Professional Documents

Culture Documents

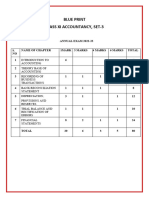

CBSE Class 11 Accountancy Sample Paper Set A Solved

Uploaded by

Kartik DhilwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBSE Class 11 Accountancy Sample Paper Set A Solved

Uploaded by

Kartik DhilwalCopyright:

Available Formats

Downloaded from https://www.dkgoelsolutions.

com

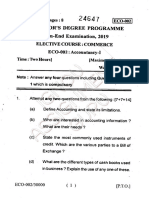

ACCOUNTANCY – Std. 11 M. Marks : 90

Time : 3 hrs.

Total printed pages : 03

Total printed questions : 24

Roll N

General instructions:

i) All questions are compulsory.

ii) Marks for questions are indicated against each.

iii) Short Answers should be brief and to the point.

iv) Attempt all parts of a particular question at one place.

FINANCIAL ACCOUNTING

m

1. Define Accountancy. (1)

co

2. What is meant by current assets? (1)

s.

3. List out any two disadvantages of accrual basis of accounting. (1)

n

4. What is meant by owner’s equity? io (1)

ut

5. Why Suspense Account is prepared? (1)

ol

ls

6. What are compensating errors? (1)

oe

7. Distinguish between double entry system and incomplete records. (3)

kg

8. Explain the following terms:

a) Legacy b) Honorarium c) Endowment Fund (3)

.d

w

9. Distinguish between customized softwares and tailor made softwares. (3)

w

10. Going concern concept underlines the assumption that the enterprise has neither any

w

intention nor any necessity to close the business. The chances to cease to operate the

//

business are too remote. Identify any three values involves in this assumption of going

s:

concern. (3)

tp

11. Explain the following assumptions with its values:

ht

a) Accrual Assumption b) Consistency Assumption. (3)

12. How much amount will be shown in Income and Expenditure Account in the following case?

Amount paid for Stationery purchased during 2007-08 34,000

Creditors for Stationery on 1-4-2007 3,000

Creditors for Stationery on 31-3-2008 4,200

Stock of Stationery on 1-4-2007 2,500

Stock of Stationery on 31-3-2008 2,800 (3)

13. In 2015, the subscriptions received by King Club of Delhi were Rs. 40,900 including

Rs. 500 for 2014 and Rs 1,000 for 2016. At the end of 2015, subscriptions outstanding

were Rs. 1,500. The subscriptions due but not received at the end of the previous year,

i.e., 31st December, 2014 were Rs. 800, while subscriptions received in advance on the

same due date were Rs. 1,800. Calculate the amount of subscriptions to be credited to the

Income and Expenditure Account for the year ended 31st December, 2015. (4)

Downloaded from https://www.dkgoelsolutions.com

Downloaded from https://www.dkgoelsolutions.com

14. Prepare a Bank Reconciliation Statement from the following particulars on 31st March 2014.

Bank statement showed a favorable balance of Rs. 12,400.

i) Cheque amounting to Rs. 45,000 was drawn on 27th March 2014 of which cheques of

Rs. 33,000 were encashed on 2nd April 2014.

ii) Cheques issued returned on technical grounds Rs. 4,000.

iii) Bank recorded a cash deposit of Rs. 3,210 as Rs. 3,120.

iv) Bill for collection not advised by the bank but credited to our account Rs. 8,000. (4)

15. Enter the following transactions in a cash book with cash and bank columns.

2016 Jan 1 Bank overdraft Rs. 2,000 Cash in hand Rs. 2,300.

7 Cheque received from S. Arjun Rs. 4,000 and allowed him discount

Rs. 200 and deposited with bank.

m

12 Cheque paid to Radha Rs. 2,500 and discount received Rs. 50.

co

15 Withdrawn from bank for domestic use Rs. 750.

s.

20 Money withdrawn for office use Rs. 800.

n

25 Cheque received from Sunderaj of Rs. 4,500.

31 io

Paid in to bank the entire balance after remaining Rs. 500. (4)

ut

16. What is meant by AIS? Explain briefly any three main components of AIS. (4)

ol

17. Rectify the following errors:

ls

a) Goods of the value of Rs. 2,000 returned by Mr. Gupta were entered in the sales

oe

day book and posted there from to the credit of his account.

kg

b) Rs. 3,000 received from a customer as an advance against order was credited

to Sales A/c.

