Professional Documents

Culture Documents

FF

Uploaded by

drea0 ratings0% found this document useful (0 votes)

7 views2 pagescosting

Original Title

ff

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcosting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesFF

Uploaded by

dreacosting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Process costing is a method of costing used to 5.

The cost of the beginning and ending

ascertain the cost of production of each process, work in process inventories

operation or stage of manufacture where processes 6. Cost transferred to a succeeding

department or to a finished goods storeroom

are carried in having one or more of the following

features: Cost of production report is divided into five

1. The output of one process becomes the input sections.

to the next process Each section is meant to provide specific

2. The continuous nature of Homogeneous information. A brief description of these sections

production is presented below:

3. There is often a loss in process due to

1. Quantity Schedule

spoilage, shrinkage, wastage so on

2. Cost Charged to the Department

4. Output from production may be a single 3. Equivalent units produced

product, but there may also be a by-product 4. Cost Per Unit

(or byproducts) and/or joint products 5. Cost Accounted for as Follows

Process costing is a costing method used where it is Equivalent Units Produced

not possible to identify separate units of production, In order to arrive at cost per unit of

output, total of each cost element is divided

or jobs, usually because of the continuous nature of

by the number of units produced. For this

the production processes. It is common to identify purpose, where at the end of costing period,

process costing with continuous production such as there are some partially completed units in

the following: process, these units must be stated in terms

- Oil refining of equivalent completed units. These

- Foods and drinks equivalent units are added to units completed

by the department to arrive at equivalent

- Paper

production. Then total cost is divided by this

- Chemicals

equivalent production figure to calculate unit

cost.

Cost per Unit

The unit cost of the equivalent units for a

given period is calculated as follows:

Process Costing (Cost of Production Report)

In process costing Cost of Production

Report also called Process Cost Sheet is the key

document. At the end of costing period, generally

a month, a Cost of Production Report is prepared.

It summarizes the data of quantity produced and

cost incurred by each producing department. It

also serves as a source document for passing

accounting entries at the end of costing period. A

cost of production report shows:

1. Total unit costs transferred to it from a

preceding department

2. Materials, labor, and factory overhead

added by the department

3. Unit cost added by the department

4. Total and unit costs accumulated to the

end of operations in the department.

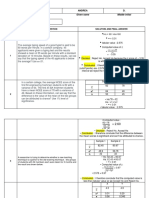

Mini Soap Manufacturing units started

to incurring cost in first department

for 1,000 soaps. At the end of the week

600 soaps were completed and 400

incomplete. 100% of direct material

had been incurred. But 75%

conversion cost was yet incurred on

the incomplete work. Detail of cost

incurred by the department I as

follows:

DM 500

DL 112

FO 168

Mini Soap Manufacturing unit

completed and transferred out 600

soaps to department II. In department

II 500 soaps completed and

transferred out. Units which were

still in process 100 (100% material,

Conversion cost 60%). Cost received

from preceding department Rs. 540

Following costs were incurred by

department II

DM 150

DL 112

FO 168

You might also like

- Characteristics (Abcd Vip)Document8 pagesCharacteristics (Abcd Vip)dreaNo ratings yet

- Post NegoDocument46 pagesPost NegodreaNo ratings yet

- Adjusted Adjusted Trial Balance Income Statement BalanceDocument1 pageAdjusted Adjusted Trial Balance Income Statement BalancedreaNo ratings yet

- Copernican Revolution: Intellectual RevolutionsDocument6 pagesCopernican Revolution: Intellectual RevolutionsdreaNo ratings yet

- NSTPTWODocument12 pagesNSTPTWOdreaNo ratings yet

- Business Taxation CalculationsDocument13 pagesBusiness Taxation CalculationsdreaNo ratings yet

- Copernican Revolution: Intellectual RevolutionsDocument6 pagesCopernican Revolution: Intellectual RevolutionsdreaNo ratings yet

- FINALNSTPDocument29 pagesFINALNSTPdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- GAAP Fundamentals ExplainedDocument6 pagesGAAP Fundamentals ExplaineddreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Copernican Revolution: Intellectual RevolutionsDocument6 pagesCopernican Revolution: Intellectual RevolutionsdreaNo ratings yet

- Negotiable Instruments CharacteristicsDocument34 pagesNegotiable Instruments CharacteristicsdreaNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6jasperkennedy094% (17)

- Process Costing: Discussion QuestionsDocument53 pagesProcess Costing: Discussion QuestionsDissa ElvarettaNo ratings yet

- Submitted By:: Last Name Given Name Middle InitialDocument9 pagesSubmitted By:: Last Name Given Name Middle InitialdreaNo ratings yet

- Stats PDFDocument7 pagesStats PDFdreaNo ratings yet

- Tan, Andrea PDFDocument9 pagesTan, Andrea PDFdreaNo ratings yet

- Stats PDFDocument7 pagesStats PDFdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Rationale: Fiscal Agency. The Senate Fiscal Agency Neither Supports Nor Opposes Legislation.)Document2 pagesRationale: Fiscal Agency. The Senate Fiscal Agency Neither Supports Nor Opposes Legislation.)dreaNo ratings yet

