Professional Documents

Culture Documents

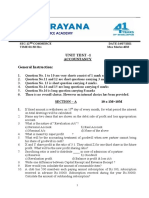

CH 1 CBQ Acc

Uploaded by

Amit GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 1 CBQ Acc

Uploaded by

Amit GuptaCopyright:

Available Formats

CHAPTER 1 :- NOT FOR PROFIT ORGANISATION

CASE/SOURCE BASED QUESTIONS:

Sl.No. Read the passage given below and answer the following questions……..

CASE-1. Dr. Rajani Mehta a qualified M.B.B.S. doctor got voluntary retirement at the age of 50

years from a renowned hospital. She was residing in a flat of a wide apartment which is

surrounded by a slum which is inhabited by economically weaker strata of the society. As

the people in that area were not aware about importance of health care, a widespread

ailment had been persistently prevailing.

Rajani met with some of the well-off people of apartment and decided to open a

dispensary named as `LOCAL Clinic’ to provide them cost free medical assistance and

make them aware about hygienic living, physical fitness, and economic balance diet. Many

of the apartment members agreed to it. She approached health department of the town

with her proposal which was accepted and an initial one time grant of ₹.2,00,000 was

sanctioned immediately for purchase of medical equipment and test kits for pathological

tests. 10 members of the apartment contributed ₹.20,000 each as lifetime subscription to

the clinic. Rajni decided to charge ₹10 as one time registration fee from patients.

Apart from above Rajni made following transactions for first year:

S. No. Particulars Amount in (₹)

1 Purchased Equipment 1,20,000

2 Purchased Medicines 95,000

3 Purchased Furniture 10,000

4 Rent paid 12,000

5 Fee received for medical tests 45,000

6 Honorarium paid to Yoga teacher 35,000

7 Honorarium paid to physiotherapist and sports teacher 38,000

Rajni informed that during the first year 10,500 patients were registered for treatment and

for other

services. Taking reference from the above, answer following questions.

Q.No.1 Not for profit organization prepares

(i) Income and Expenditure account

(ii) Trading and Profit loss account

(iii) Receipt and Payment account

(iv) None of the above

Options:

(a) Only (ii)

(b) Only (iii)

KVS ZIET BHUBANESWAR 12/10/2021 Page 1

(c) Both (i) and (ii)

(d) Both (i) and (iii)

Q.No.2 Honorarium paid to Physiotherapist and sports teacher Will be posted to

(a) Debit side of Income and Expenditure Account.

(b) Debit side of Receipt and Payment Account.

(c) Debit side of Profit and Loss Account.

(d) Credit side of Income And Expenditure account

Q.No.3 State whether the following statements are true or false:

“Donations received by MsRajani Mehta from health department should be capitalized.”

Q.No.4 Lifetime subscription paid by 10 members will be posted in

(a) Expenditure side of Income and Expenditure Account

(b) Liability side of closing Balance Sheet

(c) Income side of Income and Expenditure Account

(d) Assets side of closing Balance Sheet

CASE 2. VIJAYA SHANKAR, an Ex-Indian cricketer decided to start a cricket academy to train

the young enthusiastic players of down south. With the support and guidance of his

family he started the Star cricket academy at Tirunelveli township area on 1st April 2020.

Land was donated by his grandfather worth Rs. 10,00,000 as per his will. His father

Shankar donated Rs.5,00,000 for the construction and running the academy. He spent

Rs.3,00,000 for construction of the pavilion. 200 players of Tirunelveli joined the

academy and they paid yearly subscription of Rs.1200 each. 10 players paid in advance

for the next year 2021 -22. Vijaya shankar appointed well experienced coach for them,

the coach fee amounted to Rs. 1,20,000 p.a.

The maintenance expenses amounted to Rs.75,000. Bats and balls purchased during the

year amounted to Rs.15,000. Closing stock of bats and ball amount to Rs.1000.

Based on the above information you are required to answer the following question.

