Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account

Uploaded by

QC&ISD1 LMD COLONYOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account

Uploaded by

QC&ISD1 LMD COLONYCopyright:

Available Formats

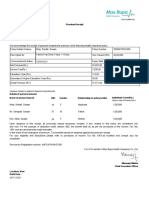

NPS Transaction Statement for Tier I Account

Statement Period: From April 01, 2017 to March 31, 2018 Statement Generation Date : March 31, 2018

PRAN 110027171906 Registration Date 08-Feb-16

Subscriber Name SHRI MOHD SHAIK NISAR AHMED Tier I Status Active

H NO 6-6-403 Tier II Status Not Activated

KARIMNAGAR Scheme Choice DEFAULT SCHEME SET-UP

Address DDO Registration No SGV209320D

TELANGANA - 505001

DDO Name EE QC&I Division No.7, Karimnagar

INDIA

IRRIGATION DIVISION PREMISES, OPP. DIST

DDO Address COLL.RESIDENCE

Mobile Number +919848617062 KARIMNAGAR, 505001

Email ID NISARAHMED.KNR@GMAIL.COM PAO Registration No 4009014

IRA Status IRA compliant PAO (Works Accounts Department), (IW) L M D

PAO Name

Colony, Karimnagar

PAO Address LMD Colony, Karimnagar, 505527

Tier I Nominee Name/s Percentage

RAYEES F ATHIMA 100%

Summary

The total contribution to your pension account till March 31, 2018 was Rs. 55846.00.

The total value of your contributions as on March 31, 2018 was Rs. 62113.19.

Your contributions have earned a return of Rs.6267.19 till March 31, 2018.

Current Scheme Preference

Investment Option Scheme Details Percentage

Scheme 1 SBI PENSION FUND SCHEME - STATE GOVT 33.00%

Scheme 2 UTI RETIREMENT SOLUTIONS PENSION FUND SCHEME- STATE GOVT 34.00%

Scheme 3 LIC PENSION FUND SCHEME - STATE GOVT 33.00%

Investment Details Summary

Total Contribution Total Withdrawal Current Valuation Notional Gain / Loss

(Rs) No of Contribution (Rs) (Rs) (Rs)

55846.00 12 0.0000 62113.19 6267.19

Investment Details - Scheme Wise Summary

Total Net Latest NAV Value at NAV Unrealized Return on

PFM/Scheme Contribution Total Units (Rs) Gain / Loss Investment(XIRR)

(Rs) Date (Rs)

22.4160

SBI PENSION FUND SCHEME - STATE GOVT 19152.40 948.7493 21267.16 2114.76

28-Mar-18

UTI RETIREMENT SOLUTIONS PENSION 22.5481

18117.86 895.5070 20191.98 2074.12 7.07%

FUND SCHEME- STATE GOVT 28-Mar-18

22.6812

LIC PENSION FUND SCHEME - STATE GOVT 18575.74 910.6243 20654.05 2078.31

28-Mar-18

Total 55846.00 62113.19 6267.19

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (Rs)

(Rs) (Rs)

01-Apr-17 Opening balance 55846.00

31-Mar-18 Closing Balance at NSDL CRA 55,846.00

Transaction Details

UTI RETIREMENT SOLUTIONS

SBI PENSION FUND SCHEME - PENSION FUND SCHEME- STATE LIC PENSION FUND SCHEME -

STATE GOVT STATE GOVT

GOVT

Date Particulars

Amount (Rs) Amount (Rs) Amount (Rs)

Units Units Units

NAV (Rs) NAV (Rs) NAV (Rs)

01-Apr-17 Opening Balance 948.7493 895.5070 910.6243

31-Mar-18 Closing Balance at NSDL CRA 19152.40 948.7493 18117.86 895.5070 18575.74 910.6243

Notes

1. The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2. 'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3. 'Total Net Contributions' indicates the cost of units currently held in the PRAN account

4. 'Unrealized Gain / Loss' indicates the gain / loss in the account for the current units balance in the account.

Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

5. calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

6. 'Changes made during the selected period' indicates all the change requests processed in PRAN account during the period for which the

statement is generated

The section 'Contribution / Redemption Details' gives the details of the contributions and redemption processed in subscribers' account during the

7.

period for which the statement is generated. While contribution amount indicates the amount invested in subscribers account, the redemption

amount indicates the cost of units redeemed from the account. The cost of units is calculated on a First-In-First-Out (FIFO) basis. The details are

sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

'Transaction Details' gives the units allotted under different schemes / asset classes for each of the contributions processed in subscribers'

8. account during the period for which the statement is generated. It also contains units debited from the account for redemption and rectification. The

details are sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

The Amount in the Closing Balance under the section 'Transaction Details' refers to the Units Balance in the books of NSDL CRA and it gives the

9. cost of investment of the balance units and not a sum total of all contributions and withdrawals. The cost of units is calculated on a First-In-First-Out

(FIFO) basis.

For transactions with the remarks "To Unit Redemption", the cost of units redeemed are adjusted against the total contribution in the Investment

10. Details section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual

redemption value corresponding to the units redeemed has been considered.

11. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

12.

The above returns are calculated based on scheme NAVs and the securities held under the scheme portfolio are valued on mark to market basis

and are subject to change on NAV fluctuations.

13. The current allocation ratio of funds (subscriber contribution remitted by the DTA/DTOs) is 33:34:33 for the three PFMs - SBI, UTI, LIC.

14.

On Nov 06, 2017, NPS Trust has revised the allocation ratio of funds (contribution remitted by the DTA/DTOs) from 35:33.50:31.50 to 33:34:33 for the

three PFMs - SBI, UTI and LIC respectively.

15.

On Nov 10, 2016, NPS Trust has revised the allocation ratio of funds (contribution remitted by the DTA/DTOs) from 34:32:34 to 35:33.50:31.50 for the

three PFMs - SBI, UTI and LIC respectively.

16. On June 25, 2015, Government has revised the allocation ratio of funds (contribution remitted by the DTA/DTOs) from 33:34:33 to 34:32:34 for the

three PFMs - SBI, UTI and LIC respectively.

17. For the FY 2014-15, after reviewing performance of the PFMs, it was decided that there is no change in the allocation ratio of funds between the

three PFMs - SBI, UTI and LIC.

The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your uploading

18. office (DTA/DTOs). In case there is no/less/excess contribution for any month or no clarity in the narration, please contact your uploading office

(DTA/DTO).

19. In case of any other queries, you may contact CRA toll free helpline 1800 222 080.

If you are an employee or if you are self-employed , you will be able to avail of deduction on contribution made from your taxable income to the extent

of (u/s 80 CCD (1) of income Tax Act, 1961)

- 10% of salary (Basic + DA ) - if you are salaried employee

- 10% of your gross income - if you are self-employed

However, please note that the maximum deduction from your taxable income is limited to RS.1.50 lac, as permitted under Sec 80 CCE of the

20.

Income Tax Act.

Further, an additional deduction from your taxable income to the extent of Rs. 50,000/- is available only for contribution in NPS u/s Sec. 80 CCD (1B).

To give an example, your salary is Rs.15 lac per annum. On contribution of Rs. 2 lac, you can avail:

Deduction under Sec. 80 CCD (1) - Rs. 1.50 lac

Deduction under Sec. 80 CCD (1B) - Rs. 0.50 lac

Total deduction - Rs. 2.00 lac

Also note that your employer's contribution upto 10% of your salary is fully deductible from your taxable income.

21. Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

Home | Contact Us | System Configuration | Entrust Secured | Privacy Policy | Grievance Redressal Policy

Best viewed in Internet Explorer 7.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

You might also like

- PremiumRept FamilyDocument2 pagesPremiumRept Familynavengg521No ratings yet

- PPF e ReceiptDocument1 pagePPF e ReceiptDhananjay RambhatlaNo ratings yet

- NPS Statement SummaryDocument3 pagesNPS Statement Summaryvikas_2No ratings yet

- Accident Investigation 1Document63 pagesAccident Investigation 1Biscuit_WarriorNo ratings yet

