Professional Documents

Culture Documents

Form A2 Cum Declaration New

Uploaded by

ronzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form A2 Cum Declaration New

Uploaded by

ronzCopyright:

Available Formats

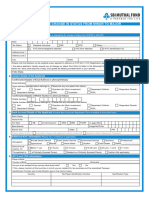

Form A2 – Application cum Declaration

(To be completed by the applicant)

I. Details of the applicant (Remitter) -

Name :

Address :

Date of Birth : Nationality :

Mobile No : Email id :

Aadhaar ID : Passport No : Date of Expiry :

II. Details of Foreign Exchange required (Currency Code & Amount)

Currency Notes Prepaid Card Trav. Cheques Out Remit(TT) FCY Drafts

III. Travel Details

Place of Travel : Date of Travel : Duration (in Days) :

Purpose of Visit : Ticket Number :

IV. Details of the Student (For Outward Remittance & FC Demand Draft)

Name of the Student :

Student Id : Name of University :

V. Outward Remittance - Beneficiary Details

Beneficiary Name :

Beneficiary Address :

Beneficiary Account No :

Bank Name :

Bank Address :

IBAN No :

SWIFT CODE :

ABA Routing / BSB/Sort Code/ Fed Wire :

Correspondent Bank Charges : To be paid bytheBeneficiary To be paid by theRemitter

VI. Foreign Demand Draft

Beneficiary Name : Country :

VII. Payment Details

Payer PAN Number : Payer Name :

OwnFunds Others For others, Specify relationship :

Source Of Funds

Bank Demand CC/

Cash Cheque Transfer Draft DC

Payer Bank Name & Instrument Details

Branch Name

Payer account no : Payer Bank IFSC code :

**In Case where account details are not reflected in payment details then cancelled cheque or bank statement need to be

provided as account details proof

** Only Closed Relatives as per section VI of Companies Act are permitted in the case of remittance which are related to

each other as Husband and wife, if they are members of HUF or they are related to each other as Father (including step

Father), Mother (including step Mother), Brother (including step Brother), Sister (including step Sister), Son (including step

son), Son’s wife, Daughter (including step Daughter), Daughter’s husband.

Declaration cum undertaking

1. I, hereby declare that the total amount of foreign exchange purchased from or remitted through all sources in India during the financial year

including this application is within the overall limit of USD 250,000/- (USD Dollar Two Hundred and Fifty Thousand Only) which is the limit

prescribed by the Reserve Bank of India for the said purpose and certify that the source of funds for making the said remittance belong to me and

the foreign exchange shall not be used for prohibited purposes. The transaction details of which are mentioned above does not involve, and is not

designed for the purpose of any contradiction or evasion of the provisions of the FEMA 1999 or of any Rule, Regulation, Notification, Direction or

Order made there under. I also hereby agree and undertake to provide such information / documents as will reasonable satisfy you about this

transaction in terms of thisdeclaration.

I, undertake that in case, if it is reported that I have breached the LRS limit, I will be my responsibility to bring back/surrender the amount

purchased/remitted in excess of the LRS limit and thereafter I will approach RBI for compounding of contravention under FEMA 1999.

Details of the remittances made /transactions effected under the Liberalized Remittance Scheme in the current financial year (April – March)

Sr No. Date Amount Name and Address of AD branch/ FFMC through which the transaction has been effected

2. I/We have / have not done LRS transaction from other Bank/ Forex issuing authorized agency or breached the ₹ 7 lakhs limit for the fiscal year

earlier with other Bank/Forex issuing authorized agency.

3. I am a foreign national permanently resident in India and that I am not availing facilities for remittance out of my salary, savings etc abroad in

terms of existing exchange control regulation (Applicable for Foreign Nationalsonly)

4. I am a foreign national permanently resident in India and that I am not availing facilities for remittance out of my salary, savings etc abroad in

terms of existing exchange control regulation (Applicable for Foreign Nationalsonly)

5. I shall be responsible and liable for any incorrect information provided by me in the formabove.

6. I further agree that in the event transaction is cancelled or revoked by me after submitting the request, any exchange losses incurred in this

connection to be recovered from the refundamount.

7. I further agree that once the funds remitted by me have been transmitted by Wall Street Finance Ltd (through AD Bank) to the correspondent

and/or beneficiary banks, Wall Street Finance Ltd shall not be responsible for any delays in the disbursement of such funds including the

withholding of such funds by the correspondent and/or beneficiary bank. I agree that once the funds are remitted, intermediary bank charges may

be levied by the correspondent and/or beneficiary banks, which may vary from bank to bank. I agree that in the event the transaction is rejected by

the correspondent and/or beneficiary bank because of incorrect information submitted by me, any charges levied by the

beneficiarybankorexchange lossesincurredinthisconnection,Iwill be liabletopaythesametoWallStreetFinanceLtd.

