Professional Documents

Culture Documents

Ind As 116

Uploaded by

fake19541998Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ind As 116

Uploaded by

fake19541998Copyright:

Available Formats

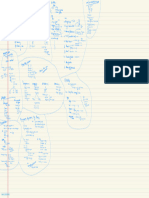

Incl AS 116 Lease

for pension exchange for consideration

-

in

to assed

Contract that right use an

conveys

Lease and lease Component

① gtfentifiabk

Non

Asset lessee Les has Lessor

by

-

or or

-

term

only one such asset

If Rv of MLP almost > Fv of asset lease is

for almost

-

u u = or .

or

Substitution

.

doesnt have substantial Separable

② Lessor Praegtipgfeeny whole economic life then finance lease else

operating

lease .

economically

.

substitution is not

sights

or f ,

Ak separately Dont separate

feasible ①

Lease All Rent ARV

Operating payable lease term is

t

.

:

over

benefit setup Cost is not a

if Nl -

components

during

all ②

③ Substantially economic

straight

immaterial

separate item is

recognized on line basis

.

lease to from asset

.

term lessee Such .

③ Allocate Lease Rent

④ Lessee has

tight to direct of

Finance

use

in ratio of Fair value Lease

Protective rights )

:

asset ( exception :

of LINC 6mF de

recognised

.

such Asset is

① Leased

.

arv ) Receivable

② PV of ( Rent GRV to

recognized

-

t as

Initial Rdm -

MLP

.

PIL

③ Diff charged to .

LL RV Hua before

of all fixed Payment t Cbr ) LL t Payment made

. -

PIL

-

.

Payment)

.

⑥ Subsequent ( and

. .

⇒ end of term Dnt on off Co to rent

based Variable before

.

-

Rv

of index commencement LI .

-

.

CMBORICMI

fixed

rate ) received deducted from Such receivable [ CINC same as

Lessee )

Payment

t Transaction

commencement

. .

§nIE¥P

.

+

Post Gst Dealer I

Residual incurred

by PL while

D

Transaction cost

Mfg charged

L

value t t

⑤ to

guaranteed ' ed

. .

are

idea

bby

? Egan

.IE?ftE7pIi3Ienji Parr

"

Term

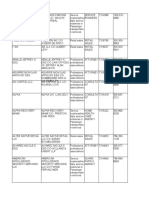

Lease :

others it is considered as of me .

Period Termination

Termination Penalty it Less e -

Rent URV

terminate a I Lease t G Rut

if expected to

.

.

expected to terminate -

,

incentive early .

N .

I .

= RV .

of GI .

Lease

.

U FI GI -

NI -

-

=

between RITA to Pit

Diff LL .

and is either Cash or

charged Sale and Lease back . ( Les > eel Seller )

Transaction

Subsequent Subsequent change in estimate ① regarded as sale .

LL . =

end of term Payment of 2. T.lv .

Rent is re discounted

a) Diff between SV -

FV = Loan Ant .

It op Cat

OR used ) -

Payment of Rent '

new disc rate and

opt

.

using

on

PV of &Rt K

GRD Laka ) L

b)

.

- .

- -

.

Els of Cx -

do .

of N . x. ) -

-

Non current Such

change in LL .

is

adjusted

Current RTUA c) C. A X RTUA

do of for to

.

c. x

.

N.y

.

.

.

= . =

d) RTUA do .

Rtua Leaseterm

if V. Rent not considered

Depor Subsequent

}

① and

over

Cash ds

-

-

#

.

option to purchase then over

as part of LL . are expended To PPE ( CA ) B "

bid

useful life Pk

to

gig

to

.

② Rim if

.

class of asset under

.

same

sale

Rm

regarded

as

2nd As 16 was

Transaction not .

②

.

read Considered loan ale as Per 2nd AS 109

using

Acm

Ant as

.

Lease Modification

I

Increase in

Scope Decrease in Scope

At Standalone MR others . Term Area .

RV ① Prop

Riva

-

PV of existing ( bat ) t

① Determine of bat 2.2 and

. . .

Ak separately

-

Li ab D. R related to reduced

LL at original

'

Add Leon .

.

MR to

determined using area charged

and diff adjusted to ② Diff in CA -

① is

pc

to PL

Riva .

charged ② Pv .

of bald .

