Professional Documents

Culture Documents

Logbook For Kudakwashe Muzambi v2

Uploaded by

Tatenda Takie Takaidza0 ratings0% found this document useful (0 votes)

16 views6 pagesThis industrial attachment log book documents Kudakwashe Raymond Muzambi's internship at Mureriwa Actuarial Outsourcing Services from January 14th to April 22nd. Over the course of the internship, Muzambi learned skills in data analysis, financial modeling, and insurance industry regulations by completing tasks such as stock market analysis, pension fund reporting, corporate valuations, and regulatory compliance templates. Muzambi gained experience in key responsibilities of an actuary such as reviewing work of other actuaries, distributing investment surpluses, and calculating accrued benefits for insurance policies.

Original Description:

Original Title

Logbook for Kudakwashe Muzambi v2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis industrial attachment log book documents Kudakwashe Raymond Muzambi's internship at Mureriwa Actuarial Outsourcing Services from January 14th to April 22nd. Over the course of the internship, Muzambi learned skills in data analysis, financial modeling, and insurance industry regulations by completing tasks such as stock market analysis, pension fund reporting, corporate valuations, and regulatory compliance templates. Muzambi gained experience in key responsibilities of an actuary such as reviewing work of other actuaries, distributing investment surpluses, and calculating accrued benefits for insurance policies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views6 pagesLogbook For Kudakwashe Muzambi v2

Uploaded by

Tatenda Takie TakaidzaThis industrial attachment log book documents Kudakwashe Raymond Muzambi's internship at Mureriwa Actuarial Outsourcing Services from January 14th to April 22nd. Over the course of the internship, Muzambi learned skills in data analysis, financial modeling, and insurance industry regulations by completing tasks such as stock market analysis, pension fund reporting, corporate valuations, and regulatory compliance templates. Muzambi gained experience in key responsibilities of an actuary such as reviewing work of other actuaries, distributing investment surpluses, and calculating accrued benefits for insurance policies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

UNIVERSITY OF ZIMBABWE

Industrial Attachment

Log Book

SURNAME : MUZAMBI

NAME(S) : KUDAKWASHE RAYMOND

REG NUMBER : R195461E

PROGRAMME : HASC

NAME OF ORGANISATION : MURERIWA ACTUARIAL

OUTSOURCING SERVICES (pvt) LTD

TRAINEE SIGNATURE:_________________ WORK SUPERVISOR’S SIGNATURE:___________________

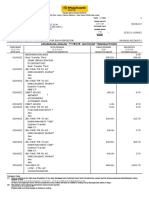

Week Ending Task(s) Done Lesson(s) Learnt

14/01/22 Introduction to Company Corporate structure and

employees and departments administration.

Introduction to company Navigating the company

policy and regulations. server and systems.

Set up into server and Obtaining detailed

computer systems. information of

organization aims and

objectives.

21/01/22 Reading key materials about Industry averages and the

industry and company products, need for collecting such

Services and intrinsic operations. information – to be able to

accurately comment about

the industry to the

company’s clients

How the company handles

various products and their

individual value to the

company

28/01/22 Prepared summarized report of How important stork

Zimbabwe Stock exchange performance is and it

performance. relevance to insurance

Advanced Excel exercises and companies.

data manipulation programs and How excel functions get

tutorials work done conveniently and

in the shortest frame of

time.

04/02/22 Perfomed Data checks for two Learnt that Data is not

Pension funds. always accurate and can

sometimes contain

inconsistencies which will

need to be revised and

corrected.

Data manipulation and

presentation.

11/02/22 Completed Revenue Account for Learnt how funds before

two pension funds. and after 2019 are to be split

between 2 accounts and

TRAINEE SIGNATURE:_________________ WORK SUPERVISOR’S SIGNATURE:___________________

how declare returns onto

pension funds.

18/02/22 Filling folders and assigning Grasped the importance of

proper names to documents. order and how convenient it

Introduction to company is to retrieve prior files

clientale and products offered to when they are needed.

each. Understood the importance

professionalism and needs

of each client and how to

deliver service to them.

25/02/22 Studying IPEC circulars Understanding the

published after 2019. regulatory requirements for

insurance companies in

Zimbabwe.

Understanding the

limitations and struggles the

insurance industry faces and

the steps being taken to

overcome it.

