Professional Documents

Culture Documents

733pgdm QP Cval Set 1

Uploaded by

sanket patilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

733pgdm QP Cval Set 1

Uploaded by

sanket patilCopyright:

Available Formats

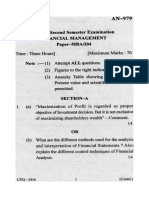

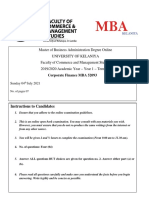

Course: PGDM (Finance)

Trimester IV

Div. Finance Grp 1/2/3 Marks 30

Date: 23rd September 2021 Time: 90 minutes

Subject: Corporate Valuation

INSTRUCTIONS:

1. Question No 1 is compulsory and carries 10 marks.

2. From the remaining three questions answer any two. Each question carries 10 marks.

Q. No. 1 10 Marks (CO1, CO2, CO3,

CO4)

Riso Detergents is a low-cost producer of a good quality detergent brand called “RISO”. The

company was set up 12 years ago by A.P. Kumar. The Income Statement and Balance sheet for the

last year is as under:

Amt INR crores

Income Statement Balance Sheet

Revenues 900 Shareholders’ funds 500

(10 crores shares @ INR10 each)

PBDIT 209 Loans 200

Depreciation 45 700

PBIT 164

Interest 24 Net Fixed Assets 450

PBT 140 Net Current Assets 250

Tax 49 700

PAT 91

Since the company was consistently performing well, A.P Kumar plans to make the company

public and liquefy a portion of his holding. He approached Anjan Gupta from Global Capital an

Investment banking firm to help him estimate the worth of his shares. The company is currently

operating in western India, plans to set up a unit in Hyderabad in the next two years which would

improve the profits of the business. After getting details of capex plans, Anjan Gupta develops the

following forecast of operating profit and investment requirements for 6 years. Beyond year 6, it is

expected that the company would grow at a stable rate of 8% which can be applied to its free cash

flow as well.

Forecasted operating profit and investments

Year 1 2 3 4 5 6

Revenues 950 1000 1200 1450 1660 1770

PBDIT 195 200 210 305 330 374

Depreciation 55 85 80 83 85 87

PBIT 140 115 130 222 245 287

Investment in Fixed Assets 100 250 85 100 105 120

Investment in net current assets 10 15 70 70 70 54

The current debt equity ratio is expected to be maintained. Pre-tax cost of debt is 12%. Tax rate is

35%, unlevered beta of similar publicly traded company is 0.9, risk free rate is taken at 5% and

risk premium at 7%. Tax rate is 25%

Calculate the DCF value of the firm and the value per share. Make suitable assumptions if

required.

Q. No. 2. 10 Marks (CO1,

CO4)

Apex Ltd has an invested capital of 500 million. Its ROCE is 18% and its weighted average cost of

capital is 14%. The expected growth rate in Apex’s revenues and invested capital will be 15% for

the first three years and 12% for the next two years.

a) Determine the intrinsic value of the enterprise using Economic Profit model. (5

marks)

b) Discuss the applicability of H Model in the context of corporate valuation.

(5 marks)

Q. No. 3. 10 Marks (CO2,

CO4)

Sasken Ltd reported sales of 1700 million for the y.e. 31/3/21 with a PAT of 181 million. Its

invested capital is 1314 million in equity (500 lakh shares @ INR 10/-) and 14 million in debt. It

proposes to use P/E, P/BV and P/Sales to get its imputed value. The relevant multiples of

comparable companies are as under:

Multiple Telelinks Ltd Datafast Ltd

P/E 25.6 12

P/BV 5.75 3.21

P/Sales 5.62 2.45

Determine the value per share of Sasken Ltd based on comparable companies. Sasken’s CMPS is

INR 200/-

Q. No. 4. Short notes (any two) 10 Marks

(CO1)

a) Critical Evaluation of EV/Sales v/s EV/BV multiples

b) Challenges in valuation of Private companies.

