Professional Documents

Culture Documents

HSN Advisory Table 12 2

Uploaded by

shadab qureshiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSN Advisory Table 12 2

Uploaded by

shadab qureshiCopyright:

Available Formats

Implementation of mandatory mentioning of HSN codes in GSTR-1

1. Vide Notification No. 78/2020 – Central Tax dated 15th October, 2020, it is mandatory for the taxpayers to

report minimum 4 digits or 6 digits of HSN Code in Table-12 of GSTR-1 on the basis of their Aggregate

Annual Turnover (AATO) in the preceding Financial Year.

To view the detailed notification, please click here.

2. To facilitate the taxpayers, these changes are being implemented in a phase-wise manner on GST Portal

as below:

Phases Taxpayers with AATO of up-to 5 cr. Taxpayers with AATO of more than 5 cr.

Taxpayers are required to mandatorily Taxpayers are required to mandatorily report

report 2-digit HSN codes for goods & 4-digit HSN codes for goods & services.

services.

Manual user entry is allowed for entering

Manual user entry is allowed for HSN or description and warning or alert

Part I entering HSN or description and message shall be shown in case of incorrect

warning or alert messageshall be HSN code.

Phase 1 shown in case of manual HSN.

However, taxpayers will be able to file GSTR-1

However, taxpayers will be able to file after manual entry.

GSTR-1 after manual entry.

Taxpayers will now have to mandatory report

Part II Same as above 6-digit HSN code.

No change in other conditions

Phase 2 to

To be communicated in due course.

Phase 4

3. Part 1 of Phase I has already been implemented from 01 st April 2022 and is currently live on GST Portal.

From 01stAugust, 2022, Part-II of Phase-I would be implemented on GST Portal and the taxpayers would

need to report HSN in table 12 of GSTR-1 as per below mentioned scheme.

Taxpayers with AATO of up-to 5 cr. Taxpayers with AATO of more than 5 cr.

Taxpayers would be required to mandatorily report 6-digit HSN

code.

Manual user entry would be allowed for entering HSN or

description and in case of a wrong HSN reporteda warning or

To continue as it is.

alert message will be shown.However, taxpayers will still be

able to file GSTR-1.

Taxpayers would be expected to correct HSN where there is an

error and a warning message shown.

4. Further phases will be implemented on GST Portal shortly and respective dates of implementation and

nature of change would be updated from time to time.

*******

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Employee's Information FormDocument1 pageEmployee's Information FormLyle RabasanoNo ratings yet

- R.A. No. 11976 - Ease of Paying TaxesDocument18 pagesR.A. No. 11976 - Ease of Paying TaxesBeaNo ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- Long Quiz AgricultureDocument3 pagesLong Quiz AgricultureTet Gomez100% (5)

- Case Study 2. R.E. Construction: It's Now or NeverDocument2 pagesCase Study 2. R.E. Construction: It's Now or NeverClarence PascualNo ratings yet

- Cost 1Document18 pagesCost 1Maryane AngelaNo ratings yet

- Pune IT Software Companies in Magarpatta City Pune ListDocument7 pagesPune IT Software Companies in Magarpatta City Pune ListRishi BachaniNo ratings yet

- Waste4Change Jan2019Document27 pagesWaste4Change Jan2019Hari SaptoadisaNo ratings yet

- Implementation of Mandatory Mentioning of HSN Codes in GSTR-1Document1 pageImplementation of Mandatory Mentioning of HSN Codes in GSTR-1Shaikh Mohd HuzaifaNo ratings yet

- HSN Table 12 10 22 Advisory NewDocument2 pagesHSN Table 12 10 22 Advisory NewAmanNo ratings yet

- Composition of LevyDocument6 pagesComposition of LevyYalini MeenakshiNo ratings yet

- Important GST Compliances As On April 1, 2021Document3 pagesImportant GST Compliances As On April 1, 2021Mohammed suhail.sNo ratings yet

- E InvoicingDocument20 pagesE Invoicingpawan dhokaNo ratings yet

- E InvoiceDocument23 pagesE Invoicenallarahul86No ratings yet

- 2301 Turnover Tax Declaration FormDocument3 pages2301 Turnover Tax Declaration FormMaddahayota College100% (1)

