Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

NIkhil GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

NIkhil GuptaCopyright:

Available Formats

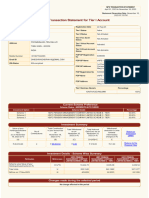

NPS TRANSACTION STATEMENT

April 01, 2022 to December 25, 2022

Statement Generation Date :December 25,

2022 07:22 PM

NPS Transaction Statement for Tier I Account

PRAN 110123578407 Registration Date 22-Apr-19

Subscriber Name SHRI NIKHIL GUPTA Tier I Status Active

G-239, JALVAYU VIHAR Tier II Status Not Activated

POCKET 4, SECTOR PHI 2 Tier II Tax Saver Not Activated

Status

UTTAR PRADESH

Tier I Virtual Account Not Activated

Address Status

GAUTAM BUDDHA NAGAR

Tier II Virtual Account Not Aplicable

UTTAR PRADESH - 201310 Status

INDIA POP-SP Registration 6396950

No

Mobile Number +919990383977 POP-SP Name eNPS - Online

Email ID NIKHIL.GUPTA07@ICLOUD.COM 1st Floor, Times Tower, Kamala, Mills

POP-SP Address Compound, Senapati Bapat

IRA Status IRA compliant Marg, Lower Parel, Mumbai, 400013

POP Registration No 5000682

POP Name eNPS - Online

1st Floor, Times Tower, Kamala, Mills

POP Address Compound, Senapati Bapat

Marg, Lower Parel, Mumbai, 400013

Tier I Nominee Name/s Percentage

VAISHALI 100%

Current Scheme Preference

Scheme Choice - ACTIVE CHOICE

Investment Option Scheme Details Percentage

Scheme 1 UTI RETIREMENT SOLUTIONS PENSION FUND SCHEME E - TIER I 50.00%

Scheme 2 UTI RETIREMENT SOLUTIONS PENSION FUND SCHEME C - TIER I 10.00%

Scheme 3 UTI RETIREMENT SOLUTIONS PENSION FUND SCHEME G - TIER I 35.00%

Scheme 4 UTI RETIREMENT SOLUTIONS PENSION FUND SCHEME A - TIER I 5.00%

Investment Summary

Value of your Total Contribution Total Withdrawal Total Notional Withdrawal/

Holdings(Investme No of in your account as as on Gain/Loss as on deduction in units

nts) on towards Return on

Contributions December 25, December 25, Investment

as on December December 25, 2022 (in ₹) 2022 (in ₹) intermediary

25, 2022 (in ₹) 2022 (in ₹) charges (in ₹) (XIRR)

(A) (B) (C) D=(A-B)+C E

₹ 2,41,434.21 21 ₹ 2,05,000.00 ₹ 0.00 ₹ 36,434.21 ₹ 69.91 Returns for the

Financial Year

Investment Details - Scheme Wise Summary

UTI RETIREMENT UTI RETIREMENT UTI RETIREMENT UTI RETIREMENT

Particulars References SOLUTIONS PENSION SOLUTIONS PENSION SOLUTIONS PENSION SOLUTIONS PENSION

FUND SCHEME E - TIER I FUND SCHEME C - TIER I FUND SCHEME G - TIER I FUND SCHEME A - TIER I

Scheme wise Value of your E=U*N 1,29,867.88 22,469.41 77,779.37 11,317.55

Holdings(Investments) (in ₹)

Total Units U 2,813.2585 716.1544 2,673.0880 771.9549

NAV as on 23-Dec-2022 N 46.1628 31.3751 29.0972 14.6609

Changes made during the selected period

No change affected in this period

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

03-Jun- By Voluntary Contributions eNPS - Online (5000682), 20,000.00 0.00 20,000.00

2022

20-Dec- By Voluntary Contributions eNPS - Online (5000682), 30,000.00 0.00 30,000.00

2022

Transaction Details

UTI RETIREMENT UTI RETIREMENT UTI RETIREMENT UTI RETIREMENT

SOLUTIONS PENSION SOLUTIONS PENSION SOLUTIONS PENSION SOLUTIONS PENSION

Withdrawal/ FUND SCHEME E - TIER FUND SCHEME C - FUND SCHEME G - TIER FUND SCHEME A -

deduction in units I TIER I I TIER I

Date Particulars

towards intermediary

Amount Amount Amount Amount

charges (₹) (₹) (₹) (₹) (₹)

Units Units Units Units

NAV (₹) NAV (₹) NAV (₹) NAV (₹)

01-Apr-

Opening balance 2,263.9394 554.2907 2,058.0520 599.9706

2022

09-Apr- Billing for Q4, 2021-2022 (13.59) (2.28) (7.78) (1.13)

(24.78) (0.3025) (0.0738) (0.2758) (0.0797)