Q. No.1 The liability towards advance subscription amounted to:

(a) Rs. 12,000

(b) Rs.24,000

(c) Rs.1,200

(d) Rs.1,20,000

Q. No.2 The amount of subscription received as per Receipts and payments Account of Star

cricket club is:

(a) Rs.2,52,000

(b) Rs.2,40,000

KVS ZIET BHUBANESWAR 12/10/2021 Page 2

(c) Rs.2,50,000

(d) None of the above

Q. No.3 What amount should be charged to the Income and Expenditure account for bats and

balls consumed during the year?

(a) Rs.15,000

(b) Rs.16,000

(c) Rs.14,000

(d) Rs.13,500

Q. No.4 The amount of subscription to be credited to income and expenditure account-------------

(a) 2,00,000

(b) 2,40,000

(c) 1,80,000

(d) 2,50,000

CASE Read the passage given below and answer the following questions……..

3. Subscriptions received during the year ₹ 50,000

Subscriptions outstanding on 31st March, 2020 ₹ 20,000

Subscriptions outstanding for the year 2020-21 ₹ 6,000

Subscriptions received in Advance on 31-3-2020 ₹ 8,000

Subscriptions received in Advance on 31-3-2021 ₹ 9,000

Subscriptions of ₹ 9,000 is still in arrears for the year 2019-20

1. What is the amount of Subscription outstanding at 31st March 2021

(A) ₹ 9,000

(B) ₹ 6,000

(C) ₹ 15,000……

(D) ₹ 3,000

2. What amont is shown in credit side of Income and Expenditure account

(A) ₹30,000

(B) ₹ 44,000…..

(C) ₹ 45,000

(D) None of above

3. What amount is shown in the Asset side of Balance sheet at 31st March 2020?

(A) ₹ 20,000

(B) ₹ 6,000

(C) ₹ 9,000

(D) ₹ 15,000

KVS ZIET BHUBANESWAR 12/10/2021 Page 3

4. What amount is shown in the Liability side of Balance sheet at 31st March 2021?

(A) ₹ 19,000

(B) ₹ 6,000

(C) ₹ 9,000

(D) ₹ 8,000

CASE Following information given below is of Good Health Sports Club for the year ended 31st

4.. March, 2021.

Particulars 01.04.2020 (Amount ₹) 31.03.2021(Amount ₹ )

Stock of Stationery 8,000 6,000

Creditors for Stationery 9,000 11,000

Stationery purchased during the year ended 31st March, 2021 was ₹ 47,000.

On the basis of above information answer the following -

1. What is the amount of stationery shown in Income and Expenditure Account for the year

ended 31st March, 2021 ?

(A) ₹ 48,000

(B) ₹40,000

(C) ₹ 49,000

(D) ₹ 51,000

2. What amount will be shown in Asset side of Balance sheet at 31st March 2021

(A) ₹ 8,000

(B) ₹ 6,000

(C) ₹ 11,000

(D) ₹ 9,000

3. What amount will be shown in Liability side of Balance sheet at 31 st March 2021

(A) ₹ 8,000

(B) ₹ 6,000

(C) ₹ 11,000

(D) ₹ 9,000

4. What amount is paid for stationery during the year 2020-21 ?

(A) ₹ 47,000

(B) ₹ 49,000

(C) ₹ 45,000

(D) ₹ 48,000

KVS ZIET BHUBANESWAR 12/10/2021 Page 4

Sl.No. Read the passage given below and answer the following questions.

CASE 5. Case:

Dr. Rajani Mehta a qualified M.B.B.S. doctor got voluntary retirement at the age of 50 years

from a renowned hospital. She was residing in a flat of a wide apartment which is surrounded

by a slum which is inhabited by economically weaker strata of the society. As the people in

that area were not aware about importance of health care, a widespread ailment had been

persistently prevailing. Rajani met with some of the well-off people of apartment and decided

to open a dispensary named as `LOCAL Clinic’ to provide them cost free medical assistance

and make them aware about hygienic living, physical fitness, and economic balance diet.