04/03/22 Summarized rules for 3 Pension Grasped that Pension funds

funds. are governed by various

rules that differ in flexibility

from the employer to the

employee.

11/03/22 Carried out corporate valuations. Grasped concept concerning

the monetary sufficiency of

an organization/fund.

Reaalised how management

makes decisions from the

statistics analysed.

18/03/22 Distributed surplus of Learnt that surplus is

investments to Policyholders distributed to various

stakeholders such as Group

Businesses,individual

businesses and

policyholders.

25/03/22 Calculation of Accrued Benefits Mastered how to

accumulate Interest and

bonus for health

benefits,death benefits and

pensions.

01/04/22 Performed peer reviews Gained proficiency in

reviewing work done by

TRAINEE SIGNATURE:_________________ WORK SUPERVISOR’S SIGNATURE:___________________

actuaries of other funds and

assign appropriate

comments were results

failed to tally or closely

align.

08/04/22 Insurance industry survey Gained an understanding of

how to measure growth of

Insurance firms and how

they deliver proficient

services to clients.

Mastered how to Analyse

trends using financial

statements of Insurers in

VBA.

15/04/22 Attended Zoom meeting about Intrinsic knowledge of

ZICARP IPEC guidelines and its

Completed ZICARP templates regulatory role in the

for insurance companies insurance industry of

Zimbabwe.

How the Company should

abide by standards

implemented for carrying

out its operations and

reporting to regulator.

Learning about risk based

capital through ASZ zoom

meetings.

22/04/22 ZSE Market reseach Learnt to analyse trends

within the stockmarket and

how stockmarket changes

affect members’ pensions.

29/04/22 Valuation of short term insurers Gained understanding in

how valuation of short term

insurers differs from long

term insurance.

Grasped how to declare

solvency of a short term

insurer.

06/05/22

Calculation of Money Weighted Linked rates of return

Rate of Return (MWRR) and provide a way of combining

Linked Rate of Return (LRR) rates of return for

successive sub-periods to

TRAINEE SIGNATURE:_________________ WORK SUPERVISOR’S SIGNATURE:___________________

obtain an approximate rate

of return over a longer

period. Linked Rates of

Return are calculated for

funds which have the month

on month fund values

provided.

MWRR is commonly used

in calculations of returns

13/05/22 Zoom webinars about the Data preparation

actuarial valuation cycle. Asset preparation

Valuation specifications

Valuation run,summary and

final report presentation

20/05/22 Carried out a financial revew Mastered how Examine

the financial condition of

the Fund

Leaned how to calculate

the rate of return for a

fund.

27/05/22

03/06/22

TRAINEE SIGNATURE:_________________ WORK SUPERVISOR’S SIGNATURE:___________________

Supervisor’s comment

TRAINEE SIGNATURE:_________________ WORK SUPERVISOR’S SIGNATURE:___________________

You might also like

- Business Continuity and ISO 22301 GreenpaperDocument8 pagesBusiness Continuity and ISO 22301 GreenpaperTarnaveanValeriuDan100% (2)

- Audit of BanksDocument59 pagesAudit of Bankskaran kapadiaNo ratings yet

- Oracle BPM For InsuranceDocument20 pagesOracle BPM For InsuranceObed Paula Galicia HernandezNo ratings yet

- BRD (HRMS)Document21 pagesBRD (HRMS)Ankhitha EkkaladeviNo ratings yet

- Cama BajaDocument32 pagesCama BajaCarlosSilvaYruretaNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Sa2 Pu 14 PDFDocument150 pagesSa2 Pu 14 PDFPolelarNo ratings yet

- KPMG - Target Operating ModelDocument2 pagesKPMG - Target Operating ModelSudip Dasgupta100% (1)

- Business RequirementsDocument12 pagesBusiness Requirementsapi-374297350% (4)

- Business Continuity Management Guidelines 1667597425Document24 pagesBusiness Continuity Management Guidelines 1667597425mujtabasiddiquiNo ratings yet

- SWFP66D Series Fine-Grinding Hammer Mill: Operation ManualDocument65 pagesSWFP66D Series Fine-Grinding Hammer Mill: Operation ManualDanielDeFrancescoNo ratings yet

