Professional Documents

Culture Documents

Discovery Fund Premium Receipts

Uploaded by

KartikOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discovery Fund Premium Receipts

Uploaded by

KartikCopyright:

Available Formats

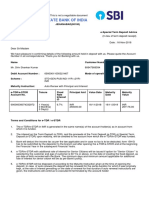

PSRLE023120041802

We have received your premium

Comp/Nov/Int/4743

10/06/2023 Receipt No: 0036027078

Kartik Sharma

F-104, Lotus Street Omaxe

Panorama Cityhomes, Bhiwadi

Bhiwadi - 301019

Rajasthan

☎ : 919999933079

@ : kartiksharma.ks1992@gmail.com

Your details as per our records

Client ID: NU854456 Payor Name: Kartik Sharma

Policy No.: 24997793 Policy Status: In Force

Plan: HDFC Life ProGrowth Plus UIN: 101L081V05

Risk Commencement

Sum Assured (INR): 600000 June 10, 2022

Date:

Payment Term: Na years Payment Frequency: Annual

Dear Kartik Sharma,

Thank you for staying insured with HDFC Life. We have received the premium payment of INR 60000 for your policy. The details are as

below:

Amount Received

Payment mode Payment avenue Date Transaction ID

(INR)

Online Auto Debit/Fund transfer June 11, 2023 - 60000

Total Amount Due

Benefit Opted For / Particulars Premium Amount (INR) Taxes and Levies as applicable (INR)

(INR)

HDFC Life ProGrowth Plus 60000 0 60000

Total Amount Due (INR) 60000

Less: Amount in Deposit (If any) (INR) 0

Total Premium Payable (INR) 60000

Actual Amount Paid (INR) 60000

NOTE:

This receipt is valid subject to realisation of payment by all modes.

The policy status mentioned above is as on the date of generation of this receipt. It does not necessarily indicate the status mentioned

above at a later date.

Taxes and levies will be applicable as per prevailing tax laws and are subject to change. Please consult your tax advisors to confirm

the applicability of the tax benefits at your end.

Tax would be deducted at source (as applicable) from the policy payments, as per the Income tax Act, 1961.

As per section 10(10D) of the Income Tax Act, 1961, any sum received under a life insurance policy will be exempt subject to

conditions specified therein.

NAV applicable on premium received is subject to cut-off rules followed by HDFC Life Insurance Co. Ltd. in accordance with IRDAI. The

current cut-off timing for same day NAV is 3.00 pm IST.

Tax benefit under Section 80C and 80 CCC of the Income Tax Act, 1961 is available to an individual or HUF for premium paid towards

life insurance or pension policy, subject to the conditions/limits specified therein.

Consolidated stamp duty of 1 (Rupee One only) paid vide Letter of Authorisation number LOA/CSD/575/2023 dated January 23, 2023.

Visit www.hdfclife.com for various premium payment options.

In case of any queries, please feel free to contact us. We'll be glad to hear from you!

Warm regards,

HDFC Life

Please verify your email ID and contact number with us to continue receiving your premium payment receipts.

******** This is an electronically generated receipt and does not require a signature. ********

You might also like

- DownloadReceipt PDFDocument2 pagesDownloadReceipt PDFJai's EpicenterNo ratings yet

- Foreclosure Letter 23-41-25Document3 pagesForeclosure Letter 23-41-25आम्हीं मालवणीNo ratings yet

- Airtel Axis Bank Credit Card Welcome Benefit Amazon VoucherDocument2 pagesAirtel Axis Bank Credit Card Welcome Benefit Amazon VouchervspcmNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyShashank SinghNo ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- HDFC Life Premium Receipts Nov 2022Document1 pageHDFC Life Premium Receipts Nov 2022kapsekunalNo ratings yet

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Ad00100972 16112018071600 PDFDocument1 pageAd00100972 16112018071600 PDFBalmukund kumarNo ratings yet

- Medical Insurance Certificate Max BupaDocument1 pageMedical Insurance Certificate Max BupaBinod DashNo ratings yet

- Bajaj Cash Assure Renewal Receipt PDFDocument1 pageBajaj Cash Assure Renewal Receipt PDFPawan KumarNo ratings yet

- Nov PDFDocument1 pageNov PDFSuresh PatelNo ratings yet

- FD Acknowledgement SlipDocument1 pageFD Acknowledgement SlipSwapnil kadamNo ratings yet

- CP PremiumReceipt 50373436 10164963 2506101435563556Document1 pageCP PremiumReceipt 50373436 10164963 2506101435563556TEENTUX100% (2)

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- Simple Bookkeeping in EntrepreneurshipDocument46 pagesSimple Bookkeeping in EntrepreneurshipVenn100% (1)

- Credit Card StatementDocument2 pagesCredit Card Statementanilvishaka7621No ratings yet