Many of the apartment members agreed to it. She approached health department of the town

with her proposal which was accepted and an initial one time grant of ₹.2,00,000 was

sanctioned immediately for purchase of medical equipment and test kits for pathological tests.

10 members of the apartment contributed ₹.20,000 each as lifetime subscription to the

clinic. Rajni decided to charge ₹10 as one time registration fee from patients. Apart from

above Rajni made following transactions for first year: S. No. Particulars Amount in (₹) 1

Purchased Equipment 1,20,000 2 Purchased Medicines 95,000 3 Purchased Furniture 10,000 4

Rent paid 12,000 5 Fee received for medical tests 45,000 6 Honorarium paid to Yoga teacher

35,000 7 Honorarium paid to physiotherapist and sports teacher 38,000 Rajni informed that

during the first year 10,500 patients were registered for treatment and for other services.

Taking reference from the above, answer following questions.

Q1) Not for profit organization prepares (i) Income and Expenditure account (ii) Trading and

Profit loss account (iii) Receipt and Payment account (iv) None of the above Options:

(a) Only (ii)

(b) Only (iii)

(c) Both (i) and (ii)

(d) Both (i) and (iii)

Q2) Honorarium paid to Physiotherapist and sports teacher Will be posted to (a) Debit side of

Income and Expenditure Account.

(b) Debit side of Receipt and Payment Account.

(c) Debit side of Profit and Loss Account.

(d) Credit side of Income And Expenditure account

Q3) State whether the following statements are true or false: “Donations received by Ms

Rajani Mehta from health department should be capitalized.”

Q4) Lifetime subscription paid by 10 members will be posted in

KVS ZIET BHUBANESWAR 12/10/2021 Page 5

(a) Expenditure side of Income and Expenditure Account

(b) Liability side of closing Balance Sheet

(c) Income side of Income and Expenditure Account

(d) Assets side of closing Balance Sheet

CASE 6 Read the following hypothetical text and answer the given questions

Ajit started “Sevarth Library” at Kolkata as a platform for the students who are not capable

enough to purchase books and they need support from the society. Ajit met a few renowned

persons and collected a good amount of donation. He purchased books, bookshelf and other

items required to start a library. His aim was to help students and not to earn any profit from

the library. 100 students joined the library from which a minimum amount of Rs. 50 p.m. was

charged as subscriptions. 5 more people joined who paid life membership fee of Rs. 5000

each. Mr. Mahendra, a businessman, once visited the library and donated Rs. 200000 for

purchasing of furniture. On the entry of every new member in the library a nominal amount

of Rs. 5/- was charged as entry fee. The Accountant prepared Receipts and Payments a/c,

Income & Expenditure a/c and balance sheet every year for the library.

1 Where should the amount of subscriptions be shown by the Accountant

(A) Receipts side of Receipts and Payments a/c

(B) Income side of the Income & expenditure a/c

(C) Liabilities side of Balance Sheet

(D) Both (A) and (C)

2 Donation received from Mr. Mahendra should be treated as a__

(A) General receipt and to be shown in the Income & Expenditure a/c

(B) Capital receipt and to be shown in the Income & Expenditure a/c

(C) Capital receipt and to be shown in the Balance Sheet

(D) General receipt and to be shown in the Balance Sheet

3 Life membership fee is

(A) Liability

(B) Income

(C) Expense

(D) Asset

4 Surplus/Deficit will be calculated with the help of

(A) Receipts and Payments a/c

(B) Income and Expenditure a/c

(C) Balance Sheet

(D) Both (A) and (B)

KVS ZIET BHUBANESWAR 12/10/2021 Page 6

SL.No Questions

CASE Following is the Receipts and Payments Account of Appollo Hospital for the year ended

7 31st March,2021:

RECEIPTS AND PAYMENTS ACCOUNT

Receipts Rs. Payments Rs.

