Professional Documents

Culture Documents

Calaguas Account

Uploaded by

Margielene Taglinao-WabeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calaguas Account

Uploaded by

Margielene Taglinao-WabeCopyright:

Available Formats

MARGIELENE T.

WABE MARCH 2 ,2022

G-2

PERPETUAL METHOD

BOOKKEEPING NC III

Merchandising Concern

T. CALAGUAS

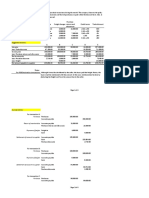

JOURNAL

DATE ACC

2014 PARTICULARS NO. DEBIT CREDIT

March 1 Cash 100 550,000.00

T. Calaguas Capital 300 550,000.00

To record initial investment.

Prepaid Rent 130 30,000.00

Cash 100 30,000.00

To record paid rental in advance

2 Supplies 140 11,700.00

Account payable-Shaw Company 200 11,700.00

To record purchased supplied on

Account-Shaw company

3 Merchandise Inventory 120 19,000.00

Account payable-CUMC 200 19,000.00

To record purchased merchandise

From CUMC

Merchandise Inventory 120 250.00

Account payable-CUMC 200 250.00

To record Ttransportation cost

4 Office Equipment 150 8,640.00

Account Payable-Regent Company 200 8,640.00

To record purchased office

Office equipment on account.

Account Receivable 110 4,000.00

Sales 400 4,000.00

To record sold merchandise on

Account.

Cost of merchandise sold 3,100.00

Merchandise Inventory 120 3,100.00

To record merchandise sold.

Delivery Expense 630 300.00

Cash 100 300.00

To record cost of delivery.

14 Account Receivable 110 25,250.00

Sales 400 25,250.00

To record sold merchandise on

Account on Sabal Hospital.

Cost of merchandise sold 15,500.00

Merchandise Inventory 120 15,500.00

To record purchased merchandise

On account

12 Delivery Expense 630 500.00

Cash 100 500.00

To record cost of delivery.

15 Salaries Expense 600 3,500.00

Cash 100 3,500.00

To record paid Salaries.

Cash 100 230.00

Merchandise Inventory 120 230.00

To record refund for cash purchases

18 Cash 100 36,200.00

Sales 400 36,200.00

To record sold merchandise

Cost of merchandise sold 24,600.00

Merchandise Inventory 120 24,600.00

To record cost of merchandise sold.

Delivery Expense 630 150.00

Cash 100 150.00

To record cost of delivery.

22 Sales Return & Allowances 420 1,550.00

Account Receivable 110 1,550.00

To record returned merchandise.

Merchandise Inventory 120 500.00

Cost of merchandise sold 500.00

To record cost merchandise.

24 Utilities Expense 610 5,250.00

Cash 100 5,250.00

To record electric & water bill.

Insurance 620 5,450.00

Cash 100 5,450.00

To record paid insurance.

5 Account payable-Shaw Company 200 5,000.00

Cash 100 5,000.00

To record partial payment.

Account payable-CUMC 200 750.00

Merchandise Inventory 120 750.00

To record sold merchandise on

Account.

Cost of merchandise sold 1,800.00

Merchandise Inventory 120 1,800.00

To record merchandise sold.

Cash 100 3,960.00

Sales Discount 410 40

Account Receivable 110 4,000.00

To record full payment.

9 Account payable-Shaw CUMC 200 19,000.00

Cash 100 18,620.00

Merchandise Inventory 380.00

Account payable-Regent company 200 4,500.00

Cash 100 4,500.00

To record partial payment.

.

11

Merchandise Inventory 120 2,700.00

Cash 100 2,700.00

To record purchased merchandise

Sales returns & allowances 430 600.00

Account REceivable 110 600.00

Merchandise Inventory 120 250.00

Cost of Merchandise Sold 250.00

To record merchandise sold.

13 Merchandise Inventory 120 29,725.00

Cash 100 29,725.00

To record purchased merchandise

Merchandise Inventory 120 275.00

Cash 100 275.00

To record cost of delivery.

Cash 100 2,600.00

Account Receivable. 110 2,600.00

26 Cash 100 23,700.00

Account Receivable. 110 23,700.00

To record full payment of Sabal

Hospital.

