Professional Documents

Culture Documents

Bank Reconciliation Statement-Theory

Uploaded by

CRITICAL GAMEROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation Statement-Theory

Uploaded by

CRITICAL GAMERCopyright:

Available Formats

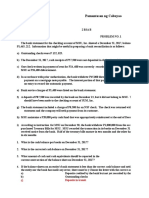

Bank Reconciliation Statement |1

Ex.01

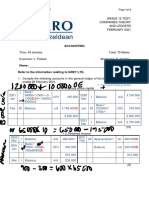

The following are the extracts from the bank book and bank statement of F.Perera

Bank Book

December Dr. Rs. December Cr. Rs.

2009 2009

01 Balance b/d 3419 08 B.Yardly 462

07 F.Liyanage 101 15 F.Gomes 21

22 G.Bastin 44 28 T.Ekanayake 209

31 W.Thomas 319 31 Balance c/d 3437

31 S.Mathew 246

4 129 4 129

Bank Statement

December Dr. Cr. Balance

2009 Rs. Rs. Rs.

01 Balance b/d 3 419

07 Cheque 101 3 520

11 B.Yardly 462 3 058

20 F.Gomes 21 3 037

22 Cheque 44 3 081

31 Credit Transfer : T. Mangala 93 3 174

31 Bank Charges 47 3 127

Required:-

a) Write the book up to date and state the new balance as on 31st December 2009.

b) Draw up a Bank Reconciliation Statement as on 31st December 2009

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |2

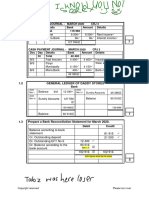

Ex.02

The bank column in the bank book for June 2007 and the Bank Statement for that month for D.Hewage are as

follows.

Bank Book

June 2007 Dr. Rs. June Cr. Rs.

2007

01 Balance b/d 1 410 05 L.Hiran 180

07 J.Mahinda 62 12 J.Renuka 519

16 T.Venuri 75 16 T.Shihan 41

28 F.Shanta 224 29 Blue Disco 22

30 G.Bandula 582 30 Balance c/d 1 591

2 353 2 353

Bank Statement

June Dr. Cr. Balance

2007 Rs. Rs. Rs.

01 Balance b/d 1 410

07 Cheque 62 1 472

08 L.Hiran 180 1 292

16 Cheque 75 1 367

17 J.Renuka 519 848

18 T.Shihan 41 807

28 Cheque 224 1 031

29 SLM Standing order 52 979

30 Prem: Traders credit 64 1 043

30 Bank Charges 43 1 000

Required:-

c) Write the book up to date to make the above into account.

d) Draw up a Bank Reconciliation Statement as on 30 June 2007

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |3

Ex.03

The bank statement for R.Hood for the month of March 2006 is:

2006 Dr. Cr. Balance

Rs. Rs. Rs.

March 01 Balance 4 200 O/D

08 T.Max 184 4 384 O/D

16 Cheque 292 4 092 O/D

20 W.Mily 160 4 252 O/D

21 Cheque 369 3 883 O/D

31 G.Frank : Traders Credit 88 3 795 O/D

31 XYZ: Standing order 32 3 827 O/D

31 Bank Charges 19 3 846 O/D

The bank book for March 2006 is:

2006 Dr. Rs. 2006 Cr. Rs.

March March

16 G.Philip 292 01 Balance b/d 4200

21 J.Foke 369 06 T.Max 184

31 S.Hare 192 30 W.Mily 160

31 Balance c/d 4195 30 S.Porter 504

5048 5048

Required:-

a) Write up the bank book up to date

b) Draw up a bank reconciliation statement as on 31st March 2006

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |4

Ex.04

The following is the bank book (bank columns) of Kavinda for December 2007.

2007 Dr. Rs. 2007 Cr. Rs.

December December

06 Prashan 230 01 Balance b/d 1900

20 Heshan 265 10 T.Max 304

31 Bimal 325 19 W.Mily 261

31 Balance c/d 1682 29 S.Porter 37

2502 2502

The bank statement for the month is:

2007 Dr. Cr. Balance

Rs. Rs. Rs.

December 01 Balance 1 900 O/D

06 Cheque 230 1 670 O/D

13 Lohan 304 1 974 O/D

20 Cheque 265 1 709 O/D

22 Viraj 261 1 970 O/D

30 Tiran : Standing Order 94 2 064 O/D

31 Renu: Traders credit 102 1 962 O/D

31 Bank Charges 72 2 034 O/D

Required-

a) Write the book up to date to take the necessary items to account

b) Draw up a bank reconciliation statement as on 31st December 2007.

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |5

Ex.05

Following are the business bank account and bank statement for the month of August of 2011

Bank Account

Date Details Amount Date Details Amount

2011 Rs. 2011 Rs.

Aug.01 b/b/f 154 000 Aug.02 Insurance (8451) 12 100

Aug.02 Cheque deposit 41 000 Aug.04 Electricity (8452) 14 200

Aug.04 Cheque deposit (4526) 12 500 Aug.06 D.Perera (8453) 20 500

Cheque deposit (2452) 18 000 Aug.08 Rates (8454) 6 000

Aug.06 Cash deposit 21 000 Aug.12 R.Silva (8455) 24 800

Aug.08 Cash deposit 13 000 M.Fernando (8456) 36 000

Aug.12 Cheque deposit (2248) 21 500 Aug.16 Travelling (8457) 2 800

Aug.15 Cheque deposit (3247) 42 000 Aug.18 Telephone charges 11 000

(8458)

