Professional Documents

Culture Documents

Survey On Remittances

Uploaded by

thenmozhi thenmozhi0 ratings0% found this document useful (0 votes)

5 views1 page1) Advanced economies like the US, UK, and Singapore surpassed the Gulf region as the top source countries for remittances to India in 2020-21, accounting for 36% of remittances compared to over 50% from the Gulf previously.

2) Maharashtra replaced Kerala as the top recipient state of remittances in India, receiving about 35% of total remittances compared to Kerala's 10%.

3) Higher wage jobs and an increasing number of skilled migrant workers from states like Maharashtra and Delhi to advanced countries contributed to the shift in remittance trends, while remittances from traditional labor states to the Gulf declined.

Original Description:

Original Title

Survey on Remittances

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Advanced economies like the US, UK, and Singapore surpassed the Gulf region as the top source countries for remittances to India in 2020-21, accounting for 36% of remittances compared to over 50% from the Gulf previously.

2) Maharashtra replaced Kerala as the top recipient state of remittances in India, receiving about 35% of total remittances compared to Kerala's 10%.

3) Higher wage jobs and an increasing number of skilled migrant workers from states like Maharashtra and Delhi to advanced countries contributed to the shift in remittance trends, while remittances from traditional labor states to the Gulf declined.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageSurvey On Remittances

Uploaded by

thenmozhi thenmozhi1) Advanced economies like the US, UK, and Singapore surpassed the Gulf region as the top source countries for remittances to India in 2020-21, accounting for 36% of remittances compared to over 50% from the Gulf previously.

2) Maharashtra replaced Kerala as the top recipient state of remittances in India, receiving about 35% of total remittances compared to Kerala's 10%.

3) Higher wage jobs and an increasing number of skilled migrant workers from states like Maharashtra and Delhi to advanced countries contributed to the shift in remittance trends, while remittances from traditional labor states to the Gulf declined.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

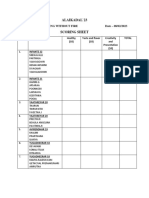

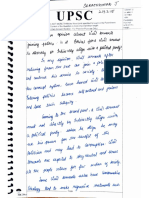

Remittances from advanced nations

beat flows from Gulf region in FY21

Maharashtra in rupee (INR), saw a sharp spike

in the consecutive waves of the

displaces Kerala pandemic, according to the art-

as the top icle. For example, NRI deposits

rose by $7.826 billion in April-

recipient State December 2020 against $5.862

billion in the year-ago period.

OUR BUREAU Apart from favourable yields,

Mumbai, July 17 deposits in the NRE accounts in-

In what is seen as a shift of work- creased significantly during

ers to the West, Advanced Eco- this period as returning over-

nomies (AEs) — particularly the seas migrants, amidst lay-offs

US, the UK and Singapore — and heightened uncertainty re-

emerged as key source coun- garding their return and future

tries for remittances pipping The US surpassed the UAE as the top source country, accounting for employment prospects, repatri-

the Gulf Cooperation Council 23 per cent of total remittances in 2020-21 ated their savings into these

region (GCC). accounts.

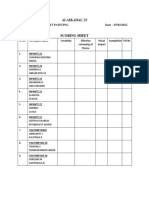

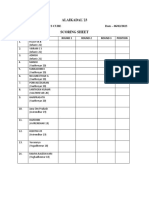

The share of the GCC region share of the traditional recipi- proved emigration clearances While overseas remittances

in India’s inward remittances is ent States of Kerala, Tamil Nadu for the GCC region in 2020 was for family maintenance, repres-

estimated to have declined and Karnataka, which had a for these States. With the dom- enting a chunk of India’s in-

from more than 50 per cent in strong presence in the GCC re- inance of low-wage unskilled la- bound remittances, moderated

2016- 17 to about 30 per cent in gion, almost halved in 2020-21, bourers, however, their share in with the loss of overseas em-

2020-21, according to the Re- accounting for only 25 per cent remittance has remained signi- ployment opportunities, local

serve Bank of India’s fifth round of the total remittances since ficantly low; while the share of withdrawals from non-resident

of Survey on Remittances. In 2016-17. Maharashtra emerged Maharashtra and Delhi has in- rupee-denominated deposit ac-

contrast, AEs accounted for a 36 the top recipient State (with creased significantly in 2020-21 counts increased implying the

per cent share in 2020-21, as per about 35 per cent of the total to about 35 per cent (from about drawdown of savings to tide

the findings of the Survey (for share) surpassing Kerala (about 17 per cent in 2016-17) and about over the crisis, the authors said.