L .

is

③ Poop . share of determined using

Riva is also MR and

diff

to Pt from

charged bat C. A-

of

-

⑥ Again PV -

of Lil LL . is adjusted

( BI ) to Rto A

is determined

.

R

Using m . .

on

Modification date .

and diff from ①

to RTUA

charged

.

You might also like

- Battlegroup - Torch MissionDocument12 pagesBattlegroup - Torch MissionFOWNo ratings yet

- Abdul Rahim Suleiman & Anor V Faridah MD Lazim & Ors (2016) 6 AMR 481Document37 pagesAbdul Rahim Suleiman & Anor V Faridah MD Lazim & Ors (2016) 6 AMR 481Maisarah MustaffaNo ratings yet

- P P P P: Machines Cloth Machines ClothDocument6 pagesP P P P: Machines Cloth Machines Cloth吳育瑄No ratings yet

- Tema 6Document2 pagesTema 6Marua AbselamNo ratings yet

- HW 3Document1 pageHW 3김가온No ratings yet

- Untitled NotebookDocument3 pagesUntitled Notebookpakaphob panyasirimongkolNo ratings yet

- Fórmulas M.FluidosDocument3 pagesFórmulas M.FluidosJonathan RuizNo ratings yet

- God's NameDocument5 pagesGod's NameDoug HunterNo ratings yet

- Iau 31858019779283 189 1673463830Document1 pageIau 31858019779283 189 1673463830Святым ДухомNo ratings yet

- 00192-Response LetterDocument3 pages00192-Response LetterlegalmattersNo ratings yet

- IntegralesDocument1 pageIntegralesPaulaNo ratings yet

- Borough: Ordinance To Install Business District Passes Parking JtletersDocument6 pagesBorough: Ordinance To Install Business District Passes Parking JtletersnarberthcivicNo ratings yet

- Progress Monitoring SheetDocument2 pagesProgress Monitoring SheetHitesh JaniNo ratings yet

- Bluewater Website Map Dec 2022Document3 pagesBluewater Website Map Dec 2022ahdlateifNo ratings yet

- Bluewater Website Map Aug 2023 0Document3 pagesBluewater Website Map Aug 2023 0sarahleemcginnNo ratings yet

- Modul Praktikum Perancangan Tata Letak FasilitasDocument74 pagesModul Praktikum Perancangan Tata Letak FasilitasHafidz Asy'ari AkbarNo ratings yet

- Arizona School Districts: Leas Eligible For The 2016 Small Rural School Achievement Program (Srsa)Document13 pagesArizona School Districts: Leas Eligible For The 2016 Small Rural School Achievement Program (Srsa)Gerson Tampolino AcostaNo ratings yet

- Vermont School Districts: Leas Eligible For The 2014 Small Rural School Achievement Program (Srsa)Document8 pagesVermont School Districts: Leas Eligible For The 2014 Small Rural School Achievement Program (Srsa)Lori MendezNo ratings yet

- Emma (18 - 12 - 23)Document1 pageEmma (18 - 12 - 23)Sameer UddinNo ratings yet

- Vienna Map City CenterDocument1 pageVienna Map City Centeragnes nathaniaNo ratings yet

- New Mexico School Districts: Leas Eligible For The 2016 Small Rural School Achievement Program (Srsa)Document4 pagesNew Mexico School Districts: Leas Eligible For The 2016 Small Rural School Achievement Program (Srsa)Gerson Tampolino AcostaNo ratings yet

- SuturesDocument1 pageSuturesgaganNo ratings yet

- Singer 478 Sewing Machine Instruction ManualDocument74 pagesSinger 478 Sewing Machine Instruction ManualiliiexpugnansNo ratings yet

- Ave Maria - AnonimusDocument2 pagesAve Maria - Anonimusdamir stancicNo ratings yet

- TH 003 WD - TH BP 003Document1 pageTH 003 WD - TH BP 003Robert SmartNo ratings yet

- TestDocument1 pageTestMarlon Eduardo Colorado BustamanteNo ratings yet

- Plan Stands v1Document1 pagePlan Stands v1Anne de MalliardNo ratings yet

- 5 PDFDocument1 page5 PDFSim Pei YingNo ratings yet

- Install Nw70 Sr3 AbapDocument168 pagesInstall Nw70 Sr3 AbapSeby DinuNo ratings yet