c) Sector specific multiples used in valuation

SECTOR-SPECIFIC MULTIPLES The value of a firm can be standardized using a number of sector-

specific multiples. The value of steel companies can be compared based on market value per ton of

steel produced, and the value of electricity generators can be computed on the basis of kilowatt

hour (kwh) of power produced. In the past few years, analysts following new technology firms have

become particularly inventive with multiples that range from value per subscriber for Internet

service providers to value per web site visitor for Internet portals to value per customer for

Internet retailers. Why Analysts Use Sector-Specific Multiples The increase in the use of sector-

specific multiples in the last few years has opened up a debate about whether they are a good way

to compare relative value. There are several reasons why analysts use sector-specific multiples:

■ They link firm value to operating details and output. For analysts who begin with these forecasts

—predicted number of subscribers for an Internet service provider, for instance—they provide a

much more intuitive way of estimating value. ■ Sector-specific multiples can often be computed

with no reference to accounting statements or measures. Consequently, they can be estimated for

firms where accounting statements are nonexistent, unreliable, or just not comparable. Thus, you

could compute the value per kwh sold for Latin American power companies and not have to worry

about accounting differences across these countries. ■ Though this is usually not admitted to,

sector-specific multiples are sometimes employed in desperation because none of the other

multiples can be estimated or used. For instance, an impetus for the use of sector-specific

multiples for new economy firms was that they often had negative earnings and little in terms of

book value or revenues. Limitations Though it is understandable that analysts sometimes turn to

sector-specific multiples, there are two significant problems associated with their use: 1. They feed

into the tunnel vision that plagues analysts who are sector focused, and thus they allow entire

sectors to become overpriced. A cable company

You might also like

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Corporate Valuation DCF ModelDocument2 pagesCorporate Valuation DCF Modelsanket patilNo ratings yet

- KC 2 Pilot PaperDocument10 pagesKC 2 Pilot Paperxanax_1984No ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- Case Summary FMDocument7 pagesCase Summary FMnrngshshNo ratings yet

- 15M 228-261 FinancialManagementInEnergySector_20190410073530.029_XDocument7 pages15M 228-261 FinancialManagementInEnergySector_20190410073530.029_XKartik AnejaNo ratings yet

- Corporate Financial ManagementDocument3 pagesCorporate Financial ManagementRamu KhandaleNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- 05 s601 SFM PDFDocument4 pages05 s601 SFM PDFMuhammad Zahid FaridNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Synopsis Crompton Greaves Consumer Electrical Ltd.Document4 pagesSynopsis Crompton Greaves Consumer Electrical Ltd.HIMANSHU RAWATNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- CBCS 3.3.3 Corporate Valuation and Restructuring 2020Document4 pagesCBCS 3.3.3 Corporate Valuation and Restructuring 2020Bharath MNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- Valuation of MEGA MART BusinessDocument2 pagesValuation of MEGA MART BusinessRadNo ratings yet

- CECDocument4 pagesCECJyoti Berwal0% (3)

- Finance II Mid-Term Exam 2020Document4 pagesFinance II Mid-Term Exam 2020Yash KalaNo ratings yet

- Initiating Coverage - Expleo Solutions - 050822Document19 pagesInitiating Coverage - Expleo Solutions - 050822rathore400No ratings yet

- Section A: Compulsory: Question 1 (25 Marks)Document10 pagesSection A: Compulsory: Question 1 (25 Marks)mis gunNo ratings yet

- AS Business AnalysisDocument4 pagesAS Business AnalysisLaskar REAZNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementhyp siinNo ratings yet

- Financial Management DecisionsDocument3 pagesFinancial Management DecisionsSwarnavNo ratings yet

- Kalpataru Power Transmission LTD.: Edelweiss Professional Investor ResearchDocument19 pagesKalpataru Power Transmission LTD.: Edelweiss Professional Investor ResearchDhavalNo ratings yet