.d

c) Payment of Rs. 500 to Mohan and Rs. 600 to Sohan was made but Mohan was

w

debited with Rs. 600 and Sohan with Rs. 500.

w

d) Sales to Nikita Rs. 500 were posted to Pritika’s Account. (4)

w

18. Give journal entries for the following adjustments in final accounts:1

//

s:

i) Closing stock at market price as on 31st March 2014 Rs. 18,000, however,

tp

its cost was Rs. 16,500.

ii) Outstanding wages Rs. 22,000.

ht

iii) Insurance premium amounted to Rs. 6,250 is paid in advance.

iv) Rent received includes Rs. 6,000 pertaining to the next year.

v) Interest accrued but not received during the accounting year Rs. 2,800.

vi) Goods values at Rs. 2,800 destroyed by fire and the insurance company admitted

a claim for Rs. 1300. (6)

19. Mr. Manu started business with a capital of Rs. 4,00,000 on 1st October 2015. He borrowed

from his friend a sum of Rs. 1,00,000 @10% per annum(interest paid) for business and

bought a further amount of Rs. 75,000 as capital. On 31st March 2016 his position was:

Cash Rs. 30,000; Stock Rs. 4,70,000; Debtors Rs. 3,50,000; Creditors Rs. 3,00,000. He

withdrew Rs. 8,000 per month during this period. Prepare Closing Statement of Affairs

and Statement of profit or loss. (6)

Downloaded from https://www.dkgoelsolutions.com

Downloaded from https://www.dkgoelsolutions.com

20. A company had brought machinery for Rs. 2,00,000 including a boiler worth Rs. 20,000.

The machinery account had been credited for Depreciation on the Reducing Installment

System for the past four years @ of 10%. During the fifth year that is the present year,

the boiler became useless on account of damage to some of its vital parts and the damaged

boiler is sold for Rs. 4,000. Write up the Machinery Account. (6)

21. Prepare Accounting equation from the following:

i)Commenced business with cash Rs. 20,000, goods Rs. 50,000 and furniture Rs. 30,000.

ii)Purchased goods from Rajiv on credit Rs. 1,00,000.

iii)Sold goods for cash Rs. 40,000 (costing Rs. 30,000).Goods costing Rs. 20,000 sold at a

loss of 5%, out of which Rs. 12,000 received in cash.

iv) Accrued interest Rs. 5,000.

m

vi)Purchased typewriter for personal use of the proprietor Rs. 20,000. (6)

co

22. M/s Joseph & Sons who are dealers in furniture purchased the following:

s.

2015 Jan 1 Purchased from Vishwaroop Furnitures , Mumbai:-

n

120 chairs @ Rs. 200 per piece.

io

20 tables @ Rs. 800 per piece. Less: 10% Trade Discount

ut

Jan 3 Purchased from Balaji house Chennai:

ol

2 typewriters @ Rs. 2500 per piece.

ls

Jan 5 Purchased from Saini Furnitures, New Delhi for cash:

oe

5 almirahs @ Rs. 3,000 per piece.

Jan 7 Purchased from Sangeeta & Sons, Mathura:

kg

20 sofa sets@ Rs. 4000 per piece

.d

25 steel cabinets @ Rs. 500 per piece.

w

Prepare Purchase book. (6)

w

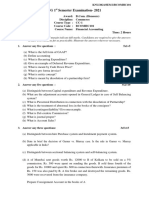

23. a) From the following balances of the year ended 31st December, 2015 and additional

w

information, prepare the Trading and Profit and Loss Account and the Balance Sheet of M/s

//

Joseph and Sons:

s:

Additional Information:

tp

a) Closing stock was valued at Rs. 20,000.

ht

b) Provide Straight line depreciation on buildings @ 5% and on furniture @ 10%.

c) Outstanding salaries Rs. 1,000.

d) Further bad debts Rs. 100.

e) Make provision for bad debts @ 3%.

f) Make a provision for discount on debtors and creditors @ 2%.

