Professional Documents

Culture Documents

RMC No. 84-2023 Guidelines

Uploaded by

sandraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No. 84-2023 Guidelines

Uploaded by

sandraCopyright:

Available Formats

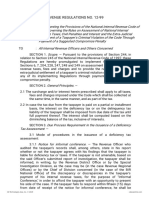

Guidelines and Instructions for BIR Form No.

2200-M [January 2018 (ENCS)] v2

Excise Tax Return for Mineral Products

These instructions are designed to assist taxpayers, or their representatives, with the Items 10 & 11 Place of Production/Removal: Enter the name of Region, Province and

preparation of the excise tax return for mineral products. If there are questions which are City where the minerals are produced/removed.

not adequately covered, please consult the Excise LT Regulatory Division. If there

appears to be any discrepancies between these instructions and the applicable laws and Items 12 & 12A: Choose “Yes” if the taxpayer is availing of tax relief under Special Law

regulations, the laws and regulations take precedence or International Tax Treaty, otherwise, choose “No”.

Who Shall File Part II – Manner of Payment (Items 13 to 15)

This return shall be filed in triplicate by the following: Indicate the manner of payment in paying this return whether:

1. Owner, lessee, concessionaire or operator of the mining claim; 1. For payment of excise tax due on the actual units of minerals to be removed from

the place of production; or

2. First buyer, purchaser or transferee for local sale, barter, transfer or exchange of 2. For prepayments, advance deposits or other similar schemes in payment of excise

indigenous petroleum, natural gas or liquefied natural gas; and tax. The balance of advanced payment or deposit of excise tax shall, in no case, be

utilized in payment of penalties. In the event that the balance is insufficient to cover

3. Owner or person having possession of the minerals and mineral products which the excise tax due, penalties shall be computed and imposed on the difference.

were mined, extracted or quarried without the payment of excise tax These shall be computed from the date of removal when the insufficiency shall be

incurred.

For imported minerals and mineral products, the excise tax shall be paid by the

importer or owner to the Bureau of Customs before removal of such imported articles for Part III – Payments and Application

the custom’s house.

Item 16 Excise Tax Due: Accomplish first Schedule 1 – Summary of Removals and Excise

Time and Manner of Filing and Payment Tax Due on Mineral Products Chargeable Against Payment. Then transfer the total

amount of tax due (from the last line of Schedule 1) in this item.

For each place of production, a separate return shall be filed and the excise tax shall

be paid upon removal of the mineral products from the place of production. Items 17 to 20: Enter and/or calculate the requested information as indicated in the return.

1. For Electronic Filing and Payment System (eFPS) Taxpayer: The return shall Penalties shall be imposed and collected as part of the tax

be e-filed and the tax shall be e-paid using the eFPS facilities thru the BIR website

www.bir.gov.ph. Item 21A Surcharge:

A surcharge of twenty-five percent (25%) for each of the following violations:

2. For Non-Electronic Filing and Payment System (Non-eFPS) Taxpayer: The

return shall be filed and the tax shall be paid with any Authorized Agent Bank 1. Failure to file any return and pay the amount of tax or installment due on or

(AAB) located within the territorial jurisdiction of the Revenue District Office before the due date; or

(RDO) where the taxpayer is required to register. In places where there are no 2. Filing a return with a person or office other than those with whom it is required to

AABs, the return shall be filed and the tax due shall be paid with the Revenue be filed, unless otherwise authorized by the Commissioner; or

Collection Officer (RCO) or duly Authorized City or Municipal Treasurer of the 3. Failure to pay the full or part of the amount of tax shown on the return, or the full

city or municipality falling under the jurisdiction of the aforesaid RDO amount of tax due for which no return is required to be filed on or before the due

date; or

Identified large excise taxpayers under RDO 121, RDO 124 and Large Taxpayers 4. Failure to pay the deficiency tax within the time prescribed for its payment in the

Division (LTD) duly informed in writing as such by the Commissioner of Internal notice of assessment.