- Course Code: MBT 551 Kolp/Rw - 19 /9207 First Semester Master of Business Administration (CBCS) ExaminationDocument3 pagesCourse Code: MBT 551 Kolp/Rw - 19 /9207 First Semester Master of Business Administration (CBCS) ExaminationHarshita NirmalNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- Pakistan: Monday, The 17th February 2014Document4 pagesPakistan: Monday, The 17th February 2014magnetbox8No ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Cosmetics Investment AnalysisDocument5 pagesCosmetics Investment AnalysisAsmita MoonNo ratings yet

- sFikv8tLO3DuTOB3I8bY--4762Document2 pagessFikv8tLO3DuTOB3I8bY--4762dipusharma4200No ratings yet

- Advanced Financial Management Elective PaperDocument3 pagesAdvanced Financial Management Elective PaperRamakrishna NagarajaNo ratings yet

- Submitted To Chitkara Business School in Partial Fulfilment of The Requirements For The Award of Degree of Master of Business AdministrationDocument8 pagesSubmitted To Chitkara Business School in Partial Fulfilment of The Requirements For The Award of Degree of Master of Business AdministrationVishu GuptaNo ratings yet

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Document20 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingHarsh DedhiaNo ratings yet

- Performance Measurement 2023Document2 pagesPerformance Measurement 20232022919913No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument10 pagesUniversity of Mauritius: Faculty of Law and Managementmis gunNo ratings yet

- Diwali Picks October - Fundamental DeskDocument16 pagesDiwali Picks October - Fundamental DeskSenthil KumarNo ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- Bec524 and Bec524e Test 2 October 2022Document5 pagesBec524 and Bec524e Test 2 October 2022Walter tawanda MusosaNo ratings yet

- Graduate School of Business ExaminationsDocument16 pagesGraduate School of Business ExaminationsLaston MilanziNo ratings yet

- CCL Products - Pick of The Week - Axis Direct - 06112021 - 08-11-2021 - 08Document5 pagesCCL Products - Pick of The Week - Axis Direct - 06112021 - 08-11-2021 - 08Tanishk OjhaNo ratings yet

- Kolte-Patil Developers LTDDocument35 pagesKolte-Patil Developers LTDArghya DasNo ratings yet

- MBA Financial Management AssignmentDocument4 pagesMBA Financial Management AssignmentRITU NANDAL 144No ratings yet

- Maximizing Value Through Optimal Capital StructureDocument4 pagesMaximizing Value Through Optimal Capital Structurehyp siinNo ratings yet

- CF Pre Final 2022Document3 pagesCF Pre Final 2022riddhi sanghviNo ratings yet

- NBS Corporate Finance 2022 Assignment 2-Due-20220916Document7 pagesNBS Corporate Finance 2022 Assignment 2-Due-20220916SoblessedNo ratings yet

- Tutorial 4 - SolutionDocument16 pagesTutorial 4 - SolutionNg Chun SenfNo ratings yet

- Century Plyboards (India) Limited: Summary of Rated Instruments Instrument Rated Amount (In Crore) Rating ActionDocument8 pagesCentury Plyboards (India) Limited: Summary of Rated Instruments Instrument Rated Amount (In Crore) Rating ActionDeepakNo ratings yet

- Corporate FinanceDocument7 pagesCorporate Financeseyon sithamparanathanNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- 01 - Adv Issues in Cap BudgetingDocument17 pages01 - Adv Issues in Cap BudgetingMudit KumarNo ratings yet

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- Evaluating Financial Viability of Construction ContractDocument5 pagesEvaluating Financial Viability of Construction ContractSyed Muhammad JawwadNo ratings yet

- Cash Flow Estimation Class ExcerciseDocument5 pagesCash Flow Estimation Class ExcercisethinkestanNo ratings yet

- Clinch The Deal QuizDocument6 pagesClinch The Deal QuizNiraj_Murarka_5987No ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Interview Shortlist - N L DalmiaDocument1 pageInterview Shortlist - N L Dalmiasanket patilNo ratings yet

