Professional Documents

Culture Documents

Registration Update Sheet: Taxpayer Information

Uploaded by

RCVZ BKOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Registration Update Sheet: Taxpayer Information

Uploaded by

RCVZ BKCopyright:

Available Formats

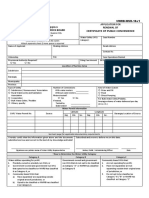

S1905 Registration Update Sheet

For Account Enrollment in Online Registration and Update System

Department of Finance

BUREAU OF INTERNAL REVENUE

AUGUST 2022 For Updating of Records Required in Taxpayer Registration System

Print the information that will be updated, supported by documents and sign the declaration. All information is required.

TAXPAYER INFORMATION

1 TIN Branch Code 2 RDO CODE DLN For BIR Use Only

CDOE

- - -

3 BIRTH/INCORPORATION DATE

2 REGISTERED NAME (For individuals, Last Name, First Name Suffix, Middle Name) MM/DD/YYYY

CONTACT INFORMATION 4 TAXPAYER’S DESIGNATED OFFICIAL EMAIL ADDRESS 5 MOBILE OR TELEPHONE NO.

The designated email address should be of the taxpayer’s official email address. This shall be used in serving BIR orders, notices, letters

and other processes/communications to the taxpayers. The designated e-mail address shall be the official e-mail address of the registered

individual or non-individual taxpayers and not the e-mail address of the authorized representative or tax agent.

UNIT/RM/FLR/BLDG NAME LT/BLK/PH/HOUSE NO./STREET NAME LT/BLK/PH/HOUSE NO./STREET NAME

TOWN/DISTRICT 6 BARANGAY 7 MUNICIPALITY/CITY 8 PROVINCE 9 ZIPCODE

THIS PORTION SHALL BE ACCOMPLISHED BY INDIVIDUALS ONLY

10 PLACE OF BIRTH

PLACE OF BIRTH

11 FATHER’S FULL NAME 12 MOTHER’S FULL MAIDEN NAME

PARENTS NAME

13 SPOUSE’S TIN Branch Code 14 SPOUSE’S FULL NAME

SPOUSE’S INFORMATION

(If married)

- - - 00000

SPOUSE’S EMPLOYER’ 15 SPOUSE EMPLOYER’S TIN Branch Code 16 SPOUSE EMPLOYER‘S REGISTERED NAME

INFORMATION

(If employed) - - -

TAXPAYER EMPLOYER’S 17 EMPLOYER’S TIN Branch Code 18 EMPLOYER’S REGISTERED NAME

INFORMATION

(If employed) - - -

AUTHORIZED REPRESENTATIVE / CONTACT PERSON (For Non-individual)

19 TIN Branch Code 20 POSITION/TITLE

AUTHORIZED REPRESENTATIVE OR

CONTACT PERSON INFORMATION

- - - 00000

21 FULL NAME

DECLARATION

I declare, under the penalties of perjury, that this application has been made in good faith, verified Stamp of BIR Receiving Office

by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of and Date of Receipt

the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Further, I give my consent to the processing of my information as contemplated under the *Data

Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

22 SIGNATURE OVER PRINTED NAME 23 DATE

TAXPAYER/AUTHORIZED REPRESENTATIVE

You may submit this sheet via email to the Revenue SCAN ME CHECKLIST OF REQUIREMENTS (scanned or photocopy)

District Office (RDO) where you are registered. For 1. Government ID of the taxpayer, if individual;

individuals, sender via email application should match or Birth Certificate;

with item 4 above if not transacting with a 2. Marriage Certificate;

representative. You may scan the QR Code for the 3. If transacting through a representative:

contact information and email address of the RDOs. SPA or Board Resolution/Secretary’s Certificate; and

Government ID of the signatory and representative.

You might also like

- Affidavit of Circumstance of Solo ParentDocument1 pageAffidavit of Circumstance of Solo ParentJenny Cypres-PaguiliganNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Republic of The Philippines Application For: National Water Resources Board Renewal ofDocument2 pagesRepublic of The Philippines Application For: National Water Resources Board Renewal ofMark PesiganNo ratings yet

- Cooperative BylawsDocument3 pagesCooperative BylawsRea Visca RubionNo ratings yet

- Promissory Note For The City TreasurerDocument1 pagePromissory Note For The City Treasurerfaith rollanNo ratings yet

- BIR's New Invoicing Requirements Effective June 30, 2013Document2 pagesBIR's New Invoicing Requirements Effective June 30, 2013lito77No ratings yet

- Checklist PcabDocument5 pagesChecklist PcabLyka Amascual ClaridadNo ratings yet

- Policies Mutual AssistanceDocument4 pagesPolicies Mutual AssistanceDonna Fe Patiluna100% (1)

- Secretary'S CertificateDocument1 pageSecretary'S CertificateBianca HerreraNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- 2307Document3 pages2307JUCONS ConstructionNo ratings yet

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloNo ratings yet

- Cost Allocation GuideDocument41 pagesCost Allocation GuideijayathungaNo ratings yet

