Professional Documents

Culture Documents

Group Activity Part 1 Jose Zapata

Uploaded by

LuisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Activity Part 1 Jose Zapata

Uploaded by

LuisCopyright:

Available Formats

Contribution Margin :

Is the result that comes from the revenues of unit sold, minus the sum of variable costs. And the results

shows , how much that product contributes to covering fixed cost and increasing profits. This can be done

per piece and would be Contribution margin per piece. (Wall Street Prep. n.d.)

Formula: (S-V) where S = Sales Revenue; V= Variable costs. (Investopedia Team , 2022)

In this activity, we have two type of products and here with see it with following financial information:

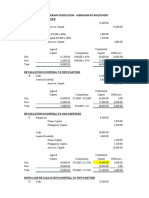

High-End Set Economical Set

Sales price $3,500 per unit $1,000 per unit

Labor $875 per unit $250 per unit

Materials $1400 per unit $300 per unit

per

Direct fixed costs $25,000 $16,500 per month

month

Allocated fixed per

$85,000 $85,000 per month

costs month

Contribution Margin for each product Line:

a) High-End Set has a Sale price per unit of $3,500 and a variable cost per unit of $2,275 ($875+$1,400 )

Contribution Margin of High-end set is S-V $3,500 - $ 2,275 = $1,225 per unit.

b) Economical Set has a Sale price per unit of $1,000 and a variable cost per unit of $550 ($250+$300)

Contribution Margin of economical set is S-V $1,000 - $ 550$ = 450 per unit.

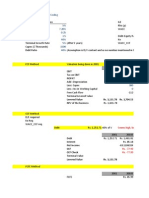

Break-Even quantities for each product line:

a) To determine High-End set Break-Even point ,this formula is used:

Break-even point (units) = fixed cost / (Sales price per unit – variable cost per unit) or Fixed cost /

Contribution Margin per. (Heisinger , Hoyle. n.d.)

Fixed cost we have two types, Direct and allocated. The values are respectively $25,000 and $85,000

adding these two numbers we get the total of fix cost ($25,000+$85,000) = 110,000

Break-even points = fixed cost/contribution margin $110,000/$1,225= 90 units

b) To determine Economical set Break-Even point ,this formula is used:

Break-even point (units) = fixed cost / (Sales price per unit – variable cost per unit) or Fixed cost /

Contribution Margin per.

Fixed cost we have two types, Direct and allocated. The values are respectively $16,500 and $85,000

adding these two numbers we get the total of fix cost ($16,500+$85,000) = 101,500

Break-even points (unit) = fixed cost/contribution margin $101,500/$450= 225 units

Break-Even quantities to earn $ 500,000 per year in the high-end line (at current sales price):

to obtain a profit on $500,000 on the high-end line I will use the following equation which is:

Q = (F+ Target Profit) / S-V (Heisinger , Hoyle. n.d.)

Q= quantity of units produced and sold. ; F= Fixed costs; S= sales price per unit; V= Variable cost per unit.

Fixed cost = ($25,000 + $85,000) x 12 meses = $1,320,000

Q= ($1,320,000 + $500,000) / $3,500 - $2,275)

Q= ($1,820,000) / $1,225

Q= 1,486 Units needs to be sold to obtain a gain of $500,000 in a year.

Break-Even quantities to earn $ 300,000 per year in the economical line (at current sales price):

to obtain a profit on $300,000 on the economical line, I will use the following equation which is:

Q = (F+ Target Profit) / S-V (Heisinger , Hoyle. n.d.)

Q= quantity of units produced and sold. ; F= Fixed costs; S= sales price per unit; V= Variable cost per unit.

Fixed cost = ($25,000 + $85,000) x 12 meses = $1,320,000

Q= ($1,320,000 + $300,000) / $1,000 - $550)

Q= ($1,620,000) / $450

Q= 3,600 Units needs to be sold to obtain a gain of $500,000 in a year.

