Professional Documents

Culture Documents

Calculation

Uploaded by

MUHAMMAD NOOR FIRDAUS / UPM0 ratings0% found this document useful (0 votes)

3 views3 pagesRatio

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRatio

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesCalculation

Uploaded by

MUHAMMAD NOOR FIRDAUS / UPMRatio

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

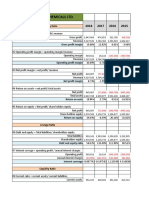

a) Liquidity Ratio (APOLLO)

Ratios 2017 2018 2019 2020

RM RM RM RM

Current Ratio: = 159,304,907 = 142,915,465 = 152,698,509 = 156,580,275

Current Asset 10,219,036 8,003,356 9,717,499 9,402,007

Current = 15.589 = 17.857 = 15.714 = 16.654

Liabilities

Quick Ratio: = (159,304,907 = (142,915,465 = (152,698,509 – = (156,580,275

(Current Assets – – 15,847,951) – 14,902,914) 15,612,549) – 14,970,305)

Inventories) 10,219,036 8,003,356 9,717,499 9,402,007

Current = 14.038 = 15.995 = 14.107 = 15.062

Liabilities

b) Asset Management Ratio (APOLLO)

Ratios 2017 2018 2019 2020

RM RM RM RM

Inventory = 298,918,294 = 190,818,447 = 188,835,828 = 174,934,531

Turnover Ratio: 15,847,951 14,902,914 15,612,549 14,970,305

Sales = 13,183 = 12.804 = 12.066 = 11.685

Inventories

Fixed Asset = 208,918,294 = 190,818,447 = 188,835,828 = 174,934,531

Turnover: 117,352,934 120,618,893 113,588,173 106,970, 143

Sales = 1.780 = 1.582 = 1.662 = 1.635

Net Fixed Assets

c) Debt Management Ratio (APOLLO)

Ratios 2017 2018 2019 2020

RM RM RM RM

Debt to Equity = 23,407,417 = 19,918,536 = 21,245,526 = 20,265,111

Ratio: 253,250,424 243,615,822 245,041,156 243,285,307

Total Debt = 0.0924 = 0.0818 = 0.0867 = 0.0833

Total Equity

Times Interest = 24,663,555 = 14,725,879 = 23,606,938 = 19,942,393

Earned Ratio: 6,830,538 3,654,038 6,181,604 5,698,242

Earnings Before = 3.611 = 4.030 = 3.819 = 3.500

Interest & Taxes

Interest Expenses

d) Profitability Ratio (APOLLO)

Ratios 2017 2018 2019 2020

RM RM RM RM

Operating = 24,663,555 = 14,725,879 = 23,606,938 = 19,942,393

Margin: 208,918,294 190,818,447 188,835,828 174,934,531

EBIT = 0.118 = 0.0772 = 0.125 = 0.114

Sales

Profit Margin: = 17,833,017 = 11,071,841 = 17,425,334 = 14,244,151

Net Income 208,918,294 190,818,447 188,835,828 174,934,531

Sales = 0.0854 = 0.0580 = 0.0923 = 0.0814

Return on Asset: = 17,833,017 = 11,071,841 = 17,425,334 = 14,244,151

Net Income 276,657,841 263,534,358 266,286,682 263,550,418

Total Assets = 0.0645 = 0.0420 = 0.0654 = 0.0540

Return on = 17,833,017 = 11,071,841 = 17,425,334 = 14,244,151

Equity: 253,250,424 243,615,822 245,041,156 243,285,307

Net Income = 0.0704 = 0.0454 = 0.0711 = 0.0585

Total Common

Equity

e) Market Ratio (APOLLO)