- Taxguru - In-Features of GSTR1 and Filing of Return of Outward Supply Under GSTDocument2 pagesTaxguru - In-Features of GSTR1 and Filing of Return of Outward Supply Under GSTpuran1234567890No ratings yet

- 1702-MX June 2013 GuidelinesDocument4 pages1702-MX June 2013 GuidelinesvicsNo ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- Lec 5 - TRAIN LawDocument74 pagesLec 5 - TRAIN LawShaun LeeNo ratings yet

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDocument2 pagesGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- Nepal TaxDocument7 pagesNepal Taxsanjay kafleNo ratings yet

- GST E InvoiceDocument23 pagesGST E Invoicenallarahul86No ratings yet

- Statement Outwrad SupplyDocument4 pagesStatement Outwrad SupplyTushar GoelNo ratings yet

- TAX 203 Other Percentage TaxesDocument9 pagesTAX 203 Other Percentage TaxesYess poooNo ratings yet

- RMC No. 73-2018Document3 pagesRMC No. 73-2018Madi KomoaNo ratings yet

- GST Circular PDFDocument11 pagesGST Circular PDFNavnera divisionNo ratings yet

- RMC No 32-2018 PDFDocument4 pagesRMC No 32-2018 PDFzooeyNo ratings yet

- GST Fi User Manual: 7th June 2017Document34 pagesGST Fi User Manual: 7th June 2017gj1ch3240okNo ratings yet

- Scheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 AmDocument9 pagesScheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 Amsnsoni 89No ratings yet

- Tax Hand Book of KPTCL 16-02-16Document111 pagesTax Hand Book of KPTCL 16-02-16Prasad IyengarNo ratings yet

- April 2021 NewsLetterDocument20 pagesApril 2021 NewsLetterSabrina CanoNo ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- Tax Awareness SessionDocument20 pagesTax Awareness SessionAli RazaNo ratings yet

- RMC No. 76-2020Document11 pagesRMC No. 76-2020Bobby LockNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- GST Pratical ApproachDocument20 pagesGST Pratical ApproachSanthoshNo ratings yet

- Guide On GSTR 1 Filing On GST PortalDocument53 pagesGuide On GSTR 1 Filing On GST PortalCA Naveen Kumar BalanNo ratings yet

- Step by Step Guide On How To File GST Tran-1Document1 pageStep by Step Guide On How To File GST Tran-1Batmanabane VaradharassouNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- RMC No. 84-2023 GuidelinesDocument1 pageRMC No. 84-2023 GuidelinessandraNo ratings yet

- Receiv: Bureau Internal RevenueDocument1 pageReceiv: Bureau Internal Revenuew8ndblidNo ratings yet

- The CBDT has clarified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01-04-2023 if PAN becomes inoperative due to non-linking of itDocument2 pagesThe CBDT has clarified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01-04-2023 if PAN becomes inoperative due to non-linking of itGovardhan VaranasiNo ratings yet

- Vat Returns Manual 2021Document25 pagesVat Returns Manual 2021mactechNo ratings yet

- E-Invoicing Under GST PPT TheTaxTellersDocument8 pagesE-Invoicing Under GST PPT TheTaxTellersThe Tax TellersNo ratings yet

- Revenue Memorandum Order No. 42-03: October 23, 2003Document11 pagesRevenue Memorandum Order No. 42-03: October 23, 2003nathalie velasquezNo ratings yet

- Advisory - Filing of ITR 2021Document2 pagesAdvisory - Filing of ITR 2021pelgonehNo ratings yet

- GST Reverse Charge: A Three Phased AnalysisDocument8 pagesGST Reverse Charge: A Three Phased AnalysisRashi AroraNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- BIR Updates Issue No. 2Document2 pagesBIR Updates Issue No. 2Jy GoNo ratings yet

- Composition SchemeDocument4 pagesComposition Schemecloudstorage567No ratings yet

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2Boss NikNo ratings yet

- Income Tax J2019Document50 pagesIncome Tax J2019Avinash ShettyNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30No ratings yet

- Post Activity ReportDocument7 pagesPost Activity ReportIrene Mae DairoNo ratings yet

- FIRS VAT Information Circular May 2020Document9 pagesFIRS VAT Information Circular May 2020David ONo ratings yet

- 2200-S Jan 2018 Guide RevisedDocument2 pages2200-S Jan 2018 Guide RevisedJoseph DoctoNo ratings yet

