Professional Documents

Culture Documents

KFS HBL Conventional Term Deposit Accounts - Dec 2022

Uploaded by

Abeer KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KFS HBL Conventional Term Deposit Accounts - Dec 2022

Uploaded by

Abeer KhanCopyright:

Available Formats

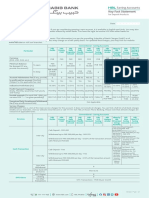

Term Deposit Accounts

Key Fact Statement

for Deposit Products

Habib Bank Limited, Date D D M M Y Y Y Y

_____________________Branch.

IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English and Urdu. You may also

use this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for

comparison.

Account Types & Salient Features

Term Deposit Accounts for investment purposes. This information is as per the prevailing Schedule of Bank Charges (SoBC) as of

01 July, 2022. Services, fees and mark-up rates may change on a half-Yearly basis. For updated fees/charges, you may visit our website

www.hbl.com or visit our branches.

Conventional - Term Deposit

HBL Advantage HBL Advantage Notice HBL Investment HBL High Yield

Particular Account* Plus deposit Plus Deposit Foreign Currency

Fixed Deposit

Account (HYFFD)

Currency

PKR USD, GBP, EUR

(PKR, USD, EUR, etc.)

Minimum Balance To open PKR 20 million (for 3 months 1,000 for eligible

PKR 25,000 PKR 1,000 maturity) PKR 100 million

for Account (If any, currency

(for 1 month maturity)

provide the amount)

To keep 0

Account Maintenance Fee

0

(If any, provide the amount)

Is profit paid on account (Yes/No)

(Subject to the applicable tax rate) Yes

Conveyed on daily basis

Indicative Profit Rate (%) 11.50% - 18.00% 11.75% - 14.75% 14.50% by Treasury Division 1.00% - 1.75%

Profit Payment Frequency

Monthly, Quarterly,

(Daily, Monthly, Quarterly, Half-yearly Monthly Maturity

Half-yearly & Maturity

and Yearly)

Provide example (On each PKR 1000, you (Principal amount x PKR 10 - 17.5 convert

can earn PKR ------ on given periodicity) PKR 9.58 - 15 PKR 9.80 - 12.30 PKR 12.08 profit rate)/profit into eligible currency

payment frequency (1 year maturity)

Minimum PLS rate to be applied that will be either the rate at Replacement cost of the

the time of booking or the prevailing rate, whichever is lower. deposit and

Penalty (2% fixed) FCY saving rate or

Premature/EarlyEncashment/Withdrawal *Penalty will be charged as per the "Opportunity Loss" for the HYFFD rate

Fee (If any, provide amount/rate) remaining days. For IPD deposit greater whichever is lower

than 1 year Cash

Reserve Requirement

(CRR) cost is also

applied

*HBL Advantage Account tenor, interest rates, and payouts are available on HBL website.

Service Charges

IMPORTANT: case premature encashment penalty is greater than or equal to the customers accrued profit, then the premature encashment

penalty will be equivalent to customer's accrued profit & customer’s principal will remain secure at all times

Conventional - Term Deposit

Services Modes HBL Advantage HBL Advantage Notice HBL Investment HBL High Yield

Account* Plus deposit Plus Deposit Foreign Currency

Fixed Deposit

Account (HYFFD)

Inter-city Not Applicable

Intra-city Not Applicable

Cash Transaction Own ATM

Not Applicable

Withdrawal

Other Bank ATM Not Applicable

ADC/Digital Not Applicable

Clearing Not Applicable

SMS Alerts

For other

Not Applicable

Transactions

Version: 1st Jan – 21

Conventional - Term Deposit

HBL Advantage HBL Advantage Notice HBL Investment HBL High Yield

Services Modes Account* Plus deposit Plus Deposit Foreign Currency

Fixed Deposit

Account (HYFFD)

