Professional Documents

Culture Documents

Balance Sheet Explanation

Uploaded by

KALAI ARASANOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet Explanation

Uploaded by

KALAI ARASANCopyright:

Available Formats

Balance Sheet Income Statement

Shows financial position Shows financial results

Tells the information of assets, liabilities and capital Tells the profit or loss made by a business

Shows the balance of assets, liabilities and capital Shows the profitability for the financial year

(till date) i.e., since the business started. under consideration. Hence it is good to say that

the P&L statement is standalone.

Based on an accounting equation. The total of Revenues – expenses = Profit/loss

Assets must match with a total of capital and

liabilities together.

Sample balance sheet

Components of Balance Sheet

1. SHAREHOLDER FUNDS

Shareholder Funds = Share capital + Reserves

1.1 Share capital

• Share capital is the amount invested by the general public for use in the business.

• The general public who provides the funds to the company gets shares of the company

and is also promised a return known as a dividend.

• Imagine, Company ABC issues 1000 shares, with each share having a face value of Rs.10

each. In this case, the total share capital would be Rs.10 x 1000 = Rs.10,000/-

1.2 Reserves

• It is a portion of available earnings that business owners keep aside to meet any sort of

financial contingencies.

• For instance, firm owners may use their reserves to invest, purchase fixed assets, install

new equipment, pay dividends to shareholders, settle legal obligations, etc.

2. LIABILITIES

• Obligations to be paid by a business in future.

• There are mainly two types of liabilities – short-term (current) liabilities and long-term

(non-current) liabilities

2.1. Short-term liabilities

• The obligations/debts, are to be paid within 12 months/365 days.

• Also known as ‘current liabilities’

• If you buy a mobile phone on EMI (via a credit card) you obviously plan to repay

(instalment) to your credit card company within a few months. This becomes your

‘current liability’.

• However, if you buy an apartment by seeking a 15-year home loan from a bank, it

becomes your ‘long term liability’.

• The current liabilities are divided into:

I. short-term borrowings (loans taken for a short period, less than a year)

II. trade payables (creditors, from whom goods are purchased on credit)

III. outstanding expenses (bills such as electricity bill, water bill, rent etc. for

which services are availed but such bills are not yet paid.

IV. short term provisions (funds set aside by business to cover future

expenses)

2.2. Long-term liabilities

• obligations to be paid beyond 1 year in future.

• The long-term liabilities are divided into:

I. Long-term liabilities (loans taken for a long period, exceeding one year such

as 3 years, 5 years or 10 years).

II. Provisions (money set aside for employee benefits such as gratuity; leave

encashment, provident funds etc.)

III. Deferred tax liabilities (The deferred tax liability is basically a provision for

future tax payments. The company foresees a situation where it may have to

pay additional taxes in the future; hence it set aside some funds for this

purpose).

3. ASSETS

• Resources which are used in business for getting economic benefits.

• The ownership of such assets belongs to the business.

• There are two types of assets – fixed assets and current assets.

3.1. Fixed Assets

• Assets which are purchased for long-term use, are not likely to be converted quickly

into cash easily.

• There are 4 types of fixed assets:

• Tangible fixed assets (which can be seen, touched, felt, and carry physical existence

such as land building, machinery, and furniture).

• Intangible fixed assets (which cannot be seen, touched, felt, and carry no physical

existence such as patents, copyrights, licences, trademarks, or brand value).

• Capital work in progress (CWIP includes building under construction, machinery

under assembly etc. at the time of preparing the balance sheet.)

• Intangible assets under development (The work in the process could be patent filing,

copyright filing, brand development etc.)

3.2. Current Assets

• Assets which are in a form of cash or can be converted into cash easily within a year.

• Examples of current assets are as follows:

• Cash balance (in the form of cash)

• Bank balance (fixed deposits of one year can be converted into cash easily)

• Stock (when sold in the market, is converted into cash)

• Debtors/receivables (money to be collected from persons to whom credit sales are

made)

• Prepaid expenses (such as insurance premium paid in advance, rent paid in advance

for whom a benefit is not yet availed but the bill is paid in advance).

