Professional Documents

Culture Documents

Tax Proof Forms

Uploaded by

RockyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Proof Forms

Uploaded by

RockyCopyright:

Available Formats

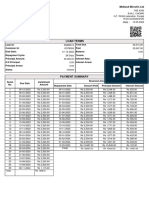

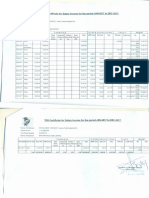

DECLARATION FOR INSURANCE PREMIUM, INVESTMENTS & RENT DUE

AFTER 1st JANUARY 2023

Employee Name:

Employee Code:

PAN A S O P N 9 6 2 6 P

Particulars Policy No. / Folio No. / Account No. Amount Remarks

Equity Linked Savings Scheme / Mutual

Rajesh.N & 3556535/07 6000

Fund *

Rajesh.N & 77758296776 6000

Rajesh.N & 477217965361 4497

Rajesh.N & 477217965361 6000

Rajesh.N & 11607209 3000

Rajesh.N & 22707318 6000

Rajesh.N & 4466332/02 6000

Rajesh.N & 4466332/02 7500

January 23 February 23 March 23

Rent payable Rs.8000 Rs.8000 Rs.8000

I hereby confirm that the following investments are due for payment after the cutoff dates laid out by you for proof submission

and therefore request you to consider the same for the tax computation purpose for the financial year 2022-2023. I undertake

that I will be depositing these premium /investment/rent payments and obtain the receipts as per the due dates or by 31st March

2023. I will be held responsible for any consequences of not remitting these payments and any liabilities arise out of th is.

Declaration: I certify that all the above details are true and correct and I am fully aware of the relevant income tax laws in force

regarding the nature of proof required to claim exemption under the above heads.

Signature of the employee

Date:

*Encl: For all investments, please attach the relevant receipt of previous (FY 19-20) financial year / premium notice to prove that the policy is in force.

Exemption will be provided only in case of the pre mium receipt provided for the previous year and not otherwise.

You might also like

- Promissory Note With Real Estate MortgageDocument3 pagesPromissory Note With Real Estate Mortgagesheila yutuc100% (9)

- Bajaj Allianz Life Insurance Co. LTD.: Date:09-01-2024Document2 pagesBajaj Allianz Life Insurance Co. LTD.: Date:09-01-2024dipeshraghav67No ratings yet

- Covid Kit BillDocument1 pageCovid Kit BillRenu AmbaniNo ratings yet

- Pension Slip AprilDocument1 pagePension Slip AprilShafiq HajiNo ratings yet

- Chase StockDocument22 pagesChase Stocktreasurebeachcag7No ratings yet

- Government of Rajasthan: Schedule of Income Tax (Budgethead 8658-00-112-00-00)Document5 pagesGovernment of Rajasthan: Schedule of Income Tax (Budgethead 8658-00-112-00-00)shane haiderNo ratings yet

- AccountStatement 53886510Document1 pageAccountStatement 53886510anandnagarNo ratings yet

- 1281 Taklikar-FaDocument1 page1281 Taklikar-FaNAGESH SARODENo ratings yet

- DownloadfileDocument1 pageDownloadfilesarika.shirgaonkarNo ratings yet

- Tax Ritan18-19 PDFDocument4 pagesTax Ritan18-19 PDFRishabh SharmaNo ratings yet

- Taklikar Fa1281Document1 pageTaklikar Fa1281NAGESH SARODENo ratings yet

- PI - Urbanscape PDFDocument1 pagePI - Urbanscape PDFSanrachna ConsultantsNo ratings yet

- Income Tax Calculation ChartDocument29 pagesIncome Tax Calculation Chartnaveed ansariNo ratings yet

- PayslipDocument1 pagePayslipRajneesh Khichar : MathematicsNo ratings yet

- Analisis KreditDocument14 pagesAnalisis KreditIndah NkNo ratings yet

- Srivinayaka 28.02.2023Document1 pageSrivinayaka 28.02.2023Sridhar GandikotaNo ratings yet

- Sri Ramadhootha 16.03.2023Document1 pageSri Ramadhootha 16.03.2023Sridhar GandikotaNo ratings yet

- Payslip Nov2023Document1 pagePayslip Nov2023laxman.annabheemojuNo ratings yet

- ListDocument1 pageListkhushichauhankc3024No ratings yet

- Customer App: For Android For iOSDocument6 pagesCustomer App: For Android For iOSKhushi JhaNo ratings yet

- Rekap Umpan Balik RanapDocument1 pageRekap Umpan Balik RanapMasruroNo ratings yet

- Loan Terms: Gram Lohadar House No. 89 Shankarpur Amkui, Amkui Nagod Satna Satna MADHYA - PRADESH, 485551Document1 pageLoan Terms: Gram Lohadar House No. 89 Shankarpur Amkui, Amkui Nagod Satna Satna MADHYA - PRADESH, 485551aakashpatelsathaniyaNo ratings yet