PayPak Not Applicable

PayPak Chip Not Applicable

Green Visa Not Applicable

Visa Chip Not Applicable

Debit Cards

Mastercard Standard Not Applicable

Mastercard Gold Not Applicable

UnionPay Mag Not Applicable

UnionPay Chip Not Applicable

Visa USD Not Applicable

Visa Chip USD Not Applicable

Mastercard Titanium Not Applicable

Mastercard World Not Applicable

Issuance Not Applicable

Cheque Book Stop Payment Not Applicable

Loose Cheque Not Applicable

Remittance Banker Cheque/

Not Applicable

(Local) Pay Order

Foreign Demand

Remittance Not Applicable

Draft

Foreign

Wire Transfer Not Applicable

Annual Not Applicable

Statement of

Half-yearly Not Applicable

Account

Duplicate Not Applicable

ADC/Digital Not Applicable

Funds Transfer Channels

Others Not Applicable

Internet Banking

subscription

(onetime & Not Applicable

annual)

Digital Banking

Mobile Banking

subscription Not Applicable

(onetime &

annual)

Normal Not Applicable

Clearing Inter-city Not Applicable

Same Day Not Applicable

Closure of Account Customer Request Not Applicable

You Must Know

Requirements to open an account: To open the account you will need to satisfy get guidance for reactivation of their account(s).

some identification requirements as per regulatory instructions and banks' Unclaimed Deposits: In terms of Section 31 of Banking Companies Ordinance,

internal policies. These may include providing documents and information to 1962 all deposits which have not been operated during the period of last ten years,

verify your identity. Such information may be required on a periodic basis. Please except deposits in the name of a minor or a Government or a court of law, are

ask us for more details by visiting any of our branch for more details, call surrendered to State Bank of Pakistan (SBP) by the relevant banks, after meeting

111-111-425 HBL 24 hours Phone Banking or visit www.hbl.com for more the conditions as per provisions of law. The surrendered deposits can be claimed

information. through the respective banks. For further information, please contact, the Branch

Cheque Bounce: Dishonouring of cheques is a criminal offence under Section Manager/Branch Operations Manager of your parent HBL branch.

489-F of the Pakistan Penal Code of 1860 and Section 20 of the Financial Closing this Account: In order to close your account, please follow Bank laid

Institutions (Recoveries Of Fiannce) Ordinance of 2001; and is subject to a down internal procedures, Individual Account holders visit nearest branch and for

criminal trial in Pakistan. Accordingly, you should be writing cheques with utmost company account you must visit parent HBL branch.

prudence.

Safe Custody: Safe custody of access tools to your account like ATM cards, PINs, How can you get assistance or make a complaint?

cheques, e-banking usernames, passwords; other personal information, (such as Habib Bank Limited,

DOB, Mother’s Maiden Name etc.) is your responsibility. Bank cannot be held Complaint Management Unit

responsible in case of a security lapse at the customer’s end. HBL will never call 9th Floor, HBL Plaza,

and ask for your personal information from any number including 111-111-425. I.I Chundrigar Road,

HBL will never ask for your sensitive information (password, debit card #, PIN, Karachi, Pakistan

CNIC, OTP, CVV) via call, SMS or email. Kindly do not disclose details to anyone. Helpline: 021-111-111-425

Be extra vigilant and do not provide any sensitive information For Inquiries: customer.care@hbl.com

(PIN/password/CNIC/ATM/credit card #) over the internet, telephone, SMS email, For Complaints: customer.complaints@hbl.com

or social media. Website: www.hbl.com

Record Updation: Always keep profiles/records updated with the bank to avoid If you are not satisfied with our response, you may contact:

missing any significant communication. You (individual customers) can contact If the Bank resolution is not satisfactory or there is no response provided within 45

your relevant nearest HBL branch for company accounts please contact parent days, then a complaint may be filed with the Banking Mohtasib Pakistan.

branch to update your information. Call 111-111-425 HBL 24 hours Phone Banking https://www.bankingmohtasib.gov.pk/complaints.php

or visit www.hbl.com for more details. or drop a written complaint at,

What happens if you do not use this account for a long period? If your account Banking Mohtasib, Pakistan

remains inoperative for 12 months, it will be treated as inactive/dormant. If your 5th Floor, Shaheen Complex, M.R. Kiyani Road, Karachi

account becomes dormant, you will be unable to execute any debit transaction till Tel No.: 92-21-99217334-38

the account is activated. Individual Account holders visit nearest branch and for Email: Info@bankingmohtasib.gov.pk

company account you must visit parent HBL branch to update records and Website: www.bankingmohtasib.gov.pk

reactivate your account. Overseas customers to email at bio.verify@hbl.com to

Version: 1st Jan – 21

(Portion to be used for the post-shopping stage)

