Professional Documents

Culture Documents

NPS 2021

Uploaded by

Jagannath PradhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS 2021

Uploaded by

Jagannath PradhanCopyright:

Available Formats

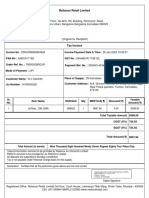

Transaction Statement - Tier I

PRAN 110152599740 From Nov 01, 2021 To Nov 30, 2021

Name JAGANNATH PRADHAN Statement Date Dec 05, 2021 06:30 PM

Address FLAT A6 Tier-1 Status Registration Date April 27, 2020

Activated

TANVI RESIDENCY Tier-2 Status Not Activated

BILEKAHALLI Scheme Choice AGGRESSIVE CHOICE

ANUGRAHA LAYOUT POP Reg No 5000800 POP-SP Reg No 6753106

NEAR APOLLO PHARMACY POP Name HDFC Bank Limited POP-SP Name HDFC Bank Limited, Empire

Plaza, Vikhroli West, Mumbai

BANGALORE POP Address 10th Floor, Peninsula POP-SP Address Empire Plaza I, Chandan Nagar,

Business Park, G. K. Marg LBS Marg Vikhroli West,

Lower Parel, Mumbai, Mumbai, 400083

400013

KARNATAKA-560076 Nominee Name TRINATH PRADHAN Percentage 100%

INDIA

IRA Status IRA Compliant

Mobile Number +919606925146

Email ID JAGANNATHPRADHAN839@GMAIL.COM

Investment Summary

Value of your Holdings (Investments) as Total Contribution in your account as on Total Notional Gain/Loss as on Nov 30,

on Nov 30, 2021 (in Rs) Nov 30, 2021 (in Rs) 2021 (in Rs)

56153.63 50000.00 6153.63

Current Scheme Preference

Scheme Details Percentage

Scheme 1 SBI PENSION FUND SCHEME E - TIER I 75.00%

Scheme 2 SBI PENSION FUND SCHEME C - TIER I 10.00%

Scheme 3 SBI PENSION FUND SCHEME G - TIER I 15.00%

Investment Details - Account Status as of Nov 30, 2021

Notional Gain / Loss Return on Investment Return on Investments

Total Contribution (Rs) No of Contribution Total Withdrawal (Rs) Current Valuation (Rs) (Rs) during last FY (XIRR)

50000.00 1 0.00 56153.63 6153.63 109.06 16.32%

Investment Details - Scheme Wise Summary

PFM/Scheme Total Net Contribution Total Units Latest NAV Value at NAV Unrealized

(Rs) (Rs) Gain /

Date Loss (Rs)

SBI PENSION FUND SCHEME E - TIER I 30800.06 1347.2733 33.25 44796.84 10627.11

31-Dec-20

SBI PENSION FUND SCHEME C - TIER I 4100.09 137.5007 32.7295 4756.66 2525.24

31-Dec-20

SBI PENSION FUND SCHEME G - TIER I 6100.62 213.0958 30.9726 6600.13 2000.51

31-Dec-20

Total 41000.77 56153.63 15152.86

Changes made during the selected period

No change affected in this period.

Contribution/ Redemption Details

Contribution

Date Particulars Uploaded By

Employee Employer's Total

Contribution (Rs) Contribution (Rs) (Rs)

01-Nov-21 Opening Balance 50000.00

30-Nov-21 Closing Balance 50000.00

Transaction Details

Date Particulars SBI PENSION FUND SCHEME E - SBI PENSION FUND SCHEME C - SBI PENSION FUND SCHEME G -

TIER I TIER I TIER I

Amount (Rs) Units Amount (Rs) Units Amount (Rs) Units

NAV (Rs) NAV (Rs) NAV (Rs)

01-Nov-21 OPENING BALANCE 1347.2733 137.5007 213.0958

30-Nov-21 Closing Balance 44796.84 1347.2733 4726.66 137.5007 6600.13 213.0958

Note:

1 The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2 'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3 'Total Net Contributions' indicates the cost of units currently held in the PRAN account

4 'Unrealized Gain / Loss' indicates the gain / loss in the account for the current units balance in the account.