Salaries Expense 600 3,500.00

Cash 100 3,500.00

To record paid salaries.

T. Calaguas Drawing. 310 5,500.00

Cash 100 5,500.00

To record drawing.

MARGIELENE T. WABE MARCH 2 ,2022

G-2

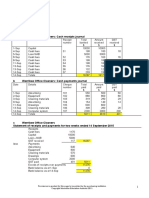

T. CALAGUAS

CHART OF ACCOUNT

DATE ACC

2014 ACCOUNT TITLE NO. DEBIT CREDIT

MARCH

ASSETS

Current Assets

Cash 100

Account receivable 110

Merchandise Inventory 120

Prepaid Rent 130

Supplies 140

Office Equipment 150

Liabelities

Account payable 200

Owners Equity

T. Calaguas Capital 300

T. Calaguas withdrawal 310

Revenue

Sales 400

Sales Discount 410

Sales Returns & Allowances 430

Expenses

Salaries Expense 600

UtilitiesExpense 610

Insurance expense 620

Delivery Expense 630

You might also like

- Rosalinda's Boutique Chart of Accounts Assets Current AssetsDocument8 pagesRosalinda's Boutique Chart of Accounts Assets Current AssetsRechelleRuthM.DeiparineNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- VertudezDocument4 pagesVertudezralph yapNo ratings yet

- CB Niat 2019 Exam SolutionsDocument14 pagesCB Niat 2019 Exam Solutionsdean garciaNo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- Midterms FAR Quiz 1Document15 pagesMidterms FAR Quiz 1mariejoyceaggabaoNo ratings yet

- InventoryDocument18 pagesInventoryAdam Cuenca100% (1)

- Chapter 6 FAR Periodic Accounting CycleDocument5 pagesChapter 6 FAR Periodic Accounting CycleShaina Lane B. AmbataliNo ratings yet

- Castro Company ZABALLADocument11 pagesCastro Company ZABALLAHelping Five (H5)No ratings yet

- Sem Plang Merchandising Perpetual Problem With AnswersDocument21 pagesSem Plang Merchandising Perpetual Problem With AnswersJayson Miranda100% (1)

- Merchandising Problem 1 AnswerDocument2 pagesMerchandising Problem 1 AnswerBrian Gerome MercadoNo ratings yet

- BOOKKEEPINGDocument59 pagesBOOKKEEPINGggtxc7x2bk100% (1)

- AIS - Midterm RequirementDocument27 pagesAIS - Midterm RequirementarriolasevNo ratings yet

- Ms. Diaz Answer KeyDocument5 pagesMs. Diaz Answer KeysheeshquietNo ratings yet

- Merchandising 105 Answer Key PeriodicDocument38 pagesMerchandising 105 Answer Key PeriodicPrincess Heart MacadatNo ratings yet

- Darliana Rebeca Ospina Duarte Ci 25.633.405 Balance de ComprobacionDocument2 pagesDarliana Rebeca Ospina Duarte Ci 25.633.405 Balance de ComprobacionDarliana Rebeca Ospina DuarteNo ratings yet

- Abad MarrietteJoyExcel Ex8Document13 pagesAbad MarrietteJoyExcel Ex8marriette joy abadNo ratings yet

- Pauline Anne R. Grana 11-ABM-A: To Record Purchase of Merchandise For CashDocument4 pagesPauline Anne R. Grana 11-ABM-A: To Record Purchase of Merchandise For CashPark EunbiNo ratings yet

- Accounting Cycle For Merchandising ConcernDocument30 pagesAccounting Cycle For Merchandising ConcernMary100% (2)

- MerchandisingDocument13 pagesMerchandisingairanicolebrugada08No ratings yet

- Answer: Problem 10-4: Requirement ADocument17 pagesAnswer: Problem 10-4: Requirement APatricia Nicole BarriosNo ratings yet

- Jornal MerchandiseDocument12 pagesJornal MerchandiseHannah Jane Toribio100% (1)

- Merchandising Perpetual Inv Sys Coco Computer StoreDocument18 pagesMerchandising Perpetual Inv Sys Coco Computer StoreMadelyn Espiritu100% (4)