Revenue, or his/her duly authorized representative, shall file the excise tax return and pay

the corresponding excise tax due with the AABs located in the BIR National Office, A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any

Diliman, Quezon City and those AABs chosen to serve them, respectively. payment has been made before the discovery of the falsity or fraud, for each of the

following violations:

Non-eFPS taxpayer may opt to use the electronic format under “eBIRForms” (refer

to www.bir.gov.ph) for the preparation, generation and submission and/or payment of 1. Willful neglect to file the return within the period prescribed by the Code or by

this return with greater ease and accuracy. rules and regulations; or

2. A false fraudulent return is willfully made.

How to Accomplish the Form

Item 21B Interest:

1. Enter all required information in CAPITAL LETTERS using BLACK INK. Mark Interest at the rate of double the legal interest rate for loans or forbearance of any

applicable boxes with an "X". Two copies MUST be filed with the BIR and one money in the absence of an express stipulation as set by the Bangko Sentral ng Pilipinas

held by the taxpayer; from the date prescribed for payment until the amount is fully paid: Provided, That, in no

2. For all questions wherein an appropriate box is provided for a possible answer, case shall the deficiency and the delinquency interest prescribed under Section 249

mark the applicable box corresponding to the chosen answer with an “X”; Subsections (B) and (C) of the National Internal Revenue Code, as amended, be imposed

3. Required information wherein the space provided has a letter separator, the same simultaneously.

must be supplied with CAPITAL LETTERS where each character (including

comma or period) shall occupy one box and leave one space blank for every word. Item 21C Compromise: Penalty pursuant to existing/applicable revenue issuances.

However, if the word is followed by a comma or period, there is no need to leave

blank after the comma or period. Do NOT write “NONE” or make any other marks Items 21D to 24: Enter and/or calculate the requested information as indicated in the

in the box/es; and return.

4. Accomplish first Part V-Schedule 1 before accomplishing Part III.

Signature Lines:

For Items 1 to 3 When all the information required are complete, sign the return in the place indicated

and provide the necessary details (e.g. title of signatory and TIN). If the return is to be filed

Item 1 Enter the month, day and year covered by the return being filed; this is the by an authorized representative, attach an authorization letter.

transaction period and not the date of filing this return.

Return filed by an accredited tax agent on behalf of a taxpayer shall bear the following

Item 2 Choose “Yes” if the tax return is one amending previous return filed, “No” if not. information:

Item 3 Indicate total number of sheet/s being attached to the return, if there is any A. For Individual (CPAs, members of GPPs and others)

1. Taxpayer Identification Number (TIN); and

Part I - Background Information 2. BIR Accreditation Number, Date of Issue, and Date of Expiry.

B. For members of the Philippine Bar (Lawyers)

Item 4 Taxpayer Identification Number (TIN): Enter TIN. If no TIN, apply for one 1. Taxpayer Identification Number (TIN);

before filing using Application for Registration (BIR Form No. 1901/1903). 2. Attorney’s Roll Number;

3. Mandatory Continuing Legal Education (MCLE) Compliance Number; and

Item 5 RDO Code: Enter the appropriate code for the RDO per filed BIR Form No. 1901 4. BIR Accreditation Number, Date of Issue, and Date of Expiry.

or 1903 and/or Certificate of Registration (BIR Form No. 2303).

Part IV Details of Payment (Items 25 to 28):

Item 6 Taxpayer’s Name: Enter taxpayer’s name as it was entered on the registration Enter the information required and then file the return to any AAB located within the

form and/or certificate of registration. territorial jurisdiction of the Revenue District Office (RDO) where the taxpayer is

registered. Refer to www.bir.gov.ph for the applicable AAB or visit the local BIR Office.

Item 7 & 7A Registered Address/ZIP Code: Enter registered address as indicated in

the BIR Form No. 2303 and the ZIP Code. If taxpayer has moved since the Schedule 1 - Summary of Removals and Excise Tax Due on Minerals Chargeable

previous filing and has NOT updated the registration, the taxpayer must update Against Payment

his/her/its registration by filing BIR Form No. 1905.

Enter the required information, then calculate as indicated in the return. The total tax

Item 8 Contact Number: Enter the taxpayer’s current contact number. due reflected on the last line of this schedule shall be transferred to Part III - Item 16.

Item 9 Email Address: Enter the requested information. In case taxpayer has no email Required Attachments:

address, leave the space blank. 1. For amended return, proof of the payment and the return previously filed.

