Professional Documents

Culture Documents

Common Sizing Edited

Uploaded by

Claudine Anne AguiatanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Common Sizing Edited

Uploaded by

Claudine Anne AguiatanCopyright:

Available Formats

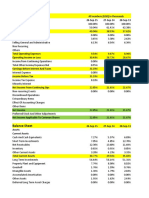

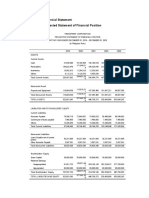

A.

Common sizing

Table 26. Return on Capital Employed

2013 2014 2015 2016 2017

ASSETS

CURRENT

Cash 1.79% 3.64% 2.05% 7.63% 14.42%

Receivables 40.15% 45.33% 43.23% 42.61% 35.97%

Inventories 3.67% 2.96% 1.92% 2.88% 3.57%

Others 4.71% 1.11% 1.46% 1.22% 1.32%

50.33% 53.04% 48.66% 54.34% 55.28%

NONCURRENT

Property & Equipment, net 49.67% 46.96% 51.34% 45.66% 44.72%

TOTAL ASSETS 100.00% 100.00% 100.00% 100.00% 100.00%

LIABILITIES AND STOCKHOLDERS'

EQUITY

CURRENT

Accounts Payable 25.42% 26.63% 28.59% 28.61% 35.79%

Current Portion of Loans Payable 24.08% 9.34% 8.83% 3.69% 2.53%

Others 5.20% 5.84% 5.38% 5.29% 5.19%

54.70% 41.81% 42.80% 37.58% 43.51%

NONCURRENT

Loans Payable - net of current portion 2.83% 20.07% 10.31% 17.99% 10.26%

Others 9.00% 1.06% 1.14% 1.01% 1.22%

11.84% 21.13% 11.46% 19.00% 11.48%

STOCKHOLDERS' EQUITY

Share Capital 10.50% 10.92% 11.78% 10.44% 10.18%

Retained Earnings 22.96% 29.41%

Unappropriated 6.49% 5.14% 7.69%

Appropriated 27.48% 27.84% 27.14%

33.46% 39.05% 45.75% 43.41% 45.01%

TOTAL LIABILITIES & STOCKHOLDERS'

EQUITY 100.00% 100.00% 100.00% 100.00% 100.00%

Table 27 shows the asset accounts as a percentage of the total assets

and liability and equity accounts as a percentage of the total liabilities and

stockholders’ equity. Assets for the latest year are mostly composed of property

and equipment which is 44.72% of the total assets this is followed by the entity’s

receivables which is 35.97%. Its liabilities and equity on the other hand is mostly

composed of accounts payable which is 35.79%. The entity has little cash for the

past five years. For the years 2013 to 2016 the entity’s cash does not exceed

10% of its total assets. This goes to show that cash alone cannot support its

current obligations which are ranging from 40 to 50% of its total liabilities and

stockholders’ equity. Receivables on the other hand are very high composing

more or less 40% of the total assets for the past five years. The entity also has

high property and equipment due to its operational needs as a manufacturing

entity. Inventories for the past five years range from 1.92 to 3.67% indicating that

the entity keeps low levels of inventory. Overall, the entity’s low level of cash

imposes a threat to its liquidity and receivables indicate high level of idle cash.