- SalarySlip Prasar-6Document1 pageSalarySlip Prasar-6mishramanu1990No ratings yet

- Ramadhootha Farm 28.02.2023Document1 pageRamadhootha Farm 28.02.2023Sridhar GandikotaNo ratings yet

- Updated-17 18Document225 pagesUpdated-17 18Akhil SheoranNo ratings yet

- Passbook 1694757785795Document11 pagesPassbook 1694757785795sameer prabhasNo ratings yet

- Welcome To HDFC Bank NetBankingDocument2 pagesWelcome To HDFC Bank NetBankingraghavendrarajput2k18appNo ratings yet

- Wassan2 26.04.2023Document1 pageWassan2 26.04.2023Sridhar GandikotaNo ratings yet

- APR23Document1 pageAPR23Dhina KaranNo ratings yet

- InvoicesDocument5 pagesInvoicesFenil SarvaiyaNo ratings yet

- Citydealer Code (Finnone) Case Numbcase Sourccredit Pro Statusgross Loan Amount Advanced Emi Amount Net Loan Amount Gross TenureDocument3 pagesCitydealer Code (Finnone) Case Numbcase Sourccredit Pro Statusgross Loan Amount Advanced Emi Amount Net Loan Amount Gross Tenurenalini saxenaNo ratings yet

- MR - Shivjee Singh: Please Call From Your Registered Mobile Number For Faster AccessDocument4 pagesMR - Shivjee Singh: Please Call From Your Registered Mobile Number For Faster AccessMANU RAJNo ratings yet

- Non Kapitasi PNCDocument9 pagesNon Kapitasi PNCPuskesmas MuarapanasNo ratings yet

- Rupees One Crore Twenty Two Lakhs Thirteen Thousand Seven Hundred and Fifty OnlyDocument81 pagesRupees One Crore Twenty Two Lakhs Thirteen Thousand Seven Hundred and Fifty OnlybhagyarajuNo ratings yet

- Sai Proteins 16.03.2023Document1 pageSai Proteins 16.03.2023Sridhar GandikotaNo ratings yet

- Unlock DEO KHURDA INCOMETAX CALCULATION SHEET FOR FY 2023-24 DT-10.02.2024Document14 pagesUnlock DEO KHURDA INCOMETAX CALCULATION SHEET FOR FY 2023-24 DT-10.02.2024nayak.dibya5111989No ratings yet

- GA55Document2 pagesGA55govt.iti.jaswantpuraNo ratings yet

- May 2023Document1 pageMay 2023Awadh GroupNo ratings yet

- Emp Annual Statement-2Document1 pageEmp Annual Statement-2shivamrajsingh12042001No ratings yet

- 7th Pay Calculator Schedule-IV Appendix-II Version 17.1 EdnnetDocument12 pages7th Pay Calculator Schedule-IV Appendix-II Version 17.1 EdnnetGuna SeelanNo ratings yet

- CPSPM 47120758 1692333407Document1 pageCPSPM 47120758 1692333407Ravi PowderNo ratings yet

- Salary SheetDocument2 pagesSalary SheetAnonymous 0DZlXbXNo ratings yet

- Noel Construction Company PVT LTD: Total 1236742 Received Payment 1200000 BlanaceDocument9 pagesNoel Construction Company PVT LTD: Total 1236742 Received Payment 1200000 BlanaceJagadeesh KNo ratings yet

- Balkrishna Navnath Andhale-4Document2 pagesBalkrishna Navnath Andhale-4andhalebn9448No ratings yet

- 1563879154024Document30 pages1563879154024Rahul GoyalNo ratings yet

- G Mark Health Incurance FY 22-23Document6 pagesG Mark Health Incurance FY 22-23vsbluemetalserodeNo ratings yet

- Earnings Amount Deductions Amount: PayslipDocument1 pageEarnings Amount Deductions Amount: PayslipshajuNo ratings yet

- 2023 09 01 2024 01 27 - Meta - Invoice - SummaryDocument3 pages2023 09 01 2024 01 27 - Meta - Invoice - SummaryRam kunwar KumawatNo ratings yet

- S.NO. Customer Name Policy Company Policy NumberDocument2 pagesS.NO. Customer Name Policy Company Policy NumberpowermuruganNo ratings yet

- LHXXXXXXXXXXXX24Document2 pagesLHXXXXXXXXXXXX24Dhananjay RambhatlaNo ratings yet

- Zestmoney StatementDocument2 pagesZestmoney StatementKumarNo ratings yet

- MAR23Document1 pageMAR23Dhina KaranNo ratings yet

- Lalan Yadav StatementDocument1 pageLalan Yadav StatementAnshuman SrivastavaNo ratings yet

