Professional Documents

Culture Documents

Test 8

Uploaded by

Gamerz Den Pes 17Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 8

Uploaded by

Gamerz Den Pes 17Copyright:

Available Formats

CAF – 03 [Test – 8]

Standard costing

Question 1

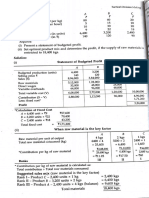

A company manufactures a single product Y. During May 2021, it processed 3,648 kgs of the

product as follows:

Actual materials used:

Materials Kg Price per kg Rupees

(Rs.)

P 1,680 42.50 71,400

Q 1,650 28.00 46,200

R 870 64.00 55,680

4,200 173,280

Loss 552

Output 3,648

Standard costs/yield per batch:

Materials Kg Price per kg Rupees

(Rs.)

P 15 40 600

Q 12 30 360

R 8 60 480

35 1,440

Less: Normal loss 3

Standard output 32

Required:

Calculate the following material variances:

(i) price (ii) usage

(iii) mix (iv) yield (07)

Question 2

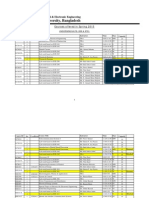

Extract from the records of AMAX Limited are as under:

Budget Actual

---------- Rupees ----------

Sales 27,000,000 27,295,000

Variable costs:

Raw Material (7,500,000) (8,461,450)

Labor (9,375,000) (9,463,125)

Variable overheads (3,000,000) (2,974,125)

Contribution 7,125,000 6,396,300

An analysis of the above figures has revealed the following:

• Actual units sold were 3% (1,500 units) more than the budgeted sales quantity and actual

sale price was lower by Rs. 10/- per unit.

• One unit of finished product requires 3 kgs of raw material and actual raw material price

was 6% higher than the budgeted price.

• Budgeted labor cost per hour was equivalent to 150% of budgeted raw material cost per

kg.

• Production department records show that labor utilization per unit of finished product

was 0.125 hour more than the budget.

• Variable overheads varied in line with labor hours.

Required:

Compute eight relevant variances and prepare a statement reconciling budgeted contribution

with the actual contribution. (18)

1|Page

You might also like

- Tesr 10 Standard Costing and Variance AnalysisDocument1 pageTesr 10 Standard Costing and Variance AnalysisAnmoul ZahraNo ratings yet

- Standard Costing Practice Questions FinalDocument5 pagesStandard Costing Practice Questions FinalShehrozSTNo ratings yet

- Practical Problems: Fybsc - Semester Ii - Management Accounting - Extra QuestionsDocument4 pagesPractical Problems: Fybsc - Semester Ii - Management Accounting - Extra QuestionsRahul SinghNo ratings yet

- Standard Costing Ex QuestionsDocument20 pagesStandard Costing Ex QuestionsKaruna ChakinalaNo ratings yet

- Limiting Factors Test TAE-1Document8 pagesLimiting Factors Test TAE-1James Martin100% (1)

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- Mock - Main and Supplementary Examination and SolutionsDocument16 pagesMock - Main and Supplementary Examination and SolutionsGurveer SNo ratings yet

- II Internal Test - Accounting For Management - Important QuestionsDocument3 pagesII Internal Test - Accounting For Management - Important QuestionsSTARBOYNo ratings yet

- Ca - Bcomph - 4th Sem - 2021Document2 pagesCa - Bcomph - 4th Sem - 2021Mandeep Kaur SahniNo ratings yet

- Project Profile On Bee - Metallurgical CokeDocument2 pagesProject Profile On Bee - Metallurgical CokeAjmalNo ratings yet

- Project Profile On Exhaust FansDocument2 pagesProject Profile On Exhaust FansPhilip KotlerNo ratings yet

- BCOM 22031 Practice Question-Varaince AnalysisDocument4 pagesBCOM 22031 Practice Question-Varaince Analysisajanthahn0% (1)

- 8 Standard CostingDocument10 pages8 Standard CostingLakshay SharmaNo ratings yet

- Semester Paper CostDocument4 pagesSemester Paper CostMd HussainNo ratings yet

- Caf-03 Cma Artt Mock QP With SolDocument16 pagesCaf-03 Cma Artt Mock QP With Solkulhaq29No ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Limiting FactorDocument4 pagesLimiting FactorVanesh Thakur0% (2)

- Basic Costing Concepts QDocument4 pagesBasic Costing Concepts QUmair GOLDNo ratings yet