You might also like

- KRA 1. Maternal, Neonatal, Child Health and Nutrition (MNCHN)Document7 pagesKRA 1. Maternal, Neonatal, Child Health and Nutrition (MNCHN)Tmo BosNo ratings yet

- 1619921936223forensic Science UNIT - I PDFDocument86 pages1619921936223forensic Science UNIT - I PDFVyshnav RNo ratings yet

- The Riches of Ra by Michael LeppierDocument18 pagesThe Riches of Ra by Michael LeppierMassimo1083100% (13)

- Pokerole Core Rulebook 2.0Document489 pagesPokerole Core Rulebook 2.0Trey Bachtiger100% (2)

- US ARMY US MARINE CORPS TM 10-4610-215-10 TM 08580A-10/1 TECHNICAL MANUAL OPERATORS MANUAL, WATER PURIFICATION UNIT, REVERSE OSMOSIS, 600 GPH TRAILER MOUNTED FLATBED CARGO, 5 TON 4 WHEEL TANDEM ROWPU MODEL 600-1 (4610-01-093-2380) AND 600 GPH SKID MOUNTED ROWPU MODEL 600-3 (4610-01-113-8651)Document223 pagesUS ARMY US MARINE CORPS TM 10-4610-215-10 TM 08580A-10/1 TECHNICAL MANUAL OPERATORS MANUAL, WATER PURIFICATION UNIT, REVERSE OSMOSIS, 600 GPH TRAILER MOUNTED FLATBED CARGO, 5 TON 4 WHEEL TANDEM ROWPU MODEL 600-1 (4610-01-093-2380) AND 600 GPH SKID MOUNTED ROWPU MODEL 600-3 (4610-01-113-8651)hbpr9999100% (2)

- Principles of AccontingDocument16 pagesPrinciples of AccontingShafqat WassanNo ratings yet

- Chapter 8-Types of Major AccountsDocument2 pagesChapter 8-Types of Major AccountsRichael Ann Delubio ZapantaNo ratings yet

- Balance SheetDocument25 pagesBalance SheetDHANUSHA BALAKRISHNANNo ratings yet

- ACC106 - Chapter 3Document30 pagesACC106 - Chapter 3Nealie100% (1)

- ACC406 - Chapter 3Document32 pagesACC406 - Chapter 3Carol Lesly100% (1)

- Corporate Financial Statements IDocument43 pagesCorporate Financial Statements IArpit SidhuNo ratings yet

- Week 1: Assignment: A Report On What Has Been Learnt by Us Over The Week 1Document9 pagesWeek 1: Assignment: A Report On What Has Been Learnt by Us Over The Week 1Govind GoelNo ratings yet

- CHAPTER 2-Accounting EquationDocument91 pagesCHAPTER 2-Accounting EquationHảo HuỳnhNo ratings yet

- Types of Major AccountsDocument2 pagesTypes of Major Accountscristin l. viloriaNo ratings yet

- FABM1TGhandouts L8 9TypesOfMajAcctsDocument2 pagesFABM1TGhandouts L8 9TypesOfMajAcctsKarl Vincent DulayNo ratings yet

- Session 2 Basic TermsDocument23 pagesSession 2 Basic TermsSagar ParateNo ratings yet

- AccountingDocument35 pagesAccountingJohn Eric Caparros AzoresNo ratings yet

- Accountingnit Jamshedpur NotesDocument47 pagesAccountingnit Jamshedpur NotesSuraj KumarNo ratings yet

- Lesson 1 SFPDocument14 pagesLesson 1 SFPLydia Rivera100% (3)

- 2assets, Liabilities and CapitalDocument5 pages2assets, Liabilities and Capitaldilhani sheharaNo ratings yet

- Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From OwnersDocument5 pagesLesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From OwnersRomae DomagasNo ratings yet

- Chapter - 2 Basic Accounting TermsDocument6 pagesChapter - 2 Basic Accounting TermsChaudhary GaylesabbNo ratings yet

- Basic Accounting TermsDocument7 pagesBasic Accounting TermsKamal SoniNo ratings yet

- Accounting: Basic Terminologies in AccountingDocument24 pagesAccounting: Basic Terminologies in AccountingRoshan JhaNo ratings yet

- Assets Assets Are The Resources Owned and Controlled by The FirmDocument4 pagesAssets Assets Are The Resources Owned and Controlled by The FirmAshaira MangondayaNo ratings yet

- XI Notes of Chapter 2 Part I PDFDocument3 pagesXI Notes of Chapter 2 Part I PDFRoshanNo ratings yet

- Acc1 Lesson Week8 1Document26 pagesAcc1 Lesson Week8 1KeiNo ratings yet

- Fabm2 1Document17 pagesFabm2 1Jacel GadonNo ratings yet

- Type of AccountsDocument35 pagesType of AccountsJennifer0% (1)

- Types of Major AccountsDocument2 pagesTypes of Major AccountsKelsey Sofia RojasNo ratings yet

- FM 101 Chapter 3Document41 pagesFM 101 Chapter 3maryjoymayo494No ratings yet

- LESSON 8 - Types of Major AccountsDocument3 pagesLESSON 8 - Types of Major Accountsdrea.heart29No ratings yet