Capital Rs. 80,000 Rent Rs. 5,100

Purchases Rs. 82,000 Insurance Rs. 600

Sales Rs. 1,10,000 Salaries Rs. 12,500

Returns Outward Rs. 1,000 Ba9d Debt Rs. 200

Building Rs. 45,000 Carriage on purchase Rs. 200

Opening stock Rs. 15,000 Commission (cr.) Rs. 1,500

Debtors Rs. 20,100 Cash in hand Rs. 5,000

Creditors Rs. 18,000 Cash at bank Rs. 25,000

Furniture Rs. 7,000 Sales Tax paid Rs. 5,000

Wages Rs. 1,800 Sales Tax Collected Rs. 3,500

Downloaded from https://www.dkgoelsolutions.com

Downloaded from https://www.dkgoelsolutions.com

(OR)

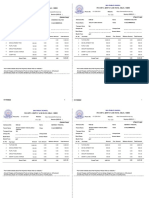

b) From the following Receipts and payments Accounts of the Indian Club for the year ended

31st December 2015 and subjoined information prepare an Income and Expenditure Account

for the year ended 31st December 2015 and the Balance Sheet on that date.

Receipts Amount (Rs.) Payment Amount (Rs.)

To balance b/d 25,000 By salaries 12,000

To subscription for : Be entertainment expenses 6,500

2014 2,000 By general expenses 3,000

m

2015 45,000 By rates and taxes 1,500

co

2016 2,000 49,000 By investments 36,000

To donations (General) 13,000 By stationary and printing 2,600

s.

To entertainment expenses 10,200 By 5% Fixed Deposit

n

(31.12.2015) 5,000

io

By balance c/d 30,600

ut

Total 97,200 Total 97,200

ol

ls

Capital fund on 31st December 2014 was Rs. 2,39,000. The club has 500 members paying an

oe

annual subscription of Rs. 100 each. Rs. 500 is still in arrears for subscription for 2014.

kg

Donations received include a sum of Rs. 2,000 in respect of 2016. Carry forward Rs. 300 for

rates paid in advance. Provide Rs. 2,000 for salaries outstanding. The club has land and

.d

building in the books at Rs. 2,00,000 and furniture standing at Rs. 12,000 on which

w

depreciation at 2% and 10% respectively is to be written off. Interest for 3 months

w

at 3% p.a. has accrued on investments. (8)

w

24. a) A book keeper prepared a trial balance on 31st March 2015 which showed a difference

//

s:

of Rs. 3715. The difference was placed to the suspense account. The under mentioned

tp

errors were subsequently discovered:-

i) Rs. 710, the total of Sales Return book has been posted to the credit of the

ht

Purchase Return Account.

ii) A Bills Receivable for Rs. 500 received from Gopal was passed through Bills

Payable Book. However, the personal account was correctly credited.

iii) An item of Rs. 626 was written off as a bad debt from Chadrakant has not

been debited to Bad Debts Account.

iv) Goods sold to X and Y for Rs. 1,600 and Rs. 1,200 respectively, but were recorded

in the Sales Book as to X Rs. 1,200 and Y as Rs. 1,600.

v) Goods of Rs. 580 were returned to Bharadwaj. It was recorded in Purchase Book

as Rs. 580.

vi) An amount of Rs. 675 for a credit sale to Govind, although correctly entered in the

Sales Book, has been wrongly posted as Rs. 756.

vii) A sum of Rs. 375 owed by Ravi has been included in the list of Sundry Creditors.

vii) An amount of Rs. 750 spent on the repairs of old machinery has been debited to

Repairs Account.

Pass Journal entries to rectify the errors and prepare Suspense Account. (8)

Downloaded from https://www.dkgoelsolutions.com

Downloaded from https://www.dkgoelsolutions.com

(OR)

st

b) On 1 Jan 2014 Raju sold goods to Manav for Rs. 37,500. Raju had drawn three bills of

exchange for Rs. 10,000, Rs. 12,500 and Rs. 15,000 respectively. These bills were drawn

for one month, two month and three month respectively. Manav accepted these bills and

returned to Raju.