8. I further confirm that the foreign exchange released for the above mentioned purpose will be used within 180 days of purchase. In case it is not

possible to use within 180 days, same will be surrendered to the authorized person. I am neither a Politically Exposed Person (PEP) nor related to

anyPEP’s.

9. *I also confirm that this foreign exchange will only be use for paying my University fees and overseas education expense only. *applicable only

for student going for overseas education.

Signature of the Applicant Date

To be filled in by Authorized Dealer)

AD Code No.: AD Cat II - 02/2006 Currency : Equivalent to Rs :

Form No : Amount :

GR. No. Purpose Group Purpose Code Description

2 Travel S0301 Business travel.

S0303 Travel for pilgrimage

S0304 Travel for medical treatment

S0305 Travel for education (including fees, hostel expenses etc.)

S0306 Other travel (including holiday trips)

Signature of Branch Official

Branch Location & Stamp

You might also like

- Kotak Multi Currency World Travel Application FormDocument2 pagesKotak Multi Currency World Travel Application FormVivek ShuklaNo ratings yet

- SBFTC Application FormDocument8 pagesSBFTC Application FormAkshay PsNo ratings yet

- A2 FormDocument5 pagesA2 Formshivam parmarNo ratings yet

- FORM A2 Revised FormDocument6 pagesFORM A2 Revised Formcopy catNo ratings yet

- Application Form - Funds Transfer (SWIFT) / Demand Draft: Indian Overseas Bank, BangkokDocument2 pagesApplication Form - Funds Transfer (SWIFT) / Demand Draft: Indian Overseas Bank, Bangkokdhanaraj4uNo ratings yet

- Foreign Currency Endorsement Request E-FormDocument1 pageForeign Currency Endorsement Request E-FormFarah AydedNo ratings yet

- LRSFormDocument3 pagesLRSFormtirthendu senNo ratings yet

- Gold Bond Form PDFDocument5 pagesGold Bond Form PDFrakesh kumar100% (1)

- SB NreDocument7 pagesSB NreAsutosaNo ratings yet

- Application For Import RemittancesDocument1 pageApplication For Import RemittancesRadhakrishnan Rb100% (2)

- Outward Telegraphic Transfer Form (2) - TOSOH 008Document2 pagesOutward Telegraphic Transfer Form (2) - TOSOH 008kanishka112No ratings yet

- Form A Application FormDocument6 pagesForm A Application FormBoinzb TNo ratings yet

- Payment InstructionDocument6 pagesPayment InstructionAstha Suri100% (1)

- IIFL Account Opening Form Non-IndividualDocument36 pagesIIFL Account Opening Form Non-IndividualidkwhiiNo ratings yet

- Client Instruction For (Wire Transfer)Document1 pageClient Instruction For (Wire Transfer)jose gabriel izaguirre DuqueNo ratings yet

- Pay-Out Request Form Ver1.1Document2 pagesPay-Out Request Form Ver1.1Mahendra AsawaleNo ratings yet

- Mam Form For Change in Status From Minor To MajorDocument2 pagesMam Form For Change in Status From Minor To MajorPratap PratapNo ratings yet

- WEL TB PAY002 Account Activation Form PDFDocument1 pageWEL TB PAY002 Account Activation Form PDFAnonymous Z6ve7AqWKNo ratings yet

- Aliceblue Account Opening Form - 12209701723508DXNPK7073QDocument29 pagesAliceblue Account Opening Form - 12209701723508DXNPK7073Qemilan980No ratings yet

- Karvy KYC 32 Pages PDFDocument32 pagesKarvy KYC 32 Pages PDFAjay PatelNo ratings yet

- IOB NRE NRO FCNR Account Opening FormDocument9 pagesIOB NRE NRO FCNR Account Opening FormPurva SoralNo ratings yet

- InstructionsDocument6 pagesInstructionsVarun RamchandaniNo ratings yet

- Application Form For Loan Against Security of Gold Ornaments/ CoinsDocument16 pagesApplication Form For Loan Against Security of Gold Ornaments/ CoinsBharath SaiNo ratings yet

- A2 Cum Lrs Declaration FormDocument1 pageA2 Cum Lrs Declaration Formjpsmu09No ratings yet

- Third Party Payment Declaration Form - PgimDocument2 pagesThird Party Payment Declaration Form - PgimmayankNo ratings yet

