Professional Documents

Culture Documents

Prudential Assurance Malaysia Berhad

Uploaded by

Swa Joanne ChanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prudential Assurance Malaysia Berhad

Uploaded by

Swa Joanne ChanCopyright:

Available Formats

To : CHAN PEI HOON SWB00001

KUCHING OFFICE

Policy No. : 31140433

Name of Assured : LEE KWANG YAW

NOTIFICATION OF REPLACEMENT OF POLICY

We would like to advise that the above policy falls under Replacement of Policy (ROP) status. The assured has

an existing policy/policies with either Reduction of Premium/Automatic Premium Loan (APL)/Paid-Up/Lapsed/

APL Lapsed/Surrendered/ Outstanding of Premium within 12 months before or after a new policy/rider is

effected.

Please find attached a summary of the benefits comparison between the existing and new policy/rider. Please

discuss this matter with the Assured and submit the duly signed ROP reply slip to us within 14 days from the

letter issuance date. This will create awareness of the disadvantages of replacing the existing policy/policies.

Should you have any enquiries or require further clarification, please do not hesitate to email us at:

E-mail : conservation.unit@prudential.com.my

Thank you.

CONSERVATION UNIT

PRUDENTIAL ASSURANCE MALAYSIA BERHAD (107655-U)

[Note : This is a computer generated document and does not require a signature]

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 1 of 8

Date : 06-11-2022

Ref : ILCEBRN_0017_001

LEE KWANG YAW

NO 11, TASMAN SUNVALLEY

JLN BAMPFYLDE

93200 KUCHING SARAWAK

Dear Sir / Madam,

REPLACEMENT OF POLICY

Life Assured LEE KWANG YAW

Policy No. (New Policy/New Rider) 31140433

Type of Policy PRUWith You

Existing Policy No. 00792561

Type of Policy PRUWith You

Policy Status LAPSED

Thank you for purchasing the above new policy/rider from us.

However, we noted that your existing policy has lapsed within the 12 months before or after the purchase of

the new policy/rider.

It may not be in your best interests to allow your existing policy to lapse. The purchase of the new policy/rider

may result in a higher premium due to current age and the risk of any potential health condition. You may have

to incur the initial costs again for the new policy/rider and may not enjoy financial benefits that may have

accumulated in the existing policy.

We would advise you to review your decision based on the illustration in the Comparison of Existing and New

Benefits table in Attachment 1.

You may contact your Servicing Agent/Bank Representative to facilitate selecting the options available as stated

in Attachment 2: Confirmation by Assured (Policyholder).

Kindly return the completed and signed copy of Attachment 2 within 14 days from the date of this letter to

your Servicing Agent/Bank Representative or to our Customer Service Executives that can be reached at:

E-mail : conservation.unit@prudential.com.my

Thank you.

Note: [Computer-generated document, no signature required.]

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 2 of 8

Attachment 1

1. Comparison Of Existing And New Benefits

Existing Policy New Policy/Rider

Basic Rider Basic Rider

Current Sum PRUWith You PRUWith You (TPD) PRUWith You PRUWith You (TPD)

Assured 100000 100000 30000 30000

PRUSaver Acci Guard Plus

Acci Guard Plus 30000

100000 Acci Med Plus 2000

Acci Med Plus 5000 Acci Income Plus 2

Total Multi Crisis unit(s)

Care 100000 Total Multi Crisis

PRUMillion Med 200 Care 30000

Med Saver 300 PRUMillion Med 200

Payor Basic 3180 p.a Med Saver 300

Payor Saver 180 p.a Payor Basic 3000 p.a

PRUMillion Med

Booster 200

Premium Amount

RM 3,360.00 RM 3,000.00

(Single/Annual)

Existing Policy New Policy/Rider

Guaranteed Non-Guaranteed Guaranteed Non-Guaranteed

Surrender Value

At Present RM 0.00 RM 0.00 RM 0.00 RM 150.00

In 5 Years RM 0.00 RM 2,336.41 RM 0.00 RM 3,205.84

Death Benefit

At Present RM 100,000.00 RM 0.00 RM 30,000.00 RM 150.00

In 5 Years RM 100,000.00 RM 2,336.41 RM 30,000.00 RM 3,205.84

Maturity Benefit

RM 0.00 RM 0.00 RM 0.00 RM 0.00

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 3 of 8

2. Surrender Value

Total accumulated surrender value under the existing policy : RM 0.00

Number of years required to build up this amount of surrender value

under the new policy/rider :1

1

Net loss as a result of this replacement

Total premium paid under existing policy (a) : RM 560.00

Total withdrawal (if any) (b) : RM 0.00

Total accumulated surrender value under existing policy (c) : RM 0.00

Net Loss1 (a) – (b) – (c) : RM 560.00

1

Net Loss = Total Premium Paid - Total withdrawal (if any) - Surrender Value. If the value shows a negative

figure, your Surrender Value is higher than the total premium paid.