- Philgeps Sworn Statement 2 PDF FreeDocument2 pagesPhilgeps Sworn Statement 2 PDF FreeSheree grace CabidoNo ratings yet

- Authorization For Credit Investigation and AppraisalDocument1 pageAuthorization For Credit Investigation and AppraisalMarvin CeledioNo ratings yet

- 192.168.1.1/telplusadmin - Go To This PageDocument2 pages192.168.1.1/telplusadmin - Go To This PageJun TalosigNo ratings yet

- SPADocument1 pageSPAPaul CasajeNo ratings yet

- Revised Statement of Management Responsibility 2017Document1 pageRevised Statement of Management Responsibility 2017MackyNo ratings yet

- Bir 2306Document2 pagesBir 2306Caroline Sanchez90% (10)

- D54 document titleDocument1 pageD54 document titleJyznareth Tapia100% (1)

- Sample SMRDocument1 pageSample SMRearl0917No ratings yet

- Verification of Cash Payment To SubscriptionDocument2 pagesVerification of Cash Payment To SubscriptionAlexNo ratings yet

- SEC-Cover-Sheet-for-AFS BlankDocument2 pagesSEC-Cover-Sheet-for-AFS BlankAljohn Sebuc100% (1)

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- Sworn Declaration of IncomeDocument1 pageSworn Declaration of IncomeVon Virchel VallesNo ratings yet

- Application For Closure of BusinessDocument2 pagesApplication For Closure of BusinessallanNo ratings yet

- Checklist of Documentary Requirements - Issuance by BIR of CARDocument1 pageChecklist of Documentary Requirements - Issuance by BIR of CARLRMNo ratings yet

- Articles of Incorporation and By-Laws - Non Stock CorporationDocument10 pagesArticles of Incorporation and By-Laws - Non Stock CorporationlividNo ratings yet

- Tax Law for BusinessDocument3 pagesTax Law for BusinessJianSadakoNo ratings yet

- Annex C-1 - Summary of System DescriptionDocument4 pagesAnnex C-1 - Summary of System DescriptionChristian Albert HerreraNo ratings yet

- SALN2012form NewDocument2 pagesSALN2012form NewAriel Jr Riñon MaganaNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- CBS Authorization For Field and Tele VerificationDocument1 pageCBS Authorization For Field and Tele VerificationKatrina JarabejoNo ratings yet

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 pagesPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNo ratings yet

- Stirling HomexDocument3 pagesStirling HomexAnne cutieNo ratings yet

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesNo ratings yet

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptrichlogNo ratings yet

- AUTHORIZATION TO QUERY BSP RECORDSDocument1 pageAUTHORIZATION TO QUERY BSP RECORDSApril NNo ratings yet

- BIR Tax Return Payment RequestDocument1 pageBIR Tax Return Payment Requestjoy buedoNo ratings yet

- Affidavit of Non-OperationDocument1 pageAffidavit of Non-OperationGerwinNo ratings yet

- Letter of Intent To BIR Apply For EfpsDocument1 pageLetter of Intent To BIR Apply For EfpsMadel TomasNo ratings yet

- Enhanced Gis Revised v.2013 092513Document9 pagesEnhanced Gis Revised v.2013 092513Don CorleoneNo ratings yet

- Module 1 - Opinions and RulingsDocument42 pagesModule 1 - Opinions and RulingsElmar Perez BlancoNo ratings yet

- BIR Citizen - S Charter 2021 EditionDocument999 pagesBIR Citizen - S Charter 2021 EditionRosalie FeraerNo ratings yet

- Fund Cluster Disbursement VoucherDocument1 pageFund Cluster Disbursement VoucherPau PerezNo ratings yet

- Efps Letter 009Document1 pageEfps Letter 009ElsieJhadeWandasAmandoNo ratings yet

- Pag-IBIG eSRS Guide for Small EmployersDocument3 pagesPag-IBIG eSRS Guide for Small EmployersJulio LuisNo ratings yet

- Journal Entry Voucher: Municipal Government of Lambunao Disbursement VoucherDocument12 pagesJournal Entry Voucher: Municipal Government of Lambunao Disbursement VoucherFrancisco Lubas Santillana IVNo ratings yet

- Tax Update RR 18-2012Document32 pagesTax Update RR 18-2012johamarz6245No ratings yet

- Requirements for securing tax clearanceDocument1 pageRequirements for securing tax clearanceDenzel Edward Cariaga100% (2)

- Form 1945 - Application For Certificate of Tax Exemption For CooperativesDocument4 pagesForm 1945 - Application For Certificate of Tax Exemption For CooperativesDarryl Jay Medina100% (1)

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Affidavit of Non Tenancy For SPADocument1 pageAffidavit of Non Tenancy For SPAGiye CornejoNo ratings yet

- Expanded Withholding TaxDocument3 pagesExpanded Withholding TaxCordero TJNo ratings yet