2020-21 reference period) pub- 10 per cent). 8 per cent (from about 6 per India remained the top recip-

lished in the RBI’s latest The RBI officials assessed that cent), respectively, according to ient country (with $89.4 billion

monthly bulletin. The US sur- apart from the host country dy- the article. inward remittances), account-

passed the UAE as the top source namics, reducing wage differ- This was despite Maha- ing for 12 per cent of total global

country, accounting for 23 per entials, changing occupational rashtra’s remittances dipping remittances, recording a mar-

cent of total remittances in patterns in these States with in- almost 13 per cent in 2020-21 ginal decline of 0.2 per cent in

2020-21. creasing white-collar migrant with the largest number of 2020 and a growth of 8 per cent

This corroborates with the workers to the GCC region and Covid-19 cases and prolonged in 2021.

World Bank report (2021) citing entry of low-wage semi-skilled lockdown.

the economic recovery in the US workers from other States and Bank group-wise share

as one of the important drivers Asian countries may have led to NRI deposits The impact of the slowdown in

of remittances into India, ac- this compositional shift. While NRI deposits are empiric- remittances has been quite di-

counting for almost 20 per cent By contrast, migration from ally found to be driven by the ex- verse across banks. In 2020-21,

of total inflows, said RBI officials Uttar Pradesh, Bihar, Orissa, and change rate and interest differ- the share of private banks in

Soumasree Tewari and Ranjeeta West Bengal to the Gulf coun- entials, the trend in NRE overall remittances stood at

Mishra in an article ‘Headwinds tries has increased in recent (Non-Resident External) ac- 52.8 per cent followed by public

of Covid-19 and India’s inward years. According to the Ministry count, which is typically used sector banks and foreign banks

remittances’. of External Affairs data, more for parking income from at 39.4 per cent and 7.8 per cent,

The officials noted that the than 50 per cent of the ap- abroad by non-resident Indians respectively.

You might also like

- Specific Factors and Income Distribution: Eleventh EditionDocument20 pagesSpecific Factors and Income Distribution: Eleventh EditionJonny FalentinoNo ratings yet

- Six The Musical - Ex WivesDocument18 pagesSix The Musical - Ex Wiveswolter.alexaNo ratings yet

- TXN 05052021 17022021 05052021 NatWestDocument8 pagesTXN 05052021 17022021 05052021 NatWestKim TaylorNo ratings yet

- Writer(s) Data Measures Approach ConclusionDocument2 pagesWriter(s) Data Measures Approach ConclusionAiza khanNo ratings yet

- The Shape-Shifting Covid-19 Catastrophe and Economic Atrophy - What To Do?Document4 pagesThe Shape-Shifting Covid-19 Catastrophe and Economic Atrophy - What To Do?AlanNo ratings yet

- Assignment Abroad Times Mumbai Saturday March 12 2022 PDFDocument6 pagesAssignment Abroad Times Mumbai Saturday March 12 2022 PDFAbdul KareemNo ratings yet

- Rajasthan Economy & Agriculture: Free PDFDocument8 pagesRajasthan Economy & Agriculture: Free PDFKriti SinghaniaNo ratings yet

- Global Investment Trends and ProspectsDocument32 pagesGlobal Investment Trends and ProspectsElsenNo ratings yet

- Economic Update March 2024Document11 pagesEconomic Update March 2024Kashf ShabbirNo ratings yet

- Crif Microlend Vol Xii June 2020Document7 pagesCrif Microlend Vol Xii June 2020Yash JoshiNo ratings yet

