Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

kids funOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

kids funCopyright:

Available Formats

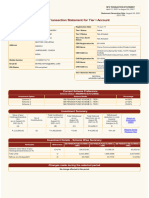

NPS TRANSACTION STATEMENT

April 01, 2021 to January 05, 2022

Statement Generation Date :January 05,

2022 01:11 PM

NPS Transaction Statement for Tier I Account

PRAN 110144409948 Registration Date 14-Feb-20

Subscriber Name SHRI NEERAJ KUMAR JAIN Tier I Status Active

S 34 Tier II Status Not Activated

NEAR OLD BUS STAND Tier II Tax Saver Not Activated

Status

PHULERA

CBO Registration No 6509451

Address NEW COLONY CBO Name Incedo Technology Solutions Limited

JAIPUR M-62 & 63, 1st Floor, Connaught Place

CBO Address

New Delhi, 110001

RAJASTHAN - 303338

CHO Registration No 5509291

INDIA

CHO Name Incedo Technology Solutions Limited

Mobile Number +918949615568 CHO Address M-62 & 63, 1st Floor, Connaught Place

null, New Delhi, 110001

Email ID J.NEERAJ2011@GMAIL.COM

IRA Status IRA compliant Tier I Nominee Name/s Percentage

PRITI JAIN 100%

Current Scheme Preference

Scheme Choice - MODERATE AUTO CHOICE

Investment Option Scheme Details Percentage

Scheme 1 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME E - TIER I 44.00%

Scheme 2 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME C - TIER I 27.00%

Scheme 3 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME G - TIER I 29.00%

Investment Summary

Value of your Total Contribution Total Withdrawal Total Notional Withdrawal/

Holdings(Investme No of in your account as as on Gain/Loss as on deduction in units

nts) on towards Return on

Contributions January 05, January 05, Investment

as on January 05, January 05, 2022 (in ₹) 2022 (in ₹) intermediary

2022 (in ₹) 2022 (in ₹) charges (in ₹) (XIRR)

(A) (B) (C) D=(A-B)+C E

₹ 1,23,637.61 23 ₹ 1,07,559.20 ₹ 0.00 ₹ 16,078.41 ₹ 119.44 Returns for the

Financial Year

Investment Details - Scheme Wise Summary

HDFC PENSION HDFC PENSION HDFC PENSION

Particulars References MANAGEMENT COMPANY MANAGEMENT COMPANY MANAGEMENT COMPANY

LIMITED SCHEME E - TIER I LIMITED SCHEME C - TIER I LIMITED SCHEME G - TIER I

Scheme wise Value of your E=U*N 54,662.37 33,431.33 35,543.91

Holdings(Investments) (in ₹)

Total Units U 1,553.0495 1,480.4809 1,623.8479

NAV as on 04-Jan-2022 N 35.1968 22.5814 21.8887

Changes made during the selected period

Date Tier Type Transaction Type

06-Sep-2021 Tier-1 On account of Rebalancing of Assets as per Regulatory Requirement

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

23-Apr-2021 For March, 2021 HDFC Securities Limited (5000542), 0.00 6,164.40 6,164.40

17-May- For April, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

2021

17-Jun- For May, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

2021

13-Jul-2021 For June, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

23-Aug- For July, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

2021

15-Sep- For August, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

2021

13-Oct-2021 For September, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

17-Nov- For October, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

2021

16-Dec- For November, 2021 HDFC Securities Limited (5000542), 0.00 6,542.40 6,542.40

2021

Transaction Details

HDFC PENSION HDFC PENSION HDFC PENSION

Withdrawal/ MANAGEMENT COMPANY MANAGEMENT COMPANY MANAGEMENT COMPANY

deduction in units LIMITED SCHEME E - TIER I LIMITED SCHEME C - TIER I LIMITED SCHEME G - TIER I

Date Particulars

towards intermediary Amount (₹) Amount (₹) Amount (₹)

charges (₹) Units Units Units

NAV (₹) NAV (₹) NAV (₹)

01-Apr- Opening balance 950.7168 679.2484 627.5204

2021

10-Apr- (19.36) (10.19) (9.36)

