Professional Documents

Culture Documents

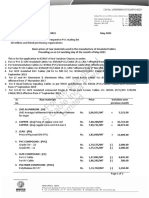

Implementation of Mandatory Mentioning of HSN Codes in GSTR-1

Implementation of Mandatory Mentioning of HSN Codes in GSTR-1

Uploaded by

Shaikh Mohd HuzaifaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Implementation of Mandatory Mentioning of HSN Codes in GSTR-1

Implementation of Mandatory Mentioning of HSN Codes in GSTR-1

Uploaded by

Shaikh Mohd HuzaifaCopyright:

Available Formats

Implementation of mandatory mentioning of HSN codes in GSTR-1

1. Vide Notification No. 78/2020 – Central Tax dated 15th October, 2020, it is mandatory for the

taxpayers to report minimum 4 digit or 6 digit of HSN Code in table-12 of GSTR-I on the basis of

their Aggregate Annual Turnover (AATO) in the preceding Financial Year. To view the detailed

notification please click here.

2. To facilitate the taxpayers, these changes are being implemented in a phase-wise manner on GST

Portal as below:

Phases Taxpayers with AATO of up- Taxpayers with AATO of more

to 5 cr than 5 cr.

Taxpayers are required to Taxpayers are required to mandatorily

mandatorily report 2-digit HSN report 4-digit HSN codes for goods &

codes for goods & services. services.

Manual user entry is allowed for Manual user entry is allowed for

entering HSN or description and entering HSN or description and

warning or alert message shall be warning or alert message shall be

Part I shown in case of manual HSN. shown in case of incorrect HSN code.

However, taxpayers will be able to However, taxpayers will be able to

Phase 1 file GSTR-1 after manual entry. file GSTR-1 after manual entry.

Part II Same as above Taxpayers will now have to mandatory

report 6-digit HSN code.

No change in other conditions

Phase 2 Mandatory reporting of HSN at No change

4-digits;

Phase 3-4

To be communicated in due course.

3. Part I & Part II of Phase 1 has already been implemented from 01st April 2022 & 01st August 2022

respectively and is currently live on GST Portal. From 01st November, 2022, Phase-2 would be

implemented on GST Portal and the taxpayers would need to report HSN in table 12 of GSTR-1

as per below mentioned scheme.

Taxpayers with AATO of up-to 5 cr Taxpayers with AATO of more

than 5 cr.

• Taxpayers would be required to mandatorily

report 4-digit HSN code.

• Manual user entry would be allowed for

entering HSN or description and in case of a

wrong HSN reported a warning or alert To continue as it is.

message will be shown. However, taxpayers

will still be able to file GSTR-1

4. The taxpayers are advised to correct the HSN details where there is an error and a warning message

is shown. However, it is not a mandatory validation for filing GSTR-1.

5. Further phases would be implemented on GST Portal shortly and respective dates of

implementation and nature of change would be updated from time to time.

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Leader Standard Work: Lean Leadership SeriesDocument11 pagesLeader Standard Work: Lean Leadership SeriesErnesto Manuel100% (1)

- 500+ Huge Facebook Groups ListDocument27 pages500+ Huge Facebook Groups ListRajesh KumarNo ratings yet

- CRM Revel WhitepaperDocument12 pagesCRM Revel Whitepaperblahze100% (2)

- Week 1 - Introduction To Transport ServicesDocument18 pagesWeek 1 - Introduction To Transport ServicesLea Mae PagaranNo ratings yet

- HSN Table 12 10 22 Advisory NewDocument2 pagesHSN Table 12 10 22 Advisory NewAmanNo ratings yet

- HSN Advisory Table 12 2Document1 pageHSN Advisory Table 12 2shadab qureshiNo ratings yet

- Taxguru - In-Features of GSTR1 and Filing of Return of Outward Supply Under GSTDocument2 pagesTaxguru - In-Features of GSTR1 and Filing of Return of Outward Supply Under GSTpuran1234567890No ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- 2301 Turnover Tax Declaration FormDocument3 pages2301 Turnover Tax Declaration FormMaddahayota College100% (1)

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- Important GST Compliances As On April 1, 2021Document3 pagesImportant GST Compliances As On April 1, 2021Mohammed suhail.sNo ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- Statement Outwrad SupplyDocument4 pagesStatement Outwrad SupplyTushar GoelNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- Composition of LevyDocument6 pagesComposition of LevyYalini MeenakshiNo ratings yet

