Professional Documents

Culture Documents

Service Request Form

Uploaded by

RS ConsultantsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Request Form

Uploaded by

RS ConsultantsCopyright:

Available Formats

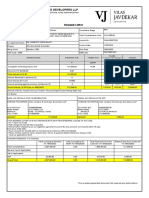

Service Request Form

Please refer to the General Instructions for assistance.

UNIT HOLDER INFORMATION

1. Folio No. 2. Folio No. 3. Folio No.

Name of Sole/1st Unit Holder First Name Middle Name Last Name

Name of the Guardian (on the folio): _____________________________________________________________________________________________________________

Date of Birth* (1st Unit Holder) D D M M Y Y Y Y Date of Birth* (2nd Unit Holder) D D M M Y Y Y Y Date of Birth* (3rd Unit Holder) D D M M Y Y Y Y

KYC is mandatory. Please enclose copies of KYC acknowledgement letters for all applicants. **PEKRN required for Micro investments upto Rs. 50,000 in a year.

^ 14 digit KYC Identification Number (KIN) and Date of Birth is mandatory for Individual(s) who has registered under Central KYC Records Registry (CKYCR).

PAN AND KYC UPDATION (Proof of KYC to be enclosed)

PAN of Sole / First Applicant / Guardian First Unit Holder PAN of Second Applicant Second Unit Holder

PAN of Third Applicant Third Unit Holder PAN of POA Holder POA Holder

Note: PAN card copy to be self attested and verified by AMC / distributor/ banker with seal of the branch, name, designation, employee code and sign of the person attesting.

CHANGE OF CONTACT DETAILS

Tel. (O) Tel. (R)

Mobile No.* +91-

SE -SELF SP -Spouse DC -Dependent Children DS- Dependent Siblings DP- Dependent Parents GD-Guardian PM- PMS CD-Custodian PO-POA

E-mail ID*

SE -SELF SP -Spouse DC -Dependent Children DS- Dependent Siblings DP- Dependent Parents GD-Guardian PM- PMS CD-Custodian PO-POA

* Mobile No and Email ID registrations are subject to further validations.

Yes No * I / We, wish to receive scheme wise annual report or an abridged summary thereof / account statements / statutory & other documents by email. If unticked, by default the above will be sent on email.

CHANGE IN MODE OF HOLDING [To be signed in accordance to the existing mode of holding]

New Mode of Holding (please tick ✓) Anyone or Survivor Joint Holding

CHANGE IN TAX STATUS

RI to NRI (Resident Individual to Non Resident Individual)

NRI to RI (Non Resident Individual to Resident Individual)

Overseas Address (Mandatory in case of RI to NRI ) (Should be same as in KRA records)

City

State Country (Mandatory) Zip Code

CHANGE IN BANK ACCOUNT

Account Number Account Type Savings Current NRE NRO FCNR Others

Bank Name _______________________________________________________________________________________________________________________________

Branch _____________________________________________________________ City _______________________________________________________________

IFSC MICR

(11 digit number next to your cheque no.) (The 9 character code on a cheque. If you do not find it, please ask your bank branch for it)

Please enclose original cancelled cheques for your old and new bank accounts. In case of non-availability of old bank proof (In-Person verification (IPV) is mandatory. Please

read the instructions for completing the IPV process.

If your Bank is a part of RBI’s NEFT clearance and settlement network, we can credit dividend/redemption payments into your account. However, if you wish to receive

payments by cheque, please state your preference below.

CHANGE OF ADDRESS (KYC Verified investors should fill the KYC form and approach a KRA POS for submission

New Address

City Pin Code

State Country

Proof of Identity attached (mandatory) Proof of Address attached (mandatory)

CONSOLIDATION OF FOLIOS

I / We wish to consolidate all my / our investments under specified folios into one folio. Folios to be consolidated i.e. source folios are given below :

TARGET FOLIO [MANDATORY] :

* I/We understand that as a result of consolidation, my/our contact details in target folio would be retained while these details featuring in all other source folios would be discarded.