- Strength From Abroad: The Economic Power of Nigeria's DiasporaDocument8 pagesStrength From Abroad: The Economic Power of Nigeria's Diasporaakomolafe makindeNo ratings yet

- Botswana Chapter4Document2 pagesBotswana Chapter4Mithun SridharNo ratings yet

- Cayman Votes - General Elections in The Best-Run Country in The CaribbeanDocument4 pagesCayman Votes - General Elections in The Best-Run Country in The CaribbeanAlanNo ratings yet

- Management DiscussionDocument27 pagesManagement DiscussionAbhiram KichuNo ratings yet

- Aug 7 2013 - The Balance of Payment 1991 and NowDocument5 pagesAug 7 2013 - The Balance of Payment 1991 and NowM WaleedNo ratings yet

- Crif Creditscape Vol VII Personal Loans in IndiaDocument16 pagesCrif Creditscape Vol VII Personal Loans in IndiaHardik ShahNo ratings yet

- All English Editorial 29-02Document20 pagesAll English Editorial 29-02daddypoolyNo ratings yet

- Ki BBTN 20240212Document8 pagesKi BBTN 20240212muh.asad.amNo ratings yet

- 2024 Year-Ahead Outlook: The Last Leg On The Long Road To NormalDocument14 pages2024 Year-Ahead Outlook: The Last Leg On The Long Road To NormaljeanmarcpuechNo ratings yet

- Caribbean Region Quarterly Bulletin Volume 8 Issue 2 June 2019 en enDocument45 pagesCaribbean Region Quarterly Bulletin Volume 8 Issue 2 June 2019 en encompumedicNo ratings yet

- Coup D'État PTSD? or Same Old Disinformation and Fear Mongering? or Both?Document4 pagesCoup D'État PTSD? or Same Old Disinformation and Fear Mongering? or Both?AlanNo ratings yet

- PPI 2020 AnnualReportDocument34 pagesPPI 2020 AnnualReportAlberto Baron SanchezNo ratings yet

- 1 - The Increasing Trend of Foreign Workers' RemittancesDocument1 page1 - The Increasing Trend of Foreign Workers' RemittancesfatinNo ratings yet

- Remittance and Economic Growth - SlidesDocument19 pagesRemittance and Economic Growth - SlidesSaima MunawarNo ratings yet

- Globalising People: India's Inward Remittances in 2016-17Document11 pagesGlobalising People: India's Inward Remittances in 2016-17aditi anandNo ratings yet

- MporwaDocument2 pagesMporwamukeshjampalNo ratings yet

- Barómetro Diciembre 2020Document36 pagesBarómetro Diciembre 2020Ismael GalarzaNo ratings yet

- Impact of Remittance On Economic Growth in BangladeshDocument8 pagesImpact of Remittance On Economic Growth in BangladeshMD Hafizul Islam HafizNo ratings yet

- II C7 Trends of International Investment 02Document48 pagesII C7 Trends of International Investment 02Nguyễn HoàiNo ratings yet

- KPMG Bangladesh - Measures in Response To CoronavirusDocument17 pagesKPMG Bangladesh - Measures in Response To Coronavirusgetcultured69No ratings yet

- 02 04 07 2017 PDFDocument16 pages02 04 07 2017 PDFOdette P. PadillaNo ratings yet

- Part III. Country Summaries and Key Indicators: 10158-EAP Economic Update - 73177 - Pt2-3.indd 159Document52 pagesPart III. Country Summaries and Key Indicators: 10158-EAP Economic Update - 73177 - Pt2-3.indd 159Thiện TâmNo ratings yet

- Sir Fareed Lec 6 Economy.Document22 pagesSir Fareed Lec 6 Economy.Fozia NazarNo ratings yet

- ANNUAL Report 57th 2021Document178 pagesANNUAL Report 57th 2021yousef alghamdiNo ratings yet

- Somalia: Recent DevelopmentsDocument2 pagesSomalia: Recent DevelopmentsPatrickLnanduNo ratings yet

