Professional Documents

Culture Documents

Chapter 4 (With Problems)

Uploaded by

Trisha Mae Austria de Torres0 ratings0% found this document useful (0 votes)

32 views60 pagesChapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( wi

Original Title

Chapter 4 ( with problems)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( wi

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views60 pagesChapter 4 (With Problems)

Uploaded by

Trisha Mae Austria de TorresChapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( with problems) Chapter 4 ( wi

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 60

Ww

swnts (Part 1)

Chapter 4

Consolidated Financial Statements (Part 1)

Related standards:

PERS 10 Consolidated Financial Statements

ection 9 of the PERS for SMEs samee

Overview on the topic

Our discussion on business combination is subdivided into the

following chapters:

Chapter Title Coverage

4 Consolidated FS (Part 1) Basic consolidation procedures

5 Consolidated FS (Part 2) _ Intercompany. transactions

6 Consolidated FS (Part 3) Miscellaneous topics

7 Consolidated FS (Part 4) | Measurement at other than cost

Learning Objectives

1. State the elements of control.

2. Prepare consolidated financial statements at the acquisition

date.

3, Prepare consolidated financial statements at a subsequent

date.

Introduction

(PERS 3 Heals with the accounting for a business combination at

the acquisition date, while PFRS 10 deals with the preparation

and presentation of consolidated financial statements after the

business combination.

> Consolidated financial statements - “the financial statements

of a group in which the assets, liabilities, equity, income,

expenses and cash flows of the parent and its subsidiaries are

Presented as those of a single economic entity.”

aparent and its subsidiaries.”

om “an entity that controls one or more entities.”

ie sidiary — “an entity that is controlled by another entity.

1W.Appendix A)

7 & R

he

4 Corot

130

hi eg

A parendentitles are required to prey

financial statements, except as follows

1, A parent is exempt from presenting consolid

statements i

a. itis a subsidiary of another entity (whether wholl

or partially-owned) and all its other owners do

to its non-presentatio

Pare

Consoy ida

Aled fing

Not ob

a of consolidated

statements; RENO OD try

y

bits debt or equity instruments are not traded in . 4

~ market (or being processed for such purpose); ang PUM

its ultimate or any intermediate parent

- consolidated financial statements that are avai

public use and comply with PFRSs.

2. Post-employment benefit plans or other long-term em;

benefit plans to which PAS 19 applies.

Prody

lable fo

r

Ployee)

Control

Control is the basis for consolidation. PFRS 10 requires an invest

to determine whether it is a parent by assessing whether |

controls the investee.

> Control of an investee — “an investor controls an investee when

the investor is exposed, or has rights, to variable returns from,

its involvement with the investee and has the ability to affed

those'returns through its power over the investee.”

(PFRS 10.Appdendix A)

Control exists if the investor has all of the following:

a. Power over the investee;

b. Exposure, or tights, to variable returns from the investee;

©. Ability to the affect returns through use of power.

such as when $e ‘estors collectively contre, ‘vested

reley. _.eY Must act together to direct the ny i

‘ant activities, none of them individually controls the inv"

ated Financial Statements (Part 1) - 431

Ac cordingly, each investor accounts for its interest in the investee

jn accordance with PFRS 11 Joint Arrangements, PAS 28 Investments

in Associates and Joint Ventures or PFRS 9 Financial Instruments, as

appropriate.

Example: ae

‘ABC Co. holds ‘70% of the voting shares of Alphabets, Inc. XYZ,

Inc, the former majority owner of Alphabets, holds 10% of the

voting shares of Alphabets but retains its power to appoint the

majority of the board of directors of Alphabets. The other 20% is

held by various shareholders holding shares of 1% or less.

Decisions about the relevant activities of Alphabets require the

approval of a majority of votes cast at relevant shareholders’

meetings - 75% of the voting rights of the investee have been cast

at recent relevant shareholders’ meetings.

Analysis:

Neither ABC Co. nor XYZ, Inc. has control over Alphabets Co.

Power

‘An investor has power over an investee when the investor has

existing rights that give it the current ability to direct the

_investee’s relevant activities.

> Relevant activities - “activities of the investee that significantly

affect the investee’s returns.” (PFRS 10.Appendiv A)

An investor's current ability to direct the investee’s

relevant activities is often evidenced by the investor's ability to

establish and direct the investee’s operating and financing

policies, eg, making operating and capital decisions, and

“appointing, remunerating, and terminating key management

Personnel,

Power arises from rights and it may be obtained directly

from the voting rights conferred by shareholdings. However,

Power may also arise from other sources, such as contractual

arrangements. Examples of rights that can give an investor power:

a. Voting rights (or potential voting rights);

b. Rights to appoint or remove members of the investee’s key

management personnel or another entity that directs the

relevant activities of the investee; .

Rights to direct the investee to enter into transactions for the

benefit of the investor; and

d. Other decision-making rights that give the investor the ability

to direct the investee’s relevant activities, (PFRS 10.815)

Administrative rights

When voting rights do not have a significant effect on an

returns, such as when voting rights relate to

administrative tasks only and contractual arrangements

determine the direction of the relevant activities, the investor

needs to assess those contractual arrangements in order to

determine whether it has rights sufficient to give it power over the

investee.

Unilateral rights

If two or more investors individually (unilaterally) have the ability

to direct different relevant activities, the investor that has the

current ability to direct the activities that most significantly affect !

the returns of the investee has power over the investee. |

Protective rights i

‘An investor can have power over an investee even if other entities !

have existing rights that give them the current ability to

participate in the direction of the relevant activities, for example

when another entity has significant influence. !

However, an investor that holds’ only protective rights

does not have power over an investee, and consequently does rat

control the investee. |

> Protective rights are “rights designed to protect the interest

the party holding those rights without giving that patty Pa

over the entity to which those rights relate.” (pres 10. appent®)

@Z

Statements (Part 1 133

examples of protective rights

.

\ Jender’s right to seize the assets of the borrower if the

* :

porower defaults on a loan, or to restrict the borrower from

undertaking activities that are detrimental to the lender.

The right of holders of non-controlling interests to approve

s

capital expenditure above a specitied amount, or the issue of

equity or debt instruments.

Un right

Entity A holds 10% voting rights in Entity B. Entity A is also the

Entity A

al right and Protectiz

franchisor of Entity B. The franchise agreement confers

come decision-making rights regarding the operations of Entity B.

Analysi

The franchise agreement — provides both — Entity = A

(investor/franchisor) and Entity B (investee/franchisee) unilateral

rights in directing the relevant activities of Entity B. In assessing

the existence of power, the entity with the ability to direct the

activities that most significantly affect the returns of Entity B has

power over Entity B.

If the decision-making rights granted to Entity A are

designed solely to protect the franchise brand (protective right)

and the unilateral right of Entity B is to operate the franchise in

accordance with the franchise agreement but for its own account,

Entity A does not have power over Entity B.

Substantive rights

In assessing whether it has a power, an investor considers only

substantive rights, i.e., rights which the investor has the ability to

exercise,

Application examples ~ Substantive rights

Fact Pattern (This applies to each of the independent case

An investee’

at schedule

.

below)

5 policies over relevant activities can be changed only

d shareholder's meetings or at special meetings.

The neat scheduled shareholders’ meeting is in § months,

Shareholders that individually or collectively hold at k

of the voting rights can call a special meeting t6 ch “ast

existing policies over the relevant activities. This ange

ig notice to the other shareholders, which ieane, i

that

givin,

special meeting cannot be held for at least 30 days.

Case #1 .

Aninvestor holds a majority of the voting rights in the investee, -

Analysis:

The investor's v

~ able to direct the investee’s relevant

shareholder's meeting and a special meeting. i

oting rights are substantive because the investo,;

activities in both a schedyj..

ed

‘Case #2 (PFRS 10.B24) :

‘An investor owns a forward contract (or an option contract that ig |

4in the money’) to purchase a majority of the investee’s shares. The

contract's settlement date is in 25 days.

Analysis:

The investor's voting right:

shareholders are unable to change

relevant activities because a special m

Jeast 30 days, at which point the contract will have been settled.

s are substantive. The existing

the existing policies over the

ecting cannot be held for at

Case #3

The settlement, date of the forward contract

contract) in Case #2 is in 6 months.

