Professional Documents

Culture Documents

Problem Set On Hoba Part 2

Uploaded by

Angela Marie PenarandaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set On Hoba Part 2

Uploaded by

Angela Marie PenarandaCopyright:

Available Formats

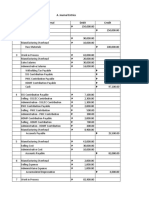

PROBLEM 1

1.

Shipments from Home Office at billed price ₱ 300,000.00

Additional shipments 120,000.00

Returns to Home Office (7,500.00)

Total shipments from Home Office at billed price ₱ 412,500.00

Divided by 120%

Shipments from Home Office at cost ₱ 343,750.00

Purchases from outside suppliers 72,500.00

Total goods available for sale ₱ 416,250.00

Ending inventory of Shipment from Home Office at cost (137,500.00)

Ending inventory of purchases from outside suppliers (20,000.00)

Total amount of Cost of Goods Sold ₱ 258,750.00

2.

Ending inventory from Home Office at billed price ₱ 165,000.00

Divided by 120%

₱ 137,500.00

Multiplied by 20%

Unrealized mark-up on ending inventory ₱ 27,500.00

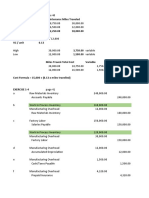

PROBLEM 2

1.

At billed price

Beginning inventory ₱ 56,250.00

Shipments from Home Office 1,156,250.00

Shipments returned (156,250.00)

Total shipments from Home Office at billed price ₱ 1,056,250.00

Less: Shipments at cost

(₱1,056,250 / 125%) 845,000.00

Allowance for Overvaluation of Branch Inventory ₱ 211,250.00

PROBLEM 3

1.

Sales ₱ 141,000.00

Cost of Sales (₱120,000 x 3/4) (90,000.00)

Gross Profit ₱ 51,000.00

Operating expenses (27,000.00)

Individual profit of the branch ₱ 24,000.00

2.

Sales ₱ 141,000.00

Cost of Sales (at cost) (72,000.00)

Gross Profit ₱ 69,000.00

Operating expenses (27,000.00)

True profit of the branch ₱ 42,000.00

Supporting computation:

Shipments from Home Office at billed price ₱ 120,000.00

Divided by 125%

Shipments from Home Office at cost ₱ 96,000.00

Multiplied by: Portion sold 3/4

Cost of Sales ₱ 72,000.00

You might also like

- Corporate Strategy Module 1Document28 pagesCorporate Strategy Module 1Omkar MulekarNo ratings yet

- Records - Management Policy ManualDocument248 pagesRecords - Management Policy ManualThulani MabalekaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Final - Home Office Branch of AccountingDocument13 pagesFinal - Home Office Branch of AccountingHazel Jane Esclamada100% (1)

- Intermediate Accounting Volume 3 ValixDocument12 pagesIntermediate Accounting Volume 3 ValixVyonne Ariane Ediong0% (1)

- 1.1 Introduction To Service ManagementDocument22 pages1.1 Introduction To Service ManagementdiporufaiNo ratings yet

- GBE-KPO-2-012-00 JidokaDocument40 pagesGBE-KPO-2-012-00 JidokaEduardo Magana100% (1)

- Sop ConstructionDocument20 pagesSop ConstructionVenkata Krishna P60% (5)

- QCM Corporate Strategy 2Document85 pagesQCM Corporate Strategy 2rupok100% (2)

- Chapter 1-Test Material 3Document9 pagesChapter 1-Test Material 3Marcus MonocayNo ratings yet

- Cost Accounting CycleDocument7 pagesCost Accounting CycleenzoNo ratings yet

- UntitledDocument14 pagesUntitledJomar PenaNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Home Office Branch AgencyyyDocument9 pagesHome Office Branch AgencyyyIyah AmranNo ratings yet

- Chapter 4-Test Material 4 1Document6 pagesChapter 4-Test Material 4 1Marcus MonocayNo ratings yet

- Problem-2.28 - & - 3.32 HMDocument8 pagesProblem-2.28 - & - 3.32 HMCorry MargarethaNo ratings yet

- Shipments To Branch Above CostDocument4 pagesShipments To Branch Above CostJohnmichael Coroza0% (1)

- Flatty FinalDocument8 pagesFlatty FinalKriz BassNo ratings yet

- Problem CH 7 Hansen Mowen Cornerstone of Managerial AccountingDocument8 pagesProblem CH 7 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Tugas Chapter 8Document8 pagesTugas Chapter 8wiwit_karyantiNo ratings yet

- AML-Excercise Week 1 & 2 (Reviandi Ramadhan)Document26 pagesAML-Excercise Week 1 & 2 (Reviandi Ramadhan)reviandiramadhanNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- Chapter 7 SolutionDocument16 pagesChapter 7 SolutionErika Anne JaurigueNo ratings yet

- Franchise and LTCCDocument4 pagesFranchise and LTCCAngela Marie PenarandaNo ratings yet

- No. 1 Home Office Books: Problem 1Document28 pagesNo. 1 Home Office Books: Problem 1Von Andrei MedinaNo ratings yet

- Factory Overhead PDFDocument18 pagesFactory Overhead PDFANDI TE'A MARI SIMBALANo ratings yet

- Cordova, Alexander JR - Individual TaskDocument6 pagesCordova, Alexander JR - Individual TaskAlexander CordovaNo ratings yet

- Oss Profit Retail Inventory MethodDocument4 pagesOss Profit Retail Inventory MethodLily of the ValleyNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- PR Week 1 - Teuku Aldefa AngkasaDocument3 pagesPR Week 1 - Teuku Aldefa AngkasaTeuku AldefaNo ratings yet