Ratios 2017 2018 2019 2020

RM RM RM RM

Price Earnings = 4.960 = 4.160 = 4.050 = 4.400

Ratio: 22.29 13.84 21.78 17.81

Price = 0.223 = 0.301 = 0.186 = 0.247

Earnings Per

Share

Market Book = 4.960 = 4.160 = 4.050 = 4.400

Ratio: 3.05 3.06 3.04 2.96

Market Price = 0.0854 = 1.332 = 1.332 = 1.486

Book Value Per

Share

You might also like

- Rasio Keuangan IndofoodDocument7 pagesRasio Keuangan IndofoodsalsabilawidyaNo ratings yet

- Fadm Project 3Document11 pagesFadm Project 3Vimal AgrawalNo ratings yet

- Ratio Analysis: Income Ratio: The Formula For Income Ratio Is-Gross Margin/Net SalesDocument4 pagesRatio Analysis: Income Ratio: The Formula For Income Ratio Is-Gross Margin/Net Saleszafar71No ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisNyll GasconNo ratings yet

- SIM KAMIS 1230 TugasTM11 VionaBianca 21190000087Document5 pagesSIM KAMIS 1230 TugasTM11 VionaBianca 21190000087Viona BiancaNo ratings yet

- Final Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Document12 pagesFinal Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Yasmine hanyNo ratings yet

- Profitability RatioDocument3 pagesProfitability RatioThiba Sathivel0% (1)

- Year 2019 (RMM) 2018 (RMM) 2017 (RMM) 2016 (RMM) 2015 (RMM)Document1 pageYear 2019 (RMM) 2018 (RMM) 2017 (RMM) 2016 (RMM) 2015 (RMM)liyaNo ratings yet

- Andhra Petrochemicals LTD.: Profitability RatioDocument13 pagesAndhra Petrochemicals LTD.: Profitability RatioDäzzlîñg HärîshNo ratings yet

- Tugas Personal 1 FINC6193Document9 pagesTugas Personal 1 FINC6193alif syahputra11No ratings yet

- Fiscal Year Ending December 31 2020 2019 2018 2017 2016Document22 pagesFiscal Year Ending December 31 2020 2019 2018 2017 2016Wasif HossainNo ratings yet

- Case IDocument20 pagesCase ICherry KanjanapornsinNo ratings yet

- Appendix BDocument5 pagesAppendix Bowenish9903No ratings yet

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- Company Vs Industry-1Document3 pagesCompany Vs Industry-1Ajay SutharNo ratings yet

- Nestle Data AnalysisDocument4 pagesNestle Data AnalysisYashika AroraNo ratings yet

- Fauji Fertilizer Company Limited: Consolidated Balance SheetDocument5 pagesFauji Fertilizer Company Limited: Consolidated Balance Sheetnasir mehmoodNo ratings yet

- Alimentation Couche-Tard Ratio Analysis 2019-2016Document2 pagesAlimentation Couche-Tard Ratio Analysis 2019-2016/jncjdncjdnNo ratings yet

- Cost AccountingDocument6 pagesCost Accountingpak digitalNo ratings yet

- 1Document7 pages1Fikri SukmaNo ratings yet

- FA2 AssignmentDocument69 pagesFA2 AssignmentWilliam Lee j. jNo ratings yet

- IndusDocument5 pagesIndusFateen HabibNo ratings yet

- Financial Plan Template StartuptipsdailyDocument27 pagesFinancial Plan Template StartuptipsdailyPaul JeanNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Coca Cola Company Financial Ratios SummaryDocument66 pagesCoca Cola Company Financial Ratios SummaryZhichang ZhangNo ratings yet

- Mumbai Delhi Commercial Poster Paint Contribution AnalysisDocument4 pagesMumbai Delhi Commercial Poster Paint Contribution AnalysismadavahegdeNo ratings yet

- Joseph FMADocument119 pagesJoseph FMAJoseph ThamNo ratings yet

- Financial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisDocument16 pagesFinancial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisFranciscoNo ratings yet

- Tugas Individu MKDocument7 pagesTugas Individu MKferawaty hutabaratNo ratings yet