- Global Debt Monitor - Sept2023 - VFDocument7 pagesGlobal Debt Monitor - Sept2023 - VFlimsixNo ratings yet

- The 30-Year Partnership of Mongolia and The AsianDocument31 pagesThe 30-Year Partnership of Mongolia and The Asianshinkaron88No ratings yet

- From Blackbirding To Blacklisting - The Eu'S Ongoing Subjugation of VanuatuDocument4 pagesFrom Blackbirding To Blacklisting - The Eu'S Ongoing Subjugation of VanuatuAlanNo ratings yet

- Caribbean Region Quarterly Bulletin Volume 8 Issue 4 December 2019 enDocument44 pagesCaribbean Region Quarterly Bulletin Volume 8 Issue 4 December 2019 encompumedicNo ratings yet

- An Assessment of India's External Debt Sustainability and VulnerabilityDocument21 pagesAn Assessment of India's External Debt Sustainability and Vulnerabilityyarramsetty geethanjaliNo ratings yet

- Pacific Finance Sector Papua New GuineaDocument5 pagesPacific Finance Sector Papua New Guineaalfred kas Simon Lucas KasNo ratings yet

- Already Weak, Hawaii's Prospects Look Increasingly DiceyDocument4 pagesAlready Weak, Hawaii's Prospects Look Increasingly DiceySandra OshiroNo ratings yet

- Macro Poverty Outlook: Europe and Central AsiaDocument50 pagesMacro Poverty Outlook: Europe and Central AsiaLiubomir Gutu0% (1)

- ICAO Coronavirus Econ ImpactDocument125 pagesICAO Coronavirus Econ ImpactRAMADHIAN EKAPUTRANo ratings yet

- Q2 2022 Earnings Release - FINALDocument12 pagesQ2 2022 Earnings Release - FINALFalsa CuentaNo ratings yet

- Budget Overview - 2022-23 2080Document23 pagesBudget Overview - 2022-23 2080Graphix ComputerNo ratings yet

- 3 The Impact of RemittancesDocument9 pages3 The Impact of RemittancesMd. Saiful IslamNo ratings yet

- Tunisia: Recent DevelopmentsDocument2 pagesTunisia: Recent DevelopmentsGem HidalgoNo ratings yet

- Nvestors Utlook: (Window Takaful Operations)Document4 pagesNvestors Utlook: (Window Takaful Operations)Stif LerNo ratings yet

- Asia Pacific Outlook Report 2022 8655Document30 pagesAsia Pacific Outlook Report 2022 8655Santhosh MNo ratings yet

- Focus BestDocument26 pagesFocus Bestsiam zamanNo ratings yet

- Delivers Healthy Performance: Sector: Agri Chem Result UpdateDocument6 pagesDelivers Healthy Performance: Sector: Agri Chem Result UpdatedarshanmadeNo ratings yet

- Deal Pro - Financial Investment Competition Team: K-Drei: Ram Prasath T Vishwath S Padma Shravan MDocument2 pagesDeal Pro - Financial Investment Competition Team: K-Drei: Ram Prasath T Vishwath S Padma Shravan MMini ClipsNo ratings yet

- Post Covid Forecasts Scenarios TablesDocument5 pagesPost Covid Forecasts Scenarios Tablesanver2679No ratings yet

- Facets: Fintech Lending Trends From FACE Members, Mar 2022 Issue 1Document14 pagesFacets: Fintech Lending Trends From FACE Members, Mar 2022 Issue 1GUPTA SAGAR SURESH 1980174No ratings yet

- ICAO Coronavirus Econ ImpactDocument125 pagesICAO Coronavirus Econ ImpactmasliliksNo ratings yet

- Pakistan Strategy 2020.Document60 pagesPakistan Strategy 2020.muddasir1980No ratings yet

- LightCastle Partners Bangladesh Startup Ecosystem Report 2021 1Document33 pagesLightCastle Partners Bangladesh Startup Ecosystem Report 2021 1Dibakar DasNo ratings yet

