Professional Documents

Culture Documents

Goods Which Are GST Exempt

Uploaded by

Saksham Shrivastava0 ratings0% found this document useful (0 votes)

6 views3 pagesGST PDF

Original Title

goods which are GST exempt

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGST PDF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesGoods Which Are GST Exempt

Uploaded by

Saksham ShrivastavaGST PDF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

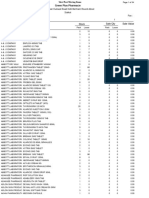

Here is a list of some of the most common goods which are GST exempt –

Types of goods Examples

Live animals Asses, cows, sheep, goat, poultry, etc.

Fish Fresh or frozen fish

Natural products Honey, fresh and pasteurized milk, cheese, eggs, etc.

Live trees and plants Bulbs, roots, flowers, foliage, etc.

Vegetables Tomatoes, potatoes, onions, etc.

Fruits Bananas, grapes, apples, etc.

Dry fruits Cashew nuts, walnuts, etc.

Tea, coffee and spices Coffee beans, tea leaves, turmeric, ginger, etc.

Grains Wheat, rice, oats, barley, etc.

Products of the milling industry Flours of different types

Seeds Flower seeds, oil seeds, cereal husks, etc.

Sugar Sugar, jaggery, etc.

Water Mineral water, tender coconut water, etc.

Baked goods Bread, pizza base, puffed rice, etc.

Fossil fuels Electrical energy

Drugs and pharmaceuticals Human blood, contraceptives, etc.

Fertilizers Goods and organic manure

Beauty products Bindi, kajal, kumkum, etc.

Waste Sewage sludge, municipal waste, etc.

Ornaments Plastic and glass bangles bangles, etc.

Newsprint Judicial stamp paper, envelopes, rupee notes, etc.

Printed items Printed books, newspapers, maps, etc.

Fabrics Raw silk, silkworm cocoon, khadi, etc.

Hand tools Spade, hammer, etc.

Pottery Earthen pots, clay lamps, etc.

GST Exemption on services:-

Types of Examples

services

Agricultural Cultivation, supplying farm labour, harvesting, warehouse related

services activities, renting or leading agricultural machinery, services provided by

a commission agent or the Agricultural Produce Marketing Committee or

Board for buying or selling agriculture produce, etc.

Government Postal service, transportation of people or goods, services by a foreign

services diplomat in India, services offered by the Reserve Bank of India, services

offered to diplomats, etc.

Transportation Transportation of goods by road, rail, water, etc., payment of toll,

services transportation of passengers by air, transportation of goods where the

cost of transport is less than INR 1500, etc.

Judicial services Services offered by arbitral tribunal, partnership firm of advocates, senior

advocates to an individual or business entity whose aggregate turnover is

up to INR 40 lakhs

Educational Transportation of faculty or students, mid-day meal scheme, examination

services services, services offered by IIMs, etc.

Medical Services offered by ambulance, charities, veterinary doctors, medical

services professionals, etc.

Organizational Services offered by exhibition organisers for international business

services exhibitions, tour operators for foreign tourists, etc.

Other services Services offered by GSTN to the Central or State Government or Union

Territories, admission fee payable to theatres, circuses, sports events,

etc. which charge a fee up to INR 250

You might also like

- Monthly Spending TrackerDocument4 pagesMonthly Spending Trackermckm123No ratings yet

- 2022379372589POSRetailers7 3 22Document260 pages2022379372589POSRetailers7 3 22Shoaib Shahid Elahi100% (1)

- Honey Value Chain in TanzaniaDocument101 pagesHoney Value Chain in TanzaniaSwahili Honey100% (1)

- Generalized Packing ListDocument2 pagesGeneralized Packing ListaomegadetroitNo ratings yet

- Plant Production and MethodDocument58 pagesPlant Production and Methodlea lynn sto. tomasNo ratings yet

- Baramati Agri TourismDocument6 pagesBaramati Agri TourismPandurang Taware89% (9)