Billing for Q4, 2020-2021 (38.91) (0.6624) (0.4730) (0.4379)

2021 29.2251 21.5431 21.3747

23-Apr- 2,835.62 1,726.03 1,602.75

By Contribution for March,2021 100.6570 79.9887 75.1988

2021 28.1711 21.5784 21.3135

17-May- 3,009.50 1,831.87 1,701.03

By Contribution for April,2021 102.2075 84.1299 79.2418

2021 29.4450 21.7743 21.4663

17-Jun- 3,009.50 1,831.87 1,701.03

By Contribution for May,2021 96.8077 83.7039 79.3135

2021 31.0874 21.8851 21.4469

03-Jul- (19.11) (9.92) (9.02)

Billing for Q1, 2021-2022 (38.05) (0.6118) (0.4534) (0.4221)

2021 31.2330 21.8776 21.3668

13-Jul- 3,009.50 1,831.87 1,701.03

By Contribution for June,2021 95.5672 83.7020 79.6914

2021 31.4909 21.8856 21.3452

23-Aug- 3,009.50 1,831.87 1,701.03

By Contribution for July,2021 92.0021 82.9016 79.0232

2021 32.7112 22.0969 21.5257

06-Sep- On account of Rebalancing of (7,297.96) 1,641.71 5,656.25

2021 Assets as per Regulatory (211.1926) 73.7257 259.4110

Requirement 34.5560 22.2678 21.8042

15-Sep- 2,878.65 1,766.44 1,897.31

By Contribution for August,2021 82.4799 79.1334 86.7191

2021 34.9012 22.3223 21.8788

09-Oct- (18.88) (11.40) (12.20)

Billing for Q2, 2021-2022 (42.48) (0.5351) (0.5097) (0.5588)

2021 35.2807 22.3657 21.8297

13-Oct- By Contribution for 2,878.65 1,766.44 1,897.31

80.3044 79.0084 87.1468

2021 September,2021 35.8467 22.3576 21.7714

17-Nov- By Contribution for 2,878.65 1,766.44 1,897.31

81.0898 78.5007 86.2660

2021 October,2021 35.4995 22.5022 21.9937

16-Dec- By Contribution for 2,878.65 1,766.44 1,897.31

84.2190 77.8743 85.7347

2021 November,2021 34.1805 22.6832 22.1300

05-Jan- Closing Balance 1,553.0495 1,480.4809 1,623.8479

2022

Notes

1.The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2.'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3.Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

View More

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

You might also like

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- NPS transaction statement breakdownDocument2 pagesNPS transaction statement breakdownLaya DonthulaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountthilaksafaryNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement for April 2022Document2 pagesNPS Transaction Statement for April 2022Rahul PanwarNo ratings yet

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- NPS TRANSACTIONDocument2 pagesNPS TRANSACTIONAmit Gupta50% (2)

- NPS TRANSACTION SUMMARYDocument2 pagesNPS TRANSACTION SUMMARYRajakumar Reddy25% (4)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- National Pension System transaction statementDocument2 pagesNational Pension System transaction statementzuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS transaction statement breakdownDocument1 pageNPS transaction statement breakdownRajakumar ReddyNo ratings yet

- NPS transaction statement summary for Apr 2022 to Dec 2022Document2 pagesNPS transaction statement summary for Apr 2022 to Dec 2022Satish Tiwari100% (1)

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- NPS Statement SummaryDocument3 pagesNPS Statement Summaryvikas_2No ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Statement SummaryDocument4 pagesNPS Statement SummaryabhishekNo ratings yet

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS transaction summaryDocument3 pagesNPS transaction summaryMd Sharma SharmaNo ratings yet

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- Online payment receipt for NPS contributionDocument1 pageOnline payment receipt for NPS contributionSandeepNayak0% (2)

- NPS Contribution 2019 20 PDFDocument1 pageNPS Contribution 2019 20 PDFbindhu lingalaNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- Online Payment Acknowledgement Receipt CDocument1 pageOnline Payment Acknowledgement Receipt CSatyanarayana BalusaNo ratings yet