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoNo ratings yet

- UCO FormA2Document4 pagesUCO FormA2bikashrgp2017No ratings yet

- Change in Address Non IndividualsDocument4 pagesChange in Address Non IndividualsMOHAN SNo ratings yet

- Account Opening RequirementDocument2 pagesAccount Opening RequirementlenovojiNo ratings yet

- Demand Draft Application FormDocument2 pagesDemand Draft Application FormKamran Atif PechuhoNo ratings yet

- Gold - Bond - Application 2022 23 Series IIIDocument9 pagesGold - Bond - Application 2022 23 Series IIIAshok GNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument22 pagesInstructions / Checklist For Filling KYC FormAshok KumarNo ratings yet

- Request For Swift Customer Transfer': Serial No 2021071506443292 Available Balance Time Received SignatureDocument2 pagesRequest For Swift Customer Transfer': Serial No 2021071506443292 Available Balance Time Received SignatureMudithan MpiniNo ratings yet

- Aliceblue Account Opening Form - 10972801621350FDTPR5379NDocument29 pagesAliceblue Account Opening Form - 10972801621350FDTPR5379Nfhkb7ymzbqNo ratings yet

- UnSignedAOFDocument62 pagesUnSignedAOFVrushab MNo ratings yet

- UnSignedAOFDocument62 pagesUnSignedAOFFlirtis InNo ratings yet

- Application Number APPLICATION FORM For Floating Rate Savings Bonds, 2020 (Taxable)Document6 pagesApplication Number APPLICATION FORM For Floating Rate Savings Bonds, 2020 (Taxable)Vikas AbhyankarNo ratings yet

- ReligareDocument2 pagesReligareAnonymous nx6TUjNP4No ratings yet

- Increase in Credit Limit Request FormDocument1 pageIncrease in Credit Limit Request FormAyra MagpiliNo ratings yet

- State Bank of India: Step 1 - Complete The Identification RequirementDocument8 pagesState Bank of India: Step 1 - Complete The Identification Requirementrafi617No ratings yet

- Data Updation Form: To Be Filled in Block Letters (Please Strike Off Section (S) That Is (Are) Not Applicable)Document2 pagesData Updation Form: To Be Filled in Block Letters (Please Strike Off Section (S) That Is (Are) Not Applicable)Kumar MNo ratings yet

- Form ISR - 1: Request For Registering Pan, Kyc Details or Changes / Updation ThereofDocument7 pagesForm ISR - 1: Request For Registering Pan, Kyc Details or Changes / Updation ThereofAshish RanaNo ratings yet

- Opening & Operation of Bank AccountDocument21 pagesOpening & Operation of Bank AccountNazmul H. PalashNo ratings yet

- Indian Overseas Bank ..BranchDocument6 pagesIndian Overseas Bank ..Branchanwarali1975No ratings yet

- Declaration Form PDFDocument2 pagesDeclaration Form PDFBoopathi KalaiNo ratings yet

- Funds Transfer Request FormDocument3 pagesFunds Transfer Request Formphabianoduor42No ratings yet

- Ερωτηματολόγιο Φυ PDFDocument4 pagesΕρωτηματολόγιο Φυ PDFJiojeqNo ratings yet

- Service Request FormDocument2 pagesService Request FormRS Consultants100% (1)

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document7 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Tejas SompuraNo ratings yet

- IFCI Long Term Infra Bonds Application FormDocument2 pagesIFCI Long Term Infra Bonds Application FormPrajna CapitalNo ratings yet

- AirAsia Product Bundling Claim FormDocument2 pagesAirAsia Product Bundling Claim FormHihiNo ratings yet

- Electoral Bond Application Form EnglishDocument2 pagesElectoral Bond Application Form EnglishJitendra RavalNo ratings yet

- Annexure IV - BarodaINSTA Appln Form - Non Individual - FinalDocument5 pagesAnnexure IV - BarodaINSTA Appln Form - Non Individual - FinalChandrasekar KrishnamurthyNo ratings yet

- Form A2 - LRSDocument6 pagesForm A2 - LRSAbhi YadavNo ratings yet

- Business Loan ApplicationDocument6 pagesBusiness Loan Applicationcatipop450No ratings yet

- Aliceblue Account Opening Form - 7611051270483DNHPA0385MDocument28 pagesAliceblue Account Opening Form - 7611051270483DNHPA0385MSudharshan AvagaddaNo ratings yet

- Sending A Payment To Europe Gibraltar Nwi68546Document3 pagesSending A Payment To Europe Gibraltar Nwi68546jamalazoz05No ratings yet