- Subham Kumar's Resume - PGDM, B.Com, Finance ExperienceDocument1 pageSubham Kumar's Resume - PGDM, B.Com, Finance Experiencesanket patilNo ratings yet

- Duration & ConDocument63 pagesDuration & Consanket patilNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Finance Elective Tri V Batch 2021-23Document12 pagesFinance Elective Tri V Batch 2021-23sanket patilNo ratings yet

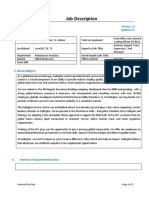

- Associate - Risk Monitoring (Mid Market)Document2 pagesAssociate - Risk Monitoring (Mid Market)sanket patilNo ratings yet

- Ia & M NldimsrDocument107 pagesIa & M Nldimsrsanket patilNo ratings yet

- JD - Credit ManagerDocument2 pagesJD - Credit Managersanket patilNo ratings yet

- AIS Question BankDocument11 pagesAIS Question Banksanket patilNo ratings yet

- Critical Analysis Of: Multiple Regression ModelDocument12 pagesCritical Analysis Of: Multiple Regression Modelsanket patilNo ratings yet

- Asian Paints Balance Sheet and Profit & Loss Statement AnalysisDocument64 pagesAsian Paints Balance Sheet and Profit & Loss Statement Analysissanket patilNo ratings yet

- SM Consolidated 2021-23batchDocument176 pagesSM Consolidated 2021-23batchsanket patilNo ratings yet

- PGDM D - Corp ValDocument2 pagesPGDM D - Corp Valsanket patilNo ratings yet

- JD - Financial Advisory - Trainee, Advisor, Sr. AdvisorDocument3 pagesJD - Financial Advisory - Trainee, Advisor, Sr. Advisorsanket patilNo ratings yet

- Relative Valuation Guide for Telecom CompanyDocument22 pagesRelative Valuation Guide for Telecom Companysanket patilNo ratings yet

- CORPORATE VALUATIONDocument26 pagesCORPORATE VALUATIONsanket patilNo ratings yet

- JD - MT - TechnicalDocument1 pageJD - MT - Technicalsanket patilNo ratings yet

- ValuationDocument18 pagesValuationsanket patilNo ratings yet

- ValuationDocument18 pagesValuationsanket patilNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelsanket patilNo ratings yet

- Antiragging FormDocument2 pagesAntiragging Formsanket patilNo ratings yet

- Discounted Cash Flow ValuationDocument45 pagesDiscounted Cash Flow Valuationnotes 1No ratings yet

- Guidelines For Filling Online Antiragging Form 1Document1 pageGuidelines For Filling Online Antiragging Form 1sanket patilNo ratings yet

- Ticket 31 OctDocument2 pagesTicket 31 Octsanket patilNo ratings yet

- JD For ESG AnalystDocument2 pagesJD For ESG Analystsanket patilNo ratings yet

- Valuation Methods Earnings Capitalisation, Net Asset, Stock and DebtDocument6 pagesValuation Methods Earnings Capitalisation, Net Asset, Stock and Debtsanket patilNo ratings yet

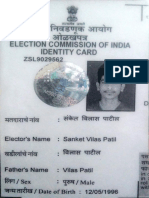

- Sanket Patil Draft1Document1 pageSanket Patil Draft1sanket patilNo ratings yet

- Voters ID - Sanket PatilDocument2 pagesVoters ID - Sanket Patilsanket patilNo ratings yet

- Equity Valuation Report - LVMHDocument3 pagesEquity Valuation Report - LVMHFEPFinanceClubNo ratings yet

- NCFM Model Test PaperDocument36 pagesNCFM Model Test PaperSpl FriendsNo ratings yet

- Ronw Roce Fixed Assest T.ODocument45 pagesRonw Roce Fixed Assest T.Ofbk4sureNo ratings yet

