Professional Documents

Culture Documents

BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and Instructions

Uploaded by

dreaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and Instructions

Uploaded by

dreaCopyright:

Available Formats

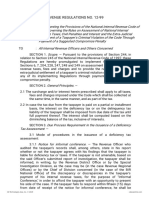

BIR FORM NO.

2550Q – Quarterly Value-Added Tax Return

Guidelines and Instructions

Definition of Terms

Who shall file Input Tax means the value-added tax due from or paid by a VAT-

registered person in the course of his trade or business on importation of

This return shall be filed in triplicate by the following taxpayers: goods, or local purchase of goods or services, including lease or use of

1. A VAT-registered person; and property, from a VAT-registered person. It shall also include the

2. A person required to register as a VAT taxpayer but failed to transitional input tax determined in accordance with Section 111 of the

register. National Internal Revenue Code, presumptive input tax and deferred input

This return must be filed by the aforementioned taxpayers for as long as tax from previous period.

the VAT registration has not yet been cancelled, even if there is no taxable

transaction during the quarter or the aggregate sales/receipts for any 12-month Output Tax means the value-added tax due on the sale or lease

period did not exceed the P1,500,000.00 threshold. of taxable goods or properties or services by any person

A person who imports goods shall use the form prescribed by the Bureau registered or required to register under Section 236 of the National

of Custom. Internal Revenue Code.

When and Where to file Penalties

The returns must be filed not later than the 25 th day following the close There shall be imposed and collected as part of the tax:

of the quarter. 1. A surcharge of twenty five percent (25%) for each of the following

The returns must be filed with any Authorized Agent Bank (AAB) within violations:

the jurisdiction of the Revenue District Office where the taxpayer is required to a. Failure to file any return and pay the amount of tax or

register. In places where there are no Authorized Agent Bank (AAB), the installment due on or before the due date;

returns shall be filed with the Revenue Collection Officer or duly Authorized b. Unless otherwise authorized by the Commissioner, filing a

City or Municipal Treasurer located within the revenue district where the return with a person or office other than those with whom it

taxpayer is required to register. is required to be filed;

c. Failure to pay the full or part of the amount of tax shown on

Any taxpayer whose registration has been cancelled shall file a return and the return, or the full amount of tax due for which no return

pay the tax due thereon within 25 days from date of cancellation of registration. is required to be filed on or before the due date;

For taxpayers with branches, only one consolidated return shall be filed for the d. Failure to pay the deficiency tax within the time prescribed

principal place of business or head office and all the branches. for its payment in the notice of assessment.

2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in

When and Where to Pay case any payment has been made on the basis of such return before the

discovery of the falsity or fraud, for each of the following violations:

Upon filing this return, the total amount payable shall be paid to the a. Willful neglect to file the return within the period prescribed

Authorized Agent Bank (AAB) where the return is filed. In places where there by the Code or by rules and regulations; or

are no AABs, payment shall be made to the Revenue Collection Officer or duly b. In case a false or fraudulent return is willfully made.

Authorized City or Municipal Treasurer who shall issue a Revenue Official 3. Interest at the rate of twenty percent (20%) per annum, on any unpaid

Receipt (ROR) therefor. amount of tax, from the date prescribed for the payment until the amount

is fully paid.

Where the return is filed with an AAB, taxpayer must accomplish and 4. Compromise penalty.

submit BIR-prescribed deposit slip, which the bank teller shall machine validate

as evidence that payment was received by the AAB. The AAB receiving the tax Attachments

return shall stamp mark the word “Received” on the return and also machine

validate the return as proof of filing the return and payment of the tax by the 1. Duly issued Certificate of Creditable VAT Withheld at Source, if

taxpayer, respectively. The machine validation shall reflect the date of payment, applicable;

amount paid and transactions code, the name of the bank, branch code, teller’s 2. Summary Alphalist of Withholding Agents of Income Payments

code and teller’s initial. Bank debit memo number and date should be indicated Subjected to Withholding Tax at Source (SAWT), if applicable;

in the return for taxpayers paying under the bank debit system. 3. Duly approved Tax Debit Memo, if applicable;

4. Duly approved Tax Credit Certificate, if applicable.

For Electronic Filing and Payment System (EFPS) Taxpayer 5. Proof of the payment and the return previously filed, for amended return.

6. Authorization letter, if return is filed by authorized representative.

The deadline for electronically filing and paying the taxes due thereon

shall be in accordance with the provisions of existing applicable revenue Note: All background information must be properly filled up.

issuances.