YOUR SIGNATURE/S (To be signed as per Mode of Holding)

DECLARATION : I/We have read and understood the Instructions on the cooling off period and the Terms and Conditions for change in bank mandate and agree to abide by the

same. I/We acknowledge that my/our request will be processed only if the request is supported by valid documents , failing which the request maybe rejected.

Sole/First Applicant/Guardian Second Applicant Third Applicant

ACKNOWLEDGEMENT SLIP (To be filled in by the Applicant)

Received from Folio no/ Application no:

For Office Use Only

Mobile No: PAN:

Request submitted Acknowledgement

Stamp & Date

Subject to further verification and furnishing of mandatory information/ documents. Please retain this slip until processed

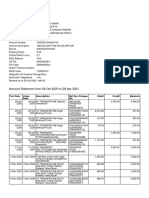

GENERAL INSTRUCTIONS

Please read the below instructions carefully before filling the form. Please fill up the form in English in BLOCK LETTERS with black ink. All information sought in the form is

mandatory except where it is specifically indicated as optional. All instructions & notes are subject to SEBI & AMFI guidelines as amended from time to time.

1. Change in Bank Account: 2. Change of Address

a) Please fill in the details of the new bank account of the Sole/First Unit a) Please provide complete details of your address .If your KYC status is

Holder only. reflecting as ‘KYC failed’ or ‘KYC unavailable’, the change of address

request will be liable for rejection and should be accompanied with KYC

b) Please fill the new bank details in the space provided and enclose proofs of

form with valid proof* of address and Identity (attested copy of your PAN

the new and old bank account details.

card) .

c) Unit holder(s) need to enclose any one of the following mandatory

*Acceptable proof of address:

documents of both new and existing/old bank accounts in original, with

respect to the addition of a new bank account in the folio. Passport, Ration Card, Registered Lease/Sale Agreement of Residence,

Checklist Driving License, Voter Identity Card, Latest Bank Bank Account Statement/

Passbook, Latest Telephone Bill (only Land Line), Latest Electricity Bill or

a) Cancelled Cheque with unit holder’s name and account number

Latest Gas Bill. The document should not be more than 3 months old.

pre- printed on the face of the cheque

b) Latest bank statement or bank pass book with current entries 3. Consolidation of Folios:

not older than 3 months having the name, address and account a) Unit holders in both the source folios and the target folio should be the

number of the account holder same.

c) A letter from the bank on their letterhead certifying that the b) The mode of operation across source folios & target folio should be the

Unitholder maintains/maintained an account with the bank, the same.

bank account information like bank account number, bank branch,

account type, the MICR code of the branch and IFSC Code (where c) The bank mandate and postal address across source folios & the target

available). Also unit holder’s personal information like PAN/DOB/ folio should be the same.

Address should match with that of our records. d) The nomination details across source folios & target folio should be the

d) Bank account closure letter (existing/old bank account). same.

d) Note: The above document can be in original or a copy which is duly e) No lien/pledge should be marked in respect of any investment in any of the

attested by the bank or verified against original by AMC / CAMS staff source/target folio.

with name of the investor pre-printed on the document which should

4. Contact Details:

match with our records.

a) Please provide the Mobile Number and E-Mail Address of the Sole / First

In the event of a request for change in bank account without original proof

Applicant in the form in case of Individuals and Key Contact in case of Non

and accompanied by the photocopy of the requisite documents.

Individuals. This would help us seamlessly communicate with you on your

# The self attested copies of the documents should be attested by Judicial investments.

Magistrate First Class (JMFC) or a Public Notary with official stamp & seal

b) Also tick the appropriate boxes of the family code (mentioned below the

of the Notary Magistrate /Notary & Regn.No or the bank manager with his/

Mobile Number and E-Mail Address) to ascertain the Actual / End user of

her full signature, name, designation, employee code, contact number and

the given Mobile Number and E-Mail Address.

bank stamp.