- E InvoiceDocument23 pagesE Invoicenallarahul86No ratings yet

- 1.what Are RFD-01 and RFD-01A & Steps To Apply For GST Refund?Document20 pages1.what Are RFD-01 and RFD-01A & Steps To Apply For GST Refund?Ravi JhaNo ratings yet

- Guide On GSTR 1 Filing On GST PortalDocument53 pagesGuide On GSTR 1 Filing On GST PortalCA Naveen Kumar BalanNo ratings yet

- Vat Returns Manual 2021Document25 pagesVat Returns Manual 2021mactechNo ratings yet

- Lec 5 - TRAIN LawDocument74 pagesLec 5 - TRAIN LawShaun LeeNo ratings yet

- GSTR1 GuidelinesDocument40 pagesGSTR1 GuidelinesJeetu PorwalNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- RMC No. 76-2020Document11 pagesRMC No. 76-2020Bobby LockNo ratings yet

- RMC No 32-2018 PDFDocument4 pagesRMC No 32-2018 PDFzooeyNo ratings yet

- Receiv: Bureau Internal RevenueDocument1 pageReceiv: Bureau Internal Revenuew8ndblidNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2Boss NikNo ratings yet

- E InvoicingDocument20 pagesE Invoicingpawan dhokaNo ratings yet

- Nepal TaxDocument7 pagesNepal Taxsanjay kafleNo ratings yet

- Changes in Section 130: National Academy of Customs, Indirect Taxes and Narcotics (NACIN)Document16 pagesChanges in Section 130: National Academy of Customs, Indirect Taxes and Narcotics (NACIN)amitshah2060No ratings yet

- Tax Hand Book of KPTCL 16-02-16Document111 pagesTax Hand Book of KPTCL 16-02-16Prasad IyengarNo ratings yet

- Tax Awareness SessionDocument20 pagesTax Awareness SessionAli RazaNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDocument2 pagesGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNo ratings yet

- FIRS VAT Information Circular May 2020Document9 pagesFIRS VAT Information Circular May 2020David ONo ratings yet

- RMC No. 73-2018Document3 pagesRMC No. 73-2018Madi KomoaNo ratings yet

- The CBDT has clarified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01-04-2023 if PAN becomes inoperative due to non-linking of itDocument2 pagesThe CBDT has clarified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01-04-2023 if PAN becomes inoperative due to non-linking of itGovardhan VaranasiNo ratings yet

- ??? ??? ???? ??? ???????????Document8 pages??? ??? ???? ??? ???????????rvs.designs162No ratings yet

- Summary of Notifications & Circular Under GST: ST THDocument4 pagesSummary of Notifications & Circular Under GST: ST THNishthaNo ratings yet

- GST - Lecture 12 - Returns Under GSTDocument11 pagesGST - Lecture 12 - Returns Under GSTmewtwovarceusNo ratings yet

- 1702-MX June 2013 GuidelinesDocument4 pages1702-MX June 2013 GuidelinesvicsNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- Key GST Compliances For Year End 2022 & New Financial Year 2023Document3 pagesKey GST Compliances For Year End 2022 & New Financial Year 2023visshelpNo ratings yet

- GST E InvoiceDocument23 pagesGST E Invoicenallarahul86No ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- Relevant BIR UpdatesDocument49 pagesRelevant BIR UpdatesElsha dela penaNo ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- Tax 1 Unit 1. Chapter 4Document5 pagesTax 1 Unit 1. Chapter 4angelika dijamcoNo ratings yet

- Taxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTDocument5 pagesTaxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTTheEnigmatic AccountantNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2JejomarNo ratings yet

- Unit 18Document20 pagesUnit 18Raja SahilNo ratings yet

- AG Approved TC Report 03012022Document17 pagesAG Approved TC Report 03012022manoharNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- TaxmannPPT - Threadbare Discussion On Clause 44Document21 pagesTaxmannPPT - Threadbare Discussion On Clause 44VaibhavNo ratings yet

- Scheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 AmDocument9 pagesScheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 Amsnsoni 89No ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- Basic Features of Value Added Tax (VAT) For ItesDocument24 pagesBasic Features of Value Added Tax (VAT) For ItesDebashishDolonNo ratings yet