Note:

The values given are estimates only and are subject to the following conditions:

i. Guaranteed & Non-Guaranteed Values at Present

· Guaranteed & Non-Guaranteed Values at Present for the existing policy are as at policy lapse

date with the assumption that the policy has lapsed.

· Guaranteed & Non-Guaranteed Values at Present for the new policy are as at letter date.

ii. Guaranteed & Non-Guaranteed Values in 5 years

· Guaranteed & Non-Guaranteed Values in 5 years projected for the existing policy are as at

policy lapse date with the assumption that the policy remains inforce and the future premiums

of the policy are to be paid on time.

· Guaranteed & Non-Guaranteed Values in 5 years projected for the new policy are as at letter

date with the assumption that the policy remains inforce and the future premiums of the

policy are to be paid on time.

· When "N/A" in shown, this indicates that the policy will be expired in 5 years.

· When 0 is shown under the Non-Guaranteed Values for investment-linked products, this

indicates that the policy is projected to lapse as the value of units is insufficient to cover total

charges.

iii. Guaranteed & Non-Guaranteed Values for Maturity Benefit

· Guaranteed & Non-Guaranteed Values projected for the existing policy are as at policy lapse

date with the assumption that the policy remains inforce and the future premiums of the

policy are to be paid on time.

· Guaranteed & Non-Guaranteed Values projected for the new policy are as at letter date with

the assumption that the policy remains inforce and the future premiums of the policy are to be

paid on time.

· When 0 is shown under the Non-Guaranteed Values for investment-linked products, this

indicates that the policy is projected to lapse as the value of units is insufficient to cover total

charges.

iv. Non-Guaranteed Values are not guaranteed and are illustrated based on the investment return of

5.00% p.a.. The actual benefit may be more or less, depending on the performance of the participating/

universal life/ investment-linked funds invested for both the existing and new policies.

v. Comparison solely based on the surrender value regardless what policy benefits the customer may

have.

vi. The value of units/bonuses are not cashed out, no alterations are made in 5 years from letter date and

all future premiums are paid on time for both the existing and new policies.

vii. The company’s bonus calculation remains the same in 5 years from the date of letter issue.

viii. Excludes any increase in loan amount during the 5 years from the date of letter issue.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 4 of 8

ix. For Accumulated Surrender Value/ Surrender Value/ Death Benefit/ Maturity Benefit, numbers stated in

this letter are not inclusive of any future withdrawal and accumulated survival benefits payout. For

detailed benefits information, please refer to your Policy Document / Product Disclosure Sheet / Sales

Illustration / Product Illustration.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 5 of 8

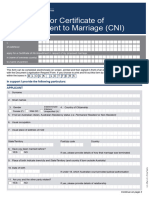

Attachment 2

Confirmation By Assured (Policyholder)

Date : 06-11-2022

Ref : ILCEBRN_0017_001

Assured : LEE KWANG YAW

Policy No. [14] : 31140433 Existing Policy No. [15]: 00792561

(New Policy/Rider)

I confirm that I am aware of the disadvantages of the existing policy being lapsed before/after the purchase of a

new policy/rider. I have decided to:

Section 1

Tick (✓) one box to indicate your selection from the options below:

Maintain the new policy/rider and maintain the decision to discontinue the

Option 1 existing policy.

(if this is chosen , please proceed to Section 2)

Option 2 Maintain the new policy/rider and revive* the existing policy.

Option 3 Revive* the existing policy and cancel the new policy**/rider

For Option 2 and 3:

*Revival is subject to assessment and business rules. Please refer to Attachment 3 for requirement documents.

**Cancellation of the new policy is subject to no claims history for the policy.

Section 2

Reasons for choosing Option 1 only. (You may (ü) more than 1 reason.)

Tick (ü) Reasons

Financial constraints

Prefer new benefit in the new policy/rider

Needs have changed

Wrong information given by previous agent

Over-insured (too many policies)

Others, please state

…………………………………………………………………………………………………..