- Kuantan Flour Mills SolverDocument20 pagesKuantan Flour Mills SolverSharmila DeviNo ratings yet

- Chenab Limited Income Statement: Rupees in ThousandDocument14 pagesChenab Limited Income Statement: Rupees in ThousandAsad AliNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Exhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017Document1 pageExhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017AviralNo ratings yet

- Vietjet Aviation Joint Stock Company: Financial Statement AnalysisDocument4 pagesVietjet Aviation Joint Stock Company: Financial Statement AnalysisMinh ThưNo ratings yet

- Consolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Document4 pagesConsolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Ferial FerniawanNo ratings yet

- Tire RatiosDocument7 pagesTire Ratiospp pp100% (1)

- Goat Trading 5-Year Forecast Profit & LossDocument82 pagesGoat Trading 5-Year Forecast Profit & LossAiskrim N' KasehNo ratings yet

- Financial Statements ForecastingDocument16 pagesFinancial Statements ForecastingDeep AnjarlekarNo ratings yet

- (Shared) Day5 Harmonic Hearing Co. - 4271Document17 pages(Shared) Day5 Harmonic Hearing Co. - 4271DamTokyo0% (2)

- Millat Tractors - Final (Sheraz)Document20 pagesMillat Tractors - Final (Sheraz)Adeel SajidNo ratings yet

- Dalal Street Investment Journal PDFDocument26 pagesDalal Street Investment Journal PDFShailesh KhodkeNo ratings yet

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCMadhusudan PartaniNo ratings yet

- Xyz Company: Profit and Loss Account For The Year EndedDocument19 pagesXyz Company: Profit and Loss Account For The Year EndedYaswanth MaripiNo ratings yet

- FM - Project - Report - I - (AB02) - (274840) RevisionDocument21 pagesFM - Project - Report - I - (AB02) - (274840) Revisionmaulana anjasmaraNo ratings yet

- Income Statement Analysis and Projections 2005-2010Document5 pagesIncome Statement Analysis and Projections 2005-2010Gullible KhanNo ratings yet

- Vietjet Aviation Joint Stock Company: Financial Statement AnalysisDocument4 pagesVietjet Aviation Joint Stock Company: Financial Statement AnalysisMinh ThưNo ratings yet

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqNo ratings yet

- OrientDocument6 pagesOrientAda AdelineNo ratings yet

- Davao Oriental Travel Agency GuideDocument31 pagesDavao Oriental Travel Agency GuideJay ArNo ratings yet

- Abbott IbfDocument16 pagesAbbott IbfRutaba TahirNo ratings yet

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- Excel - 13132110014 - Draft Paper Individu - FNT 4A-1Document53 pagesExcel - 13132110014 - Draft Paper Individu - FNT 4A-1Ferian PhungkyNo ratings yet

- Investment Appraisal and Analysis Ide 2018Document4 pagesInvestment Appraisal and Analysis Ide 2018vincentNo ratings yet

- Ceres Gardening Company Submission TemplateDocument9 pagesCeres Gardening Company Submission TemplateAkshay RoyNo ratings yet

- LANKA CERAMICDocument34 pagesLANKA CERAMICSanduni JayasuriyaNo ratings yet

- Past Papers2Document46 pagesPast Papers2leylaNo ratings yet

- Excel Advanced Excel For Finance EXERCISEDocument91 pagesExcel Advanced Excel For Finance EXERCISEhaz002No ratings yet

- Case RibaDocument2 pagesCase RibaMUHAMMAD NOOR FIRDAUS / UPMNo ratings yet

- Class Discussion 2 - Interest Rate BondDocument2 pagesClass Discussion 2 - Interest Rate BondMUHAMMAD NOOR FIRDAUS / UPMNo ratings yet

- GRP AssignmentDocument1 pageGRP AssignmentMUHAMMAD NOOR FIRDAUS / UPMNo ratings yet