To balance b/d 8,500 By payment for 33,000

To Subscriptions 48,000 medicine

To Donations 15,000 By fees to Doctors 24,000

To interest on - By Salaries 27,000

investments @9% 9,000 By Equipment 15,000

To proceeds from 12,000 purchased

charity show By Charity show 4,000

To Grant in aid 20,000 expenses

By Sundry Expenses 1,200

By balance c/d 8,300

1,12,500 1,12,500

Other Information:

Particulars 1.4.2020 31.3.2020

Subscription due 500 1,000

Subscription received in advance 1,000 500

Stock of Medicines 10,000 15,000

Amount due to medicine suppliers 8,000 12,000

Value of Equipments 25,000 33,000

Value of Buildings 70,000 65,000

You are required to furnish the following information:

(A) What will be the amount of Capital Fund:

(i) Rs.2,00,000

(ii) Rs.2,10,000

(iii) Rs.3,00,000

(iv) Rs.3,15,000

(B) What will be the value of investment at the beginning of the year:

(i) Rs.10,00,000

(ii) Rs. 1,00,000

(iii) Rs. 1,10,000

(iv) Rs. 1,45,000

(C) How much amount of medicine is consumed during the year:

(i) Rs.3,00,00

(ii) Rs. 36,000

(iii) Rs.32,000

(iv) Rs.27,000

(D) How much amount of subscription will be shown on the income side of the

income and expenditure account:

(i) Rs.51,000

(ii) Rs.49,000

(iii) Rs.43,000

(iv) Rs.46,000

KVS ZIET BHUBANESWAR 12/10/2021 Page 7

CASE Following is the Receipts and Payments Account of Excel Club for the year ended 31 st

March,2021:

8

RECEIPTS AND PAYMENTS ACCOUNT

Receipts Rs. Payments Rs.

To balance b/d 1,90,000 By Salaries 3,30,000

To subscriptions By Sports Materials 4,00,000

6,60,000

To interest on- By balance c/d 1,60,000

investments@8% for - 40,000

full year

8,90,000 8,90,000

Additional Information:

(i) The club had received Rs,20,000 for subscription in 2019-20 for 2020-21

(ii) Salaries had been paid only for 11 months.

(iii) Stock of Sports Material on 31st March,2020 was Rs.3,00,000 and on 31st

March ,2021 Rs.6,50,000.

You are required to calculate the following:

(A) How much amount of Salaries will be shown on the expenditure side of Income

and Expenditure Account.

(i) Rs,9,00,000

(ii) Rs.8,00,000

(iii) Rs.3,60,000

(iv) Rs.10,00,000

(B) What will be the value of investment at the beginning of the year.

(i) Rs.1,00,000

(ii) Rs.2,00,000

(iii) Rs.4,00,000

(iv) Rs.5,00,000

(C) How much will be the amount of Surplus(excess of Income over Expenditure):

(i) Rs.3,05,000

(ii) Rs.3,10,000

(iii) Rs.3,50,000

(iv) Rs.3,60,000

(D) What is the amount of Sports material consumed during the year:

(i) Rs.60,000

(ii) Rs.45,000

KVS ZIET BHUBANESWAR 12/10/2021 Page 8

(iii) Rs.50,000

(iv) Rs.52,000

CASE 9 Read the information given below and answer the following questions: Following is the

Receipt and payment of Literacy Club for the year ended 31.3.2020

Receipt Rs Payment Rs

To balance b/d 19550 By salary 3000

To Subscriptions: By newspaper 2050

2018-19 1200 By electricity bill 1000

2019-20 26500 By Fixed deposits (as on

2020-21 500 28200 1.7.2019 @9%p.a.) 20000

To sale of old news paper 1250 By books

To Govt. grants 10000 By rent 10600

To sale of old furniture (book By furniture 6800

value Rs7000) 5700 By balance c/d 10500

To interest on F.D. 450 11200

65150 65150

Additional information:

(i) Subscription outstanding as on 31.3.2019 were Rs.2000 and on 31.3.2020 Rs.2500