On 4th Jan 2014, Raju endorsed the first bill to Shanu in full settlement of his account of

Rs. 10,300. This bill was met on maturity.

On 1st Feb 2014 the second bill was discounted from the bank for Rs. 12,125. On the due

date the bill was dishonored and the bank had to pay Rs. 100 as noting charges. Manav

requested Raju to draw another bill (fourth bill) on Manav for the amount due including

interest of Rs. 500 for an extended period of two months.

m

Now the third bill was paid by Manav before one month of maturity under a rebate of 15%

co

per annum. The fourth bill was sent to bank for collection on 3rd May 2014, this bill was

met on maturity.

s.

You are requested to pass journal entries in the books of Raju. (8)

n

io

-x-x-x-x-x-x-

ut

ol

ls

oe

kg

.d

w

w

// w

s:

tp

ht

Downloaded from https://www.dkgoelsolutions.com

You might also like

- Q2 Entrepreneurship - Module 1.2 - Supply Chain RecruitmentDocument14 pagesQ2 Entrepreneurship - Module 1.2 - Supply Chain Recruitmentjames coloquit69% (16)

- Corporate and Business Strategy Toolkit - Overview and ApproachDocument37 pagesCorporate and Business Strategy Toolkit - Overview and Approachazul1386% (7)

- 12th Book Keeping Board Papers PDFDocument50 pages12th Book Keeping Board Papers PDFRam IyerNo ratings yet

- Mobileye - The Future of Driverless CarsDocument3 pagesMobileye - The Future of Driverless CarsMonica PandeyNo ratings yet

- CRIM2 43. Abalos-vs-People-of-the-PhilippinesDocument2 pagesCRIM2 43. Abalos-vs-People-of-the-PhilippinesKirstie Lou Sales100% (1)

- Developing A Google SRE CultureDocument25 pagesDeveloping A Google SRE Cultureyazid yazidcodersNo ratings yet

- Mother of Perpetual Help School, Inc.: Quarter 1 - Module 1/ Week 1-2Document14 pagesMother of Perpetual Help School, Inc.: Quarter 1 - Module 1/ Week 1-2Lunilyn Ortega100% (1)

- WhatsApp Payment Kumar Simplilearn CBAP PROJECT PDFDocument18 pagesWhatsApp Payment Kumar Simplilearn CBAP PROJECT PDFPriyanka Shrivastava100% (1)

- Practice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsDocument4 pagesPractice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsSNPS BhadraNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Mock Paper - 2017-18 Class-Xi: General InstructionsDocument6 pagesMock Paper - 2017-18 Class-Xi: General InstructionsMukul YadavNo ratings yet

- 2015 Accountancy Question PaperDocument4 pages2015 Accountancy Question PaperJoginder SinghNo ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoDocument4 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoAbhishek ChaubeyNo ratings yet

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- AccountancyDocument8 pagesAccountancyAnkit KumarNo ratings yet

- Show Your Working Clearly.: AccountancyDocument8 pagesShow Your Working Clearly.: AccountancyYash SardaNo ratings yet

- BlueprintDocument6 pagesBlueprintYash GuptaNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- 11th AccountDocument6 pages11th Accountumesh chandraNo ratings yet

- Accounts 11th Class Sample PaperDocument8 pagesAccounts 11th Class Sample PaperVineet SinghNo ratings yet

- HSC Commerce 2015 March BK PDFDocument5 pagesHSC Commerce 2015 March BK PDFShaiviNo ratings yet

- Eco-2 EngDocument4 pagesEco-2 EngAmit AdhikariNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- XI Accountancy T-IIDocument5 pagesXI Accountancy T-IIBaluNo ratings yet

- Acc Mba Int - 1 Dec 2022Document3 pagesAcc Mba Int - 1 Dec 2022Hema LathaNo ratings yet

- 25 Question PaperDocument4 pages25 Question PaperPacific Tiger0% (1)

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- Accountancy Sample Paper Class 11 PDFDocument6 pagesAccountancy Sample Paper Class 11 PDFAnkit JhaNo ratings yet