(or the option

7

are not substantive. The existing |

e relevant

Analysis: °

The investor's voting rights

shareholders can change the existing policies over th

activities through a special meeting.

Voting rights

The i ‘s abili i

zn re s ability to direct the relevant activities of an inv

mally obtained through voting or similar rights.

er

i inancial Statentents

consolidated Fin ments (Part 1) 15.

power witha majority of the voting rights

saninvestor that holds more than half (51% or more) of the voting

rights ofan investee is presumed to have power over the investee,

a when this is clearly not the case.

© .

Holding more than half of the voting rights results to

power when: oe

The relevant activities are directed through majority vote; or

‘rity of the members of the governing body that directs

p. Amal ee :

vant activities are appointed through majority vote.

the rele’

of the voting rights but no power

does not have power over an investee, even if he

an half of the voting rights, if:

direct the inyestee’s relevant activities is coriferred *

party who is not an agent of the investor. For

the investee’s relevant activities are subject to

government, court, administrator, receiver,

Majority

‘An investor

olds more th

a, The right to

to a third

example,

direction by @

liquidator oT regulator.

"4, The investor's voting rights are of substantive.

Power without a majority of the voting rights

power even if he holds less than a majority

An investor can have

of the voting rights of an investee. For example, through:

a. A contractual arrangement between the investor and other

vote holders;

Rights arising from other contractual arra

The investor's voting rights;

Potential voting rights; or

A combination of (a) - (d).

ngements;

eppnos

Contractual arrangement with other vote holders

A contractual arrangement between an investor and other vote

holders can give the investor power if the contractual

arrangement gives the investor: .

a. The right to exercise the voting rights of oth,

eT Vote ho

sufficient to give the investor power; or

b.’ The right to direct how other vote holders vote to by

"investor to make decisions about the relevant actiyi ties,

"+ Under the Corporation Code of the Philippines, an example of g a

arrangement described above is referred to as “proxy.

Example: (PFRS 10.843 - B45)

Investor A holds 40% of the voting rights of an investee, The

60% is held by 12 other investors, each holding 5%. A shareholgy

agreement grants Investor A the right to appoint, remove and gy

the remuneration of management. responsible for directin,

televant activities. To change the agreement, a two-thirds Vote of

the shareholders is required.

Analysis:

Investor A has power over the investee because of his contractual

tight to appoint, remove and set the remuneration of

management. :

example, the investee’s ‘manufacturing Processes or other

Operating or financing, activities that si

investee’s returns, However, in the absence of any other rights,

economic’ dependence of an invest

; tee on the investor (such as

customer-supplier telationship) does Not result to Power.

The investor's voting rights .

An investor with less than a majority of the Vv

Power when he. has -the Practical ability to di

activities unilaterally. .

Oting rights has

ect the relevant

aap

+ r eae :

Mvestee’s relevant activities, for _

nificantly affect the |

ements (Part 1) 137

Example 1

Entity A holds 40% of the voting rights of Entity B. The remaining

@% is held by numerous shareholders in very small

denominations. None of the shareholders make collective

Anal

Entity A has power over Entity B because the other shareholdings

are widely dispersed and are not being exercised collectively.

Example 2

Entity A holds 30% of the voting rights of Entity B. Four other

investors hold 5% each. The remainder is widely dispersed. None

of the shareholders make collective decisions. Decisions about

Entity B’s relevant activities require a majority of vote. Seventy

five percent of the voting rights have been cast in previous

shareholders’ meetings.

Analysis:

Entity A has 110 power over Entity B because it does not have the

ability to unilaterally direct Entity B’s relevant activities. This

requires the active participation of the other shareholders.

Example 3 ;

Entity A holds 40% of the voting rights of Entity B. Two other

investors hold 28% each. The remaining 4% is held by numerous

other investors.

Analysis:

Entity A has no power over Entity B because the two other

investors have the ability to cooperate and prevent Entity A from

directing the relevant activities of Entity B.

Potential voting rights

When determining the existence of control, an investor considers

potential voting rights that are currently exercisable, regardless of

the intention or financial ability to exercise them.

138 chapters

ee

Potential voting rights include share warrants oe a

options, debt or equity instruments that are cOmvET TD

ordinary shares, or other similar instruments that S hd

have the potential to give the entity voting POW’ ue

another party’s voting power over an investee- ercisable if a4

Potential voting rights are not currently ex

cannot be exercised until a future date or until the occurrence of

future event. . :

However, during consolidation, non-controlling interes

are determined on the basis of present ownership interests and do

not reflect the effect of potential voting rights. Potential voting.

rights are considered only for purposes of determining thy

existence of control, which in turn determines whether an investeg|

should be consolidated.

Example:

Entity A owns'40% of the voting rights in Entity B. Entity A ag

holds bonds that are currently convertible into Entity B’s ordinay

shares. If the bonds were converted, Entity. A’s voting ti

would be increased to 60%.

Analysis:

Entity A has power over Entity B. The existing voting rights plus

the substantive potential voting rights result to a majority of the

Voting rights in Entity B.

Substantive removal and other rights held by other parties

Substantive removal and other rights held by other parties

affect the decision maker's ability to direct the relevant activ

of an investee,

> Removal rights are “tights to deprive the decision maker

decision-making authority.” (PFRs 10.Appendix A)

Such rights are considered when evaluating whethet

decision maker is a principal or an agent for other parties:

Investor acting as an agent ‘does..not control an inven

dated Financial Statements (Part 1) 439

example, @ decision maker that is required to obtain approval

froma small num

ber of other parties for its actions is generally an

agent.

Exposure or rights to variable returns

Aw investor is exposed, or-has a right, to variable returns if its

om its involvement with the investee vary depending on

returns

the investee’s performance.

Ability to use power to affect investor's returns

The investor's ability to use its power to affect its returns from the

investee provides the link between power and variable returns.

Only if this ability exists along with power and exposure or right

to variable returns does the investor obtain control over the

investee.

Elements of Control

Variable

returns

Power | > _| Ability to affect returns |g

|

Control

Accounting requirements

Reporting dates

The financial statements of the parent and its subsidiaries used in

preparing consolidated financial statements shall have the same

reporting date.

If the parent’s and its subsidiary’s reporting periods do

not coincide, the subsidiary shall prepare financial statements that

coincide with the parent’s reporting period before consolidation.

If this is impracticable, the subsidiary’s financial

statements shall be adjusted for significant transactions and events

that occur between the end of the subsidiary’s reporting period

and that of the parent's. The difference between the parent's and

bing OPS. PRE $l Wd Wwingol/ Br

v's end of reporting periods shall not exceeg

subsidial

Ss.

months Sine SPINIMLD g

Uniform accounting policies POLICIES |

Uniform accounting policies shall be used. It the subsidiary

different accounting policies, its financial statements nee, dtp

adjusted to conform to the parent’s accounting policies before they

are consolidated. Ree Ab pir roti

Example:

A British parent entity uses the revaluation model to measure its

property, but a Philippine subsidiary uses the cost model.’ The j

Philippine subsidiary’s directors find the revaluation mode] too /

costly to implement. j

Question: In the consolidated financial statements, is the group /

allowed to measure the Philippine subsidiary’s property under )

the cost model? 5

Eprss ier |

Answer: No, the Philippine subsidiary’s property shall be adjusted |

to conform to the group’s accounting policy of revaluation model. , i

PRAM B

Consolidation period

Consolidation begins from the date the investor obtains control of |

the investee and ceases when the investor loses control of the |

investee.

