Professional Documents

Culture Documents

Chapter 16 Notes

Uploaded by

Angel Lea Regalado0 ratings0% found this document useful (0 votes)

10 views4 pages1) Retained earnings represent cumulative profits retained by a business and not yet distributed to owners. Dividends are distributions of cash or property to shareholders that are accounted for by debiting retained earnings and crediting dividends.

2) There are key dates for accounting of dividends including the date of declaration when dividends are announced and the date of distribution when dividends are paid to shareholders.

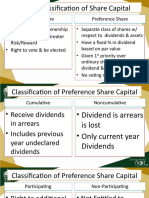

3) Preference shares may receive preference over ordinary shares in the distribution of assets in liquidation or distribution of dividends.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Retained earnings represent cumulative profits retained by a business and not yet distributed to owners. Dividends are distributions of cash or property to shareholders that are accounted for by debiting retained earnings and crediting dividends.

2) There are key dates for accounting of dividends including the date of declaration when dividends are announced and the date of distribution when dividends are paid to shareholders.

3) Preference shares may receive preference over ordinary shares in the distribution of assets in liquidation or distribution of dividends.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesChapter 16 Notes

Uploaded by

Angel Lea Regalado1) Retained earnings represent cumulative profits retained by a business and not yet distributed to owners. Dividends are distributions of cash or property to shareholders that are accounted for by debiting retained earnings and crediting dividends.

2) There are key dates for accounting of dividends including the date of declaration when dividends are announced and the date of distribution when dividends are paid to shareholders.

3) Preference shares may receive preference over ordinary shares in the distribution of assets in liquidation or distribution of dividends.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

CHAPTER 16: Accounting for Dividends • date of record

o the date on which the stock and

Retained earnings transfer book of the corporation is

• represent the cumulative profits (net of closed for registration

losses, distribution to owners, and other o only those listed as of this date are

adjustments) that are retained to the business entitled to dividends

and not yet distributed to owners • date of distribution

• consists of: o the date when the dividends declared

o unrestricted are distributed to the shareholders

▪ the portion of retained

earnings that is available for Accounting for cash dividends

future distribution to the • the most common for of distribution to

shareholders owners

o appropriated (restricted) • may be declared as a certain amount per

▪ the portion of retained share or as a certain percentage of the par

earnings that is not available value of the shares

for distribution unless the • only outstanding shares are entitled to

restriction is subsequently dividends

reversed • outstanding shares = issued shares +

▪ appropriations do not mean subscribed shares – treasury shares

that a cash fund has been set • the ‘dividends account’ may be debited in

aside, only indicate amounts lieu of ‘retained earnings’ and may be used

that are not available for if dividends are declared more than once a

distribution to the owners year

• when retained earnings has a negative • the dividends account is closed to retained

balance, it is described as “deficit” earnings, similar to the drawings account

• when total shareholders’ equity has a

negative balance, it is described as “capital Accounting for share dividends

deficiency” • if share dividends are considered ‘small’

meaning less than 20% of the outstanding

Dividends shares, the share dividends are accounted for

• distributions to shareholders at fair value

• may be in the form of o retained earnings is debited at fair

o cash dividends value on declaration date

▪ distributions in the form of o difference between the fair value and

cash par value is credited to share

o property dividends premium

▪ distributions in the form of • if share dividends are considered ‘large’

noncash assets meaning 20% or more of the outstanding

o share dividends shares, the share dividends are accounted for

▪ distributions in the form of at par value

the entity’s own share o retained earnings are debited for the

par value of the share dividends

Dates relevant to the accounting for dividends o no share premium arises

• date of declaration • share dividends do not affect total

o the date when the board of directors shareholders’ equity, a portion of the

formally announces the distribution retained earnings is just transferred to the

of dividends share capital and share premium accounts

• the stock dividends payable or share

dividends payable is an adjunct equity

account, not a liability account

Treasury shares declared as dividends

• the accounting for ‘small’ or ‘large’ share Preference over dividends

dividends do not apply to treasury shares • upon declaration, preference shares that are

