Professional Documents

Culture Documents

Ushr

Uploaded by

ISHFAQ AHMAD LONEOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ushr

Uploaded by

ISHFAQ AHMAD LONECopyright:

Available Formats

www.EthicaInstitute.

com

USHR

Ushr

What is ushr?

“It is He who produces gardens trellised, and untrellised, palm-trees, and crops diverse in produce,

olives, pomegranates, like each to each, and each unlike to each. Eat of their fruits when they

fructify, and pay the due thereof on the day of its harvest; and be not prodigal; God loves not the

prodigal”(6:141).

Ushr is the zakat equivalent for agricultural produce, charged at a rate of 5% or 10% depending on

the means of irrigation by which the crop is produced.

Who Pays Ushr

Who is obliged to pay ushr?

Ushr payment is obligatory on any landowner, lessee or tenant, adult or minor, sane or insane, who

receives monetary benefit, regardless of the agricultural output of the land or the nisab eligibility of

the individual.

Ushr Payment In Case Of Shared Land

What is the liability of the partners who jointly own an ushr-qualifying land?

If more than one individual owns, leases or rents ushr-qualifying land, each individual pays ushr

according to the proportion of monetary benefit received, regardless of the individual’s participation

in capital investment, costs and expenses. If one individual owns the land, while another individual

owns the produce from the land and all the resultant monetary benefit, then ushr is paid only by the

one owning the produce.

Ushr In Non-Muslim Lands

Am I liable to pay ushr for crops grown in non-Muslim lands?

Ushr is payable whether the crop is grown on Muslim lands or non-Muslim lands.

Islamic Finance Questions and Answers 611

www.EthicaInstitute.com

Rate Of Ushr

What rate is ushr charged at?

Ushr is payable at the rate of 10% of total output on agricultural produce irrigated naturally, whether

by rain or by natural bodies of water such as rivers, springs, streams, or the like. Ushr is payable at

the rate of 5% of total output on agricultural produce irrigated artificially, whether by canals, wells,

sprinkling, dams, motorization, or the like. When a single crop is irrigated by both artificial and

natural means, the predominant method relied upon, whether artificial or natural, determines the

rate of ushr of either 5% or 10% (or a weighted average).

Ushr On Non-Tradable Crops

Is ushr due on crop that is not meant for trade?

Ushr is due on all tradable crops but not on non-tradable crops used for one’s household

consumption, such as fruits and vegetables grown in one’s garden.

Kinds Of Crop Ushr Is Due On

What kinds of crop is ushr due on?

Ushr is payable on every kind of fruit, vegetable, grain, nut, and honey product.

Ushr On Waqf

Is ushr due on a waqf (endowment property)?

Ushr is payable on a waqf (endowment property).

Ushr On Crops Purchased For Trade

Is ushr due on crops purchased with the intent of reselling?

Ushr is not due on crops purchased with the intention of selling, in which case the zakat of tradable

goods is paid on them; rather ushr is paid on crops raised with the intention of harvesting.

Islamic Finance Questions and Answers 612

www.EthicaInstitute.com

Ushr On Minerals And Buried Treasure

Is ushr due on minerals, metals and hidden treasure?

Twenty percent of unearthed solid minerals and metals (e.g. gold, iron, etc.) and hidden treasure

belongs to the public treasury (bait-ul-mal) and the remainder with the property owner, and no ushr

payment is made.

Ushr On Precious Stones And Liquid Minerals And Metals

Is ushr due on precious stones and liquid minerals and metals?

All precious stones and liquid minerals and metals (e.g. oil, mercury, etc.) belong to the property

owner, and neither payment to the public treasury nor ushr payment is made.

Ushr On Destroyed Property

Is ushr due on destroyed property?

There is no ushr on property that is destroyed before or after assessment.

Stolen Property As Ushr

Is it permissible to give or take stolen property as ushr?

It is impermissible to give or take stolen property as ushr one is certain is stolen; if there is doubt

then it is permissible to give or take the ushr, though it is always superior to avoid the doubtful.

When Ushr Becomes Due

When does ushr become due?

Ushr is due at the time of harvest before any portion of the crop becomes usable, whether as food or

otherwise; ushr assessment is obligatory before any portion of the crop is used, and the crop owner

must account for any portion of the crop that is used before assessment.