- Statement de Aprail - 20-Mar 2021Document175 pagesStatement de Aprail - 20-Mar 2021Balachander RNo ratings yet

- Your Policy Purchase Premium Receipt (Provisional) : Receipt Number: OT043152810 Date: 19-03-2023Document2 pagesYour Policy Purchase Premium Receipt (Provisional) : Receipt Number: OT043152810 Date: 19-03-2023kp gamerNo ratings yet

- Multimodal Dangerous Goods Form: Shipper'S DeclarationDocument2 pagesMultimodal Dangerous Goods Form: Shipper'S DeclarationCeDíazNo ratings yet

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsHarish SharmaNo ratings yet

- Rachit HDFCDocument1 pageRachit HDFCrahul srivastavaNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsMuthyam PallapuNo ratings yet

- HDFC LifeDocument1 pageHDFC LifeDr. Vishal GOELNo ratings yet

- 4229 1542982512 0 Receipt 0023138589Document1 page4229 1542982512 0 Receipt 0023138589Ekta BaraskarNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptspinki gNo ratings yet

- 0 Receipt 0029319078Document1 page0 Receipt 0029319078saamrockstarNo ratings yet

- 4229 1542982512 0 Receipt 0023138589Document1 page4229 1542982512 0 Receipt 0023138589Ekta BaraskarNo ratings yet

- HDFC LifeDocument1 pageHDFC Lifevirendra singhNo ratings yet

- We Have Received Your Premium: Keshav PrasadDocument1 pageWe Have Received Your Premium: Keshav Prasadnavinyadavkori67No ratings yet

- We Have Received Your Premium: Rahul PahadeDocument1 pageWe Have Received Your Premium: Rahul PahaderahulpahadeNo ratings yet

- Bajaj Finance LTD: Ganesh So UdaymalDocument4 pagesBajaj Finance LTD: Ganesh So UdaymalYASH PATNINo ratings yet

- Glosent Ann EdDocument4 pagesGlosent Ann EdGLOSENTNo ratings yet

- AgreementDocument18 pagesAgreementVaishnaviNo ratings yet

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- Covernote SA895634 1667212040025Document2 pagesCovernote SA895634 1667212040025Karthik RamNo ratings yet

- Kulkarni Sarang MilindDocument21 pagesKulkarni Sarang MilindSarang KulkarniNo ratings yet

- Personal Nivedhitha N Narayana Swamy Saradhamani 1995-07-09 Female Single Private Employee Indian Indian CBBPN3910N Paperlessaadhaar PermanentDocument29 pagesPersonal Nivedhitha N Narayana Swamy Saradhamani 1995-07-09 Female Single Private Employee Indian Indian CBBPN3910N Paperlessaadhaar PermanentnavaneethakrishnanNo ratings yet

- PP000208 0FR9G CertificateOfInsDocument2 pagesPP000208 0FR9G CertificateOfInsAbhijeetPawarNo ratings yet

- Duplicate Receipt Dear Sandip KamaniDocument2 pagesDuplicate Receipt Dear Sandip KamaniSandip PatelNo ratings yet

- IDFC FIRST Bank - Credit Card - Statement - 22062023Document5 pagesIDFC FIRST Bank - Credit Card - Statement - 22062023Udaya KumarNo ratings yet

- PDFDocument1 pagePDFShankar SumanNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateBhanu YadavNo ratings yet

- OS15830487 PremiumPaymentCertificateDocument1 pageOS15830487 PremiumPaymentCertificateRohit ChogleNo ratings yet

- Bajaj Finance LTD: Karanbhai BharvadDocument4 pagesBajaj Finance LTD: Karanbhai BharvadChiripal IndustriesNo ratings yet

- HDFC Life - Online Premium Payment PDFDocument1 pageHDFC Life - Online Premium Payment PDFmilan shrivastavaNo ratings yet

- Account Certificate 20240214053224 20078018Document2 pagesAccount Certificate 20240214053224 20078018ArunNo ratings yet

- Loan Agreement LAI1005782312Document3 pagesLoan Agreement LAI1005782312orugalluNo ratings yet

- 80C Relience InsuranceDocument1 page80C Relience Insuranceshailesh.kumarNo ratings yet

- HDFC SL Crest Receipt For 2018 For Tax Purpose VijeshDocument1 pageHDFC SL Crest Receipt For 2018 For Tax Purpose VijeshraviNo ratings yet

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. PAWAN KUMAR Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - NON ULIP: Life Assured: Mr. PAWAN KUMAR Assignee: N.A. Policy DetailsPawan KumarNo ratings yet

- Long Term SheetDocument8 pagesLong Term SheetZabid khanNo ratings yet

- Sanction LetterDocument1 pageSanction Letterdipakk21051994No ratings yet

- Loan Term Sheet - 17!57!59Document16 pagesLoan Term Sheet - 17!57!59Kishan AhirNo ratings yet