(ii) On 31.3.2020 salary outstanding was Rs.600 and rent outstanding was Rs.1200

(iii) The club owned furniture Rs.15000 and books Rs.7000 on 1.4.2019

1 Opening capital fund of the club will be

(A) Rs.32000

(B) Rs.43550

(C) Rs.25000

(D) Rs.11200

2 What will be total interest on fixed deposits owned by the Club

(A) Rs.1350

(B) Rs.450

(C) Rs,1800

(D) None of the above

3 Which of the following will not be recorded in income and expenditure account of the club

(A) Electricity bill

(B) Rent

(C) Books

(D) Salary

4 Outstanding salary and outstanding rent is recorded in the receipt and payment account of

the club as

(A) It is related with the current year expenses

(B) no payment in the form of cash

(C) Liability is creating

(D) not recorded in the Receipt and Payment account

KVS ZIET BHUBANESWAR 12/10/2021 Page 9

CASE Read the information given below and answer the following questions:

10 Following is the extract of the balance sheet of Bharat Sports Club for the year ending

31.3.2019 and 31.3.2020

particulars 31.3.2019 31.3.2020

(Rs) (Rs)

Advance subscription 8000 9500

Outstanding subscription 7000 12500

During the year, the club received Rs,120000 as subscription which included Rs.5000 for the

year ending 31.3.2019.

1 How subscription in advance in the beginning will be treated

(A) Asset and shown in opening Balance Sheet

(B) Liability and shown in opening Balance Sheet

(C) Accrued Income and shown in opening Balance Sheet

(D) Prepaid expense and shown in opening Balance Sheet

2 Subscription received during the year will be treated as

(A) Revenue Receipts

(B) Capital Receipts

(C) Any of the above depending on the information

(D) None of the above

3 Amount to be credited in Income and Expenditure account during the year 31.3.2021

(A) Rs 120000

(B) Rs.15000

(C) Rs.137000

(D) Rs.9500

4 Subscription outstanding as on 31.3.2021, shown in the balance Sheet of the Club will be

(A) Rs.12500

(B) Rs.17500

(C) Rs.5000

(D) Rs.12000

KVS ZIET BHUBANESWAR 12/10/2021 Page 10

ANSWER KEY

Case Study Questions (1)

Q.No.1 C

Q.No.2 B

Q.No.3 A

Q.No.4 C

Case Study Questions (2)

Q.No.1 C

Q.No.2 B

Q.No.3 C

Q.No.4 C

Case Study 3

Q.No.1 (d) Both (i) and (iii)

Q.No. 2 2 (a) Debit side of Income and Expenditure Account.

Q.No. 3 3 True

Q.No.4 (b) Liability side of closing Balance Sheet

Case Study 4

Q.No.-1 (a) Rs.12,000

Q.No. 2 (a) Rs.2,52,000

Q.No. 3 ( c) Rs.14,000

Q.No.4 (b) 2,40,000

Case Study 5

Q1 (d) Both (i) and (iii)

Q2 (a) Debit side of Income and Expenditure Account.

Q3 True

Q4 (b) Liability side of closing Balance Sheet.

Case Study 6

KVS ZIET BHUBANESWAR 12/10/2021 Page 11

1 Subscription

2 Rs.2,40,000

3 Vijaya Shankar’s grandfather donated a land for cricket coaching which is to be treated as legacy

and is to be capitalized.

4 (a) Rs.12,000

Case Study 7

(A)-(ii)

(B)-(ii)

(C)-(iii)

(D)-(ii)

Case Study 8

(A)-(iii)

(B)-(iv)

(C)-(ii)

(D)-(iii)

CASE 9

S.NO. ANSWER

1 B

2 A

3 C

4 D

CASE 10

S.NO. ANSWER

1 B

2 A

3 C

4 B

PREPARED BY THE PGTs ( COMMERCE ) OF BHUBANESWAR, GUWAHATI, KOLKATA,

RANCHI, SILCHAR AND TINSUKIA REGIONS.