Aug.22 Cash deposit 30 000 Aug.20 Goodluck Ltd. (8459) 15 500

Aug.24 Cheque deposit (5262) 14 000 Aug.26 Purchases (8460) 46 000

Aug.26 Cash deposit 26 000 Aug.30 Star traders (8461) 26 500

Aug.28 Cheque deposit (4628) 50 000

Aug.29 Cheque deposit (3420) 26 000

Aug.31 Cash deposit 44 000 Aug.31 b/c/d 297 000

513 000 513 000

b/b/f 297 600

Bank Statement

Date Description Dr. Cr. Balance

2011 Rs. Rs. Rs.

Aug.01 b/b/f 154 000

Aug.02 Cash deposit 41 000 195 000

Aug.03 Cheque (8451) 12 100 182 900

Aug.06 Cheque deposit 12 500 195 400

Cheque deposit 18 000 213 400

Cheque (8452) 14 200 199 200

Cash deposit 21 000 220 200

Aug.08 Cash deposit 13 000 233 200

Aug.10 Loan installment 17 000 216 200

Cheque (8454) 6 000 210 200

Aug.13 Cheque deposit 21 500 231 700

Aug.16 Cheque deposit 42 000 273 700

Cheque (8455) 24 800 248 900

Aug.18 Cheque (8456) 36 000 212 900

Aug.20 Leasing installment 16 400 196 500

Cheque (8457) 2 800 193 700

Aug.21 Cheque (8458) 11 000 182 700

Aug.22 Cash deposit 30 000 212 700

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |6

Investment income 21 500 234 200

Aug.26 Cash deposit 26 000 260 200

Aug.28 Cheque (8460) 46 000 214 200

Standing order – Insurance charges 13 500 200 700

Aug.29 Credit transfer – Amal 22 000 222 700

Aug.30 Credit transfer – Anil 14 000 236 700

Aug.31 Cash deposit 44 000 280 700

Bank charges 2 300 278 400

Prepare: -

a) Amended bank account

b) Bank reconciliation statement as at 31st August 2011

Ex.06

The following relates to Preston & co. Prepare the bank reconciliation statement

Cash book

1/12 b/d 8700 6/12 Little 1745

7/12 Blake 440 14/12 Jones 165

20/12 Dyson 365 21/12 Fraser 575

30/12 Veale 945 31/12 c/d 9155

31/12 Woodburn 300

31/12 May 890

11640 11640

Bank statement

Date Details Dr Cr Balance

1/12 B/d 8700

9/12 Cheque 440 9140

10/12 Little 1745 7395

19/12 Jones 165 7230

20/12 Cheque 365 7595

26/12 BGC: todd 270 7865

31/12 Bank charges 110 7755

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |7

Ex.07

The following relates to Flynn & co. Prepare the bank reconciliation statement

Cash book

6/12 Hall 155 1/12 b/d 3872

20/12 Walters 189 10/12 Wood 206

31/12 Miller 211 19/12 Roberts 315

31/12 c/d 3922 29/12 Phillips 84

4477 4477

Bank statement

Date Details Dr Cr Balance

1/12 B/d 3872 O/D

6/12 Cheque 155 3717 O/D

13/12 Wood 206 3923 O/D

20/12 Cheque 189 3734 O/D

22/12 Roberts 315 4049 O/D

30/12 Standing order 200 4249 O/D

31/12 Saunders:BGC 180 4069 O/D

31/12 Bank charges 65 4134 O/D

Ex.08

The following relates to Baxter & co. Prepare the bank reconciliation statement

Cash book

16/12 Morris 122 1/12 b/d 2598

21/12 Fraser 167 6/12 Young 61

31/12 Southern elect 160 30/12 Duffy 104

31/12 c/d 2804 30/12 Clark 490

3253 3253

Bank statement

Date Details Dr Cr Balance

1/12 B/d 2598 O/D

8/12 Young 61 2659 O/D

16/12 Cheque 122 2537 O/D

20/12 Duffy 104 2641 O/D

21/12 Cheque 167 2474 O/D

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |8

31/12 BGC: May 929 1545 O/D

31/12 Standing order 100 1645 O/D

31/12 Bank chargers 28 1673 O/D

Ex.09

The following is the bank statement of Nimal Traders for the month of January 2003

Date Particulars Debit (Rs). Credit (Rs). Balance (Rs).

01.01.2003 Balance 12 500

02.01.2003 Debit tax 50 11 450

05.01.2003 Chq.563761 4000 7 450

06.01.2003 Cash 5 000 12 450

10.01.2003 Chq. 15 000 27 450

15.01.2003 Interest 450 27 000

25.01.2003 Chq. 10 000 37 000

26.01.2003 Chq.563763 2 500 34 500

27.01.2003 Chq.book 75 34 425

Other information: -

i. It was revealed that the following cheques which are recorded in the bank book did not appear in the

above bank statement

Date Chq.No. Amount Details

26.01.2003 563762 Rs.4 800 Issued to Nihal Ltd

30.01.2003 721620 Rs.5 600 Deposited in the bank

ii. The balance as at 1st January 2003 in the cash book was the same as that in the bank statement

Required: -

1) Prepare bank account as it appeared in the books of Nirmal Traders from 1 st January 2003 to 31st January

2003

2) Enter all adjustments in the bank account after receipt of the bank statement

3) Prepare bank reconciliation statement for the month of January 2003

(A/L - 2003)

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement |9

Ex.10

Following are transactions appearing in the bank account of Gajaba Sons for the month of July 2005

Date Description Dr.(Rs) Date Description Chq.No Cr.(Rs)

01 July Balance b/f 31 000 01 July Purchases 234533 12 000

03 July Cash 13 500 03 July Drawings 234534 12 400

12 July Cheque- Silva 6 700 10 July Salary 234535 12 000

14 July Cheque – Kasun 2 500 15 July Purchases 234536 5 600

28 July Cheque - Ruwan 9 400 24 July Rent 234537 3 200

Cheque – Sajith 4 500 31 July Balance c/f 26 900

30 July Cash 4 500

You are given the following bank statement of Gajaba Sons received for the month of July 2005

Date Description Dr. (Rs) Cr. (Rs) Balance (Rs)

01 July Balance 31 000

Cash 13 500 44 500

10 July 234535 12 000 32 500

12 July 234534 12 400 20 100

13 July Cheque – Silva 7 600 27 700

Bank charges 800 26 900

25 July 234537 3 200 23 700

28 July 345678 60 000 -36 300

Cheque – Ruwan 9 400 -26 900

Cheque – Sajith 4 500 -22 400

30 July Cash 4 500 -17 900

Interest 600 -18 500

You are required to prepare: -

a) An amended bank account as at 31st July 2005

b) A bank reconciliation statement as at 31st July 2005

Ex.11

You are given the following bank statement of Sisila Enterprise received for the month of May 2003

2003 Description Dr.(Rs). Cr.(Rs). Balance (Rs).

01 May Balance b/f 11 000

Cash 13 500 24 500

11 May 233335 1 200 23 300

12 May 233334 12 400 10 900

13 May Cheque – Perera 6 700 17 600

Bank charges 800 16 800

25 May 233337 3 200 13 600

28 May 444444 600 13 000

Cheque - Saman 4 900 17 900

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 10

Cheque – Sarath 5 400 23 300

30 May Cash 4 500 27 800

The bank account of Sisila Enterprise for the month of May 2003 as follows:

Date Description Dr.(Rs) Date Description Chq.No Cr.(Rs)

01 May Balance b/f 11 000 01 May Purchases 233333 12 000

03 May Cash 13 500 03 May Drawings 233334 12 400

13 May Cheque- Perera 6 700 Salary 233335 1 200

14 May Cheque – Cooray 2 500 15 May Purchases 233336 5 600

28 May Cheque – Saman 4 900 24 May Rent 233337 3 200

Cheque – Sarath 5 400 31 May Balance c/f 15 000

30 May Cash 5 400

49 400 49 400

You are required to: -

1. Prepare the amended bank account showing only the corrections/ adjustments before reconciling with

the bank balance

2. Prepare a bank reconciliation statement of Sisila Enterprise as at 31st May 2003

Ex.12

On 31st December 2006 the bank account of K.Thompson’s showed a balance of Rs.4 500. The bank statement as

at 31st December showed a credit balance of Rs.8 850 on the account. You checked the bank statement with the

bank account and found that the following had not been entered in the bank account.

a) A standing order to RB insurance Rs.600 had been paid by the bank

b) Bank interest receivable of Rs.720 had not been entered into the account

c) Bank charges of Rs.90 had been made

d) A credit transfer of Rs.780 from KB Ltd, had been paid direct into the account

e) Thompson’s deposit account balance of Rs.4 200 had been transferred into his bank current account

f) A returned cheque of Rs.210, dishonored by C.Hall, had been entered on the bank statement

You also found the two cheques, payable to L.Young Rs.750 and K.Clerk Rs.870, had been entered into the bank

account but had not been presented for payment. In addition a cheque for Rs.2070 had been paid into the bank on

31st December 2006 but had not been credited on the bank statement until 2nd January 2007.