- EBITDAC - A New Financial Metric?: Earnings Before Interest, Taxes, Depreciation, Amortization, and CoronavirusDocument24 pagesEBITDAC - A New Financial Metric?: Earnings Before Interest, Taxes, Depreciation, Amortization, and Coronavirusks frNo ratings yet

- Chapter # 1 Business TransactionDocument22 pagesChapter # 1 Business TransactionWaleed NasirNo ratings yet

- Account Tiltes HandoutsDocument2 pagesAccount Tiltes HandoutsSean Andreson MabalacadNo ratings yet

- Users of Accounting InformationDocument4 pagesUsers of Accounting InformationWycliffe OgetiiNo ratings yet

- CMBE 2 - Lesson 3 ModuleDocument12 pagesCMBE 2 - Lesson 3 ModuleEunice AmbrocioNo ratings yet

- The Accounting EquationDocument4 pagesThe Accounting EquationjcwimzNo ratings yet

- Basic Accounting TermsDocument16 pagesBasic Accounting TermsKusum MotwaniNo ratings yet

- Basic Terminologies of Accounting: 1. AssetsDocument10 pagesBasic Terminologies of Accounting: 1. AssetsSophiya PrabinNo ratings yet

- ABM ReviewerDocument2 pagesABM Reviewermary christy mantalabaNo ratings yet

- An Introduction To Business and AccountingDocument43 pagesAn Introduction To Business and AccountingKeo VannuthNo ratings yet

- The Five Major Accounts & The Chart of AccountsDocument29 pagesThe Five Major Accounts & The Chart of AccountsPrecious Leigh VillamayorNo ratings yet

- Flow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atDocument36 pagesFlow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atLong NguyenNo ratings yet

- Module - 6 Balance SheetDocument67 pagesModule - 6 Balance Sheetlakshmi dileepNo ratings yet

- EC480 Banks Balance Sheet AnalysisDocument110 pagesEC480 Banks Balance Sheet Analysistugrul.kartalogluNo ratings yet

- Statement of Financial PositionDocument8 pagesStatement of Financial PositionKaye LiwagNo ratings yet

- Acconting NotesDocument27 pagesAcconting NotesparinkhonaNo ratings yet

- Chapter 2 HandoutsDocument15 pagesChapter 2 HandoutsBlackpink BtsNo ratings yet

- Accounting: Ankon Gopal BanikDocument9 pagesAccounting: Ankon Gopal BanikAnkon Gopal BanikNo ratings yet

- Chapter 2 NLKTDocument58 pagesChapter 2 NLKTPhan Lê Anh Đào100% (1)

- Short-Questions (Accounts) 1.goodsDocument3 pagesShort-Questions (Accounts) 1.goodsUrvishNo ratings yet

- Chapter 2 FarDocument2 pagesChapter 2 FarAdil KaranNo ratings yet

- Financial Accounting and Analysis: Internal Assignment Applicable For June 2021examinationDocument10 pagesFinancial Accounting and Analysis: Internal Assignment Applicable For June 2021examinationTeChtroNiCS [AK]No ratings yet

- FABM2 - Statement of Financial PositionDocument36 pagesFABM2 - Statement of Financial PositionVron Blatz100% (6)

- Types of Major AccountsDocument30 pagesTypes of Major AccountsEstelle GammadNo ratings yet

- Statement of Financial PositionDocument64 pagesStatement of Financial PositionDaphne Gesto SiaresNo ratings yet

- Accounting Chapter 2. Financial Statements For Decision MakingDocument56 pagesAccounting Chapter 2. Financial Statements For Decision MakingMichenNo ratings yet

- 8011 Topper 21 101 503 550 10598 Basic Accounting Terms Up201904301415 1556613905 1714Document7 pages8011 Topper 21 101 503 550 10598 Basic Accounting Terms Up201904301415 1556613905 1714Madhu SNo ratings yet

- Balance Sheet: Mehwish KiranDocument28 pagesBalance Sheet: Mehwish KiranAlina ZubairNo ratings yet

- UNIT II The Accounting Process Service and TradingDocument22 pagesUNIT II The Accounting Process Service and TradingAlezandra SantelicesNo ratings yet

- MODULE 5-The Five Major AccountsDocument6 pagesMODULE 5-The Five Major Accountsgerlie gabrielNo ratings yet

- Fabm2 02Document24 pagesFabm2 02Alyza Maegan SebastianNo ratings yet

- 2 Elements of AccountingDocument4 pages2 Elements of Accountingapi-299265916No ratings yet

