Professional Documents

Culture Documents

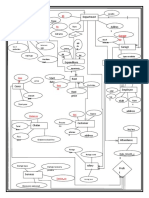

Sources of Finance Mindmap

Uploaded by

LindsayyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sources of Finance Mindmap

Uploaded by

LindsayyCopyright:

Available Formats

Sources

OF FINANCE

Comes from their

personal savings

Long-term

s a v in g s

Owner's loan for

purchase of

land or Interest is

Money the

charged on

Interal

No interest charges buildings

entrepreneur Mortage

saved up applied

Extermal Must be paid each

amount

borrowed

year

rm

g -te

Remaining profit n

Lo ance

Agreement

d business's

R e t a in e

Share issue

after all expenses Some of with bank

fin

apital Overdraft

and distribution

p r o f it s working c Bank loan

among dividends Short-ter

Sales m Debenture

of non finance

curren - Reduced Hire purchase

Sale and t asse

sts Cash inventory Allows

Remained profit is leaseback Trade Source of

balances levels withdrawal

reinvested Used for Reduced credit Leasing permanent

of money Bank

funding trade Bond capital

greater provides

capital issued by available

receivables than the Debt factoring finance Similar to

a to limited

expenditure Sale of balance of which will leasing but

Amount Business buys company liability

projects Non- unwanted Reduce their be repaid business

of goods on to raise companies

current non-current materials, account with Getting will own

account, long-term

asset sold money interest asset when

assests components usage of finance

on hand paying the over an all

No cost to (ex.land) (ex.machine Customers non-current

or finished supplier at a Trade agreed payments

business and asset s,buildings) receive asset by

goods later receivables time are made

is leased paying a

Available only goods and scheduled sold to

back holded fixed

when business pay at a date improve Company

amount per

is profitable set date in Flexible liquidity time period can offer

Cannot the future source for fixed to sell

Leasing

spend all of period of After shares up

charges could Limitation:

cash to finance Variable time buying to a

increase expensive

finance Fixed interest rate bond maximum

No direct Longer

Business interest buyer number

cost to capital credit terms

spending gets rate gets fixed

business Business negotiated = rate of

reduce increase immediate

interest

length of short-term cash

But, leasing per year

time to Used only to finance Can rise or Interest

charges could But buyer Asset not

Risking not wait for meet short- Reduces fall charges are

increase and has to be owned by Capital

being able to payment term cash risk to depending business and higher than raised

future fixed searched for

pay day-to- shortages business on can be other becomes

costs will day expenses of economic finance Security permanent

Debt-factoring returned

increase increased factors back options provided so capital

company

costs debenture

receives

holder is

Total accounts receivable customer's full guaranteed

payment Leasing company

are reduced so business's money back

responsible for repairs

cash balance increases

of asset

You might also like

- CR NotesDocument1 pageCR Notesvivekanantha velappanNo ratings yet

- February Monthly Collection, Grade 5From EverandFebruary Monthly Collection, Grade 5Rating: 3 out of 5 stars3/5 (1)

- Cummins Product Rating GuideDocument4 pagesCummins Product Rating GuideOmeir AnsariNo ratings yet

- Bonds (Basic Concepts)Document1 pageBonds (Basic Concepts)Shania SainiNo ratings yet

- Decentralized Microgrid With Energy Trading Platform For Remote VillageDocument4 pagesDecentralized Microgrid With Energy Trading Platform For Remote VillageValentine EkuNo ratings yet

- The Time LineDocument2 pagesThe Time Linenibrah faheemNo ratings yet

- Cummins G-Drive Engines: 1800 RPM (60 HZ), 1800 T/MN, 1800 U/minDocument3 pagesCummins G-Drive Engines: 1800 RPM (60 HZ), 1800 T/MN, 1800 U/minNickNo ratings yet

- Capital AllowanceDocument6 pagesCapital Allowancef7vertexlearningsolutionsNo ratings yet