5 Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of

XIRR. The calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest

valuation of the investments. The transactions are sorted based on the NAV date.

6 'Changes made during the selected period' indicates all the change requests processed in PRAN account during the period for which the

statement is generated

7 The section 'Contribution / Redemption Details' gives the details of the contributions and redemption processed in subscribers' account

during the period for which the statement is generated. While contribution amount indicates the amount invested in subscribers account,

the redemption amount indicates the cost of units redeemed from the account. The cost of units is calculated on a First-In-First-Out

(FIFO) basis. The details are sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for

allotment of the NAV.

8 'Transaction Details' gives the units allotted under different schemes / asset classes for each of the contributions processed in

subscribers' account during the period for which the statement is generated. It also contains units debited from the account for

redemption and rectification. The details are sorted based on date when the transaction is posted in PRAN account, which may / may not

be the date for allotment of the NAV.

9 The Amount in the Closing Balance under the section 'Transaction Details' gives the cost of investment of the balance units and not a

sum total of all contribution and withdrawal. The cost of units is calculated on a First-In-First-Out (FIFO) basis.

10 This scheme (NPS Tier I) qualifies for deduction u/s 80C of the Income-Tax Act, 1961(the "Act"), subject to the limits and conditions

specified in Sec.80C read with Sec.80CCE of the Act.

11 For transactions with the remarks "To Unit Redemption", the cost of units redeemed are adjusted against the total contribution in the

Investment Details section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns

based on Inflows', the actual redemption value corresponding to the units redeemed has been considered.

12 The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

13 The above returns are calculated based on scheme NAVs and the securities held under the scheme portfolio are valued on mark to market

basis and are subject to change on NAV fluctuations.

14 The contents of the Transaction Statement will be deemed to be correct and accepted by you unless you inform us of any error/

discrepancy within 30 days of receipt of the Transaction Statement.

15 This is computer generated statement and does not require any signature/stamp.

You might also like

- PPF e ReceiptDocument1 pagePPF e ReceiptDhananjay RambhatlaNo ratings yet

- Philip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Document117 pagesPhilip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Mohamed Hussien100% (1)

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- NPS transaction statement breakdownDocument1 pageNPS transaction statement breakdownRajakumar ReddyNo ratings yet

- Inner Circle Trader - Sniper Course, Escape & EvasionDocument3 pagesInner Circle Trader - Sniper Course, Escape & EvasionKute HendrickNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- NPS transaction summaryDocument3 pagesNPS transaction summaryMd Sharma SharmaNo ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- FM11 CH 25 Test BankDocument21 pagesFM11 CH 25 Test BankDaood AbdullahNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- Account Summary As On 31-Mar-2021: Page 1 of 1Document1 pageAccount Summary As On 31-Mar-2021: Page 1 of 1Sachin KhamitkarNo ratings yet

- HDFC Tli Converted by AbcdpdfDocument1 pageHDFC Tli Converted by Abcdpdfharshim guptaNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- Dividend Policy - Sample Problems - ICAIDocument2 pagesDividend Policy - Sample Problems - ICAIgfahsgdahNo ratings yet

- Elss - Fy 2021-22Document2 pagesElss - Fy 2021-22Amit SinghNo ratings yet

- Account Summary: Page 1 of 1Document1 pageAccount Summary: Page 1 of 1Sachin KhamitkarNo ratings yet

- Sailaja Jaliparthi Icici PrudentialDocument1 pageSailaja Jaliparthi Icici PrudentialSobhan JaliparthiNo ratings yet

- NPS Transaction Statement for April 2022Document2 pagesNPS Transaction Statement for April 2022Rahul PanwarNo ratings yet

- TG1628 NPS ContributionsDocument1 pageTG1628 NPS ContributionsAnandKumarPNo ratings yet

- Screenshot 2023-12-14 at 1.02.56 PMDocument1 pageScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711No ratings yet

- From 05-MAR-2021 To 05-MAR-2021: Non-TransferableDocument3 pagesFrom 05-MAR-2021 To 05-MAR-2021: Non-TransferableNeha100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- Account Statement: Folio No.: 11325320 / 36Document2 pagesAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNo ratings yet