- Unit I IVDocument169 pagesUnit I IVKALAI ARASANNo ratings yet

- CF FormulaesDocument30 pagesCF FormulaesKALAI ARASANNo ratings yet

- Unit IvDocument18 pagesUnit IvKALAI ARASANNo ratings yet

- Sources of FinanceDocument44 pagesSources of FinanceKALAI ARASANNo ratings yet

- Cost of CapitalFM 1.1Document54 pagesCost of CapitalFM 1.1KALAI ARASANNo ratings yet

- Canopy Growth Corporation Final ReportDocument14 pagesCanopy Growth Corporation Final ReportKALAI ARASANNo ratings yet

- Time Value of MoneyDocument78 pagesTime Value of MoneyKALAI ARASANNo ratings yet

- Persuasive EssayDocument8 pagesPersuasive EssayBri GringNo ratings yet

- TLM When To Sit & StandDocument1 pageTLM When To Sit & Standluthien tasadurNo ratings yet

- Iwo Jima Amphibious Ready Group/24TH Marine Expeditionary Unit (IWOARG/24 MEU) NDIA Post-Deployment BriefDocument13 pagesIwo Jima Amphibious Ready Group/24TH Marine Expeditionary Unit (IWOARG/24 MEU) NDIA Post-Deployment Briefthatguy96No ratings yet

- Ainbook Unit6wk2Document10 pagesAinbook Unit6wk2GarrettNo ratings yet

- BS en 14399-3-2015Document32 pagesBS en 14399-3-2015WeldedSplice100% (3)

- Homeless Serving Land Use Overnight Shelter Parcel DataDocument14 pagesHomeless Serving Land Use Overnight Shelter Parcel DataAbhishekh GuptaNo ratings yet

- Trading Legends Million MovesDocument7 pagesTrading Legends Million Movesjoxax95901No ratings yet

- Innovative Practices in HRM at Global LevelDocument5 pagesInnovative Practices in HRM at Global LevelInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Goddess Within and Beyond The Three PDFDocument417 pagesThe Goddess Within and Beyond The Three PDFEkaterina Aristova100% (4)

- Intercultural Competence in Elt Syllabus and Materials DesignDocument12 pagesIntercultural Competence in Elt Syllabus and Materials DesignLareina AssoumNo ratings yet

- Purchase Request: Supplies and Materials For Organic Agriculture Production NC IiDocument13 pagesPurchase Request: Supplies and Materials For Organic Agriculture Production NC IiKhael Angelo Zheus JaclaNo ratings yet

- Arjuna Prime FinalDocument27 pagesArjuna Prime FinalTejaswi SaxenaNo ratings yet

- Respondent 2007 - Asia Cup MootDocument31 pagesRespondent 2007 - Asia Cup MootNabilBariNo ratings yet

- SMC vs. Laguesma (1997)Document2 pagesSMC vs. Laguesma (1997)Kimberly SendinNo ratings yet

- Documentary: A War From Another Galaxy: Hoodedcobra666Document2 pagesDocumentary: A War From Another Galaxy: Hoodedcobra666kevin lopes cardosoNo ratings yet

- Ethicalaspectsof FinanciaDocument6 pagesEthicalaspectsof FinanciaVinay RamaneNo ratings yet

- AL-qadim Archetypes: Scimitars Against The DarkDocument33 pagesAL-qadim Archetypes: Scimitars Against The DarkJes100% (14)

- A Beckett Canon PDFDocument433 pagesA Beckett Canon PDFMyshkin100% (1)

- PitchbookDocument6 pagesPitchbookSAMEERNo ratings yet

- Esusu Africa - Digital Cooperative Banking - ProposalDocument6 pagesEsusu Africa - Digital Cooperative Banking - Proposalchristian obinnaNo ratings yet

- Taxation - Constitutional Limitations PDFDocument1 pageTaxation - Constitutional Limitations PDFVicson Mabanglo100% (3)

- Professional Practice Law and Ethics 1st Unit Lecture NotesDocument27 pagesProfessional Practice Law and Ethics 1st Unit Lecture NotesRammohanreddy RajidiNo ratings yet

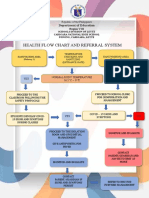

- Health Flow Chart and Referral System: Department of EducationDocument2 pagesHealth Flow Chart and Referral System: Department of EducationWendy TablaNo ratings yet

- Deferred AnnuityDocument10 pagesDeferred AnnuityYoon Dae MinNo ratings yet

- Philip B. Magtaan, Rcrim, Mscrim, CSP: LecturerDocument13 pagesPhilip B. Magtaan, Rcrim, Mscrim, CSP: LecturerPhilip MagtaanNo ratings yet