Professional Documents

Culture Documents

Financial Planning and Budgeting

Uploaded by

Trisha Mae Austria de Torres0 ratings0% found this document useful (0 votes)

78 views30 pagesfinancial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting finan

Original Title

financial planning and budgeting

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinancial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting finan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

78 views30 pagesFinancial Planning and Budgeting

Uploaded by

Trisha Mae Austria de Torresfinancial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting financial planning and budgeting finan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 30

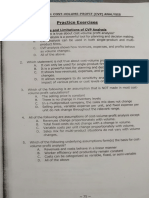

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

Practice Exercises

1. acelag is

‘A. Used to compare actual costs with standard costs

B. Used to determine the cost of manufactured products

C. A detailed plan that translates objectives or goals into financial

terms

D. Ameans of product costing that emphasizes activities as basic

cost objects

2. The major objectives of any budget system are to

A. Define responsibility centers, provide a framework for

performance evaluation, and promote communication and

coordination among organization segments.

B. Define responsibility centers, facilitate the fixing of blame for

missed budget predictions, and ensure goal congruence

between superiors and subordinates.

C. Foster the planning of operations, provide a framework for

performance evaluation, and promote communication and

coordination among organization segments.

D. Foster the planning of operations, facilitate the fixing of blame

for missed budget predictions, and ensure goal congruence

between superiors and subordinates.

3. Which of the following is false regarding budgeting?

A. The essential features of the budgeting process are planning

and control

B. Availability of idle cash for investment is shown in the capital

expenditures budget

C. Comparing actual results with budgeted results will help

mangers evaluate the performance of individuals

D. Budgeting requires managers from different functional areas to

communicate and coordinate their activities

4. TANG? Ok Rise cei eens 'egarting budgets ie faige?

Budgets are used only as a planning function.

Budgets may be developed for cash flows or labor usage.

A budget is a plan that contains a quantitative statement of

expected results,

Budgets present organizational plans in a formal, logical, and

integrated manner,

9 OPP

~219 ~

,

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

5. Which of the following is not part of the operating budget?

A. Sales budget C. Manufacturing overhead

- budget

B. Capital budget D. Selling and administrative

expense budget

6. Budgeting

A. Is primarily a bookkeeping task.

B. Primarily focuses on past performance.

C. Involves the input from a broad range of managers.

D. Should be built from the bottom of the hierarchy to the top.

7. Budgeting involves thi ni rn " whi

as Shien e concept “management by exception” which takes

A. Only rare events that would occur

B. Only significant unfavorable deviations

C. The samples selected at random or arbitrarily from a population

D. Those items that vary materially from expectations, favorable or

unfavorable

8. The following are reasons why a company would prepare a budget,

except

To make sure the company expands its operations

To provide a basis for comparison of actual performance

To control income and expenditure in a particular period

To communicate the company’s plans throughout the entire

business organization

9Op>

9. The following are distinguishable attributes of a budget, except

A. Itis a motivating device.

B. It is a guideline for operations.

C. Itis a guarantee of actual results.

D. It is an organization's operational plan.

rations for slightly different

. ization plans and budgets its opel

Sn s t a significant reason for

yreasons. Which one of the following is not

planning? :

‘A. Ensuring profitable operations.

viding a basis for controlling operations. ele

ee foward the objectives of the organization.

B.

Cc. Checkin progress t

D. Forcing Be agers to consider expected future trends and

conditions.

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

11. Which of the following is a use of budgets for control?

A. Communication is improved.

B, Plans can be made for the future.

C. Budgets set a standard against which results can be compared,

D. If conditions change between the formation of the budget and

the current time, budgets can be quickly adapted,

12. Which of the following budgets can be used for control?

A. Cash budget C. Budgeted income statement

B, Production budget D. All of the choices

‘in

13. Budgeting

A. Forces managers to look ahead and address potential problems

B. Motivates employees to work hard to meet the company’s

objectives

C. Fosters the planning of operations, provide a framework for

performance evaluation and promote communication and

coordination among organization segments

D. All of the above

14. One of the primary advantages of budgeting is that it

A. Bases the profit plan on estimates.

B. Is continually adapted to fit changing circumstances.

C. Does not take the place of management and administration.

D. Require departmental managers to make plans in conjunction

with the plans of other interdependent departments.

15. Which one of the following is usually not cited as being an advantage of

a formal budgetary process?

A. Provides a formal benchmark to be used for feedback and

performance evaluation.

B. Ensures improved cost control within the organization and

prevents inefficiencies.

C. Serves as a coordination and communication device between

management and subordinates.

D. Forces management to evaluate the reasonableness of

assumptions used and goals identified in the budgetary process.

16. All of the following are advantages of the use of budgets in a

management control system except that budgets

A. Provide performance criteria.

B. Limit unauthorized expenditures.

C. Force management planning.

D. Promote communication and coordination within the

organization.

~ 221+

|G AND BUDGETS

CHAPTER 6: FINANCIAL PLANNIN

17. Which of the following is not an advantage of budgeting?

A. It requires managers to state their objectives.

B. It facilitates control by permitting comparisons of budgeted and

actual results.

C. It provides a check-up device that allows managers to keep

close tabs on their subordinates.

D. It facilitates performance evaluation by permitting comparisons

of budgeted and actual results.

Role of Top Management

18. In the process of budgeting, the role of the top management should

A. Be limited to the approval process

B. 2 ele including using the budget process to communicate

cs Be limited because they do not have sufficient information of

daily operations

D. None of the above

19. Which one of the following best describes the role of top management in

the budgeting process? Top management

‘A. Should be involved only in the approval process.

B. Needs to be involved, including using the budget process to

communicate goals.

C. Lacks the detailed knowledge of the daily operations and should

limit their involvement.

D. Needs to separate the budgeting process and the business

planning process into two separate processes.

t director and the budgeting department is

ge the budget process.

mittee of the board of

20. The primary role of the budget

‘A. Compile the budget and mana

B. Justify the budget to the executive com!

directors.

C. Settle disputes al

development of the annual 0}

D. Develop the annual profit plan 1

» be adopted from the suggestions submit

operating segments.

following is most important to

mong operating executives during the

perating plan.

by selecting the alternatives to

itted by the various

21. Which one of the a successful budgeting

effort?