5. Change In Tax Status:

Alternatively, Investors may comply with the IPV process. Please refer to

the instructions below for completing the IPV process. For change in tax status from RI to NRI ,please ensure to provide the following

mandatory documents.

# Unitholders may also bring a copy of any of the documents mentioned

above along with the original documents to the ISCs/Official Points of a) New bank account type should mandatorily be NRO .SB to NRE bank

Acceptance of L&T Mutual Fund. The copy of such documents will be account is not permissible as the source of Investment is from SB account.

verified with the original documents to the satisfaction of the Fund and the b) FATCA declaration with TAX id

original documents will be returned across the counter to the Unitholder

after due verification. c) Existing & New bank proof.for both RI –NRI & NRI to RI

In case the Investor fails to provide any of the specified documents for the 6. Signature Validation: For processing of any Non Financial Transaction ,signature

existing /old bank account, they are requested to visit the nearest Investor of the unit holder is validated with AMC records for security reasons and also with

Service Centre of L&T Mutual Fund with original identity (PAN) & address a view to safeguard Investor’s interest. Incase of mismatch in the signature the

proof for In Person Verification by the ISC representative in lieu of old bank request stands rejected .For change in existing signature ,you are requested to

account proof. submit Signature updation/attestation form attested by the banker.

e) We offer the facility to register multiple bank accounts against your 7. Applicability of Cooling off period; Incase of Multiple NFT (Non Financial

investments. If you wish to avail this facility, please ask for a Multiple Bank Transaction) request cooling period of 10 days is involved for processing of every

Details Registration Form. NFT submitted together as a single request. Refer to the below cooling period

matrix.

f) If your units are held in the Dematerialised Form, please note that your

Bank Account Details appearing in the Depository’s records would be Request type Processing Sequence with

considered for redemption / dividend payments. Cooling off period

g) For security reasons, if the verification of your bank details is pending or if it PAN update + Change in Email Id + PAN update (*C) Email id update (*C)

fails,your redemption proceeds/dividends will be paid only by cheque even if Change in Mobile Number + Change Mobile number update (*C) Change of

you have a bank account with a direct credit facility. of Bank Bank

h) If you wish to receive payments by cheque instead of direct credit, please Any NFT + Signature updation Signature update (*C) NFT

tick the check-box provided for this purpose. Change in Email id + Mobile number Email update (*C) Mobile number

update

Name change + PAN + Signature PAN update (*C) Signature update

update (*C) Name update

*C – denotes cooling off period of 10 calendar days.

#Alternatively, Investor’s may visit the nearest Investor Service Centre of L&T

Mutual Fund with original identity (PAN) & address proof for In Person Verification

by the ISC representative to process the Multiple NFT request without any cooling

off period.

call 1800 4190 200 or 1800 2000 400 whatsapp @ 9326929294 email investor.line@lntmf.co.in www.lntmf.com

Join us on WhatsApp @ 9326929294 for financial and non-financial transactions, account statements, etc or you can connect with us on Chatbot as well by visiting our website

(https://www.ltfs.com/companies/lnt-investment-management/lnt-mutual-fund.html) (For Resident individual investors only with mode of holding as single).

Please note our lines are open from 9 am to 6 pm, Monday to Friday and 9 am to 1 pm on Saturday.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. CL09410

Scan our WhatsApp

QR code and say ‘Hi’

You might also like

- RA - LIST - REPORT KeralaDocument20 pagesRA - LIST - REPORT KeralaChandra HasanNo ratings yet

- LIN0931584 (VAN004) (Linkqage CC) (2022-06-17)Document1 pageLIN0931584 (VAN004) (Linkqage CC) (2022-06-17)RC Proptech SolutionsNo ratings yet

- Edzel AberiaDocument1 pageEdzel AberiaEdz carl AberiaNo ratings yet

- Kenwood KVT 915Document98 pagesKenwood KVT 915Juan SolisNo ratings yet

- P ¡Cs¡e : Your Reliance Communications BillDocument2 pagesP ¡Cs¡e : Your Reliance Communications BillKarthick KumarNo ratings yet