Required:

a) Starting with the bank account debit balance of Rs.4 500, write the bank account up to date

b) Draw up a bank reconciliation statement as on 31st December 2006

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 11

Ex.13

The bank account of Kumara Ltd, showed a debit balance of Rs.52 000 on 31st March 2006, the bank statement

credit balance to this date was Rs.128 000

Subsequent examination revealed the following

i. Unpresented cheques issued to suppliers Rs.35 500 and Rs.17 500

ii. Standing order paid to traders association Rs.5 000

iii. Bank charges not appeared in the bank account Rs.1 500

iv. Deposited but not realized cheques Rs.12 000

v. Traders credit Rs.18 000 and Rs.31 000

vi. Cheque returned by the bank Rs.7 500

Prepare:

a) Adjusted bank account

b) Bank reconciliation statement for the month of March 2006 (A/L - 2006)

Ex.14

The bank account of Vasana Trading Co. showed a debit balance of Rs.14 000 and the bank statement showed a

credit balance of Rs.42 500 on 31.03.2007. Subsequent examination revealed the following

i. A cheque of Rs.14 500 deposited in the bank account on 30.03.2007 was not recorded in the bank

statement

ii. A cheque of Rs.50 000 has been directly deposited by a customer in the bank account on 25.03.2007. This

amount was not recorded in the bank account till 31.03.2007

iii. Cheques amounting to Rs.15 000 and Rs.20 000 issued to a supplier were not presented to the bank for

payment till the end of March.

iv. A cheque received from a customer for Rs.32 000 was deposited in the bank on 26.03.2007. This cheque

was dishonoured. However this dishonoured cheque was not recorded in the bank account till

31.03.2007.

v. Bank debit tax of Rs.500 and standing order payment for owners life insurance premium of Rs.9 500

appeared in the bank statement were not recorded in the bank account till 31.03.2007.

Required:

a) Record the relevant transactions in the bank account showing the adjusted bank balance on 31.03.2007

b) Prepare bank reconciliation statement for the month of March 2007

(A/L - 2007)

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 12

Ex.15

The bank book of a business showed a debit bank balance of Rs.20 000 as at 31.03.2012. On this date, the bank

statement showed an overdrawn balance of Rs.10 000. The subsequent investigation revealed the following

i. Cheques deposited in the bank amounting to Rs.80 000 have not been realized

ii. Cheques issued to suppliers for Rs.40 000 have not been presented to bank for payment

iii. Interest on fixed deposit of Rs.25 000 directly remitted to the bank has not been recorded in the bank

book

iv. A payment of Rs.5 000 made by the bank as insurance premium on a standing order has not been

recorded in the bank book

v. A cheque for Rs.10 000 deposited in the bank has been dishonoured, but no entry has been made in the

bank book.

Required:

a) Adjusted balance of bank book as at 31.03.2012

b) Bank reconciliation statement for the month of March 2012

(A/L - 2012)

Ex.16

The bank column of Crown Ltd, showed a credit balance of Rs.30 000 on 31.12.2007. However on this date the

bank statement showed a balance of Rs.18 000 O/D. The following were revealed at the subsequent examination

conducted by the accountant of the company.

i. A cheque of Rs.30 000 deposited with the bank has not yet realized

ii. A cheque of Rs.50 000 issued has not yet been presented for payment.

iii. An investment income of Rs.7 000 directly collected by the bank has not been recorded in the bank

account

iv. A payment of Rs.5 000 for insurance premium made on a standing order has not been recorded in the

bank account

v. A deposited cheque of Rs.10 000 has been dishonoured by the bank, but no entry has been made in the

bank account.

Required:-

a) Make required adjustment in the bank account of the company

b) Prepare the bank reconciliation statement as at 31.12.2007 after adjusting the bank book

(A/L - 2008)

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 13

Ex.17

The bank statement balance of Vindy High Tea Ltd., did not agree with the debit balance of Rs.107,000/- as per

bank column of the cash book as at 31st March 2016. At the same date bank statement has shown a favourable

balance of Rs.227,000/-.

The following reasons were revealed subsequently for the difference:

(1) The following issued cheques had not been presented for payment to the bank as at 31st March 2016:

Cheque No. Date Issued Amount Rs.

750298 25.03.2016 5,500 750307 28.03.2016 70,000 750136 30.03.2016 83,000

(2) The following cheque deposit was not realized during the month of March 2016:

Cheque No. Date Deposited Amount Rs. 345675 30.03.2016 25,000

(3) The bank had erroneously debited an amount of Rs.11,000/- to Vindy High Tea Ltd.’s bank account on 30th

March 2016.

(4) Bank charges of Rs.2,500/- for the month of March 2016 which was charged by bank has not been

recorded in the Cash Book. You are required to,

Prepare the following for Vindy High Tea Ltd.:

(a) Adjusted Cash Book as at 31st March 2016. (b) Bank Reconciliation Statement as at 31st March 2016.

Ex.18

As at 31st March 2015, cash book of Perfect (Pvt) Ltd. shows a debit bank balance of Rs.156,400/- which is

different from the bank statement balance.

Examination of the records revealed the following reasons for the said difference;

(1) The bank has charged bank charges of Rs.3,000/-.

(2) Cheque book charges erroneously charged by the bank is Rs.750/-.

(3) Direct deposit of Rs.10,000/- into the bank account by a customer has not been recorded in the cash book.

(4) Following deposited cheques were not realized during the month: No. 750121 : Rs. 25,000/- No. 141510 : Rs.

110,000/-

(5) Following issued cheques were not presented for payments: No. 500221 : Rs.65,000/- No. 500300 : Rs.27,000/-

You are required to:

Prepare the Bank Reconciliation Statement and identify the balance that appeared in the bank statement as at

31st March 2015.

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 14

Ex.19

The bank statement of Charm Cakes Ltd. as at 31st December 2016 showed an overdraft balance of Rs.53,029/-,

while the cash book of the company showed a debit balance of Rs.15,274/-. The following reasons were identified

for the difference:

(1) The following cheques deposited have not been realized by 31st December 2016:

Cheque No. Date of Deposit Amount (Rs.)

321154 28.12.2016 156,200

265471 31.12.2016 24,675

(2) The following cheques issued by the company have not been presented for payments by 31st December 2016:

Cheque No. Date of Issued Amount (Rs.)