• the cost method is used ‘preferred as to dividends’ are paid first

o retained earnings is debited for the before ordinary shareholders

cost of the treasury shares declared • preference dividends may be

o no share premium arises o noncumulative

▪ is one which the dividend

Preference shares entitlement for a year is

• preference shares have one or both of the forfeited when dividends are

following preferences over ordinary shares not declared in that year

o preference in the distribution of o cumulative

assets in case of liquidation ▪ is one which the dividend

(preferred as to assets) entitlement accumulates each

o preference in the distribution of year until paid

dividends (preferred as to • accumulated unpaid

dividends) dividends are

disclosed as dividends

Preference over assets in arrears but not

• upon liquidation and after creditors’ claims accrued as liability

(liabilities) are settled, preference shares that unless the dividends

are preferred as to assets are settled first are declared

and any remaining amount is paid to o nonparticipating

ordinary shareholders ▪ is one which is entitled only

• if the preference shares are not preferred as to a fixed amount of

to assets, the remaining amount after dividends

settlement of liabilities is shared o participating

proportionately by the preference and ▪ is one which is entitled to an

ordinary shareholders amount in excess of the fixed

• preference shares that are preferred as to amount of dividends

assets are normally entitled to liquidation ▪ the amount of participation is

value computed after both the

o liquidation value pertains to the preference and ordinary

amount that preference shareholders shares are allocated their

are entitled to receive in case of basic dividends

liquidation • the basic dividend of

o usually more than the par value of cumulative

the preference shares preferred shares

• in case where the net assets after settlement includes dividends in

of liabilities are insufficient to pay the arrears

liquidation value, the preference • the basic dividend of

shareholders will be entitled only to the noncumulative

remaining net assets preferred shares

o none will be paid to ordinary includes only the

shareholders, but they will not be current-year dividends

obliged to provide any additional entitlement

capital • the basic dividend of

o in accordance with the limited ordinary

liability characteristic of a shareholders is equal

corporation, the personal assets are to the aggregate par

not subject to corporate claims value of the

outstanding ordinary o P5 preference

shares multiplied by share

the preference rate ▪ In the absence of evidence to

• if there is more than the contrary, preference

one class of shares are presumed to be

preference shares, the ‘preferred as to dividends’

lowest preference rate with dividend preference of

is used to compute for ‘noncumulative and

the basic dividend nonparticipating’

• any excess of ▪ when preference shares are

dividends declared participating only up to a

after deducting the certain percentage, the

basic dividends is the participation is computed as

amount subject to the excess of the participation

participation percentage over the fixed

▪ participating preference dividend rate multiplied by

shares may be either the aggregate par value of

• fully participating preference shares outstanding

o participates on

a pro rata Liquidating dividends

basis (based • are dividends declared out of capital, rather

on aggregate than from retained earnings

par values of • normally declared only upon liquidation

outstanding • however, the wasting asset doctrine permits

shares) with wasting asset corporations to declare

ordinary dividends of capital during their existence

shareholders • there may be instances where unintentional

• partially participating liquidating dividends occur such as when

o participates dividends are declared out of retained

only up to a earnings that is overstated

certain • when unintentional liquidating dividends are

amount or subsequently discovered, a correcting entry

percentage is made to adjust the retained earnings and

▪ preference shares may have other affected accounts

more than one dividend • dividends declared in excess of unrestricted

preference retained earnings are considered liquidating

▪ preference shares may be dividends

both cumulative and • liquidating dividends are charged to the

participating capital liquidated account which is a

▪ the dividend entitlement of deduction from total shareholders’ equity

preference shares may be

expressed as: Share split

• percentage of par • share splits may be in the form of

value (fixed rate o split up or share split

based on par value) o split down or reverse share split

o 12% • split up occurs when old shares are cancelled

preference and replaced by a larger number of new

share shares but with a reduced par value (stated

• specific monetary value) per share

amount per share

o share split increases the number of

shares available for issuance while

decreasing the fair value per share

o the fair value of the entity’s net

assets will be divided by a larger

number of outstanding shares

o with decreased fair value per share,

the shares become more affordable to

potential investors

• split down is whereby old shares are

cancelled and replaced by a smaller

number of new shares but with an

increased par value (stated value) per share

• share splits only affect the number of

outstanding shares and par value per share

• they do not affect assets, liabilities, equity,

or the aggregate par value of issued shares

• share splits are recorded only through memo

entry

You might also like

- Share Rights & TypesDocument18 pagesShare Rights & TypesHeer ChaudharyNo ratings yet