2. All returns filed by an authorized representative must attach Authorization Letter.

You might also like

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Guidelines and Instructions For BIR Form No. 2200-M Excise Tax Return For Mineral ProductsDocument1 pageGuidelines and Instructions For BIR Form No. 2200-M Excise Tax Return For Mineral ProductsCindy RioNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDocument2 pagesGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNo ratings yet

- Guide to Filing BIR Form 2200-SDocument2 pagesGuide to Filing BIR Form 2200-SJoseph DoctoNo ratings yet

- 2550Q Guidelines 2023 - FinalDocument1 page2550Q Guidelines 2023 - Finallorenzo ejeNo ratings yet

- 2551QDocument1 page2551QchelissamaerojasNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- Closely-Held Corporation IAET Return RequirementsDocument1 pageClosely-Held Corporation IAET Return RequirementsRizza Mae RodriguezNo ratings yet

- BIR FORM 2551Q InstructionsDocument2 pagesBIR FORM 2551Q InstructionskehlaniNo ratings yet

- 2550Q InstructionsDocument1 page2550Q InstructionsMay RamosNo ratings yet

- MINERAL CompleteDocument3 pagesMINERAL CompleteAngela ArleneNo ratings yet

- Tax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentDocument9 pagesTax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentJeni ManobanNo ratings yet

- Guidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnDocument1 pageGuidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnRieland CuevasNo ratings yet

- Shall File A Return Under OathDocument17 pagesShall File A Return Under OathMixx MineNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnneNo ratings yet

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsDocument2 pagesBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodNo ratings yet

- TAX-1601 (Additions To Tax)Document4 pagesTAX-1601 (Additions To Tax)lyndon delfinNo ratings yet

- R.A. No. 11976 - Ease of Paying TaxesDocument18 pagesR.A. No. 11976 - Ease of Paying TaxesBeaNo ratings yet

- Tax-Remedies (Govt-Remedies-Highlights)Document38 pagesTax-Remedies (Govt-Remedies-Highlights)Yves Nicollete LabadanNo ratings yet

- PenaltiesDocument2 pagesPenaltiesfatmaaleahNo ratings yet

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDocument1 pageGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNo ratings yet

- Revenue Regulations 4-2019Document41 pagesRevenue Regulations 4-2019HaRry PeregrinoNo ratings yet

- RMC No. 12-2020 Annex A - 2552 GuidelinesDocument1 pageRMC No. 12-2020 Annex A - 2552 GuidelinesDarla EnriquezNo ratings yet

- Return of Percentage TaxDocument2 pagesReturn of Percentage TaxfatmaaleahNo ratings yet

- 1601-EQ Guide January 2019 ENCS RevDocument1 page1601-EQ Guide January 2019 ENCS RevErika OrellanoNo ratings yet

- 1702 RTsasaDocument4 pages1702 RTsasaEysOc11No ratings yet

- 2551QDocument3 pages2551QJerry Bantilan JrNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Tax Deficiency and Tax DeliquencyDocument4 pagesTax Deficiency and Tax DeliquencyJanelleNo ratings yet

- 2async023 REMEDIESDocument27 pages2async023 REMEDIESBogs QuitainNo ratings yet

- Percentage TaxDocument7 pagesPercentage TaxArielle CabritoNo ratings yet

- Tax RemediesDocument8 pagesTax RemediesKhim BebicNo ratings yet

- RR 12-99Document16 pagesRR 12-99doraemoanNo ratings yet

- Estate Tax ReturnDocument36 pagesEstate Tax ReturnMikee TanNo ratings yet

- Revenue Regulations on Tax AssessmentDocument16 pagesRevenue Regulations on Tax AssessmentI.G. Mingo MulaNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document1 pageGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoNo ratings yet

- Title VIII Tax Remedies NotesDocument7 pagesTitle VIII Tax Remedies NotesAnthony Yap100% (1)

- Revenue Regulations No. 9-2001Document6 pagesRevenue Regulations No. 9-2001Anonymous GMUQYq8No ratings yet

- CODAL - TAXATION - TITLE VIII RemediesDocument10 pagesCODAL - TAXATION - TITLE VIII RemediesTea AnnNo ratings yet

- A. Letter of Authority (La)Document15 pagesA. Letter of Authority (La)ZengardenNo ratings yet

- Bir RR 12-99Document21 pagesBir RR 12-99Isaac Joshua AganonNo ratings yet

- Proposed RR Tax DelinquenciesDocument7 pagesProposed RR Tax DelinquenciesEster RebanalNo ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- Percentage Tax ReviewerDocument5 pagesPercentage Tax ReviewerJerico ManaloNo ratings yet

- BIR Form Payment GuideDocument8 pagesBIR Form Payment GuideRaxelle MalubagNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesAnonymous 1tTxK4No ratings yet

- DST-CTA-gr 221655 2021Document5 pagesDST-CTA-gr 221655 2021Teresita TibayanNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument7 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinancejoanneNo ratings yet

- RMO - No. 33-2019 PDFDocument7 pagesRMO - No. 33-2019 PDFRedbutterfly Del Mundo GalindoNo ratings yet