I ACKNOWLEDGE RECEIVING AND UNDERSTAND THIS KEY FACT STATEMENT

Customer Name Date D D M M Y Y Y Y

Product Chosen

Mandate of Account Single/Joint/Either or Survivor

Address

…

Contact No. Mobile No. Email Address

Customer Signature Signature Verified

I confirm that I have received a copy of the Key Fact Statement

Version: 1st Jan – 21

Term Deposit Accounts

Key Fact Statement

Y Y Y Y M M D D

1.00% - 1.75% 14.50% 11.75% - 14.75% 11.50% - 18.00%

12.08 9.80 - 12.30 9.58 - 15

Version: 1st Jan – 21

Version: 1st Jan – 21

Y Y Y Y M M D D

Version: 1st Jan – 21

You might also like

- KFS HBL Conventional Saving Account 28-12-2023Document6 pagesKFS HBL Conventional Saving Account 28-12-2023Awais PanhwarNo ratings yet

- Key Fact Statement H1 2023Document8 pagesKey Fact Statement H1 2023H&H PRODUCTIONSNo ratings yet

- Woman Savings Account KFSDocument2 pagesWoman Savings Account KFSQ Trade DistributorsNo ratings yet

- SMF Term Sheet (Pay Less EARN More) 19.6.20 To 31.12.20Document1 pageSMF Term Sheet (Pay Less EARN More) 19.6.20 To 31.12.20Tee Nick VannNo ratings yet

- Saving Accounts: Key Fact StatementDocument6 pagesSaving Accounts: Key Fact StatementAfaq YousafNo ratings yet

- Saving Account Key FeaturesDocument6 pagesSaving Account Key Featuresmaya aliNo ratings yet

- KFS PersonalFinance EADocument8 pagesKFS PersonalFinance EAHameed Ullah KhanNo ratings yet

- PDS Equity Home Financing IDocument10 pagesPDS Equity Home Financing IsyahnooraimanNo ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- KFS HBL Conventional Current Account-07-Nov-2022Document6 pagesKFS HBL Conventional Current Account-07-Nov-2022Faique MemonNo ratings yet

- CitiBusiness CurrentAccount SOCDocument1 pageCitiBusiness CurrentAccount SOCbdhariwala48No ratings yet

- An accelerated dealer finance platformDocument2 pagesAn accelerated dealer finance platformneeraj guptaNo ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- Feedback Demat Tariff For Retail Clients W e F 01-07-2016Document2 pagesFeedback Demat Tariff For Retail Clients W e F 01-07-2016vinay senNo ratings yet

- Axis Direct PDFDocument2 pagesAxis Direct PDFMahesh KorrapatiNo ratings yet

- AL Habib Mahana Munafa Key FactDocument2 pagesAL Habib Mahana Munafa Key FactAmir Mehmood AbbasiNo ratings yet

- KFS - Islamic - CarFinance Jul Dec 2023Document1 pageKFS - Islamic - CarFinance Jul Dec 2023crkriskyNo ratings yet

- BOP NAAZ (Current Account)Document2 pagesBOP NAAZ (Current Account)umerbashir743No ratings yet

- Service Charges: An Easy Guide To Banking FeesDocument24 pagesService Charges: An Easy Guide To Banking FeesolimNo ratings yet

- Schedule of Charges For Retail Customers (Effective From 1 JULY 2016)Document3 pagesSchedule of Charges For Retail Customers (Effective From 1 JULY 2016)atulNo ratings yet

- Conventional Schedule of TariffsDocument19 pagesConventional Schedule of TariffsgodsonNo ratings yet

- Basics of Accounting and Finance: by S.S. BarmaDocument29 pagesBasics of Accounting and Finance: by S.S. BarmaArya BarmaNo ratings yet

- Edel PlansDocument4 pagesEdel PlansSubhas ChilumulaNo ratings yet

- MS11 - Capital BudgetingDocument8 pagesMS11 - Capital BudgetingElsie GenovaNo ratings yet

- ppdaaf-presentation(1)Document21 pagesppdaaf-presentation(1)Chirag PanditNo ratings yet

- Working Captain and Current Asset MGTDocument42 pagesWorking Captain and Current Asset MGTTahsinur Rahman PialNo ratings yet

- Fa Cheat Sheet MM MLDocument8 pagesFa Cheat Sheet MM MLIrina StrizhkovaNo ratings yet