………………………………………….. ……………………………………

Signature of Assured (Policyholder) Date

Doc ID: 114010

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 6 of 8

Attachment 3

Requirements For Revival

1. The policyholder is required to pay the total outstanding premium from 01-03-2022 until 06-11-2022

amounting to RM 2,520.00 as at date of letter issue which may be subject to change.

2. Revival Application Form to be completed and signed (if necessary).

3. Units will be allocated at next pricing date following revival.

Note:

• Additional requirements and/or premium may be called for depending on assessment of the policy.

• Revival is subject to assessment and business rules.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 7 of 8

Private and Confidential

Dear Sir / Madam,

NOTIFICATION OF REPLACEMENT OF POLICY (ROP)

We would like to advise you that the above new policy was detected as a replacement and as per Bank Negara

Guidelines, the following actions are required to be taken:

1. You will need to create the customer awareness of the disadvantages of replacing the existing policy by:

a. reviewing the replacement decision with the customer based on the benefits comparison between the

existing and new benefits and

b. facilitate the selection of options to revive/reinstate/settle the premium dues.

Kindly submit the duly completed and signed copy of the “Confirmation by Assured”.

2. You and your agency leader will not be entitled to all commissions and bonuses payout, including

production credit on the new policy. Any prior payout credited to you will be clawed back accordingly.

If you wish to appeal against this decision, please complete the following within 3 months from the date of this

Notice:

1. Kindly access https://tinyurl.com/y54n9gok , complete the required fields and click “Submit” button, and

2. Submit the duly completed and signed copy of the “Confirmation by Assured”.

Please be informed that appeal received will be reviewed and considered, however the final decision of your

appeal will be at the sole discretion of the Company.

For further clarification, kindly send your queries to the following department:

Type of Enquiry Department

ROP Appeal Status Agency Governance

Email : mys.pamb.rop@prudential.com.my

Production Related Matters Agency Reports & Statistics

Email : agencysupport@prudential.com.my

Commission & Balanced Score Agency Compensation

Card Related Matters Email : agencypayments@prupartner.com.my

ROP Guidelines & Customers Conservation Unit

related matter Email : conservation.unit@prudential.com.my

Thank you.

Regards,

Agency Governance

No signature is required on this computer-generated document.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala

Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1 Page 8 of 8

You might also like

- Pharmaceutical Distribution Business PlanDocument5 pagesPharmaceutical Distribution Business Planmolla fentaye85% (20)

- Smart Life Advantage Sample BIPSDocument83 pagesSmart Life Advantage Sample BIPSTimNo ratings yet

- Mrprintables Printable Map Usa BW States PDFDocument1 pageMrprintables Printable Map Usa BW States PDFjecanaj0% (1)

- Internal Audit Checklist of Administration DepartmentDocument6 pagesInternal Audit Checklist of Administration DepartmentRojan ShresthaNo ratings yet

- Toppling The Eusebio Dynasty PDFDocument4 pagesToppling The Eusebio Dynasty PDFCharles RiveralNo ratings yet

- PRUBiz Flyer Protect ENG FADocument5 pagesPRUBiz Flyer Protect ENG FAAmmar Ismail (Sparky90)No ratings yet

- Quotation Letter PDFDocument4 pagesQuotation Letter PDFchang muiyunNo ratings yet

- PruBSN Medic Protector Brochure ENGDocument12 pagesPruBSN Medic Protector Brochure ENGseefengshuiNo ratings yet

- BenefitIllustartion AAP V03 1452022131747Document1 pageBenefitIllustartion AAP V03 1452022131747Dark HoundNo ratings yet

- NivaBupa 2023Document83 pagesNivaBupa 2023Aniket Yadav100% (1)

- Preview PDFDocument6 pagesPreview PDFMATHANA SOORIA A/P ADEYAH MoeNo ratings yet

- ReportDocument19 pagesReportGambar GambarNo ratings yet

- Aditya Birla Sun Life Insurance Vision Lifeincome PlanDocument2 pagesAditya Birla Sun Life Insurance Vision Lifeincome PlanSneha SruthiNo ratings yet

- ZGIMB Individual Personal Accident Insurance PDS V6 HODocument4 pagesZGIMB Individual Personal Accident Insurance PDS V6 HONurul IzzatiNo ratings yet

- BenefitIllustration PAR 201905065Document1 pageBenefitIllustration PAR 201905065jaya siNo ratings yet