- SBI Insurance 2021Document1 pageSBI Insurance 2021personal listNo ratings yet

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Sanjay JajuDocument1 pageSanjay JajuShivangi SaxenaNo ratings yet

- WL4955W67QDocument5 pagesWL4955W67Qaman khatriNo ratings yet

- Premium Receipt HDFC LifeDocument2 pagesPremium Receipt HDFC Lifekp gamerNo ratings yet

- PPF Account Statement for Mr. Himanshu ChoukseyDocument1 pagePPF Account Statement for Mr. Himanshu ChoukseyHimanshu ChoukseyNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Rent Agreement 2023Document5 pagesRent Agreement 2023Arun RajputNo ratings yet

- National Pension System transaction statementDocument2 pagesNational Pension System transaction statementzuheb0% (1)

- Ather Tax Invoice EVDocument1 pageAther Tax Invoice EVKing EzekielNo ratings yet

- Mrs. KOTLA LAKSHMI bank account statement from 1 Apr 2020 to 13 Apr 2020Document1 pageMrs. KOTLA LAKSHMI bank account statement from 1 Apr 2020 to 13 Apr 2020Praveen Kumar pkNo ratings yet

- 3.1 Research Methodology: Mutual FundDocument12 pages3.1 Research Methodology: Mutual FundAbdulRahman Elham50% (6)

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Globe TelecomDocument8 pagesGlobe TelecomLesterAntoniDeGuzmanNo ratings yet

- NPS Account StatementDocument2 pagesNPS Account Statementdinesh rajendranNo ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS transaction statement overviewDocument2 pagesNPS transaction statement overviewABhishekNo ratings yet

- Atal Pension YojanaDocument1 pageAtal Pension YojanaHimanku BoraNo ratings yet

- formFeeRecieptPrintReport Duplicate RC Book PDFDocument1 pageformFeeRecieptPrintReport Duplicate RC Book PDFsnaehalNo ratings yet

- NPS statement shows Rs. 39,000 voluntary contributionsDocument1 pageNPS statement shows Rs. 39,000 voluntary contributionsamit_saxena_10No ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- CertificateDocument4 pagesCertificatemadhu gandheNo ratings yet

- Intermediary Details Name Code Contact Number Iifl Insurance Brokers Limited 20024612 9819286666Document4 pagesIntermediary Details Name Code Contact Number Iifl Insurance Brokers Limited 20024612 9819286666Pramila DeviNo ratings yet

- PVS Lakshmiprasad: IRDA Regn. No 129 Corporate Identity Number U66010TN2005PLC056649 Email ID: Info@starhealth - inDocument1 pagePVS Lakshmiprasad: IRDA Regn. No 129 Corporate Identity Number U66010TN2005PLC056649 Email ID: Info@starhealth - inSatvinder Singh ChandiNo ratings yet

- In Voice HistoryDocument2 pagesIn Voice Historyshiva keerthiNo ratings yet

- Renewal of Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Optima Restore Floater Insurance PolicyAarti BalmikiNo ratings yet

- Vikas Soni HealthDocument1 pageVikas Soni HealthVikas SoniNo ratings yet

- HDFC BANK ONLINE PAYMENT RECEIPT FOR INITIAL CONTRIBUTIONDocument1 pageHDFC BANK ONLINE PAYMENT RECEIPT FOR INITIAL CONTRIBUTIONHimalayan MandererNo ratings yet

- Reliance Retail tax invoiceDocument3 pagesReliance Retail tax invoicemukeshNo ratings yet

- Renewal Premium Receipt: Benefit Opted For Tax Benefit Available Under The Income Tax Act, Premium PayableDocument1 pageRenewal Premium Receipt: Benefit Opted For Tax Benefit Available Under The Income Tax Act, Premium PayableAmit MishraNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- 02122020Document5 pages02122020Kumar FanishwarNo ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- Contribution Receipt: Details of BeneficiaryDocument1 pageContribution Receipt: Details of Beneficiarysachin dubeyNo ratings yet