- NPS transaction statement breakdownDocument1 pageNPS transaction statement breakdownRajakumar ReddyNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- Consti2digest - Accfa Vs Cugco, G.R. No. L-21484 (29 Nov 1969)Document1 pageConsti2digest - Accfa Vs Cugco, G.R. No. L-21484 (29 Nov 1969)Lu Cas0% (1)

- NPS transaction summaryDocument3 pagesNPS transaction summaryMd Sharma SharmaNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- 1501137243609Document2 pages1501137243609Sougata Ghosh0% (1)

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDocument5 pagesReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- Parents Insurance PremiumDocument1 pageParents Insurance Premiumprajeesh.vijayanNo ratings yet

- Elss - Fy 2021-22Document2 pagesElss - Fy 2021-22Amit SinghNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- NPS Transaction Statement for April 2022Document2 pagesNPS Transaction Statement for April 2022Rahul PanwarNo ratings yet

- PPFDocument1 pagePPFArnab RoyNo ratings yet

- Hlintcertificate BIDHAN64 PDFDocument1 pageHlintcertificate BIDHAN64 PDFBIDHANNo ratings yet

- NPS Statement SummaryDocument4 pagesNPS Statement SummaryabhishekNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- PPF E-Receipt: Debit Account No Transaction Type Debit Branch NameDocument1 pagePPF E-Receipt: Debit Account No Transaction Type Debit Branch NameMohit SharmaNo ratings yet

- SBI Insurance 2021Document1 pageSBI Insurance 2021personal listNo ratings yet

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- HDFC Life Premium Receipts Nov 2022Document1 pageHDFC Life Premium Receipts Nov 2022kapsekunalNo ratings yet

- Final-Project Report On Various Labour Welfare Activities Done by Jaypee Group and Its Effectiveness (HR)Document65 pagesFinal-Project Report On Various Labour Welfare Activities Done by Jaypee Group and Its Effectiveness (HR)Aditya SubramanianNo ratings yet

- Declaration 80D 80DDBDocument1 pageDeclaration 80D 80DDBShobit0% (1)

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- PPF Account Statement for Mr. Himanshu ChoukseyDocument1 pagePPF Account Statement for Mr. Himanshu ChoukseyHimanshu ChoukseyNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountthilaksafaryNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Max Bupa Health Insurance ReceiptDocument1 pageMax Bupa Health Insurance ReceiptSaurabh RaghuvanshiNo ratings yet

- National Pension System transaction statementDocument2 pagesNational Pension System transaction statementzuheb0% (1)

- Ather Tax Invoice EVDocument1 pageAther Tax Invoice EVKing EzekielNo ratings yet

- Assignment Money Cash Flow Inc Group 21,23,27,30Document3 pagesAssignment Money Cash Flow Inc Group 21,23,27,30Karan Vashee100% (3)

- Job SatisfactionDocument88 pagesJob Satisfactionshanmugaraja85100% (1)

- Compensation Management SYNOPSISDocument94 pagesCompensation Management SYNOPSISbantu121100% (2)

- PPF Account Opening FormDocument2 pagesPPF Account Opening Formprithvirajd20No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- Donatekart Foundation receiptDocument1 pageDonatekart Foundation receiptSunilSingh100% (1)

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- NPS transaction statement breakdownDocument2 pagesNPS transaction statement breakdownLaya DonthulaNo ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- NPS Account StatementDocument2 pagesNPS Account Statementdinesh rajendranNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS transaction statement summary for Apr 2022 to Dec 2022Document2 pagesNPS transaction statement summary for Apr 2022 to Dec 2022Satish Tiwari100% (1)

- Atal Pension YojanaDocument1 pageAtal Pension YojanaHimanku BoraNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- PolicyDocument1 pagePolicyaniket goyalNo ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Premium Receipt for Shefali Sawan's Family Health Insurance PolicyDocument1 pagePremium Receipt for Shefali Sawan's Family Health Insurance PolicyanuNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- HealthCheckup Invoice 1Document3 pagesHealthCheckup Invoice 1Karthick KannanNo ratings yet

- LIC Aug 2020 PDFDocument1 pageLIC Aug 2020 PDFShantanu MetayNo ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I AccountY. T. RNo ratings yet