KVS ZIET BHUBANESWAR 12/10/2021 Page 12

You might also like

- I Never Knew I Had A Choice 11th Edition Corey Test BankDocument10 pagesI Never Knew I Had A Choice 11th Edition Corey Test BankLeroyBrauncokfe100% (12)

- David Deida - Wild NightsDocument120 pagesDavid Deida - Wild NightsRosatvision100% (8)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Partnership Accounts Fundamentals of Partnershi1Document16 pagesPartnership Accounts Fundamentals of Partnershi1ramandeep kaur100% (1)

- Learning Styles: DR Anish KotechaDocument5 pagesLearning Styles: DR Anish KotechaNicolas ObandoNo ratings yet

- Read The Following Hypothetical Text and Answer The Given QuestionsDocument12 pagesRead The Following Hypothetical Text and Answer The Given QuestionsRoshan KardaNo ratings yet

- Class Xii Cbse Question Bank AccountancyDocument23 pagesClass Xii Cbse Question Bank AccountancyBinoy TrevadiaNo ratings yet

- Accountancy-SQP Term2Document8 pagesAccountancy-SQP Term2radhikaNo ratings yet

- 12 Term t2 AccountancyDocument17 pages12 Term t2 AccountancySIFANA ARIMANICHOLA100% (1)

- CH 1 Paper OLDDocument3 pagesCH 1 Paper OLDMaulik ThakkarNo ratings yet

- 12 Accountancy SQP 4Document11 pages12 Accountancy SQP 4KandaroliNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- All Chapter Case Based Accountancy Class 12Document93 pagesAll Chapter Case Based Accountancy Class 12Isha PatelNo ratings yet

- CH 2 CBQ AccDocument7 pagesCH 2 CBQ AccAmit GuptaNo ratings yet

- XII Accountancy in Eng QPDocument6 pagesXII Accountancy in Eng QPSarang KrishnanNo ratings yet

- XII Accounts Test With SolutionDocument12 pagesXII Accounts Test With SolutionKritika Mahalwal100% (1)

- SAHODAYAModel Question Acc SET 2Document9 pagesSAHODAYAModel Question Acc SET 2aamiralishiasbackup1No ratings yet

- Practic Question Paper Term 2 Accountancy Class 12Document52 pagesPractic Question Paper Term 2 Accountancy Class 12Final Strike50% (2)

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Npo Collage SPCC Term 2 NewDocument9 pagesNpo Collage SPCC Term 2 NewTaaran ReddyNo ratings yet

- Mock 1Document5 pagesMock 1Yashi JainNo ratings yet

- DR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyDocument17 pagesDR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyPiyush HazraNo ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- 12 Accounts 2020 21 Practice Paper 4Document14 pages12 Accounts 2020 21 Practice Paper 4Vijey RamalingamNo ratings yet

- Sample Paper-5Document8 pagesSample Paper-5Keshav GoyalNo ratings yet

- 652oswaal Case-Based Questions Accountancy 12th (Issued by CBSE in April-2021)Document7 pages652oswaal Case-Based Questions Accountancy 12th (Issued by CBSE in April-2021)Vidhi Jain UNo ratings yet

- 652oswaal Case-Based Questions Accountancy 12th (Issued by CBSE in April-2021)Document7 pages652oswaal Case-Based Questions Accountancy 12th (Issued by CBSE in April-2021)Nitesh kuraheNo ratings yet

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- Accountancy Set 1 QPDocument6 pagesAccountancy Set 1 QPShaurya JainNo ratings yet

- Accountancy PQ2Document10 pagesAccountancy PQ2Arpan DasNo ratings yet

- Accountancy PDFDocument36 pagesAccountancy PDFAaditya PanwarNo ratings yet

- Accountancy Question BankDocument41 pagesAccountancy Question BankKashishlalwaniNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- Class XII Acc PB HC Mock 2021-22Document15 pagesClass XII Acc PB HC Mock 2021-22Satinder SandhuNo ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- Accounting For Specialized InstituitionsDocument4 pagesAccounting For Specialized InstituitionsTitus Clement100% (1)