Islamic Finance Questions and Answers 613

www.EthicaInstitute.com

When Ushr Is Paid

How often is ushr paid?

Unlike zakat which is paid annually, ushr is paid by harvest, only once, whether the harvest occurs

once a year or more than once a year, even if the produce remains stored with the owner for more

than a year.

Ushr On Unusable Crop

Who is liable to pay ushr for crop that is sold before it becomes usable?

For crop that is sold before it becomes usable, the onus of ushr payment rests on the buyer (i.e. new

owner) once the crop actually becomes usable, not on the seller (i.e. original owner).

Recipients Of Ushr

Who is eligible to receive ushr?

Ushr recipients are the same as zakat recipients; the eight categories of zakat recipients are: 1) the

poor; 2) those short of money; 3) zakat collectors; 4) those whose hearts are to be won over; 5) the

slave seeking ransom; 6) the indebted; 7) those fighting for the cause of Allah; and 8) the needy

traveler.

Ushr From Person With Unlawful Earnings

Is it permissible to accept ushr from a person whose earnings are unlawful?

The permissibility of taking ushr from a source whose earnings might be unlawful depends on the

extent to which the source’s wealth is unlawful and the degree of certainty to which the ushr

recipient determines the extent of this unlawfulness. The ushr recipient should determine the

unlawfulness of the source’s earnings according to that which is reasonably apparent; it is neither

recommended nor preferred to seek out information about the unlawfulness of a source’s earnings.

Ushr To Non-Muslims

Are non-Muslims entitled to receive ushr?

Islamic Finance Questions and Answers 614

www.EthicaInstitute.com

Non-Muslims may not receive ushr.

Ushr To Members Of Prophetic Household

May I pay ushr to members of the Prophet’s family?

Members of the Prophet’s Family (Allah bless them and give them peace) and their descendants may

not receive ushr, even as remuneration for collection, though they may collect and distribute ushr

without compensation.

Ushr To Recipients Who May Use It In Unlawful Ways

Is it permissible to give ushr to recipients who would use it in unlawful ways?

It is impermissible to give ushr to an eligible recipient when one is certain it will not be used

lawfully, and offensive if one doubts whether it will be used lawfully.

Ushr In Cash Or Kind

Is ushr paid in cash or in kind?

Ushr is payable in kind or in its cash equivalent.

Measuring Ushr-Chargeable Property

How is ushr-chargeable property measured?

Ushr is calculated from total agricultural output, not net of operational costs and expenses (i.e. labor

cost, seed cost, equipment depreciation, property tax, etc.).

Islamic Finance Questions and Answers 615

You might also like

- Zakat (Alms Tax) : Compiled By: Ms. Iffat KhalidDocument27 pagesZakat (Alms Tax) : Compiled By: Ms. Iffat Khalida_mohid17No ratings yet

- Ethica Zakat Q and A HandbookDocument42 pagesEthica Zakat Q and A HandbookAshurboki KurbonovNo ratings yet

- Sinai Palm Foundation: Frequently Asked QuestionsDocument2 pagesSinai Palm Foundation: Frequently Asked Questionsnuweiba7393No ratings yet

- Living TrustDocument7 pagesLiving TrustRocketLawyer100% (30)

- Living Trust TemplateDocument12 pagesLiving Trust TemplatecaseyscribdNo ratings yet

- Separating Terumot and Ma'asrot in Chutz LaAretzDocument4 pagesSeparating Terumot and Ma'asrot in Chutz LaAretzaaronshalom5899No ratings yet

- Hiba Under Muslim LawDocument7 pagesHiba Under Muslim LawManini JaiswalNo ratings yet

- Donation As A Mode of Acquiring Ownership: Art. 735 - 773 of The New Civil Code of The PhilippinesDocument46 pagesDonation As A Mode of Acquiring Ownership: Art. 735 - 773 of The New Civil Code of The Philippinesmoshi kpop cartNo ratings yet

- Common Rulings Related To ZakahDocument5 pagesCommon Rulings Related To ZakahmusarhadNo ratings yet

- Will For Grandparent With A Grandchildren's TrustDocument10 pagesWill For Grandparent With A Grandchildren's TrustRocketLawyer100% (1)