- BSP1702 NotesDocument7 pagesBSP1702 NotesliyangwongNo ratings yet

- Ind As 116Document1 pageInd As 116fake19541998No ratings yet

- Bata Father's NameDocument377 pagesBata Father's NameharkeshNo ratings yet

- Fixed Deposit FD Fixed Deposit: 6 Days Ago - Sep 29, 2017 - Uploaded by State Bank of IndiaDocument1 pageFixed Deposit FD Fixed Deposit: 6 Days Ago - Sep 29, 2017 - Uploaded by State Bank of Indiastevejac__bNo ratings yet

- Form - X: Plot No 116-117 & 65-66, Part-A, Mie, Bahadurgarh, Distt - Jhajjar (Haryana)Document11 pagesForm - X: Plot No 116-117 & 65-66, Part-A, Mie, Bahadurgarh, Distt - Jhajjar (Haryana)Varun MalhotraNo ratings yet

- 4 Ethics - Monet CoDocument4 pages4 Ethics - Monet Cosbracca1No ratings yet

- Condition Report 2020 PerthDocument15 pagesCondition Report 2020 PerthFaisal BhatNo ratings yet

- Large and Medium Scale Manufacturing Industries in EthiopiaDocument47 pagesLarge and Medium Scale Manufacturing Industries in EthiopiaAdmachew MohammedNo ratings yet

- Stock Feb - 2021Document175 pagesStock Feb - 2021Sompal SinghNo ratings yet

- Leases Study MaterialDocument37 pagesLeases Study MaterialHammadNo ratings yet

- Nas 40Document1 pageNas 40Mfeo Prakash LamichhaneNo ratings yet

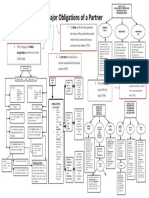

- Major Obligations of A Partner: Competition With His Own FirmDocument1 pageMajor Obligations of A Partner: Competition With His Own FirmXaina BanayagNo ratings yet

- Stock March - 2021Document192 pagesStock March - 2021Sompal SinghNo ratings yet

- ShieldGruppe Dashboard Model Work Task 1Document1 pageShieldGruppe Dashboard Model Work Task 1Charielle Esthelin BacuganNo ratings yet

- Nodex 255Document4 pagesNodex 255TATA URUSAN TEKNOLOGI & JARINGANNo ratings yet

- Adobe Scan Apr 27, 2023Document1 pageAdobe Scan Apr 27, 2023Ratheesh RNo ratings yet

- JICA Mula Mutha Pollution AbatementDocument1 pageJICA Mula Mutha Pollution AbatementsukhdeepNo ratings yet

- List of Numeric Codes For Railway Companies (RICS Code)Document8 pagesList of Numeric Codes For Railway Companies (RICS Code)Md. Shiraz JinnathNo ratings yet

- 2 Accountancy Test (Partnerships) (Responses)Document1 page2 Accountancy Test (Partnerships) (Responses)Raghav MadaanNo ratings yet

- Aarti Drugs (2021)Document337 pagesAarti Drugs (2021)insaafduggal33No ratings yet

- Comfull 007 BrochureDocument2 pagesComfull 007 BrochureDon RidzwanilNo ratings yet

- Chapter-4 Accounting, Finance and Operations (Responses)Document3 pagesChapter-4 Accounting, Finance and Operations (Responses)Santanu MukherjeeNo ratings yet

- Hockey Stadium at Manjeri Lighting Design Report - Rev. 01Document1 pageHockey Stadium at Manjeri Lighting Design Report - Rev. 01Treesa ArchnanaNo ratings yet

- Rust Cheat SheetDocument1 pageRust Cheat SheetLắng DũngNo ratings yet

- Trading IncomeDocument15 pagesTrading IncomeJalees Ul HassanNo ratings yet

- Scan 31 Mar 2023Document2 pagesScan 31 Mar 2023Jayshree YadavNo ratings yet

- 2018 Statement of Changes in EquityDocument2 pages2018 Statement of Changes in EquityTuyết NgânNo ratings yet