- Inter Cost 2Document27 pagesInter Cost 2Anirudha SatheNo ratings yet

- Part - 2 Costing - 27124255 PDFDocument5 pagesPart - 2 Costing - 27124255 PDFMaharajan GomuNo ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- CMA QN November 2017Document7 pagesCMA QN November 2017Goremushandu MungarevaniNo ratings yet

- Managerial Accounting (Acct 321) 3rd Trimester 2016Document5 pagesManagerial Accounting (Acct 321) 3rd Trimester 2016Nodeh Deh SpartaNo ratings yet

- Management AccountingDocument8 pagesManagement AccountingPrem BhojwaniNo ratings yet

- In May 2010 The Budgeted Sales Were 19Document4 pagesIn May 2010 The Budgeted Sales Were 19Bisag AsaNo ratings yet

- PST Fundamentals of Management Accounting Past Papers 2015 2022Document53 pagesPST Fundamentals of Management Accounting Past Papers 2015 2022benard owinoNo ratings yet

- 4 2005 Jun ADocument7 pages4 2005 Jun Aapi-19836745No ratings yet

- Variance QuestionsDocument11 pagesVariance QuestionskajaleNo ratings yet

- Institute of Cost and Management Accountants of PakistanDocument11 pagesInstitute of Cost and Management Accountants of PakistanAsad RiazNo ratings yet

- Cost Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesCost Accounting: The Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Project Profile On Personnelcomputers AssemblyDocument2 pagesProject Profile On Personnelcomputers AssemblyNaveen InfocomNo ratings yet

- 2014 - Quiz 3Document12 pages2014 - Quiz 3rohitmahato10No ratings yet

- Assignment1 10%Document3 pagesAssignment1 10%Felicia ChinNo ratings yet

- 4 2 Sma 2017Document5 pages4 2 Sma 2017Nawoda SamarasingheNo ratings yet

- Standard Costing - Solutions To Home Work Problems: Question No: 19 Reconciliation With Finished Goods InventoryDocument7 pagesStandard Costing - Solutions To Home Work Problems: Question No: 19 Reconciliation With Finished Goods InventoryDevi ParameshNo ratings yet

- Manac 3 Sem 1 Test 1 2023Document6 pagesManac 3 Sem 1 Test 1 2023LuciaNo ratings yet

- Variance Analysis CW QuestionsDocument14 pagesVariance Analysis CW QuestionsMedhaNo ratings yet

- MCS Question BankDocument4 pagesMCS Question BankVrushali P.No ratings yet

- Project Profile On Personnelcomputers AssemblyDocument2 pagesProject Profile On Personnelcomputers AssemblyAditya singhNo ratings yet

- Standard CostingDocument13 pagesStandard CostingRevathy MohanNo ratings yet

- Special QuestionsDocument42 pagesSpecial QuestionsSaloni BansalNo ratings yet

- Basic VariancesDocument11 pagesBasic VariancesMazni HanisahNo ratings yet

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- AFAR Set BDocument11 pagesAFAR Set BRence Gonzales0% (2)

- Cost Accounting B.Com III YearDocument4 pagesCost Accounting B.Com III Yeartadepalli patanjaliNo ratings yet

- Combinepdf 2Document6 pagesCombinepdf 2saisandeepNo ratings yet

- Cost DJB - ICAI Mat Additional QuestionsDocument29 pagesCost DJB - ICAI Mat Additional QuestionsSrabon BaruaNo ratings yet

- MA Pastpapers 2015-2023Document68 pagesMA Pastpapers 2015-2023nderitulinetNo ratings yet

- Chapter-: Standard CostingDocument28 pagesChapter-: Standard CostingDurdana NasserNo ratings yet

- Pac Cma Complete Referral Test With Solution Regards Fahad IrfanDocument38 pagesPac Cma Complete Referral Test With Solution Regards Fahad IrfanShehrozSTNo ratings yet

- BhaDocument25 pagesBharishu jainNo ratings yet

- Problems On Standard Costing & Variance Analysis: SolutionDocument3 pagesProblems On Standard Costing & Variance Analysis: SolutionsafwanhossainNo ratings yet

- RUNNING HEAD: Accounting Questions 1Document6 pagesRUNNING HEAD: Accounting Questions 1Chirayu ThapaNo ratings yet

- Project Profile On Drawing BoardsDocument2 pagesProject Profile On Drawing BoardsAR MOHANRAJNo ratings yet

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Unit 2-3 ADM TYBBADocument24 pagesUnit 2-3 ADM TYBBAVohra AimanNo ratings yet