- Joint Living TrustDocument8 pagesJoint Living TrustRocketLawyer50% (2)

- Islamic Pawnshop FinalDocument14 pagesIslamic Pawnshop FinalSaadat ShaikhNo ratings yet

- "Acquired by Right of Redemption" - Whoever Had The Rights Gets The Property Redeemed. The Source of Money Is Not ImportantDocument2 pages"Acquired by Right of Redemption" - Whoever Had The Rights Gets The Property Redeemed. The Source of Money Is Not ImportantM A J esty FalconNo ratings yet

- HibaDocument5 pagesHibaShital ModiNo ratings yet

- Zakat and EconomyDocument16 pagesZakat and Economyzzgohar100% (1)

- Ctu 351Document19 pagesCtu 351afinaramziNo ratings yet

- Modes of Aquiring OwnershipDocument7 pagesModes of Aquiring OwnershipDanNo ratings yet

- WAQfDocument7 pagesWAQfAnam PatelNo ratings yet

- Digital Asset TrustDocument11 pagesDigital Asset TrustRocketLawyer100% (3)

- Islamic Law of Inheritance by Dr. Abdul Hai ArfiDocument80 pagesIslamic Law of Inheritance by Dr. Abdul Hai ArfiShahood Ahmed100% (1)

- JCJ Palakondawrkshp1 PDFDocument19 pagesJCJ Palakondawrkshp1 PDFSushil Jindal100% (1)

- Gift, HibbaDocument5 pagesGift, HibbaBhupendra SainiNo ratings yet

- Day Scholars Estate Claim Form Guide-EnDocument11 pagesDay Scholars Estate Claim Form Guide-EncharlenecsoaringeagleNo ratings yet

- What Is The Meaning of Waqf?Document5 pagesWhat Is The Meaning of Waqf?Adan HoodaNo ratings yet

- Estate DutyDocument17 pagesEstate Dutykelvin mkweshaNo ratings yet

- Family Law II - Unit IV Notes - WordDocument47 pagesFamily Law II - Unit IV Notes - Wordsyed Md Ibeahim AhmedNo ratings yet

- Failure of GiftsDocument6 pagesFailure of GiftsSyahirah ArifNo ratings yet

- Intestacy & TestacyDocument3 pagesIntestacy & TestacyMastura Asri0% (1)

- Ashu ZakatDocument3 pagesAshu ZakatMuhammad NABEEGHNo ratings yet

- Asset Protection for Business Owners and High-Income Earners: How to Protect What You Own from Lawsuits and CreditorsFrom EverandAsset Protection for Business Owners and High-Income Earners: How to Protect What You Own from Lawsuits and CreditorsNo ratings yet

- Ctu 351 (Uitm)Document18 pagesCtu 351 (Uitm)afinaramziNo ratings yet

- Deed of WakfDocument3 pagesDeed of WakfAdv Samarth KumarNo ratings yet

- Hiba Under Muslim LawDocument7 pagesHiba Under Muslim LawSourabh Yadav100% (3)

- Wills Trusts and Succession PlanningDocument26 pagesWills Trusts and Succession PlanningLawQuestNo ratings yet

- Faraid or Muslim Inheritance Law - SingaporeDocument10 pagesFaraid or Muslim Inheritance Law - Singaporekannan_kunaseeran4356No ratings yet

- Living TrustDocument3 pagesLiving TrustShevis Singleton Sr.100% (5)

- Succession - Main Reviewer 102-112Document11 pagesSuccession - Main Reviewer 102-112Meet MeatNo ratings yet

- WakfDocument2 pagesWakfPallavi UNo ratings yet

- HF PracticalGuideforCalculatingZakatDocument12 pagesHF PracticalGuideforCalculatingZakatWaqas AtharNo ratings yet

- Transfer Taxes: Modes of Acquiring OwnershipDocument31 pagesTransfer Taxes: Modes of Acquiring OwnershipMary Joy DenostaNo ratings yet

- Unit-5-Gift & WillDocument17 pagesUnit-5-Gift & WillShubhangi soniNo ratings yet

- Rule 96Document17 pagesRule 96Robelen CallantaNo ratings yet

- Riphah International University IslamabadDocument5 pagesRiphah International University IslamabadAnees Ur RehmanNo ratings yet