Investopedia Team. (2022, Sept. 23) Contribution Margin. Definition, overview and how to calculate

https://www.investopedia.com/terms/c/contributionmargin.asp

Heisinger, K., & Hoyle, J. (n.d.). Managerial accounting. Open Textbook Library. Retrieved November

05,2022. https://open.umn.edu/opentextbooks/textbooks/137

Wall Street Prep (n.d.). Contribution Margin, Guide to understanding contribution margin.

https://www.wallstreetprep.com/knowledge/contribution-margin/

You might also like

- Accounting As & A LevelDocument674 pagesAccounting As & A Leveldiya ramani100% (9)

- Tutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisDocument7 pagesTutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisVincent TanNo ratings yet

- High Low Method ExercisesDocument4 pagesHigh Low Method ExercisesPhoebe Llamelo67% (12)

- Hospital Supply Inc. - SolutionsDocument5 pagesHospital Supply Inc. - SolutionsMEERA JOSHY 192743633% (3)

- BUS 5110 Group 4B Project v2.0Document14 pagesBUS 5110 Group 4B Project v2.0SAM100% (1)

- Financial Exercises, KP #1 - 9Document15 pagesFinancial Exercises, KP #1 - 9Bhavik MohanlalNo ratings yet

- Accounting Problems and SolutionsDocument3 pagesAccounting Problems and SolutionsKavitha Ragupathy100% (1)

- Revise Mid TermDocument43 pagesRevise Mid TermThe FacesNo ratings yet

- 9-25 Variable Versus Absorption Costing. The Zeta Company Manufactures Trendy, GoodDocument3 pages9-25 Variable Versus Absorption Costing. The Zeta Company Manufactures Trendy, GoodElliot Richard100% (1)

- Breakeven Analysis 0Document35 pagesBreakeven Analysis 0Nistha Bisht100% (1)

- DocxDocument6 pagesDocxLeo Sandy Ambe CuisNo ratings yet

- Test Bank - Chapter 8 ABC For Decision MakingDocument44 pagesTest Bank - Chapter 8 ABC For Decision MakingAiko E. Lara100% (5)

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- Exercises With Solutions - CH0104Document17 pagesExercises With Solutions - CH0104M AamirNo ratings yet

- Notes CVP 2009, 2017Document13 pagesNotes CVP 2009, 2017Aaron ForbesNo ratings yet

- Cost-Volume-Profit (CVP) Analysis: MODULE 7 - Applied EconomicsDocument5 pagesCost-Volume-Profit (CVP) Analysis: MODULE 7 - Applied EconomicsAstxilNo ratings yet

- Chap 7 - Flexible Budget, Direct Cost Variance and Management Control - Students NoteDocument13 pagesChap 7 - Flexible Budget, Direct Cost Variance and Management Control - Students NoteZulIzzamreeZolkepliNo ratings yet

- Man15e SG-Solutions Ch-06Document20 pagesMan15e SG-Solutions Ch-06DeniseNo ratings yet

- 3.sales Variance AnalysisDocument38 pages3.sales Variance Analysiskamasuke hegdeNo ratings yet

- Profit PlanningDocument32 pagesProfit PlanningSandra LangNo ratings yet

- Tutorial 3 - Student AnswerDocument7 pagesTutorial 3 - Student AnswerDâmDâmCôNươngNo ratings yet

- Varaible Costing 2Document18 pagesVaraible Costing 2AIRA NHAIRE MECATENo ratings yet

- Numerical Exercise On Cost Behavior ClassificationDocument2 pagesNumerical Exercise On Cost Behavior ClassificationnaimNo ratings yet

- Flexiblebudgets 1Document48 pagesFlexiblebudgets 1anon-654501No ratings yet

- Cost Behavior and Cost-Volume-Profit AnalysisDocument56 pagesCost Behavior and Cost-Volume-Profit Analysisjeela1No ratings yet

- Tutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Document3 pagesTutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Hu-Ann KeymistNo ratings yet

- MBA 504 Ch5 SolutionsDocument12 pagesMBA 504 Ch5 SolutionspheeyonaNo ratings yet

- Garrison 17e GEs PPT Chapter 1Document15 pagesGarrison 17e GEs PPT Chapter 1Princess Jullyn ClaudioNo ratings yet

- Marginal CostingDocument30 pagesMarginal Costinganon_3722476140% (1)

- 7 Variable Absorption CostingDocument37 pages7 Variable Absorption CostingBəhmən OrucovNo ratings yet