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- HealthCheckup Invoice 1Document3 pagesHealthCheckup Invoice 1Karthick KannanNo ratings yet

- Bill 12sep2023Document1 pageBill 12sep2023UR12ME148 PrafullaNo ratings yet

- Vivek LicDocument1 pageVivek Licranjeet kumarNo ratings yet

- Mediclaim Format 1Document1 pageMediclaim Format 1Urvashi JainNo ratings yet

- Chapter 10 Making Capital Investment DecisionsDocument15 pagesChapter 10 Making Capital Investment DecisionsHồng HạnhNo ratings yet

- Foreign Investment in India: Classification, Modes, and ImpactDocument27 pagesForeign Investment in India: Classification, Modes, and ImpactHimanshu GuptaNo ratings yet

- IIPM CoursewareDocument58 pagesIIPM CoursewareAkansha Singh RoyalNo ratings yet

- CASHFLOW TemplateDocument6 pagesCASHFLOW Templatemilabol100% (1)

- RbiDocument25 pagesRbiShubham SaxenaNo ratings yet

- Chapter 6 Hedge Accounting IG (FINAL Draft)Document51 pagesChapter 6 Hedge Accounting IG (FINAL Draft)aNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 5: Risk and Rates of Return (Common Questions)Document3 pagesNanyang Business School AB1201 Financial Management Tutorial 5: Risk and Rates of Return (Common Questions)asdsadsaNo ratings yet

- Financing in Startups (Venture Capital) : Project TopicDocument5 pagesFinancing in Startups (Venture Capital) : Project TopicKaran Raj DeoNo ratings yet

- Global Industry Classification StandardDocument52 pagesGlobal Industry Classification StandardAshwin GoelNo ratings yet

- Far Reviewer SituationalDocument13 pagesFar Reviewer SituationalMaria Nicole PetillaNo ratings yet

- SAMPLE FORMULA SHEET - ENG 111 MIDTERMDocument1 pageSAMPLE FORMULA SHEET - ENG 111 MIDTERMjohn wickonsonNo ratings yet

- Full-Goodwill Method of Accounting For Business Combinations and Quality of Financial StatementsDocument12 pagesFull-Goodwill Method of Accounting For Business Combinations and Quality of Financial StatementsForeign GraduateNo ratings yet

- Financial Institutions Instruments and Markets 8th Edition Viney Solutions ManualDocument35 pagesFinancial Institutions Instruments and Markets 8th Edition Viney Solutions Manualchicanerdarterfeyq100% (25)

- Presentation of "Basic Concept Under Corporate Laws, Incorporation of Companies & Annual Filings" by Mr. Rahat AzizDocument22 pagesPresentation of "Basic Concept Under Corporate Laws, Incorporation of Companies & Annual Filings" by Mr. Rahat AzizMuhammad FahadNo ratings yet

- DEPOSITORY AND CUSTODIAL SERVICESDocument25 pagesDEPOSITORY AND CUSTODIAL SERVICESRiya Das RdNo ratings yet

- Indian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaDocument7 pagesIndian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Catholic Educational Association of The Philippines Retirement PlanDocument2 pagesCatholic Educational Association of The Philippines Retirement PlanRosannaNo ratings yet

- Braking China Without Breaking The World: Blackrock Investment InstituteDocument32 pagesBraking China Without Breaking The World: Blackrock Investment InstitutetaewoonNo ratings yet

- Homework on investment property analysisDocument2 pagesHomework on investment property analysisCharles TuazonNo ratings yet

- Garp MarchDocument5 pagesGarp MarchZerohedgeNo ratings yet

- Components of A Balance Sheet AssetsDocument3 pagesComponents of A Balance Sheet AssetsAhmed Nawaz KhanNo ratings yet

- PavREIT - Management Roadshow Presentation 100323 (For Sharing)Document27 pagesPavREIT - Management Roadshow Presentation 100323 (For Sharing)Guan JooNo ratings yet

- Marquee - Medallion Case StudyDocument1 pageMarquee - Medallion Case StudytigerNo ratings yet