- Bank Application System Java Project DDocument4 pagesBank Application System Java Project DPrince Agyenim BoatengNo ratings yet

- The Evolution To Electronic Data Interchange Are TDocument6 pagesThe Evolution To Electronic Data Interchange Are Tsuman tamangNo ratings yet

- Human Resources SystemsDocument25 pagesHuman Resources SystemsAnkhitha EkkaladeviNo ratings yet

- Mutual Insurance Company of IowaDocument6 pagesMutual Insurance Company of IowaKristine AngelieNo ratings yet

- IBM Replication For Business Continuity - Disaster Recovery and High Availabilit 2013Document25 pagesIBM Replication For Business Continuity - Disaster Recovery and High Availabilit 2013Raul RamirezNo ratings yet

- Software Requirements Specification For Mpayment in Banking SystemDocument4 pagesSoftware Requirements Specification For Mpayment in Banking Systemgib ashNo ratings yet

- Systematic Literature Review Predictive Maintenance SolutionsDocument15 pagesSystematic Literature Review Predictive Maintenance SolutionsLucia StrassburgerNo ratings yet

- ESSCI Market Research Report 2019Document93 pagesESSCI Market Research Report 2019DSC IdukkiNo ratings yet

- SCNL Investor PPT - Q2 FY20Document69 pagesSCNL Investor PPT - Q2 FY20fghjmkNo ratings yet

- Composable Banking Deloitte Be Report v2 en PDFDocument8 pagesComposable Banking Deloitte Be Report v2 en PDFSushma KazaNo ratings yet

- BP.080 BR.030 V3Document27 pagesBP.080 BR.030 V3Sayed RamadanNo ratings yet

- S221. 1 Introduction To Operations and Supply Chain ManagementDocument14 pagesS221. 1 Introduction To Operations and Supply Chain ManagementNguyễn Ngô Quốc VươngNo ratings yet

- A3 P1-P3 - Final - Group11Document16 pagesA3 P1-P3 - Final - Group11Sadia AbdullahNo ratings yet

- Remote Governance and Controls: The New Reality Publication SeriesDocument20 pagesRemote Governance and Controls: The New Reality Publication Serieskovi mNo ratings yet

- Software Requirements Specification For MPAYMENT ParisDocument4 pagesSoftware Requirements Specification For MPAYMENT ParisbeckokoNo ratings yet

- Next Generation Challenges-EnergyBizMagazineDocument7 pagesNext Generation Challenges-EnergyBizMagazineAmin BisharaNo ratings yet

- Plug-and-Play GRC Overhaul in One WeekDocument4 pagesPlug-and-Play GRC Overhaul in One Weekshekhar guptaNo ratings yet

- Introduction To Operations ManagementDocument16 pagesIntroduction To Operations ManagementHynie AgravanteNo ratings yet

- Level 2 Certificate in Principles of Customer ServiceDocument15 pagesLevel 2 Certificate in Principles of Customer ServiceDavid Faulkner100% (1)

- Shanduka Black Pages - Introduction To BEE - Module 3bDocument7 pagesShanduka Black Pages - Introduction To BEE - Module 3bhenrydeeNo ratings yet

- SsssDocument41 pagesSsssgoodmorningviewersNo ratings yet

- PWC A Billion Dollar Successful SeparationDocument3 pagesPWC A Billion Dollar Successful SeparationPrateekNo ratings yet

- DB10 FullReportDocument231 pagesDB10 FullReportBảo PhươngNo ratings yet

- Paper 8Document8 pagesPaper 8Lingha Dharshan AnparasuNo ratings yet

- A Framework For Analyzing Service OperationsDocument13 pagesA Framework For Analyzing Service Operationskarthik sNo ratings yet

- The Nigerian Code of Corporate Governance 2018: Highlights and ImplicationsDocument21 pagesThe Nigerian Code of Corporate Governance 2018: Highlights and ImplicationsrkolarskyNo ratings yet

- QMS ManualDocument32 pagesQMS ManualSampath MalaarachchiNo ratings yet

- EOS Basic Account Works Level IIDocument60 pagesEOS Basic Account Works Level IINigatu Mekonnen BulgaNo ratings yet

- Oipa New Business Underwriting DsDocument3 pagesOipa New Business Underwriting DsFaisal AzizNo ratings yet