- Fina and Mana Accounting Chapter FourDocument77 pagesFina and Mana Accounting Chapter FourAklilu TadesseNo ratings yet

- Chapter Five 111Document76 pagesChapter Five 111Ras DawitNo ratings yet

- Case 16-1 (Alfi & Yessy)Document4 pagesCase 16-1 (Alfi & Yessy)Ana KristianaNo ratings yet

- Case 17-19: Changes in Break - Even Points With Changes in Unit PricesDocument15 pagesCase 17-19: Changes in Break - Even Points With Changes in Unit PricesAnonymous v5lH8CeFjiNo ratings yet

- A. $800,000 B. $600,000 C. $440,000 D. $200,000Document15 pagesA. $800,000 B. $600,000 C. $440,000 D. $200,000sino akoNo ratings yet

- Hospital Supply: Alternative Choice Decisions Differential CostingDocument13 pagesHospital Supply: Alternative Choice Decisions Differential Costingksandeep25No ratings yet

- 4524 Robby Wangsa Saputra 1601226743 AkuntansiDocument3 pages4524 Robby Wangsa Saputra 1601226743 AkuntansiGatau JdodksjsjNo ratings yet

- Geronimo e - Assignment 2Document1 pageGeronimo e - Assignment 2Geronimo EnguitoNo ratings yet

- Variable CostingDocument34 pagesVariable CostingAra Marie MagnayeNo ratings yet

- FM 225 Kulang 4Document4 pagesFM 225 Kulang 4Karen AlonsagayNo ratings yet

- Capacity PlanningDocument5 pagesCapacity Planninglingat airenceNo ratings yet

- Unit-CostDocument3 pagesUnit-CostJennelNo ratings yet

- CH 3Document17 pagesCH 3trishanjaliNo ratings yet

- Econ Module-7 CVP AnalysisDocument7 pagesEcon Module-7 CVP AnalysisJOHN PAUL LAGAONo ratings yet

- CVP AnalysisDocument8 pagesCVP AnalysisEricka Mae AntiolaNo ratings yet

- ACT 202 (18), Mehedi Hasan Polash, 1620850030Document1 pageACT 202 (18), Mehedi Hasan Polash, 1620850030MH PolashNo ratings yet

- Chapter 7 Garrison 13eDocument40 pagesChapter 7 Garrison 13efarhan MomenNo ratings yet

- At Wid SolDocument4 pagesAt Wid SolglamfactorsalonspaNo ratings yet

- Chapter 6 (Part I) Cost-Volume-Profit Analysis: A Simple Model For Planning & Decision-MakingDocument10 pagesChapter 6 (Part I) Cost-Volume-Profit Analysis: A Simple Model For Planning & Decision-MakingKhaled Abo YousefNo ratings yet

- Module 7 CVP Analysis SolutionsDocument12 pagesModule 7 CVP Analysis SolutionsChiran AdhikariNo ratings yet

- Hospital SupplyDocument3 pagesHospital SupplyJeanne Madrona100% (1)

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Managerial Accounting Final ExamDocument14 pagesManagerial Accounting Final ExamatifNo ratings yet

- Pertemuan 11 Chap007-008 Hilton - EditDocument58 pagesPertemuan 11 Chap007-008 Hilton - Editferly12No ratings yet

- Cost Management Accounting Assignment Bill French Case StudyDocument5 pagesCost Management Accounting Assignment Bill French Case Studydeepak boraNo ratings yet

- CVP2 MarkupsDocument19 pagesCVP2 MarkupsWaleed J.No ratings yet

- Break Even Analysis Excel Template: Visit: EmailDocument9 pagesBreak Even Analysis Excel Template: Visit: EmailOFFADNo ratings yet

- Chapter 7 Facility LayoutDocument6 pagesChapter 7 Facility LayoutAndrew Miranda100% (1)

- 3 Flexible Budgets & StandardsDocument33 pages3 Flexible Budgets & StandardsmedrekNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- MAS.m-1415 Variable CostingDocument7 pagesMAS.m-1415 Variable CostingCharry Ramos100% (1)