- Prospective Analysis ForecastingDocument17 pagesProspective Analysis ForecastingYang Ying ChanNo ratings yet

- Common Fraud Scenarios GuideDocument16 pagesCommon Fraud Scenarios GuideMaria Rona SilvestreNo ratings yet

- Speciality Chemicals - Nirmal Bang - Rally JustifiedDocument21 pagesSpeciality Chemicals - Nirmal Bang - Rally Justifiedvipul sharmaNo ratings yet

- AC3059 Financial Management Subject Guide 2012Document166 pagesAC3059 Financial Management Subject Guide 2012Emily Tan50% (2)

- Sample Test Bank Valuation Measuring and Managing The Value of Companies 6th Edition McKinseyDocument7 pagesSample Test Bank Valuation Measuring and Managing The Value of Companies 6th Edition McKinseySandra Navarrete100% (1)

- BANK JAGO EXECUTIONDocument5 pagesBANK JAGO EXECUTIONTasya AngelineNo ratings yet

- Bioalpha Holdings (Biohldg-Ku) : Average ScoreDocument11 pagesBioalpha Holdings (Biohldg-Ku) : Average ScoreShahrul NizamNo ratings yet

- SWAP Cocept Construction & ValuationDocument71 pagesSWAP Cocept Construction & ValuationKaushik BhattacharjeeNo ratings yet

- ch07 Week 7Document112 pagesch07 Week 7AsiiyahNo ratings yet

- Operations ManagementDocument9 pagesOperations ManagementVmani KandanNo ratings yet

- ExxonMobil Analysis ReportDocument18 pagesExxonMobil Analysis Reportaaldrak100% (2)

- 07 JUNE QuestionDocument11 pages07 JUNE Questionkhengmai67% (3)

- High Court Judgement - Hansen 2006-06-04Document16 pagesHigh Court Judgement - Hansen 2006-06-04api-53711077No ratings yet

- S4Hana - SD Integration With FICODocument74 pagesS4Hana - SD Integration With FICOBhargav ReddyNo ratings yet

- DerivSERV Technical Specification - Equity Derivatives v6.0 Revision 4Document255 pagesDerivSERV Technical Specification - Equity Derivatives v6.0 Revision 4Binny SharmaNo ratings yet

- Annexure 9 Functional and Technical Requirement (UPDATED) Annexure 9.0 GeneralDocument47 pagesAnnexure 9 Functional and Technical Requirement (UPDATED) Annexure 9.0 GeneraldarshangoshNo ratings yet

- Christensen 12e Chap01 2019Document70 pagesChristensen 12e Chap01 2019Christy You100% (2)

- 2018 6-10-104 KB1-Business Financial ReportingJune 2018 EnglishDocument11 pages2018 6-10-104 KB1-Business Financial ReportingJune 2018 EnglishharoldpsbNo ratings yet

- Professional Stock Market Training Course by Shakti Shiromani ShuklaDocument12 pagesProfessional Stock Market Training Course by Shakti Shiromani ShuklaShakti ShuklaNo ratings yet

- Arshiya IPM01010 ReportDocument19 pagesArshiya IPM01010 ReportKeshav AgarwalNo ratings yet

- Chapter 6.valuation of SDocument48 pagesChapter 6.valuation of SPark CảiNo ratings yet

- 08 Inventories MeasurementDocument97 pages08 Inventories Measurementwerewolf966No ratings yet

- LaundromatDocument10 pagesLaundromatCharlotte GarciaNo ratings yet

- National Msme Awrads 2021 - 22 To 2025 - 26Document18 pagesNational Msme Awrads 2021 - 22 To 2025 - 26Lalith VaradhanNo ratings yet

- Out PDFDocument16 pagesOut PDFsuharditaNo ratings yet

- Europe and China Play A Role-Reversal: European Investment StrategyDocument23 pagesEurope and China Play A Role-Reversal: European Investment StrategySiphoKhosaNo ratings yet