628734 25.12.2016 3,274

628742 28.12.2016 115,248

(3) The book-keeper has erroneously entered the value of the issued cheque number 628730 as Rs.69,745/- in the

cash book, whereas the correct value of the cheque was Rs.67,945/-.

(4) The bank has charged cheque book charges of Rs.2,500/- on 31st December 2016, which was not recorded in

the cash book.

(5) The bank has erroneously credited an amount of Rs.5,250/- to the bank account of Charm Cakes Ltd. on 31st

December 2016.

You are required to: Prepare the following for Charm Cakes Ltd.:

(a) Adjusted cash book as at 31st December 2016.

(b) Bank Reconciliation Statement as at 31st December 2016.

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 15

Starting with bank statement balance (Debit or Credit)

Unrealized (+)

Unpresented (-)

Ex.20

From the following particulars, prepare the adjusted bank account and bank reconciliation statement of

Mahendran Ltd. As at 31st December 1990

i. Overdraft as at 31st December 1990, as per bank statement was Rs.15 400

ii. Five cheques of Rs.6 400, Rs.8 900, Rs.498, Rs.780, and Rs.3 260 issued to creditors during the last

week of December were not appearing in the bank statement

iii. A cheque received and recorded in the bank column account but not realized in the bank during

month of December Rs.6 500

iv. Bank charges pf Rs.8 and interest recovered by the bank Rs.3 450 were not entered in the bank

account

v. Dividend Rs.40 450 collected by the bank on behalf of Mahendran Ltd, was not entered in the bank

account

vi. A cheque for Rs.99 deposited in the bank on 20th December and appearing in the bank statement was

not entered in the bank account

vii. The cheques of Rs.2 400, Rs.545 and Rs.769 were deposited in the bank on 27 th December, but were

cleared on 10th of January.

(A/L - 1991)

Ex.21

At the close of business on 31st December 2007 Sahan Perera’s bank statement showed a balance of Rs.2 460

which did not agree with his bank account account due to the following reasons: -

i. Cheques issued but not presented: Beauty Rs.330, Kamal Rs.475, Ashini Rs.76

ii. Amounts paid on 28th December not credited by the bank Rs.370

iii. Traders credit transfers not entered in the bank account: Judo Rs.51, Ludo Rs.320

iv. A standing order for Rs.101 subscription to a trade association had been paid by the bank and bank

charges of Rs.80 not entered in the bank account

Required: -

1. Prepare a bank reconciliation statement as at 31st December showing the calculation of the correct

balance

2. Show the bank account entries, working back to the original balance on 31st December 2007

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 16

Ex.22

A company bank statement shows a favorable balance of Rs.30 100 as at 31.03.2001

The statement includes bank charges of Rs.50 and direct deposit of Rs.1 000 from customer, which have not yet

been recorded in the cash book.

This statement does not include a cheque issued to a creditor amounting to Rs.700 and a cheque deposited

amounting to Rs.1 500 received from a debtor

Required: -

1. Prepare a bank reconciliation statement as at 31.03.2001 showing the calculation of the correct balance

2. Show the bank account entries, working back to the original balance on 31.03.2001

Ex.23

The bank statement of a business showed a credit balance of Rs.3 000 as at 31.02.2010. The following information

was revealed when reconciling the bank book balance with the bank statement balance as of that date

i. Cheques deposited amunting to Rs.80 000 has not been realized

ii. A cheque issued to a supplier for Rs.30 000 has not been presented to the bank

iii. Bank charges of Rs.500 and standing order payment of Rs.1 500 for rent as per bank statement have

not been recorded to the bank book

iv. No entry has been made in the bank book with respect to a cheque amounting to Rs.20 000 returned

by the bank. This cheque had been received from a debtor and deposited in the bank

Required: -

1. Bank reconciliation statement

2. The balance of cash book as at 31st March 2010 before making necessary adjustments

3. Journal entry to record the dishonoured cheque

(A/L - 2010)

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 17

Adjustments which are not related to the current period

When there are cheques which are not related to the current period, the following steps are to be followed.

1. All unrealized and unpresented cheques which relates to the previous time period are now realized or

presented do not take take to the accounts

2. Any previous dated cheque dishonoured or expired enter to the current period amended bank account

3. All brought forward unrealized and unpresented cheques that belong to the previous time period should

be taken into consideration when preparing the bank reconciliation statement

Ex.24

Information given below relates to Kalyani Ltd.

i. Bank statement for the month of March 2000

Date Particulars Dr. Cr. Balance

Rs. Rs. Rs.

01/03 Balance 15 000

02/03 Cheques 8 000 23 000

05/03 Cash 20 000 43 000

18/03 Cheque – 532451 6 000

Cheque – 532456 19 000 18 000

24/03 Dividends 2 000 20 000

25/03 Cheque 4 000 24 000

26/03 Standing order 4 000 20 000

27/03 Cheques 3 000 23 000

31/03 Cheque Return 3 000 20 000

ii. Out of cheques issued in February 2000, cheques (Nos. 532451 and 532455) for Rs.6 000 and Rs.8 000

respectively had not been presented for payment as at March 1, 2000

iii. The bank balance as per bank account as at 31st March 2000, stood at Rs.12 000 before accounting

for dividends, standing order and cheque return

iv. Out of the cheques issued during the month, the cheque no.532457 for Rs.7 000 has not been

presented for payment as at March 31

v. The cheque for Rs.2 000 deposited during the month has not been realized as at March 31.

Required: -

1. Adjust the bank account as at 31st March 2000

2. With the use of adjusted bank balance, prepare the Bank Reconciliation Statement for the month of

March 2000

(A/L – 2000)

Ex.25

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 18

Bank statement and the bank account of Liyanage and Co. Ltd. As at 28 th February 2003, is given below.

1. Bank reconciliation statement as at 28th February 2003.

Rs.

Balance as per bank statement (Cr) 9 800

(+) Cheque deposited but not credited 1 500

11 300

(-) Cheque issued but not presented

Chq.No. 056 1 275

Chq.No.059 1 500 (2 775)

Balance as per bank account (Dr) 8 525

2.

Bank Account

Date Description Amount Date Description Amount

1993 Rs. 1993 Rs.

01/03 b/b/f 8 525 05/03 Purchase 063 5 600

03/03 Upul 2 500 08/03 Mohan 064 3 860

Lakmini 1 750 15/03 Wages 065 3 200

Cash deposit 3 700 18/03 Rent (std. order) 2 500

08/03 Cash deposit 7 800 20/03 Baratha 066 1 750

14/03 Kapila 1 600 23/03 Petty cash 067 1 000

18/03 Dayananda 1 800 25/03 Purchase 068 18 500

Wilson 3 100 30/03 Advertising 069 2 800

28/03 Perera 14 100

b/c/d 5 665

44 875 44 875

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 19

3.

Bank Statement

Date Description Dr. Cr. Balance

Rs. Rs. Rs.