- MOHAMMED_AHMED_attachement_(1)[1][1]Document17 pagesMOHAMMED_AHMED_attachement_(1)[1][1]kash KingNo ratings yet

- Wmcustomer C029-19-00127420 CustomerInvoice PDFDocument1 pageWmcustomer C029-19-00127420 CustomerInvoice PDFHema Chandra Reddy KarimireddyNo ratings yet

- Chapter 1 The Conceptual Framework: Answer 1Document11 pagesChapter 1 The Conceptual Framework: Answer 1samuel_dwumfourNo ratings yet

- Corporate Governance: Accountants and AuditorsDocument22 pagesCorporate Governance: Accountants and AuditorsVam EnzioNo ratings yet

- Summative Assessment-Partnership Dissolution - Admission by InvestmentDocument10 pagesSummative Assessment-Partnership Dissolution - Admission by InvestmentAllondra DapengNo ratings yet

- 5 Key Financial Ratios and How To Use ThemDocument10 pages5 Key Financial Ratios and How To Use ThemdiahNo ratings yet

- 145002883941Document3 pages145002883941Nathasya SahabatiNo ratings yet

- 25th June - Sampa VideoDocument6 pages25th June - Sampa VideoAmol MahajanNo ratings yet

- Aom 2023-001 Sto. NinoDocument19 pagesAom 2023-001 Sto. NinoKen BocsNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- GDST - Annual Report 2018 PDFDocument148 pagesGDST - Annual Report 2018 PDFPutra AjaNo ratings yet

- Chapter 13 Translation of Financial Statements of Foreign Affiliates - 2ndDocument41 pagesChapter 13 Translation of Financial Statements of Foreign Affiliates - 2ndMuhammad Za'far SiddiqNo ratings yet

- Ujaf8 12227137predictorsofqualifyingintheaccountancyprogramDocument10 pagesUjaf8 12227137predictorsofqualifyingintheaccountancyprogramDrahneel MarasiganNo ratings yet

- Corporate Governance in India An OverviewDocument21 pagesCorporate Governance in India An OverviewVaishnavi VenkatesanNo ratings yet

- General Ledger User ManualDocument225 pagesGeneral Ledger User ManualLaxmidhara NayakNo ratings yet

- PrakbiDocument195 pagesPrakbiTheresia TjiaNo ratings yet

- Suggested Structure For OBU Research Report: Using Secondary Data CollectionDocument2 pagesSuggested Structure For OBU Research Report: Using Secondary Data CollectionAaryanNo ratings yet

- Audit in CIS EnvironmentDocument49 pagesAudit in CIS Environmentlongix100% (3)

- Paper - 6-Auditing and Assurance (New Course) : Which of The Following Is Fund Based Advance?Document4 pagesPaper - 6-Auditing and Assurance (New Course) : Which of The Following Is Fund Based Advance?Bharat SoniNo ratings yet

- Internal Auditing As An Aid To ManagementDocument73 pagesInternal Auditing As An Aid To ManagementRhodaNo ratings yet

- Accounting Excel AssDocument15 pagesAccounting Excel AssFrancheskalane ValenciaNo ratings yet

- 10 - SolAccounting Basic QuestionsDocument4 pages10 - SolAccounting Basic Questionssneha patelNo ratings yet

- Solutions - Midterms Reviewer - Q1Document21 pagesSolutions - Midterms Reviewer - Q1Jack Herer100% (1)

- GAT Subject (Management Sciences)Document298 pagesGAT Subject (Management Sciences)Farhan Q. Qureshi93% (98)

- Peer Review Print Version M23 OnwardsDocument13 pagesPeer Review Print Version M23 Onwardsmdasifraza3196No ratings yet

- Wave AppDocument10 pagesWave AppV ChandriaNo ratings yet

- ACCOUNTANCY - (055) Periodic Test-1 Class - Xi Marks: 40M Time: 90 MinDocument5 pagesACCOUNTANCY - (055) Periodic Test-1 Class - Xi Marks: 40M Time: 90 MinvyshnaviNo ratings yet

![MOHAMMED_AHMED_attachement_(1)[1][1]](https://imgv2-2-f.scribdassets.com/img/document/730892579/149x198/9d1d3b755a/1715264836?v=1)