- ECG CABLE SALES INVOICEDocument1 pageECG CABLE SALES INVOICEHEMANTH RAMACHANDRAN AMUTHAVALLINo ratings yet

- Agihan Pensyarah Lawatan LiDocument158 pagesAgihan Pensyarah Lawatan LiFariha AhmadNo ratings yet

- Tax Invoice for Gold BraceletDocument1 pageTax Invoice for Gold BraceletParthiban ManiNo ratings yet

- Canara Bank statement transactionsDocument92 pagesCanara Bank statement transactionsDIVYANSHU CHATURVEDINo ratings yet

- AMILCAR RUBEN PORRAS SAMUEL HUGHES ACCOUNT DETAILSDocument2 pagesAMILCAR RUBEN PORRAS SAMUEL HUGHES ACCOUNT DETAILSthebuyNo ratings yet

- Airtel Xstream Bill OcttDocument2 pagesAirtel Xstream Bill OcttAniket SolseNo ratings yet

- Business Finance II: Course Title: Course ID: FIN302 Section: 02 Semester: Spring, 2022Document25 pagesBusiness Finance II: Course Title: Course ID: FIN302 Section: 02 Semester: Spring, 2022gaja babaNo ratings yet

- Frequency Domain Modelling of Control SystemsDocument51 pagesFrequency Domain Modelling of Control Systemsعمر الفهدNo ratings yet

- Existing Investor'S Folio Number Unit Holding Options: Transaction Charges ORDocument4 pagesExisting Investor'S Folio Number Unit Holding Options: Transaction Charges ORraj tripathiNo ratings yet

- Your Electricity Bill For: Loknath Developers PVTDocument2 pagesYour Electricity Bill For: Loknath Developers PVTRahul NaagNo ratings yet

- Po 4701558619Document2 pagesPo 4701558619Roger Sebastian Rosas AlzamoraNo ratings yet

- Two Wheeler Insurance Policy SummaryDocument7 pagesTwo Wheeler Insurance Policy SummaryAswini Kumar PaloNo ratings yet

- DPBillSummary 0009254820 20171231Document1 pageDPBillSummary 0009254820 20171231Saket ShahNo ratings yet

- 4 BollousDocument172 pages4 Bollousmedicina garridoNo ratings yet

- Ajio 1679480146740 PDFDocument1 pageAjio 1679480146740 PDFsahajathallamNo ratings yet

- Statement PDFDocument1 pageStatement PDFHusanjeet SinghNo ratings yet

- Tax invoice detailsDocument1 pageTax invoice detailsBsj VsheNo ratings yet

- Tax Invoice SummaryDocument1 pageTax Invoice SummarySwapnanil ChakrabortyNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBK Venture Capital PVT LTDNo ratings yet

- HDFC ERGO Health Insurance Policy DetailsDocument4 pagesHDFC ERGO Health Insurance Policy DetailsDr Ankit PardhiNo ratings yet

- InvoiceDocument1 pageInvoiceOmprakash NandlaNo ratings yet

- Financial Analysis MIDHANIDocument14 pagesFinancial Analysis MIDHANIArghyadeep SinhaNo ratings yet

- S-3109 FinalDocument60 pagesS-3109 FinalRaúl Oscar LedesmaNo ratings yet

- Print AditayDocument2 pagesPrint AditayTanush KhoseNo ratings yet

- Insurance Acknowledgment ReceiptDocument2 pagesInsurance Acknowledgment ReceiptArman PenalosaNo ratings yet

- Ola Ride Receipt 19 Jan 2023Document3 pagesOla Ride Receipt 19 Jan 2023Anonymous Clm40C1No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemozo dingdongNo ratings yet

- WalmartcaseDocument30 pagesWalmartcaseBarret RobisonNo ratings yet

- InvoiceDocument2 pagesInvoiceJagat PapaNo ratings yet

- Agent/ Intermediary Name and Code:CHAGANTIPATI MALLIKARJUNA RAO POS0004710Document4 pagesAgent/ Intermediary Name and Code:CHAGANTIPATI MALLIKARJUNA RAO POS0004710Hari AmaNo ratings yet