Feb.28 Balance 9 800

Mar.01 Cheque 1 500 11 300

03 Cash 3 700 15 000

08 063 5 600 9 400

Cheque 1 750 11 150

Cash 7 800 18 950

10 059 1 500 17 450

064 3 860 13 590

15 Cheque 1 600 15 190

16 065 3 200 11 990

18 Standing order 2 500 9 490

20 Cheque 1 800 11 290

Returned cheque 1 810 9 480

25 067 1 000 8 480

28 068 18 500 10 020 O/D

Dividends 2 000 8 020 O/D

Cheque 1 300 6 720 O/D

30 Bank charges 350 7 070 O/D

31 b/b/f 7070 O/D

Additional information: -

1. The cheque received from Wilson on 16th March 2003 was Rs.1 300 not Rs.3 100

2. The cheque received from Dayananda was returned and the bank charged Rs.10 to send the cheque to

the business

Required: -

1. Do the necessary adjustments to amend the bank account

2. By using the amended cash book balance prepare the Bank Reconciliation Statement as at 31 st March

2003.

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 20

Ex.26

By using the following bank statement and bank account, prepare the adjusted bank account and bank

reconciliation statement.

Date Description Dr. Cr. Balance

Rs. Rs. Rs.

Feb.28 B/b/f 9 000

Mar.03 1024 1 600 7 400

03 Cheque 1 000 8 400

05 1025 2 000 6 400

05 1023 2 000 4 400

06 Cheque 6 400 10 800

10 Cheque 1 000 11 800

14 1026 4 400 7 400

20 1027 2 600 4 800

20 Cheque 7 400 12 200

28 1028 3 600 8 600

28 Dividends 8 000 16 600

30 Cheque book 50 16 550

30 Bank charges 100 16 450

Bank Account

2008 Particulars Bank 2008 Particulars Cheque Bank

March Column March No. Column

Rs. Rs.

01 b/b/f 8 000 03 Cash 1024 1 600

04 Mahadeva 6 400 05 Drawings 1025 2 000

08 Dharmadasa 1 000 10 Kulasekara 1026 4 400

18 Nanayakkara 7 400 15 Sirimal 1027 2 600

21 Dayananda 2 800 28 cash 1028 3 600

28 Athukorala 200 29 Manoharan 1029 3 800

30 Karunaratne 400 30 Salaries 1030 3 400

30 Stationeries 1031 400

31 b/c/d 4 400

26 200 26 200

April 01 4 400

Additional Information: -

Unpresented Cheques Rs.2 000

Unrealized Cheques Rs.1 000

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 21

Ex.27

The following information relates to Thisara Ltd.

1. Items appeared in the bank reconciliation statement for the month of June 2009

Cheques issued but not presented for payment

Cheque No. Payee Amount (Rs).

100100 Saliya 2 000

100110 Sunimal 5 000

Cheques deposited but not realized

Cheque No. Payee Amount (Rs).

456371 Sarath 2 000

900200 Sunill 6 000

2. The bank account of the business for the month of July 2009

Date Description Dr. (Rs) Date Description Cr. (Rs).

01/07 b/b/f 3 000 06/07 Thilak chq.No 800

100120

02/07 Nimal Chq.No 124500 5 000 20/07 Saliya chq.no 3 000

100121

04/07 Lal chq. No 840222 1 000 30/07 Silva Chq.No 100122 200

08/07 Allen Ch.No 750200 1 200 30/07 Senath chq.no 2 000

100125

12/07 Sarath Ch.No. 500500 1 800 31/07 Insurance premium 5 000

12/07 Cash 5 000

20/07 Ranjan Chq.No 10 000 31/07 Balance C/F 16000

123456

27 000 27 000

3. An extract of the bank statement for the month of July 2009 was as follows

Date Description Dr. (Rs). Cr.(Rs). Balance (Rs).

01/07 b/f 2 000

02/07 Cheque 124500 5 000 7 000

03/07 100110 5 000 2 000

04/07 Cheque 900200 6 000 8 000

06/07 Cheque 840222 1 000 9 000

06/07 Returns 840222 1 000 8 000

18/07 Cheque 750200 1 200 9 200

10/07 100120 800 8 400

22/07 100121 3 000 5 400

30/07 Cash deposit 5 000 10 400

31/07 Ranjan 10 000 20 400

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 22

31/07 Standing order - insurance 5 000 15 400

31/07 Bank charges 400 15 000

Required:-

1. The cash at bank balance of Thisara Ltd, to be shown in the Balance sheet as at 31.07.2009

2. List the following separately as at 31.07.2009

a) The cheque issued but not presented

b) The cheque deposited but not realized

Ex.28

The following information is extracted from the books of Recon Traders:

(1) Bank Reconciliation Statement as at 30th April 2018

Balance as per Cash Control Account (cash book) as at 30th April 2018 15,200

Add: Cheques issued but not presented for payments:

265975 12,300

265985 15,350 27,650

Less: Unrealized deposits:

Cheque deposit 257461 (65,000)

Balance as per Bank Statement as at 30th April 2018 (22,150)

(2) On 31st May 2018, the bank has deducted cheque book charges of Rs.3,500/- and this was not recorded in the

cash book.

(3) The following issued cheques were not presented to the bank by 31st May 2018

Cheque No. Date of Issue Amount, Rs.

265975 15.04.2018 12,300

266105 15.05.2018 3,200

266115 31.05.2018 60,000

(4) All the unrealized deposits as at 30th April 2018 have been realized during the month of May 2018.

(5) On 29th May 2018, the bank has erroneously debited an amount of Rs.13,200/- to Recon Trader’s bank

account.

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 23

(6) The following cheque which has been deposited to the bank account by the company on 27th May 2018 has

not been realized by 31st May 2018: Cheque No. 452122 Rs.25,000

(7) The debit balance (favorable balance) of cash control account (cash book) as at 31st May 2018 was

Rs.49,000/-.

Prepare the following:

(a) The Adjusted Cash Control Account (cash book) as at 31st May 2018.

(b) The Bank Reconciliation Statement as at 31st May 2018.

Ex.29

The Bank Reconciliation Statement as at 28th February 2017 of Siva (Pvt) Ltd. was as follows:

Balance as per Cash Book as at 28th February 2017 (12,300)

Add: Cheques issued but not presented for payments:

No. 251371 12,000

No. 251372

13,200 25,200

Less: Cheques deposited but not realized No. 265971 (50,000)

Balance as per bank statement (overdraft) as at 28th February 2017 (37,100)

The following information is also provided for the month of March 2017:

(1) As per the bank statement for March 2017, the bank has deducted cheque book charges of Rs.3,000/- which

was not recorded in the cash book.

(2) The following cheques which were issued during the month of March 2017 were not presented for payments

by 31st March 2017:

Cheque No. Date of Cheque Amount

251433 27.03.2017 4,500

251439 31.03.2017 12,890

(3) The following cheque deposited during the month of March 2017 has not been realized by 31st March 2017:

Cheque No. Date of Cheque Amount (Rs.)

452316 30.03.2017 12,200

(4) The unrealized deposit of Rs.50,000/- which was included in the bank reconciliation as at 28th February 2017

has been realized during the month of March 2017.