- Economic ForecastDocument8 pagesEconomic ForecastHNNNo ratings yet

- Money and BankingDocument10 pagesMoney and BankingAbdul RehmanNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- Rethinking Infrastructure Financing for Southeast Asia in the Post-Pandemic EraFrom EverandRethinking Infrastructure Financing for Southeast Asia in the Post-Pandemic EraNo ratings yet

- Bangladesh’s Agriculture, Natural Resources, and Rural Development Sector Assessment and StrategyFrom EverandBangladesh’s Agriculture, Natural Resources, and Rural Development Sector Assessment and StrategyNo ratings yet

- Cooking Without FireDocument2 pagesCooking Without Firethenmozhi thenmozhiNo ratings yet

- Format For OBC Non Creamy Layer CertificateDocument2 pagesFormat For OBC Non Creamy Layer Certificatethenmozhi thenmozhiNo ratings yet

- T - Shirt Painting-1Document2 pagesT - Shirt Painting-1thenmozhi thenmozhiNo ratings yet

- Rubik's CubeDocument1 pageRubik's Cubethenmozhi thenmozhiNo ratings yet

- Mehandi 1Document2 pagesMehandi 1thenmozhi thenmozhiNo ratings yet

- Application Form 2023Document10 pagesApplication Form 2023thenmozhi thenmozhiNo ratings yet

- KHADI Rama Yellow Black .xlsx-2Document9 pagesKHADI Rama Yellow Black .xlsx-2thenmozhi thenmozhiNo ratings yet

- Infrastructure DevelopmentDocument3 pagesInfrastructure Developmentthenmozhi thenmozhiNo ratings yet

- PH CertificateDocument1 pagePH Certificatethenmozhi thenmozhiNo ratings yet

- Muslin 2387-1Document3 pagesMuslin 2387-1thenmozhi thenmozhiNo ratings yet

- 2364 Black FoilDocument24 pages2364 Black Foilthenmozhi thenmozhiNo ratings yet

- 2012 08 31 Lvpei HydDocument40 pages2012 08 31 Lvpei Hydthenmozhi thenmozhiNo ratings yet

- 2314 Kota EmbroideryDocument7 pages2314 Kota Embroiderythenmozhi thenmozhiNo ratings yet

- Day 17 Ethics Case StudyDocument3 pagesDay 17 Ethics Case Studythenmozhi thenmozhiNo ratings yet

- Upsc Where To Study PrelimsDocument8 pagesUpsc Where To Study Prelimsthenmozhi thenmozhiNo ratings yet

- RAGAKAVYADocument4 pagesRAGAKAVYAthenmozhi thenmozhiNo ratings yet

- Polity 1 AarambDocument2 pagesPolity 1 Aarambthenmozhi thenmozhiNo ratings yet

- Upsc 2022 - Essay Questions PaperDocument3 pagesUpsc 2022 - Essay Questions Paperthenmozhi thenmozhiNo ratings yet

- Karthika KDocument4 pagesKarthika Kthenmozhi thenmozhiNo ratings yet

- Perio Papers (Feb21 To July12)Document36 pagesPerio Papers (Feb21 To July12)thenmozhi thenmozhiNo ratings yet

- BRAHAMANAYAGIDocument4 pagesBRAHAMANAYAGIthenmozhi thenmozhiNo ratings yet

- Unit 7Document10 pagesUnit 7thenmozhi thenmozhiNo ratings yet

- PCD Papers (Feb21 To July12)Document36 pagesPCD Papers (Feb21 To July12)thenmozhi thenmozhiNo ratings yet

- Prosthodontics Section I Complete Denture Chapter 1 IntroductionDocument12 pagesProsthodontics Section I Complete Denture Chapter 1 Introductionthenmozhi thenmozhiNo ratings yet

- W1 CDEAwardeesDocument117 pagesW1 CDEAwardeesthenmozhi thenmozhiNo ratings yet

- Pedo Papers (Feb21 To July12)Document36 pagesPedo Papers (Feb21 To July12)thenmozhi thenmozhiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument20 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAmaresh NayakNo ratings yet