- BTS SUGA Interlude ShadowDocument3 pagesBTS SUGA Interlude ShadowAlexandra LeeNo ratings yet

- BTS SUGA Interlude ShadowDocument3 pagesBTS SUGA Interlude ShadowAlexandra LeeNo ratings yet

- IIASA BROCHURE - 210x594 (FINAL) WEBDocument2 pagesIIASA BROCHURE - 210x594 (FINAL) WEBMing MartNo ratings yet

- Cobotta eDocument6 pagesCobotta eThắng HoàngNo ratings yet

- Athens Metro MapDocument1 pageAthens Metro MapEl Comandante GeneralNo ratings yet

- Screenshot 2022-02-07 at 4.16.55 PMDocument1 pageScreenshot 2022-02-07 at 4.16.55 PMnenhakNo ratings yet

- Seminar Geometrie DifDocument14 pagesSeminar Geometrie DifAndra FotaNo ratings yet

- Fina1310 Fmla PDFDocument3 pagesFina1310 Fmla PDFTiffany ChanNo ratings yet

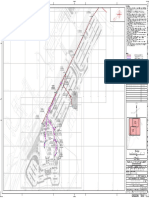

- Notes:: Highways and Airports B.SC Graduation Project 2016Document1 pageNotes:: Highways and Airports B.SC Graduation Project 2016Eslam BelalNo ratings yet

- Untitled NotebookDocument1 pageUntitled NotebookJasmine JawandaNo ratings yet

- TP - M019 - M020-PlanDocument1 pageTP - M019 - M020-PlanON ROADING CONTRACTING LLCNo ratings yet

- Scania DealershipDocument31 pagesScania DealershipOluwaseyi JohnNo ratings yet

- Week 2 VectorDocument1 pageWeek 2 VectorPhruek NatthaphatNo ratings yet

- SFWMD Rain Monitor MapDocument1 pageSFWMD Rain Monitor Mapsomshekhar1983No ratings yet

- 01 Jawaahir e Kohsaar 22jul2Document4 pages01 Jawaahir e Kohsaar 22jul2md1fahim1islamNo ratings yet

- MATH IN THE MODERN WORLD - DRPN PDFDocument10 pagesMATH IN THE MODERN WORLD - DRPN PDFHazel IsturisNo ratings yet

- Project Oxygas (15687530)Document2 pagesProject Oxygas (15687530)Mario Alberto Pineda CastilloNo ratings yet

- Ataglance 200910Document2 pagesAtaglance 200910Asghar KhanNo ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicsMartyna RutkowskaNo ratings yet

- Bogra Sub-Station Dimension MapDocument1 pageBogra Sub-Station Dimension Mapأون جهادNo ratings yet

- 05 Tant. Bajo - 3 Lotes-Lote 5-6Document1 page05 Tant. Bajo - 3 Lotes-Lote 5-6Modulaser IdeasNo ratings yet

- Discussion EntropyDocument4 pagesDiscussion EntropyAyuni MokhtarNo ratings yet

- Fema P-1078Document1 pageFema P-1078Ronny FortaNo ratings yet

- Fema P-1078 PDFDocument1 pageFema P-1078 PDFeerrddeemmNo ratings yet

- Lab Systemic Path CNS Exercise NeucomDocument7 pagesLab Systemic Path CNS Exercise NeucomElysa Dela CruzNo ratings yet

- Quaternary Chart 2016Document1 pageQuaternary Chart 2016vin_sa14230No ratings yet

- Stat Review For APDocument2 pagesStat Review For APknrek aNo ratings yet

- Mecânica Geral 2Document1 pageMecânica Geral 2Renan QueirozNo ratings yet

- Untitled NotebookDocument1 pageUntitled Notebookpixisom201No ratings yet

- H020999001P00Document1 pageH020999001P00MohammadNo ratings yet

- It's So Easy Going Green: An Interactive, Scientific Look at Protecting Our EnvironmentFrom EverandIt's So Easy Going Green: An Interactive, Scientific Look at Protecting Our EnvironmentNo ratings yet

- Angola Light Well InterventionDocument2 pagesAngola Light Well InterventionWilliam EvansNo ratings yet

- 23 W Group 8 Final Project CapstoneDocument14 pages23 W Group 8 Final Project CapstoneQwertNo ratings yet

- Atriark WhitepaperDocument40 pagesAtriark Whitepaperbudi satrio pratamaNo ratings yet