(5) The following cheque which was issued during the month of February 2017 remained unpresented as at 31st

March 2017:

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 24

Cheque No. Date of Cheque Amount (Rs.)

251372 17.02.2017 13,200

(6) Favorable balance of the bank column as per the cash book of Siva (Pvt) Ltd. as at 31st March 2017 was

Rs.107,000/-.

You are required to: Prepare the following:

(a) The adjusted Cash Book as at 31st March 2017. (b) The Bank Reconciliation Statement as at 31st March

2017.

Ex.30

The bank column of the cash book, the bank statement for the month of September 2015 and the bank

reconciliation statement prepared as at 31st August 2015 of Hi-Fi (Pvt) Ltd. are as follows:

Hi-Fi (Pvt) Ltd. Cash Book (Bank Column) for the month of September 2015

Date Description Dr (Rs.) Cr (Rs.) Balance (Rs.)

01/09/2015 Balance (375,050)

02/09/2015 Cash deposit 425,500 50,450

05/09/2015 Creditor payment 750131 38,000 12,450

10/09/2015 VAT payment 750132 125,200 (112,750)

12/09/2015 Creditor payment 750133 73,350 (186,100)

15/09/2015 Rent Payment 750134 50,700 (236,800)

15/09/2015 Cash Deposit 120,000 (116,800)

18/09/2015 Debtor Deposit 123,000 6,200

18/09/2015 Cash Deposit 254,000 260,200

21/09/2015 Maintenance 750135 12,000 248,200

Payment

21/09/2015 Creditor Payment 750136 83,000 165,200

25/09/2015 Salaries Direct 223,000 (57,800)

Transfer

30/09/2015 Cheque Deposit 123456 50,000 (7,800)

30/09/2015 Balance (7,800)

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 25

Hi-Fi (Pvt) Ltd. Bank Statement for the month of September 2015

Date Description Dr (Rs.) Cr (Rs.) Balance (Rs.)

01/09/2015 Balance - - (172,550)

01/09/2015 Cheque deposit 148350 - 50,000 (122,550)

01/09/2015 Cheque payment 750128 125,000 (247,550)

02/09/2015 Cash deposit 425,500 177,950

11/09/2015 Cheque payment 750132 125,200 52,750

15/09/2015 Cash deposit 120,000 172,750

18/09/2015 Direct deposit Ref. 12465974 123,000 295,750

18/09/2015 Cash deposit 254,000 549,750

22/09/2015 Cheque payment 750135 12,000 537,750

23/09/2015 Direct deposit Ref. 26487582 93,000 630,750

23/09/2015 Cheque payment 750131 38,000 592,750

25/09/2015 Transfer Ref. 32648751 223,000 369,750

30/09/2015 Standing order Loan no. 62587413 57,000 312,750

30/09/2015 Overdraft interest & 2,500 310,250

charges.

30/09/2015 Cheque payment 750133 73,350 236,900

30/09/2015 Cheque payment 750134 50,700 186,200

30/09/2015 Balance 186,200

Hi-Fi (Pvt) Ltd.

Bank Reconciliation Statement as at 31st August 2015

Rs. Rs.

Balance as per Cash Book [Adjusted] 31-08-2015 (Overdraft) (375,050)

Add: Unpresented Cheques:

750120 127,500

750128 125,000 252,500

Less: Unrealized Deposits:

148350 (50,000)

Balance as per Bank Statement 31-08-2015 (Overdraft) (172,550)

You are required to,

Prepare the following:

a. The Adjusted Cash Book for the month of September 2015.

b. The Bank Reconciliation Statement as at 30th September 2015.

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 26

BRS MCQS

1. An entity carries out all transactions through a bank account. Its monthly bank statement showed a credit

balance of Rs 270000/= as at 31.01.2012. on this date,cheques deposited but not realized and cheques issued but

not presented for payment were Rs 85000/= and Rs 45000/= respectively. The bank balance (debit) in the books of

the entity as at

31.01.2012 is,

a) Rs 225000

b) Rs 230000

c) Rs 270000

d) Rs 310000

e) Rs 355000

(A/L 2012)

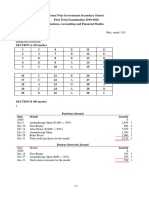

The summary of cheques deposited and issued during the month of march and February 2013 is as follows,

March 2013 February 2013

Description (000) (000)

Cheques deposited in the

bank 1000 900

Cheques issued 750 600

Following informations is also given,

As at As at 28.02.2013

Description 31.03.2013

Deposited cheques issued 750 900

Cheques presented for

payment 600 500

Interest income received by

the bank directly - 50

Bank charges 10 05

Bank account balance (before

adjusting for

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 27

interest income and bank 395 100

charges)

Balance as per bank

statement ? 245

Cheques unpresented for payment during the month of February have been presented in march.

1. What is the adjusted balance of the bank account as at 28.02.2013?

a) Rs 145000 c) Rs 200000 e) Rs 345000

b) Rs 190000 d) Rs 290000

2. What is the balance of the bank statement as at 31.03.2013

a. Rs 245000 c) Rs 295000 e)Rs 395000

b. Rs 285000 d) Rs 385000 (A/L 2013)

A business carries out all its transactions through a bank current account.

A summary of the cash transactions as per books of account for the month of March 2017;

DESCRIPTION RS ‘000’

Cash balance as at 01.03.2017 100

Total of cash receipts journal as at 31.03.2017 1200

Total of cash payments journal as at 31.03.2017 900

A summary of bank statement for the month of March 2017 received on 04.04.2017

DESCRIPTION RS ‘000’

Balance as at 01.03.2017 100

Cheques realized 1000

Cheques paid 750

Fixed deposit interest credited directly 200

Standing order payments 50

Fixed deposit interest and standing order payments are recorded in the books after receiving the bank statement.

There were no unrealized or unpresented cheques as at 31.03.2017

3. What is the adjusted balance of the cash account of the business as at 31.03.2017

a. Rs 300000 c) Rs 400000 e) Rs 550000

b. Rs 350000 d) Rs 500000

4. Which of the following statements are correct with respect to cash transactions of this business for the

month of March 2017,

A. The total cash receipts for the month of March 2017 were Rs 1400000

B. The total of cash payments for the month of March 2017 were Rs 950000

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 28

C. The unrealized cheques as at 31.03.2017 were Rs 200000

D. The unpresented cheques as at 31.03.2017 were Rs 150000

a. A and B only c) B and D only e) All A,B,C and D

b. A and C only d) C and D only

( A/L 2017)

5. A bank balance of a company as at 31.03.2016 was Rs 450000. It did not agree with the bank statement

balance on this date. The following were revealed in reconciling these balances,

A debtor has directly deposited a cheque of Rs 80000 in the bank

Standing order payments made by the bank was Rs 40000

A cheque of Rs 60000 deposited in the bank has been dishonoured

A cheque of Rs 20000 deposited in the bank has not yet been realized

Cheques issued for Rs 30000 have not yet been presented for payment

Calcualte the following as at 31.03.2016,

a. Adjusted bank balance?

b. Bank statement balance? (A/L 2016)

6. The balance of the bank account of a business as at 31.03.2015 was higher than the balance that

appeared in its bank statement. .