For example, if an investor obtains control of an investee i

on July 1, 20x1, the group’s consolidated financial statements for

the year ended December 31, 20x1 shall include only the investee’s

results of operations from July 1 to December 31, 20x1,

On the other hand, if a parent loses control over its

subsidiary on September 30, 20x2, the 8roup’s consolidated’

financial statements for the year ended December 31, 95.9 shall

include only the investee’s results of operations from, January 1,10

September 30, 20x2.

ym

Ot ee

poe inc avsiton Day ir

to¥vy Wy Ye

I Statements (Part 1) vn g vawiiege mn

a L pre Gime rmrr AY Ta 141

ry np HARTER PT tHe ba Wi

easurement Cu tisitons ae oF

d expenses

Income -

nd expenses of the Subsidiary are based on the amounts

s unt

income an epee

ssets and liabilities recognized in the consolidated financial

”

ts at the acquisition date. ‘ayo? 13"\- sy Congouiunt

For example, depreciation expense in the consolidated

ments is based on the related asset's acquisition-date

financial state

fair value, rather than its carrying, amount in the, subsi

accounting Feo" eed fn eH 2

Weer enti) i eee jess

nvestment in subsidiary reqer tHE ONT 6 A

in. subsidiaries are accounted for in the parent's

t 10% ACGu Est

Investments i

al statements either:

separate. financi

a. at cost; y my

b. in accordance with PERS 9; or *

c._ using the equity method. Emad hae WPET rereoro Se

eee nus yun Pa et MUTE pies

Measurement at cost AYA

in subsidiary is initially measured equal to the

The investment

value assigned to

date and subsequently mea:

investment becomes impaired.

ransferred at the acquisition

the consideration t

hat amount, unless the

sured at t

PERS 9

initially measured equal to the

red at the acquisition

ment in accordance with

ary is i

ideration transfe

ed at fair value.

Measure

The investment in subsidi

value assigned to the consi

date and subsequently measur

hod

initially measured equal to the

transferred at the acquisition

d for the investor's

Measurement using the equity met

The investment in subsidiary is

value assigned to the consideration

date and subsequently increased or decrease

share in the changes in the investee’s equity.

Chay

stephen 5

ping boven 7 a)

ee enaeeroet “

Non-controling intorests (NCI) j

assets of the subsidiary

net assets 0)

NCI in the resented in the consolidated state,

net assets is P ; rately from the ¢ a

nancial position within equity, separately Pamity of

financial po

owners of the parent,

s of the subsidiary consists of:

the net assets of the su y consis

cone amount determined at the acquisition date using PrRg

a

and , ee

b. The NCI's share of changes in equity since the Acquis

date.

NCI in profit or loss and comprehensive income

The profit or loss and each component of other comprehengi

income in the consolidated statement of profit or loss

comprehensive income are attributed to the fol lowing:

1. Owners of the parent

2 Non-controlling interests

and oth

Total comprehensive income

the parent and to the NCI eve

controlling interests h;

Preparing the Consolidated financial Statements

nancial statements are

~onecl Prepared ining

financial Statements of the parent and its subsidi bier

by adding together sim Forcier

. ilar items of

income and expenses,

is attributed to the owners

nif this re :

sults inthe n

‘aving a deficit balance,

e by line

liabilities, equity,

the acy

Y the statements ial peition da

entities are consodai “he fanca posit e are simple

steps: CONSoli dati, © combining

1

Eliminate the “4

Mvesty

requires: pment’ hy SUbSidiany»

jo Pinal Statements (Part 1) a

Consildl — ————__—

4, Measuring the identifiable assets acquired and liabilities

assumed in the business combination at their acquisition-

date fair values.

b, Recognizing the goodzwill from the business combination.

Eliminating the subsidiary’s pre-combination equity

accounts and replacing them with the non-controlling

interest.

2, Add, line by line, similar items of assets and liabilities of the

combining entities. The subsidiary’s assets and liabilities are

included in the consolidated financial statements at 100% of

their amounts irrespective of the interest acquired by the

parent.

Illustration: Consolidation at acquisition date

On January 1, 20x1, ABC Co. (parent) acquires 80% interest in

XYZ, Inc. (subsidiary). The financial statements of the combining

entities immediately after the business combination are shown

below:

Parent Subsidiary

Cash 10,000 5,000

Accounts receivable 30,000 12,000

Inventory 40,000 23,000

Investment in subsidiary 75,000 :

Equipment, net 180,000 40,000

Total assets 335,000. 80,000.

Accounts payable 50,000 6,000

Share capital 7 170,000 50,000

Share premium 65,000 a

Retained earnings 50,000 24,000

Total liabilities and equity 335,000 80,000

Additional information:

* The subsidiary’s assets and liabilities are stated at their

Acquisition-date fair values, except for the following:

1000. Fy

ment, net, 48,000 =

Inventory, P5:

Equip!

mined using PERS 3 is 3,000.

+ The goodwill dete ts of the subsidiary, also determing

The NCI in the net asset

PERS 3, is 918,000.

.

using

Requirement: Prepare the consolidated statement of finangy

position.

Solution:

Step 1: Eliminate the “Investment in subsidiary” account and:

a. Measure the subsidiary’s assets and liabilities at thei

acquisition-date fair values;

b. Recognize the goodwill; and_

Replace the subsidiary’s.pre-combination equity accounts

with the NCI in net assets,

Step 1- Eliminate “Investment in

subsidiary” account.

Cash

“ccounts receivable

Inventory

Step 1(a) - Measure

Subsidiary’s assets and

liabilities at

acquisition-date fair

Values.

2

Step U6) - Replace the

Subsidiary’s pre-

combination equity

Sounts with the NCI

net assets,

ac

in

aements (Part 1)

— 145

cyoy 22 Ant Hine By Tne similar tems of assets an Fail

$ of assets and liabilities

the combining constituents,

Parent Subsidiary Consolidated

Cash 7 10,000

Accounts receivable 30,000 oon pan

Inventory 40,000 31,000 71,000

Investment in subsidiary "

Equipment, net 180,000 48,000 228,000

Goodwill 3,000 3,000

Total assets 359,000,

Accounts payable 50,000 6,000 56,000

Share capital 170,000 | 170,000

Share premium 65,000 65,000

Retained earnings 50,000 50,000

NClin net assets 18,000 18,000

359,000

Total liabilities & equity

diary are included

hough the parent

lowing,

& Notes:

# 100% of the assets and liabilities of the subsi

in the consolidated financial statement even U

holds only 80% interest. This is an application of the foll

concepts:

a. (Substance over

statements report

of the subsidiary and not j

legal percentage acquired.

b. “Entity theory” ~ the parent and subsis

Single reporting entity.

© The subsidiary’s pre-combination equity accounts

capital and retained earnings) are elimina’ di

replaced with the non-controlling interesi

© The share capital, share premium, anc 722%

accounts in the consolidated financ

the consolidated financial

control the whole

to the extent of the

form” —

t the parent’s ability t

just only UP

asa

diary is viewed

the owners of the parent, while the NON-Controlfin,

account pertains to the other owners of the subsidiary, 8 int

* The equity structure appearing in the Consolidate, i

statements reflects that of a “legal entity,” The “groupe ang

a legal entity although each member ofthe group i et

legal entity. Thus, the consolidated financial Statement iS

the equity structure of the legal parent. The equity of the

members of the group is Presented in a single ling i

described as non-controlling interests, t

The consolidated statement of financial osition is shown below.

i ABC Group

| Consolidated statement of financial position

| As of January 1, 20x1

| ASSETS

| Cash : 15,000

| Accounts receivable 42,000

| Inventory 71,000

| Equipment, net 228,000

| Goodwill ~ 3,000

| TOTAL ASSETS 359,000

LIABILITIES AND EQUITY

| Accounts payable 56,000

| Total liabilities 56,000

| share capital 170,000

| Share premium 65,000

l Retained earnings 50,000

| Owners of parent 285,000

| Non-controlling interest 18,000

Total equit 303,000

TOTAL LIABILITIES AND EQUITY

359,000

* Observe that the non-controlling interest ig presented

within equity but separately from the equity of the owners of the

parent.

sated Financial Statements (Part 1)

Traditional Accounting Method

The consolidated financial statements can also be prepared by

using (

worksheet.

147

‘a) consolidation journal entries and (b) consolidation

CJE #1: To elintinate investment in subsidiary and recognize goodwill

yan. 1,

20x1

Inventory

Equipment

Share capital - XYZ, Inc.

Retained earnings — XYZ, Inc.