- Xii AccountancyDocument152 pagesXii AccountancySahyogNo ratings yet

- KV XII ACC Question Bank of MCQ - Reason Based - Case Study Based Questions Rajan KapoorDocument151 pagesKV XII ACC Question Bank of MCQ - Reason Based - Case Study Based Questions Rajan KapoorMrityunjay KumarNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- MKGM Accounts Question Papers ModelDocument101 pagesMKGM Accounts Question Papers ModelSantvana ChaturvediNo ratings yet

- GD Goinka QPDocument10 pagesGD Goinka QPNishant SharmaNo ratings yet

- Practice Paper 1 - Accounts MCQ With AnswersDocument24 pagesPractice Paper 1 - Accounts MCQ With AnswersHarshal KaramchandaniNo ratings yet

- Accountancy QP 1 (A) 2023Document5 pagesAccountancy QP 1 (A) 2023mohammedsubhan6651No ratings yet

- Accountancy Sample PaperDocument24 pagesAccountancy Sample PaperJutishmita SaikiaNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- ACCOUNTANCY Question Paper 2022 (67-1-1) Set - 1Document6 pagesACCOUNTANCY Question Paper 2022 (67-1-1) Set - 1Manogya GondelaNo ratings yet

- AccountancyDocument18 pagesAccountancyMeena DhimanNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Tls Cl-Xii Accountancy P.T 3 Q.P 2021-22Document13 pagesTls Cl-Xii Accountancy P.T 3 Q.P 2021-22Priyank DhadhiNo ratings yet

- Cac ElvnDocument4 pagesCac Elvnsamarthj.9390No ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Answer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)Document15 pagesAnswer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)shashank saxenaNo ratings yet

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- Class 11 Accountancy Top 55 Mcqs by DR Vinod Kumar Author of Ultimate Book of AccountancyDocument18 pagesClass 11 Accountancy Top 55 Mcqs by DR Vinod Kumar Author of Ultimate Book of AccountancyJasmine SainiNo ratings yet

- 12 Accounts 2020 21 Practice Paper 3Document9 pages12 Accounts 2020 21 Practice Paper 3Vijey RamalingamNo ratings yet

- 12 Ut 1,2Document7 pages12 Ut 1,2Soni soniyaNo ratings yet

- Accounts Final Exam of BCADocument6 pagesAccounts Final Exam of BCAAtul Kumar100% (1)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Strengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceFrom EverandStrengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceNo ratings yet

- CH 4 MCQ AccDocument21 pagesCH 4 MCQ AccAmit Gupta100% (1)

- CH 4 Arq AccDocument11 pagesCH 4 Arq AccAmit GuptaNo ratings yet

- CH 2 CBQ AccDocument7 pagesCH 2 CBQ AccAmit GuptaNo ratings yet

- CH 2 TFQ AccDocument2 pagesCH 2 TFQ AccAmit GuptaNo ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.Amit GuptaNo ratings yet

- CH 3 Arq AccDocument5 pagesCH 3 Arq AccAmit GuptaNo ratings yet

- CH 1 TFQ AccDocument2 pagesCH 1 TFQ AccAmit GuptaNo ratings yet

- CH 3 CBQ AccDocument6 pagesCH 3 CBQ AccAmit GuptaNo ratings yet

- Assertion Reasoning Questions: 2 - Accounting FOR Partnership: FundamentalsDocument8 pagesAssertion Reasoning Questions: 2 - Accounting FOR Partnership: FundamentalsabiNo ratings yet

- CH 1 MCQ AccDocument12 pagesCH 1 MCQ AccAmit GuptaNo ratings yet

- CH 1 Arq AccDocument5 pagesCH 1 Arq AccAmit GuptaNo ratings yet

- Pit Toraks Radiologi 2nd Announcement 2023Document8 pagesPit Toraks Radiologi 2nd Announcement 2023Wyka FaulaniNo ratings yet