- Dec-23 500056Document9 pagesDec-23 5000568179242888suryaNo ratings yet

- Assignment PPF Accounr StmtassDocument1 pageAssignment PPF Accounr StmtassKUMARI JYOTSNA LATA RANINo ratings yet

- Apr PayslipDocument1 pageApr PayslipSidvik InfotechNo ratings yet

- TES EXCEL 03 Akhmad Hafiz AnsariDocument7 pagesTES EXCEL 03 Akhmad Hafiz Ansaribtn JoneNo ratings yet

- Feb2019Document3 pagesFeb2019DeepakNo ratings yet

- Venvet 16.03.2023Document1 pageVenvet 16.03.2023Sridhar GandikotaNo ratings yet

- Jupiter Distributors 16.05.2023Document1 pageJupiter Distributors 16.05.2023Sridhar GandikotaNo ratings yet

- Impairment of Loans and Receivable Financing PDFDocument9 pagesImpairment of Loans and Receivable Financing PDFJoy UyNo ratings yet

- World BankDocument3 pagesWorld BankaditiNo ratings yet

- Fundamentals of Engineering Economic NinoelDocument60 pagesFundamentals of Engineering Economic NinoelAmelita Mendoza PaduaNo ratings yet

- Magnum v SummerlyDocument5 pagesMagnum v SummerlyabramNo ratings yet

- Final Balance Sheet As On 31.03.2021... 06.12.2021Document101 pagesFinal Balance Sheet As On 31.03.2021... 06.12.2021Naman JainNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsRishav GopeNo ratings yet

- Calapan City, Oriental Mindoro: City Government of Calapan Statement of Condensed Cash Flows General FundDocument3 pagesCalapan City, Oriental Mindoro: City Government of Calapan Statement of Condensed Cash Flows General FundkQy267BdTKNo ratings yet

- Assets Contributed by The Partners To A Partnership Business Should Be Initially Measured in The Partnership Books atDocument15 pagesAssets Contributed by The Partners To A Partnership Business Should Be Initially Measured in The Partnership Books atBerna MortejoNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961tusharmohite0No ratings yet

- Marathon 1 - Time Value of MoneyDocument96 pagesMarathon 1 - Time Value of MoneyMirdula SharmaNo ratings yet

- UGBA 120AB Chapter 14 Debt Spring 2020 With Solutions For BCoursesDocument126 pagesUGBA 120AB Chapter 14 Debt Spring 2020 With Solutions For BCoursesyadi lauNo ratings yet

- SODPRMDP-Makaguro Loans (1) (2) (1) - 1Document13 pagesSODPRMDP-Makaguro Loans (1) (2) (1) - 1MaximusNo ratings yet

- Fess 1 PsDocument13 pagesFess 1 Psvinod maddikeraNo ratings yet

- f7 Mock QuestionDocument20 pagesf7 Mock Questionnoor ul anumNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net Worthmarco medurandaNo ratings yet

- Contract of Guarantee (Sec 126)Document10 pagesContract of Guarantee (Sec 126)Carry MinatiNo ratings yet

- Maf253 - SS - July 2021Document11 pagesMaf253 - SS - July 2021Shazrul FadzlyNo ratings yet

- Partnership Formation OperationsDocument8 pagesPartnership Formation OperationsSherwin Benedict Sebastian100% (1)

- 04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services LimitedDocument3 pages04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services Limitedkishore13No ratings yet

- Floreza V EvangelistaDocument2 pagesFloreza V EvangelistaLeo TumaganNo ratings yet

- 3 - Partnership DissolutionDocument6 pages3 - Partnership DissolutionAangela Del Rosario CorpuzNo ratings yet

- Finance Account - ProjectDocument12 pagesFinance Account - ProjectSnigdha AgrawalNo ratings yet

- (A) J00183 RAK Trade Finance S&P Guide Trade Only-25-11-2021 enDocument7 pages(A) J00183 RAK Trade Finance S&P Guide Trade Only-25-11-2021 enbAYASUNo ratings yet

- Personal Finance CH 3 NotesDocument2 pagesPersonal Finance CH 3 NotesJohn RammNo ratings yet

- Semi Detailed Lesson Plan in Journalizing TransactionsDocument5 pagesSemi Detailed Lesson Plan in Journalizing TransactionsJayron NonguiNo ratings yet

- Chapter # 4 Final AccountDocument39 pagesChapter # 4 Final AccountRooh Ullah KhanNo ratings yet

- UWC Financial Circumstances Declaration Form: InstructionsDocument8 pagesUWC Financial Circumstances Declaration Form: InstructionsYahaira AcostaNo ratings yet

- Letter To Marcel PAVELDocument2 pagesLetter To Marcel PAVELAndrei PavelNo ratings yet

- Accounting 1-4Document37 pagesAccounting 1-4Abed M. SallamNo ratings yet