- 1.3.1. Problems - Hoba - General Transactions IllustrationDocument15 pages1.3.1. Problems - Hoba - General Transactions IllustrationJane DizonNo ratings yet

- Perusahaan DagangDocument7 pagesPerusahaan DagangWidad NadiaNo ratings yet

- PerpetualDocument23 pagesPerpetualPia SurilNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- DocxDocument35 pagesDocxjikee11No ratings yet

- 2.ast - Hoba Part 1Document12 pages2.ast - Hoba Part 1ElaineJrV-IgotNo ratings yet

- Computerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENTDocument24 pagesComputerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENThello nasty100% (1)

- Accounting 1 - Part 2Document18 pagesAccounting 1 - Part 2Jessica ManuelNo ratings yet

- Activity Review StatementDocument5 pagesActivity Review Statementangel ciiiNo ratings yet

- John Paul Mi Oza - Midterm - Sample Worksheet - 1ST ActivityDocument21 pagesJohn Paul Mi Oza - Midterm - Sample Worksheet - 1ST Activityjohnpaulminoza2No ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Solutions To Problems AFAR2 Chapter 13Document18 pagesSolutions To Problems AFAR2 Chapter 13Jane DizonNo ratings yet

- Merchandise Business Class Performance AnswersDocument14 pagesMerchandise Business Class Performance AnswersLerry RosellNo ratings yet

- Handout No. 03 - Purchase TransactionsDocument4 pagesHandout No. 03 - Purchase TransactionsApril SasamNo ratings yet

- FAR Chapt 11 Answer KeyDocument19 pagesFAR Chapt 11 Answer KeyJerickho JNo ratings yet

- Guimbungan, Core Competency Module 1 - Part 3 PDFDocument11 pagesGuimbungan, Core Competency Module 1 - Part 3 PDFSharlyne K. GuimbunganNo ratings yet

- Alternate Demonstration Problem MerchandisingDocument5 pagesAlternate Demonstration Problem MerchandisingmoNo ratings yet

- Answers Part 2Document23 pagesAnswers Part 2YUE LIE PALANCANo ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Riverdale Mechanical Supply Chart of Accounts Includes The FollowingDocument15 pagesRiverdale Mechanical Supply Chart of Accounts Includes The FollowingJames Benedict BantilingNo ratings yet

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- China Trade, Inc. Journal Entries: Date GL Number Description Debit CreditDocument7 pagesChina Trade, Inc. Journal Entries: Date GL Number Description Debit CreditJalaj GuptaNo ratings yet

- Module 3 - EA03Document30 pagesModule 3 - EA03Vaseline QtipsNo ratings yet

- Kashato Practice Set - 2020-10thedDocument84 pagesKashato Practice Set - 2020-10thedMary Jhiezael Pascual83% (12)

- Castro CompanyDocument41 pagesCastro CompanyMarinel Abril100% (1)

- Date Januar y Accounts Title Description P R Debts CreditDocument3 pagesDate Januar y Accounts Title Description P R Debts CreditMariel Samonte VillanuevaNo ratings yet

- Week2 Acitivty Financial REportsDocument4 pagesWeek2 Acitivty Financial REportsAngelie PajaresNo ratings yet

- Transactions For JulyDocument5 pagesTransactions For JulyJohn Austria100% (2)

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- PArtnership FormationDocument6 pagesPArtnership FormationJasmine ActaNo ratings yet

- Finals Lecture Discussion On Special JournalsDocument36 pagesFinals Lecture Discussion On Special JournalsGarpt Kudasai100% (1)

- Partnership ActivityDocument12 pagesPartnership ActivityTeresa Pantallano DivinagraciaNo ratings yet

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- LCCI Chapter 17 (Eg.2-6) - 1Document77 pagesLCCI Chapter 17 (Eg.2-6) - 1Khin Lay HtetNo ratings yet

- Exercises - Financial Statements - 8.1.18Document3 pagesExercises - Financial Statements - 8.1.18Hanjin Margaret ZaportezaNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- An20230925 1407Document7 pagesAn20230925 1407oluwasegunNo ratings yet