(Assume there were no errors either in the bank account of the business or in the bank statement)

State two possible reasons for this difference? (A/L 2015)

7. The bank account balance of a firm as at 31.03.2014 was Rs 680000. However, it did not agree with the

balance of the bank statement on the same date. The following are the reasons for this difference,

A standing order payment of Rs 10000 has not been recorded in the books.

A cheque of Rs 40000 deposited in the bank has not been realized

What is the balance as per bank statement as at 31.03.2014?

What is the bank balance to be stated in the statement of financial position as at 31.03.2014?

( A/L 2014)

M. Shafee Ibrahim Advanced Level – Accounting Theory

Bank Reconciliation Statement | 29

M. Shafee Ibrahim Advanced Level – Accounting Theory

You might also like

- Class Exercise Bank Recon (1) .Document2 pagesClass Exercise Bank Recon (1) .annahkaupaNo ratings yet

- Cash Book NotesDocument4 pagesCash Book NotesJoRaccoonaNo ratings yet

- Reconciliation StatementsDocument26 pagesReconciliation StatementsPetrinaNo ratings yet

- Books of Prime Entry: The Cash BookDocument11 pagesBooks of Prime Entry: The Cash Bookأحمد عبد الحميدNo ratings yet

- Bank Reconciliation IntroductionDocument7 pagesBank Reconciliation IntroductionLesego HlezaNo ratings yet

- Bank Reconciliation Statement - Docx QueDocument5 pagesBank Reconciliation Statement - Docx QueannahkaupaNo ratings yet

- STMT - Ent - Book - Vista - 2022-03-16T084221.580Document1 pageSTMT - Ent - Book - Vista - 2022-03-16T084221.580Wadda ChelseaNo ratings yet

- UTS MM Herbert Ray Prasety 197007089 AkutansiDocument23 pagesUTS MM Herbert Ray Prasety 197007089 Akutansihrp0603No ratings yet

- Assignment Individual - Cuac111Document6 pagesAssignment Individual - Cuac111shiloh chipendoNo ratings yet

- Bank Recon-4Document11 pagesBank Recon-4HassleBustNo ratings yet

- Chap05 Balancing-Off AccountsDocument9 pagesChap05 Balancing-Off AccountsLinh Le Thi ThuyNo ratings yet

- Income Statements: Making Adjustments: DR Electricity Account CRDocument2 pagesIncome Statements: Making Adjustments: DR Electricity Account CRSCRIBDerNo ratings yet

- CCP402Document19 pagesCCP402api-3849444No ratings yet

- Bank Reconciliation Statements: Advanced LevelDocument5 pagesBank Reconciliation Statements: Advanced LevelAdil Khan LodhiNo ratings yet

- BookDocument9 pagesBookcheesesiz yumNo ratings yet

- 01+individual+activity+ Sweet+sweets +memoDocument2 pages01+individual+activity+ Sweet+sweets +memondzalo050822No ratings yet

- Chapter 7 Correction of Errors (II) TestDocument6 pagesChapter 7 Correction of Errors (II) Test陳韋佳No ratings yet

- Assignment 3 Apple BlossomDocument21 pagesAssignment 3 Apple BlossomMonica NainggolanNo ratings yet

- Acc 103 - Day 23 - SasDocument3 pagesAcc 103 - Day 23 - Sasfecamacho53No ratings yet

- Review Questions Volume 1 - Chapter 30Document2 pagesReview Questions Volume 1 - Chapter 30YelenochkaNo ratings yet

- InstructionsDocument8 pagesInstructionsPhuong ThuyNo ratings yet

- PDF Kunci Jawab Tahap 3 PD Angkasa - CompressDocument19 pagesPDF Kunci Jawab Tahap 3 PD Angkasa - CompressCandra Pramula PinanditaNo ratings yet

- Bank Reconciliations - 1Document9 pagesBank Reconciliations - 1ZAKAYO NJONYNo ratings yet

- Bank RecDocument24 pagesBank RecbillNo ratings yet

- Closing Entries Activity - SolutionDocument2 pagesClosing Entries Activity - Solution최성우No ratings yet

- Online StatementDocument2 pagesOnline StatementLong Lee100% (1)

- Tutorial 1week 11Document2 pagesTutorial 1week 11Lawrence Mirie MudakuvakaNo ratings yet

- Case Study Acct MGT - ACCT 102 - FinalDocument5 pagesCase Study Acct MGT - ACCT 102 - FinalbrightsparksintlNo ratings yet

- Companies GL 2021 MemoDocument4 pagesCompanies GL 2021 MemoJayden KaydrnNo ratings yet

- 2023 Grade 11 Written Report MGDocument5 pages2023 Grade 11 Written Report MGfiercestallionofficial0% (2)

- Ud Wirastri: General LedgerDocument26 pagesUd Wirastri: General LedgerRay GhuNo ratings yet

- GR 10 Accounting P2 (English) November 2022 Question PaperDocument10 pagesGR 10 Accounting P2 (English) November 2022 Question PaperspbdinkebogileNo ratings yet

- Accounting-A1 ST10028294 NsitholeDocument7 pagesAccounting-A1 ST10028294 NsitholeBuhlebendalo MsizaNo ratings yet

- statementကာာမDocument2 pagesstatementကာာမfootballitt71No ratings yet

- Bank Reconciliations MemoDocument15 pagesBank Reconciliations Memolindort00No ratings yet

- Irfan Fauzan Tugas 3Document25 pagesIrfan Fauzan Tugas 315 - Irfan Fauzan100% (1)

- Acc Section 7a - Bank ReconDocument9 pagesAcc Section 7a - Bank ReconJae-Moy KeymistNo ratings yet

- Topic 7 - Cash Management and Control Lecture Illustrations: Pampered Pets Bank Reconciliation Statement, 31 MayDocument4 pagesTopic 7 - Cash Management and Control Lecture Illustrations: Pampered Pets Bank Reconciliation Statement, 31 MayMitchell BylartNo ratings yet

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 AnswersAhmed Zeeshan100% (22)

- Nuqui - Quiz On Special JournalsDocument25 pagesNuqui - Quiz On Special JournalsJesther NuquiNo ratings yet

- Controlled Test GR11 MG 13 April 2021Document6 pagesControlled Test GR11 MG 13 April 2021fatimah WajoodeenNo ratings yet

- Financial Accounting Assisgnment 1.2021Document9 pagesFinancial Accounting Assisgnment 1.2021Mudada Trevor IINo ratings yet

- June Grade 10 Marking Guideline PDFDocument7 pagesJune Grade 10 Marking Guideline PDFBasetsana MakuaNo ratings yet

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 Answersalya mahaputriNo ratings yet

- Financial SupportDocument4 pagesFinancial SupportgloriousconsultantsandagencycoNo ratings yet