- Instru Manual English - CodesDocument32 pagesInstru Manual English - Codeslalapo1100No ratings yet

- Custom TariffDocument97 pagesCustom Tariffsmshashmi110% (1)

- VAT Excempted Goods and ServicesDocument3 pagesVAT Excempted Goods and ServicesAda DeranaNo ratings yet

- Alternative Crops and Enterprises For Small Farm DiversificationDocument14 pagesAlternative Crops and Enterprises For Small Farm Diversificationjmarco51No ratings yet

- Chapter 2 Concept of AgricultureDocument79 pagesChapter 2 Concept of AgricultureMerrylyn Traje Pilar100% (1)

- Composting GuideDocument5 pagesComposting Guidej scriNo ratings yet

- Get Your Pitchfork On!: The Real Dirt on Country LivingFrom EverandGet Your Pitchfork On!: The Real Dirt on Country LivingRating: 3.5 out of 5 stars3.5/5 (3)

- Products and Services in e Retail in IndiaDocument5 pagesProducts and Services in e Retail in Indiadone manNo ratings yet

- Exempted Goods in GST Exemption ListDocument3 pagesExempted Goods in GST Exemption Listgplanetagra02No ratings yet

- FSN111Document69 pagesFSN111Lavan GaddamNo ratings yet

- NTFP22Document88 pagesNTFP22Aatmika RaiNo ratings yet

- List of College MajorsDocument1 pageList of College Majorsomar.ahmed1806No ratings yet

- Dav College Anurag 5th SemDocument14 pagesDav College Anurag 5th Semanuragyadav1611No ratings yet

- Flipkart CategoriesDocument15 pagesFlipkart Categoriesramanjaneya reddyNo ratings yet

- Introduction To Agricultural ScienceDocument4 pagesIntroduction To Agricultural ScienceKeyara KnightsNo ratings yet

- Diet Plan StarterDocument23 pagesDiet Plan Starterabhishek mittalNo ratings yet

- Federal GovernmentDocument8 pagesFederal Governmentapi-300924554No ratings yet

- Shopping ListDocument1 pageShopping ListBeverlyFarmersMarketNo ratings yet

- SST ProjectDocument5 pagesSST ProjectAnwar HossainNo ratings yet

- Veegaland Amusement Park: Enterprise Vs Regulation?Document45 pagesVeegaland Amusement Park: Enterprise Vs Regulation?Equitable Tourism Options (EQUATIONS)No ratings yet

- Dr. N. Varadharaju Professor and Head Post Harvest Technology Centre TNAUDocument74 pagesDr. N. Varadharaju Professor and Head Post Harvest Technology Centre TNAURameshSuruNo ratings yet

- Rajasthan VatDocument119 pagesRajasthan VatRakesh ParaliyaNo ratings yet

- Tidying Checklist: 1st - ClothingDocument4 pagesTidying Checklist: 1st - ClothingVero ParedesNo ratings yet

- Best Business in Ethiopia Invest in Ethiopia and Start A Business in EthiopiaDocument5 pagesBest Business in Ethiopia Invest in Ethiopia and Start A Business in EthiopiaBeleteNo ratings yet

- Types of ProductionDocument8 pagesTypes of ProductionPaul PeartNo ratings yet

- Food: Where Does It Come From?Document9 pagesFood: Where Does It Come From?Pranit PrasoonNo ratings yet

- WelcomeDocument25 pagesWelcomeitsmehaNo ratings yet

- Stuff The Turkey 2019Document2 pagesStuff The Turkey 2019api-419016958No ratings yet

- Solid Waste ManagementDocument48 pagesSolid Waste ManagementTalari UcheerappaNo ratings yet

- Introduction To Food TechnologyDocument42 pagesIntroduction To Food TechnologyNGUYEN CONG DUONGNo ratings yet