- Solution Manual For Auditing Assurance Services by William F Messier Steven M Glover Douglas F Prawitt Edition 9Document36 pagesSolution Manual For Auditing Assurance Services by William F Messier Steven M Glover Douglas F Prawitt Edition 9lyermanseamellrl8zhNo ratings yet

- Solution Manual For Auditing Assurance Services by William F Messier Steven M Glover Douglas F Prawitt Edition 9Document36 pagesSolution Manual For Auditing Assurance Services by William F Messier Steven M Glover Douglas F Prawitt Edition 9urocelespinningnuyu100% (46)

- All Year RTP AuditDocument564 pagesAll Year RTP AuditShivam ChaudharyNo ratings yet

- Help University Acc 202 Assignment 2017Document5 pagesHelp University Acc 202 Assignment 2017Chan Tze HenNo ratings yet

- Release 12 DemoDocument27 pagesRelease 12 DemoSupratik DeyNo ratings yet

- E Index Global Identifier: Enabling A Single Customer ViewDocument19 pagesE Index Global Identifier: Enabling A Single Customer ViewskleinmaNo ratings yet

- CBN IT GuidelinesDocument76 pagesCBN IT GuidelinesAbiodun Akinnagbe100% (1)

- Group 7 Presents: How IT Enabled Business Model Innovation at VdabDocument30 pagesGroup 7 Presents: How IT Enabled Business Model Innovation at VdabBAarunShNo ratings yet

- Vision and ScopeDocument9 pagesVision and ScopeKamya JangNo ratings yet

- Managerial Accounting Basics - 20240109 - 100321 - 0000Document20 pagesManagerial Accounting Basics - 20240109 - 100321 - 0000shafinasimanNo ratings yet

- Celent EXLDocument32 pagesCelent EXLFelipe AbarcaNo ratings yet

- Enhancing BPM With A Business Rule EngineDocument11 pagesEnhancing BPM With A Business Rule Enginemsgtokumar123No ratings yet

- Theoretical Interpretation of Business Processes in Insurance Activity: Generality and SpecificityDocument9 pagesTheoretical Interpretation of Business Processes in Insurance Activity: Generality and SpecificityResearch ParkNo ratings yet

- Cmmi GovDocument4 pagesCmmi Goveng.emanahmed2014No ratings yet

- Car Care Plan (CCP) : BM1708 Task PerformanceDocument5 pagesCar Care Plan (CCP) : BM1708 Task PerformanceChristianallen DenoloNo ratings yet

- Corporate Issuers Chapter1Document8 pagesCorporate Issuers Chapter1Pranjal ShendeNo ratings yet

- Mckinsey The Capex ChallengeDocument5 pagesMckinsey The Capex ChallengeNur AfiyatNo ratings yet

- FI Valuation DeckDocument28 pagesFI Valuation DeckoodidayooNo ratings yet

- Be Prepared For The Uncleared Margin Rules (UMR) : ContactsDocument4 pagesBe Prepared For The Uncleared Margin Rules (UMR) : ContactsAreeb AbbasNo ratings yet

- Key FindingsDocument2 pagesKey FindingsQWERTYNo ratings yet

- Computer Information in The EnterpriseCh02 PDFDocument30 pagesComputer Information in The EnterpriseCh02 PDFภาณุพงศ์ วิจิตรทองเรืองNo ratings yet

- DB18 About Doing BusinessDocument11 pagesDB18 About Doing BusinessComputer Cell MCKNo ratings yet

- تقارير مختبر محركات احتراق داخليDocument19 pagesتقارير مختبر محركات احتراق داخليwesamNo ratings yet

- F612/F627/F626B: Semi-Lugged Gearbox Operated Butterfly Valves PN16Document1 pageF612/F627/F626B: Semi-Lugged Gearbox Operated Butterfly Valves PN16RonaldNo ratings yet

- Lesson 12&13Document4 pagesLesson 12&13Jhynes RenomeronNo ratings yet

- Coursera XQVQSBQSPQA5 - 2 PDFDocument1 pageCoursera XQVQSBQSPQA5 - 2 PDFAlexar89No ratings yet