- Bba 208Document3 pagesBba 208armaanNo ratings yet

- Financial Accounts Questoin Paper UNOM 2017Document6 pagesFinancial Accounts Questoin Paper UNOM 2017lucy artemisNo ratings yet

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Document15 pages13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNo ratings yet

- Eco 02Document6 pagesEco 02rykaNo ratings yet

- Accountancy: General InstructionsDocument5 pagesAccountancy: General InstructionsSwami NarangNo ratings yet

- B 71, E.F Un!s Mwxin Marks A11.nver Any Five Questions Includihg Question No D1/Jerent Parts of A Question Must Be Answered in The Same Place.)Document4 pagesB 71, E.F Un!s Mwxin Marks A11.nver Any Five Questions Includihg Question No D1/Jerent Parts of A Question Must Be Answered in The Same Place.)Md Sajib KaisarNo ratings yet

- BA7106-Accounting For Management Question Bank - Edited PDFDocument10 pagesBA7106-Accounting For Management Question Bank - Edited PDFDhivyabharathiNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityRenieNo ratings yet

- Accountancy Master Test 4 PDFDocument5 pagesAccountancy Master Test 4 PDFRaghav PrajapatiNo ratings yet

- EconomicsDocument2 pagesEconomicskaransidhu8544No ratings yet

- Ev 2Document9 pagesEv 2minita sharmaNo ratings yet

- AFS 93th JAIBBDocument4 pagesAFS 93th JAIBBAtabur RahmanNo ratings yet

- May 2012Document17 pagesMay 2012Cayden FavaNo ratings yet

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDocument4 pagesशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- 202AF13A Financial AccountingDocument14 pages202AF13A Financial AccountingkalpanaNo ratings yet

- Financial Accounting: Roll No.........................Document7 pagesFinancial Accounting: Roll No.........................bangoangoNo ratings yet

- RAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteDocument5 pagesRAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteRishikesh KalantriNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Set 1 QuestionsDocument6 pagesCbse Class 11 Accountancy Sample Paper Set 1 QuestionsNishtha 3153No ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Smt. K.K. Dholakiya School - Rajkot: STD 11 Commerce AccountDocument3 pagesSmt. K.K. Dholakiya School - Rajkot: STD 11 Commerce AccountStudentBroNo ratings yet

- Class Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsDocument22 pagesClass Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsjashanjeetNo ratings yet

- 4.dissolution of Partnership FirmDocument11 pages4.dissolution of Partnership Firmtripatjotkaur757No ratings yet

- Class Xi Accountancy PT 1 2017Document2 pagesClass Xi Accountancy PT 1 2017Arunava DuttaNo ratings yet

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- Accounting: Required: Prepare Journal Entries To Record The Above TransactionsDocument3 pagesAccounting: Required: Prepare Journal Entries To Record The Above TransactionsMahediNo ratings yet

- Credit Risk Assessment 1 - May 2015Document6 pagesCredit Risk Assessment 1 - May 2015Basilio MaliwangaNo ratings yet

- Acc Xi See QP With BP, MS-31-43Document13 pagesAcc Xi See QP With BP, MS-31-43Sanjay PanickerNo ratings yet

- ACC XI SEE QP For RevisionDocument31 pagesACC XI SEE QP For Revisionvarshitha reddyNo ratings yet

- ECO-14 - ENG - CompressedDocument4 pagesECO-14 - ENG - CompressedYzNo ratings yet

- Acc Xi See QP With BP, Ms-31-43Document13 pagesAcc Xi See QP With BP, Ms-31-43AmiraNo ratings yet

- 250 Question PaperDocument3 pages250 Question PaperSam NayakNo ratings yet

- Nulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Document2 pagesNulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Shyamal dasNo ratings yet

- CBSE Grade 11 Accounts Practice Paper 234521Document8 pagesCBSE Grade 11 Accounts Practice Paper 234521The DealerNo ratings yet

- BM102TDocument25 pagesBM102TMariamma KuriakoseNo ratings yet

- Product HierarchyDocument5 pagesProduct HierarchyKartik DhilwalNo ratings yet

- 7 Nov 22Document1 page7 Nov 22Kartik DhilwalNo ratings yet

- Fee Bill Fee Bill: Dav Public School, Dav Public SchoolDocument33 pagesFee Bill Fee Bill: Dav Public School, Dav Public SchoolKartik DhilwalNo ratings yet