Goodwill

Investment in subsidiary

Non-controlling interest

to adjust the subsidiary's assets to

acquisition-date fair values, to eliminate the

investment in subsidiary and subsidiary’s pre-

combination equity, and to recognize goodwill

and non-controlling interest in the consolidated

financial statements

8,000

8,000

50,000

24,000

3,000

75,000

18,000

eameseprromse,y “epi om

womaae 4 0 *y00q 5 Aseypregnes ag er

ey ‘

_

vanecial Statements (Part 1)

inal

sagan TON

149

ation subsequent to date of acquisition

idation procedures subsequent to the acquisition date

» same procedures of (a) eliminating the investment in

jrnvatve the account and (b) adding, line by line, similar items of

subea ities, income and expenses of the parent and the

. However, this time, changes in the subsidiary’s net

consi

Inustration 1: Consolidation - Subsequent to date of acquisition

lus

On January 1, 20x1, ABC acquired 80% interest in XYZ, Inc. for

975,000.

Information on acquisition date (Jan. 1, 20x1):

+ XYZ's net. identifiable assets have a ca

trying amount of

74,000 and fair value of P90,000. The difference is due to the

following:

Carrying Fair Fair value

amount value adjustment (FVA)

Inventory 20,000 24,000 4,000

Equipment, net 40,000 52,000 12,000

Totals 60,000 76,000 16,000

* The remaining useful life of the e

quipment is 6 years, ~

* ABC measured the NCI at ‘prop

ortionate share’,

Information on Subsequent reporting date (Dec. 31, 20x1):

Statements of financial position

As at December 31, 20x1

ABC Co, XYZ, Inc.

ASSETS

Cash 23,000 57,000

Accounts receivable 75,000 32,000

Inventory 105,000 15,000

Investment in subsidi c 75,000

ubsidiary (at cost) i ,

wipment, net 140,000 30,006

T

OTAL AssETs

418,000 124,000.

c Napto, 4

is

ques AND EQUITY 7,000 4

us ts YY able 3,000 1H

170,000 4

65,000, }

|

110,000 Py

" |

evant earings 415,000 ol

Mi

00 a

AL LIABILITIES AND EQUITY 118,

TU

fit or loss

tements of profit or

i. the year ended December 31, 20x17

for the y

ABC Co. xyz

300,000 id

(165,000) (7g

135,000 48,0,

Depreciation expense (40,000) (10,0

Distribution co

(35,000) (18,09,

Profit for the year 002000

* Ther were no dividends declared, no intercompany

transactions and no impairment of goodwill in 20x 1

Requirement: Prepare the December 31, 20x1 consolidated financial

statements,

Solutions:

The first thing that w

subsidiary’s net asset c

formulas below to simplify thi:

© should do is to analyze the changes in tht

fon date, We will use the

he acquis

8 Proc

Step 1: a

Step t: Analysis, of Subsidlary's net assets

XYZ, Inc, - : Ne

Sd Jan. 1 2001 Dee. 34, 2081 yayge

at carrying amount

Fair value adjustment 74,000 94,000.

SCEVA) 16,000 10,000 A

Net assets at fy ir value 90,000 4000 14 1000,

daneial Statements (Part 1)

spate

oon in

oases alate

: doy late fess tibet

sp atagmnte tlopreelation

—_ FV

Ff 000

javenwly a0

Lip — —— ee 10,000

_rguipe 10,000 4.000 ,

Toul i 10,000

anes sts bo have Ber sol ating dhe ye

ego ents NY huring, the year lope +t

dwill computation

2; Goo!

is reported in the post-combination financial

goodwill that

ents 1S the amou!

step 2:

The

nt_ determined at the acquisition date less

stateme

accumulated impairment losses.

Consideration transferred - 75,000

Non controlling, interest in the acquire (90K x 20%) = Step 1 18,000

Previously bel equity interest in the acquire :

Total 93,000

of net identifiable assets: acquired (see Step 1) +

jan. 1, 20x71

ated impairment losses

ic, 31, 201

Fair value

Goodwill -

Less: Accumul

Goodwill - Dec.

Step 3: Non-controlling interest in net assets

iary'snet assets al fair value ~ Dec. 31, 2081 (este) 104,000

Su

Multiply by: NCI percentage 20%

Non-controlling interest in 20,800

Step 4: Consolidated retained earnings

— retained earnings ~ Dee. 31, 20x1 110,000

= : share in the net change in subsidiary's net assets 11,200

‘onsolidated retained earnings = Dec. 31, 20x1 121, 200.

14,000

Nel i

we change in XYZ’s net assets (see Step 1)

aa by: ABC’s interest in XYZ sv"

5s share in the i — 7

in the net change in XYZ's net assets 11200

152 Chapter 4

ao

'

led as )

The NCI computed in Step 3 can also be reconciled as follows;

t

a 180,

NCi at acquisition date on

NC's share in wet change in subsidiary’s net assets 04K x 27%) — 2a

NCI - Dee. 31,20x1 we ,

Both the parent and NCI share in the post-combinati,

ge in the subsidiary’s net assets. The parent's share j,

included in retained earnings, while the NCI's share is included jy

NCL.

Step 5: Consolidated profit or loss

Profits of ABC & XYZ (60k + 20K) 80,000 ly

Depreciation of FVA (se Step 1) (6,000) | ;

Consolidated profit 74,000 |

The consolidated profit is attributed to the owners of the

parent and NCI as follows:

Owners of parent NCI Consolidated

Parent's profit before FVA 60,000 N/A 60,000 | |

Share in XYZ's profit before FVA 16,000 4,000 20,000 |

Depreciation of FVA™ (4,800) (1,200) _(6,000)

Totals

71,200 2,800. 74,000

° (20,000 profit of XYZ x 80! 16,000 shi

000 share of ABC); (20K x 20% = 4,000

share of XYZ). This allocation is lik uf \ nie

¢ the parent saying, “what is yours is outs,

What is mine is mine alone.”

“6

” (96,000 depreciation of F VA x 80% = 4,800 shi

share of XYZ), are of ABC); (6K x 20% = 1,200

We no . t

Consolidated yaa i" ne information we need to draft

oe jal stateme: i

Consolidation Procedures, ‘ements, Recall the — follo

Statements (Part D)

. 153

sestment in subsidiary” account,

pate the “ne

and liabilities at their

the subsidia:

weadate firir values, net of depreciation.

the goodwill.

psidiary’s equity account

pm

3. Measure

asset!

py, Recogniz

Replace the sul s with NCI in net

Ada, line by line, similar items of assets and liabilities.

‘ABC Group

Consolidated statement of financial position

As of December 31, 20x1

ASSETS

ash 3000+ 57.00) 80,000

cable (73,000 + 22,000) 97,000

120,000

‘Accounts recelvs

Inventory (105,000 +

ent in subsidiary (Eliminated)

180,000

\)+ 0 FVA net, Step 1)

Investme’

Equipment, net (140.000 + 30,000 + 10,000 FVA net, Step 1)

Goodwill (Step 2) 3,000

TOTAL ASSETS 480,000

=

LIABILITIES AND EQUITY

Accounts payable (73,000 ~ 30,000) 103,000 |

Total liabilities 103,000

Share capital (Parent only) 170,000

Share premium (Parent only) 65,000

Retained earnings (Parent only - Step 4) 121,200

Ors of pret 356,200

paconroling interest (Step 3) 20800

ital equity 3 77000

TOTAL LI

LIABI A

ND EQUITY 480,000

154 Chapter 4

ABC Group

Statement of profit or loss

For the year ended December 31, 20x1

‘Salles (800.000 + 120,000)

_ Cost of goods sold (165k 6 72K 44K dep'n, of FVA on inventory)

Gross profi

Depreciation expense (40k + 10K + 2K dep'n. of FVA on equipt)

Distribution costs (35,000 + 18,000) — _

Profit for the year

Profit attributable to:

Owners of the parent (Step 5)

Non-controlling interests (Step 5)_

Traditional accounting method

The consolidated financial statements can also be prepared by

(a) consolidation journal entries and (b) consolidation

using

worksheet.

