Professional Documents

Culture Documents

8 Projected Balance

Uploaded by

Shubham Jha0 ratings0% found this document useful (0 votes)

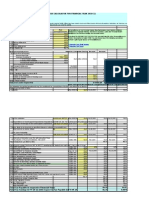

10 views2 pagesThis document projects a balance sheet for a company over a 12 month period. It provides notes on how to prepare the projected balance sheet by using the previous balance sheet as a starting point and forecasting how asset, liability, and equity accounts will change based on projections for sales growth, expenses, and financing needs. Key accounts that may increase include inventory, accounts receivable, fixed assets, retained earnings, and debt. The exercise helps plan future capital needs and financing sources.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document projects a balance sheet for a company over a 12 month period. It provides notes on how to prepare the projected balance sheet by using the previous balance sheet as a starting point and forecasting how asset, liability, and equity accounts will change based on projections for sales growth, expenses, and financing needs. Key accounts that may increase include inventory, accounts receivable, fixed assets, retained earnings, and debt. The exercise helps plan future capital needs and financing sources.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pages8 Projected Balance

Uploaded by

Shubham JhaThis document projects a balance sheet for a company over a 12 month period. It provides notes on how to prepare the projected balance sheet by using the previous balance sheet as a starting point and forecasting how asset, liability, and equity accounts will change based on projections for sales growth, expenses, and financing needs. Key accounts that may increase include inventory, accounts receivable, fixed assets, retained earnings, and debt. The exercise helps plan future capital needs and financing sources.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

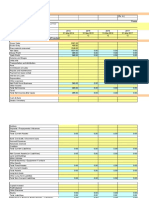

Balance Sheet (Projected)

Enter your Company Name here

Beginning Projected

as of mm/dd/yyyy as of mm/dd/yyyy

Assets

Current Assets Notes on Preparation

Cash in bank Rs0.00 Rs0.00 Note: You may want to print this information to use as reference la

Accounts receivable Rs0.00 Rs0.00 delete these instructions, click the border of this text box and then p

Inventory Rs0.00 Rs0.00 the DELETE key.

Prepaid expenses Rs0.00 Rs0.00

Projecting your balance sheet can be quite a complex accounting p

Other current assets Rs0.00 Rs0.00

but that does not mean you need to be a professional accountant t

Total Current Assets Rs0.00 Rs0.00 or to benefit from the exercise. The desired result is not a perfect f

but rather a thoughtful plan detailing what additional resources will

Fixed Assets needed by the company, where they will be needed, and how they

Machinery & equipment Rs0.00 Rs0.00 financed. Using your last historical balance sheet as a starting poin

Furniture & fixtures Rs0.00 Rs0.00 project what your balance sheet will look like at the end of the 12 m

Leasehold improvements Rs0.00 Rs0.00 period covered in your Profit & Loss and Cash Flow forecasts. How

the year's operations affect assets, debts, and owners' equity? For

Land & buildings Rs0.00 Rs0.00

example, let us say you are planning significant sales growth in the

Other fixed assets Rs0.00 Rs0.00 year. Go through the balance sheet item by item, asking what the e

(LESS accumulated depreciation will likely be:

on all fixed assets) Rs0.00 Rs0.00 ASSETS: Inventory and Accounts Receivable will have to grow. Ne

Total Fixed Assets (net of equipment may be needed for increased production. You may draw

depreciation) Rs0.00 Rs0.00 on cash to finance some of this.

Now, since a balance must balance, you need to consider the effec

the other half of the statement: LIABILITIES & EQUITY: Some of th

Other Assets

growth may be financed by profits retained in the business as Reta

Intangibles Rs0.00 Rs0.00 Earnings. Your Profit & Loss Projection will tell you how much migh

Deposits Rs0.00 Rs0.00 available from that source. Funds may be contributed by the owner

Goodwill Rs0.00 Rs0.00 through contributions of more Invested Capital or loans to the comp

Other Rs0.00 Rs0.00 (Notes Payable to Stockholders). Suppliers may provide some of th

Total Other Assets Rs0.00 Rs0.00 financing via increased Accounts Payable. The rest will have to be

financed by borrowing, which can be: Short term loans (due within

months) such as a line of credit. Or by Long Term Debt (maturity gr

TOTAL Assets Rs0.00 Rs0.00

than 12 months).

Liabilities and Equity Technical Tips:

1. Your firm's balance sheet no doubt has more lines than this temp

Current Liabilities For clarity and ease of analysis, we recommend you combine categ

Accounts payable Rs0.00 Rs0.00 fit into this compressed format.