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Document1 pageVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNo ratings yet

- InternetbillAug DecDocument4 pagesInternetbillAug DecushaNo ratings yet

- 8 NpsDocument1 page8 Npsvidhya PavanNo ratings yet

- Terms and Conditions VietjetDocument18 pagesTerms and Conditions VietjetHoàng GiangNo ratings yet

- InvoiceDocument1 pageInvoiceAradhy TripathiNo ratings yet

- Tshirt InvoiceDocument1 pageTshirt InvoiceSayantanNo ratings yet

- National Education Policy 2020 and Higher Education: A Brief ReviewDocument5 pagesNational Education Policy 2020 and Higher Education: A Brief ReviewAli NadafNo ratings yet

- MTR Zavadskiy BULKDocument3 pagesMTR Zavadskiy BULKСвятославNo ratings yet

- 23033000185167KKBK ChallanReceiptDocument1 page23033000185167KKBK ChallanReceiptAtik ModgiNo ratings yet

- NN2919750178302 InvoiceDocument2 pagesNN2919750178302 InvoiceSohaib DurraniNo ratings yet

- Television: Total Amount PayableDocument2 pagesTelevision: Total Amount PayableSean MartynNo ratings yet

- Globe at Home E-Bill - 0279057747-2022-04-13 PDFDocument2 pagesGlobe at Home E-Bill - 0279057747-2022-04-13 PDFRen DiocalesNo ratings yet

- Acctstmt LDocument11 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- Receipt SummaryDocument1 pageReceipt SummaryKamna VaidNo ratings yet

- 1673 00T3s00002oE1AjEAKDocument6 pages1673 00T3s00002oE1AjEAKJonas GonzalesNo ratings yet

- AEPS, Mini ATM, DMT Commission Slabs for SDSO, MDSO, DSO and RetailersDocument23 pagesAEPS, Mini ATM, DMT Commission Slabs for SDSO, MDSO, DSO and RetailersVishal Singh Chauhan Dogma SoftNo ratings yet

- Tax Invoice for Flight Booking from Mumbai to KolkataDocument2 pagesTax Invoice for Flight Booking from Mumbai to KolkataAvik ModakNo ratings yet

- Government of Maharashtra: Motor Vehicle Department DY.R.T.O.BORIVALI, MaharashtraDocument1 pageGovernment of Maharashtra: Motor Vehicle Department DY.R.T.O.BORIVALI, Maharashtraankitiec03No ratings yet

- Bill of Supply For Electricity: Due Date: 09-03-2021Document1 pageBill of Supply For Electricity: Due Date: 09-03-2021Suryakumar BendalamNo ratings yet

- Fr0148 RDCDocument1 pageFr0148 RDCmcNo ratings yet

- Ethnicity and Sexuality - NagelDocument28 pagesEthnicity and Sexuality - NagelFernando UrreaNo ratings yet

- Reliance Retail tax invoiceDocument2 pagesReliance Retail tax invoicelokesh321No ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1001 0405 1200 000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 1001 0405 1200 000gggggjoshi.gaurav1991No ratings yet

- MUTUAL FUND EnglishDocument2 pagesMUTUAL FUND EnglishPukazhendhi BoominathanNo ratings yet

- Coa NSDL New Format-202109011551001360379Document2 pagesCoa NSDL New Format-202109011551001360379DrSyed ShujauddinNo ratings yet

- Speech Delivered by Dr. Ernest Addison, Governor, at Launch of Payswitch Company LTDDocument8 pagesSpeech Delivered by Dr. Ernest Addison, Governor, at Launch of Payswitch Company LTDNana KofiNo ratings yet

- CHAPTER 5 Sales Obligations of The VendeeDocument3 pagesCHAPTER 5 Sales Obligations of The VendeeErra PeñafloridaNo ratings yet