- Online Payment Receipt for Initial Contribution to PRAN 400020173294Document1 pageOnline Payment Receipt for Initial Contribution to PRAN 400020173294Harish Ghorpade67% (6)

- Online Payment Receipt for NPS ContributionDocument1 pageOnline Payment Receipt for NPS ContributionPranay Kumar0% (1)

- Payment ReceiptDocument1 pagePayment Receiptnizamsagar tsgenco75% (4)

- Online Payment Receipt for NPS Initial ContributionDocument1 pageOnline Payment Receipt for NPS Initial ContributionHarish Ghorpade59% (17)

- Health Insurance Premium Receipt-RaviDocument2 pagesHealth Insurance Premium Receipt-RaviSanjay Balamurthy100% (1)

- Mediclaim Premium Receipt 2018Document1 pageMediclaim Premium Receipt 2018faizahamed111100% (1)

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- Naresh Kumar: Customer Care CenterDocument2 pagesNaresh Kumar: Customer Care Centernaresh2912275% (4)

- PPF e-Receipt shows 10k deposit on May 2ndDocument1 pagePPF e-Receipt shows 10k deposit on May 2ndanurag srivastavaNo ratings yet

- MediclaimDocument3 pagesMediclaimPrajwal ShettyNo ratings yet

- 4128i HP 90979507 03 000Document4 pages4128i HP 90979507 03 000Rita OshanNo ratings yet

- Housing Laon (0726675100007849) Provisional Certificate PDFDocument1 pageHousing Laon (0726675100007849) Provisional Certificate PDFanon_1747268810% (1)

- Repay CertificateDocument1 pageRepay Certificateacrajesh50% (2)

- HDFC Ergo Policy Renewal 2023 SelfDocument5 pagesHDFC Ergo Policy Renewal 2023 SelfGopivishnu KanchiNo ratings yet

- Premium Receipt for Family Health InsuranceDocument2 pagesPremium Receipt for Family Health InsuranceJaid RukadikarNo ratings yet

- Hospital Premium CertificateDocument1 pageHospital Premium CertificateD Kesava Rao0% (1)

- Self & Wife - Mediclaim PolicyDocument5 pagesSelf & Wife - Mediclaim PolicyShrikant Sahu100% (4)

- Mediclaim ParentsDocument1 pageMediclaim ParentsCA Ashish MehtaNo ratings yet

- Health Insurance Receipt 2022Document1 pageHealth Insurance Receipt 2022Vijay SekarNo ratings yet

- Premium Paid Certificate: Date: 14-SEP-20 16Document1 pagePremium Paid Certificate: Date: 14-SEP-20 16Koushik DuttaNo ratings yet

- Icici Premium Paid Certificate SampleDocument1 pageIcici Premium Paid Certificate SampleRahul Kandiyal100% (1)

- Payment ReceiptDocument1 pagePayment ReceiptAnjan Debnath75% (4)

- Medical Insurance ParentsDocument1 pageMedical Insurance Parentsraghuveer9303No ratings yet

- Health Insurance ParentsDocument1 pageHealth Insurance ParentscagopalofficebackupNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceBhanu PrakashNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Kumar SinghNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument4 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencerahulNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument5 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencedk1100861No ratings yet

- 1669292247218Document2 pages1669292247218Bikram NongmaithemNo ratings yet

- 1536923049EtenderingofE T P ChemicalsDocument10 pages1536923049EtenderingofE T P ChemicalsAnshul BansalNo ratings yet

- Inspector Vision Sensors: The Intelligent Vision Solution in An Easy-To-Use Sensor PackageDocument30 pagesInspector Vision Sensors: The Intelligent Vision Solution in An Easy-To-Use Sensor PackageANDRICO ANTONIUSNo ratings yet

- Liedtka, J. M. (1998) - Strategic Thinking. Can It Be TaughtDocument10 pagesLiedtka, J. M. (1998) - Strategic Thinking. Can It Be TaughtOscarAndresPinillaCarreñoNo ratings yet