CE #1: To eliminate investment in subsidiary

[De] Inventory 4,000

| | Equipment 12,000

| | Share capital (same as yearend) 40,000

Share premium (same as yearend) 10,000

| Retained earnings (74K ~ 40K - 10K) 24,000

| Goodwill 3,000

Investment in subsidiary

NCI (90K x 20%)

The entry above is exactly the same consolidation jou

entry that was made at the acquisition-date consolidation. Nol

that all amounts pertain to the acquisition date.

yer

jaated Financial Statemen

ts (Part 155

55

0

EF cst ofS

4,000

psoquent £0 soxt, the accounts debited for the depreciation

4 oa in preceding years are the “yetained earnings” of both

for their respective shares. For

i

e ee ‘and the subsidiary

the pare jn the December 31, 20x2 consolidation, the

ean ‘on of FVA.S recorded as follows:

p ings — ABC (6K°» 60%) 4,800

ed earnings XYZ (6K* x 20%) 1,200

; 2,000

4,000

4,000

gnized in 20x1

his amount pertains ——o

JE #3 To adjust the Parent's and Subsidiary’s retained earnings for the

depreciation 9 -FVA during the year _

Retained earnings - ABC (GK +2K) x 80%) 4,800

1,200

Retained earnings — XYZ [(4K + 2K) * 20%)

come summary — working paper —

JE #4: To recognize NCI in ost-acquisition change 1! XYZ

18,

‘he | Retained earnings - XYZ

Retained earnings —

NCI (post - acquisition

ABC ®

ye |

\ This represents the parent's share 17 the profit or loss of

before FVA (‘Step 5’,

Th :

is represents the profit or loss attr ibutable to NCI

The su si

he ie of Na sin CJE’s #1 and #4 represents the Dec

ca icquisition-date net assets (CJE #1)

Novara tision net assets (CJE #4)

ing interest in net assets - Dec. 31, 20x1

a _

QO0OPL

(o00'es) ‘000°SE) ISSO UORNGUISIG

(o00'zs) 000'z z (000'0L) (000'0r) esuedxe uojeioeideq:

000624 000'8r 000'ge4 3yOsd SSID

“(0007rrz) 000'r z { (000'S9 1 PIOs Spoob jo }s0D

o00‘0zr 000'0ZL 000‘008 sales

000'08¢ 008"ZEE 008ZbE 000‘rzb 000°8 Le "ALOZ 2 AVIT WWLOL

000°LZE 000°%6 000°SbE Aunbe je}OL

00802. vee oos'oz = S ySe78}u! Burjoquoo-UON

002'1Z4 ’ 000'91 oos'sr yee — 000'rr 000‘OLL sOulwee poulejoy

000's9 000°! + 000'01 000's9 winjweud eseys

000'021 o00'ov st 000'0r 000041 feydeo areys

000°€0r 0000 000°%Z SanGeEH EOL

000°e01 000'0E O000°EL ‘aiqeked sjunoooy

ALINDA GNV SALLITIGWIT

p00%08y 00°24 000°8LF SLSSSV TVLOL

000°E 000'e 4 5 = TMpooS

o00'o8L z o00'z ooze o00'0e 000'0rL yeu wewdinb3

- 5 000'sz S 000'sz Aueipisqns ul juauysanul

oo0'oz a 000'r o00'y + o00's o00'soL . Asoquaauj

000'26 000'zz 000'Sz aqealaoas syuncooy

00'08 = = 000'2S 000'ez yse

= —— aie} aa siassv

“peiepyjosuon 4 Je1 37D Sjueunsni[pe uopepliosuoD # ye15rO “dul ZAK “0D OaV

9ST

Consolidated Financial Statements (Part 1) ~——T

15

Whether the contemporary method (

iilustrated) or the traditional method » the first method

used in preparing

consolidated financial statements, the concepts applied

same, Analyze the summary below: Sais

an ABC Co, XYZ Inc, Consolidated —

a 23000 57,000 60.000 _/ Subsdlny eos

acces abe 75,000 22,000 $7,000 =

. 105,000 15,000 120,009//__ | Measure asuts and Liabilities at

Sem bedi 75,000 ES | acquisition date fai values, net of

Invensnen 140,000 30,000 coereciaieny

guigenent net 180,000 "| -tavty (105K +15K + OFVA, net)

Equip (MOK +30K + 10K FVA, ne)

coodwill 3,000,

TOTAL ASSETS 478,000 124,000 480,000. \ eee

Recognize the goodwill

[ABILITIES AND EQUITY

Accounts 73,000 _ 30,000 103,000

2 oxalate 75,000 30000 103,009. | These erain to theparet onl

Sexe 7000 40900 17000° £7 ther te chap nubs

share premium 65,000 10,000 65,000

Retained earings 110,000 44,000 121,200

203800 <_| Replace the subsidiary’ equity

accounts with the NCI in net assets.

so

Total eqxty "345,000 94,000 ___ 377,000

480,000

‘TOTAL LIABILITIES & FOS

TOTAL LIABILITIES & EQUITY 418,000 _ 124,000

oy 300,000 120,000 420,000 -—_| Recognize depreciation of FVA:

(165,000) (72,000) _ (241,000) <_] ~ COCS: GeSK 72K: Ak Ine

* Depreciation expense: (WOK + 10K +2K

Cost of goods sold

% 135,000 48,000 179,000, /| isin

‘Gras profit

Depreciation expense (40,000) (20,000) (62,000)

Diseibution costs (85,000) (28,000) _* 63,000)

60,000 20,000 74,000

‘rok forthe year

The formulas below may provide additional guidance in

e formulas are

a

solving CPA board questions. Analyze how th

derived from the summary above.

Total assets of parent _ 418,000

Total assets of subsidiary 124,000

Investment in subsidiary (75,000)

Fair value adjustments — net 10,000

Goodwill - net 3,000

Consolidated total assets 480,000

qilustration 2: NC

ary 1, 2

ion date

« XZ

97000 and fair value of P90,000. The difference is due toa.

pment with a carrying amount of 60,000 and fair

value of 976,000. The equipment’s remaining useful life is

piece of equ

years.

{ measured at Fair Value

20x1, ABC acquired 80% interest in XYZ, Ine. fy.

7 in. 1, 20x1):

7's net identifiable assets have a carrying amount of

Chapter 4

ew

«ABC measured the NCI at a fair value of ®20,000.

assets

ent in subsidiary (at cost)

Equipment, net

TOTAL ASSETS

Total liabitities

Share capital

Retained earnings

Total equity

TOTAL ABILITIES AND. EQUITY

ion on subsequent reporting date (Dec. 31, 20x):

ABC Co.

178,000

80,000

160,000

418,000

73,000

235,000

110,000

345, 5, 000

418,000.

(Part

159

In ren 130,000

5 (240,000) (10,0

expe an — (240,000) __(100,000)

pRoHT FOR THE YEAR a 60,000 30,000

«There were NO dividends declared, no intercompany

transactions and no impairment of goodwill in 20x1.

Prepare the consolidated financial information on.

Step 1: Analysis of subsidiary’s net assets

: ‘Net

XYZ, Inc. Jan, 1, 20x1 Dec. 31, 20x1 change

Net assets at carrying amount 74,000 104,000

Fair value adjustments: (FVA) 16,000" 12,000

90,000 116,000 26,000

Net assets at fair value

Useful life Depreciation FVA, 12/31/x1

Gl] FVA, 1/1/x1

Equipment _ 16,000" 4yrs. 4,000 12,000

Totals 16,000, 4,000. 12,000

* (75,000 fair value ~ 60,000 carrying amount)

Step 2: Goodwill computation

aimee at ‘proportionate share’, the goodwill is

7 aa to the owners of the parent. However, if NCI is

ownets of the ir value, the goodwill is attributable to both the

parent and NCI. To compute for the attributed

amounts, we wi .

follows: will modify our previous formula for goodwill as

160 Chapter 4

Consideration transferred

Previously held equity interest in the acquiree

Total

Less: Parent's proportionate share in the net assets

of subsidiary (90,000 x 80%) - Step 1

Goodwill attributable to owners of the parent

Fair value of NCI

Less: NCI's proportionate share in the net assets

of subsidiary (90,000 x 20%) - Step 1

Goodwill attributable to NCI

Goodwill - Dec. 31, 20x1

We can reconcile the computed amount using our

previous formula:

Consideration transferred 80,000

Non-controlling interest in the acquiree (air value) 20,000

Previously held equity interest in the acquiree Z

Total

Fair value of net identifiable assets acquired (Step 1)

Goodwill - Dec. 31, 20x1

- Step 3: Non-controlling interest in net assets

The amount of goodwill attributable to NCI is included in the nai

net assets as follows:

Step 4: Consolidated retained earnings

late retained earings ~ Dec. 31, 20x1

a S share in the net change in subsidiary's net assets

‘onsolidated retained arming ngs - Dec. 31, 20x1

sat Finacial Statements Dart 1)

consi

ny lol

w Net change xy : Set Assets (Sty

mratipt’ [ABC's interest in XY a

veces in the net change ind net asset, 80%

ABC'S Ss net assets 5

step consolidated profit or loss

rise ABC & XYZ (81K 308) 90,000

Depreciation of FVA (Ste) (4000)

restate meh 86,000

Owners of parent_NCI Consolidated

spafore FVA 60,000 N/A 60,000

24,000 6,000 30,000

cats provi

part Z's profit before FVA “?