A. Experienced analysts c. Top management support

B. Integrated budget D. Reliable forecasts and

i trend analyses

software

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

22, The budgeting process should be one that motivates managers and

employees to work toward organizational goals. Which one of the

following is least likely to motivate managers?

A, Use of management by exception.

B. Having top management set budget levels.

C. Setting budget targets at attainable levels,

D. Participation in the budgetary process.

ing Pre

23, A budget manual, which enhances the operation of a budget system,

is most likely to include

A. Achart of accounts

B. Distribution instructions for budget schedules

C, Employee hiring policies

D. Documentation of the accounting system software

24. When developing a budget, an external factor to consider in the

planning process is

New product development

B. The merger of two competitors

C. The implementation of a new bonus program.

D. Achange to a decentralized management system

ie

25. A planning calendar, for budgeting purposes is the

A. Calendar year covered by the budget

B. Schedule of dates at which goals are to be met

C. Schedule of activities for the development and adoption of the

budget

D. Schedule of dates when new products should be launched in the

market

26. Which one of the following statements concerning approaches for the

budget development process is correct?

A. The top-down approach to budgeting will ensure adherence to

strategic organizational goals.

B. With the information technology available, the role of budgets

as an organizational communication device has declined.

C. To prevent ambiguity, once departmental budgeted goals have

been developed, they should remain fixed even if the sales

forecast upon which they are based proves to be wrong in the

middle of the fiscal year.

D. Since department managers have the most detailed knowledge

about organizational operations, they should use this

information as the building blocks of the operating budget.

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

27. Which one of the following is not a characteristic of a successful budget

"A. Gaining top management's support.

B. Using market feedback to assist in setting expectations.

Cc. Setting specific expectations to compare to actual results.

D. Implementing the budget as the only benchmark for

28. vay of the following are advantages of the budgeting process except that

Allocates resources on an as-needed basis.

ew oe among organizational units.

anagement to assess the future obj

ee, ure objective of the

Establishes benchmarks to identify unsat i

tisfact

mq ory organizational

° 99>

Ineffective Budgets

29. An ineffective budget control system is characterized by

Lack of timely feedback in the use of the budget.

Use of budgets as a planning but not a control tool.

Use of budgets for harassment of individuals rather than

motivation.

All of the answers are correct.

9 NEP

30. An improperly executed budget process might have the effect(s) of

A. Inflated budget requests

B. Meeting short-term but not long-term goals

C. Disregard of overall company goals

D. All of the choices

31. The finance department of 4 large company has prepared a master

budget with very limited expense budgets for each department. The

department managers are worried about being held accountable for these

assigned targets, but senior management wants to keep spending

‘ reduced to allow for contingencies ‘and strategic adjustments to the

company-wide master budget. Based on this information, this budget

process is

A. Nota successful budgeting process because it has not been

widely accepted by the employees.

B. Nota successful budgeting process because management has

left too much room for strategic unknowns.

1 Cc. A successful budgeting process because it will encourage the

! associates to work their hardest to meet the goals.

D. Assuccessful budgeting process because it will be a very useful

tool to hold people accountable for overspending.

it

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

32. When budgets are used to evaluate performance

spending, the process will often result in Capattiante in eee Rs

‘extra’ to ensure the budgets will be met. This ‘extra’ is = ws

A. Budgetary slack C. Strategic Planning

B. Management by objectives D. Continuous budgeting

33, There is budgetary slack when

A. Costs are estimated too high, but sales are estimated too low

B. Costs are estimated too low and sales are estimated too low

C. Costs are estimated too high and sales are estimated too high

D. Costs are estimated too low, but sales are estimated too high

34. Which of the following statements best describes budgetary slack?

A. The margin of error assigned to each cost center to encourage

the manager to budget accurately and consistently.

B. The total amount that actual expenses are below budgeted

expenses and actual revenues exceed budgeted revenues.

C. The practice of understating budgeted revenues or

overestimating budgeted costs to make budgeted targets more

achievable.

D. The practice of management assigning relaxed budgetary goals

after the company achieves the first several months of the

annual budget.

35. Which of the following is correct regarding budgetary slack?

A. It eliminates the likelihood that a manager will receive the

personal rewards that follow from meeting the expectations of

superiors

B. It is the process of making the budget look good by either

overstating expected sales or understating budgeted expenses

C. The use of which allows the use of budget to control subordinate

performance

D. From the perspective of corporate management, the use of

budgetary slack increases the likelihood of inefficient resource

allocation

~225~

ee " q

—————

FINANCIAL PLANNING AND BUDGETS

CHAPTER 6:

36. In an organization that plans by using comprehensive budgeting, the }

master is

‘A. The current budget updated for operations for part of the

current year.

B. A budget for a non-profit entity after it as approved by the :

appropriate authoritative body. ’

C. The booklet containing budget guidelines, policies, and forms to

use in the budgeting process.

D. A compilation of all the separate operational and financial

budget schedules of the organization. .

37. The master budget

A. Reflects controllable costs only

B. Shows forecasted and actual results

C. Contains the operating budget

D. Can be used to determine manufacturing cost variances

:

:

38. Which one of the following may be considered an independent item in

the preparation of the master budget?

‘A. Ending inventory budget C. Capital investment budget i

B. Pro forma income D. Pro forma statement of ;

statement financial position

39. The preparation of a comprehensive master budget culminates with the

preparation of the

A. Production budget C. Capital investment budget

B. Strategic budget D. Cash management and

working capital budget

40. ABC Company uses a comprehensive planning and budgeting system.

The apes order for ABC to prepare certain budget schedules would be

CGS, balance sheet, income statement and statement of cash

flows.

B. Income statement, balance sheet, statement of cash flows, and ‘

CGS 3

r C. Statement of cash flows, CGS, income statement, and balance

sheet

D. CGS, income statement, balance sheet, and statement of cash

flows

Sales Budget

A 5 ith

41. A comprehensive budget operational budget starts wit! :

A. Sales forecast C. Budgeted income

statement

B. Production budget D. Raw materials purchase

budget

42. The foundation of a profit plan is the

~ 226~

CE

CHAPTER 6: FINANCIAL PLANNING AND. BUDGETS

A. Sales forecast C. Capital budget

B. Production plan D. Cost and expense budget.

ee 43. Which of the following is the usual starting point in di it

forecast? on

A. The production budget C. Last year’s level of sal

B. The cash receipts budget D. Competitor a

information

44. Using the concept of ‘expected value’ in sales forecasting means that the

sales forecast to be used as

A. Based on probabilities.

B. Based on expected selling prices of the products,

C. Developed using the indicator method.

D. The sum of the sales expected by the individual,

45. Which one of the following items should be done first when developing a

comprehensive budget for a manufacturing company?