- 2 Slides Curso de Ingles Intermedio - Vocabulario y Expresiones Parte 1Document275 pages2 Slides Curso de Ingles Intermedio - Vocabulario y Expresiones Parte 1jassonNo ratings yet

- WRRCDocument11 pagesWRRCappu11vkNo ratings yet

- Uses of The PlantsDocument8 pagesUses of The PlantsSheryl TantiadoNo ratings yet

- FederalDocument1 pageFederalapi-301932438No ratings yet

- List of Alternative Dispute Resolution Entities: (Belgium)Document78 pagesList of Alternative Dispute Resolution Entities: (Belgium)KerNel0x45No ratings yet

- Agriculture PDFDocument53 pagesAgriculture PDFrohin haroonNo ratings yet

- A Project Report On Community-Based Eco TourismDocument12 pagesA Project Report On Community-Based Eco TourismKishalaya ChatterjeeNo ratings yet

- Overview of Commodities - Agricultural CommoditiesDocument53 pagesOverview of Commodities - Agricultural Commoditiesyashs-pgdm-2022-24No ratings yet

- India: India:: Food ProcessingDocument8 pagesIndia: India:: Food Processingmath_mallikarjun_sapNo ratings yet

- Importance of Farming For Ecology, Economy and HealthDocument18 pagesImportance of Farming For Ecology, Economy and HealthMallinath HemadiNo ratings yet

- Exemptions From GST: "It Is Not The End But The Start of The Journey"-Arun JaitleyDocument24 pagesExemptions From GST: "It Is Not The End But The Start of The Journey"-Arun JaitleyRadhika AggarwalNo ratings yet

- Unpan 015183Document1 pageUnpan 015183api-279624167No ratings yet

- Rural Marketting Dr.R.S.Chauhan SR - Scientist, K.V.K KurukshetraDocument13 pagesRural Marketting Dr.R.S.Chauhan SR - Scientist, K.V.K Kurukshetrachetan39No ratings yet

- Year 6 VocabularyDocument28 pagesYear 6 VocabularyNajid OthmanNo ratings yet

- Turkiye - Food Production Consumption and WastingDocument31 pagesTurkiye - Food Production Consumption and Wastingapi-574463684No ratings yet

- Agriculture Study Notes PDF by AffairsCloudDocument13 pagesAgriculture Study Notes PDF by AffairsCloudMD ANIRUZZAMANNo ratings yet

- All India Village Trade Fair and Sales in Temple CityDocument4 pagesAll India Village Trade Fair and Sales in Temple CityRAJANo ratings yet

- AgribusinessDocument12 pagesAgribusinessanamayamigoNo ratings yet

- Importance of Healthy LivingDocument36 pagesImportance of Healthy Livingchetanashetye100% (1)

- Agritech - Tnau.ac - in Horticulture SP Horticulture2013Document12 pagesAgritech - Tnau.ac - in Horticulture SP Horticulture2013Sundara VeerrajuNo ratings yet

- Agritourism and Alternative Ag - Our Diversity Is Delicious: James A. MaetzoldDocument26 pagesAgritourism and Alternative Ag - Our Diversity Is Delicious: James A. Maetzoldchandru683No ratings yet

- Animal Byproducts Utilization & Abattoir DesignDocument13 pagesAnimal Byproducts Utilization & Abattoir DesignBashiru GarbaNo ratings yet

- AgricultureDocument25 pagesAgricultureLINDSEY KATE TABAYOYONNo ratings yet

- Note On Resources From Living and Non-Living ThingsDocument2 pagesNote On Resources From Living and Non-Living ThingsSamuel AjanaNo ratings yet

- Exploring - Our - Environment Very Good InfoDocument54 pagesExploring - Our - Environment Very Good InfoMadhav V UpadhyeNo ratings yet

- Ethiopia Import Sample ReportDocument5 pagesEthiopia Import Sample ReportYimer AliNo ratings yet

- MTC Certificate - Doc CHASEDocument1 pageMTC Certificate - Doc CHASEERIC GERARDNo ratings yet