De vecation of EVA o ee ae

0,800 5,200 86,000

Totals

og = 24,000); (30K x 20% = 6,000)

ve ok profit of XYZ x 80% =

a of FVA x 80% = 3,200); (AK om

dated financial jnformation — December 31, 20x1

Consoli

ther assets (178000 +44,000) 222,000

Investment in subsidiary (Eliminated)

Equipment, net 160,000 90.000 + 12,000 FVA net, Step 1) 262,000

Goodwill (Step 2) 10,000 _|

TOTAL ASSETS 494,000

LIABILITIES AND EQUITY

Total liabilities (73,000 + 30,000) 103,000

Share capital (Parent only) 235,000

\ Retained earnings (Parent ontly - Step 4) 130,800.

Otoners of parent . 356,800

| Non-contolling interest (Step 3 25,200

{ol equity 391,000

494,000.

TOTAL LIABILITIES AND EQUITY

430,000

Income (200,000 + 130,000)

(344,000)

Expense

PROFIT} TON es 100,000 + 4,000 dep’n of FVA, Step 1)

ITFOR THE YEAR _ = 86,000

162 Chapte

“—

gor goodie anol NCL gy,

an the Same.

pampurtations

> When NCL is measured at ftir value, the 00

ps ema

#s (Le. Stops 2 and 3) are modified, The other Se

Subsidiary’s cumulative preference shares /

cumulative preference shang

If the subsidiary has outstanding ae

“ad held by non-controlling kere

~ qwhether declared OF HOt, ay

profit before computing, for the

that are classified as equity

one-year preferred divident

deducted from the subsidiary’s

share.

parent’

Mlustration: Subsidiary’s cumulative preference shares

Bear Co. owns 75% of Cub Co's ordinary shares. Cub Co. his

P100,000 outstanding 12" preference shares, none ¢

which are held by Bear C ted individual

234,000 and PI 0x1. Neither

declared dividends.

> cumulative

9. Bear and Cub report

000, respectively, in

The preference shares have

profits of

company

dividends in arrears of 3 years.

Requirement: Compute for the profit attributable lo the owners of

the parent and NCL

Solution: —_ _

Owners ofparent NCI __ Consolidated

Bear's profit 234,000 N/A 234,000

Share in Cub’s profit 52,7500 175,000

Total 2,750 409,000

© Profit of Cub. Co. 175,000

One-year dividends on cumulative preference sh. (100K x 12%) (12,00)

Profit of Cub Co. attributable to ordinary shareholders oi

> Bear's share (163,000 x 75%) 122,280

> NCI's share (163,000 x 25%) 40,730

}

12,000

Profi :

rofit of Cub. Co. attributable to preference shareholders

NCI’s share in profit al al dinary shareholders

: a profit attributable to ordinary 5

: y shareholders _40/

Total NCI's share in Cub’s profit , =

_163

ot SUMED ned Tran]

quired to prepare consolidated finan

c Fe arent is re

cgavement except in limited cases mentioned in PFRS 10.

jdated financial statements provide information on a

parent and its subsidiaries viewed asa single reporting entity.

Tre basis fOr consolidation is control. Control exists if an

5 the following over an investee: (1) power; (2)

*yestor has

or rights, to variable returns, and (b) ability to affect

when control is obtained and ceases when

ied for prospectively.

prepared using uniform

ation starts ¥

Jost. Both cases are account

financial statements are

cies and same reporting date.

Ives the following:

ent in subsidiary” account.

ry’s assets and liabilities at their

net of depreciation.

jidation invo!

the “Invest

a. Measure the subsidia

| acquisition-date fair values,

p.Recognize the goodwill.

c Replace the subsidiary’s eq

assets.

2 Add, line by Jin

« Co

1. Eliminate

uity accounts with NCI in net

e, similar items of assets and liabilities.

gS include the retained earnings

+ Consolidated retained earnin|

hare in the change in net assets

of the parent plus the parent's $

of the subsidiary since acquisition date.

0 Na in net assets includes the NCI at acq

Ndls share in the change in net assets of

| , ee date.

| a init is presented within equi

| te owners of the parent.

eae

| solidated profit or loss is attributed to the (

f the parent/and (b) NC

uisition date plus the

the subsidiary since

ty but separate from

a) owners

164 '

=e Chap

Relevant provisions of the PFRS for SMEs

Section 9 Consolidated and Separate Financial Staten,

A parent is required to prepa’ consolidated financial giant

except if: oa “Mey

a. the parent is itself 4 subsidiary and it5 Ultima, |

intermediate parent roduces consolidated 4,\"°

ith full PERSS or the PERS fo,

statements that comply with fu sor the PERS for sue

Ss,

quired with the intention of a

the acquisition date. ing

is not sold within one year, it m

consolidated by restating all prior period financial statems

except when the failure to sell is beyond the parent's con,"

sare parent remains committed t0 sell the subsidiary ny

b. the subsidiary is a

within one year from

If the subsidiary

A subsidiary is not excluded from consolidation sing

2. the investor is a venture capital organization or similar ent

or

b. the subsidiary’s business activities are dissimilar to those ¢

the other entities within the group, OF

c. the subsidiary operates in a jurisdiction that imposes

restrictions on transferring cash or other assets out of the

jurisdiction.

A parent that does not have public accountability may

preseni its separate financial statements in accordance with the

PERS for SMEs, even if it presents its consolidated finandal

statements in accordance with full PFRSs.

Special purpose entities (SPE)

An SPE is an entity that is created to accomplish a nal

objective (eg,, to effect a lease, undertake R&D activities

securitize financial assets). An SPE may take the form

corporation, trust, partnership or unincorporated entity. j

entitys oe are controlled by an entity are include

ted financial statements.

fe

ajidated Financial Statements (Part 1) 165

Consolidate

control is “the power to govern the financial and operating

» eivcies of an entity s0 as to obtain benefits from its activities”

or intro is presumed to exist when the parent owns, directly

oe indirectly through subsidiaries, more than half of the

voting power of an entity.” (PFRS for SMES 9.4 & 9.5)

Consolidation procedures ;

a. Eliminate the investment in subsidiary.

b Measure the NCI in net assets and NCI in profit or loss and

: present them separately from those of the owners of the

parent. ;

c. Add, line by line, similar items of assets, liabilities, equity,

income and expenses of the combining entities.

The parent’s and NCI’s shares in the subsidiary’s changes

in equity and profit or loss are computed based on existing

ownership interests and do not reflect the possible exercise or

conversion of options or convertible instruments

Intragroup balances and transactions

Intragroup balances and transactions, including income,

expenses

and dividends, are eliminated in full.

Uniform reporting date -

The parent's and the subsidiary’s financial statements used in

Consolidation shall be Prepared as of the same reporting date. If

not, the subsidiary’s financial statements are adjusted first before

they are consolidated,

Uniform accounting Policies

— ae nancial statements are Prepared using uniform

are Giferent gn Ifa subsidiary uses accounting policies that

Statements are ie those of the group’s, the subsidiary’s financial

Justed first before they are consolidated.

