Professional Documents

Culture Documents

SMF Term Sheet (Pay Less EARN More) 19.6.20 To 31.12.20

Uploaded by

Tee Nick Vann0 ratings0% found this document useful (0 votes)

17 views1 pageThis document provides details on a share margin financing promotion from June 19th to December 31st 2020 for individual applicants. Key details include an interest rate of base rate + 0.1% for the first 6 months and base rate + 1.1% thereafter, financing up to 65% of the value of pledged collateral, a 3 day grace period if the margin ratio exceeds the approved level by more than 5%, and force selling if the ratio exceeds 76.92% or the margin call notice expires. Required documents include identification, income proof, bank statements, and existing margin account statements if redeeming a previous facility.

Original Description:

Original Title

SMF Term Sheet (Pay less EARN More) 19.6.20 to 31.12.20

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides details on a share margin financing promotion from June 19th to December 31st 2020 for individual applicants. Key details include an interest rate of base rate + 0.1% for the first 6 months and base rate + 1.1% thereafter, financing up to 65% of the value of pledged collateral, a 3 day grace period if the margin ratio exceeds the approved level by more than 5%, and force selling if the ratio exceeds 76.92% or the margin call notice expires. Required documents include identification, income proof, bank statements, and existing margin account statements if redeeming a previous facility.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views1 pageSMF Term Sheet (Pay Less EARN More) 19.6.20 To 31.12.20

Uploaded by

Tee Nick VannThis document provides details on a share margin financing promotion from June 19th to December 31st 2020 for individual applicants. Key details include an interest rate of base rate + 0.1% for the first 6 months and base rate + 1.1% thereafter, financing up to 65% of the value of pledged collateral, a 3 day grace period if the margin ratio exceeds the approved level by more than 5%, and force selling if the ratio exceeds 76.92% or the margin call notice expires. Required documents include identification, income proof, bank statements, and existing margin account statements if redeeming a previous facility.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

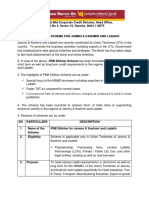

SHARE MARGIN FINANCING – Pay less EARN More

(Promotion Period: 19th June – 31st Dec 2020)

(Individual Application)

Facility Limit ✓ Minimum of RM50,000

➢ Base Rate + 0.10% p.a. (3.75% p.a.) for first 6 months.

Interest Rate ➢ Thereafter, Base Rate + 1.10% p.a. (4.75% p.a.)

Note: Current Base Rate is at 3.65% p.a. with effect from 13/05/2020

Tenor ✓ 3 months with rollover

Margin of Finance (MOF) ✓ Up to 65%*

Margin Call Ratio / Days ✓ Above Approved MOF + 5% / 3 days grace period

Force Selling Ratio ✓ Above 76.92% or expiry of margin call notice, whichever is earlier

Type of collateral Multiplier

Cash MYR 2.8X

Collateral Flexibility

Foreign cash SGD, USD, HKD, AUD, GBP, THB and JPY 1.8X

Bursa Malaysia, SGX, HKEX and US Markets

Quoted shares 1.8X

(NYSE & NASDAQ)

As per CGS-CIMB marginable list

Documentation Fee : RM70 (Waived)

CDS Opening Fee : RM10 (Waived)

CDS Transfer Fee

: Waived up to 20 marginable Bursa Malaysia counters

(redemption case only)

Fees & Charges : 0.50% on the outstanding amount

Rollover fee (Waived for first 12 months thereafter waived if meet 1x turnover

of the facility limit)

Stamp Duty

• Principal Agreement : Ad Valorem 0.5% of Facility Limit

• Subsidiary Agreement : RM10 each

✓ Account Application Form;

✓ Photocopy of NRIC (Front & Back);

✓ Income proof :

Documents Required

• Latest one (1) month salary slip; or

• EA Form / Form B / Form BE; or

• Latest EPF statement;

✓ Latest three (3) months savings/ current account; and/ or

✓ Latest margin account statement from your existing financier (if redemption case).

