Professional Documents

Culture Documents

Worksheet - Sheet1

Uploaded by

kim leiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet - Sheet1

Uploaded by

kim leiCopyright:

Available Formats

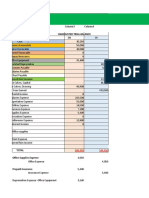

Unadjusted trial balance Adjustments Income Statement Balance Sheet

PARTICULARS PR DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT

Cash and cash equivalents 124134 124134

Accounts receivable 21900 21900

Equipment 40000 40000

Accounts payable 89400 89400

Withholding tax payable 0 0

Expanded withholding tax payable 750 750

SSS,Pag-ibig,PhilHealth contributions payable 0 0

Perstaym, Capital 200000 200000

Sales 140000 140000

Sales Discount 2240 2240

Sales Returns 500 500

Purchases 110000 110000

Purchase Discount 224 224

Purchase Returns 200 200

Salaries Expense 100000 100000

Rent Expense 15000 15000

SSS,Pag-ibig,PhilHealth contributions 10000 10000

Input VAT 18600 18600

Output VAT 16800 16800

Supplies expense 5000 5000

Total 447374 447374

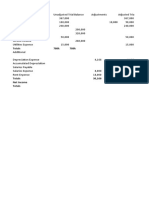

ADJUSTMENTS;

Merchandise inventory-end 40000 40000

Accumulated depreciation 166.67

Depreciation expense 166.67 166.67 166.67

Income Summary 40000 40000

Total 40166.67 40166.67 261506.67 197224 226034 290316.67

Net loss 64282.67 64282.67

TOTAL 261506.67 261506.67 290316.67 290316.67

You might also like

- Teresita Buenaflor ShoesDocument13 pagesTeresita Buenaflor ShoesThe Phoebie JhemNo ratings yet

- Allan & WallyDocument10 pagesAllan & WallyLaura OliviaNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementNarayan DhunganaNo ratings yet

- Unit NDocument1 pageUnit NjharithpalaciosNo ratings yet

- Financial Statement 1st PaperDocument24 pagesFinancial Statement 1st PaperMtNo ratings yet

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisDocument3 pagesFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisBetcy RaetoraNo ratings yet

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Accounting 1 (Chapter 9)Document3 pagesAccounting 1 (Chapter 9)angel cao100% (2)

- Jawaban CH 5 - TM 11Document3 pagesJawaban CH 5 - TM 11ahmad shinigamiNo ratings yet

- The Balance Sheet of Bharat LTD As at 31st MarchDocument4 pagesThe Balance Sheet of Bharat LTD As at 31st Marchsunny_masand1990No ratings yet

- Accounts Unajusted Trial Balance Adjusted Trial Balance DR CR DR CRDocument2 pagesAccounts Unajusted Trial Balance Adjusted Trial Balance DR CR DR CRAlexa RamosNo ratings yet

- Book 1Document4 pagesBook 1monteNo ratings yet

- DFNDFNDFNDFNDFDocument6 pagesDFNDFNDFNDFNDFMohammad Ibnu LapaolaNo ratings yet

- 17 - Accounting For Incomplete Records (Single Entry)Document7 pages17 - Accounting For Incomplete Records (Single Entry)KAMAL POKHRELNo ratings yet

- Ily Abella Surveyors - WorksheetDocument2 pagesIly Abella Surveyors - WorksheetNeilan Jay FloresNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Comprehensive Problem For Merchandising OperationsDocument8 pagesComprehensive Problem For Merchandising OperationsSam Rae LimNo ratings yet

- Financial Accounting-I Assignment 2: InstructionsDocument3 pagesFinancial Accounting-I Assignment 2: InstructionsMemes CreatorNo ratings yet

- Sample Excel File (Flip Shoes Financial Statements)Document8 pagesSample Excel File (Flip Shoes Financial Statements)Miguel BautistaNo ratings yet

- ACTIVITY111111101Document6 pagesACTIVITY111111101VanessaNo ratings yet

- Cash Flow QN 3Document4 pagesCash Flow QN 3Takudzwa LanceNo ratings yet

- Topic Worksheet 6.1: Trial BalanceDocument1 pageTopic Worksheet 6.1: Trial Balance21ke23b15089No ratings yet