A. Development of a sales budget

B. Development of a capital budget

C. Determination of the advertising budget

D. Preparation of a pro forma income statement

46. An overly optimistic sales budget would most likely result in

A. Excessive inventories C. _ Insufficient inventories

B. Increased sales during the D. Increases in selling prices

year late in the year

Purchasing Budget

47. Bucks Company desires an ending inventory of Php62,000 and a

* beginning inventory of Php55,000. Gross profit is estimated to be 25% of

sales. The expected sales amounted to Php320,000. Budgeted purchases

would amount to

A. Php230,000 C. Php247,000

B. Php240,000 D. Php370,000

48. ABC Company is a maker of men’s jeans. The company would like to

maintain 32,000 yards of fabric in ending inventory. The beginning fabric

inventory is expected to contain 40,000 yards. The expected yards of

fabric needed for sales is 144,000. Compute the yards of fabric that ABC

needs to purchase,

A. 136,000 yards C. 152,000 yards

B. 144,000 yards D. 216,000 yards

~227~

CHAPTER, 6; FINANCIAL PLANNING AND BUDGETS

49, The budget that would provide necessary input data for the raw materials

budget, direct labor budget and manufacturing overhead

is

‘A. Sales forecast C. Cash recei

; ipts budget

B. Production budget D. Cash disbursement budget

50. Which one of the following best descri i

» A, It summarizes Boe ee cock. Brocuction pusaet?

B, It includes required direct labor hours.

= it includes required material purchases.

D. Itis calculated from the desired ending inventory and the sales

forecast.

51. In going from the sales budget to the production budget

t, ad}

the sales budget need to be made for pee

A. Cash receipts C. Factory overhead costs

B. Selling expenses D. Finished goods inventories

52. The production budget process usually begins with the

A. Sales budget C. Direct materials budget

B. Direct labor budget D. Manufacturing overhead

budget

ble sales and production for several years. Next

year, sales are expected to increase by at least 50%. If the company

maintains its policy for desired ending inventories of finished product and

direct materials purchases, what will be the likely effect on the desired

ending inventory of finished product?

C. It will decrease

A. It will increase

B. It will stay the same D. It will be twice the size of

desired ending inventory

53. A company has had stal

54. ABC Company's sales budget shows quarterly sales for ti

quarter equal to 2(

the second quarter of the next year would be c

A. 10,440 units Cc. 12,180 units

B. 11,600 units D. 12,760 units

~ 228 ~

he next year as

follows: :

> Quarter Units Quarter —_Units

1 14,500 3 17,400

Zi 11,600 4 20,300

Com| licy is to have a finished goods inventory at the end of each

pe Ee 10% of the net quarter's sales. Budgeted production for

.

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

55. A company provided the following information on sales for the coming

year:

Qi Q2 Q3 Q4]

Units 40,000 | 40,000 | 30,000 | 80,000

Average selling price Php5 | PhpS | Php | _Php6

‘Assuming that the beginning inventory is 3,000 units, and that the

company policy is to have 25% of the next quarter's sales in ending

inventory, which quarter will have the lowest production?

Am Of B. Q2 C aa D. Q4

; Raw Materials Purchase Budget

56. Direct materials needed for production is calculated by

A. Adding units to be produced to direct materials per unit.

B. Dividing units to be produced by direct materials per unit.

C. Multiplying units to be produced by direct materials per unit.

D. Subtracting units to be produced from direct materials per unit.

57. Straw Company manufactures a single product. It has a policy of keeping

finished goods inventory amounting to 150% the coming month's

budgeted sales. Raw materials, on the other hand, are kept at twice the

coming month's budgeted production requirements. Each unit of product

requires 4 kilos of raw materials. The production budgets (in units)

consist of the following:

January 5,000 units February 5,500 units

March 4,700 units April 4,500 units

Purchases of raw materials in March would be

A. 15,600 kilos C. 18,000 kilos

B. 17,200 kilos D. 24,000 kilos

Items 58 and 59 are based on the following information:

DELL Company has budgeted sales of 60,000 units in July; 80,000 units

in August; and 120,000 in September. The Company has 6,000 units of

finished goods and 49,600 pieces of raw materials on hand on July 1.

Each unit of product requires 4 pieces of materials. The desired inventory

of finished goods is 10% of the next month’s sales. The desired inventory

of materials is 20% of the next month’s production needs. Each raw

material can be purchased for Php0.50 per material.

58. How many pieces of raw materials are purchased in July?

A. 248,000 pieces C. 345,600 pieces

B. 265,600 pieces D. 355,200 pieces

59. How much would be the purchases in July?

A. Php132,800 C. Php172,800

B, Php177,600 D. None

~229~

——_

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

ea The budget schedule that would provide the i

Bor budget would be the e necessary input data for the

A. Production budget Cc. Sal

. les forecast

B. as, eo, purchase’ D. Schedule of cash receipts

lg and disbursements

61. Each unit of Product X requires two direct |

, labor hours. E

costs are treated as direct labor costs. Data on direct mere en

Number of direct employees 25

Weekly productive hours per employee ab

Estimated weekly wages per employee Php12,250

Employee benefits (related to weekly wages) 20%

The standard direct labor cost per unit of Product X is

A. Php840.00 Cc. Php1,323.00

B. Php945.00 D. Php1,653.75

Overhead Budget

62. A company that manufactures furniture is establishing its budget for the

upcoming year. All of the following items would appear in the overhead

budget except for the ‘.

A. Fringe benefits paid to the production supervisor.

B. Cost of glue used to secure the attachment of the legs to the

tables.

C. Overtime paid to the workers who perform production

scheduling.

D. Freight charges paid for the delivery of raw materials to the

company.

63. The information contained in a cost of goods manufactured budget most

directly relates to the

A. Materials use

in-process.

: B. Materials used, direct labor,

goods inventories budgets.

Cc. Materials used, direct labor,

: :

i rocess inventories budgets. 7 ;

j D. eateries used, direct labor, overhead applied, and work-in-

process inventories, and finished goods inventories budgets.