- A Practical Guide For Calculating ZakatDocument12 pagesA Practical Guide For Calculating ZakatAbdurrahman WijayaNo ratings yet

- The Inventor's Trust 98-XxxxxxxDocument7 pagesThe Inventor's Trust 98-XxxxxxxParnell DubNo ratings yet

- Trust DeedDocument8 pagesTrust Deedrathikaudhayan5No ratings yet

- By: Rashmi Dubey Faculty of LawDocument10 pagesBy: Rashmi Dubey Faculty of LawKevin JoyNo ratings yet

- Type of ZakatDocument7 pagesType of ZakatMuhd Zulhusni MusaNo ratings yet

- Restatement of TrustDocument19 pagesRestatement of TrustAlex CastroNo ratings yet

- About Ushar & Zakat 000000000000034 PDFDocument3 pagesAbout Ushar & Zakat 000000000000034 PDFsyed Muhammad farrukh bukhariNo ratings yet

- Sux LMT (JPL)Document6 pagesSux LMT (JPL)Jaya LapecirosNo ratings yet

- Test On AlimonyDocument6 pagesTest On AlimonyDeepanshu AgrawalNo ratings yet

- Mahr (Dower) : Submitted By: Meenakshi Sharma Malika LalitDocument14 pagesMahr (Dower) : Submitted By: Meenakshi Sharma Malika LalitMeenakshi SharmaNo ratings yet

- Possessor in Good FaithDocument2 pagesPossessor in Good Faithheribert abutarNo ratings yet

- Chapter 4 ZakatDocument5 pagesChapter 4 ZakatAlif HakimNo ratings yet

- ZakatDocument39 pagesZakatAmeer HamzaNo ratings yet

- Standard Living Trust FormDocument8 pagesStandard Living Trust FormMr D.0% (1)

- History of Inheritance Law: Everything You Need to KnowFrom EverandHistory of Inheritance Law: Everything You Need to KnowNo ratings yet

- The New American Homestead: Sustainable, Self-Sufficient Living in the Country or in the CityFrom EverandThe New American Homestead: Sustainable, Self-Sufficient Living in the Country or in the CityNo ratings yet

- Meaningoftraditionintroductionin WF2000 UuuDocument20 pagesMeaningoftraditionintroductionin WF2000 UuuISHFAQ AHMAD LONENo ratings yet

- Text Book An Introduction To Literary LaDocument6 pagesText Book An Introduction To Literary LaISHFAQ AHMAD LONENo ratings yet

- NNNNDocument4 pagesNNNNISHFAQ AHMAD LONENo ratings yet

- ContentsDocument1 pageContentsISHFAQ AHMAD LONENo ratings yet

- 430964Document37 pages430964ISHFAQ AHMAD LONENo ratings yet

- CV GmsheikhDocument5 pagesCV GmsheikhISHFAQ AHMAD LONENo ratings yet

- Literature ThemeDocument2 pagesLiterature ThemeISHFAQ AHMAD LONENo ratings yet

- Political Science-BADocument6 pagesPolitical Science-BAISHFAQ AHMAD LONENo ratings yet

- Hum'jinsi Insaniat Ki Kholi DushmanDocument3 pagesHum'jinsi Insaniat Ki Kholi Dushmanmaqsood hasniNo ratings yet

- Universitas Diponegoro Lembaga Penelitian Dan Pengabdian Kepada MasyarakatDocument6 pagesUniversitas Diponegoro Lembaga Penelitian Dan Pengabdian Kepada MasyarakatAbrilla Sidiq MNo ratings yet

- The Song - of Truth Satya GitaDocument279 pagesThe Song - of Truth Satya GitaAmiya Roy Choudhury DadajiNo ratings yet

- HSSCI Principles of CommerceDocument40 pagesHSSCI Principles of Commercehamidalikhanscorpion100% (1)

- Obedience To One's ParentsDocument12 pagesObedience To One's Parentsrayman100No ratings yet

- An Archaeology of Light in Classical Islam. Studying An Immaterial Phenomenon in Medieval MosquesDocument13 pagesAn Archaeology of Light in Classical Islam. Studying An Immaterial Phenomenon in Medieval MosquesMuhammad AfiqNo ratings yet

