Professional Documents

Culture Documents

Ratio Excercise 2

Uploaded by

Marwan Aqrab0 ratings0% found this document useful (0 votes)

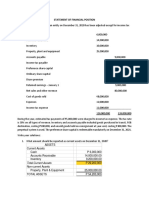

4 views1 pageThe document provides the balance sheet and income statement for a company as of December 31, 2018. The balance sheet shows total assets of 6,768,900 JD and total liabilities and owner's equity of the same amount. The income statement shows the company had net sales of 4,450,000 JD and net profit after tax of 2,104,875 JD for the year ended December 31, 2018. The document asks to calculate 10 different financial ratios based on the information provided.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides the balance sheet and income statement for a company as of December 31, 2018. The balance sheet shows total assets of 6,768,900 JD and total liabilities and owner's equity of the same amount. The income statement shows the company had net sales of 4,450,000 JD and net profit after tax of 2,104,875 JD for the year ended December 31, 2018. The document asks to calculate 10 different financial ratios based on the information provided.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageRatio Excercise 2

Uploaded by

Marwan AqrabThe document provides the balance sheet and income statement for a company as of December 31, 2018. The balance sheet shows total assets of 6,768,900 JD and total liabilities and owner's equity of the same amount. The income statement shows the company had net sales of 4,450,000 JD and net profit after tax of 2,104,875 JD for the year ended December 31, 2018. The document asks to calculate 10 different financial ratios based on the information provided.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Ratio Analysis Ratio

Balance Sheet As On 31 / 12 / 2018

liabilities and Owner Equity 2018 Assets 2018

Account payable 195,000 Cash 140,000

Accruals 90,000 Short term investment 620,000

Outstanding tax 75,000 Account receivable 120,000

Inventory 700,000

Bank loan 400,000

Bonds 400,000 Long term investment 2,850,000

Land and Buildings 650,000

Common stock (Par Value J.D.2) 3,500,000 Plant and Machinery 1,200,000

Reserve 250,000 .Accumulated Dep 27,000-

Retained earnings 1,858,900 Other Assets 515,900

Total liabilities and Owner Equity 6,768,900 Total Assets 6,768,900

Income statement for the year ended 31/12/2018

Particulars .J.D

Gross Sales 4,500,000

less:- Allowances 50,000-

Net sales 4,450,000

Less:- Cost of goods sold 1,250,000-

Gross profit 3,200,000

Less:- Operating expenses 220,000-

Less:- Administrative expenses 115,000-

Less:- depreciation 25,000-

EBIT 2,840,000

Less:- Interest expenses 40,500-

Add- profit on sale of Plant and Machinery 7,000

EBT 2,806,500

less:- Income tax 701,625-

Net profit after tax 2,104,875

Retained earnings for the year 841,950

From the above financial data find out the following ratios and explain your results: -

1- Test acid ratio.

2- ROA.

3- Collection Period.

4- Total debt ratio.

5- Dividend per share.

6- Net-working capital turnover.

7- Days to sell inventory.

8- Price / Earnings ratio, (Stock market value J.D. 3.40)

9- Stock book value.

10- EPS.

You might also like

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- LZC Ltd Financial Statement AnalysisDocument2 pagesLZC Ltd Financial Statement AnalysisIQRAsummers 2021No ratings yet

- SOLUTION TO SCHEDULE 3gDocument4 pagesSOLUTION TO SCHEDULE 3gKrushna Omprakash MundadaNo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- Colleagues Co. Statement of Financial Statements December 31, 20X1Document6 pagesColleagues Co. Statement of Financial Statements December 31, 20X1Keahlyn BoticarioNo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Colleagues CoDocument7 pagesColleagues CoKeahlyn BoticarioNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Zach Industries Financial Ratio AnalysisDocument2 pagesZach Industries Financial Ratio AnalysisCarla RománNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- Finac 3 TopicsDocument9 pagesFinac 3 TopicsCielo Mae Parungo60% (5)

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (27)

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Cash Flow and Financial Planning Chapter SolutionsDocument3 pagesCash Flow and Financial Planning Chapter SolutionsSaifur R. SabbirNo ratings yet

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1Puteri Noor SyahiraNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Case Study 1Document2 pagesCase Study 1ruruNo ratings yet

- BusFin PT 4Document2 pagesBusFin PT 4Nadjmeah AbdillahNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMelanie SamsonaNo ratings yet

- Preparation of Financial Reports for Activity 1.4.ADocument1 pagePreparation of Financial Reports for Activity 1.4.AheyheyNo ratings yet

- Line ItemDocument295 pagesLine ItemEve Rose Tacadao IINo ratings yet

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Entity ADocument4 pagesEntity Ataeyung kimNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsAsad RehmanNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- The Deluxe Store Income Statement For The Year Ended November 30, 2020Document2 pagesThe Deluxe Store Income Statement For The Year Ended November 30, 2020Charisa BenjaminNo ratings yet

- 11 To 20Document96 pages11 To 20JorniNo ratings yet

- IND AS CASH FLOW AND INVENTORY ERRORSDocument75 pagesIND AS CASH FLOW AND INVENTORY ERRORSshagufta afrin100% (1)

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Final Account, Income Statement and Financial Analysis Practice QuestionsDocument36 pagesFinal Account, Income Statement and Financial Analysis Practice QuestionsMansi GoelNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Non-Current Asset: Balance Sheet 31-Dec-20Document4 pagesNon-Current Asset: Balance Sheet 31-Dec-20Shehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Ratio Analysis WorksheetDocument5 pagesRatio Analysis WorksheetAnish AroraNo ratings yet