- Chapter 3 Introduction To Company Accounting SDocument7 pagesChapter 3 Introduction To Company Accounting Skhoagoku147No ratings yet

- Chapter 4 Stock Valuation (Student)Document10 pagesChapter 4 Stock Valuation (Student)Nguyễn Thái Minh ThưNo ratings yet

- FIN222 Lecture 3 Share Valuation: Lecture 3 Chapters Lecture 4 ChaptersDocument10 pagesFIN222 Lecture 3 Share Valuation: Lecture 3 Chapters Lecture 4 ChaptersStephanie BuiNo ratings yet

- FIN242: Preferred Stock Investment GuideDocument10 pagesFIN242: Preferred Stock Investment GuideMūhãmmâd Åïmãñ Bïn ÂbddūllähNo ratings yet

- ASPE at a Glance Share Cap Equity Reserves and Cap TransDocument4 pagesASPE at a Glance Share Cap Equity Reserves and Cap TransMarium RafiqNo ratings yet

- 7 - Intro To Company AccountingDocument13 pages7 - Intro To Company AccountingsurangauorNo ratings yet

- Session 7 - Equity - For Students and MoodleDocument74 pagesSession 7 - Equity - For Students and Moodless9723No ratings yet

- Chapter 15 NotesDocument5 pagesChapter 15 NotesAngel Lea RegaladoNo ratings yet

- 7 - Intro To Company AccountingDocument13 pages7 - Intro To Company AccountingsurangauorNo ratings yet

- Book Value Per ShareDocument29 pagesBook Value Per ShareKaren MagsayoNo ratings yet

- FAR17 Dividends - With AnsDocument7 pagesFAR17 Dividends - With AnsAJ CresmundoNo ratings yet

- Dividend Policy 1Document56 pagesDividend Policy 1hardika jadavNo ratings yet

- Investment Management: Preference Shares and DebenturesDocument12 pagesInvestment Management: Preference Shares and DebenturesBhavanya RavichandrenNo ratings yet

- ACA Accounting Lecture Chap 11-16-14jul2022Document50 pagesACA Accounting Lecture Chap 11-16-14jul2022Nguyễn Thanh Thanh HươngNo ratings yet

- Differences Between SharesDocument9 pagesDifferences Between SharesAnjan IkonNo ratings yet

- Shareholders' Equity: Tenth Canadian EditionDocument70 pagesShareholders' Equity: Tenth Canadian Editionmdal10No ratings yet

- Equity Markets: Bulatao, Clemente, Dalope, Mercado, Nelmida, Ramilo, SantosDocument206 pagesEquity Markets: Bulatao, Clemente, Dalope, Mercado, Nelmida, Ramilo, SantosJayveerose BorjaNo ratings yet

- Partnership LiquidationDocument10 pagesPartnership LiquidationAmie Jane MirandaNo ratings yet

- Accounting For Limited Companies: An OverviewDocument32 pagesAccounting For Limited Companies: An OverviewAninditaBasuNo ratings yet

- ch08 Valuation and Characteristics of StockDocument47 pagesch08 Valuation and Characteristics of Stock蘇則翰No ratings yet

- Introduction To Company AccountingDocument19 pagesIntroduction To Company AccountingIsra GhousNo ratings yet

- Dividend Decisions: Unit 5Document41 pagesDividend Decisions: Unit 5Fara HameedNo ratings yet

- Shares and Share Capital: Mrs. Shruti Reddy Upes SolDocument137 pagesShares and Share Capital: Mrs. Shruti Reddy Upes SolshubhNo ratings yet

- Shares and Debentures: A Comparison ChartDocument2 pagesShares and Debentures: A Comparison ChartJobin JohnNo ratings yet

- Corporation - Contributed Capital - Initial Share TransactionsDocument38 pagesCorporation - Contributed Capital - Initial Share TransactionsIvanNo ratings yet

- Shares & Share Capital FinalDocument37 pagesShares & Share Capital FinalRupal Bharat Bhansali100% (1)

- Preference Shares: BY Madhan C Shyam Sudheer K Suganya R Sweatha RDocument10 pagesPreference Shares: BY Madhan C Shyam Sudheer K Suganya R Sweatha RShyam SudheerNo ratings yet

- Advacc - Midterm NotesDocument7 pagesAdvacc - Midterm Notesthirdyear83No ratings yet