All returns filed by an accredited tax representative on behalf of a taxpayer

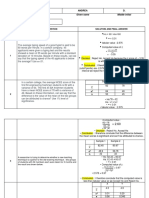

Rates and Bases of Tax shall bear the following information:

A. For CPAs and others (individual practitioners and members of

GPPs);

A. On Sale of Goods and Properties – twelve percent (12%) of the gross a.1 Taxpayer Identification Number (TIN); and

selling price or gross value in money of the goods or properties a.2 Certificate of Accreditation Number, Date of Issuance,

sold, bartered or exchanged. and Date of Expiry.

B. On Sale of Services and Use or Lease of Properties – twelve percent B. For members of the Philippine Bar (individual practitioners,

(12%) of gross receipts derived from the sale or exchange of services, members of GPPs);

including the use or lease of properties. b.1 Taxpayer Identification Number (TIN); and

C. On Importation of Goods – twelve percent (12%) based on the total value b.2 Attorney’s Roll number or Accreditation Number, if any.

Box No. 1 refers to transaction period and not the date of filing this return.

used by the Bureau of Customs in determining tariff and customs duties, The last 3 digits of the 12-digit TIN refers to the branch code.

plus customs duties, excise taxes, if any, and other charges, such tax to TIN = Taxpayer Identification Number

be paid by the importer prior to the release of such goods from customs ENCS

custody: Provided, That where the customs duties are determined on the

basis of quantity or volume of the goods, the value added tax shall be

based on the landed cost plus excise taxes, if any.

D. On Export Sales and Other Zero-rated Sales - 0%.

You might also like

- Business Taxation CalculationsDocument13 pagesBusiness Taxation CalculationsdreaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- SEC. 202-207 Collection of Delinquent TaxesDocument14 pagesSEC. 202-207 Collection of Delinquent TaxesweygandtNo ratings yet

- Tax Remedies Under The NIRCDocument7 pagesTax Remedies Under The NIRCmaeprincess100% (1)

- 7 ElevenDocument17 pages7 ElevenCir Arnold Santos IIINo ratings yet

- Tax-Remedies (Govt-Remedies-Highlights)Document38 pagesTax-Remedies (Govt-Remedies-Highlights)Yves Nicollete LabadanNo ratings yet

- 7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestDocument2 pages7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestHarleneNo ratings yet

- PI Industries April 2020 Pay SlipDocument1 pagePI Industries April 2020 Pay SlipRahul mishraNo ratings yet

- Financial Planning - FinalDocument56 pagesFinancial Planning - FinalMohammed AkbAr Ali100% (1)

- CPA Review Problems on Operating Segment and Interim ReportingDocument3 pagesCPA Review Problems on Operating Segment and Interim ReportingLui100% (2)

- Taxation LawDocument10 pagesTaxation LawflorNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6jasperkennedy094% (17)

- Impact of Globalization On PakistanDocument17 pagesImpact of Globalization On PakistanEngr Majid Ali Baig85% (48)

- RR 12-99Document16 pagesRR 12-99doraemoanNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- 2550Q InstructionsDocument1 page2550Q InstructionsMay RamosNo ratings yet

- 2550Q Guidelines 2023 - FinalDocument1 page2550Q Guidelines 2023 - Finallorenzo ejeNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- BIR FORM 2551Q InstructionsDocument2 pagesBIR FORM 2551Q InstructionskehlaniNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document1 pageGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoNo ratings yet

- 2551QDocument1 page2551QchelissamaerojasNo ratings yet

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDocument1 pageGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- 1601-EQ Guide January 2019 ENCS RevDocument1 page1601-EQ Guide January 2019 ENCS RevErika OrellanoNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- PenaltiesDocument2 pagesPenaltiesfatmaaleahNo ratings yet

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsDocument2 pagesBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodNo ratings yet

- Closely-Held Corporation IAET Return RequirementsDocument1 pageClosely-Held Corporation IAET Return RequirementsRizza Mae RodriguezNo ratings yet

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnneNo ratings yet

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesAnonymous 1tTxK4No ratings yet

- Guidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnDocument1 pageGuidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnRieland CuevasNo ratings yet

- RMC No. 12-2020 Annex A - 2552 GuidelinesDocument1 pageRMC No. 12-2020 Annex A - 2552 GuidelinesDarla EnriquezNo ratings yet

- Taxation Law Reviewer Key ConceptsDocument13 pagesTaxation Law Reviewer Key ConceptsJericho PedragosaNo ratings yet

- 2000 June 2006 (Back)Document1 page2000 June 2006 (Back)Rica Santos-vallesteroNo ratings yet

- Tax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentDocument9 pagesTax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentJeni ManobanNo ratings yet

- Percentage Tax Requirements and ProceduresDocument8 pagesPercentage Tax Requirements and ProceduresDura LexNo ratings yet