- RMC No. 122-2022 S1905-RUSDocument1 pageRMC No. 122-2022 S1905-RUSAshaNo ratings yet

- RMC No. 122-2022 S1905-RUSDocument1 pageRMC No. 122-2022 S1905-RUSWilliam CortezNo ratings yet

- RMC No. 122-2022 S1905-RUSDocument1 pageRMC No. 122-2022 S1905-RUSArjay DelapeñaNo ratings yet

- RMC No. 122-2022 S1905-RUSDocument1 pageRMC No. 122-2022 S1905-RUSmark jefferson borromeo100% (2)

- BIR S1905 - Registration Update SheetDocument1 pageBIR S1905 - Registration Update SheetAron Garcia100% (1)

- Diophantine Equations - PRMODocument6 pagesDiophantine Equations - PRMOapocalypticNo ratings yet

- How To Eliminate Cost of Poor Quality COPQDocument3 pagesHow To Eliminate Cost of Poor Quality COPQsudar1477No ratings yet

- FEEI (Core)Document10 pagesFEEI (Core)jigarNo ratings yet

- Schedule LecturesDocument1 pageSchedule LecturesIsmael LidayNo ratings yet

- Makex Brochure MainDocument12 pagesMakex Brochure MainAtharv BalujaNo ratings yet

- Top devices and drivers in Windows system reportDocument8 pagesTop devices and drivers in Windows system reportQ Sang PangerandzNo ratings yet

- Age Of Empires III guide with keys, screenshots & downloadDocument2 pagesAge Of Empires III guide with keys, screenshots & downloadRamon_sjcNo ratings yet

- E-Link Eagle User Interface Manual - 05212014 - BDocument57 pagesE-Link Eagle User Interface Manual - 05212014 - BКурбан УмархановNo ratings yet

- NGT Transceiver Reference Manual - ENDocument427 pagesNGT Transceiver Reference Manual - ENMarcus0% (1)

- ArcSyn User ManualDocument20 pagesArcSyn User ManualHigaru KawasakiNo ratings yet

- 12.4 Unmanned Aerial VehicleDocument18 pages12.4 Unmanned Aerial VehicleJose Luis FloresNo ratings yet

- BINGDocument7 pagesBINGIpansyahNo ratings yet

- FinalpayrollsmsdocuDocument127 pagesFinalpayrollsmsdocuapi-271517277No ratings yet

- CERES Chemical Emergency Response App Fact SheetDocument4 pagesCERES Chemical Emergency Response App Fact SheetenviroNo ratings yet

- FTTH Business GuideDocument78 pagesFTTH Business Guidesatyvan2003No ratings yet

- Cummins Serie K Calibracion de ValvulasDocument63 pagesCummins Serie K Calibracion de Valvulasfrank_16100% (1)

- Exercise 3.3: Configure Probes: Simpleapp - YamlDocument5 pagesExercise 3.3: Configure Probes: Simpleapp - Yamlrevelanatoly9776No ratings yet

- Red Hat Enterprise Linux-9-Monitoring and Managing System Status and Performance-En-UsDocument358 pagesRed Hat Enterprise Linux-9-Monitoring and Managing System Status and Performance-En-Uselmallaliomar01No ratings yet

- DP Wlan-Wifi 15125 DriversDocument3,211 pagesDP Wlan-Wifi 15125 Driversviki mikiNo ratings yet

- Toastmasters Magazine 0319Document32 pagesToastmasters Magazine 0319Gnana Reuben ANo ratings yet

- Low Power Low Dropout Middle Current Voltage Regulators: General Description FeaturesDocument10 pagesLow Power Low Dropout Middle Current Voltage Regulators: General Description Features171 171No ratings yet

- Service Manual BTS-350Document46 pagesService Manual BTS-350João GamaNo ratings yet

- Engineering Structures Rahman Et Al 2021Document22 pagesEngineering Structures Rahman Et Al 2021José GomesNo ratings yet

- Implementing Cisco IP RoutingDocument1,320 pagesImplementing Cisco IP Routingnsellers89No ratings yet

- 6 Strategies For Prompt EngineeringDocument9 pages6 Strategies For Prompt EngineeringSyed MurtazaNo ratings yet

- 3CX VoIP Telephone, Phone SystemDocument18 pages3CX VoIP Telephone, Phone SystemRob Bliss Telephone, Phone System SpecialistNo ratings yet

- Ariprus-GST Readiness AppraochDocument18 pagesAriprus-GST Readiness AppraochPraful SatasiaNo ratings yet

- SAP Brazil Localization PortfolioDocument31 pagesSAP Brazil Localization Portfoliosatishkr14No ratings yet

- E5-SAJ Off Grid Solar Inverter - 2023Document2 pagesE5-SAJ Off Grid Solar Inverter - 2023OurBadminton MalaysiaNo ratings yet

- 9.5.1.2 Packet Tracer - Putting It All Together: Addressing TableDocument6 pages9.5.1.2 Packet Tracer - Putting It All Together: Addressing TableGaz ArtimisNo ratings yet