- Preview PDFDocument3 pagesPreview PDFMATHANA SOORIA A/P ADEYAH MoeNo ratings yet

- Product Disclosure Sheet: AIA General BerhadDocument9 pagesProduct Disclosure Sheet: AIA General BerhadMusk BengshengNo ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Policy 2022-23Document6 pagesPolicy 2022-23paras INSURANCENo ratings yet

- Dushyant HP Apollo 2017Document10 pagesDushyant HP Apollo 2017niren4u1567No ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- 0287764082 (1)Document8 pages0287764082 (1)rmohanNo ratings yet

- Salary StackDocument3 pagesSalary StackAbdul Khadar Jilani ShaikNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- Premium Paid Certificate: Date: 14-SEP-20 16Document1 pagePremium Paid Certificate: Date: 14-SEP-20 16Koushik DuttaNo ratings yet

- Soumyaranjan RoutrayDocument3 pagesSoumyaranjan RoutraySounmya LikuNo ratings yet

- eMedic+Plus PDS Deductible+ (Individual) ENG Ver022022Document4 pageseMedic+Plus PDS Deductible+ (Individual) ENG Ver022022Prasen RajNo ratings yet

- Kavita 2Document2 pagesKavita 2api-3721187No ratings yet

- Proposal Summary Tool-1Document4 pagesProposal Summary Tool-1Nhirrmal VejayanNo ratings yet

- Amit JanaDocument1 pageAmit JanaPravin ThoratNo ratings yet

- IllustrationDocument3 pagesIllustrationsukh37949No ratings yet

- Business Plan For Beauty SalonDocument18 pagesBusiness Plan For Beauty Salonhinsene begna100% (1)

- Divi Thilina: (Terms & Conditions Applied)Document1 pageDivi Thilina: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- TranningDocument31 pagesTranningapi-564750164No ratings yet

- MRP May 2023Document3 pagesMRP May 2023princeNo ratings yet

- Stock On Radar - 15jan24 - 240115 - 082157Document3 pagesStock On Radar - 15jan24 - 240115 - 082157iamamusleemNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- F6mys 2017 Sept Dec QDocument12 pagesF6mys 2017 Sept Dec QMuhammad ZabhaNo ratings yet

- Taxation (Malaysia) : March/June 2018 - Sample QuestionsDocument13 pagesTaxation (Malaysia) : March/June 2018 - Sample QuestionsTeneswari RadhaNo ratings yet

- Statement Ilps 2020Document8 pagesStatement Ilps 2020Faiz RosliNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Elite Powertech Pvt. Ltd. R1 - 1611202312557758Document4 pagesElite Powertech Pvt. Ltd. R1 - 1611202312557758Neeraj GoswamiNo ratings yet

- PYQ AT Sep-Dec2018 PDFDocument11 pagesPYQ AT Sep-Dec2018 PDF炜伦林No ratings yet

- P6mys 2015 Dec QDocument13 pagesP6mys 2015 Dec QMERINANo ratings yet

- Appointment Letter T.KumundhvathiDocument2 pagesAppointment Letter T.KumundhvathiMadhu MadhanNo ratings yet

- PDFDocument4 pagesPDF24allamiNo ratings yet

- eAFYAH PDS PDFDocument13 pageseAFYAH PDS PDFkim karrenNo ratings yet

- CandidateDocument4 pagesCandidateabbai rNo ratings yet

- I-Great Evo - Female 2Document1 pageI-Great Evo - Female 2Fuad ShakirNo ratings yet

- Sufyan Bhai 12 Years PlanDocument4 pagesSufyan Bhai 12 Years Planسفیان علیNo ratings yet

- FWD: Offer Letter For Meenu Singh: 1 MessageDocument3 pagesFWD: Offer Letter For Meenu Singh: 1 Messagerajprince26460No ratings yet

- ICICI Prudential Life InsuranceDocument3 pagesICICI Prudential Life InsuranceArjun BhatnagarNo ratings yet

- Axa Emedic: 1. 1 What Is This Product About?Document4 pagesAxa Emedic: 1. 1 What Is This Product About?Afiq de WinnerNo ratings yet

- M3 AyurSoulsDocument13 pagesM3 AyurSoulsKhyati MakwanaNo ratings yet

- 70014913388Document4 pages70014913388Manish YadavNo ratings yet

- PT1 Sept 2022 Exams Question Paper G1, G2, G3 22 July 2022Document13 pagesPT1 Sept 2022 Exams Question Paper G1, G2, G3 22 July 2022stacyyauNo ratings yet