- Manappuram Chairman On CNBCDocument3 pagesManappuram Chairman On CNBCRaghu.GNo ratings yet

- 德勤 - 数字化精益制造工业4.0技术改变了精益流程,从而推动企业发展 -DI Digital Lean DSNDocument20 pages德勤 - 数字化精益制造工业4.0技术改变了精益流程,从而推动企业发展 -DI Digital Lean DSNxiao pengNo ratings yet

- Analysis 4Document1 pageAnalysis 4Axiel Jay DanipogNo ratings yet

- Laudon Mis16 PPT ch02 KL CEDocument40 pagesLaudon Mis16 PPT ch02 KL CEVân HảiNo ratings yet

- Hris NotesDocument5 pagesHris NotesSatyam GuptaNo ratings yet

- How Would You Characterize Your Trading Style?: Tony Oz: Short-Term Trading, Part IDocument8 pagesHow Would You Characterize Your Trading Style?: Tony Oz: Short-Term Trading, Part ItonerangerNo ratings yet

- Exercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalDocument9 pagesExercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalDoan Chan PhongNo ratings yet

- ALL GOLD OFFERS June 2021-1-1Document15 pagesALL GOLD OFFERS June 2021-1-1Lin Chris100% (1)

- Principles of Sustainable Finance - (2 Externalities Internalization)Document35 pagesPrinciples of Sustainable Finance - (2 Externalities Internalization)SebastianCasanovaCastañedaNo ratings yet

- Draft: The Benefits of Sustainability ReportingDocument2 pagesDraft: The Benefits of Sustainability ReportingIndranil MitraNo ratings yet

- Lean Six Sigma Principles - DMAIC&DMADV - ExampleDocument6 pagesLean Six Sigma Principles - DMAIC&DMADV - ExampleMichael HeryantoNo ratings yet

- Solutions Manual: 1st EditionDocument23 pagesSolutions Manual: 1st EditionJunior Waqairasari67% (3)

- Case IDocument3 pagesCase IYatharth Shukla100% (1)

- WorksheetDocument2 pagesWorksheetHaima Paula DalatenNo ratings yet

- Prestige Private LimitedDocument28 pagesPrestige Private Limitedlery.aryNo ratings yet

- Multilocational RetailingDocument33 pagesMultilocational RetailingAkshay ShahNo ratings yet

- VAT and OPTDocument10 pagesVAT and OPTSharon CarilloNo ratings yet

- BILALDocument105 pagesBILALrahulprajapNo ratings yet

- Prefinals ExamDocument3 pagesPrefinals ExamKate Crystel reyesNo ratings yet

- Job Design Its Importance and ApproachDocument2 pagesJob Design Its Importance and ApproachElan Robert Sh100% (1)

- 2019 UPS Pulse of The Online Shopper U.S. Presentation Deck PDFDocument22 pages2019 UPS Pulse of The Online Shopper U.S. Presentation Deck PDFEvangeline LouiseNo ratings yet

- Topic 3 - Tutorial Question - Contract - Part - ADocument2 pagesTopic 3 - Tutorial Question - Contract - Part - AYuenNo ratings yet

- Module Handbook Tourism Marketing PrinciplesDocument13 pagesModule Handbook Tourism Marketing PrinciplesJay MenonNo ratings yet

- Michael Watkins - The First 90 DaysDocument28 pagesMichael Watkins - The First 90 DaysBabis Arbilios64% (22)

- Club of Rome Sustainable DevelopmentDocument8 pagesClub of Rome Sustainable Developmentnortherndisclosure100% (1)

- Pc102 Document SemesterProjectWorkbookDocument6 pagesPc102 Document SemesterProjectWorkbookAngel FajardoNo ratings yet

- Enterpreneurship and Small Business DevelopmentDocument17 pagesEnterpreneurship and Small Business DevelopmentBasil AugustineNo ratings yet

- Advertising Activities - Bajaj MotorsDocument44 pagesAdvertising Activities - Bajaj MotorsL. V B ReddyNo ratings yet

- Pas 14 Segment ReportingDocument3 pagesPas 14 Segment ReportingrandyNo ratings yet