Acquisition and disposal of subsidiaries

The subsidiary’s income and expenses are consolidated

acquisition date to the date the parent ceases to conty

subsidiary. ;

When control ceases, the difference between the di

proceeds and the subsidiary’s carrying amount at disposal d;

recognized as gain or loss.

The cumulative amount of any exchange differen,

relate to a foreign subsidiary recognized in other compre

income is not reclassified to profit or loss on disposal of

subsidiary. ¥;

If control ceases but the investor (former parent) cor

to hold investment in the former subsidiary, the invest

accounted for

2. at fair value, with changes in fair value recognized in profi

less, or

b. at cost less accumulated impairment losses.

Investments in quoted shares and investments for w

the fair value-can be measured reliably are measured at fair va

Measurement at cost is appropriate only when fair value cat

be measured reliably. The carrying amount of the investment

the date control ceases is the investment’s deemed co:

measurement purposes. d

If the investment retained in the former subsid

qualifies as an investment in associate or an interest in a joi

controlled entity, the investment is accounted for

a. at fair value, with changes in fair value recognized in profit

_ _ |oss,or 3

o at cost less accumulated impairment losses, or

* using the equity method.

a eweweGme—— 167

PROBLEMS:

pROBLEM 1: TRUE OR FALSE

1, The bas! for consolidation is power. fF Creo

> Entity A acquires Entity B on November 1, 20x1. The 20x1

consolidated profit includes Entity B’s profit from January 1 to

December 31, 20x1 - it is as if control had existed for the entire

year. F ; Trem NOW 4 1 V awoke

Goodwill is remeasured to fair value at each reporting date. ¢

' py F en “DBT Fy LESS

w

Shecomyc ned Mh VaeD Lass

Use the, following information for the next two items:

Entity A acquired 90% interest in Entity B on January 1, 20x1

when Entity B’s net assets had a fair value of #100. On December

31, 20x2, Entity B’s net assets increased to 200 after adjustments

for acquisition-date fair values, net of depreciation.

The NCI on December 31, 20x2 is 20. ¥

Before consolidation, Entity A’s retained earnings balance is

1,000. The consolidated retained earnings is P 1,090. ¢ x

6. NCI in the net assets of a subsidiary is presented in the

consolidated financial statements as a mezzanine item. '

7. Goodwill is attributed both to the owners of the parent and

non-controlling interests only if the non-controlling interests

are measured at fair value. ~

8. The amount of goodwill attributed to non-controlling interests

is included in the measurement of non-controlling interests in

gn

the subsidiary’s net assets. 7

Use the following information for the next two items:

wy Co. owns 80% of Night Co. Day and Night reported profits of

fa and 100, respectively, in 20x1. There is no depreciation of

‘air value adjustment.

9, ‘

* Pe consolidated profit is P300, 7 Cart"

' The profit attributable to the owners of Day Co. is P280. *

[20+ & win] ° 25

aaSSQQx>__—_ i

—

Chapter 4

168

PROBLEM 2: FOR CLASSROOM pIsCUSSION

Consolidation at acquisition date

1. On January 1, 20x1, Health Co acquired 70% interes;

Wealth Co. The finanei@ ai stacemen's of the combining enti

right after the business combination are as follows:

Health Co- Weailtirg

Cy,

Cash 100.00 nt

" 00

Accounts receivable O ra c ay

Inventory y 4

Investment in subsidiary 560,000 |

4 30,000 10 py

400m)

Prepaid assets

5700)

Building, net ! f

Total assets 2ALY

70,000 90,0

Accounts payable )

Share capital ! 1,000,000 20000

Share premium d 350,000 50.00

Retained earings 990,000 230.05)

2,410,000 570.000

Total liabilities and equity,

of Wealth’s assets and liabilities

ate fair values, exce ot as follows:

Fair value

The carrying) amounts

approximate the acquisition-d

Carrying amount

‘Accounts receivable 40,000 20,000

7 400,000 540,000

Building, net

Health measured the NCI at ‘proportionate share’.

Requirement: °] .

quirements Prepare the consolicated statement of financial

position.

‘proportionate’

ea

consolidation subsequent to acquisition date -

ary

2. Pink Co. acqui: I% i

a quired 90% interest in Floyd, Inc. on Janu

sancial Statements (Part 1)

sion on Jan. 1, 20x1:

net identifiable assets have a carrying amount

i ni

and fair value of P600,000. The difference is due S

* plovd’s

psd, 000

.

5 the following: :

Carrying amount Fair value .**

Tentory 100,000

Building, net 400,000

The remaining

pink measure

Information’ on Dec. 31, 20x1:

‘d the NCI at ‘prop

110,000 *%

510,000 1'¢

ugafal life of the building is 5 years.

ortionate share’.

statements of) ‘financial position

“ysat December 31, 20x1

ASSETS Pink Co. Floyd Co.

Cash . 620,000 120,000

‘Accounts receivable me ans

Nee bad 56000 ;

Investment in subsidiary (at cost) PaO j a

Prepaid assets D

paling et 1,100,000 350,000

Total assets 2,660,000. 658,000,

Accounts payable 50,000 90,000

Share capital 1,000,000 200,000

Share premium 350,000 50,000

Retained earnings 1,260,000 318,000

Bs

Teta iabltes and equity 2,660,000 658,000.

Statements of profit or loss

For the year ended December 31, 20x1 :

Sales Pink Co. Floyd Co.

Cost of 600,000 200,000

Gispat sold (200,000) (60,000)

Depreciation o 400,000 140,000

ee (100,000) 60,000)

170

Chaptery

Distribution costs

Profit for the

year

no dividends declared, 0° intercom,

goodwill in 201 7

e There were

ment of

transactions and no impair

Requirement: Prepate the December 31, 20x1 consolidated finang,

statements.

Solution:

quisition date - ‘fair value’

receding problem except that Pi

£965,000.

mn subsequent toa

Consolidatio

formation in the p

3, Use the ink

measured the NCTat a fair palue 0}

the December 31, 20x1 consolidated finané:

Requirement: Prepare

statements.

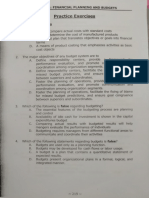

PROBLEM 3: EXERCISES

4. On January 1, 20x1, Sunny Co. acquired 60% interest in Rai

Co. for 300,000. The financial statements of Sunny Co.

i ght after the business combination follows:

Sunny CO. Rainy Co- i!

Carrying Carrying

amt. amt.

Inventory 400,000

Investment in subsidiary 300,000

600,000

Accounts payable

Share capital

Retained earnings

ted Financial Sta

1

Chis measured uneler the proportionate share metho

Requirement: Prepare the consolidated statement. of financial

position on January 1, 20x1.

On January 1, 20x1, Hammer Co. acquired 80% interest in Volk

Co. The financial statements of the combining entities right

Cash 160,000 70,000

‘Accounts receivable 200,000 110,000

Inventory 400,000 80,000

Investment in subsidiary 520,000 2

Building, net 1,000,000 300,000

Total assets - 2,280,000 500,000

Accounts payable 100,000 20,000

Share capital 1,000,000 200,000

Share premium 300,000 100,000

Retained earnings 880,000 180,000

Total liabilities and equity 2,280,000 500,000

bilities approximate their fair values,

+ Folk’s assets and lial

100,000) and building (fair

except inventory (fair value is

value is ®400,000).

+ Hammer measured the NCI at ‘proportionate share’.

Requirement: Prepare the consolidated statement of financial

position.

3. On January 1, 20x1, Run Co. acquired 80% interest in Walk Co.

Information on Jan. 1, 20x1:

©. Walk 1. 1 20x

pare net identifiable assets have a carrying amount of

,000 and fair value of P600,000. The difference is due to

the following: inventory (carrying amount, g; 00

100,000) and building (carrying amount, 300,009 fap

400,000). a

«The remaining useful life of the building ig 10 Year

« Runmeasured the NCI at ‘proportionate Share’, *

Information on Dec. 31, 20x1: 7

Statements of financial position

As at December 31, 20x1

ASSETS Run Co, +)

Cash 750,000 k

Accounts receivable 260,000

Inventory 200,000

Investment in subsidiary (at cost) 520,000

ant

Total assets 2,680,000 al

=

Accounts payable 80,000 ir

Share capital 1,000,000 2ang

Share premium 300,000

Retained earnings 1,300,000

Total liabilities and equity 2,680,000

Statements of profit or loss

For the year ended December 31, 20x1

Run Co.