- ALI HAIDER 2019-Ag-6828Document9 pagesALI HAIDER 2019-Ag-6828مہر علی حیدرNo ratings yet

- Types and Forms of Dividends ExplainedDocument9 pagesTypes and Forms of Dividends ExplainedKram Olegna AnagergNo ratings yet

- Share Capital ExplainedDocument5 pagesShare Capital ExplainedkalinovskayaNo ratings yet

- Cfas SummaryDocument4 pagesCfas Summaryfatima airis aradaisNo ratings yet

- Money Equity and Credit MarketsDocument32 pagesMoney Equity and Credit MarketsAbhijeet BhattacharyaNo ratings yet

- Short and Long Term Finance Incl Islamic Finance Lecture 3Document60 pagesShort and Long Term Finance Incl Islamic Finance Lecture 3Ambreen RabbaniNo ratings yet

- Investment in Equity SecuritiesDocument23 pagesInvestment in Equity SecuritiesJay-L TanNo ratings yet

- 6.04 Overview of Equity Securities - AnswersDocument25 pages6.04 Overview of Equity Securities - AnswersClaptrapjackNo ratings yet

- AFAR PartnershipDocument3 pagesAFAR PartnershipClyde RamosNo ratings yet

- Share CapitalDocument10 pagesShare CapitalMae PanganibanNo ratings yet

- AFA - 4e - PPT - Chap12 (For Students)Document22 pagesAFA - 4e - PPT - Chap12 (For Students)Cẩm Tú NguyễnNo ratings yet

- Long Term Finance Sources 2020Document50 pagesLong Term Finance Sources 2020Rudraksh PareyNo ratings yet

- Retained Earnings Lecture NotesDocument2 pagesRetained Earnings Lecture Notesbum_24100% (2)

- Types of Shares and Dividends ExplainedDocument18 pagesTypes of Shares and Dividends ExplainedcdarshakNo ratings yet

- Preference Shares and DividendsDocument3 pagesPreference Shares and DividendsEd ViggayanNo ratings yet

- Intermediate Accounting: Shareholders' EquityDocument49 pagesIntermediate Accounting: Shareholders' EquityShuo Lu100% (1)

- Karan - Fi.Document12 pagesKaran - Fi.Mrunmayee KulkarniNo ratings yet

- PPT-5 Corporate Action-Dividends, Bonus, Splits EtcDocument16 pagesPPT-5 Corporate Action-Dividends, Bonus, Splits EtcAmrita GhartiNo ratings yet

- Corporation - Remaining SlidesDocument21 pagesCorporation - Remaining SlidesRey ArellanoNo ratings yet

- Chapter 15Document49 pagesChapter 15m.garagan16No ratings yet

- PLI Fundamentals of Capital Structures Pocket MBA Nov 2019Document85 pagesPLI Fundamentals of Capital Structures Pocket MBA Nov 2019Satya Prakash TrivediNo ratings yet

- Accounting For Companies: BCM 1204: Accounting in Business IiDocument49 pagesAccounting For Companies: BCM 1204: Accounting in Business IiMaryjoy KilonzoNo ratings yet

- Capital Structure and ReservesDocument40 pagesCapital Structure and ReservesEverjoice ChatoraNo ratings yet

- Lecture14 Financing The CompanyDocument34 pagesLecture14 Financing The CompanyHarishvardhanNo ratings yet

- Partnership Liquidation Lump SumDocument38 pagesPartnership Liquidation Lump SumDennis L. Udani0% (1)

- Partnership Liquidation With Problem.1.2.4Document48 pagesPartnership Liquidation With Problem.1.2.4axeaapolloNo ratings yet

- For Quiz 4Document29 pagesFor Quiz 4ncq6dmzmp4No ratings yet

- Chapter 10b Long Term Finance - EquityDocument27 pagesChapter 10b Long Term Finance - EquityIvy CheekNo ratings yet

- 1 What Are Corporate Actions?: CreditorsDocument14 pages1 What Are Corporate Actions?: Creditorsstudenthc100% (1)

- Difference Between Equity and Prefrence ShareDocument8 pagesDifference Between Equity and Prefrence ShareShreyas TrivediNo ratings yet

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksFrom EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksNo ratings yet

- Chapter 3 Digital EntrepreneurshipDocument17 pagesChapter 3 Digital Entrepreneurshipj9cc8kcj9wNo ratings yet