- Causes of Disequilibrium in Balance of PaymentCAUSES OF DISEQUILIBRIUM IN BALANCE OF PAYMENTDocument36 pagesCauses of Disequilibrium in Balance of PaymentCAUSES OF DISEQUILIBRIUM IN BALANCE OF PAYMENTAlisha Singh67% (3)

- Sworn Declaration: Annex DDocument3 pagesSworn Declaration: Annex DellamanzonNo ratings yet

- Porter's Five Forces "Cadbury"Document3 pagesPorter's Five Forces "Cadbury"Cristian MazurNo ratings yet

- Broadcast Engineering Consultants India Limited: Vacancy Advertisement No. 127Document2 pagesBroadcast Engineering Consultants India Limited: Vacancy Advertisement No. 127Bipin KashyapNo ratings yet

- Sampling Aggregates: Standard Practice ForDocument7 pagesSampling Aggregates: Standard Practice ForAnonymous x7VY8VF7100% (1)

- Practice BookDocument20 pagesPractice Booktamim haqueNo ratings yet

- Project Proposal To Establish A Chicken ProjectDocument4 pagesProject Proposal To Establish A Chicken ProjectIsaac Chinoda100% (1)

- Name: Unsa Soomro Roll no:20S-MSHRM-BS-01 Assigned By: Sir. DR Shah Mohammad KamranDocument12 pagesName: Unsa Soomro Roll no:20S-MSHRM-BS-01 Assigned By: Sir. DR Shah Mohammad Kamranunsa soomro100% (1)

- Cherukuri Vinay Kumar-AWS Cloud EngineerDocument1 pageCherukuri Vinay Kumar-AWS Cloud EngineerEmdadul Hoque TusherNo ratings yet

- E - TRADE Confirm Residency StatusDocument4 pagesE - TRADE Confirm Residency Statusjagendra singhNo ratings yet

- Review Jurnal - 3Document20 pagesReview Jurnal - 3eko hadiNo ratings yet

- Amazon CaseDocument2 pagesAmazon CaseradhikaNo ratings yet

- Human Resource ProcuretmentDocument14 pagesHuman Resource Procuretmentjeje jeNo ratings yet

- ILO Guide To Myanmar Labour LawDocument62 pagesILO Guide To Myanmar Labour LawKaung Myat HtunNo ratings yet

- From Data To Action How Marketers Can Leverage AIDocument17 pagesFrom Data To Action How Marketers Can Leverage AIFRANCO PAREDES SCIRICANo ratings yet

- Servicenow Interview Question and AnswersDocument72 pagesServicenow Interview Question and Answersswapneshsurwade29No ratings yet

- S4hana MorDocument24 pagesS4hana MorARYAN SINHANo ratings yet

- Group 7 Bergerac Systems - Challenge of Backward IntegrationDocument4 pagesGroup 7 Bergerac Systems - Challenge of Backward Integrationkiller dramaNo ratings yet

- How To Write Your Performance Objective Statements: Our Top TipsDocument2 pagesHow To Write Your Performance Objective Statements: Our Top TipsShruti KochharNo ratings yet

- Nelba: Case StudyDocument7 pagesNelba: Case StudyVictor Sabrera ChiaNo ratings yet

- QM PM Calibration CycleDocument44 pagesQM PM Calibration CycleRohit shahiNo ratings yet

- Our Products: Powercore Grain Oriented Electrical SteelDocument20 pagesOur Products: Powercore Grain Oriented Electrical SteelkoalaboiNo ratings yet

- Standard Terms and Conditions Senheng - APPLE IPHONE 12 1.0 Promotion PeriodDocument2 pagesStandard Terms and Conditions Senheng - APPLE IPHONE 12 1.0 Promotion PeriodcikgutiNo ratings yet

- 15 Marzo 21 BrikelDocument20 pages15 Marzo 21 BrikelAndres TabaresNo ratings yet

- TIG Welding (GTAW) - MIG Welding (GMAW) - Stick Welding (SMAW) Questions, and AnswersDocument23 pagesTIG Welding (GTAW) - MIG Welding (GMAW) - Stick Welding (SMAW) Questions, and AnswerssanthakumarNo ratings yet

- RAIN Business Plan TemplateDocument17 pagesRAIN Business Plan TemplateRavindra SinghNo ratings yet