Interest payable Rs0.00 Rs0.00 2. As always for projections, we recommend that you condense you

numbers. Most people find it useful to express the values in thousa

Taxes payable Rs0.00 Rs0.00

rounding to the nearest hundred dollars; for example, $11,459 wou

Notes, short-term (due within 12 entered as 11.5.

months) Rs0.00 Rs0.00 3. In the Fixed Assets section, the "LESS accumulated depreciation

Current part, long-term debt Rs0.00 Rs0.00 figure is the total of all depreciation accrued over the years on all fi

Other current liabilities Rs0.00 Rs0.00 assets still owned by the company. Be sure to enter it as a negative

Total Current Liabilities Rs0.00 Rs0.00 number so the spreadsheet will subtract it from Total Fixed Assets.

4. In Owners' Equity, "Retained Earnings-Beginning" is retained ea

as of the last historical balance sheet or the end of the last fiscal ye

Long-term Debt

"Retained Earnings-Current" is net profit for the period of the projec

Bank loans payable Rs0.00 Rs0.00 less any owner's draw (for partnerships and proprietorships) or divi

Notes payable to stockholders Rs0.00 Rs0.00 paid (for corporations).

LESS: Short-term portion Rs0.00 Rs0.00

Other long term debt Rs0.00 Rs0.00

Total Long-term Debt Rs0.00 Rs0.00

Total Liabilities Rs0.00 Rs0.00

Owners' Equity

Invested capital Rs0.00 Rs0.00

Retained earnings - beginning Rs0.00 Rs0.00

Retained earnings - current Rs0.00 Rs0.00

Total Owners' Equity Rs0.00 Rs0.00

Total Liabilities & Equity Rs0.00 Rs0.00

use as reference later. To

s text box and then press

omplex accounting problem,

ssional accountant to do it

sult is not a perfect forecast,

tional resources will be

eded, and how they will be

eet as a starting point,

t the end of the 12 month

Flow forecasts. How will

owners' equity? For

nt sales growth in the coming

m, asking what the effects

will have to grow. New

uction. You may draw down

to consider the effects on

EQUITY: Some of the

he business as Retained

you how much might be

ributed by the owners

or loans to the company

ay provide some of the

rest will have to be

m loans (due within 12

rm Debt (maturity greater

e lines than this template.

d you combine categories to

at you condense your

the values in thousands,

ample, $11,459 would be

mulated depreciation"

er the years on all fixed

enter it as a negative

m Total Fixed Assets.

nning" is retained earnings

d of the last fiscal year.

e period of the projections,

oprietorships) or dividends

You might also like

- Free Business TemplatesDocument3 pagesFree Business Templateshowieg43100% (9)

- Clothing E-Commerce Site Business Plan - Financial Plan - Bplans - ComDocument7 pagesClothing E-Commerce Site Business Plan - Financial Plan - Bplans - ComLINDALIENCRUZNo ratings yet

- Bank of India Fund BasedDocument33 pagesBank of India Fund Basedhariram v choudharyNo ratings yet

- Doors & Window Installation - DraftDocument7 pagesDoors & Window Installation - DraftGaneshNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting Entriesitsayuhthing100% (1)

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- NRF National Retail Security Survey 2023Document24 pagesNRF National Retail Security Survey 2023Veronica Silveri100% (1)

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationRajkumar NateshanNo ratings yet

- IMT CDL Finance - All Questions & AnswersDocument12 pagesIMT CDL Finance - All Questions & AnswersPranav Sharma33% (3)

- Catawba Industrial Company SlidesDocument15 pagesCatawba Industrial Company SlidesCR7pNo ratings yet

- Fractal Blaster Trading Strategy ReportDocument22 pagesFractal Blaster Trading Strategy ReportIcky IckyNo ratings yet

- Velasco Vs Ca - DigestDocument2 pagesVelasco Vs Ca - DigestJoshhh rcNo ratings yet

- Money Banking and Finance Notes For Bcom Part 1 PDFDocument59 pagesMoney Banking and Finance Notes For Bcom Part 1 PDFCss Junction0% (2)

- Porter Vs Ansoff StrategiesDocument15 pagesPorter Vs Ansoff StrategiesBeth Kimathi78% (9)

- Erp Case Study With Solution PDFDocument2 pagesErp Case Study With Solution PDFJazmine40% (5)

- Financial Statements and Financial AnalysisDocument17 pagesFinancial Statements and Financial AnalysisVaibhav MahajanNo ratings yet

- 2.aboitiz Shipping Corporation v. Insurance Company of North AmericaDocument2 pages2.aboitiz Shipping Corporation v. Insurance Company of North AmericaEA100% (1)