* Applicable for collateral which consist of diversified shares portfolio

* Terms and conditions apply

Dated 15 June 2020

You might also like

- Business Transport LoanDocument8 pagesBusiness Transport LoanJan RootsNo ratings yet

- Ebook4Expert Ebook CollectionDocument202 pagesEbook4Expert Ebook CollectionTee Nick VannNo ratings yet

- ForexProGuide PDFDocument31 pagesForexProGuide PDFManish Sharma100% (1)

- Credit Process Manual For Lending Against GoldDocument28 pagesCredit Process Manual For Lending Against GoldAmit SinghNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicemozo dingdongNo ratings yet

- SC-251 - Design of Guidance Systems For Lifting and PlacementDocument68 pagesSC-251 - Design of Guidance Systems For Lifting and PlacementSantanuNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Adviceekta rajoriaNo ratings yet

- Glencoe Life Science2Document93 pagesGlencoe Life Science2Cosmina MariaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceSethurajan ShanmugamNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicepramodyad5810No ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceAster D SilvaNo ratings yet

- DLL SubstanceDocument3 pagesDLL SubstanceReign Honrado100% (1)

- Hohner Accordions Nova III 96 Fingering ChartDocument4 pagesHohner Accordions Nova III 96 Fingering ChartFilipe Monteiro TavaresNo ratings yet

- KFS HBL Conventional Term Deposit Accounts - Dec 2022Document6 pagesKFS HBL Conventional Term Deposit Accounts - Dec 2022Abeer KhanNo ratings yet

- Home Loan: TCHFL HL MITC Version 17Document4 pagesHome Loan: TCHFL HL MITC Version 17Ali Khan AKNo ratings yet

- Product Disclosure Sheet Apr 22Document13 pagesProduct Disclosure Sheet Apr 22Admin SMKPekanKBNo ratings yet

- Product Disclosure SheetDocument7 pagesProduct Disclosure SheetNurulhikmah RoslanNo ratings yet

- CC Products Disclosure SheetDocument13 pagesCC Products Disclosure SheetLoVe YiYiNo ratings yet

- PDS Equity Home Financing IDocument10 pagesPDS Equity Home Financing IsyahnooraimanNo ratings yet

- Franchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®Document2 pagesFranchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®ydjnaxNo ratings yet

- KFS PersonalFinance EADocument8 pagesKFS PersonalFinance EAHameed Ullah KhanNo ratings yet

- Ppdaaf PresentationDocument21 pagesPpdaaf PresentationChirag PanditNo ratings yet

- All You Wanted To Know About Bajaj Finance Flexi LoanDocument6 pagesAll You Wanted To Know About Bajaj Finance Flexi LoanAwadhesh Kumar KureelNo ratings yet

- PNB Shikhar SchemeDocument3 pagesPNB Shikhar Schemeomkar maharanaNo ratings yet

- Transaction Conversion FormDocument1 pageTransaction Conversion FormROQUE JAY BROCENo ratings yet

- Angel One Limited: Daily Margin Statement For The Day: 20/10/2022Document1 pageAngel One Limited: Daily Margin Statement For The Day: 20/10/2022Ankit SharmaNo ratings yet

- Angel Broking Limited.: Daily Margin Statement For The Day: 23/11/2021Document1 pageAngel Broking Limited.: Daily Margin Statement For The Day: 23/11/2021Pratish kutalNo ratings yet

- HPCL Campaign Flyer EnglishDocument2 pagesHPCL Campaign Flyer Englishneeraj guptaNo ratings yet

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MNo ratings yet

- Nike Case NotesDocument2 pagesNike Case NotesPrarthuTandonNo ratings yet

- TermLoanASBProductDisclosureSheet IDocument8 pagesTermLoanASBProductDisclosureSheet IamirulNo ratings yet

- Key Fact DocumentDocument7 pagesKey Fact Documentdeepak799sgNo ratings yet

- GSFC Spendz 1apr22Document1 pageGSFC Spendz 1apr22AtulNo ratings yet

- Credit Card PDS V42 (Eng) - CompressedDocument4 pagesCredit Card PDS V42 (Eng) - Compressedrf_1238No ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceRitu PatelNo ratings yet

- Trad Free ChargesDocument3 pagesTrad Free Chargestejasparmar12345678No ratings yet

- Kotak Advance Fee-OnlineDocument1 pageKotak Advance Fee-Onlinejay.kumNo ratings yet

- RHB Islamic Credit Cards PDSDocument11 pagesRHB Islamic Credit Cards PDSDyana AmnaniNo ratings yet

- Term Deposit Related RequestsDocument2 pagesTerm Deposit Related Requestskumar281472No ratings yet