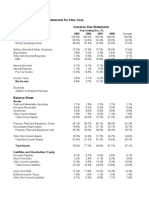

Table 28. Common Sized of Statement of Comprehensive Income

2013 2014 2015 2016 2017

SALES 100.00% 100.00% 100.00% 100.00% 100.00%

COST OF SALES 87.14% 84.95% 88.35% 88.25% 87.41%

GROSS INCOME 12.86% 13.83% 11.65% 11.75% 12.59%

OPERATING EXPENSES 7.03% 6.77% 6.92% 6.90% 7.81%

INCOME FROM OPERATIONS 5.83% 7.06% 4.73% 4.86% 4.79%

OTHER CHARGES

Interest Income 0.02%

Interest Expense -0.73% -0.34% -0.32% -0.36% -0.43%

-0.73% -0.34% -0.32% -0.36% -0.41%

INCOME BEFORE TAX 5.10% 6.72% 4.41% 4.49% 4.38%

Provision for Income Tax 1.53% 2.02% 1.32% 1.35% 1.48%

Deficiency Tax 0.22% 0.30%

NET INCOME AFTER TAX 3.35% 4.40% 3.08% 3.15% 2.89%

Table 25 shows the accounts under the statement of income and

expenses as percentages of the sales. The biggest portion of the entity’s sales

goes to the cost of sales account which is 87.41% this is the same for the past

four years where the cost of sales is ranging from 84 to 89% of the total sales.

Operating expenses on the other hand is only 6 to 8% of the total sales. The

entity also has very low net income after all the deductions which are only 2 to

4% of the total sales. It is also shown that the values of every account do not

vary much for the past five years. This makes for a very low profit margin.

Overall, the high level of cost of sales indicates that the entity is having difficulty

in managing its cost structure thus, it affects the profitability of the entity.

You might also like

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- GCB Bank's profitability and liquidity ratios over 2010-2015Document4 pagesGCB Bank's profitability and liquidity ratios over 2010-2015YAKUBU ISSAHAKU SAIDNo ratings yet

- Horizontal Analysis AltmanDocument8 pagesHorizontal Analysis AltmanClaudine Anne AguiatanNo ratings yet

- Daktronics Analysis 1Document27 pagesDaktronics Analysis 1Shannan Richards100% (3)

- Financial Overview5Document8 pagesFinancial Overview5Nishad Al Hasan SagorNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Activity 3 123456789Document7 pagesActivity 3 123456789Jeramie Sarita SumaotNo ratings yet

- Financial Performance OverviewDocument102 pagesFinancial Performance Overviewaditya jainNo ratings yet

- Financial Statement Analysis FIN3111Document9 pagesFinancial Statement Analysis FIN3111Zile MoazzamNo ratings yet

- Macy's, Inc. Financial HealthDocument2 pagesMacy's, Inc. Financial Healthjoia.dej1234No ratings yet

- AAPL - Income StatementDocument31 pagesAAPL - Income StatementRahul BindrooNo ratings yet

- P95 100 UsonDocument2 pagesP95 100 Usoncarlos uson IIINo ratings yet

- Group3 - DIY - Garware Wall Ropes - Stock PitchDocument5 pagesGroup3 - DIY - Garware Wall Ropes - Stock PitchBhushanam BharatNo ratings yet

- Retail Bakeries Financial Industry Analysis - SageworksDocument4 pagesRetail Bakeries Financial Industry Analysis - SageworksMichael Enrique Pérez MoreiraNo ratings yet

- Mod1 How Numbers Tells The Story Words (1473)Document3 pagesMod1 How Numbers Tells The Story Words (1473)Pritam Kumar NayakNo ratings yet

- Group Members Financial ProjectionsDocument12 pagesGroup Members Financial ProjectionsManmeet SinghNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Petron vs Shell Financial AnalysisDocument5 pagesPetron vs Shell Financial AnalysisFRANCIS IMMANUEL TAYAGNo ratings yet

- YPF SA EV/EBITDA NTM ratio significantly below peersDocument3 pagesYPF SA EV/EBITDA NTM ratio significantly below peersIsra MachicadoNo ratings yet

- Financial Statement Analysis of PRAN-RFL GroupDocument9 pagesFinancial Statement Analysis of PRAN-RFL GroupSandy Xavier67% (3)

- Analysis Common Size Balance SheetDocument2 pagesAnalysis Common Size Balance SheetAnh Trần ViệtNo ratings yet