- Guidelines FICODocument2 pagesGuidelines FICORajeev BangaNo ratings yet

- Bajrangi BhaijkanDocument3 pagesBajrangi Bhaijkanshadab qureshiNo ratings yet

- Iatil'1 - 1 ,: - 4lrctcbililDocument1 pageIatil'1 - 1 ,: - 4lrctcbililshadab qureshiNo ratings yet

- Department of Law Notice - Ll.m. Sem I Hall TicketDocument1 pageDepartment of Law Notice - Ll.m. Sem I Hall Ticketshadab qureshiNo ratings yet

- Department of English Ph.D. Admission Notification January 2019Document4 pagesDepartment of English Ph.D. Admission Notification January 2019shadab qureshiNo ratings yet

- Department of Physics M.SC - Course Semster IV Lecture ScheduleDocument1 pageDepartment of Physics M.SC - Course Semster IV Lecture Scheduleshadab qureshiNo ratings yet

- Department of Law NOTICE - ALL STUDENTS - Wi Fi Facility.Document1 pageDepartment of Law NOTICE - ALL STUDENTS - Wi Fi Facility.shadab qureshiNo ratings yet

- Department of Physical Education Admission Notice of M.Phil Ph.D..Document1 pageDepartment of Physical Education Admission Notice of M.Phil Ph.D..shadab qureshiNo ratings yet

- Department of Law First Alumni Meet.Document2 pagesDepartment of Law First Alumni Meet.shadab qureshiNo ratings yet

- Department of Law Notice - Ll.m. Sem II Lectures On 7.2.2019.Document1 pageDepartment of Law Notice - Ll.m. Sem II Lectures On 7.2.2019.shadab qureshiNo ratings yet

- Department of Computer Science Notification For Ph.D. M.Phil Admission 2019Document3 pagesDepartment of Computer Science Notification For Ph.D. M.Phil Admission 2019shadab qureshiNo ratings yet

- Department of Law Notice - Ll.m. Sem IV Lecture by Dr. Oza On 11.2.2019.Document1 pageDepartment of Law Notice - Ll.m. Sem IV Lecture by Dr. Oza On 11.2.2019.shadab qureshiNo ratings yet

- Consultation On Revisions in The Adjusted MIFOR and Modified MIFOR Methodology A0f13add41Document4 pagesConsultation On Revisions in The Adjusted MIFOR and Modified MIFOR Methodology A0f13add41shadab qureshiNo ratings yet

- Department of Statistics Notification of PH.D Admission 2018 2019.Document1 pageDepartment of Statistics Notification of PH.D Admission 2018 2019.shadab qureshiNo ratings yet

- Advertisement For Recruitment of A M Research 783f7d1411Document5 pagesAdvertisement For Recruitment of A M Research 783f7d1411shadab qureshiNo ratings yet

- Advertisement For Recruitment of Assistant Manager IT 64056feeaaDocument4 pagesAdvertisement For Recruitment of Assistant Manager IT 64056feeaashadab qureshiNo ratings yet

- Pricing of FBIL G Sec Valuation and SDL Valuation Benchmarks E79a222a7fDocument2 pagesPricing of FBIL G Sec Valuation and SDL Valuation Benchmarks E79a222a7fshadab qureshiNo ratings yet

- Press Release Revised Publication Time For Adjusted Modified MIFOR US Dalylight Saving 0802b406faDocument1 pagePress Release Revised Publication Time For Adjusted Modified MIFOR US Dalylight Saving 0802b406fashadab qureshiNo ratings yet

- FBIL Advertisement For AM Operations 2022 02795a3209Document4 pagesFBIL Advertisement For AM Operations 2022 02795a3209shadab qureshiNo ratings yet

- Press Release Revisions in The FBIL Modified MIFOR and Adjusted MIFOR Methodology 9e08347d42Document3 pagesPress Release Revisions in The FBIL Modified MIFOR and Adjusted MIFOR Methodology 9e08347d42shadab qureshiNo ratings yet

- CBDT - E-Filing - ITR 1 - Validation RulesDocument15 pagesCBDT - E-Filing - ITR 1 - Validation Rulesshadab qureshiNo ratings yet