- AMA Terminal Fall 20Document3 pagesAMA Terminal Fall 20Ibrahim IbrahimchNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Hi ThereDocument4 pagesHi TherePipun MaliNo ratings yet

- Name: Maturan, Renz Myko B. Date: November 28, 2022 Subject & Section: EE 330 AC/DC Machineries - CDocument7 pagesName: Maturan, Renz Myko B. Date: November 28, 2022 Subject & Section: EE 330 AC/DC Machineries - CRenz MykoNo ratings yet

- RSLogix 5000 Report(s) 120511Document74 pagesRSLogix 5000 Report(s) 120511Renji JacobNo ratings yet

- Differences ISO11737-1 2018 and 2006 VersionsDocument11 pagesDifferences ISO11737-1 2018 and 2006 VersionsVickysh MevawalaNo ratings yet

- 33198Document8 pages33198tatacpsNo ratings yet

- Class NotesDocument610 pagesClass NotesNiraj KumarNo ratings yet

- Miele G 666Document72 pagesMiele G 666tszabi26No ratings yet

- 15 TribonDocument10 pages15 Tribonlequanghung98No ratings yet

- SSP700ADocument4 pagesSSP700AKanwar Bir SinghNo ratings yet

- Op Starchem 611Document1 pageOp Starchem 611Sinead1990No ratings yet

- Using GPS, GIS, and Accelerometer Data To Predict Transportation ModesDocument7 pagesUsing GPS, GIS, and Accelerometer Data To Predict Transportation ModesAdanely Escudero BarrenecheaNo ratings yet

- Honeywell S4565 CVI Ignition ControlDocument66 pagesHoneywell S4565 CVI Ignition ControlcarlosNo ratings yet

- An Isolated Bridge Boost Converter With Active Soft SwitchingDocument8 pagesAn Isolated Bridge Boost Converter With Active Soft SwitchingJie99No ratings yet

- Bulk MicromachiningDocument14 pagesBulk MicromachiningSrilakshmi MNo ratings yet

- Modern Guide To Plo ExtractDocument24 pagesModern Guide To Plo ExtractSteve ToddNo ratings yet

- Courses Offered in Spring 2015Document3 pagesCourses Offered in Spring 2015Mohammed Afzal AsifNo ratings yet

- He 2011Document11 pagesHe 2011DarshilNo ratings yet

- Ar Adirafinance-2018 EngDocument586 pagesAr Adirafinance-2018 EngHendra GuntoroNo ratings yet

- CMMI DAR Effectively Apply The Decision Analysis and Resolution (DAR) ProcessDocument26 pagesCMMI DAR Effectively Apply The Decision Analysis and Resolution (DAR) Processjgonzalezsanz8914100% (1)

- Stem D Chapter 1 3 Group 6sf RTPDocument35 pagesStem D Chapter 1 3 Group 6sf RTPKrydztom UyNo ratings yet

- Chart-5050 by Songram BMA 54thDocument4 pagesChart-5050 by Songram BMA 54thMd. Noor HasanNo ratings yet

- Steam Turbine and Condenser Lab Report FullDocument2 pagesSteam Turbine and Condenser Lab Report FullJoshua Reynolds0% (3)

- Prelude by Daryll DelgadoDocument3 pagesPrelude by Daryll DelgadoZion Tesalona30% (10)

- Analisis Perencanaan Strategis Sebagai Determinan Kinerja Perusahaan Daerah Air Minum PDAM Kota Gorontalo PDFDocument19 pagesAnalisis Perencanaan Strategis Sebagai Determinan Kinerja Perusahaan Daerah Air Minum PDAM Kota Gorontalo PDFMuhammat Nur SalamNo ratings yet

- Ductile-Iron Pressure Pipe: Standard Index of Specifications ForDocument2 pagesDuctile-Iron Pressure Pipe: Standard Index of Specifications ForTamil funNo ratings yet

- Load Tracing PDFDocument19 pagesLoad Tracing PDFAngelique StewartNo ratings yet

- Weekly Science Report 29th July 2022Document12 pagesWeekly Science Report 29th July 2022John SmithNo ratings yet

- Organizational Changes and Stress Management - OBDocument52 pagesOrganizational Changes and Stress Management - OBBenny WeeNo ratings yet

- Course Reader For Chapter IiiDocument33 pagesCourse Reader For Chapter Iiipau baniagaNo ratings yet

- The Awakening Study Guide AnswersDocument24 pagesThe Awakening Study Guide AnswersAli RidhaNo ratings yet