- Orbis FPI II ProposalDocument5 pagesOrbis FPI II ProposalBalakrishnan IyerNo ratings yet

- ADCB Personal Banking Fees GuideDocument11 pagesADCB Personal Banking Fees GuideVeera ManiNo ratings yet

- Faysal Car Finance Key FactsDocument4 pagesFaysal Car Finance Key FactsHaiderAliTauqeerNo ratings yet

- Ch.9 DCF in Making Invesment DecisionsDocument15 pagesCh.9 DCF in Making Invesment DecisionsJezza Mae C. SanipaNo ratings yet

- Master in Business Administration Mba 308 - Financial ManagementDocument7 pagesMaster in Business Administration Mba 308 - Financial ManagementJhaydiel JacutanNo ratings yet

- SOF DL Eng Brand V13 Tcm9 153873Document11 pagesSOF DL Eng Brand V13 Tcm9 153873AlejandroNo ratings yet

- Income Statement and Balance Sheet AnalysisDocument3 pagesIncome Statement and Balance Sheet AnalysisDGNo ratings yet

- Mahana MunafaDocument2 pagesMahana Munafaalimurtaza6582No ratings yet

- Assumptions For Financial ModelingDocument3 pagesAssumptions For Financial Modelingken dexter m. barreraNo ratings yet

- ValuationDocument37 pagesValuationDivyam AgarwalNo ratings yet

- Addendum To SOBC Jan-June 2018Document4 pagesAddendum To SOBC Jan-June 2018Shaza FaizanNo ratings yet

- MM L1 Formula SheetDocument20 pagesMM L1 Formula SheetMlungisi MalazaNo ratings yet

- RHB Credit Cards Explained in 40 CharactersDocument13 pagesRHB Credit Cards Explained in 40 CharactersLoVe YiYiNo ratings yet

- PDS Affin Home Fin I ENG 1Document8 pagesPDS Affin Home Fin I ENG 1Iman KamalNo ratings yet

- Dukandar Overdraft ProgramDocument18 pagesDukandar Overdraft Programkumar maniNo ratings yet

- Schedule of Fees Personal Banking English - tcm41 375297Document11 pagesSchedule of Fees Personal Banking English - tcm41 375297nagendraNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicemozo dingdongNo ratings yet

- Home Loan: TCHFL HL MITC Version 17Document4 pagesHome Loan: TCHFL HL MITC Version 17Ali Khan AKNo ratings yet

- Accounting Simplified 1Document6 pagesAccounting Simplified 1kala1975No ratings yet

- Working Capital ManagementDocument7 pagesWorking Capital ManagementLumingNo ratings yet

- Fam - 1Document20 pagesFam - 1shahidNo ratings yet

- Personal Banking Fees ScheduleDocument11 pagesPersonal Banking Fees ScheduleAnkur GargNo ratings yet

- PDS SMART Mortgage SJKPDocument7 pagesPDS SMART Mortgage SJKPmujahadahNo ratings yet

- Personal Finance Islamic Desktop v0Document8 pagesPersonal Finance Islamic Desktop v0kpsakkeer034No ratings yet

- FRA AssignmentDocument31 pagesFRA AssignmentPranav ViswanathanNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicepramodyad5810No ratings yet

- Capital Budgeting Lecture UpdatedDocument5 pagesCapital Budgeting Lecture UpdatedMark Gelo WinchesterNo ratings yet

- Recurring Deposit Monthly Income OptionDocument1 pageRecurring Deposit Monthly Income OptionkorivisarojiniNo ratings yet

- C I SDocument40 pagesC I SrohanNo ratings yet

- Tariff Booklet: October 2021Document16 pagesTariff Booklet: October 2021Anonymous ameerNo ratings yet

- BFD - Weighted Average Cost of Capital by Ahmed Raza Mir & Taha PopatiaDocument6 pagesBFD - Weighted Average Cost of Capital by Ahmed Raza Mir & Taha PopatiaAiman TuhaNo ratings yet

- Cost of CapitalDocument75 pagesCost of CapitalManisha SanghviNo ratings yet

- Petition for issuance of second owner's duplicate titleDocument2 pagesPetition for issuance of second owner's duplicate titlebernard jonathan Gatchalian100% (1)