- June 2019 (IAL) QP - Unit 2 Edexcel Economics A-LevelDocument32 pagesJune 2019 (IAL) QP - Unit 2 Edexcel Economics A-LevelArthur SimõesNo ratings yet

- CASE STUDY ON Pakistan EconomyDocument1 pageCASE STUDY ON Pakistan EconomyAbdul MoizNo ratings yet

- Market AnalysisDocument5 pagesMarket AnalysisTienieNo ratings yet

- Arihant Upsc Indian Economy Practice Set 1. CB1198675309Document4 pagesArihant Upsc Indian Economy Practice Set 1. CB1198675309Lavita DekaNo ratings yet

- Structure and Management of Indian Sugar IndustryDocument27 pagesStructure and Management of Indian Sugar IndustryKishor BaradNo ratings yet

- Di Ho 1001804Document3 pagesDi Ho 1001804dev100% (1)

- Presentation On IfciDocument9 pagesPresentation On IfciSumitNo ratings yet

- SB Inward Return PDFDocument16 pagesSB Inward Return PDFAtri Deb ChowdhuryNo ratings yet

- Adani Enterprises Limited IPO PDFDocument1 pageAdani Enterprises Limited IPO PDFvasanthkumar.santhu2100% (1)

- Central Banks and Monetary Organisations Website ListDocument20 pagesCentral Banks and Monetary Organisations Website ListholyblackmariaNo ratings yet

- Phiel Daphine Nacionales BSA-BACDocument1 pagePhiel Daphine Nacionales BSA-BACedrianclydeNo ratings yet

- Mega Projects - BhutanDocument4 pagesMega Projects - BhutanMadhuree PerumallaNo ratings yet

- Pozos Michail - Pest Analysis For GreeceDocument6 pagesPozos Michail - Pest Analysis For Greeceapi-730064797No ratings yet

- Manishkumar Kumudchandra Dhruve AY 2021-2022: Computation of Income (ITR2)Document3 pagesManishkumar Kumudchandra Dhruve AY 2021-2022: Computation of Income (ITR2)Sanjay ThakkarNo ratings yet

- Ahmad Riaz 100330070 ACCT 3320 (A10) Assignment #2: CH 3 - Question 1Document3 pagesAhmad Riaz 100330070 ACCT 3320 (A10) Assignment #2: CH 3 - Question 1Ahmad RiazNo ratings yet

- Economics Commentary 3Document4 pagesEconomics Commentary 3ajspspNo ratings yet

- QTA041904KS Proforma Invoice For 100F663N and FTTH Accessories For Kenya Nyuliah Simon-Alice QueentonDocument1 pageQTA041904KS Proforma Invoice For 100F663N and FTTH Accessories For Kenya Nyuliah Simon-Alice QueentonSimon NyuliahNo ratings yet

- WK 1 Globalization-3Document11 pagesWK 1 Globalization-3Nicole See Ming HuiNo ratings yet

- Chapter 11 Key Issue 4Document4 pagesChapter 11 Key Issue 4Jack StreamNo ratings yet

- Estonia in TransitionDocument5 pagesEstonia in TransitionErwinsyah RusliNo ratings yet

- Power Crisis FinalDocument11 pagesPower Crisis FinalKanwal EjazNo ratings yet

- Source: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIDocument4 pagesSource: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIManikanda Bharathi SNo ratings yet

- Seminar Paper On KIIFBDocument4 pagesSeminar Paper On KIIFBAthiraNo ratings yet

- Biotechusa KFT Beu22006334Document1 pageBiotechusa KFT Beu22006334Brunhilda BrunhildaNo ratings yet

- Success and Failures of Economic Planning in IndiaDocument6 pagesSuccess and Failures of Economic Planning in Indiavikram inamdar100% (1)

- Paysafecard Direct and Paysafecash Product IdentifiersDocument11 pagesPaysafecard Direct and Paysafecash Product Identifiersflaviusapostoae208No ratings yet