Sales 800,000

Cost of goods sold (200,000)

Gross profit 600,000

Depreciation expense (50,000)

Distribution Costs (130,000)

420,000

: . cai

There were no dividends declared, no interc™!

transactions and no impairment of goodwill in 20x1-

yr

sted Finacial Statements (Part 1)

yuo Prepare the December 31, 20x1 consolidated financial

gqatementS:

information in #3 above except that Run Co.

use the same

ata fair value of P130,000.

? red the NCI

meas

Requirement? Prepare the December 31, 20x1 consolidated financial

e

statements.

20x1, Joy Co. acquired 60% interest in Axion,

5. On January 1,

Information on Axion’s financial position on

Inc. for £300,000.

this date follows: .

+ The identifiable assets and liabilities approximated their

fair values except for inventories with carrying amount of

120,000 and. fair value of P80,000 and building with

carrying amount of P200,000 and fair value of ?250,000.

The building has a remaining useful life of 5 years.

+ Axion’s equity comprises only share capital and retained

earnings with carrying amounts of P250,000 and P40,000,

respectively.

« NClis measured at ‘proportionate share’.

All the inventories on January 1, 20x1 were sold during 20x1. No

dividends were declared by either entity during 20x1. There were

also no intercompany transactions and no impairment of

goodwill. The individual financial statements of the entities on

December 31, 20x1 are shown below:

Statements of financial position

4s at December 31, 20x1

JoyCo. Axion Co.

—_ foy Co. ‘ion Co.

“ash

4 143,000 60,000

Wentory

msn 440,000 160,000

ment in subsidiary (at cost) 300,000

ial =net 560,000 160,000

TAL ASSET: : =

SS 1,443,000 380,000

>,

14

LIABILITIES AND EQUITY

ble 200,000

1,000,000

243,000

1,243,000

1,443, 000

apital

Retained earnings

TOTAL LIABILITIES AND EQUITY

Statements of profit or loss

For the year ended December 31, 20x1

Joy Co.

Sales 300,000,

Cost of goods sold (165,000)

Gross profit . 135,000

Depreciation expense (40,000)

Distribution costs (32,000)

Profit for the year__

Reguirement: Prepare the consolidated financial statements as

December 31, 20x1.

6. Use the same information in #5 except that Joy Co. measu

the NCI at fair value of ®132,000.

Requirement: Prepare the consolidated financial statements as a

December 31, 20x1.

Consolidated Financial Statements (Part 1) 17

5

pROBLEM 4: MICROSOFT EXCEL -

NOTE: This activity is OPTIONAL as the learner will need to

have access to a COMPUTER with a Microsoft Excel _®

tion installed in it.

applica

Open a Microsoft Excel® Worksheet and copy the following:

fa feat, |

fa Parent Subsidiary

2) Cash 40,000 5,000

3 | Accounts receivable 50,000 20,000

4, Inventory 10,000 25,000

5 investment in subsidiary 180,000

ra} Land 800,000 250,000

7

8 | Accounts payable 90,000 130,000

“9 | Share capital 500,000 80,000

10) Share premium 100,000

“1| Retained earnings 390,000 90,000

> To place commas on the amounts or increase/decrease

decimal places, use these buttons.

Dao ae 7

FI ee rete temas 0s trv

Bec re a ee Mere,

Be Bee Rupioe SA

Boor

hdd

Aoret c

SS

2. Make your table look like this:

Parent

1

2

3

4

5

6

7 Goodwill

8 Toto, 4,080,000 300,009

9

“10 Accounts payable 30,000 130,000

“11. Share capital 500,000 80,000

“22. Share premium 100,000 ;

43. Retained earnings 390,000 90,000

44 NC

300,000

To format words or amountsinto *bold’, ‘italic’, or ‘bold ital,

use these:

Date

SG are

ha lines or double-rutes, use this:

shortcut for bold is CTRLAB, while the shortcut for italic is

Subsidiary Consolidated

40,000 5,000

50,000 20,000

Invento! 10,000 25,000

{ment in subsidiary 180,000

800,000 250,000

Land

aright click, @ dropdown list appears, select ‘Insert’ from that list.

@ To get the total of Parent's assets, you can do any of the

following:

a. Select cell B8 then left click “AutoSum” (located: on the

“Honie” tab, “Editing” menu bar) - this one; or

b. Select cell BS then type the following formula =sum(B2:B7)

> To check a formula, select the cell with the formula (e.g., cell

B8) then press the ‘F2’ key on the keyboard.

> To get the total of Subsidiary’s assets, you can copy the

formula in cell B8 and paste it on cell C8, for example, select

cell B then press CTRL+C (shortcut for copy), select cell C8

then press CTRL+V (shortcut for paste).

> Get the totals of Parent's and Subsidiary’s liabilities and

equity,

CX

5 eS ATON PROCEDURES

, 5 pre the investment in subsidiary account by:

, asuring the subsidiary’s assets and liabilities at their

cquisition-date fair values;

pter 4

ee

b Recognizing ree

: Replacing the sub:

net assets.

sdiary' equity accounts'with the No,

eenanress and liabilities approximate td

’ oe fair values, except for the following:

- Inventory, #5,000

- Land, 630,000

+ The goodwill is $30,000.

. The NCLis ®50,000. -

Step 1: Type zero for investment in subsidiar

column, :

'y in the “Consolidatg

Step 1(a);

® Select cell D4 then type

=B4+5000, Press enter.

* Select cell D6 then type

=B6+300000. Press enter.

Step 1(b);

ep 1(b): Ye 30000 for goodwill in the ‘Consoli ated’ column.

Step 1(c):

® 10): Type 50000 for NClin the ‘Consolidated’ colu

At this poj |

'S Point, your table Should look like

Ike this: .

r

Statements (are

nancial Statement

cant Fi

Subsidiary Consolidated

40,000 5,000

| ats receivable 50,000 20,000

scour 10,000 25,000 15,000

4 ee ent in subsidiary 180,000 A

$ Invest™ 800,000 250,000 1,100,000

6 wil 30,000

90,000 130,000

accounts payable

44. share capital 100.000 “mm

“> share premium -

a2) St , 390,000 90,000

= petained earnings d

3B 50,000

44 NC 1,080,000 300,000

5. Totals

Step 2: Add, Tine by line, similar items of assets and liabilities: of

the combining entities.

> Select cell D2 then type =B2+C2. Press enter.

> Copy the formula in cell D2 (select cell D2 then press CTRL+C

on your keyboard).

Goto cell D3 and paste the formula (CTRL+V).

Go to cell D10 and press CTRL+V.

Select cell D1 then type =B11. Press enter.

Copy the formula in cell D11 and paste it on cell D12 and cell

D13,

Get the totals of asse

Consolidated’ colu mns.

vvv

F

ts and liabilities and equity in. the

These should be equal.

YX

Our table should look like this:

5 Investment in subsidiary 180,000 S,oqy

6 | Land 300,000 250,000

7 | Goodwill 7,100,099

8 Totals 7,080,000 __300,000 fl ae

9

10. Accounts payable 90,000 130,000 200%

11. Share capital 500,000 80,000 Sony

12. Share premium 100,000 100.0%,

13. Retained earnings 390,000 90,000 390,009

14 | NCL 00t9

15 | Totals 7,080,000 300,000 7,260,000"

Print the file and submit it to your teacher for grading.

PROBLEM 5: MULTIPLE CHOICE - THEORY

1. According to PFRS 10

a. a parent entity is required to consolidate its subsidiaries.

b, a parent entity is encouraged but not required to

consolidate its subsidiaries.

c. a parent need not consolidate a subsidiary if the

subsidiary’s business is different from that of the parent.

d. a parent entity is required to consolidate its subsidiaries

only for internal reporting purposes.

2. Which of the following is not an element of control?

a. Power

b. Exposure, or rights, to variable returns

©) Major holdings

d. Ability to affect return

8

ithe essential elements of control ig

yne oF s wows cd

$ peRS 10, an investor has power if

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)