.d, direct labor, overhead applied, and ending work-

overhead applied, and finished

overhead applied, and work-in-

~230~

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

64. Which one of the following state i

administrative budgets is most Caer ents regarding seling and

A. Selling and administrative budgets are fixed in nature.

8. Selling and administrative budgets are usually optional

C. Selling and administrative budgets need to be detailed in ord

that the key assumptions can be better understood. .

D. Selling and administrative budgets are difficult to all

month and are best presented as one number for t

year.

locate by

he entire

65. ABC Company pays out sales commissions to its sales team in the month

the company receives cash for payment. These commissions equal 8%

of total (monthly) cash inflows as a result of sales. ABC has budgeted

sales of Php375,000 for August, PhpS00,000 for September, and

Php250,000 for October. Approximately 80% of all sales are on credit,

and the remaining balance is cash sales. Experience indicates that 60%

of the budgeted credit sales will be collected in the month following the

sale, 30% the month after that, and 10% of the sales will be uncollectible.

Based on this information, what should be the total amount of sales

commissions paid out by ABC in the month of October?

A. Php21,250 C. Php27,500

B. Php26,400 D. Php30,400

Financial Budget; Cash jet

66. The financial budget process includes

A. The cash budget C. The capital budget

B. The budgeted statement D. All of the choices

of cash flows

67. Which of the following is normally included in the financial budget of a

firm?

A. Direct materials budget C. Sales budget

B. Budgeted balance sheet D. Selling expense budget

68. Bank loan officers would find which of the following budgets to be one of

the most important in determining whether to give a company a loan?

A. Sales budget C. Production budget

B. Cash budget D. Budgeted balance sheet

69. The last budget schedule prepared before the financial statements is the

A. Cash budget C. Manufacturing overhead

budget

B, Cost of goods sold budget D. Selling and administrative

expenses budget

~21~

J

4 CHAPTER, FINANCIAL PLANNING AND BUDGETS

70. Acash budget should help to ensure

‘A. That cash dividends can be paid every quarter.

B. eet Pret an excess amount of idle cash.

S enough cash is always on hand i i SI

accel to satisfy maximum cash

D. That enough cash is available to pay salaries and wages, even if

it means borrowing money.

71. Accompany anticipates selling Php200,000 of goo

will probably be uncollectible. Which of the Bae ee ae eter

A. Php215,000 is added to the cash budget. :

B. Php15,000 is subtracted from the cash budget.

C. Php15,000 does not appear on the cash budget.

©. Php185,000 appears as a disbursement on the cash budget.

i : 72. As part of the master budget process, a merchandising company begins

° to prepare the cash budget for the same period. Which of the following

i el will be most useful to management in preparing

a A. Credit policies, projected expenses, and inventory procurement

| policies.

| B. Sales credit policies, purchasing terms, and planned capital

acquisition.

C. Projected revenues, projected expenses, and intended financing

. activities.

D. Planned direct material purchases, planned direct labor, and

} purchasing terms.

calendar year and prepares a cash budget for each

73. ABC Company uses a

hich one of the following items should be considered

; month of the year. WI

i when developing July’s cash budget? ;

A. Recognition that 0.5% of the July sales on account will be

| uncollectible.

B. Quarterly cas! dividends scheduled to be declared on July 15 and

to shareholders of record as of July 25.

tax and Social Security contributions withheld

checks to be remitted to the Bureau of

paid on August 6

: C. National income

from employees’ June pay

‘al Revenue in July.

Tie the last calendar year scheduled to be

D. Property taxes levied in n

paid quarterly in the coming year during the last month of each

calendar quarter.

~ 232~

Sone Re

CHAPTER 6: FINANCIAL PLANNING AND. BUDGETS

Collections and Disbursements

74. Which of the following would be found in the cash receipts budget?

A. Loan proceeds C. Extinguishing a loan

B. Depreciation of factory D. Amount of factory supplies

equipment ‘on hand

75. Which one of the following items would have to be included for a

company preparing a schedule of cash receipts and disbursements for

calendar Year 1?

A. The amount of uncollectible customer accounts for Year 1.

B. A purchase order issued in December Year 1 for items to be

delivered in February Year 2.

C. Dividends declared in November Year 1 to be paid in January

Year 2 to shareholders of record as of December Year 1.

D. The borrowing of funds from a bank on a note payable taken

out in June Year 1 with an agreement to pay the principal and

interest in June Year 2.

76. ABC Company budgeted sales of Php220,000 for June, Php200,000 for

July, Php280,000 for August, Php264,000 for September, Php244,000 for

October, and Php300,000 for November. Approximately 75% of sales are

on credit; the remainder are cash sales. Collection experience indicates

that 60% of the budgeted credit sales will be collected the month after

the sale, 36% the second month, and 4% will be uncollectible. Which

month has the highest budgeted cash receipts?

A, August C. October

B. September D. November

Items 77 and 78 are based on the following information:

The ee Company has the following historical pattern on its credit sales:

60% collected in the month of sale

20% is collected in the first month after sale

12% is collected in the second month after sale

5% is collected in the third month after sale

3% uncollectible

The sales on open account have been budgeted for last six months of

2018 are show below:

July Php84,000 October Php125,000

‘August 90,000 November 140,000

‘September 110,000 December 120,000

77. The estimated total cash collection during the fourth calendar quarter

would be

A. Php120,500 C, Php299,000

B. Php247,200 D. Php359,200

78. The estimated total cash collections during the fourth calendar quarter

from sales made during the fourth calendar quarter would be

~ 233~

P CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

‘A. Phpi20,500 C. Php299,000

B. , Php247,200 D. Php359,200

79. ABC Company’s master budget was Prepared based on the followin

Pisses

les

Decrease in inventories a Fas rt

Decrease in accounts payable 225, oa

Gross margin rate 30%

fo

ABC's estimated cash disbursements for inventories are

A. Php2,070,000 C. Php3,150,000

B. Php2,250,000 D. Php3,870,000

Comprehensive Problems; Operating Budget

Items 80 to 84 are based on the following information:

MJY Company produces and sells only one product. The selling price is

expected to be the prevailing price of Php14 per unit. The company

expects to sell 270,000 units of product during the period. The desired

finished goods inventory at the end of the period is 180,000 units while

the expected beginning inventory is 150,000 units.

Each unit of product requires 3.60 kilograms of raw materials. Only one

kind of raw material is used, and it is expected to cost Php0.50 per

kilogram. The desired ending inventory of raw materials is 28,800

kilograms; the expected beginning inventory is 22,800 kilograms. Direct

labor is Php5.00 per hour. Each product requires 1 hour completing.