- PDFDocument11 pagesPDFdreaNo ratings yet

- GroupDocument4 pagesGroupdreaNo ratings yet

- Stats PDFDocument7 pagesStats PDFdreaNo ratings yet

- Purcom 1Document3 pagesPurcom 1dreaNo ratings yet

- StatsDocument14 pagesStatsdreaNo ratings yet

- Proof of Cash Worksh1Document1 pageProof of Cash Worksh1Akomismo ToNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Tamil Nadu Prize SchemesDocument4 pagesThe Tamil Nadu Prize SchemesShashank RaoNo ratings yet

- InfoCell Award & Certificate v2212 FADocument10 pagesInfoCell Award & Certificate v2212 FAMelancholy To MagiecNo ratings yet

- 17 Mergers LBOs Divestitures and Business FailureDocument2 pages17 Mergers LBOs Divestitures and Business FailureKristel Sumabat100% (1)

- Oracle Application Implementation Methodology AIMDocument6 pagesOracle Application Implementation Methodology AIMGuillermo ToddNo ratings yet

- Account Transactions ReportDocument2 pagesAccount Transactions ReportdennycaNo ratings yet

- Consumer ActDocument35 pagesConsumer ActAnnabelle RafolsNo ratings yet

- HunterDocument10 pagesHuntersuneetaNo ratings yet

- A Study On Public Perception Towards Social Media AdvertisingDocument113 pagesA Study On Public Perception Towards Social Media AdvertisingRanit MajumderNo ratings yet

- Module 7 Handouts: The Nature of Strategy ImplementationDocument4 pagesModule 7 Handouts: The Nature of Strategy ImplementationvivianNo ratings yet

- IFRS S2sDocument46 pagesIFRS S2sComunicarSe-ArchivoNo ratings yet

- Prepared by Mohammad Maruf ID No: B113119 Program: BBA Semester: Autumn 2015Document15 pagesPrepared by Mohammad Maruf ID No: B113119 Program: BBA Semester: Autumn 2015Tamim SikderNo ratings yet

- Distribution Channel of Mutual Funds in IndiaDocument73 pagesDistribution Channel of Mutual Funds in IndiaGeorge T Cherian100% (2)

- Entrepreneurship & Innovation: 3 EditionDocument46 pagesEntrepreneurship & Innovation: 3 EditionSamNo ratings yet

- Henry SyDocument2 pagesHenry Sydaenarrold76No ratings yet

- Case Study Poor ComunicationDocument3 pagesCase Study Poor ComunicationSohaib HaqNo ratings yet

- Accounting Principles Lectures PDFDocument10 pagesAccounting Principles Lectures PDFprasad vinnyNo ratings yet

- Asia Paci Fic Management Review: Yu-Shun Hung, Yu-Chen ChengDocument14 pagesAsia Paci Fic Management Review: Yu-Shun Hung, Yu-Chen ChenggitaNo ratings yet

- Chapter 5 & 6 exercises solutionsDocument7 pagesChapter 5 & 6 exercises solutionsĐức TiếnNo ratings yet

- Start-Up E-Commerce Financial ModelDocument8 pagesStart-Up E-Commerce Financial ModelManish SharmaNo ratings yet

- Coc Project 17bba021 VguardDocument5 pagesCoc Project 17bba021 VguardKathir SNo ratings yet

- 12 Teamwork Interview Questions and Best AnswersDocument29 pages12 Teamwork Interview Questions and Best AnswersShalom FikerNo ratings yet

- Invoice 50698496Document1 pageInvoice 50698496monicahmuthee22No ratings yet

- Notch Damage in 79903206 Cover Assy: One Pager Problem StatementDocument2 pagesNotch Damage in 79903206 Cover Assy: One Pager Problem StatementRohit QualityNo ratings yet

- Stock List: Description: Export Date: Sorted:: Symbol Rank PriceDocument10 pagesStock List: Description: Export Date: Sorted:: Symbol Rank PriceParth PatelNo ratings yet

- Coca-Cola Case StudyDocument8 pagesCoca-Cola Case StudyDiogo GomesNo ratings yet

- Baker Hughes Interview Questions and Answers (HireVue)Document12 pagesBaker Hughes Interview Questions and Answers (HireVue)Mukaila IbrahimNo ratings yet

- Retail Management MCQ Questions and AnswersDocument43 pagesRetail Management MCQ Questions and Answersafsana khatunNo ratings yet

- Entrep ReviewerDocument5 pagesEntrep ReviewerJemima MendezNo ratings yet

- BSBMKG414: Cert IV BusinessDocument86 pagesBSBMKG414: Cert IV BusinessXavar XanNo ratings yet

- Steel BusinessDocument10 pagesSteel BusinessEricge PSB TradingNo ratings yet