- December 31 2004 2005 2006 2007 2008 2009Document2 pagesDecember 31 2004 2005 2006 2007 2008 2009adilroseNo ratings yet

- Understanding Private Bank Fundamentals and RatiosDocument19 pagesUnderstanding Private Bank Fundamentals and RatiosAbhishekNo ratings yet

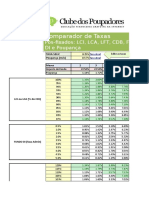

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- DR Lal Path Labs Financial Model - Ayushi JainDocument45 pagesDR Lal Path Labs Financial Model - Ayushi JainTanya SinghNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- HDFC Bank LTD - Income Statement 11-Sep-2021 21:22Document7 pagesHDFC Bank LTD - Income Statement 11-Sep-2021 21:22Naman KalraNo ratings yet

- Ambuja Cements: Profit & Loss AccountDocument15 pagesAmbuja Cements: Profit & Loss Accountwritik sahaNo ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- AOFSDocument15 pagesAOFS1abd1212abdNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Financials of Wipro LTD.: Yukta Rajpurohit 17030720022Document10 pagesFinancials of Wipro LTD.: Yukta Rajpurohit 17030720022Gautam MulchanNo ratings yet

- Vertical Analysis Income StatementDocument1 pageVertical Analysis Income StatementlNo ratings yet

- CH 13 Mod 2 Common Size StatementsDocument2 pagesCH 13 Mod 2 Common Size StatementsAkshat JainNo ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- CRISILDocument19 pagesCRISILBcomE ANo ratings yet

- Samsung FY16 Q4 PresentationDocument8 pagesSamsung FY16 Q4 PresentationJeevan ParameswaranNo ratings yet

- Samsung Electronics: Earnings Release Q4 2020Document8 pagesSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNo ratings yet

- Income Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2Document9 pagesIncome Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2ramarao1981No ratings yet

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- IIFL Wealth Q4 and FY21 Performance Update SummaryDocument21 pagesIIFL Wealth Q4 and FY21 Performance Update SummaryRohan RautelaNo ratings yet

- Jubilant FoodsDocument24 pagesJubilant FoodsMagical MakeoversNo ratings yet

- LARSEN & TOUBRO BALANCE SHEET ANALYSISDocument24 pagesLARSEN & TOUBRO BALANCE SHEET ANALYSISPihu MouryaNo ratings yet

- Common Size P&L - VEDANTA LTDDocument20 pagesCommon Size P&L - VEDANTA LTDVANSHAJ SHAHNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- Phil HealthDocument9 pagesPhil Healthlorren ramiroNo ratings yet

- Starbucks Internal Audit Financial AnalysisDocument5 pagesStarbucks Internal Audit Financial AnalysisLovely Mae LariosaNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- IM ProjectDocument24 pagesIM ProjectDäzzlîñg HärîshNo ratings yet

- DR Lal Path Labs Financial Model - Ayushi JainDocument39 pagesDR Lal Path Labs Financial Model - Ayushi JainDeepak NechlaniNo ratings yet

- PT Semen Indonesia Financial Analysis 2017 vs 2016Document4 pagesPT Semen Indonesia Financial Analysis 2017 vs 2016Ayu TriNo ratings yet

- KPR Phase_1Document23 pagesKPR Phase_1Satyam1771No ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- Aztecsoft Financial Results Q2 09Document5 pagesAztecsoft Financial Results Q2 09Mindtree LtdNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- North South University: Finance ReportDocument43 pagesNorth South University: Finance Reportsabit safriNo ratings yet

- Projected Forcasted TrulyDocument8 pagesProjected Forcasted TrulyClaudine Anne AguiatanNo ratings yet

- Industry Ratio Final Na Final 1 With InterpretationDocument3 pagesIndustry Ratio Final Na Final 1 With InterpretationClaudine Anne AguiatanNo ratings yet