Factory overhead is applied to production on the basis of direct labor

hours. Variable factory overhead cost at the planned level of operations

is budgeted at Php135,000; fixed budgeted overhead is budgeted at

Php450,000.

\d administrative expenses amounted to Php3.50 per

i selling ant : e

eer, elling and administrative expenses is

unit of product sold while fixed sé

+ budgeted at Php200,000.

80. The budgeted production is

A. 125,000 units

B. 240,000 units

C. 270,000 units

D. 300,000 units

i hases for the period is

81. The budgeted material purc! eras 000

000

5 ps7 000 D. Php1,086,000

~ 234~

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

82. The budgeted direct labor cost is

A. 300,000 ¢. 1,200,000

B. 900,000 D. 1,500,000

83. The budgeted cost of goods sold on an absorption Costing basis is

A. Php2,362,500 C. Php3,820,500

B. Php2,421,000 D. Php3,879,000

84. The budgeted income before tax is

A. Php214,000 C. (Php1,186,500)

B. Php272,500 D. (Php1,244,000)

Items 85 to 90 are based on the following information:

Presented below is the balance sheet of ABC Company as of December 31,

2017:

Assets Liabilities & Equity

Cash Php30,400 _—IT payable Php4,800

AR 48,000

Inventory 17,600 Ordinary Shares 256,000

PPE 232,000__Retained Earnings 67,200

Total Assets Php328,000 ‘Total L&E Php328,000

The manager instructs you to update the balances based on the budget

below:

Q rq 3Q FQ]

Sales Php112,000 | Phpi28,000 | Php144,000 | Php140,800

Production Costs 76,800 80,000 89,600 80,000

Operating expenses 25,600 27,200 28,800 30,400

«Annual depreciation (included in the amounts above):

© Production costs: Php70,400

o Operating expenses: Php19,200

« — Inventory balances are expected to be:

March 31: Php56,000 June 30: 52,000

September 30: Php60,000 December 31: 48,000

¢ All production costs and operating expenses, except depreciation,

are to be paid during the quarter incurred.

* Sales are made either through cash or credit. The Company expects

quarterly sales to be made 20% in cash and 80% in credit. As to the

credit sales, the same are collected 50% in the quarter of sales and

48% in the quarter after the sale. The rest are budgeted to be

uncollectible and recognized as bad debts in the quarter incurred.

There is no allowance for bad debts as of December 31, 2017.

* Dividends are paid at the end of June and December. The number

of dividends is based on 10% of the cash balance available at the

end of the 1% quarter for June dividends and the 3° quarter for

December dividends.

~235~

———

ya CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

+ Income tax is equal

in the Paice.” of the quarter's income tax and is paid

The

December 31, 2018 budgeted balance sheet would show

85. Budgeted cash of

A.

e ey 10,992.00 C. Php142,280.00

. Np 139,776.00 D. Php153,379.20

86, Budgeted accounts receivable (net) of

A. Php54,067.20

1,067. c Ph

B. Php55,296.00 D. phe? 44.00

87. Budgeted Inventory of

A. Php48,000 C. Phpst

; : 6,0

B. Php52,000 D. Bh 60,000

88. Budgeted Property, Plant and Equipment of

A. Php142,400 C. Php187,200

B. Php164,800 D. Php209,600

89. Budgeted income tax payable of

A. Php4,425.60 C. Php9,388.80

B. Php4,844.16 D, Php13,862.40

90. Budgeted retained earnings of

A. Php99,545.60 C. Php125,903.04

B. Php103,792.00 D. Php125,669.20

Comprehensive Problems; Financial Budget

nthe following infc :

NI Company is preparing its cash budget for the last two months of the

fourth quarter of the calendar year 2016. Following are some pertinent

budget data gathered by the company’s budget committee:

October November — December

* Sales Php280,000 Php300,000 Php360,000

Accounts payable for

merchandise 100,000 140,000 144,000

purchases

Salaries 100,000 150,000 180,000

Other expenses 110,000 130,000 58,500

‘Additional information from the budgets is presented below:

« Collection pattern: 60% of each month's sales is collected in the

month of sale; the balance is collected in the following month

«Payment of accounts payable: 80% of the current month's

accounts payable budget is paid during the month of purchase

and the balance is paid in the following month

~ 236 ~

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

* The budgeted other expenses include dey

amount of Php22,000 per month Biperias rection co F

outlays are paid for in the month of incurrence, :

* The company intends to maintain a cash balance Php100,000,

© In case of deficits, the company may borrow from its

bank in multiples of Php10,000 which would bear an

interest rate of 12% per year. Principal repayments are

to be made in any month in which there is a surplus of

cash. Interest is paid monthly,

o There is no outstanding balance of loans from

banks as of November 1,

o Tf there is no outstanding balance on the loan, the

company will invest any cash in excess of its desired

end-of-month cash balance in government securities.

No investments were outstanding as of November 1.

91. Determine the amount borrowed for the month of November

A. Phpo C, Php90,000

B. Php80,000 D. Php100,00

92. For the month of December, determine the ending cash balance

A, Php77,300 C. Php102,000

B, Php10,000 D. Php107,300

93. A budgeting process where information flows top down and bottom up is

referred to as:

A. Joint budgeting C. Continuous budgeting

B. Perpetual budgeting D. Participative budgeting

94. Which one of the following is not an advantage of a participatory

budgeting process?

A. Goal congruence C. Coordination between

departments

B. Control of uncertainties D. Communication between

departments

~Biw

JE-PROFIT (CVP) ANALYSIS a

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

95. The ce are the benefits of participative budgeting, except?

c

It involves those most directh

It is more like! Pees

ly to motivate

orgaizatons Pau people to work toward an

it improves accountability _ be

ecause managers are held

pee for reaching goals, such that they cannot shift their

ponsibility by blaming the unrealistic goals demanded by the

budget

Top management need not be concerned with the overall

profitability of the current operations because lower-level

managers set the final target for the budget

96. Participative budgeting

A

B.

ice

D.

Ts the same as an imposed budget

Would be the responsibility of each responsibility unit

Does not require the support of top management to promote

budget participation

Does not require the review and approval of top management

97. An advantage of participative budgeting is that it

A

B.

cS

D.

