Professional Documents

Culture Documents

Premium Receipts

Uploaded by

Harish SharmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Premium Receipts

Uploaded by

Harish SharmaCopyright:

Available Formats

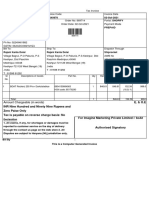

PSRLE023120041802

We have received your premium

Comp/Nov/Int/4743

03/06/2022 Receipt No: 0023193955

Mandhir Kaur

442 Partap Nagar Near Pink

Palace Amritsar

Amritsar - 143001

Punjab

☎ : 918389010007

@ : mandhirdhillon9@gmail.com

Your details as per our records

Client ID: J0182985 Payor Name: Mandhir Kaur

Policy No.: 20299993 Policy Status: Temporary Lapse

Plan: HDFC Life ProGrowth Plus UIN: 101L081V04

Sum Assured (INR): 500000 Risk Commencement Date: April 09, 2018

Payment Term: 10 years Payment Frequency: Annual

Dear Mandhir Kaur,

Thank you for staying insured with HDFC Life. We have received the premium payment of INR 50000 for your policy. The details are as below:

Amount Received

Payment mode Payment avenue Date Transaction ID

(INR)

Online Net Banking June 03, 2022 HL1142279303062022132848 50000

Benefit Opted For / Particulars Premium Amount (INR) Taxes and Levies as applicable (INR) Total Amount Due (INR)

Death Benefit 50000 0 50000

Revival or Reinstatement Charges 0 0 0

Interest 0 NA 0

Total Amount Due (INR) 50000

Less: Amount in Deposit (If any) (INR) 0

Total Premium Payable (INR) 50000

Actual Amount Paid (INR) 50000

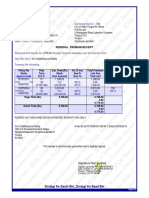

NOTE:

This receipt is valid subject to realisation of payment by all modes.

The policy status mentioned above is as on the date of generation of this receipt. It does not necessarily indicate the status mentioned above at a later

date.

Taxes and levies will be applicable as per prevailing tax laws and are subject to change. Please consult your tax advisors to confirm the applicability of

the tax benefits at your end.

Tax would be deducted at source (as applicable) from the policy payments, as per the Income tax Act, 1961.

As per section 10(10D) of the Income Tax Act, 1961, any sum received under a life insurance policy will be exempt subject to conditions specified

therein.

NAV applicable on premium received is subject to cut-off rules followed by HDFC Life Insurance Co. Ltd. in accordance with IRDAI. The current cut-off

timing for same day NAV is 3.00 pm IST.

Tax benefit under Section 80C and 80 CCC of the Income Tax Act, 1961 is available to an individual or HUF for premium paid towards life insurance or

pension policy, subject to the conditions/limits specified therein.

Consolidated stamp duty of 1 (Rupee One only) paid vide Letter of Authorisation number LOA/CSD/179/2021 dated November 09, 2021.

Visit www.hdfclife.com for various premium payment options.

In case of any queries, please feel free to contact us. We'll be glad to hear from you!

Warm regards,

HDFC Life

Please verify your email ID and contact number with us to continue receiving your premium payment receipts.

******** This is an electronically generated receipt and does not require a signature. ********

You might also like

- Foreclosure Letter - 20 - 49 - 45Document3 pagesForeclosure Letter - 20 - 49 - 45Suman KumarNo ratings yet

- D More - 47004Document1 pageD More - 47004Dinesh RNo ratings yet

- Max Bupa Health Insurance Company LimitedDocument1 pageMax Bupa Health Insurance Company LimitedTarunNo ratings yet

- TG1628 NPS ContributionsDocument1 pageTG1628 NPS ContributionsAnandKumarPNo ratings yet

- HDFC ERGO General Insurance Company Limited: Date: 25/06/2018Document5 pagesHDFC ERGO General Insurance Company Limited: Date: 25/06/2018nilesh sawantNo ratings yet

- Happy Family Floater-2015 Policy Schedule: UIN: IRDAI/HLT/OIC/P-H/V.II/450/15-16Document4 pagesHappy Family Floater-2015 Policy Schedule: UIN: IRDAI/HLT/OIC/P-H/V.II/450/15-16Sanjay ShahNo ratings yet

- Bajaj AL-Premium Receipts1Document1 pageBajaj AL-Premium Receipts1Anil KumarNo ratings yet

- Rent Receipts PDFDocument4 pagesRent Receipts PDFJinit BhedaNo ratings yet

- Invoice 4Document1 pageInvoice 4api-368429342No ratings yet

- Co Mprehens Ive Po Licy Co Mprehens Ive Po Licy: Acko AdvantageDocument6 pagesCo Mprehens Ive Po Licy Co Mprehens Ive Po Licy: Acko AdvantageRajesh NatarajanNo ratings yet