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisAsad RehmanNo ratings yet

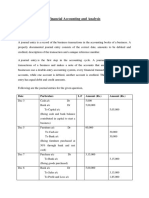

- Financial Accounting and AnalysisDocument19 pagesFinancial Accounting and AnalysisSanchi AggarwalNo ratings yet

- Financial Accounting and AnalysisDocument19 pagesFinancial Accounting and AnalysisSanchi AggarwalNo ratings yet

- Ratio AnalysisDocument34 pagesRatio AnalysisNUR FATIN FISALNo ratings yet

- Chapter 2: Evaluation of Financial PerformanceDocument41 pagesChapter 2: Evaluation of Financial PerformanceNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Balance Sheet TemplateDocument8 pagesBalance Sheet TemplateJerarudo BoknoyNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAsad RehmanNo ratings yet

- Ma Internal Question BankDocument4 pagesMa Internal Question Bankvarmapriya712No ratings yet

- AccountDocument2 pagesAccountvetijeb369No ratings yet

- Sample Audit ReportDocument9 pagesSample Audit ReportWhydoyouneedNo ratings yet

- Financials TemplateDocument4 pagesFinancials TemplateEarl Warrin P DeiparineNo ratings yet

- 2018 - Session11 - 12 FSA - PGP - SentDocument40 pages2018 - Session11 - 12 FSA - PGP - SentArty DrillNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Amalgamation and Valuation by CA RajDocument72 pagesAmalgamation and Valuation by CA Rajkoppineni srikanthNo ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- Relying On Book Rate of Return May Lead To Bad Investment DecisionsDocument2 pagesRelying On Book Rate of Return May Lead To Bad Investment DecisionsAniKelbakianiNo ratings yet

- Cash Flow HeeraDocument31 pagesCash Flow HeeraChristian AgultoNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- TASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraDocument4 pagesTASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraSincy MathewNo ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisAsad RehmanNo ratings yet

- Income Tax Calculator FY 2010 11 1Document2 pagesIncome Tax Calculator FY 2010 11 1nchary_2010No ratings yet

- Assets: Balance Sheet Notes and DescriptionsDocument2 pagesAssets: Balance Sheet Notes and DescriptionsNahom AsamenewNo ratings yet

- Pilotage FinancierDocument75 pagesPilotage FinancierAyoub AaliliNo ratings yet

- Mock TestDocument26 pagesMock TestRadhika KushwahaNo ratings yet

- Magyardokumentum 12314 A 325Document2 pagesMagyardokumentum 12314 A 325Arlen PribisánNo ratings yet

- Fabm Group 4. Closing EntriesDocument11 pagesFabm Group 4. Closing Entriesjoel phillip GranadaNo ratings yet

- Ratio Analysis-1Document3 pagesRatio Analysis-1Ramakrishna J RNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisRamakrishna J RNo ratings yet

- Ratio & Financial Analysis: by Danial RezaDocument11 pagesRatio & Financial Analysis: by Danial Rezaansary75No ratings yet

- Unit 4 Working Capital ManagementDocument56 pagesUnit 4 Working Capital Managementshubh sharmaNo ratings yet

- LLP Dormant AccountsDocument2 pagesLLP Dormant AccountsMarryNo ratings yet

- Start-Up Expenses Year 1 (Starting Balance Sheet) : Fixed Assets Amount Notes Depreciation (Years)Document1 pageStart-Up Expenses Year 1 (Starting Balance Sheet) : Fixed Assets Amount Notes Depreciation (Years)Anthony Burson-ThomasNo ratings yet

- Fundamentals of Accounting 1 BDocument6 pagesFundamentals of Accounting 1 BAle EalNo ratings yet

- Final Module TaskDocument5 pagesFinal Module TaskQuienilyn SanchezNo ratings yet

- Financial Accounting and AnalysisDocument7 pagesFinancial Accounting and AnalysisKush BafnaNo ratings yet

- Personal Event Planning Business PlanDocument24 pagesPersonal Event Planning Business PlanFaisal NawazNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Financial Accounting & AnalysisDocument6 pagesFinancial Accounting & AnalysisRajni KumariNo ratings yet

- Lesson Eleven-AccountingDocument9 pagesLesson Eleven-AccountingKovács Zsuzsanna BorókaNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- Shri Guru Kripa Learning Centre, Chennai 600 024. PhoneDocument16 pagesShri Guru Kripa Learning Centre, Chennai 600 024. PhoneCAclubindiaNo ratings yet

