet

- Sop On Maintenance of Air Handling Unit - Pharmaceutical GuidanceDocument3 pagesSop On Maintenance of Air Handling Unit - Pharmaceutical Guidanceruhy690100% (1)

- IXL - Fifth Grade Language Arts PracticeDocument3 pagesIXL - Fifth Grade Language Arts PracticeJanderson Barroso0% (1)

- Notice Machine À CoudreDocument62 pagesNotice Machine À Coudreker lenoNo ratings yet

- Flooding & Flood RisksDocument1 pageFlooding & Flood RisksCarlNo ratings yet

- Group 2I - Herman Miller Case AnalysisDocument7 pagesGroup 2I - Herman Miller Case AnalysisRishabh Kothari100% (1)

- Raghunathan 2015Document5 pagesRaghunathan 2015STOCK IKRAM GROUPNo ratings yet

- Factsheet 2022Document1 pageFactsheet 2022Kagiso Arthur JonahNo ratings yet

- Agriculture4 0-IEEETIIDocument13 pagesAgriculture4 0-IEEETIIAmanda FNo ratings yet

- Grundfos - SL1 50 65 22 2 50D CDocument13 pagesGrundfos - SL1 50 65 22 2 50D CThilina Lakmal Edirisingha100% (1)

- 126961BALOI CENTRAL ES ENHANCED SIP 2019 2022 New TemplateDocument18 pages126961BALOI CENTRAL ES ENHANCED SIP 2019 2022 New TemplateALAYSHA ALINo ratings yet

- VW - tb.17!06!01 Engine Oils THat Meet VW Standards VW 502 00 and VW 505 01Document8 pagesVW - tb.17!06!01 Engine Oils THat Meet VW Standards VW 502 00 and VW 505 01SlobodanNo ratings yet

- Modicon M251 - Programming Guide EIO0000003089.02Document270 pagesModicon M251 - Programming Guide EIO0000003089.02mariookkNo ratings yet

- Qualcast Trucks Catalog2015Document188 pagesQualcast Trucks Catalog2015Edwin Javier Garavito100% (2)

- Unit 2Document7 pagesUnit 2Hind HindouNo ratings yet

- Bella Pro Series 5.3 Qt. Digital Air Fryer 90065Document32 pagesBella Pro Series 5.3 Qt. Digital Air Fryer 90065مصطفى الأصفرNo ratings yet

- Project Sem6Document40 pagesProject Sem6Alisha riya FrancisNo ratings yet

- The Evolution of The Byzantine Liturgy - Juan MateosDocument29 pagesThe Evolution of The Byzantine Liturgy - Juan MateosȘtefan NuicăNo ratings yet

- LampiranDocument26 pagesLampiranSekar BeningNo ratings yet

- Math4 q2 Mod6 FindingtheLCM v3 - For MergeDocument21 pagesMath4 q2 Mod6 FindingtheLCM v3 - For MergeJoanna GarciaNo ratings yet

- 1test PDFDocument2 pages1test PDFPaul John Garcia RaciNo ratings yet

- Coral Reef Restoration A Guide To EffectDocument56 pagesCoral Reef Restoration A Guide To EffectDavid Higuita RamirezNo ratings yet

- Mosquetes Political Economy of The Philippines Transportation LRT MRT Issues and How It Affects The Filipino WorkersDocument12 pagesMosquetes Political Economy of The Philippines Transportation LRT MRT Issues and How It Affects The Filipino WorkersLouisky MosquetesNo ratings yet

- Biomedical Engineering Jobs in Gulf CountriesDocument2 pagesBiomedical Engineering Jobs in Gulf CountriesramandolaiNo ratings yet

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)