- Yellampalli S. Wireless Sensor Networks - Design, Deployment..2021Document314 pagesYellampalli S. Wireless Sensor Networks - Design, Deployment..2021Myster SceneNo ratings yet

- Teambang Unit Plan Final PlanDocument7 pagesTeambang Unit Plan Final Planapi-312120177No ratings yet

- ITIL® 4 Drive Stakeholder Value (DSV)Document2 pagesITIL® 4 Drive Stakeholder Value (DSV)Eugene ArkadievNo ratings yet

- Utilities User Guide: Caefatigue Software (CF)Document38 pagesUtilities User Guide: Caefatigue Software (CF)Oliver RailaNo ratings yet

- Unit 8. New Ways To Learn: Part I. PhoneticsDocument14 pagesUnit 8. New Ways To Learn: Part I. PhoneticsPhạm Gia LợiNo ratings yet

- Avamar-4.1-Technical-Addendum. Avamar Commandspdf PDFDocument537 pagesAvamar-4.1-Technical-Addendum. Avamar Commandspdf PDFdanilaix50% (2)

- Ethical Hacking DissertationDocument5 pagesEthical Hacking DissertationWriteMyPapersUK100% (1)

- Solaris 10 Installation Guide: Basic InstallationsDocument58 pagesSolaris 10 Installation Guide: Basic InstallationsHakim HamzaouiNo ratings yet

- Psychology of Color2Document33 pagesPsychology of Color2abdikani abdilaahiNo ratings yet

- About GoogleDocument7 pagesAbout GoogleMeera Gayathri DNo ratings yet

- Power Learning Strategies Success College Life 7th Edition Feldman Test BankDocument24 pagesPower Learning Strategies Success College Life 7th Edition Feldman Test BankKathyHernandeznobt100% (32)

- Spun Pipe RCC Pipe Hume PipeDocument1 pageSpun Pipe RCC Pipe Hume PipeAbhiishek SinghNo ratings yet

- Woson TandaDocument46 pagesWoson Tandapfe120No ratings yet

- JEDAH 21473 (SPI) K.S.A: Ductile Cast Iron Pipes & FittingsDocument2 pagesJEDAH 21473 (SPI) K.S.A: Ductile Cast Iron Pipes & FittingsLord DaenNo ratings yet

- Discrete Mathematics - Propositional LogicDocument8 pagesDiscrete Mathematics - Propositional LogicAldrich PanioNo ratings yet

- Ibs Kota Bharu 1 30/06/22Document7 pagesIbs Kota Bharu 1 30/06/22Nik Suraya IbrahimNo ratings yet

- Research Assistant - Smart Manufacturing Factory Designer 230795 at University of StrathclydeDocument1 pageResearch Assistant - Smart Manufacturing Factory Designer 230795 at University of StrathclydeOzden IsbilirNo ratings yet

- LAB 7: Functions: Student Name: Nathaneal Anak Biat Student ID: EP01081100 Section:02ADocument9 pagesLAB 7: Functions: Student Name: Nathaneal Anak Biat Student ID: EP01081100 Section:02AWilfredNo ratings yet

- Md. Shahriar Haque Mithun: GPH Ispat LimitedDocument3 pagesMd. Shahriar Haque Mithun: GPH Ispat LimitedMd. Shahriar haque mithunNo ratings yet

- Submittal Patterson Bombs PDFDocument77 pagesSubmittal Patterson Bombs PDFFred GarciaNo ratings yet

- Common Hydraulic Problems - Symptoms and Causes - Hydraproducts - Hydraulic Systems - Hydraulic Power Packs - BlogDocument3 pagesCommon Hydraulic Problems - Symptoms and Causes - Hydraproducts - Hydraulic Systems - Hydraulic Power Packs - BlogLacatusu MirceaNo ratings yet

- MS Disc Brake CaliperDocument2 pagesMS Disc Brake Caliperghgh140No ratings yet

- AN1009: Driving MOSFET and IGBT Switches Using The Si828x: Key FeaturesDocument22 pagesAN1009: Driving MOSFET and IGBT Switches Using The Si828x: Key FeaturesNikolas AugustoNo ratings yet

- Maytag MDG30 MDG50 MDG75 PNH SpecificationsDocument2 pagesMaytag MDG30 MDG50 MDG75 PNH Specificationsmairimsp2003No ratings yet