- QC Cov LR To EE IB JGTLDocument1 pageQC Cov LR To EE IB JGTLQC&ISD1 LMD COLONYNo ratings yet

- Government of Telangana Irrigation & Cad DepartmentDocument1 pageGovernment of Telangana Irrigation & Cad DepartmentQC&ISD1 LMD COLONYNo ratings yet

- Checkdam, Eradpally, SKPT 27-08-19Document3 pagesCheckdam, Eradpally, SKPT 27-08-19QC&ISD1 LMD COLONYNo ratings yet

- Government of Telangana Irrigation & Cad Department Quality Control CertificateDocument1 pageGovernment of Telangana Irrigation & Cad Department Quality Control CertificateQC&ISD1 LMD COLONYNo ratings yet

- QC Cov LR To EE IB JGTLDocument1 pageQC Cov LR To EE IB JGTLQC&ISD1 LMD COLONYNo ratings yet

- Work Master MISSION KAKATIYA phase-II 02.03.17Document108 pagesWork Master MISSION KAKATIYA phase-II 02.03.17QC&ISD1 LMD COLONYNo ratings yet

- Scanned by CamscannerDocument2 pagesScanned by CamscannerQC&ISD1 LMD COLONYNo ratings yet

- Government of Telangana Irrigation & Cad DepartmentDocument2 pagesGovernment of Telangana Irrigation & Cad DepartmentQC&ISD1 LMD COLONYNo ratings yet

- Works Master MISSION KAKATIYA Phase - I 02.03.17Document21 pagesWorks Master MISSION KAKATIYA Phase - I 02.03.17QC&ISD1 LMD COLONYNo ratings yet

- PDFDocument2 pagesPDFDeepak ThakurNo ratings yet

- Government of Telangana Irrigation & Cad DefinalmentDocument2 pagesGovernment of Telangana Irrigation & Cad DefinalmentQC&ISD1 LMD COLONYNo ratings yet

- Government of Telangana issues quality certificate for irrigation workDocument2 pagesGovernment of Telangana issues quality certificate for irrigation workQC&ISD1 LMD COLONYNo ratings yet

- Bill of CostDocument1 pageBill of CostQC&ISD1 LMD COLONYNo ratings yet

- Received With Thanks ' 1,824.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 1,824.00 Through Payment Gateway Over The Internet FromQC&ISD1 LMD COLONYNo ratings yet

- Payment Receipt ConfirmationDocument1 pagePayment Receipt ConfirmationQC&ISD1 LMD COLONYNo ratings yet

- PDFDocument2 pagesPDFDeepak ThakurNo ratings yet

- Royal Sundaram InsuranceDocument3 pagesRoyal Sundaram InsuranceQC&ISD1 LMD COLONYNo ratings yet

- UpendarDocument1 pageUpendarQC&ISD1 LMD COLONYNo ratings yet

- Comparative Statement 2015-16 NEWDocument56 pagesComparative Statement 2015-16 NEWQC&ISD1 LMD COLONYNo ratings yet

- 1 NIL NIL NIL NIL NIL NIL NIL NIL NIL: PDF NO:201829544 Page 1Document3 pages1 NIL NIL NIL NIL NIL NIL NIL NIL NIL: PDF NO:201829544 Page 1Venkataraju BadanapuriNo ratings yet

- Government of Telangana Irrigation & CAD DepartmentDocument2 pagesGovernment of Telangana Irrigation & CAD DepartmentQC&ISD1 LMD COLONYNo ratings yet

- Cancellation of AE's deputation and relieving orderDocument1 pageCancellation of AE's deputation and relieving orderQC&ISD1 LMD COLONYNo ratings yet

- LetterDocument57 pagesLetterQC&ISD1 LMD COLONYNo ratings yet

- Attendance Report of QC - I - SD1 - LMD Feb-2020 (22-02-2020)Document3 pagesAttendance Report of QC - I - SD1 - LMD Feb-2020 (22-02-2020)QC&ISD1 LMD COLONYNo ratings yet