- Projects 2Document16 pagesProjects 2Jai GauravNo ratings yet

- Agronomic and Economic Efficiency of Manure and UrDocument10 pagesAgronomic and Economic Efficiency of Manure and UrDereje NegasaNo ratings yet

- Am S Product Label Fact SheetDocument7 pagesAm S Product Label Fact SheetRichard Sinto PenitonNo ratings yet

- Himanshu Patel Handbook For Chemical Process IndustriesDocument2 pagesHimanshu Patel Handbook For Chemical Process IndustriesJoao VictorNo ratings yet

- UPSC Mains 2023 Economy: (By CA Atul Mittal-Faculty of GS Economy For UPSC Prelims & Mains)Document3 pagesUPSC Mains 2023 Economy: (By CA Atul Mittal-Faculty of GS Economy For UPSC Prelims & Mains)Rahul BhoyarNo ratings yet

- P267601coll4 10341Document76 pagesP267601coll4 10341RajpurNo ratings yet

- The Main Staple Food in The Philippines Is RiceDocument2 pagesThe Main Staple Food in The Philippines Is RiceErnest ArceosNo ratings yet

- Je Mondejar Computer College: International Trade & AgreementDocument2 pagesJe Mondejar Computer College: International Trade & AgreementMaria Ester KaysonNo ratings yet

- PGFS ND 023 R0 PrimusGFS General Regulations Appendix 4 Scope Education and Work Experience PDFDocument3 pagesPGFS ND 023 R0 PrimusGFS General Regulations Appendix 4 Scope Education and Work Experience PDFGreilin CastilloNo ratings yet

- 1132Document112 pages1132Kevin AndersonNo ratings yet

- Joint Summary SheetDocument6 pagesJoint Summary Sheetchandana kumarNo ratings yet

- F 1232040111 Lamp IranDocument132 pagesF 1232040111 Lamp IranAry Kharisma SahbanaNo ratings yet

- Waste Disposal FormDocument1 pageWaste Disposal FormNEHEMIA MANUCDUCNo ratings yet

- (MCQ) On Textile IndustryDocument12 pages(MCQ) On Textile Industrysandip kumar mishra100% (1)

- 52 - FINAL Coffee Project Document For AG Group - UNIDO Project PDFDocument60 pages52 - FINAL Coffee Project Document For AG Group - UNIDO Project PDFLee HailuNo ratings yet

- Introduction To AGRICULTUREDocument17 pagesIntroduction To AGRICULTUREVan SweetingNo ratings yet

- 2023 Waste Calendar 8x11Document2 pages2023 Waste Calendar 8x11kahvynNo ratings yet

- Soil Testing 2021Document2 pagesSoil Testing 2021Heather Marie SNo ratings yet

- PuffcornwriteupDocument30 pagesPuffcornwriteupyoelNo ratings yet

- Contents Green Revolution in IndiaDocument13 pagesContents Green Revolution in IndiaShubham KrNo ratings yet

- Maasin Nursery and Training Center READY FOR DEFENSEDocument23 pagesMaasin Nursery and Training Center READY FOR DEFENSERucild SurrigaNo ratings yet

- International Trade Law Termpaper Topics-1Document3 pagesInternational Trade Law Termpaper Topics-1Aniketh SharmaNo ratings yet

- Business Opportunities Updated 07 Mac 2022 11amDocument39 pagesBusiness Opportunities Updated 07 Mac 2022 11amazim ireadyNo ratings yet

- Slow Fast Moving ItemsDocument34 pagesSlow Fast Moving Itemshirairfan990No ratings yet

- Final Group1 - HandoutDocument2 pagesFinal Group1 - Handoutpayprima paytongNo ratings yet

- CIPETDocument58 pagesCIPETsenthilvelanNo ratings yet

- TDS RB-0152-BDocument1 pageTDS RB-0152-BGabriel MorosanuNo ratings yet