- Step by Step Guide On How To File GST Tran-1Document1 pageStep by Step Guide On How To File GST Tran-1Batmanabane VaradharassouNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Return ChapterDocument8 pagesReturn ChapterShubham KuberkarNo ratings yet

- Revenue Regulations No. 12-2002Document5 pagesRevenue Regulations No. 12-2002Sy HimNo ratings yet

- Spray S - 5 Dec 81 To 100 50 ML CF 1Document1 pageSpray S - 5 Dec 81 To 100 50 ML CF 1Shaikh Mohd HuzaifaNo ratings yet

- LL.M. SEM. I Time Table 2020 2021 REVISED With LinksDocument6 pagesLL.M. SEM. I Time Table 2020 2021 REVISED With LinksShaikh Mohd HuzaifaNo ratings yet

- Spray S - 5 Dec 41 To 60 50 ML CF 1Document1 pageSpray S - 5 Dec 41 To 60 50 ML CF 1Shaikh Mohd HuzaifaNo ratings yet

- Spray S - 5 Dec 1 To 20 50 ML CF 1Document1 pageSpray S - 5 Dec 1 To 20 50 ML CF 1Shaikh Mohd HuzaifaNo ratings yet

- Spray S - 5 Dec 21 To 40 50 ML CF 1Document1 pageSpray S - 5 Dec 21 To 40 50 ML CF 1Shaikh Mohd HuzaifaNo ratings yet

- Spray S - 5 Dec 1 To 30 30 ML CF 1Document1 pageSpray S - 5 Dec 1 To 30 30 ML CF 1Shaikh Mohd HuzaifaNo ratings yet

- RR Notice Contact Details First Half 2020Document3 pagesRR Notice Contact Details First Half 2020Shaikh Mohd HuzaifaNo ratings yet

- Admission Notification Part Time 2022 2023Document1 pageAdmission Notification Part Time 2022 2023Shaikh Mohd HuzaifaNo ratings yet

- NOTICE For PH.D RegistrationDocument1 pageNOTICE For PH.D RegistrationShaikh Mohd HuzaifaNo ratings yet

- List 4Document1 pageList 4Shaikh Mohd HuzaifaNo ratings yet

- List 3Document1 pageList 3Shaikh Mohd HuzaifaNo ratings yet

- List 2Document1 pageList 2Shaikh Mohd HuzaifaNo ratings yet

- Department-of-English - List-of-Selected-Candidates-for-Ph.D.-in-English-2022 3Document2 pagesDepartment-of-English - List-of-Selected-Candidates-for-Ph.D.-in-English-2022 3Shaikh Mohd HuzaifaNo ratings yet

- List 1Document1 pageList 1Shaikh Mohd HuzaifaNo ratings yet

- Department of English - Online Applications For Admission To Ph.D. in English 2022 23Document2 pagesDepartment of English - Online Applications For Admission To Ph.D. in English 2022 23Shaikh Mohd HuzaifaNo ratings yet

- Department of English - Second Selection List For Ph.D. in English 2022Document2 pagesDepartment of English - Second Selection List For Ph.D. in English 2022Shaikh Mohd HuzaifaNo ratings yet

- PHD Admissions 2022 23 - UDCPDocument2 pagesPHD Admissions 2022 23 - UDCPShaikh Mohd HuzaifaNo ratings yet

- Notice Mphil Open Defence Viva Mr. Shrikant OzaDocument1 pageNotice Mphil Open Defence Viva Mr. Shrikant OzaShaikh Mohd HuzaifaNo ratings yet

- NOTICE LL.M. SEM. IIIIII IV REPEATER STUDENTS ONLINE EXAMINATION FORM RevisedDocument3 pagesNOTICE LL.M. SEM. IIIIII IV REPEATER STUDENTS ONLINE EXAMINATION FORM RevisedShaikh Mohd HuzaifaNo ratings yet

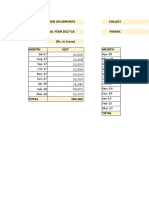

- IGST On Import 2021 2022Document4 pagesIGST On Import 2021 2022Shaikh Mohd HuzaifaNo ratings yet

- Notification 21 2022Document165 pagesNotification 21 2022Shaikh Mohd HuzaifaNo ratings yet

- IGST On Import 2017 2018Document4 pagesIGST On Import 2017 2018Shaikh Mohd HuzaifaNo ratings yet

- GSTR 1 2017 2018Document24 pagesGSTR 1 2017 2018Shaikh Mohd HuzaifaNo ratings yet