98. Which

Minimizes the cost of developing budgets.

Encourages acceptance of the budget by employees.

Reduces the effect on the budgetary process of employee

biases.

Yields information known to management but not to employees.

‘one of the following is not considered to be a benefit of

participative budgeting?

A

B.

iG

The budget estimates are prepared by those in direct contact

with various activities.

Managers are more motivated to reach the budget objectives

since they participated in setting them. ;

Individuals at all organizational levels are recognized as being

part of the team; this results in greater support of the

organization. ‘

When managers set the final targets for the budget, senior

management need not be concerned with the overall

profitability of current operations.

~ 238 ~

INANCIAL PLANNING AND BUDGETS

Zero-Based Budgeting

99. One of the techniques or processes in budgeting is zero-based

which is

A. Developing budgeted costs from clear-cut

relationships between inputs and outputs.

B. Budgeting from the ground up as though the budget Process

were being initiated for the first time.

C. Using the prior year’s budget as a base year and adjusting it

based on the experiences of the prior year and the expectations

for the coming year.

D. Budgeting for cash inflows and outflows to time investments and

borrowings in a way to maintain a bank account with a minimum

balance.

budgeting,

Measured

100.The major appeal of zero-based budgeting is that it

‘A. Solves the problem of measuring program effectiveness.

B. Reduces significantly the time required to review a budget.

C. Deals with some of the problems of the incremental approach

to budgeting.

D. Relates performance to resource inputs by an integrated

planning and resource-allocation process.

101.Which of the following pertains to zero-based budgeting?

‘A. A variant of fiscal-year budgeting whereby a twelve-month

projection in the future is maintained

B. Involves the review of each cost component from a cost/benefit

perspective

C. Presents the plan for a range of activity so that the plan can be

adjusted for changes in activity levels

D. A budgeting approach which top management sets the budget

and imposes it on lower levels of the organization

102.The major feature of zero-based budgeting is that it

‘A. Takes the previous year’s budgets and adjusts them for inflation.

B. Focuses on planned capital outlays for property, plant, and

equipment.

C. Questions each activity and determines whether it should be

maintained as it is, reduced, or eliminated.

D. Assumes all activities are legitimate and worthy of receiving

budget increases to cover any increased costs.

103.A company that uses zero-based budgeting has

A. An expense budget of zero.

B, An assumed sales level of zero.

C. Azero variance between budgeted and actual performance.

D. Zero as the starting point of budgeting the coming year’s

expenses.

104.Zero-based budgeting forces managers to

~239~

——— ULL

a

Ss ‘

6: FINANCIAL PLANNING AND BUDGETS

A

B.

Cc:

Dd.

Prepare a budget based on historical

| costs.

Jocarate @ budget by objective rather than function

Justify Spenares at the beginning of every budget period.

— Product's revenues and expenses over its expected

105.An advantage of increme:

ntal budgeting wher :

based budgeting is that incremental budgeting res th 70°

9 NPP,

106.A contin

one»

Encourages adopting new

Projects quickly.

Accepts the existing base as being satisfactory.

Eliminates functions and duties

thi

ane: lat have outlived their

Eliminates the need to review all functions periodically to obtain

optimum use of resources.

uous profit plan

Is an annual plan that is part of a 10-year plan.

Is a plan that is revised monthly or quarterly.

Is a plan devised by a full-time planning staff.

Works best for a company that can reliably forecast events a

year or more into the future.

107.A continuous (rolling) budget .

9 9 @ >

Is a plan that is revised monthly or quarterly, dropping one

period and adding another.

Presents the plan for a range of activity so the plan can be

adjusted for changes in activity.

Presents the plan for only one level of activity and does not

adjust to changes in the level of activity.

Is one of the budgets that is part of a long-range strategic plan,

unchanged unless the strategy of the company changes.

Static Budgeting

108.The use of the master budget throughout the year as a constant

i? A

B.

with actual results signifies that the master budget is also a

Static budget C. Flexible budget

Capital budget D. Zero-based budget

runereo % COST-VOLUME-PROFIT (CvP) ANALYSIS

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS,

109.A static

A

B.

ca

D.

budget

Presents a statement of expectations for a period

Present a firm commitment. me Gots not

Presents the plan for only one level of activity

adjust to changes in the level of activity. on

Presents the plan for a range of activity so that the plan can be

adjusted for changes in activity.

Drops the current Month or quarter and adds a future month or

a future quarter as the current month or quarter is completed.

110.A major disadvantage of static budget is that

A.

B.

Cc

D,

Tt is made for only one level of activity.

Tt is more difficult to develop than a flexible budget.

Variances tend to be smaller than when flexible budgeting is

used.

Variances are more difficult to compute than when flexible

budgeting is used.

Flexible Budgeting

111A flexible budget is

. The same as a continuous budget.

One that can be changed whenever a manager so desires.

Adjusted to reflect expected costs at the actual level of

9 o>

activity.

One that uses the formula “total cost = cost per unit * units

produced”

112.Which one of the following statements regarding the difference between

a flexible budget and a static budget is true?

A

i.

A flexible budget includes only variable costs, whereas a static

budget includes only fixed costs.

A flexible budget is established by operating management, while

a static budget is determined by top management.

A flexible budget primarily is prepared for planning purposes,

while a static budget is prepared for performance evaluation.

D. A flexible budget provides cost allowances for different levels of

activity whereas a static budget provides costs for one level of

activity. ‘

ee

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

113.When compared to static bud: il

A. Provide a better ae pele gets

rstandi is

tthe period being evalus ae Of the capacity variances during

B. Offer managers

a more listi is

actual fixed cost items sie. peepatieon of budget. and

Beer ler their control.

ta es aise to use fewer fixed cost items and more

e fat are under their control.

Offer istic

ores fuanscers @ more realistic comparison of budget and

avenue and cost items under their control.

eee ae oh see ae budget compared to a statistic budget is

A. Fixed Cost variances are more clearly presented.

aerials in planned production are clearly presented.

ee easily be changed to adjust to changing

Budget costs for a given output level can be compared with

actual costs for the same level of output.

B.

i,

D.

115.Which of the following pertains to flexible budgeting?

A. A budget that presents the plan for a range of activity

B. A budget that sets allowances based on prior year expenditures

C. A budget that is established at the beginning of the period and

not adjusted for different levels of actual sales activity

D. The process of developing budget estimates by requiring all

levels of management to estimate sales, production, and other

operating data as though operations were being initiated for the

first time

116.Which one of the following budgeting methodologies would be most

appropriate for a firm facing a significant level of uncertainty in unit sales

volumes for next year?