- Dispenser of California - Rahul - MattaDocument9 pagesDispenser of California - Rahul - MattaHarsh MaheshwariNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- Safari - 12 Aug 2019 at 1:00 PM PDFDocument1 pageSafari - 12 Aug 2019 at 1:00 PM PDFPauline BiancaNo ratings yet

- BA713 Financial Management Tutorial 2Document4 pagesBA713 Financial Management Tutorial 2Ten NineNo ratings yet

- Worksheet: Zainy-Arif Endaila BSA-1Document4 pagesWorksheet: Zainy-Arif Endaila BSA-1Zainy EndailaNo ratings yet

- Accounts Unadjusted Trial Balance Adjustments Ajusted Trial Balance Income Statement Balance Sheet Debit Credit Debit Credit DR CR DR CR DR CRDocument4 pagesAccounts Unadjusted Trial Balance Adjustments Ajusted Trial Balance Income Statement Balance Sheet Debit Credit Debit Credit DR CR DR CR DR CRGIDEON, JR. INESNo ratings yet

- Chapter 2 - Partnership Operations PROBLEM 6 and 8 With Worksheet 6.)Document12 pagesChapter 2 - Partnership Operations PROBLEM 6 and 8 With Worksheet 6.)sanjoeNo ratings yet

- J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Document2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Minjin lesner ManalansanNo ratings yet

- 0422 Topic 1 Single EntryDocument22 pages0422 Topic 1 Single Entryانيس AnisNo ratings yet

- JOURNALDocument1 pageJOURNALMAGOMU DAN DAVIDNo ratings yet

- Trial BalDocument1 pageTrial BalRameena NiyasNo ratings yet

- Accounting CycleDocument3 pagesAccounting CycleSelahNo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- Prob 5 UnsolvedDocument3 pagesProb 5 UnsolvedBhushan ShirsathNo ratings yet

- ActivityDocument49 pagesActivityAshanti ashley gueseNo ratings yet

- Explained: AccountingDocument3 pagesExplained: AccountingAJNo ratings yet

- Anteneh Assignment 1Document17 pagesAnteneh Assignment 1Abatneh mengistNo ratings yet

- Bsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyDocument7 pagesBsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyGarp BarrocaNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemENIDNo ratings yet

- Partnership Liquidation Exam AnswersDocument7 pagesPartnership Liquidation Exam AnswersAlexandriteNo ratings yet

- Girdharilal Case StudyDocument1 pageGirdharilal Case StudySandipan DawnNo ratings yet

- 2024 Budget OverviewDocument2 pages2024 Budget Overviewapi-278699601No ratings yet

- Worksheet J. P. Peralta Computer ClinicDocument2 pagesWorksheet J. P. Peralta Computer ClinicMinjin lesner ManalansanNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- Particular Unadjusted Trial BalanceDocument4 pagesParticular Unadjusted Trial BalanceRaymon Villapando BardinasNo ratings yet

- Statement of Comprehensive Income RM RMDocument11 pagesStatement of Comprehensive Income RM RMKashveena BathmanathanNo ratings yet

- Accounting Cycle 3Document8 pagesAccounting Cycle 3Ahmer NaeemNo ratings yet

- Comprehensive ProblemDocument14 pagesComprehensive ProblemMarian Augelio PolancoNo ratings yet

- B.A Laundry ShopDocument6 pagesB.A Laundry ShopMary Grace BituinNo ratings yet

- BLT FINAL Assignment (Feb - June 2020) FINALDocument16 pagesBLT FINAL Assignment (Feb - June 2020) FINALSalman SajidNo ratings yet

- MidtermDocument11 pagesMidtermdumpanonymouslyNo ratings yet

- Final GENERAL LEDGER - Sheet1Document2 pagesFinal GENERAL LEDGER - Sheet1kim leiNo ratings yet

- GENERAL LEDGER - Sheet1Document2 pagesGENERAL LEDGER - Sheet1kim leiNo ratings yet

- Subsidiary LedgerDocument1 pageSubsidiary Ledgerkim leiNo ratings yet

- What Are The Parts of The Cooling SystemDocument2 pagesWhat Are The Parts of The Cooling Systemkim leiNo ratings yet