- CAPEXDocument1 pageCAPEXClaudine Anne AguiatanNo ratings yet

- Trend Ratios EDITEDDocument10 pagesTrend Ratios EDITEDClaudine Anne AguiatanNo ratings yet

- Inter Process ProfitsDocument10 pagesInter Process ProfitsKella Pradeep100% (1)

- IMC's Vision to Delight CustomersDocument65 pagesIMC's Vision to Delight CustomersNida Akram0% (2)

- HandoutDocument14 pagesHandoutJuzer ShabbirNo ratings yet

- Financial Management: I. Concept NotesDocument6 pagesFinancial Management: I. Concept NotesDanica Christele AlfaroNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- Cost of CapitalDocument33 pagesCost of CapitalMichaela San DiegoNo ratings yet

- Unit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516Document8 pagesUnit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516mimi96No ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- 09-13-12 Hillsborough Solid WasteDocument157 pages09-13-12 Hillsborough Solid WasteSeanWMNFNo ratings yet

- SITXFIN009 Assessment C Bistro Reports V1Document3 pagesSITXFIN009 Assessment C Bistro Reports V1Sylovecy EXoNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- Aeb SM CH11 1 PDFDocument16 pagesAeb SM CH11 1 PDFAdi SusiloNo ratings yet

- 98 2 Fin Homework Part 04Document6 pages98 2 Fin Homework Part 04Yan Ho YeungNo ratings yet

- Lia Contiu - Engleza Comerciala Si de AfaceriDocument263 pagesLia Contiu - Engleza Comerciala Si de AfaceriGabriela MusoiuNo ratings yet

- 09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingDocument8 pages09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingAnnaNo ratings yet

- 64.double Taxation ReliefDocument14 pages64.double Taxation ReliefMohit MalhotraNo ratings yet

- Property Management Business Plan ExampleDocument32 pagesProperty Management Business Plan ExampleSomNo ratings yet

- Hire PurchaseDocument23 pagesHire PurchaseSenelwa Anaya100% (1)

- 2 - Dehydration Unit - Fuel Powered Dryer PDFDocument76 pages2 - Dehydration Unit - Fuel Powered Dryer PDFWasim MalikNo ratings yet

- Final Project KusumgarDocument62 pagesFinal Project KusumgarAvinash SahuNo ratings yet

- Foxwood Company Data For 2014Document2 pagesFoxwood Company Data For 2014Vermuda VermudaNo ratings yet

- Portfolio RevisionDocument55 pagesPortfolio RevisionAkhilesh KumarNo ratings yet

- "An Insight Into Production-Sharing Agreements: How They Prevent States From Achieving Maximum Control Over Their Hydrocarbon Resource" by Mary Sabina Peters and Manu KumarDocument8 pages"An Insight Into Production-Sharing Agreements: How They Prevent States From Achieving Maximum Control Over Their Hydrocarbon Resource" by Mary Sabina Peters and Manu KumarThe International Research Center for Energy and Economic Development (ICEED)No ratings yet

- Oceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Document1 pageOceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Oceanic Bank International PLC100% (1)

- The 1995 CIA World Factbook by United States. Central Intelligence AgencyDocument1,543 pagesThe 1995 CIA World Factbook by United States. Central Intelligence AgencyGutenberg.orgNo ratings yet

- FIXED INCOME MULTI-FACTOR RISK METRICSDocument1 pageFIXED INCOME MULTI-FACTOR RISK METRICSpare121No ratings yet

- Profit LossDocument8 pagesProfit LossVishnu S. M. YarlagaddaNo ratings yet

- CANCER POLICY TITLEDocument19 pagesCANCER POLICY TITLEMuktikant MishraNo ratings yet

- Startup Financial Planning - PPT DownloadDocument7 pagesStartup Financial Planning - PPT DownloadhomsomNo ratings yet

- Security Rate For Security GuardsDocument1 pageSecurity Rate For Security GuardsengelNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)