- IBRegForm 1Document3 pagesIBRegForm 1Bharat JohnNo ratings yet

- Field Observations SRSP DBM-1 To 5Document10 pagesField Observations SRSP DBM-1 To 5QC&ISD1 LMD COLONYNo ratings yet

- Date & Time Places Visited Mode of Conveyance & Distance Report by The Assistant Executive Engineer Remarks by The D.E.E/EE From To 1 2 3 4 5 6Document2 pagesDate & Time Places Visited Mode of Conveyance & Distance Report by The Assistant Executive Engineer Remarks by The D.E.E/EE From To 1 2 3 4 5 6QC&ISD1 LMD COLONYNo ratings yet

- Attendance Report of QC - I - SD1 - LMD Feb-2020 (22-02-2020)Document3 pagesAttendance Report of QC - I - SD1 - LMD Feb-2020 (22-02-2020)QC&ISD1 LMD COLONYNo ratings yet

- CC Cube StrengthDocument28 pagesCC Cube StrengthQC&ISD1 LMD COLONYNo ratings yet

- Human Resource Management: Sneha Sharma Asst - Professor IITMDocument29 pagesHuman Resource Management: Sneha Sharma Asst - Professor IITMSneha SharmaNo ratings yet

- Attitudes and Job SatisfactionDocument13 pagesAttitudes and Job SatisfactionAkb BhanuNo ratings yet

- Iceberg Ahead: The Hidden Cost of Public-Sector RetireeDocument29 pagesIceberg Ahead: The Hidden Cost of Public-Sector RetireeRick KarlinNo ratings yet

- Case Study - Industry RelationsDocument2 pagesCase Study - Industry RelationsJojis JosephNo ratings yet

- Lincoln CompanyDocument25 pagesLincoln Companydiandra dista aji100% (1)

- Gs ProfileDocument4 pagesGs ProfileeshwaarNo ratings yet

- Sop Human ResourceDocument3 pagesSop Human ResourceANGELOU SAGARALNo ratings yet

- 2Document2 pages2satheshNo ratings yet

- Reward Systems: Due ProcessDocument3 pagesReward Systems: Due ProcessImogen SuarezNo ratings yet

- 068 Price V InnodataDocument3 pages068 Price V InnodataGui EshNo ratings yet

- Method StatementDocument7 pagesMethod StatementPhil Baker100% (1)

- Final Report of HR EssarDocument98 pagesFinal Report of HR EssarNikhil Bhat67% (3)

- EPRS For PhilhealthDocument2 pagesEPRS For PhilhealthBuddy Chua67% (6)

- Multiskilling: Benefits of a Flexible WorkforceDocument34 pagesMultiskilling: Benefits of a Flexible WorkforcesantoshtandavNo ratings yet

- USL Annual Report 09 2010Document120 pagesUSL Annual Report 09 2010Shadab HussainNo ratings yet

- Reinventing The Wheel at Apex Door CompanyDocument11 pagesReinventing The Wheel at Apex Door Companyjuzzy52100% (1)

- Job Hazard Analysis Ladder Safety: ReferenceDocument2 pagesJob Hazard Analysis Ladder Safety: ReferenceSteve WilliamsonNo ratings yet

- Luxury Hotel Chain Ritz CarltonDocument2 pagesLuxury Hotel Chain Ritz CarltonSahithi TadalaNo ratings yet

- AttachmentDocument34 pagesAttachmentSiraj ShaikhNo ratings yet

- PHI 1502 Unit 3 Case StudyDocument1 pagePHI 1502 Unit 3 Case StudyAssignment ExpertsNo ratings yet

- Linking Business Strategy and Human Resource Management: Issues and ImplicationsDocument22 pagesLinking Business Strategy and Human Resource Management: Issues and ImplicationsNilesh TeelokuNo ratings yet

- BusinessDocument3 pagesBusinessmarkosNo ratings yet

- Human Resource Organization Employees Stakeholders: Talent Development, Part ofDocument6 pagesHuman Resource Organization Employees Stakeholders: Talent Development, Part ofTusharika MudgalNo ratings yet

- RITES General Conditions of ServiceDocument7 pagesRITES General Conditions of ServiceAMAN JHANo ratings yet