- HDFC Health Insurance PolicyDocument4 pagesHDFC Health Insurance PolicyrahulpahadeNo ratings yet

- Kamisetti Rajesh - Offer LetterDocument4 pagesKamisetti Rajesh - Offer Letterbharath rajeshNo ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- Screenshot 2024-03-22 at 12.59.42 PMDocument40 pagesScreenshot 2024-03-22 at 12.59.42 PMYash ChaudharyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryFrom EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryNo ratings yet

- Cambridge IGCSE: Accounting 0452/22Document20 pagesCambridge IGCSE: Accounting 0452/22Han Thi Win KoNo ratings yet

- Corporate Governance & Business EthicsDocument79 pagesCorporate Governance & Business EthicsRishi Ahuja0% (1)

- State IncomeTaxDocument5 pagesState IncomeTaxMark RanzenbergerNo ratings yet

- Chapter 3. Vedic AgesDocument20 pagesChapter 3. Vedic AgesRANJAN YADAVNo ratings yet

- White Collar Crimes KSLU Notes Grand Final PDFDocument78 pagesWhite Collar Crimes KSLU Notes Grand Final PDFPraveen r nNo ratings yet

- Corporate Governance Reforms in IndiaDocument19 pagesCorporate Governance Reforms in IndiaPrabal TiwariNo ratings yet

- Labour Law ProjectDocument11 pagesLabour Law ProjectdivyavishalNo ratings yet

- Corectii (NM 1652)Document3 pagesCorectii (NM 1652)Vitalie FricatelNo ratings yet

- Case Study Singapore Presentation Development v1Document22 pagesCase Study Singapore Presentation Development v1NaizJuzharNo ratings yet

- One-Drop RuleDocument19 pagesOne-Drop RuleAnonymous BeoWLI3D7QNo ratings yet

- 8 - Intangible AssetsDocument80 pages8 - Intangible AssetsKRISTINA DENISSE SAN JOSENo ratings yet

- How To Be A Human Firewall at WorkDocument1 pageHow To Be A Human Firewall at WorkCorey MolinelliNo ratings yet

- Joe Carvin June 7 EventDocument1 pageJoe Carvin June 7 EventNicholasLenceNo ratings yet

- Lorenzo Vs Posadas 64 Phil 353Document1 pageLorenzo Vs Posadas 64 Phil 353Gina Portuguese GawonNo ratings yet

- Council Resolution Calling For UnityDocument2 pagesCouncil Resolution Calling For UnityCharlesPughNo ratings yet

- Mid - Term Examination Business Ethics and Social Responsibility Grade - 12Document2 pagesMid - Term Examination Business Ethics and Social Responsibility Grade - 12jameswisdom javier86% (7)

- 74 Alvc 164245Document13 pages74 Alvc 164245roozbehxoxNo ratings yet

- The Protection of Rights - This Way, That Way, Forwards, Backwards...Document27 pagesThe Protection of Rights - This Way, That Way, Forwards, Backwards...Joshua Rozenberg100% (2)

- F7 SMART Notes ACCADocument41 pagesF7 SMART Notes ACCAzemy jackson100% (1)

- Estrada OaniDocument26 pagesEstrada OaniAerith AlejandreNo ratings yet

- Desiree Yagan's FOIL Statement Re NDNY Armond Scipione, DHS Jeff Berwald Re SEPT 23, 2014 CSO IncidentDocument4 pagesDesiree Yagan's FOIL Statement Re NDNY Armond Scipione, DHS Jeff Berwald Re SEPT 23, 2014 CSO IncidentDesiree YaganNo ratings yet

- ComparativeDocument29 pagesComparativeSaurabh KumarNo ratings yet

- Philippines HistoryDocument25 pagesPhilippines HistorylimbadzNo ratings yet

- Karnataka Minimum Wages For The Year 2021Document1 pageKarnataka Minimum Wages For The Year 2021Anusree RoyNo ratings yet

- 2nd EXAM OBLI. Case DigestsDocument31 pages2nd EXAM OBLI. Case DigestsJennica Gyrl G. DelfinNo ratings yet

- Form No Impediment MarriageDocument3 pagesForm No Impediment MarriageE QNo ratings yet

- Resolution - BDRRM 3Document1 pageResolution - BDRRM 3Barangay BayanihanNo ratings yet