- Sanction Letter FAST7651617444854859 371328176989144Document7 pagesSanction Letter FAST7651617444854859 371328176989144hm7072302No ratings yet

- Premium Debit Note Debit Note No - 12214: Bank Account DetailsDocument1 pagePremium Debit Note Debit Note No - 12214: Bank Account DetailsIYEMPERUMALNo ratings yet

- PPC 03745733 1671523503Document1 pagePPC 03745733 1671523503Rajshree SamantrayNo ratings yet

- StatementOfAccount TCFTW0260000010725367 11 04 2024 11 55 49Document6 pagesStatementOfAccount TCFTW0260000010725367 11 04 2024 11 55 49smaheshwari816No ratings yet

- DownloadDocument1 pageDownloadlovep9416No ratings yet

- Your Tax Invoice: Particulars Amount (RS)Document2 pagesYour Tax Invoice: Particulars Amount (RS)Siddhartha kumar singhNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVishal DNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held bySURYKRIT SINGHNo ratings yet

- KIA Booking DocketDocument7 pagesKIA Booking DocketArjun KatiyarNo ratings yet

- 11 38 42 AmDocument1 page11 38 42 AmSUMIT SAHANo ratings yet

- Medical Report Form 3906 v1Document2 pagesMedical Report Form 3906 v1Cofadredel AgustinoNo ratings yet

- TRIP-065515: Contact: Carrier: Order(s) : Driver Name: Driver's Cell #Document2 pagesTRIP-065515: Contact: Carrier: Order(s) : Driver Name: Driver's Cell #Kt DerickNo ratings yet

- Directions Credit Union Online Banking PDFDocument1 pageDirections Credit Union Online Banking PDFTyler GroveNo ratings yet

- Confirmation Letter Mr. Hartono (29-30 Jun)Document1 pageConfirmation Letter Mr. Hartono (29-30 Jun)IT KokoonNo ratings yet

- PE 10WirelessAndMobileSecurityDocument7 pagesPE 10WirelessAndMobileSecuritygayathrideviNo ratings yet

- Family Travel Planner: Trip Overview & ItineraryDocument4 pagesFamily Travel Planner: Trip Overview & ItineraryRJNo ratings yet

- Presentation On MCB BankDocument35 pagesPresentation On MCB BankMuhammad Shakeel Ijaz DhuddiNo ratings yet

- Parcial Resuelto Ingles Tecnico 1 Adm. Emp. Preguntas 1-2-3Document4 pagesParcial Resuelto Ingles Tecnico 1 Adm. Emp. Preguntas 1-2-3Valentin MacagnoNo ratings yet

- The Institute of Chartered Accoutants of India: S. No. Place MR./ DR./ CA./ Ms. Name Designation Section Pay in BandDocument27 pagesThe Institute of Chartered Accoutants of India: S. No. Place MR./ DR./ CA./ Ms. Name Designation Section Pay in BandInsta SickNo ratings yet

- SIP: Session Initiation Protocol: The Internet Multimedia StackDocument6 pagesSIP: Session Initiation Protocol: The Internet Multimedia StackFidel Atahuichi TorrezNo ratings yet

- Revised - TATA Product Deck - Sales Training For Customers18AugDocument8 pagesRevised - TATA Product Deck - Sales Training For Customers18AugVipin K GuptaNo ratings yet

- Pid App Form W Gen Terms 1Document2 pagesPid App Form W Gen Terms 1Andrew GautaneNo ratings yet

- 448199Document40 pages448199薇艾No ratings yet

- Health Recharge - Single SheeterDocument2 pagesHealth Recharge - Single SheeterChinmoy BaruahNo ratings yet

- PB Enterprise - Main Page 99000000000Document2 pagesPB Enterprise - Main Page 99000000000Zarif Ahmed AnikNo ratings yet

- Malayan Insurance Co. V Pap Co. LTDDocument2 pagesMalayan Insurance Co. V Pap Co. LTDGin FranciscoNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Sa Fastrack NotesDocument36 pagesSa Fastrack Noteskunika bachhasNo ratings yet

- Startups 8Document2 pagesStartups 8Rafi AzamNo ratings yet

- Soneri Gold & Classic Debit Card Schedule of ChargesDocument1 pageSoneri Gold & Classic Debit Card Schedule of ChargesFurqan AhmedNo ratings yet

- Recharge Receipt Template 1Document1 pageRecharge Receipt Template 1harshitagarwal381No ratings yet

- Chapter 09 - Operational Traffic and TransportDocument38 pagesChapter 09 - Operational Traffic and TransportShubham BaderiyaNo ratings yet

- Literature ReviewDocument8 pagesLiterature ReviewAshi GargNo ratings yet

- First RepublicDocument2 pagesFirst RepublicSTOjedenNo ratings yet