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- CODAL - TAXATION - TITLE VIII RemediesDocument10 pagesCODAL - TAXATION - TITLE VIII RemediesTea AnnNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- W3 Module 3 - Tax Administration Part IIDocument14 pagesW3 Module 3 - Tax Administration Part IIElmeerajh JudavarNo ratings yet

- Transfer of Shares and Real Property DST ReturnDocument1 pageTransfer of Shares and Real Property DST ReturnJeric BlasurcaNo ratings yet

- Percentage Tax ReviewerDocument5 pagesPercentage Tax ReviewerJerico ManaloNo ratings yet

- 0619-E Jan 2018 GuidelinesDocument1 page0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagNo ratings yet

- 2551QDocument3 pages2551QJerry Bantilan JrNo ratings yet

- RMC No. 84-2023 GuidelinesDocument1 pageRMC No. 84-2023 GuidelinessandraNo ratings yet

- Lesson 8 BtaxDocument4 pagesLesson 8 Btaxdin matanguihanNo ratings yet

- Compliance RequirementsDocument27 pagesCompliance Requirementsedz_1pieceNo ratings yet

- Taxation 1 Lesson 1. Returns and Payment of TaxDocument42 pagesTaxation 1 Lesson 1. Returns and Payment of TaxHarui Hani-31No ratings yet

- Tax RemediesDocument8 pagesTax RemediesKhim BebicNo ratings yet

- January 14, 2011: DescriptionDocument11 pagesJanuary 14, 2011: DescriptionRosselle GuevarraNo ratings yet

- Guide to Filing BIR Form 2200-SDocument2 pagesGuide to Filing BIR Form 2200-SJoseph DoctoNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-FQ Quarterly Remittance Return of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 1601-FQ Quarterly Remittance Return of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- TAX-1601 (Additions To Tax)Document4 pagesTAX-1601 (Additions To Tax)lyndon delfinNo ratings yet

- Guidelines and Instructions For BIR Form No. 2200-M Excise Tax Return For Mineral ProductsDocument1 pageGuidelines and Instructions For BIR Form No. 2200-M Excise Tax Return For Mineral ProductsCindy RioNo ratings yet

- 2551 MDocument2 pages2551 MAdrian AyrosoNo ratings yet

- Sales Tax Sir MADocument35 pagesSales Tax Sir MAAbdullah SheikhNo ratings yet

- Accounting Technician Level 3 - Module 3 Part 2Document4 pagesAccounting Technician Level 3 - Module 3 Part 2Rona Amor MundaNo ratings yet

- VAT Tax ReportDocument8 pagesVAT Tax ReportMichelle Marie TablizoNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- What Is Percentage Tax?Document3 pagesWhat Is Percentage Tax?Lucas JuanchoNo ratings yet

- Item No. 1 - Taxable Period: 1. Purely Compensation Income Earner BIR Annual Income Tax Return (ITR) Form No. 1700Document48 pagesItem No. 1 - Taxable Period: 1. Purely Compensation Income Earner BIR Annual Income Tax Return (ITR) Form No. 1700Miguel CasimNo ratings yet

- Tanzania Revenue Authority - VAT RefundDocument1 pageTanzania Revenue Authority - VAT RefundMICHAEL MBILINYINo ratings yet

- Post NegoDocument46 pagesPost NegodreaNo ratings yet

- FINALNSTPDocument29 pagesFINALNSTPdreaNo ratings yet

- Copernican Revolution: Intellectual RevolutionsDocument6 pagesCopernican Revolution: Intellectual RevolutionsdreaNo ratings yet

- Adjusted Adjusted Trial Balance Income Statement BalanceDocument1 pageAdjusted Adjusted Trial Balance Income Statement BalancedreaNo ratings yet

- Characteristics (Abcd Vip)Document8 pagesCharacteristics (Abcd Vip)dreaNo ratings yet

- NSTPTWODocument12 pagesNSTPTWOdreaNo ratings yet

- GAAP Fundamentals ExplainedDocument6 pagesGAAP Fundamentals ExplaineddreaNo ratings yet

- Negotiable Instruments CharacteristicsDocument34 pagesNegotiable Instruments CharacteristicsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Process Costing: Discussion QuestionsDocument53 pagesProcess Costing: Discussion QuestionsDissa ElvarettaNo ratings yet

- Copernican Revolution: Intellectual RevolutionsDocument6 pagesCopernican Revolution: Intellectual RevolutionsdreaNo ratings yet

- Copernican Revolution: Intellectual RevolutionsDocument6 pagesCopernican Revolution: Intellectual RevolutionsdreaNo ratings yet