- 0.00 Indicate The Expenses To Be Drawn From The Start-Up Capital and Expenses Drawn From Sales. TotalDocument4 pages0.00 Indicate The Expenses To Be Drawn From The Start-Up Capital and Expenses Drawn From Sales. TotalNeal AlonzoNo ratings yet

- 21020538-Analysis of Financial StatementDocument9 pages21020538-Analysis of Financial StatementRITU SINGHNo ratings yet

- Overall Profitability RatiosDocument12 pagesOverall Profitability RatiosAtharva VirehNo ratings yet

- Assignment On Financial Accounting & AnalysisDocument7 pagesAssignment On Financial Accounting & AnalysisArko RoyNo ratings yet

- CourseraDocument23 pagesCourseraBeatriz LopesNo ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- Tax Calculator 2010-2011Document1 pageTax Calculator 2010-2011Sanjay Kumar GuptaNo ratings yet

- Computation of NAVDocument33 pagesComputation of NAVMannu SolankiNo ratings yet

- Adv AnsDocument13 pagesAdv AnsOcto ManNo ratings yet

- MBA in Business AnalyticsDocument13 pagesMBA in Business AnalyticsShubham JhaNo ratings yet

- Financial Projection TemplateDocument62 pagesFinancial Projection TemplateShubham JhaNo ratings yet

- Balance Sheet Profit Loss AccountDocument2 pagesBalance Sheet Profit Loss AccountShubham JhaNo ratings yet

- Projected Balance SheetDocument2 pagesProjected Balance SheetShubham JhaNo ratings yet

- Running Head: Global It InnovationDocument5 pagesRunning Head: Global It InnovationExpert TutoraNo ratings yet

- 15934/ASR NTSK EXP Sleeper Class (SL) : WL WLDocument2 pages15934/ASR NTSK EXP Sleeper Class (SL) : WL WLikonmobileshopNo ratings yet

- 85th SLC MinutesDocument201 pages85th SLC MinutesSHANMUKHA INDUSTRIESNo ratings yet

- How Is Entrepreneurship Good For Economic Growth?: Zoltan AcsDocument22 pagesHow Is Entrepreneurship Good For Economic Growth?: Zoltan AcsshuchiroyNo ratings yet

- RESUME UPD - 1670820102755 - Chinmay Vithal ChavanDocument3 pagesRESUME UPD - 1670820102755 - Chinmay Vithal ChavanRahul PatankarNo ratings yet

- Research Methodology: Dr. Eisha KhanDocument12 pagesResearch Methodology: Dr. Eisha KhanTushar KambojNo ratings yet

- RPC MT 4Document3 pagesRPC MT 4Lasitha MuhandiramgeNo ratings yet

- PDF Sample 3Document2 pagesPDF Sample 3Edmark PedranoNo ratings yet

- Strengths: Company Strengths and WeaknessessDocument2 pagesStrengths: Company Strengths and WeaknessessexquisiteNo ratings yet

- 53B Intro To TPM Six Big LossesDocument32 pages53B Intro To TPM Six Big Lossesechsan dwi nugrohoNo ratings yet

- Australian Sharemarket: TablesDocument20 pagesAustralian Sharemarket: TablesallegreNo ratings yet

- 1.0 Executive Summary: 1.1 ObjectivesDocument5 pages1.0 Executive Summary: 1.1 Objectivesethnan lNo ratings yet

- A Study On Fixed Asset ManagementDocument8 pagesA Study On Fixed Asset ManagementShrid GuptaNo ratings yet

- Nateshwori Nirman Sewa and Order SuppliersDocument1 pageNateshwori Nirman Sewa and Order Suppliersvetraan100% (1)

- CCS Joining Time Rules 1979 20210405120021Document10 pagesCCS Joining Time Rules 1979 20210405120021Rajesh LakshmipathyNo ratings yet

- Centrale À Cycle Combiné Bi-Arbres Rades C 1 X 450MW: GT Control Oil Jib Crane Installation ProcedureDocument3 pagesCentrale À Cycle Combiné Bi-Arbres Rades C 1 X 450MW: GT Control Oil Jib Crane Installation ProcedureWajdi MansourNo ratings yet

- PHD Thesis Mechanical EngineeringDocument4 pagesPHD Thesis Mechanical EngineeringBestCustomPapersWashington100% (1)

- HSE Management System PresentationDocument16 pagesHSE Management System PresentationAshraf AboeleninNo ratings yet

- Study Material RIsk ManagementDocument48 pagesStudy Material RIsk ManagementVaghelaNo ratings yet

- Ashlee Yvon Degumbis - Activity 10.1Document5 pagesAshlee Yvon Degumbis - Activity 10.1Ashlee DegumbisNo ratings yet