2022 44.9138 30.8788 28.2046 14.1743

03-Jun- By Voluntary 10,000.00 2,000.00 7,000.00 1,000.00

235.1762 66.5079 255.1215 70.1995

2022 Contributions 42.5213 30.0716 27.4379 14.2451

09-Jul- Billing for Q1, 2022-2023 (13.15) (2.35) (8.09) (1.19)

(24.78) (0.3119) (0.0772) (0.2897) (0.0832)

2022 42.1598 30.4079 27.9241 14.2913

08-Oct- Billing for Q2, 2022-2023 (11.09) (1.86) (6.43) (0.97)

(20.35) (0.2443) (0.0604) (0.2269) (0.0653)

2022 45.3785 30.7604 28.3313 14.8462

20-Dec- By Voluntary 15,000.00 3,000.00 10,500.00 1,500.00

315.0016 95.5672 360.7069 102.0130

2022 Contributions 47.6188 31.3915 29.1095 14.7040

25-Dec- Closing Balance 2,813.2585 716.1544 2,673.0880 771.9549

2022

Notes

1.The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2.'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3.Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

View More

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

You might also like

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- NPS Statement SummaryDocument3 pagesNPS Statement Summaryvikas_2No ratings yet

- NPS Statement SummaryDocument4 pagesNPS Statement SummaryabhishekNo ratings yet

- NPS Transaction Statement for April 2022Document2 pagesNPS Transaction Statement for April 2022Rahul PanwarNo ratings yet

- NPS transaction statement summary for Apr 2022 to Dec 2022Document2 pagesNPS transaction statement summary for Apr 2022 to Dec 2022Satish Tiwari100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountthilaksafaryNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- NPS transaction statement breakdownDocument2 pagesNPS transaction statement breakdownLaya DonthulaNo ratings yet

- NPS transaction summaryDocument3 pagesNPS transaction summaryMd Sharma SharmaNo ratings yet

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS transaction statement breakdownDocument1 pageNPS transaction statement breakdownRajakumar ReddyNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- National Pension System transaction statementDocument2 pagesNational Pension System transaction statementzuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funNo ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- NPS TRANSACTION SUMMARYDocument2 pagesNPS TRANSACTION SUMMARYRajakumar Reddy25% (4)

- 1501137243609Document2 pages1501137243609Sougata Ghosh0% (1)

- NPS Account StatementDocument2 pagesNPS Account Statementdinesh rajendranNo ratings yet

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Health Insurance ParentsDocument1 pageHealth Insurance ParentscagopalofficebackupNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- NPS Contribution 2019 20 PDFDocument1 pageNPS Contribution 2019 20 PDFbindhu lingalaNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- Online Payment Acknowledgement Receipt CDocument1 pageOnline Payment Acknowledgement Receipt CSatyanarayana BalusaNo ratings yet

- PPFDocument1 pagePPFArnab RoyNo ratings yet

- Donation Detail Partner Ngo Program Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Program Donation Giveindia Retention TotalHarshit SinghNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateSenthil balasubramanianNo ratings yet

- Possession Certificate Bangalore RuralDocument1 pagePossession Certificate Bangalore RuralShanka ShankaNo ratings yet

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- Mediclaim ParentsDocument1 pageMediclaim ParentsCA Ashish MehtaNo ratings yet

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation Receiptqwert0% (1)

- LIC Aug 2020 PDFDocument1 pageLIC Aug 2020 PDFShantanu MetayNo ratings yet

- Receipt DocDocument1 pageReceipt Doccharchit123No ratings yet

- Declaration 80D 80DDBDocument1 pageDeclaration 80D 80DDBShobit0% (1)

- Education Loan Interest CertificateDocument1 pageEducation Loan Interest CertificatePavan KumarNo ratings yet

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Premium Receipt for Shefali Sawan's Family Health Insurance PolicyDocument1 pagePremium Receipt for Shefali Sawan's Family Health Insurance PolicyanuNo ratings yet

- Mediclaim Premium Receipt 2018Document1 pageMediclaim Premium Receipt 2018faizahamed111100% (1)

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- FHP H0225594Document2 pagesFHP H0225594Raghavendra KamathNo ratings yet

- MediclaimDocument3 pagesMediclaimPrajwal ShettyNo ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Donation Receipt for Ayodhya Ram Mandir ConstructionDocument1 pageDonation Receipt for Ayodhya Ram Mandir Constructionkonda83No ratings yet

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- Home Loan - Certificate - 2022-23Document1 pageHome Loan - Certificate - 2022-23cont2chandu100% (1)

- Payment ReceiptDocument1 pagePayment Receiptnizamsagar tsgenco75% (4)

- Star Health PolicyDocument5 pagesStar Health PolicyTripathy RadhakrishnaNo ratings yet

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDocument5 pagesReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNo ratings yet

- Max Bupa Health Insurance ReceiptDocument1 pageMax Bupa Health Insurance ReceiptSaurabh RaghuvanshiNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencedilip kumarNo ratings yet