- FearDocument2 pagesFearapi-3835659No ratings yet

- Pembiayaan Qardul Hasan Di Bank Syariah Mandiri Kota MataramDocument5 pagesPembiayaan Qardul Hasan Di Bank Syariah Mandiri Kota MataramAsrho Nadziroh AzzimahNo ratings yet

- YasiinDocument5 pagesYasiinchyykkaNo ratings yet

- Dozakhnama - Conversations in Hell Between Ghalib and Manto by Rabisankar Bal Arunava Sinha TranslatorDocument291 pagesDozakhnama - Conversations in Hell Between Ghalib and Manto by Rabisankar Bal Arunava Sinha Translatorzain67% (9)

- Read Text 2 To Answer Questions 3 To 5.: CongratulationsDocument2 pagesRead Text 2 To Answer Questions 3 To 5.: CongratulationsTien Wahyu Dwi AmaliaNo ratings yet

- Daftar Peserta Didik TK Pertiwi Ii Sukoharjo: No. Nama JK Tempat Lahir Tanggal LahirDocument2 pagesDaftar Peserta Didik TK Pertiwi Ii Sukoharjo: No. Nama JK Tempat Lahir Tanggal LahirAtik Dwi YulistinaNo ratings yet

- European History, 31 BC-AD 900: Historical Tripos Part I, Paper 13Document32 pagesEuropean History, 31 BC-AD 900: Historical Tripos Part I, Paper 13Kroner DebilaNo ratings yet

- KeputusanDocument19 pagesKeputusanMohd JoekairiNo ratings yet

- The Traditional Mediterranean: Essays From The Ancient To The Early Modern EraDocument2 pagesThe Traditional Mediterranean: Essays From The Ancient To The Early Modern EraGlen CooperNo ratings yet

- The Conflict of KargilDocument16 pagesThe Conflict of KargilEusaf YaqubNo ratings yet

- Al-Fath Ar-Rabbani (22nd Discourse) - Abdul Qadir Al-JilaniDocument1 pageAl-Fath Ar-Rabbani (22nd Discourse) - Abdul Qadir Al-JilaniAdam Bin Bob100% (1)

- Tadabbur-050 Surah QafDocument43 pagesTadabbur-050 Surah QafMonty AlfiantoNo ratings yet

- Gandhi Vs TRUTHDocument18 pagesGandhi Vs TRUTHapi-19602721100% (1)

- History of SabahDocument50 pagesHistory of SabahJoy TagleNo ratings yet

- Headcount SPM 2022Document18 pagesHeadcount SPM 2022adamNo ratings yet

- Schedule/ Agenda: Opening CeremonyDocument4 pagesSchedule/ Agenda: Opening Ceremonykhizar ahmadNo ratings yet

- Makalah Filsafat Hukum Islam, An Fiqh Dan Sufi, The Tension Between Fiqh N SufismeDocument2 pagesMakalah Filsafat Hukum Islam, An Fiqh Dan Sufi, The Tension Between Fiqh N Sufismemusafir1412No ratings yet

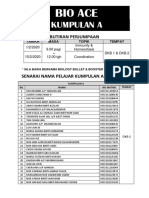

- Bio Ace Sem 2 1920 - Edaran Pelajar PDFDocument25 pagesBio Ace Sem 2 1920 - Edaran Pelajar PDFAzra JulianaNo ratings yet

- Domestication of Camels - Task SheetDocument3 pagesDomestication of Camels - Task SheetHome Of EverythingNo ratings yet

- Landscape ReportDocument17 pagesLandscape ReportReem M FarghaliNo ratings yet

- BritishConquest HyderabadCarnaticAwadhBengalMysoreDocument24 pagesBritishConquest HyderabadCarnaticAwadhBengalMysoreRahulNaroliyaRajputNo ratings yet

- Idrus - Cerpen - Jalan Lain Ke Roma - EnglishDocument15 pagesIdrus - Cerpen - Jalan Lain Ke Roma - EnglishMelodia MetaforaNo ratings yet

- Projects Assessments For Welding ProcessDocument2 pagesProjects Assessments For Welding ProcessKamarul NizamNo ratings yet

- Total Delivery 16-31 Juli - NGG05Document208 pagesTotal Delivery 16-31 Juli - NGG05arilamunesNo ratings yet