- Circular 20 2022Document1 pageCircular 20 2022Shaikh Mohd HuzaifaNo ratings yet

- IGST On Import 2020 2021Document4 pagesIGST On Import 2020 2021Shaikh Mohd HuzaifaNo ratings yet

- Ewb Data 2018 19Document16 pagesEwb Data 2018 19Shaikh Mohd HuzaifaNo ratings yet

- Digital Image Processing - Wikipedia, The Free Encyclopedia PDFDocument4 pagesDigital Image Processing - Wikipedia, The Free Encyclopedia PDFAnil JobyNo ratings yet

- Hadoop Fundamentals and Hive Interview QuestionsDocument8 pagesHadoop Fundamentals and Hive Interview Questionsmichel jonsonNo ratings yet

- 00092021005MMDocument2 pages00092021005MMAMARENDRA SINo ratings yet

- Unit I Software Process and Project Management: Hindusthan College of Engineering and TechnologyDocument1 pageUnit I Software Process and Project Management: Hindusthan College of Engineering and TechnologyRevathimuthusamyNo ratings yet

- Illia Melnyk: ContactsDocument1 pageIllia Melnyk: ContactsIllia MelnykNo ratings yet

- My EclipseDocument12 pagesMy Eclipsenaveen mekalaNo ratings yet

- MS Project-Rajeev SharmaDocument185 pagesMS Project-Rajeev SharmaCEG BangladeshNo ratings yet

- Cargo Dan DumbwaiterDocument7 pagesCargo Dan DumbwaiterJon AsibiNo ratings yet

- Part B Unit 1 Introduction To Artificial IntelligenceDocument15 pagesPart B Unit 1 Introduction To Artificial IntelligenceOjaswi BhandariNo ratings yet

- Exm 2020Document5 pagesExm 2020Frederick MullerNo ratings yet

- Traverse Reading Testing FormDocument1 pageTraverse Reading Testing FormJHON CHRISTOPHER CENTINONo ratings yet

- RachmatDocument5 pagesRachmatRoy AiminNo ratings yet

- HSBC Digital Starter Kit Credit CardDocument16 pagesHSBC Digital Starter Kit Credit CardJulian SandovalNo ratings yet

- C Language CheatSheet - CodeWithHarryDocument10 pagesC Language CheatSheet - CodeWithHarryAryan The GreatNo ratings yet

- DTC P2716 Pressure Control Solenoid "D" Electrical (Only For 5VZ-FE)Document3 pagesDTC P2716 Pressure Control Solenoid "D" Electrical (Only For 5VZ-FE)Erln LimaNo ratings yet

- Trusted Performance Without Compromise: Answers For LifeDocument24 pagesTrusted Performance Without Compromise: Answers For LifeSergeyKuznetsovNo ratings yet

- C3502 SMB Tech PubDocument4 pagesC3502 SMB Tech PubPlagio OmarNo ratings yet

- 300t DatasheetDocument4 pages300t DatasheetChito PrietoNo ratings yet

- 1707 NEC3 Price ListDocument5 pages1707 NEC3 Price ListVíctor CasadoNo ratings yet

- Egypt ACI Shipper GuideDocument9 pagesEgypt ACI Shipper GuideShaymaa RachidNo ratings yet

- Quot SMS Gateway Custom 30 SeptDocument1 pageQuot SMS Gateway Custom 30 SeptNiel DariusNo ratings yet

- Process Engineer - RO Plant OmanDocument1 pageProcess Engineer - RO Plant OmanmaniyarasanNo ratings yet

- Criterion B ChecklistDocument1 pageCriterion B Checklistapi-251349619No ratings yet

- Resume Letter: Osagie Jude ChukwudiDocument2 pagesResume Letter: Osagie Jude ChukwudiJûdê MorgäñNo ratings yet

- Report On Industrial Training AT Chaudhary Charan Singh International Airport Lucknow (Uttar Pradesh)Document59 pagesReport On Industrial Training AT Chaudhary Charan Singh International Airport Lucknow (Uttar Pradesh)Akanksha SinghNo ratings yet

- Fisa Tehnica Kit Automatizare Poarta Batanta Motorline KIT JAG 600 - 230VDocument13 pagesFisa Tehnica Kit Automatizare Poarta Batanta Motorline KIT JAG 600 - 230VMondenBand Din FocsaniNo ratings yet