- Heritage MITCDocument12 pagesHeritage MITCSankalp PatelNo ratings yet

- JCL PDSDocument1 pageJCL PDSSelvi GanesanNo ratings yet

- CitiBusiness CurrentAccount SOCDocument1 pageCitiBusiness CurrentAccount SOCbdhariwala48No ratings yet

- Angel One Limited: Daily Margin Statement For The Day: 06/07/2022Document1 pageAngel One Limited: Daily Margin Statement For The Day: 06/07/2022Joy Prakash kiskuNo ratings yet

- Key FactsDocument4 pagesKey Factsej ejazNo ratings yet

- Most Important Terms & ConditionsDocument8 pagesMost Important Terms & ConditionsmvprakashNo ratings yet

- Sanction Letter FAST7186877785851539 775883241168816Document4 pagesSanction Letter FAST7186877785851539 775883241168816yogeshmepindiaNo ratings yet

- Angel Broking Limited.: Daily Margin Statement For The Day: 22/12/2021Document1 pageAngel Broking Limited.: Daily Margin Statement For The Day: 22/12/2021Aniket ShivganNo ratings yet

- Key Fact Sheet - Credit Cards - 1st January 2020 To 30th June 2020 PDFDocument2 pagesKey Fact Sheet - Credit Cards - 1st January 2020 To 30th June 2020 PDFAbdul Rehman IlahiNo ratings yet

- FORMS Conso - Loan PDFDocument3 pagesFORMS Conso - Loan PDFMaramina Matias Roxas - MallariNo ratings yet

- Tariff Sheet Youth PlanDocument1 pageTariff Sheet Youth PlanDeebak Ashwin ViswanathanNo ratings yet

- Tariff Booklet: October 2021Document16 pagesTariff Booklet: October 2021Anonymous ameerNo ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Service Charges Final - 03.06.2017for Circular IssuingDocument39 pagesService Charges Final - 03.06.2017for Circular IssuingshivaNo ratings yet

- CM D59707 10042018 CombmarginDocument1 pageCM D59707 10042018 CombmarginDarshil DilipbhaiNo ratings yet

- IOB9540Foot Service Charges 01.07.2017 PDFDocument39 pagesIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNo ratings yet

- Bajaj Tiger CC MITC NewDocument12 pagesBajaj Tiger CC MITC NewMinatiNo ratings yet

- Change of Broker - Marcellus PMSDocument6 pagesChange of Broker - Marcellus PMSDOLLY KHAPRENo ratings yet

- Banking OadsdDocument85 pagesBanking Oadsdkalis vijayNo ratings yet

- Ril Pe Price Dt. 13.07.2017Document47 pagesRil Pe Price Dt. 13.07.2017Akshat JainNo ratings yet

- Trust Deposit Jan09Document5 pagesTrust Deposit Jan09mayurdjNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdvicemudrikaNo ratings yet

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearDocument3 pagesTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.seNo ratings yet

- Sign Here X - : Product Disclosure SheetDocument4 pagesSign Here X - : Product Disclosure SheetJosh lamNo ratings yet

- Key Fact DocumentDocument2 pagesKey Fact DocumentJagiNo ratings yet

- Edelteq 2023 05 09 Factsheet VfinalDocument2 pagesEdelteq 2023 05 09 Factsheet VfinalTee Nick VannNo ratings yet

- AT Systemisation - What Investors Should KnowDocument2 pagesAT Systemisation - What Investors Should KnowTee Nick VannNo ratings yet

- BioA - Presentation - 2020 11 24 PDFDocument32 pagesBioA - Presentation - 2020 11 24 PDFTee Nick VannNo ratings yet

- Press Statement: Top Glove Corporation BHDDocument2 pagesPress Statement: Top Glove Corporation BHDTee Nick VannNo ratings yet

- BioA - PR - 2020 12 02 - Ritamix Vfinal PDFDocument6 pagesBioA - PR - 2020 12 02 - Ritamix Vfinal PDFTee Nick VannNo ratings yet

- BioA - PR - 2020 12 02 - Ritamix Vfinal PDFDocument6 pagesBioA - PR - 2020 12 02 - Ritamix Vfinal PDFTee Nick VannNo ratings yet

- Numerical Scale Performance Review Form: Employee: Employee Title: Supervisor: Performance PeriodDocument3 pagesNumerical Scale Performance Review Form: Employee: Employee Title: Supervisor: Performance PeriodTee Nick VannNo ratings yet