A. _ Static budgeting C. Life-cycle budgeting

B. Flexible budgeting D. Top-down budgeting

117.When preparing 2 performance report for a cost center using flexible

* budgeting techniques, the planned cost column should be based ‘on the

‘A. Actual amount for the same period in the preceding year.

B. Budget adjusted to the actual level of activity for the period

being reported ‘ :

cy Breet rica to the planned level of activity for the period

reported.

D. pudgeted amount in the original budget prepared before the

beginning of the year.

Li ~ 242~

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

118.The difference between the actual amounts and the flexi

amounts for the actual output achieved is the tbe budget

A. Sales volume variance C. Production

variance

B. Flexible budget variance D. Standard cost variance

Volume

Ani

119.ABC, Inc. has prepared budgets for the next 5 months: May, June, July,

August, and September. As soon as May results are reported, ABC will

add October to their budget plans. What type of budget system is ABC

using?

‘A. Project budgeting C. Continuous budgeting

B. Flexible budgeting D. Activity-based budgeting

120.ABC has found that its annual budgets are quickly outdated once actual

data is recorded. Sometimes actual preparations have already begun for

the period being budgeted by the time the annual budget is finished,

which leaves no time to react to changing factors. ABC wants the budget

to be as up to date as possible, and management is willing to revise

budgets as needed. Which budgeting solution would be most appropriate

for ABC?

A. Flexible budgeting C. Continuous budgeting

B. Zero-based budgeting D. Activity-based budgeting

121.A company is focused on continuous improvement and wants to ensure

that its budgeting process supports this goal. The company has already

eliminated much of the waste from activities during previous budget

periods and now wants to concentrate on value-added activities and

improving relationships with suppliers and customers. Which of the

following is the least beneficial budget solution for this company?

A. Flexible budgeting C. Continuous budgeting

B. Zero-based budgeting D. Activity-based budgeting

122.ABC Company has certain peak seasons; namely the Christmas season,

the summer season, and the last 2 weeks of February. During these

periods of increased output, the firm leases additional production

equipment and hires additional temporary employees. Which of the

following budget techniques would best fit this firm’s needs?

A. Flexible budgeting C. Continuous budgeting

B. Zero-based budgeting D. Activity-based budgeting

~ 243 ~ :

124.After performing a thorough study of ABC Company's operations, an

independent consultant determined that the firm's labor standards were

probably too tight. Which one of the following facts would be inconsistent

with the consultant's conclusion?

A. ABC's budgeting process was well-defined and based on a

bottom-up philosophy.

B. Management noted that minimal incentive bonuses have been

paid in recent periods.

C. Areview of performance reports revealed the presence of many

unfavorable efficiency variances. é

D. Production supervisors found several significant fluctuations in

manufacturing volume, with short-term increases on output

being followed by rapid, sustained declines.

‘(AL PLANNING AND BUDGETS

lanagement tea:

plan to allow more time and Bate

For the next budget year, idle

i a i

will be undertaken, The Soe Feview of all activities and functions

budget as the starting point for ller has elected to use this year’s master

management's goals, did the ae year’s budget process. Considering

of bu ségeting methodologies? ler make the most appropriate choice

No, he should sel

Hi lect zero-| 4

unless they are eRnEINe ‘based budgeting to allow no costs

B. No, he should sel ar

a lect activity-

historical patterns. ae coe ca) Cociess On Uc

C. No, he i

i Be eee implement a continuous budget to provide current

D.

Yes, he should take the current budget and make incremental

changes to reduce waste.

-END-

~ 2M4~

CHAPTER 6: FINANCIAL PLANNING AND BUDGETS

ANSWER KEY

a 26 | D 51[D 76D

ig 27[ 0 52 LA 7 io 8

B 28 [A 53] A 78 Lc iTS

A 29 | D 54] D 79 1D torte]

B 30 | D 55 |B 80 | D 1051-5

Cc 31] A 56 | C [sic 106 -B

D 32] A 57 |B 82 | D 107A

A 33 [A 58/8 8A 108 TA

G 34] Cc 59 A | 84] B 1091 B |

A 35 | D 60 | A |meSemG 110/ a |

GC 36 | D 61 | A | 86 | A 1u[c¢

D BZ 62/D 87 | A 1121 D

D SeamG: 63 | C | 88 | A 113 | D

D 39 | D Saal 89 | B 114 | D

B 40 | D 65 | D Eu Le 115 | A

B 41 A 66 | D 91 | D 116/ B

Cc 42 | A 67 | B 92 | D 117| B

B Ge} LL © 68 | B Sma) 118 | B

B 44] A 69 | A 94 | B 119| C

A 4S] A 70| 8B 95m MID} 120 | C

Cc 46 | A Pies 96 | B 121| A

B EZ 72 | B S7m/mB) 122| A

B 48 | A 73 | C LES JLo) 123 | A

B 49 | B 74, A Oo) | Bi 124| A

c 50 | D 75 | D 100 | C

Ans. | Comment

Option A pertains to standard costing.

Option B is incorrect since we do not determine the cost of

c_ | Manufactured products. In budgeting, we only use

manufacturing cost as basis for total production costs.

Option C is incorrect since budgeting is not a product

costing method.

¢€

Budgeting only covers operational and financial budgets.

Idle cash for investment purposes may be seen in the

financial budget when we prepare a cash budget.

8 ty

Option C is not in contrast with Option A in Item

Bipeted results are different from standard costs. oe

are different from standards. In budgeting, te ie

__| function of measuring performance while in

245.0

‘R 6: FINANCIAL PLANNING AND BUDGETS

there is an imposition of responsi

; [ r i f responsibility for the resulting |

As mention in Option A in Item

¢ in Option A in

el i Ttem 3, budgeting is used for

he operating budget mainly in ns y,

ting budget mainly focuses on operations. Clearl

capital budget pertain: it

outside routine ae ane een |

Budgeting is also used as sales and purchases).

- a ee = @s communication tool. It

GC x activities between the mi

subordinate. Thus, to establish epee ae

hoe ne an effective and useful

sdget, we need the input from a broad range of mana |

Again, we are introduced with the concept of mana on |

7 D by exception (also brought up in Chapter 4 Standard |

Costing). In budgeting, we only consider those items that

vary materially from expectations.

ade ne Cie assurance that the company can

perations. Budgeting is not made for this

purpose.