- Account Determination MM en PKDocument27 pagesAccount Determination MM en PKHammad KahnNo ratings yet

- PinPointPDF - Charges - ElectricityDocument12 pagesPinPointPDF - Charges - ElectricityP. V. GAMINGNo ratings yet

- LM Scale Furniture Manufacturing Industries in EthiopiaDocument7 pagesLM Scale Furniture Manufacturing Industries in EthiopiaDaniel AlemayehuNo ratings yet

- Income StatementDocument1 pageIncome StatementAYOUB ELGARNENo ratings yet

- Power Team Couplers - CatalogDocument1 pagePower Team Couplers - CatalogTitanplyNo ratings yet

- Account Determination MM en AUDocument28 pagesAccount Determination MM en AURtaccaNo ratings yet

- Paper MakingDocument1 pagePaper MakingBurak KucukkelesNo ratings yet

- P P P P: Machines Cloth Machines ClothDocument6 pagesP P P P: Machines Cloth Machines Cloth吳育瑄No ratings yet

- Supply and DemandDocument3 pagesSupply and DemandAbderrahim ballNo ratings yet

- Ja RawalDocument1 pageJa Rawalfigigob267No ratings yet

- Mind Map - Disclosure - Capital StructureDocument1 pageMind Map - Disclosure - Capital StructureAhmad SyubailiNo ratings yet

- Alfa Laval Decanter Upgrade PresentationDocument15 pagesAlfa Laval Decanter Upgrade PresentationMohamed AliNo ratings yet

- Valuation of Goodwill PDFDocument17 pagesValuation of Goodwill PDFSanskriti SenNo ratings yet

- Recap 4th QTR Gss-Pro3 (Format)Document135 pagesRecap 4th QTR Gss-Pro3 (Format)Mpsmu Paombong MpsNo ratings yet

- Employment IncomeDocument29 pagesEmployment IncomeJalees Ul HassanNo ratings yet

- Real Estate Board of Vancouver BC MLS Sales Facts Jan 2011Document1 pageReal Estate Board of Vancouver BC MLS Sales Facts Jan 2011Maggie ChandlerNo ratings yet

- Statements Are: Half Yearly Am - (2022-2023)Document8 pagesStatements Are: Half Yearly Am - (2022-2023)RomitNo ratings yet

- AccountDocument32 pagesAccountelias dawudNo ratings yet

- DownloadDocument1 pageDownloadsoniaNo ratings yet

- MLS Listing Facts, Jan 2011Document1 pageMLS Listing Facts, Jan 2011Maggie ChandlerNo ratings yet

- Financial Accounting SummaryDocument23 pagesFinancial Accounting SummaryKapeLatte (카페라떼)No ratings yet

- ErdcarrentalDocument1 pageErdcarrentalKhalid FarooqNo ratings yet

- CH 16Document1 pageCH 16陳郁茗No ratings yet

- The Cuban Missile CrisisDocument2 pagesThe Cuban Missile CrisisLindsayyNo ratings yet

- Note-Taking of The Cuban Missile CrisisDocument1 pageNote-Taking of The Cuban Missile CrisisLindsayyNo ratings yet

- Chemistry P6Document2 pagesChemistry P6LindsayyNo ratings yet

- Thermal ProcessesDocument27 pagesThermal ProcessesLindsayyNo ratings yet

- CHEMISTRYDocument41 pagesCHEMISTRYLindsayyNo ratings yet

- Biology MindmapDocument3 pagesBiology MindmapLindsayyNo ratings yet

- PrinciplesofFinance WEBDocument643 pagesPrinciplesofFinance WEBGLADYS JAMES100% (2)

- Immediate Payment NotificationDocument1 pageImmediate Payment NotificationcyrilpjoodNo ratings yet

- Knowledge Value Chain' Framework For Tendering in Construction Organisations: Quantity Surveying PerspectiveDocument157 pagesKnowledge Value Chain' Framework For Tendering in Construction Organisations: Quantity Surveying PerspectiveBimsara MalithNo ratings yet