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- 08-21-10 HW01 (Page294-Exercise 7-1&7-2)Document2 pages08-21-10 HW01 (Page294-Exercise 7-1&7-2)Seng Sopheak100% (1)

- Your Statement: Smart AccessDocument16 pagesYour Statement: Smart AccessDanielWildSheepZaninNo ratings yet

- Grade 8 EMS Excercise MemoDocument13 pagesGrade 8 EMS Excercise MemoElon RuskNo ratings yet

- Bank Statement CommonweathDocument1 pageBank Statement CommonweathTuma NiceNo ratings yet

- Grade 10 Provincial Exam Accounting June 2017 Answer Book - 050243Document9 pagesGrade 10 Provincial Exam Accounting June 2017 Answer Book - 050243hobyanevisionNo ratings yet

- Ac108 May2017Document5 pagesAc108 May2017Sahid Afrid AnwahNo ratings yet

- Bank Reconciliation AssignmentDocument2 pagesBank Reconciliation AssignmentOckouri BarnesNo ratings yet

- 2019-20 S5 BAFS 1st Term Exam AnsDocument7 pages2019-20 S5 BAFS 1st Term Exam AnsJay TangNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Worksheet8 1Document3 pagesWorksheet8 1RealGenius (Carl)No ratings yet

- BRS 1Document24 pagesBRS 1JishnuPatilNo ratings yet

- Banking and FinanceDocument9 pagesBanking and FinanceCRITICAL GAMERNo ratings yet

- IGCSE Economics (Summary Updated)Document91 pagesIGCSE Economics (Summary Updated)CRITICAL GAMERNo ratings yet

- November 2023 Int Gcse FinalDocument18 pagesNovember 2023 Int Gcse FinalCRITICAL GAMERNo ratings yet

- BankingDocument10 pagesBankingCRITICAL GAMERNo ratings yet

- Unit-1 Chain of ProductionDocument7 pagesUnit-1 Chain of ProductionCRITICAL GAMERNo ratings yet

- Quadratics New1Document10 pagesQuadratics New1CRITICAL GAMERNo ratings yet

- November 2023 Int Gcse FinalDocument1 pageNovember 2023 Int Gcse FinalCRITICAL GAMERNo ratings yet

- AccountingF2 February 5th 2023 Monthly ExamDocument4 pagesAccountingF2 February 5th 2023 Monthly ExamCRITICAL GAMERNo ratings yet

- SOFTWARE TuteDocument6 pagesSOFTWARE TuteCRITICAL GAMERNo ratings yet

- Memory and Processor TuteDocument5 pagesMemory and Processor TuteCRITICAL GAMERNo ratings yet

- Accounting MockDocument6 pagesAccounting MockCRITICAL GAMERNo ratings yet

- Different Types of PrintersDocument4 pagesDifferent Types of PrintersCRITICAL GAMERNo ratings yet

- Firm 10409Document139 pagesFirm 10409Todd VseteckaNo ratings yet

- Advertising Planning & StrategyDocument29 pagesAdvertising Planning & StrategyMALAY KUMARNo ratings yet

- Lec 5 WH MGTDocument23 pagesLec 5 WH MGTShahriat Sakib DhruboNo ratings yet

- Chapter 2Document12 pagesChapter 2Nurul Islam SojibNo ratings yet

- Coca ColaDocument18 pagesCoca Colapradeepan sivayogalingamNo ratings yet

- Primark and J CrewDocument15 pagesPrimark and J CrewASTHA AKRITINo ratings yet

- PT. Makmur Berkat Solusi: Company Profile 2020Document19 pagesPT. Makmur Berkat Solusi: Company Profile 2020Dea Candra Ivana PutriNo ratings yet

- Technical Communication A Practical Approach 8th Edition Pfeiffer Test BankDocument5 pagesTechnical Communication A Practical Approach 8th Edition Pfeiffer Test BankMatthewBaileypnmig100% (16)

- What Is Maintenance?: The Objective of Plant MaintenanceDocument4 pagesWhat Is Maintenance?: The Objective of Plant MaintenanceabdullahNo ratings yet

- Book 1Document2 pagesBook 1Laika DuradaNo ratings yet

- InvoiceDocument1 pageInvoiceIslamic PrincessNo ratings yet

- Executive Summary: The ConceptDocument8 pagesExecutive Summary: The Conceptcamile buhanginNo ratings yet

- Wipo Pub Gii 2021Document226 pagesWipo Pub Gii 2021AK Aru ShettyNo ratings yet

- Demand Forecasting Model Dengan Pendekat D8d035e2Document14 pagesDemand Forecasting Model Dengan Pendekat D8d035e2Tari Wahyuni LubisNo ratings yet

- Amul Vs Mother Diary - PDFDocument52 pagesAmul Vs Mother Diary - PDFrohit katkarNo ratings yet

- Iia Australia White Paper Fraud IndicatorsDocument12 pagesIia Australia White Paper Fraud IndicatorsWajdi Alissawi100% (1)

- Complete Digital Surgeons - Project Report 1Document16 pagesComplete Digital Surgeons - Project Report 1raviNo ratings yet

- Social Media A Critical Introduction (Christian Fuchs) (Z-Lib - Org) - 134-160Document27 pagesSocial Media A Critical Introduction (Christian Fuchs) (Z-Lib - Org) - 134-160Ebit Eko BachtiarNo ratings yet

- Task 2: Airbnb and It's Turnaround Strategy During PandemicDocument2 pagesTask 2: Airbnb and It's Turnaround Strategy During PandemicKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- Us Digital Gambling Halftime Report August 2023Document34 pagesUs Digital Gambling Halftime Report August 2023Antonius VincentNo ratings yet

- EmperadorDocument2 pagesEmperadorRena Jocelle NalzaroNo ratings yet

- New - Delhi SouvenirDocument52 pagesNew - Delhi SouvenirDavid ThomasNo ratings yet

- DL101 Module4 Trademarks PDFDocument43 pagesDL101 Module4 Trademarks PDFAbhishek ShahNo ratings yet

- Online Training Calendar October - December 2021: Sitrain - Digital Industry AcademyDocument3 pagesOnline Training Calendar October - December 2021: Sitrain - Digital Industry AcademyCandrá WardayaNo ratings yet

- Carmix Auto Spares (T) LTDDocument7 pagesCarmix Auto Spares (T) LTDSalim Abdulrahim BafadhilNo ratings yet

- Multinational Corporation Curse or BoonDocument38 pagesMultinational Corporation Curse or BoonShubhangi GhadgeNo ratings yet

- Leave Summary-VapDocument1 pageLeave Summary-VapSuresh MeenaNo ratings yet

- GlobalizationDocument4 pagesGlobalizationMark MorongeNo ratings yet

- 1 - SPA Hongkong 3 ASI (印尼马鲁古)25 Nov 2021Document17 pages1 - SPA Hongkong 3 ASI (印尼马鲁古)25 Nov 2021budiNo ratings yet

- Com643a SCM CRM Unit 3Document37 pagesCom643a SCM CRM Unit 3Thanmay B.SNo ratings yet

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)