- Chakra Mantra MagickDocument36 pagesChakra Mantra MagickPaul Asturbiaris100% (4)

- LIC Health Plus Plan No.901 Full FormDocument15 pagesLIC Health Plus Plan No.901 Full FormDhaval SarvaiyaNo ratings yet

- B. Jungian Psychology and Its Archetypal InsightsDocument6 pagesB. Jungian Psychology and Its Archetypal InsightskatburnerNo ratings yet

- Gratitude Guide: by Intelligent ChangeDocument7 pagesGratitude Guide: by Intelligent ChangemNo ratings yet

- Metabolic Syndrome DiseasesDocument8 pagesMetabolic Syndrome DiseasesMahmoud SelimNo ratings yet

- Muhammad Jameel BBA, 6 Semester Sociology (Anum Kamal) Assignment No 1Document3 pagesMuhammad Jameel BBA, 6 Semester Sociology (Anum Kamal) Assignment No 1Mohammad JamilNo ratings yet

- FITT PrincipleDocument21 pagesFITT PrincipleEmily Tatunay EspejoNo ratings yet

- Tom Hardy Bane Workout: Bonus PDFDocument6 pagesTom Hardy Bane Workout: Bonus PDFDavid CiuffaniNo ratings yet

- Cwts 10023 - Civic Welfare Training Service May 29, 2021Document3 pagesCwts 10023 - Civic Welfare Training Service May 29, 2021Aly CapistranoNo ratings yet

- SandokDocument1 pageSandokKyzen BinondoNo ratings yet

- Group2 HP49-50 Act6Document4 pagesGroup2 HP49-50 Act6Marie Sandra Itliong LomibaoNo ratings yet

- Nursing Team Leader JOB DESCRIPTIONDocument3 pagesNursing Team Leader JOB DESCRIPTIONkhoiril anwarNo ratings yet

- Sample Ym ProposalDocument11 pagesSample Ym ProposalAfiq KechekNo ratings yet

- Note by Izza - Acute Decompensated Heart FailureDocument3 pagesNote by Izza - Acute Decompensated Heart FailureIzzati N. SariNo ratings yet

- Factor Analysis and Construct Validity of The Safer-Home: Teresa Chiu, Rosemary OliverDocument11 pagesFactor Analysis and Construct Validity of The Safer-Home: Teresa Chiu, Rosemary OliverSze Wing LeeNo ratings yet

- Gas Detection Bump Test and Calibration FrequencyDocument2 pagesGas Detection Bump Test and Calibration FrequencywertyyyNo ratings yet

- FARMACO-Table of Pharmacogenomic Biomarkers in Drug Labeling - FDADocument41 pagesFARMACO-Table of Pharmacogenomic Biomarkers in Drug Labeling - FDAClarice AlhoNo ratings yet

- Lab 7-Practic Aplic.Document5 pagesLab 7-Practic Aplic.anaNo ratings yet

- Ares2 Lesson1Document7 pagesAres2 Lesson1Jochene Eve AldamiaNo ratings yet

- Leave Certification Requirements: Page 1 of 14Document14 pagesLeave Certification Requirements: Page 1 of 14Anonymous zEf2TWiHgWNo ratings yet

- Vitality Book (1606456525)Document57 pagesVitality Book (1606456525)Ritu ShewaniNo ratings yet

- Appendix 5 Risk Assessment ApproachDocument8 pagesAppendix 5 Risk Assessment ApproachKirana RoonnaphaiNo ratings yet

- Advance K Send-SayfalarDocument40 pagesAdvance K Send-SayfalarOya Ozkan YilmazNo ratings yet

- Đề Ôn HN 1Document4 pagesĐề Ôn HN 1Tran Thi ThanhNo ratings yet

- Amethyst Academy Expanded - The HomebreweryDocument11 pagesAmethyst Academy Expanded - The HomebrewerySteve DonahueNo ratings yet

- HSE Performance Statistics RecordDocument3 pagesHSE Performance Statistics RecordGaneshNo ratings yet