- Gokuldham Marathi Prelim 2023Document8 pagesGokuldham Marathi Prelim 2023Aarushi GuptaNo ratings yet

- Financial Shenanigans 3rd EditionDocument6 pagesFinancial Shenanigans 3rd Editionpwsicher100% (1)

- Full Text of Results CPA Board ExamDocument2 pagesFull Text of Results CPA Board ExamTheSummitExpressNo ratings yet

- Mindmap: English Grade 5Document19 pagesMindmap: English Grade 5Phương HoàngNo ratings yet

- Former Ohio Wildlife Officer Convicted of Trafficking in White-Tailed DeerDocument2 pagesFormer Ohio Wildlife Officer Convicted of Trafficking in White-Tailed DeerThe News-HeraldNo ratings yet

- The Circular Economy Opportunity For Urban Industrial Innovation in China - 19 9 18 - 1 PDFDocument166 pagesThe Circular Economy Opportunity For Urban Industrial Innovation in China - 19 9 18 - 1 PDFaggarwal_996354920No ratings yet

- Lesson 4 Jobs and Occupations PDFDocument2 pagesLesson 4 Jobs and Occupations PDFronaldoNo ratings yet

- Nodalo - Medicard vs. CirDocument3 pagesNodalo - Medicard vs. CirGenebva Mica NodaloNo ratings yet

- G.R. No. 148991 January 21, 2004 People of The Philippines, Appellee, Leonardo Nuguid Y Mayao, AppellantDocument21 pagesG.R. No. 148991 January 21, 2004 People of The Philippines, Appellee, Leonardo Nuguid Y Mayao, Appellantida_chua8023No ratings yet

- Ugc Good PracticesDocument21 pagesUgc Good PracticesIngryd Lo TierzoNo ratings yet

- Case DigestDocument4 pagesCase DigestSarabeth Silver MacapagaoNo ratings yet

- Straightforward Pre-intermediate Unit Test 4 Vocabulary and Grammar ReviewDocument3 pagesStraightforward Pre-intermediate Unit Test 4 Vocabulary and Grammar ReviewLaysha345678No ratings yet

- Dildilian Exhibition DiyarbakirDocument1 pageDildilian Exhibition DiyarbakirArmen MarsoobianNo ratings yet

- The Intelligent Investor Chapter 6Document3 pagesThe Intelligent Investor Chapter 6Michael PullmanNo ratings yet

- Confidentiality Agreement GuideDocument11 pagesConfidentiality Agreement GuideSeema WadkarNo ratings yet

- 516 Application CarDocument2 pages516 Application Carazamkhan13No ratings yet

- Loan Agreement DetailsDocument21 pagesLoan Agreement DetailssherrieNo ratings yet

- Stamped Original Petition, RFD, and Request For D R-2Document8 pagesStamped Original Petition, RFD, and Request For D R-2KHOU100% (1)

- History and Political Science: Solution: Practice Activity Sheet 3Document9 pagesHistory and Political Science: Solution: Practice Activity Sheet 3Faiz KhanNo ratings yet

- Computation of Basic and Diluted Eps Charles Austin of The PDFDocument1 pageComputation of Basic and Diluted Eps Charles Austin of The PDFAnbu jaromiaNo ratings yet

- Notes On Collective NounsDocument7 pagesNotes On Collective NounsTuisyen Dewan Hj Ali50% (2)

- Sara's CAS Proposal FormDocument3 pagesSara's CAS Proposal FormsaraNo ratings yet

- USA2Document2 pagesUSA2Helena TrầnNo ratings yet

- Croatian Films of 2006 ExploredDocument80 pagesCroatian Films of 2006 ExploredCoockiNo ratings yet

- PIL For Generic Drugs by DR Sanjay KulshresthaDocument23 pagesPIL For Generic Drugs by DR Sanjay KulshresthaSanjay KulshresthaNo ratings yet

- ResumeDocument2 pagesResumeapi-297703195No ratings yet

- From Vision To Reality: GebizDocument10 pagesFrom Vision To Reality: Gebizmaneesh5100% (1)

- The Warrior KingDocument4 pagesThe Warrior Kingapi-478277457No ratings yet

- Darwin Route10 Pocket Maps/TimetableDocument2 pagesDarwin Route10 Pocket Maps/TimetableLachlanNo ratings yet