- Form14052021 ARDocument5 pagesForm14052021 ARKasim ShaikhNo ratings yet

- Contract Type: Lottery/inheritance/ Undelivered Lottery FundDocument2 pagesContract Type: Lottery/inheritance/ Undelivered Lottery FundLoveofyouth ReddyNo ratings yet

- RBI Committee Report On MSMEsDocument142 pagesRBI Committee Report On MSMEsmeenaldutiaNo ratings yet

- FOREXDocument24 pagesFOREXPrasenjit Chakraborty0% (1)

- FIRMS - User ManualDocument112 pagesFIRMS - User ManualAnkit AgarwalNo ratings yet

- GDP For 1st QuarterDocument5 pagesGDP For 1st QuarterUmesh MatkarNo ratings yet

- 1688679676387june 2023 Current Affairs Notes by IBPS GurujiDocument87 pages1688679676387june 2023 Current Affairs Notes by IBPS GurujiJyoti KhatavakarNo ratings yet

- Question Booklet: Read The Following Instructions Carefully Before You Begin To Answer The QuestionsDocument16 pagesQuestion Booklet: Read The Following Instructions Carefully Before You Begin To Answer The QuestionsSwabya Sachi DasNo ratings yet

- A Report On - Npa in BankingDocument120 pagesA Report On - Npa in Bankingsachin99% (129)

- Indian Banking SystemDocument67 pagesIndian Banking SystemTejas MakwanaNo ratings yet

- In Fs Roadmap For Foreign Banks in IndiaDocument35 pagesIn Fs Roadmap For Foreign Banks in IndiaManishNo ratings yet

- ESFB Q2FY23 Investor-Presentation FinalDocument34 pagesESFB Q2FY23 Investor-Presentation FinalDhanush Kumar RamanNo ratings yet

- Self Help Groups (SHGS) in India: Ethiopian DelegationDocument10 pagesSelf Help Groups (SHGS) in India: Ethiopian DelegationKamal DeenNo ratings yet

- OpTransaction - HistoryUX30-01-2023Document4 pagesOpTransaction - HistoryUX30-01-2023Manoj Kumar SharmaNo ratings yet

- IDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Document273 pagesIDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Sourabh PorwalNo ratings yet

- Alteration MemorandumDocument7 pagesAlteration MemorandumPurushotham manthripragadaNo ratings yet

- Scenario of Foreign Banks in IndiaDocument62 pagesScenario of Foreign Banks in IndiaYesha Khona100% (1)

- Career Empire: Judiciary - LL.B Entrance - IAS. Rajouri Garden, Call:9268322688Document9 pagesCareer Empire: Judiciary - LL.B Entrance - IAS. Rajouri Garden, Call:9268322688Shashank PathakNo ratings yet

- 1575374115836b6i6NQFfANE8fi1o PDFDocument8 pages1575374115836b6i6NQFfANE8fi1o PDFRaju SavadattiNo ratings yet

- Wealth Management For NRIsDocument4 pagesWealth Management For NRIsVishal SoniNo ratings yet

- Project On NpaDocument83 pagesProject On NpaTouseef Shagoo64% (11)

- Name: Nikhil P. PalanDocument7 pagesName: Nikhil P. PalanVinit BhindeNo ratings yet

- Banking Regulation Act, 1949Document8 pagesBanking Regulation Act, 1949Animesh BawejaNo ratings yet

- Chapter - 01 Introduction of BankDocument37 pagesChapter - 01 Introduction of BankJeeva JeevaNo ratings yet

- Credit Creation ProcessDocument5 pagesCredit Creation ProcessHarshad NagreNo ratings yet

- Rural Credit..it States Rural Scenerio..helps Rural To Get Credit Easily With The Help of Financial Informations.Document68 pagesRural Credit..it States Rural Scenerio..helps Rural To Get Credit Easily With The Help of Financial Informations.Ankit Yogesh BavishiNo ratings yet

- Bank P.O Preparation Exam GuideDocument166 pagesBank P.O Preparation Exam GuideHimanshu Goel100% (1)

- 5 6332186987344167904Document21 pages5 6332186987344167904ergsanjaliNo ratings yet

- Nit Ceg9620l19Document118 pagesNit Ceg9620l19Bittudubey officialNo ratings yet

- Report - 3Document58 pagesReport - 3RahulNo ratings yet

- Operational Risk: An Overview: Dr. Richa Verma BajajDocument37 pagesOperational Risk: An Overview: Dr. Richa Verma BajajJoydeep DuttaNo ratings yet