- Contoh Soalan Final FM COCDocument1 pageContoh Soalan Final FM COCMUHAMMAD NOOR FIRDAUS / UPMNo ratings yet

- CV - Tim SonmezDocument1 pageCV - Tim Sonmezapi-356802988No ratings yet

- Research Paper Allotment DEFDocument15 pagesResearch Paper Allotment DEFSanjana MouliNo ratings yet

- Thanos Industries Case StudyDocument48 pagesThanos Industries Case StudyWJ TanoNo ratings yet

- Chapter 02 National Differences in Political EconomyDocument38 pagesChapter 02 National Differences in Political EconomyNiladri RaianNo ratings yet

- 20211018-Chapter 4 - PPT MarxismDocument25 pages20211018-Chapter 4 - PPT Marxismuzair hyderNo ratings yet

- An Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevanceDocument2 pagesAn Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevancemikeNo ratings yet

- Summer Project On Chocolate Industry in Lotte India Corporation Ltd1Document51 pagesSummer Project On Chocolate Industry in Lotte India Corporation Ltd1jyotibhadra67% (3)

- Benchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationDocument14 pagesBenchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationJenny BascunaNo ratings yet

- Government Accounting ManualDocument9 pagesGovernment Accounting ManualGabriel PonceNo ratings yet

- Caltex V CBAA DigestDocument2 pagesCaltex V CBAA DigestNikki Estores GonzalesNo ratings yet

- Tracxn Startup Research Global SaaS India Landscape May 2016 1Document125 pagesTracxn Startup Research Global SaaS India Landscape May 2016 1Shikha GuptaNo ratings yet

- Lean Retailing at Tanishq BoutiquesDocument100 pagesLean Retailing at Tanishq BoutiquesAgraj BhartiyaNo ratings yet

- Qualitative ResearchDocument3 pagesQualitative ResearchEumy JL JeonNo ratings yet

- ASEAN - Economic Integration and Development of SMEsDocument6 pagesASEAN - Economic Integration and Development of SMEssreypichNo ratings yet

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- Prevention Appraisal Internal Failure External Failure: Iona CompanyDocument5 pagesPrevention Appraisal Internal Failure External Failure: Iona CompanyFrans KristianNo ratings yet

- GST Question Bank Nov 22Document750 pagesGST Question Bank Nov 22mercydavizNo ratings yet

- Company Profile 032019 (Autosaved)Document29 pagesCompany Profile 032019 (Autosaved)ePeople ManpowerNo ratings yet

- Cupcake Business PlanDocument13 pagesCupcake Business PlanCarl Wency Sarco Galenzoga67% (3)

- Majid Al Futtaim's Employment Conditions PolicyDocument6 pagesMajid Al Futtaim's Employment Conditions PolicyFilms PointNo ratings yet

- Unit 1: Entrepreneurship - RevisedDocument53 pagesUnit 1: Entrepreneurship - Revisedmms66No ratings yet

- Case Studies For Acc2Document2 pagesCase Studies For Acc2jtNo ratings yet

- D0683SP Ans5Document20 pagesD0683SP Ans5Tanmay SanchetiNo ratings yet

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksDocument23 pagesGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuNo ratings yet

- A Quick Guide To The Program DPro PDFDocument32 pagesA Quick Guide To The Program DPro PDFstouraNo ratings yet

- Practice Exam - QuestionsDocument5 pagesPractice Exam - QuestionsHoàng Võ Như QuỳnhNo ratings yet

- Advanced Financial MGMT Notes 1 To 30Document87 pagesAdvanced Financial MGMT Notes 1 To 30Sangeetha K SNo ratings yet

- Jwi 530 Assignment 4Document3 pagesJwi 530 Assignment 4gadisika0% (1)

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Furkhan Pasha - ResumeDocument3 pagesFurkhan Pasha - ResumeFurquan QuadriNo ratings yet