- Role Soft Switch in NGNDocument6 pagesRole Soft Switch in NGNHung Nguyen HuyNo ratings yet

- CV Kawsar Molla Marketing Executive BangladeshDocument2 pagesCV Kawsar Molla Marketing Executive BangladeshMostakNo ratings yet

- Artist Management Contract 07Document14 pagesArtist Management Contract 07Yah MCNo ratings yet

- Your Career Game How Game Theory Can Help You Achieve Your Professional Goals PDFDocument271 pagesYour Career Game How Game Theory Can Help You Achieve Your Professional Goals PDFMarcNo ratings yet

- 12 Selimovic Martinovic HurkoDocument19 pages12 Selimovic Martinovic Hurkoangelina chandraNo ratings yet

- 3rd INTERNATIONAL WORKSHOP ON UI GREENMETRICDocument36 pages3rd INTERNATIONAL WORKSHOP ON UI GREENMETRICNugroho Widyo P, SNo ratings yet

- Chapter 2 - CreditDocument18 pagesChapter 2 - CreditĐỉnh Kout NamNo ratings yet

- Ces Report in BusinessDocument54 pagesCes Report in Businessnicole alcantaraNo ratings yet

- Limitations of the IS-LM model and how it is affectedDocument1 pageLimitations of the IS-LM model and how it is affectedRai JiNo ratings yet

- MANPOWER PLANNING - INTRO-RecordedDocument10 pagesMANPOWER PLANNING - INTRO-Recordedsammie celeNo ratings yet

- Job Description Design Engineer FresherDocument2 pagesJob Description Design Engineer Fresherpraveenraokh32No ratings yet

- The Signal Report 2022 - FINAL PDFDocument28 pagesThe Signal Report 2022 - FINAL PDFANURADHA JAYAWARDANANo ratings yet

- Tricocat PDFDocument44 pagesTricocat PDFJuan PabloNo ratings yet

- Amazon As An EmployerDocument2 pagesAmazon As An EmployerSagar Bhoite100% (1)

- Saudi Aramco Port and Terminal Booklet 2020 PDFDocument384 pagesSaudi Aramco Port and Terminal Booklet 2020 PDFmersail100% (1)

- Hilton Glossary of Terms PDFDocument33 pagesHilton Glossary of Terms PDFgokhans7650% (2)

- Final PaperDocument11 pagesFinal Paperapi-601299997No ratings yet

- Surface Discontinuities of Bolts, Screws, and Studs, Inch and Metric SeriesDocument6 pagesSurface Discontinuities of Bolts, Screws, and Studs, Inch and Metric SeriesAlejandro ValdesNo ratings yet

- Organizational Change ManagementDocument235 pagesOrganizational Change ManagementtavanNo ratings yet

- DHL Express - USA Customs Duty InvoiceDocument1 pageDHL Express - USA Customs Duty InvoiceShahid SaleemNo ratings yet

- Al Habtoor Motors Announcement - Pagani - ENGDocument2 pagesAl Habtoor Motors Announcement - Pagani - ENGMartín SacánNo ratings yet

- Chapter 5-Elasticity Multiple ChoiceDocument33 pagesChapter 5-Elasticity Multiple ChoiceBriceHong100% (4)

- Subject - An Application For The Post of JR - Executive (Merchandising)Document4 pagesSubject - An Application For The Post of JR - Executive (Merchandising)aman shovonNo ratings yet

- Train With Bain 2 HandoutDocument7 pagesTrain With Bain 2 HandoutAnn100% (1)

- Effect of Organizational Ethics On Employee Performance in Airline Industry: A Nigerian PerspectiveDocument12 pagesEffect of Organizational Ethics On Employee Performance in Airline Industry: A Nigerian PerspectiveabbeyNo ratings yet

- Vitamin B12 order invoiceDocument1 pageVitamin B12 order invoiceDanielVasquezNo ratings yet

- 4 Financial Management ND2020Document4 pages4 Financial Management ND2020Srikrishna DharNo ratings yet

- Session 6 - Conflicts of Interest in Business - The Accounting ProfessionDocument27 pagesSession 6 - Conflicts of Interest in Business - The Accounting Profession20201211053 NUR AZIZAHNo ratings yet

- Sample Questions MBADocument8 pagesSample Questions MBAMike McclainNo ratings yet