- Tan, Andrea PDFDocument9 pagesTan, Andrea PDFdreaNo ratings yet

- PDFDocument11 pagesPDFdreaNo ratings yet

- Stats PDFDocument7 pagesStats PDFdreaNo ratings yet

- Submitted By:: Last Name Given Name Middle InitialDocument9 pagesSubmitted By:: Last Name Given Name Middle InitialdreaNo ratings yet

- Rationale: Fiscal Agency. The Senate Fiscal Agency Neither Supports Nor Opposes Legislation.)Document2 pagesRationale: Fiscal Agency. The Senate Fiscal Agency Neither Supports Nor Opposes Legislation.)dreaNo ratings yet

- GroupDocument4 pagesGroupdreaNo ratings yet

- Proof of Cash Worksh1Document1 pageProof of Cash Worksh1Akomismo ToNo ratings yet

- FFDocument2 pagesFFdreaNo ratings yet

- Stats PDFDocument7 pagesStats PDFdreaNo ratings yet

- Stats PDFDocument7 pagesStats PDFdreaNo ratings yet

- Purcom 1Document3 pagesPurcom 1dreaNo ratings yet

- StatsDocument14 pagesStatsdreaNo ratings yet

- Classification of Deductible Expenses Section 212 Expenses:: Have AGI LimitationsDocument6 pagesClassification of Deductible Expenses Section 212 Expenses:: Have AGI Limitations张心怡No ratings yet

- krisAR 2016 2017Document86 pageskrisAR 2016 2017sharkl123No ratings yet

- MIDTERM EXAM - Mahardika Ayunda C1I019034 AKMDocument12 pagesMIDTERM EXAM - Mahardika Ayunda C1I019034 AKMMahardika AyundaNo ratings yet

- Comparing Mutual Funds and ULIPsDocument44 pagesComparing Mutual Funds and ULIPsKrishna Prasad GaddeNo ratings yet

- BK Dass ProfileDocument9 pagesBK Dass ProfileShreyas ShrivastavaNo ratings yet

- CustomerInvoiceDocument1 pageCustomerInvoicePritam JanaNo ratings yet

- Acca f9 Revision Kit Acca 24 Old Past Paper Solved Old Professional Scheme - CrackedDocument237 pagesAcca f9 Revision Kit Acca 24 Old Past Paper Solved Old Professional Scheme - CrackedAlex SemusuNo ratings yet

- Competetive MagazineDocument138 pagesCompetetive MagazineantonyNo ratings yet

- Dunham-Bush Limited: Standard Terms and Conditions of SaleDocument1 pageDunham-Bush Limited: Standard Terms and Conditions of SaleMarry RieNo ratings yet

- Bilt Annual ReportDocument94 pagesBilt Annual Reportbobbilia3100% (1)

- IDT Last Day Revision Notes Free VersionDocument11 pagesIDT Last Day Revision Notes Free Versionmanognap33No ratings yet

- Exercise 1 SolutionsDocument7 pagesExercise 1 SolutionsBen SaadNo ratings yet

- 2012 National BudgetDocument236 pages2012 National BudgetPrince ZhouNo ratings yet

- Circle 089Document2 pagesCircle 089MD Rashad HossainNo ratings yet

- Digital Service Tax Debate FinalDocument9 pagesDigital Service Tax Debate FinalShivi CholaNo ratings yet

- Public Fisca Administration and ManagementDocument32 pagesPublic Fisca Administration and ManagementDARLENENo ratings yet

- Icome Regime of AgriDocument13 pagesIcome Regime of AgriZ_JahangeerNo ratings yet

- Managerial Economics For Quick RevisionDocument224 pagesManagerial Economics For Quick RevisionSuparna2No ratings yet

- S01 Review On SFP, NFS and RPTDocument3 pagesS01 Review On SFP, NFS and RPTYen YenNo ratings yet

- CV Annisa AmaliaDocument6 pagesCV Annisa AmaliaViriya ParamitaNo ratings yet

- Jacqueline Haverals 2007Document21 pagesJacqueline Haverals 2007Arnoldus ApriyanoNo ratings yet

- GST White Paper in PDFDocument14 pagesGST White Paper in PDFReggeloNo ratings yet

- Dubai FDI Why Dubai Report PDFDocument20 pagesDubai FDI Why Dubai Report PDFRachit KothariNo ratings yet

- Alabang SupermarketDocument17 pagesAlabang SupermarketSammy AsanNo ratings yet

- Magento Enterprise Edition 2.0 User Guide-2016-03!30!02!54!57Document1,358 pagesMagento Enterprise Edition 2.0 User Guide-2016-03!30!02!54!57Manik shaikhNo ratings yet

- Cost of Machine QuestionDocument1 pageCost of Machine QuestionRaffayNo ratings yet