- Introduction To Income Tax: Multiple Choice QuestionsDocument6 pagesIntroduction To Income Tax: Multiple Choice QuestionsNidhi LathNo ratings yet

- FINANCE CASES AND TOPICSDocument7 pagesFINANCE CASES AND TOPICSFuzael AminNo ratings yet

- Completion Fluids BaroidDocument26 pagesCompletion Fluids Baroidcrown212No ratings yet

- Best Practices for 802.11 Radios on 70 Series and CK3R/X DevicesDocument4 pagesBest Practices for 802.11 Radios on 70 Series and CK3R/X DevicesHilber Ricardo MoyanoNo ratings yet

- Unit 3 Secondary MarketDocument21 pagesUnit 3 Secondary MarketGhousia IslamNo ratings yet

- Quotation: Spray Extraction Carpet Cleaner Model No: PUZZI 8/1 Technical DataDocument8 pagesQuotation: Spray Extraction Carpet Cleaner Model No: PUZZI 8/1 Technical DataMalahayati ZamzamNo ratings yet

- Improve Asset Performance with Integrated Asset ManagementDocument12 pagesImprove Asset Performance with Integrated Asset ManagementArun KarthikeyanNo ratings yet

- Sustainable Development & Environmental Assessment QuizDocument2 pagesSustainable Development & Environmental Assessment QuizramananNo ratings yet

- Ee Room VentilationDocument7 pagesEe Room VentilationNiong DavidNo ratings yet

- Pert and CPM Detailed - Session-1Document42 pagesPert and CPM Detailed - Session-1azsrxNo ratings yet

- Chapter 7 by Murali PrasadDocument28 pagesChapter 7 by Murali PrasadWatiri SteveNo ratings yet

- Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test BankDocument46 pagesManagerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test Bankmable100% (18)

- Paired and Independent Samples T TestDocument34 pagesPaired and Independent Samples T TestMcjohnden LorenNo ratings yet

- Insurance As A Investment Tool at Icici Bank Project Report Mba FinanceDocument73 pagesInsurance As A Investment Tool at Icici Bank Project Report Mba FinanceBabasab Patil (Karrisatte)No ratings yet

- DBMS Lecture NotesDocument120 pagesDBMS Lecture NoteshawltuNo ratings yet

- B757-767 Series: by Flightfactor and Steptosky For X-Plane 11.35+ Produced by VmaxDocument35 pagesB757-767 Series: by Flightfactor and Steptosky For X-Plane 11.35+ Produced by VmaxDave91No ratings yet

- NTP Dummy ConfigDocument1 pageNTP Dummy Configastir1234No ratings yet

- TransformersDocument24 pagesTransformersWonbae ChoiNo ratings yet

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingNo ratings yet

- Customers' Role in Service Delivery & Self-Service TechDocument32 pagesCustomers' Role in Service Delivery & Self-Service TechSubhani KhanNo ratings yet

- Apparent Density of Free-Flowing Metal Powders Using The Hall Flowmeter FunnelDocument4 pagesApparent Density of Free-Flowing Metal Powders Using The Hall Flowmeter Funnelİrem Şebnem SorucuNo ratings yet

- Nozzles - Process Design, From The OutsideDocument12 pagesNozzles - Process Design, From The OutsideperoooNo ratings yet

- 1 s2.0 S0021979718302352 MainDocument6 pages1 s2.0 S0021979718302352 MainShuvam PawarNo ratings yet

- Direct and Inverse ProportionDocument4 pagesDirect and Inverse Proportionjoannng76No ratings yet

- 4x7.1x8.5 Box CulvertDocument1,133 pages4x7.1x8.5 Box CulvertRudra SharmaNo ratings yet

- Who Moved My CheeseDocument12 pagesWho Moved My CheeseTYAGI PROJECTSNo ratings yet

- Colorful Fun Doodles and Blobs Colorful Social Media Creative Presentation SlidesCarnivalDocument28 pagesColorful Fun Doodles and Blobs Colorful Social Media Creative Presentation SlidesCarnivalIlham Abinya LatifNo ratings yet