- Basic Financial Management Booklet For Elementary Community Primary SchoolsDocument42 pagesBasic Financial Management Booklet For Elementary Community Primary SchoolsFrance Bejosa100% (1)

- (Type Text) : Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur, Malaysia Telephone +603 2070 8833 Telex MA 32837Document7 pages(Type Text) : Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur, Malaysia Telephone +603 2070 8833 Telex MA 32837uniten alertNo ratings yet

- Jestra Development and Management Corporation V. Daniel Ponce Pacifico 513 SCRA 403 (2007)Document1 pageJestra Development and Management Corporation V. Daniel Ponce Pacifico 513 SCRA 403 (2007)Vox PopuliNo ratings yet

- Extinguishing Obligations GuideDocument13 pagesExtinguishing Obligations GuideCassandra PereyNo ratings yet

- Challan FormDocument1 pageChallan FormAnonymous 0izsN2No ratings yet

- Customer Service Observation Report ExampleDocument20 pagesCustomer Service Observation Report ExamplesamNo ratings yet

- 7 StatementOfAccount-July2023Document2 pages7 StatementOfAccount-July2023cailinghoneygenNo ratings yet

- City Online (3538.82) HDFC AC - 86Document3 pagesCity Online (3538.82) HDFC AC - 86Siva rajNo ratings yet

- Badan Pengurusan Bersama Binjai 8Document4 pagesBadan Pengurusan Bersama Binjai 8JagdieshNo ratings yet

- Cloud Computing For Small Business PDFDocument1 pageCloud Computing For Small Business PDFPallavy DananjoyNo ratings yet

- Prepare bank reconciliation and adjusting entriesDocument4 pagesPrepare bank reconciliation and adjusting entriesGuddataa DheekkamaaNo ratings yet

- NODz To B5 Ocrv 0 EZhDocument9 pagesNODz To B5 Ocrv 0 EZhRajesh PanchalNo ratings yet

- Soriano v. People PDFDocument8 pagesSoriano v. People PDFANDREA JOSES TANNo ratings yet

- OPPT: Courtesy Notice FAQDocument8 pagesOPPT: Courtesy Notice FAQAqiezeNo ratings yet

- Proforma Invoice and Purchase Agreement No.2140758Document6 pagesProforma Invoice and Purchase Agreement No.2140758benel esdras rollsNo ratings yet

- Batas Pambansa Bilang 22Document3 pagesBatas Pambansa Bilang 22Crisanto King CortezNo ratings yet

- Submit Your Application inDocument10 pagesSubmit Your Application inRakib AhasanNo ratings yet

- ND THDocument5 pagesND THjyash8475No ratings yet

- Bertieindia 45Document8 pagesBertieindia 45thestorydotieNo ratings yet

- Oblicon MidtermsDocument59 pagesOblicon MidtermsNathalie Jean YapNo ratings yet

- ClozeDocument5 pagesClozenguyenductaiNo ratings yet

- IM Series Counter Service PDFDocument14 pagesIM Series Counter Service PDFCarlos Castillo UrrunagaNo ratings yet

- UPI Specifications Version 1.2.1Document107 pagesUPI Specifications Version 1.2.1Amit Singh100% (1)

- Credit Card StatementDocument4 pagesCredit Card StatementGurpreet SinghNo ratings yet

- Tax RTP 2019 PDFDocument40 pagesTax RTP 2019 PDFvenkateshNo ratings yet

- PGMP Credential Application: Page 1 of 11 - Your InformationDocument15 pagesPGMP Credential Application: Page 1 of 11 - Your InformationPanduNo ratings yet

- CALCULATE Shopping With Interest 3.2 Under 6 WORD DocumentDocument4 pagesCALCULATE Shopping With Interest 3.2 Under 6 WORD Documentawsomepant2327No ratings yet

- B. Business Scope C. Data Model E. Upgrade IntervalsDocument4 pagesB. Business Scope C. Data Model E. Upgrade Intervalsshashi rai100% (1)