- Copy 1 ACC 223 Practice Problems for Financial Ratio AnalysisDocument3 pagesCopy 1 ACC 223 Practice Problems for Financial Ratio AnalysisGiane Bernard PunayanNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Activity 1 FinMaDocument3 pagesActivity 1 FinMaDiomela BionganNo ratings yet

- Finlord Traders RatiosDocument6 pagesFinlord Traders RatiosMUINDI MUASYA KENNEDY D190/18836/2020No ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Prepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceDocument4 pagesPrepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceEntertainment StatusNo ratings yet

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument4 pagesEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- The Determinants of Profitability in Listed Enterprises - A Study From Vietnamese Stock ExchangeDocument12 pagesThe Determinants of Profitability in Listed Enterprises - A Study From Vietnamese Stock ExchangeTrần Thái Đình KhươngNo ratings yet

- Study OmanDocument10 pagesStudy OmanMarwan AqrabNo ratings yet

- Study USADocument11 pagesStudy USAMarwan AqrabNo ratings yet

- Study MalaysiaDocument17 pagesStudy MalaysiaMarwan AqrabNo ratings yet

- Principles, Tools, and TechniquesDocument12 pagesPrinciples, Tools, and TechniquesLaz FaxNo ratings yet

- DBB2104 Unit-08Document24 pagesDBB2104 Unit-08anamikarajendran441998No ratings yet

- PS 10 - Chapter 12 - Standard Setting - Economic Issues (Solutions)Document33 pagesPS 10 - Chapter 12 - Standard Setting - Economic Issues (Solutions)Matteo VidottoNo ratings yet

- Gujarat State Eligibility Test: Gset SyllabusDocument6 pagesGujarat State Eligibility Test: Gset SyllabussomiyaNo ratings yet

- MS Ase20104Document17 pagesMS Ase20104Aung Zaw HtweNo ratings yet

- Ultimate Sample Paper 2Document22 pagesUltimate Sample Paper 2Tûshar ThakúrNo ratings yet

- NUS GraduateModulesOutlineDocument19 pagesNUS GraduateModulesOutlinePua Suan Jin RobinNo ratings yet

- M Arkan Hafidz - 2602297301 - Assignment Week 2Document6 pagesM Arkan Hafidz - 2602297301 - Assignment Week 2Arkan HafidzNo ratings yet

- WORKSHEET Erlinda Seechua AutosavedDocument3 pagesWORKSHEET Erlinda Seechua AutosavedJeraldine DejanNo ratings yet

- BCOE - 143 E DoneDocument4 pagesBCOE - 143 E DoneAmit YadavNo ratings yet

- BAC 1 Lesson8CompletingtheAccountingProcessforaServiceBusiness PDFDocument21 pagesBAC 1 Lesson8CompletingtheAccountingProcessforaServiceBusiness PDFAndwaeNo ratings yet

- MiniScribe Corporation - FSDocument5 pagesMiniScribe Corporation - FSNinaMartirezNo ratings yet

- SM Ch3-6Document14 pagesSM Ch3-6Danka PredolacNo ratings yet

- Statement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FDocument2 pagesStatement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FPavan BasundeNo ratings yet

- Management Thesis: Sbi Mutual Fund Is Better Investment PlanDocument19 pagesManagement Thesis: Sbi Mutual Fund Is Better Investment Plansukra vaniNo ratings yet

- Calculating Days Sales Outstanding, Working Capital Ratio & Economic Order QuantityDocument2 pagesCalculating Days Sales Outstanding, Working Capital Ratio & Economic Order QuantityViren BansalNo ratings yet

- AmalagamationDocument3 pagesAmalagamationPavan ReddyNo ratings yet

- Lecture 4 TAXES AND THE MARGINAL INVESTORDocument14 pagesLecture 4 TAXES AND THE MARGINAL INVESTORAshiv MungurNo ratings yet

- GAAPDocument12 pagesGAAPshuvo134100% (3)

- Lucky Cement Financial Reports AnalysisDocument9 pagesLucky Cement Financial Reports AnalysistimezitNo ratings yet

- Laws On Enterprises: LLM. Bui Doan Danh ThaoDocument65 pagesLaws On Enterprises: LLM. Bui Doan Danh ThaoThuỷ VươngNo ratings yet

- Piramal Glass: Climbing Up The "Glass Value Chain"Document12 pagesPiramal Glass: Climbing Up The "Glass Value Chain"Jayaprakash MNo ratings yet

- Startup Financial Planning - PPT DownloadDocument7 pagesStartup Financial Planning - PPT DownloadhomsomNo ratings yet

- Nism XV - Research Analyst Exam - Last Day Test 1Document54 pagesNism XV - Research Analyst Exam - Last Day Test 1roja14% (7)

- Delos Santos Engineering Economy Lesson 9 10Document25 pagesDelos Santos Engineering Economy Lesson 9 10Navarro, Jherwin F.No ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- SHORT NOTES (Got It Pass)Document124 pagesSHORT NOTES (Got It Pass)HossainAmzadNo ratings yet

- CUAC 408 Advanced Taxation Course Outline 2023Document9 pagesCUAC 408 Advanced Taxation Course Outline 2023Fungai ManganaNo ratings yet

- Portfolio Management in IndiaDocument12 pagesPortfolio Management in IndiaiammonelNo ratings yet

- Depreciation DBM DDBM SYDDocument16 pagesDepreciation DBM DDBM SYDTayam Prince RussellNo ratings yet