- Tata Indicom BillDocument7 pagesTata Indicom BillNikhil JainNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- Feb InvioceDocument4 pagesFeb InvioceVijay GuptaNo ratings yet

- Screenshot 2023-12-14 at 1.02.56 PMDocument1 pageScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711No ratings yet

- Your Policy Purchase Premium Receipt (Provisional) : Receipt Number: OT043152810 Date: 19-03-2023Document2 pagesYour Policy Purchase Premium Receipt (Provisional) : Receipt Number: OT043152810 Date: 19-03-2023kp gamerNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument1 pageStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMangilal MoondNo ratings yet

- InvoiceDocument1 pageInvoiceSaaksshi TyagiNo ratings yet

- InvoicesDocument148 pagesInvoicesBijak DataNo ratings yet

- CertificateDocument4 pagesCertificatemadhu gandheNo ratings yet

- JRF Kundan UGC NET Merged-CompressedDocument2 pagesJRF Kundan UGC NET Merged-CompressedZytk0wNo ratings yet

- Amount Due: Rs 1,146.89 Rs 1,150.00 Rs 0.00 Rs 201.30Document5 pagesAmount Due: Rs 1,146.89 Rs 1,150.00 Rs 0.00 Rs 201.30sonugautam421No ratings yet

- TN12S3618Document6 pagesTN12S3618Ragavendaran ANo ratings yet

- Tatay YaluDocument2 pagesTatay Yalusreedhar reddyNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAarti BalmikiNo ratings yet

- Policy 7100643751Document14 pagesPolicy 7100643751Urban Mystique Homes LLPNo ratings yet

- 15180125864942bTbD6sKH05uYfPT PDFDocument1 page15180125864942bTbD6sKH05uYfPT PDFHimanshu ChoukseyNo ratings yet

- My - Bill - 14 Oct, 2022 - 13 Nov, 2022 - 7483059812Document11 pagesMy - Bill - 14 Oct, 2022 - 13 Nov, 2022 - 7483059812Ashwani YadavNo ratings yet

- WWW LenskartDocument2 pagesWWW LenskartRajesh AggarwalNo ratings yet

- Tally Bill The Perfect 1Document1 pageTally Bill The Perfect 1Unnat aggarwalNo ratings yet

- Tax CertificateDocument3 pagesTax CertificateSharpReXNo ratings yet

- Zomato Food Order: Summary and Receipt: Item Quantity Unit Price Total PriceDocument1 pageZomato Food Order: Summary and Receipt: Item Quantity Unit Price Total PriceAnantharajNo ratings yet

- InvoiceDocument1 pageInvoiceRichest TechNo ratings yet

- Broadband Clime July Sep-2021Document6 pagesBroadband Clime July Sep-2021VENKATESH NVSNo ratings yet

- InvoiceDocument1 pageInvoiceJatt satyam kambojNo ratings yet

- Account Statement 1649661081074Document2 pagesAccount Statement 1649661081074manas trivediNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Joy SharmaNo ratings yet

- Axis Statement Fy 2020 - 2021Document3 pagesAxis Statement Fy 2020 - 2021ok okNo ratings yet

- Policy ScheduleDocument4 pagesPolicy ScheduleacrajeshNo ratings yet

- Contribution Receipt: Details of BeneficiaryDocument1 pageContribution Receipt: Details of Beneficiarysachin dubeyNo ratings yet

- BNG TicketeditedDocument1 pageBNG Ticketeditednsm8f10 kevinNo ratings yet

- Statement of Accounts - 053243181Document4 pagesStatement of Accounts - 053243181Gaurav SongraNo ratings yet

- Amount Chargeable (In Words)Document1 pageAmount Chargeable (In Words)Rajani Kanta Dolai 3366No ratings yet

- Retired NPS: Life Ka Sahara, HamaraDocument1 pageRetired NPS: Life Ka Sahara, Hamaraहादीँक कुंभाणीNo ratings yet

- JIO International RechargeDocument1 pageJIO International RechargeC ANo ratings yet

- Oct19 BillDocument11 pagesOct19 Billtikam jainNo ratings yet

- You Bella Alloy Bangle Set: Grand Total 153.00Document6 pagesYou Bella Alloy Bangle Set: Grand Total 153.00Prabha NigamNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- Lic Receipt PDFDocument1 pageLic Receipt PDFAndroid TricksNo ratings yet

- Statement of Voluntary Contribution Under National Pension System (NPS)Document1 pageStatement of Voluntary Contribution Under National Pension System (NPS)amit_saxena_10No ratings yet

- End of StatementDocument1 pageEnd of StatementSoumyadeep MahapatraNo ratings yet

- Receipt DocDocument1 pageReceipt DocParikshit YadavNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)ISHANNo ratings yet

- Monthly Statement: This Month's SummaryDocument17 pagesMonthly Statement: This Month's SummaryDhendhi Buchi ReddyNo ratings yet