- RESTORATION OF PUBLICATION TIME OF FBIL BENCHMARKS 6c71b82bc4Document1 pageRESTORATION OF PUBLICATION TIME OF FBIL BENCHMARKS 6c71b82bc4shadab qureshiNo ratings yet

- FBIL EOI For SDL ZCYC Par Yield Curve 08865f11c1Document19 pagesFBIL EOI For SDL ZCYC Par Yield Curve 08865f11c1shadab qureshiNo ratings yet

- Advisory Tran Links UpdatedDocument8 pagesAdvisory Tran Links Updatedshadab qureshiNo ratings yet

- Astragraphia - IA ITB 2017Document10 pagesAstragraphia - IA ITB 2017Ade FajarNo ratings yet

- Case Study - Fashion Forward Vs Dream DesignDocument6 pagesCase Study - Fashion Forward Vs Dream DesignmynalawalNo ratings yet

- FC ProjectDocument25 pagesFC ProjectRaut BalaNo ratings yet

- 3.the Power Lantern Jackpot Nifty Trade - 2.10-3Document11 pages3.the Power Lantern Jackpot Nifty Trade - 2.10-3arveti bhuvaneshNo ratings yet

- Coa Circular 2009-002Document21 pagesCoa Circular 2009-002Krizzel SandovalNo ratings yet

- A. B. C. D.: 1-Malcolm Baldrige National Quality Award Is For (MBNQA)Document132 pagesA. B. C. D.: 1-Malcolm Baldrige National Quality Award Is For (MBNQA)vikash kumarNo ratings yet

- Spira (2001) Enterprise and Accountability Striking A BalanceDocument10 pagesSpira (2001) Enterprise and Accountability Striking A Balancebaehaqi17No ratings yet

- Fighting Modern Slavery and Human TraffickingDocument69 pagesFighting Modern Slavery and Human TraffickingEdward AmanyireNo ratings yet

- Assignment 2Document2 pagesAssignment 2mikeeNo ratings yet

- Deed of Absolute Sale of A Portion of Registered LandDocument3 pagesDeed of Absolute Sale of A Portion of Registered LandChristian Jade HensonNo ratings yet

- Indiabulls Housing Finance Limited: D D M M Y Y Y YDocument2 pagesIndiabulls Housing Finance Limited: D D M M Y Y Y YSwastik MaheshwaryNo ratings yet

- Kasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneDocument1 pageKasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneTimo PaulNo ratings yet

- Diwakar Kukreja: Key Skills Profile SummaryDocument2 pagesDiwakar Kukreja: Key Skills Profile SummarySAMSON GLOBALNo ratings yet

- This Month's Summary: Total 1178.82Document4 pagesThis Month's Summary: Total 1178.82it proNo ratings yet

- Curiculum Vitae: ExperienceDocument12 pagesCuriculum Vitae: ExperienceDesi Hendaryanie WiramiharjaNo ratings yet

- Africa in The Global Climate Change NegotiationsDocument18 pagesAfrica in The Global Climate Change Negotiationsmatue77@yahoo.comNo ratings yet

- MSM ChecklistDocument15 pagesMSM ChecklistjeremydallasliveNo ratings yet

- BA LLB Eco 1st Sem PaperDocument4 pagesBA LLB Eco 1st Sem PaperBrinda VishwanathNo ratings yet

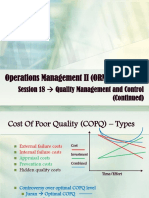

- ORM2BJ (D) 22-3 - Session 18Document16 pagesORM2BJ (D) 22-3 - Session 18mohit9811No ratings yet

- Local Media1683093690696683162Document24 pagesLocal Media1683093690696683162fearl evangelistaNo ratings yet

- CH 4Document14 pagesCH 4Abd El-Rahman El-syeoufyNo ratings yet

- Economic Production Lot Size Model: Josef, Andrea Jessa C. Laplano, FernalouDocument19 pagesEconomic Production Lot Size Model: Josef, Andrea Jessa C. Laplano, Fernalounatalie clyde matesNo ratings yet

- Arms Length PrincipleDocument18 pagesArms Length PrincipleMARY IRUNGUNo ratings yet

- The Health and Growth Potential of The Steel Manufacturing Industries in SADocument94 pagesThe Health and Growth Potential of The Steel Manufacturing Industries in SAShumani PharamelaNo ratings yet