- New-Product Development and Life-Cycle StrategiesDocument22 pagesNew-Product Development and Life-Cycle Strategiesashfaqmemon2001No ratings yet

- Affiliate Marketing - Unit 1 1Document64 pagesAffiliate Marketing - Unit 1 1Kartik DhilwalNo ratings yet

- Bhavnath Temple: Case AnalysisDocument2 pagesBhavnath Temple: Case Analysismanvi singhNo ratings yet

- New Zealand Port Company Stems Tide of Overdue IT Tickets: Making The Case For QualityDocument5 pagesNew Zealand Port Company Stems Tide of Overdue IT Tickets: Making The Case For QualityManoj Pai DNo ratings yet

- Raj Rishi Bhartrihari Matsya University, Alwar: Affiliation Form For Additional Subjects/Increased SeatsDocument3 pagesRaj Rishi Bhartrihari Matsya University, Alwar: Affiliation Form For Additional Subjects/Increased SeatsDeepak KumarNo ratings yet

- Maintenance and Warranty Processing (274) : S/4HANA 1610 2017Document24 pagesMaintenance and Warranty Processing (274) : S/4HANA 1610 2017Secret EarthNo ratings yet

- Factors Affecting Bank's PerformanceDocument8 pagesFactors Affecting Bank's Performanceswarnim singhNo ratings yet

- Achieving Superior QualityDocument2 pagesAchieving Superior QualityPradeep ChintuNo ratings yet

- 15th Recitation 1380-1402Document161 pages15th Recitation 1380-1402Sumpt LatogNo ratings yet

- Chapter 3 Case Part 2Document3 pagesChapter 3 Case Part 2graceNo ratings yet

- PROPOSAL OF RM SabinaDocument22 pagesPROPOSAL OF RM SabinaSushma chhetriNo ratings yet

- SCM Group D Ca 1Document32 pagesSCM Group D Ca 1shubo palitNo ratings yet

- Ent300 Assignment 3 Business Plan General Guidelines 2021Document18 pagesEnt300 Assignment 3 Business Plan General Guidelines 2021anisNo ratings yet

- Smartly Guide To Gen AI For Digital Advertising ExcellenceDocument16 pagesSmartly Guide To Gen AI For Digital Advertising ExcellenceDivyansh ApurvaNo ratings yet

- PEXQ1277 Virtual - Cat - RemanU-Flier - DPC (Cat Dealer)Document1 pagePEXQ1277 Virtual - Cat - RemanU-Flier - DPC (Cat Dealer)Limosh BsNo ratings yet

- Leac202 DebenturesDocument75 pagesLeac202 DebenturesMidhunidharNo ratings yet

- Prajwalit Dalai Dessertation 2022Document81 pagesPrajwalit Dalai Dessertation 2022Praj Walit DalaiNo ratings yet

- ACCOUNTINGDocument12 pagesACCOUNTINGharoonadnan196No ratings yet

- Chapter 8 - Bank ReconciliationDocument6 pagesChapter 8 - Bank ReconciliationAdan EveNo ratings yet

- Office 2013 Pro Plus Volume License MAK KeyDocument3 pagesOffice 2013 Pro Plus Volume License MAK KeyFiftys Sabz KedewaNo ratings yet

- Case Analysis: A Simple Strategy at Costco: Informative Background InformationDocument15 pagesCase Analysis: A Simple Strategy at Costco: Informative Background InformationFred Nazareno CerezoNo ratings yet

- Dunkin' Donuts: The History of The Phenomenal BrandDocument9 pagesDunkin' Donuts: The History of The Phenomenal BrandMacMac DañasNo ratings yet

- Trariti Consulitng Group Turnaround Case 1Document4 pagesTrariti Consulitng Group Turnaround Case 1Vansh AggarwalNo ratings yet

- Accounting in Mesopotamia, Circa 3500 B.C.Document6 pagesAccounting in Mesopotamia, Circa 3500 B.C.AMAURYNo ratings yet

- BusplanDocument38 pagesBusplanCrissa MorescaNo ratings yet