- UFO Fondue Marketing PlanDocument15 pagesUFO Fondue Marketing PlanTee Nick VannNo ratings yet

- Memo - Operation Hours During RMCODocument1 pageMemo - Operation Hours During RMCOTee Nick VannNo ratings yet

- DinosaursDocument4 pagesDinosaursGayani Dulmala ImbulanaNo ratings yet

- Digitalization in The Financial StatementsDocument12 pagesDigitalization in The Financial Statementsrockylie717No ratings yet

- Hy1906b Hooyi PDFDocument11 pagesHy1906b Hooyi PDFJose Antonio Ramos MuñosNo ratings yet

- Lesson 1 M2Document6 pagesLesson 1 M2Ede ShingNo ratings yet

- Andy Bushak InterviewDocument7 pagesAndy Bushak InterviewLucky ChopraNo ratings yet

- Shankar Ias Revision QuestionsDocument23 pagesShankar Ias Revision QuestionskankirajeshNo ratings yet

- Cmiller CSW 2010Document90 pagesCmiller CSW 2010dty001No ratings yet

- The Evidence Base For The Efficacy of Antibiotic Prophylaxis in Dental PracticeDocument17 pagesThe Evidence Base For The Efficacy of Antibiotic Prophylaxis in Dental PracticebmNo ratings yet

- Why Am I A Living HeroDocument10 pagesWhy Am I A Living Herojf_dee24No ratings yet

- Miramer M210 TDS - Rev1.0Document1 pageMiramer M210 TDS - Rev1.0Adesh GurjarNo ratings yet

- BED-2912-0000922351 Backend Development Vijay Vishvkarma: Phase I - Qualifier Round 1Document1 pageBED-2912-0000922351 Backend Development Vijay Vishvkarma: Phase I - Qualifier Round 1vijayNo ratings yet

- Guus Houttuin Alina Boiciuc: The SOCFIN Case From A Human Rights Perspective" (Document3 pagesGuus Houttuin Alina Boiciuc: The SOCFIN Case From A Human Rights Perspective" (FIDHNo ratings yet

- Prolystica Restore SterisDocument13 pagesProlystica Restore SterisPaola Andrea Del Rio RuizNo ratings yet

- Tadlak Elementary School Tle (Ict) 2 QTR Week 6Document3 pagesTadlak Elementary School Tle (Ict) 2 QTR Week 6Rowena Casonete Dela Torre100% (1)

- Gamification Toward A Definition PDFDocument4 pagesGamification Toward A Definition PDFFrancis Joe RodriguezNo ratings yet

- Nordex N60: Long-Term Experience All Over The WorldDocument8 pagesNordex N60: Long-Term Experience All Over The WorldHung NGUYENNo ratings yet

- Raguindin, Maricel B. (P.E Activity 2)Document4 pagesRaguindin, Maricel B. (P.E Activity 2)Maricel RaguindinNo ratings yet

- Tri Review Turbidity Fact Sheet 01-08-15Document2 pagesTri Review Turbidity Fact Sheet 01-08-15Shyla Fave EnguitoNo ratings yet

- 4 Types of Business OrganizationsDocument3 pages4 Types of Business OrganizationsAnton AndayaNo ratings yet

- 12V 150ah (10hr) : Shenzhen Center Power Tech - Co.LtdDocument2 pages12V 150ah (10hr) : Shenzhen Center Power Tech - Co.Ltddarwin darioNo ratings yet

- Nervous KeyDocument10 pagesNervous KeyAngel Natty NewNo ratings yet

- Fashion - February 2014 CADocument144 pagesFashion - February 2014 CAAlmaMujanovićNo ratings yet

- 65 Tips To Help You Find A Job Quicker: Mark PearceDocument20 pages65 Tips To Help You Find A Job Quicker: Mark PearceMubeen GhawteNo ratings yet

- OCTG & PIPELINE Coatings Brochure PDFDocument41 pagesOCTG & PIPELINE Coatings Brochure PDFfelipe castellanosNo ratings yet

- 52 Words Greek MythDocument6 pages52 Words Greek MythGade PornraweeNo ratings yet

- Navigate A2 Elementary CoursebookDocument207 pagesNavigate A2 Elementary CoursebookGuadalupe Colman100% (1)