- Isabelo de Los ReyesDocument12 pagesIsabelo de Los Reyeskim leiNo ratings yet

- Corrugated Board Bonding Defect VisualizDocument33 pagesCorrugated Board Bonding Defect VisualizVijaykumarNo ratings yet

- GMAT Sentence Correction Practice Test 03Document5 pagesGMAT Sentence Correction Practice Test 03krishnachivukulaNo ratings yet

- God Made Your BodyDocument8 pagesGod Made Your BodyBethany House Publishers56% (9)

- For Printing Week 5 PerdevDocument8 pagesFor Printing Week 5 PerdevmariNo ratings yet

- Journal of The Folk Song Society No.8Document82 pagesJournal of The Folk Song Society No.8jackmcfrenzieNo ratings yet

- Mutants & Masterminds 3e - Power Profile - Death PowersDocument6 pagesMutants & Masterminds 3e - Power Profile - Death PowersMichael MorganNo ratings yet

- Agrarian ReformDocument40 pagesAgrarian ReformYannel Villaber100% (2)

- Waldorf Curriculum ChartDocument1 pageWaldorf Curriculum Chartplanetalingua2020100% (1)

- JurisprudenceDocument11 pagesJurisprudenceTamojit DasNo ratings yet

- Novi Hervianti Putri - A1E015047Document2 pagesNovi Hervianti Putri - A1E015047Novi Hervianti PutriNo ratings yet

- Masmud Vs NLRC and Atty Go DigestDocument2 pagesMasmud Vs NLRC and Atty Go DigestMichael Parreño Villagracia100% (1)

- Julian BanzonDocument10 pagesJulian BanzonEhra Madriaga100% (1)

- Sona Koyo Steering Systems Limited (SKSSL) Vendor ManagementDocument21 pagesSona Koyo Steering Systems Limited (SKSSL) Vendor ManagementSiddharth UpadhyayNo ratings yet

- National Healthy Lifestyle ProgramDocument6 pagesNational Healthy Lifestyle Programmale nurseNo ratings yet

- Electric Trains and Japanese Technology: Breakthrough in Japanese Railways 4Document9 pagesElectric Trains and Japanese Technology: Breakthrough in Japanese Railways 4Aee TrDNo ratings yet

- RulesDocument508 pagesRulesGiovanni MonteiroNo ratings yet

- Question 1 (1 Point) : SavedDocument31 pagesQuestion 1 (1 Point) : SavedCates TorresNo ratings yet

- How To Select The Right Motor DriverDocument4 pagesHow To Select The Right Motor DriverHavandinhNo ratings yet

- ESS Revision Session 2 - Topics 5-8 & P1 - 2Document54 pagesESS Revision Session 2 - Topics 5-8 & P1 - 2jinLNo ratings yet

- Statement 876xxxx299 19052022 113832Document2 pagesStatement 876xxxx299 19052022 113832vndurgararao angatiNo ratings yet

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocument332 pagesList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedNo ratings yet

- DB - Empirically Based TheoriesDocument3 pagesDB - Empirically Based TheoriesKayliah BaskervilleNo ratings yet

- Google Chrome OSDocument47 pagesGoogle Chrome OSnitin07sharmaNo ratings yet

- 7 CAAT-AIR-GM03 Guidance-Material-for-Foreign-Approved-Maintenance-Organization - I3R0 - 30oct2019 PDFDocument59 pages7 CAAT-AIR-GM03 Guidance-Material-for-Foreign-Approved-Maintenance-Organization - I3R0 - 30oct2019 PDFJindarat KasemsooksakulNo ratings yet

- Safe Britannia PDFDocument2 pagesSafe Britannia PDFeden4872No ratings yet

- Soal Pas Myob Kelas Xii GanjilDocument4 pagesSoal Pas Myob Kelas Xii GanjilLank BpNo ratings yet

- Air Microbiology 2018 - IswDocument26 pagesAir Microbiology 2018 - IswOktalia Suci AnggraeniNo ratings yet

- Grade 10 Science - 2Document5 pagesGrade 10 Science - 2Nenia Claire Mondarte CruzNo ratings yet

- Pre Joining Guidelines For InfosysDocument21 pagesPre Joining Guidelines For InfosysGokul0% (2)

- Agitha Diva Winampi - Childhood MemoriesDocument2 pagesAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiNo ratings yet