‘As mentioned, budgeting cannot be a guarantee of actual

i] ic results. It serves as a mere expectation of actual results

+. (i.e., expected results).

The preparation of budgets neither guarantees actual

10 A results nor ensure profitable operations. It is only a plan

that contains a quantitative statement of expected

aI. results.

We go back to a basic function of management: control.

Here, the budgets are used so set a standard against which

results can be compared.

aa Cc

Option A pertains to budgeting as a communication tool;

Option B pertains to planning, @ separate function; and

Option D goes beyond the control function.

12 D

13. D :

rE Budgeting is also used as a ‘communication tool. It would

14 D require managers to make plans in conjunction with the

plans of other interdependent departments. we

Budgeting does not improve cost control. Again, this is only

a5 B | a plan that contains 4 quantitative statement of expected

results.

lA pudget contains the costs that are expected to be

incurred. jowever, cannot limit unauthorized

6 B_ | expenditures. There is no assurance that unauthorized

: expenditures can happen. Unauthorized expenditures may

still occu! even though the com ny has a concrete budget.

Budgeting faci itates evaluation of performance and

rovision of incentives since it compares actual results wi

i” Bally ults_which will help managers evaluate the

_—

CHAPTER

INANCIAL PLANNING AND BUDGETS

Performance of individuals, departments, NS, OF

entire companies, Budgeting could also be used to provide

incentives for people to Perform well. It is not used to

Provide a check-up device so Managers would keep close

tabs on their subordinates.

The role of top management is very important to make a

successful budget. Management should be involved.

Although Option C may seem correct since top management

do not have sufficient information of daily operations, this

does not mean that top management should limit its |

Participation. To make a budget, top management should

be there to supervise.

The role of top management is very important to make a

successful budget. Management should be involved. To

make a budget, top management should be there to

supervise.

The role of top management is very important to make a

successful budget. Management should be involved. To

make a budget, top management should be there to

supervise.

By having top managemert set budget levels, the

subordinates are given no opportunity to voice their

opinions and/or concerns. This is a top-down approach

which is usually frowned upon as compared to the bottom-

up approach.

Department managers have the most detailed knowledge

about organizational operations, they should use this

information as the building blocks of the. operating budget.

Options A, C, and D would also affect the budget, but the

item is looking for external factors. A merger of two

competitors would affect the budget (e.g., sales forecast).

The common error in this item is choosing Option A. When

ABC Company makes a budget for 2019, the planning

calendar is not from January 1, 2019 to December 31, 2019.

The planning calendar is actually the schedule of activities

for the development and adoption of the budget (e.9.,

September 1, interview sales department; or December 10,

Obtain top management approval).

>|9|0|>|o\0

~ 247 ~

FINANCIAL PLANNING AND BUDGETS

A budgetary slack is created when employees estimate

Costs too high and estimate sales too low. :

A budgetary slack is created when employees estimate

costs too high and estimate sales too low.

A budgetary slack is created when employees estimate

costs too high and estimate sales too low.

‘One of the main reasons why budgetary slacks are frowned |

upon is that there would be the likelihood of inefficient

resource allocation. In Chapter 12: Relevant Costing,

one of the subtopics is resource allocation in case there are |

insufficient resources. Remember that the product to which

the resources are allocated first is not the one with the

highest contribution margin per unit but the one with the

highest contribution margin per constrained resource. So, if

an employee adds a budgetary slack, e.g., underestimating

sales forecasts of A and B, then the allocation of resources

would be altered as well.

The master budget is a comprehensive set of budgets that

covers all phases of an organization’s planned activities for

a specified period. Within the master budget are individual

budgets which can be classified as either operating budgets

or financial budgets.

The master budget is a comprehensive set of budgets that

covers all phases of an organization's planned activities for

a specified period. Within the master budget are individual

budgets which can be classified as either operating

budgets or financial budgets.

39

D | we need information from the sales budget; to get cash

D knowing how many units must

The master budget is a comprehensive set ‘of budgets that

covers all phases of an organization's planned activities for

a specified period. Within the master budget are individual

budgets which can be classified as either oper

budgets or financial budgets.

Capital investment budget is separate from the master

budget since the latter covers only the phases of an

organization's operations. ,

The preparation of the cash management and working

capital budget needs all the information from the other

budgets in the master budget. E.g., To get cash receipts,

disbursements, we need information from the purchasing

budget, labor budget, overhead budget, etc. :

If you follow the sequence in our material, oe a of wid

sales budget to know how many units will be sold, thus

rk aE be produced (if

chased (if merchandising firm).

wufacturing firm) or

ee anit of the production or

From there, we determine the cost

~ 248.»

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Goverisk ReviewerDocument9 pagesGoverisk ReviewerTrisha Mae Austria de TorresNo ratings yet

- Stratax PrelimDocument12 pagesStratax PrelimTrisha Mae Austria de TorresNo ratings yet

- CVP AnalysisDocument16 pagesCVP AnalysisTrisha Mae Austria de TorresNo ratings yet

- Chapter 6 - RemovedDocument9 pagesChapter 6 - RemovedTrisha Mae Austria de TorresNo ratings yet

- Chapter 4 (With Problems)Document60 pagesChapter 4 (With Problems)Trisha Mae Austria de TorresNo ratings yet

- Chapter 4 (With Problems) - RemovedDocument18 pagesChapter 4 (With Problems) - RemovedTrisha Mae Austria de TorresNo ratings yet

- Jpia Got Talent GuidelinesDocument2 pagesJpia Got Talent GuidelinesTrisha Mae Austria de TorresNo ratings yet

- Group 4 HumborgDocument3 pagesGroup 4 HumborgTrisha Mae Austria de TorresNo ratings yet

- JoseRiz Reviewer PrelimsDocument12 pagesJoseRiz Reviewer PrelimsTrisha Mae Austria de TorresNo ratings yet

- Case Analysis Final Excelsior PDF FreeDocument4 pagesCase Analysis Final Excelsior PDF FreeTrisha Mae Austria de TorresNo ratings yet

- Frederick Taylor The Father of Scientific Management (1856-1915)Document4 pagesFrederick Taylor The Father of Scientific Management (1856-1915)Trisha Mae Austria de TorresNo ratings yet