- Stag Notes 2021 Capuno TopicsDocument22 pagesStag Notes 2021 Capuno TopicsBrigette Domingo100% (3)

- 300+ TOP Engineering Economics Multiple Choice Questions & AnswersDocument50 pages300+ TOP Engineering Economics Multiple Choice Questions & AnswersFawa TubeNo ratings yet

- Billion Exchange - Google SearchDocument1 pageBillion Exchange - Google Searchandrew.mccornicheNo ratings yet

- Sanction LetterDocument7 pagesSanction LetterPrimon KarmakarNo ratings yet

- B-4 HomeworkDocument5 pagesB-4 HomeworkDaniel GabrielNo ratings yet

- FIN 390 DeVry University Fixed Income Securities in Apple Inc Research PaperDocument3 pagesFIN 390 DeVry University Fixed Income Securities in Apple Inc Research PaperEassignmentsNo ratings yet

- Bayantel Digested G R Nos 175418 20Document4 pagesBayantel Digested G R Nos 175418 20Shane Fernandez JardinicoNo ratings yet

- Test Bank For Auditing and Assurance Services 7th Edition by Timothy LouwersDocument33 pagesTest Bank For Auditing and Assurance Services 7th Edition by Timothy Louwersisaticculeragek53mgt100% (48)

- Asian Paints BsDocument2 pagesAsian Paints BsPriyalNo ratings yet

- Fge 50081884 2990936 01-11-2022 1 YDocument2 pagesFge 50081884 2990936 01-11-2022 1 YRafael MendesNo ratings yet

- Thesis On Exchange Rate DeterminationDocument5 pagesThesis On Exchange Rate DeterminationYolanda Ivey100% (2)

- Annual Enterprise Survey 2021 Financial Year Provisional 1Document3 pagesAnnual Enterprise Survey 2021 Financial Year Provisional 1Harden CraterNo ratings yet

- FFMFM Section1 Group2Document21 pagesFFMFM Section1 Group222204 NIDASH PRASHARNo ratings yet

- 1056am1.dr. H.R Kaushal & Dr. Bhagwateshwari KarkiDocument5 pages1056am1.dr. H.R Kaushal & Dr. Bhagwateshwari Karkiअंशुमान आदित्यNo ratings yet

- OBE - COST QB With ANSWERS - FINALDocument92 pagesOBE - COST QB With ANSWERS - FINALPavi NishaNo ratings yet

- Subtopic 1 - Overview of Time SeriesDocument30 pagesSubtopic 1 - Overview of Time SeriesKim VincereNo ratings yet

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocument2 pagesLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaNo ratings yet

- Investment Analysis1Document9 pagesInvestment Analysis1Kanchanit BangthamaiNo ratings yet

- MacroC10 The Swan-Solow ModelDocument66 pagesMacroC10 The Swan-Solow ModelNgọc Minh Đỗ NguyễnNo ratings yet

- MD Onin Hasan - ECN202Document12 pagesMD Onin Hasan - ECN202Onin HasanNo ratings yet

- Provisions and Other Non-Current Liabilities: Note 12Document4 pagesProvisions and Other Non-Current Liabilities: Note 12Ons MnejjaNo ratings yet

- CitizensBank 2020Document94 pagesCitizensBank 2020FarihaHaqueLikhi 1060No ratings yet

- InvoiceDocument1 pageInvoicePankaj TrigunNo ratings yet

- Week 3 Workshop QuestionsDocument3 pagesWeek 3 Workshop QuestionsAmber YangNo ratings yet

- Interpretation of Bajaj FinanceDocument6 pagesInterpretation of Bajaj Financehimanshu shuklaNo ratings yet

- KSA IT Sector U CapitalDocument27 pagesKSA IT Sector U Capitalikhan809No ratings yet

- Quiiz 1Document4 pagesQuiiz 1max pNo ratings yet