- 0619-E Jan 2018 GuidelinesDocument1 page0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagNo ratings yet

- Cash Management ModelsDocument2 pagesCash Management ModelsyukesrajaNo ratings yet

- Basic Tax Principles ExplainedDocument46 pagesBasic Tax Principles Explained在于在No ratings yet

- Fa IiiDocument76 pagesFa Iiirishav agarwalNo ratings yet

- Project Report Tenthouse PDFDocument10 pagesProject Report Tenthouse PDFsinghNo ratings yet

- BondsDocument58 pagesBondsKunal ChoudharyNo ratings yet

- 1-Delivering Quality Services of SME-Based Construction Firms in The Philippines PDFDocument6 pages1-Delivering Quality Services of SME-Based Construction Firms in The Philippines PDFjbjuanzonNo ratings yet

- Derivative Report For 04 Jan - Mansukh Investment and Trading SolutionsDocument3 pagesDerivative Report For 04 Jan - Mansukh Investment and Trading SolutionsMansukh Investment & Trading SolutionsNo ratings yet

- Corporate PresentationDocument49 pagesCorporate PresentationroopcoolNo ratings yet

- Copia de Preparing For The LINGUASKILL - Speaking Section Part TWODocument8 pagesCopia de Preparing For The LINGUASKILL - Speaking Section Part TWOMauricio MenesesNo ratings yet

- Internet Marketing Plan GuideDocument5 pagesInternet Marketing Plan GuideMario MitevskiNo ratings yet

- Pakistan's Ghost Kitchen Industry AnalysisDocument4 pagesPakistan's Ghost Kitchen Industry AnalysisHaiqa SheikhNo ratings yet

- Report of Collections and DepositsDocument3 pagesReport of Collections and DepositsReign Hernandez100% (1)

- 10k - Manpower Inc 2011Document115 pages10k - Manpower Inc 2011dayalratikNo ratings yet

- 3.7 Who Should Buy Life Insurance?: 1. Begining FamiliesDocument10 pages3.7 Who Should Buy Life Insurance?: 1. Begining FamiliesFarhana Foysal SatataNo ratings yet

- Chapter V. Unit1Document9 pagesChapter V. Unit1Rosewhayne Tiffany TejadaNo ratings yet

- 2023 Slides On Exempt IncomeDocument31 pages2023 Slides On Exempt IncomeSiphesihleNo ratings yet

- China's Economic Growth and Foreign Business Environment in 40 CharactersDocument23 pagesChina's Economic Growth and Foreign Business Environment in 40 CharactersAsad BilalNo ratings yet

- Business Plan HacheryDocument52 pagesBusiness Plan HacherypipestressNo ratings yet

- SAP Implementation Chklist 18-03-2019Document38 pagesSAP Implementation Chklist 18-03-2019Muhammed ASNo ratings yet

- Ax2009 Enus TL1 03Document78 pagesAx2009 Enus TL1 03amirulzNo ratings yet

- 7011 - 01 - Edexcel-GCE-O-level-Accounting-Answer Sheeet-January-2011Document24 pages7011 - 01 - Edexcel-GCE-O-level-Accounting-Answer Sheeet-January-2011MahmozNo ratings yet

- Lec 3 TransportationDocument22 pagesLec 3 TransportationSADDAF NOORNo ratings yet

- Projet: Telecom Africa Distrubition Expertise Security (Tades)Document8 pagesProjet: Telecom Africa Distrubition Expertise Security (Tades)Maimouna NdiayeNo ratings yet

- Tax Banggawan2019 Ch.15-ADocument12 pagesTax Banggawan2019 Ch.15-ANoreen LeddaNo ratings yet

- Dell LBO model case studyDocument21 pagesDell LBO model case studyMohd IzwanNo ratings yet

- McDonalds Final Exam (VerC)Document8 pagesMcDonalds Final Exam (VerC)Jose BarrosNo ratings yet

- Chapter 09. Ch09 P18 Build A Model: Cost of DebtDocument2 pagesChapter 09. Ch09 P18 Build A Model: Cost of Debtk3jooo كيجوووNo ratings yet

- Project Charter Peer Review 1Document3 pagesProject Charter Peer Review 1Hassan Elmi0% (1)

- Final Report - Master ThesisDocument78 pagesFinal Report - Master ThesisrichyNo ratings yet

- Customer Centric Data and AnalyticsDocument18 pagesCustomer Centric Data and AnalyticschrysobergiNo ratings yet