- Black Monthly Statement: This Month's SummaryDocument9 pagesBlack Monthly Statement: This Month's SummaryKirti Ranjan Behera (M22RM214)No ratings yet

- Bill 10835410 ExcitelDocument1 pageBill 10835410 ExcitelAbhinav TiwariNo ratings yet

- Consumer CirDocument6 pagesConsumer CirsathyaNo ratings yet

- Printer 5Document2 pagesPrinter 5SSE WASNo ratings yet

- Discovery Fund Premium ReceiptsDocument1 pageDiscovery Fund Premium ReceiptsKartikNo ratings yet

- HDFC LifeDocument1 pageHDFC LifeDr. Vishal GOELNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsMuthyam PallapuNo ratings yet

- Dindigul City Municipal Corporation Act, 2013Document7 pagesDindigul City Municipal Corporation Act, 2013Latest Laws TeamNo ratings yet

- Unit StatementDocument3 pagesUnit StatementMrshiva2No ratings yet

- Appendix Chapter IIDocument57 pagesAppendix Chapter IItridibmtNo ratings yet

- Verbs Followed by PrepositionsDocument11 pagesVerbs Followed by PrepositionsNagendra PrasadNo ratings yet

- Payslip TemplateDocument1 pagePayslip TemplatemashipooNo ratings yet

- QropsDocument35 pagesQropsmuralicgc1544No ratings yet

- Fred Meyer Statement On StrikeDocument2 pagesFred Meyer Statement On StrikeKGW NewsNo ratings yet

- Joint Venture in Insurance Company in IndiaDocument37 pagesJoint Venture in Insurance Company in IndiaSEMNo ratings yet

- Unit 5Document43 pagesUnit 5sujal mundhraNo ratings yet

- 7 CPC Information Brochure (English)Document80 pages7 CPC Information Brochure (English)ShounakNo ratings yet

- Cases 270-311 LaborDocument175 pagesCases 270-311 Labormary_rose_314No ratings yet

- Paryant Agarwal SIP ReportDocument59 pagesParyant Agarwal SIP ReportjatinNo ratings yet

- Fundamental RulesDocument86 pagesFundamental RulesRupakDas50% (4)

- Edelweiss Retirement Plan Investor PresentationDocument28 pagesEdelweiss Retirement Plan Investor Presentationnarayan.mitNo ratings yet

- Recruitment and Selection in Canada 7th Edition Catano Test BankDocument25 pagesRecruitment and Selection in Canada 7th Edition Catano Test BankDavidLeekemt97% (35)

- 2 The Gazette of India: Extraordinary (Part Ii-Sec. 3 (I) ) : Tft.5R.FfDocument2 pages2 The Gazette of India: Extraordinary (Part Ii-Sec. 3 (I) ) : Tft.5R.FfLatest Laws TeamNo ratings yet

- FIN 345 - Week 16 - Chap 21 & 22 + Investing Insights-1Document21 pagesFIN 345 - Week 16 - Chap 21 & 22 + Investing Insights-1RhomNo ratings yet

- JSPL Joining FormDocument17 pagesJSPL Joining FormAneek Roy ChoudhuryNo ratings yet

- Amit KumarDocument48 pagesAmit KumarAnonymous V9E1ZJtwoENo ratings yet

- BCOM 4 Income Tax Procedure Practice1Document47 pagesBCOM 4 Income Tax Procedure Practice1Ather RabbaniNo ratings yet

- Faircrest Time Clock Moves Discussed With Company: Volume 57, No. 3 March 2010Document8 pagesFaircrest Time Clock Moves Discussed With Company: Volume 57, No. 3 March 2010usw1123No ratings yet

- Employee Group & Sub GroupDocument9 pagesEmployee Group & Sub GroupShashank GodavartyNo ratings yet

- 2023 Slides On Exempt IncomeDocument31 pages2023 Slides On Exempt IncomeSiphesihleNo ratings yet

- Lesson 4 - Annuity (Ordinary)Document37 pagesLesson 4 - Annuity (Ordinary)Neil Ivan Ballesta Dimatulac0% (2)

- Item No.1 Sub: Denial of Financial Upgradation Under MACP Scheme To Drawing/Design Staff Initially Recruited As TracerDocument23 pagesItem No.1 Sub: Denial of Financial Upgradation Under MACP Scheme To Drawing/Design Staff Initially Recruited As TracerHoney GuptaNo ratings yet

- Corporate TaxationDocument82 pagesCorporate Taxationjayen0296755No ratings yet

- Retirement Plan Case StudyDocument30 pagesRetirement Plan Case Studyjeemee0320No ratings yet

- Provident Fund PP TDocument12 pagesProvident Fund PP TPintu KumarNo ratings yet

- JDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Document2 pagesJDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Antoinette MoederNo ratings yet

- GISHD8450269688833075 Priyanka SrinivasanDocument15 pagesGISHD8450269688833075 Priyanka SrinivasanmcaviimsNo ratings yet