- Anchor IntimationDocument2 pagesAnchor IntimationNIkhil GuptaNo ratings yet

- MR - Nikhil GuptaDocument3 pagesMR - Nikhil GuptaNIkhil GuptaNo ratings yet

- PPFTransactionHistory25 12 2022Document1 pagePPFTransactionHistory25 12 2022NIkhil GuptaNo ratings yet

- MR - Nikhil GuptaDocument3 pagesMR - Nikhil GuptaNIkhil GuptaNo ratings yet

- D074923716 4499464597781740 RenewalDocument5 pagesD074923716 4499464597781740 RenewalNIkhil GuptaNo ratings yet

- LESSONS LEARNED FROM CO2 SYSTEM SHUTDOWNDocument6 pagesLESSONS LEARNED FROM CO2 SYSTEM SHUTDOWNLuthius100% (2)

- Full AssignmentDocument46 pagesFull AssignmentCassandra LimNo ratings yet

- Nec TSC High Pressure Cleaning ServicesDocument35 pagesNec TSC High Pressure Cleaning ServicesLiberty MunyatiNo ratings yet

- MPR Project Report Sample FormatDocument24 pagesMPR Project Report Sample FormatArya khattarNo ratings yet

- HR Examiner's Guide to Free Speech at WorkDocument10 pagesHR Examiner's Guide to Free Speech at WorkShiba LodhiNo ratings yet

- Fifo, Lifo, Simple and Weighted AverageDocument12 pagesFifo, Lifo, Simple and Weighted AverageSanjay SolankiNo ratings yet

- 39 Different Types of Candlesticks PatternsDocument47 pages39 Different Types of Candlesticks Patternspritesh.tiwariNo ratings yet

- Sixty First Annual Report 2012-13Document131 pagesSixty First Annual Report 2012-13Ishanvi AgarwalNo ratings yet

- TRAKHEES CertificateDocument1 pageTRAKHEES CertificatePriyanka JNo ratings yet

- Contract of AgencyDocument2 pagesContract of Agencyjonel sembranaNo ratings yet

- Specialized Expertise: Established Knowledge, Guiding You ThroughDocument6 pagesSpecialized Expertise: Established Knowledge, Guiding You ThroughOmar GuillenNo ratings yet

- Inb 372 Course Outline Summer 2022Document6 pagesInb 372 Course Outline Summer 2022Imrul JoyNo ratings yet

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- Dragon Fruit Greek Yogurt Feasibility StudyDocument16 pagesDragon Fruit Greek Yogurt Feasibility StudyJamie HaravataNo ratings yet

- Growing Ampalaya (Bitter Gourd) in The Philippines 2Document29 pagesGrowing Ampalaya (Bitter Gourd) in The Philippines 2kishore_hemlani86% (7)

- Business Finance Lesson 2Document20 pagesBusiness Finance Lesson 2Iekzkad RealvillaNo ratings yet

- Types of Media and Media ConvergenceDocument47 pagesTypes of Media and Media ConvergenceEmely FrancoNo ratings yet

- Marketing Strategy Chapter 3 Version 2 - 4Document57 pagesMarketing Strategy Chapter 3 Version 2 - 4Inès ChougraniNo ratings yet

- Why China's Economic Growth Has Been Slow Despite SuccessDocument2 pagesWhy China's Economic Growth Has Been Slow Despite SuccessBraeden GervaisNo ratings yet

- Chap 007 Business PlanDocument31 pagesChap 007 Business PlanAliAdnan AliAdnanNo ratings yet

- Galfar MS 000-ZX-E-77758Document22 pagesGalfar MS 000-ZX-E-77758Ramaraju RNo ratings yet

- Annual Report Laporan Tahunan: PT Gudang Garam TBKDocument132 pagesAnnual Report Laporan Tahunan: PT Gudang Garam TBKAnnisa Rosie NirmalaNo ratings yet

- Csec Poa June 2010 p2Document12 pagesCsec Poa June 2010 p2Renelle RampersadNo ratings yet

- Location Intelligence White PaperDocument23 pagesLocation Intelligence White Paperanon_552101118No ratings yet

- Kel. 6 - Sesi 9 Strategic PositioningDocument22 pagesKel. 6 - Sesi 9 Strategic PositioningRidho AnjikoNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- Canara HSBC Life Insurance Premium ReceiptDocument1 pageCanara HSBC Life Insurance Premium Receiptyogesh bafnaNo ratings yet

- GeM Bidding 3335448Document7 pagesGeM Bidding 3335448Bhumi ShahNo ratings yet

- ACCENTURE SOLUTIONS PVT LTD EARNINGS STATEMENTDocument1 pageACCENTURE SOLUTIONS PVT LTD EARNINGS STATEMENTavisinghoo7No ratings yet

- ASE20091 April 2016 Examiner ReportDocument7 pagesASE20091 April 2016 Examiner ReportTin Zar ThweNo ratings yet