- Chapter 2-Test Material 2 1Document7 pagesChapter 2-Test Material 2 1Marcus MonocayNo ratings yet

- 102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Document4 pages102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Darasin, Mhirasol B.No ratings yet

- Asistensi Akmen Ch.8Document12 pagesAsistensi Akmen Ch.8Irham SistiasyaNo ratings yet

- SCM Chap 3 Probs 1-3Document4 pagesSCM Chap 3 Probs 1-3aj dumpNo ratings yet

- Dakota - Classic Pen - Group 1 - Section ADocument9 pagesDakota - Classic Pen - Group 1 - Section AanshulaNo ratings yet

- IIlustration - CFS Special ProblemDocument4 pagesIIlustration - CFS Special ProblemMarion MalabananNo ratings yet

- LaraDocument19 pagesLarajuri kimNo ratings yet

- Contribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is ADocument7 pagesContribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is AEVELYN ROSE MOGAONo ratings yet

- Baking DepartmentDocument6 pagesBaking DepartmentkmarisseeNo ratings yet

- 1256 ArruejoDocument4 pages1256 ArruejoTitania ErzaNo ratings yet

- Problem 8-35 Hansen Mowen Cornerstone of Managerial AccountingDocument4 pagesProblem 8-35 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- ACC60181H619 Managerial AccountingDocument9 pagesACC60181H619 Managerial AccountingaksNo ratings yet

- Net SalesDocument2 pagesNet SalesNicole VinaraoNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Class Case 4 - Whitney CompanyDocument3 pagesClass Case 4 - Whitney Company9ry5gsghybNo ratings yet

- Estimate How Much of The: Problem 3-15Document7 pagesEstimate How Much of The: Problem 3-15Cheveem Grace EmnaceNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- Cost - Concepts and ClassificationsDocument23 pagesCost - Concepts and ClassificationsYehetNo ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- Class Case 6 - Charmingly, Personalli, YoursDocument5 pagesClass Case 6 - Charmingly, Personalli, Yours9ry5gsghybNo ratings yet

- Chapter 3-Test Material 1Document6 pagesChapter 3-Test Material 1Marcus MonocayNo ratings yet

- IIlustration - Combined Financial StatementsDocument6 pagesIIlustration - Combined Financial StatementsMarion Malabanan100% (1)

- Afar 2 LQ T2Document14 pagesAfar 2 LQ T2Alexandria EvangelistaNo ratings yet

- Computations On Relevant CostingDocument9 pagesComputations On Relevant CostingVixen Aaron EnriquezNo ratings yet

- 2020-10-12 - ACCT Test Practice ExercisesDocument146 pages2020-10-12 - ACCT Test Practice ExercisesAlenne FelizardoNo ratings yet

- Gawagawa Din Company COGS StatementDocument5 pagesGawagawa Din Company COGS StatementJosh AlvarezNo ratings yet

- Discussed Solutions 2Document18 pagesDiscussed Solutions 2Christy HabelNo ratings yet

- AE 112 - Midterm Summative Assessment (Quiz 1) Suggested Answers and SolutionsDocument3 pagesAE 112 - Midterm Summative Assessment (Quiz 1) Suggested Answers and SolutionsDjunah ArellanoNo ratings yet

- Exercise in SCIDocument2 pagesExercise in SCIRizty CabibilNo ratings yet

- Proforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Document6 pagesProforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Kelsey VersaceNo ratings yet

- PROBLEM 4 (Evaluation of Performance) : TotalDocument3 pagesPROBLEM 4 (Evaluation of Performance) : TotalArt IslandNo ratings yet

- Cost Sheet, ABC CostingDocument29 pagesCost Sheet, ABC CostingRajshri SaranNo ratings yet

- Proforma Cost Sheet Particulars Amount (RS.) Total Cost (RS.)Document4 pagesProforma Cost Sheet Particulars Amount (RS.) Total Cost (RS.)Naman GuptaNo ratings yet

- TUT 3 - Relevant Information&decision MakingDocument10 pagesTUT 3 - Relevant Information&decision MakingKim Chi LeNo ratings yet

- Statement of Comprehensive Income - PROBLEMSDocument20 pagesStatement of Comprehensive Income - PROBLEMSSarah GNo ratings yet

- Practice Problems (Spoilage in Process Costing)Document3 pagesPractice Problems (Spoilage in Process Costing)lalalalaNo ratings yet

- Ias 34Document4 pagesIas 34Angela Marie PenarandaNo ratings yet

- Chapter 1 THE INFORMATION SYSTEM AN ACCOUNTANT'S PERSPECTIVEDocument11 pagesChapter 1 THE INFORMATION SYSTEM AN ACCOUNTANT'S PERSPECTIVEAngela Marie PenarandaNo ratings yet

- Probset (HOBA)Document2 pagesProbset (HOBA)Angela Marie PenarandaNo ratings yet

- ProbSet On Joint ArrangementsDocument2 pagesProbSet On Joint ArrangementsAngela Marie PenarandaNo ratings yet

- CHAPTER 7 - The Conversion CycleDocument6 pagesCHAPTER 7 - The Conversion CycleAngela Marie PenarandaNo ratings yet

- CHAPTER 9 - Database Management SystemsDocument6 pagesCHAPTER 9 - Database Management SystemsAngela Marie PenarandaNo ratings yet

- CHAPTER 6 - The Expenditure Cycle Part 2: Payroll Processing and Fixed Asset ProceduresDocument4 pagesCHAPTER 6 - The Expenditure Cycle Part 2: Payroll Processing and Fixed Asset ProceduresAngela Marie PenarandaNo ratings yet

- CHAPTER 8 - Financial Reporting and Management Reporting SystemsDocument6 pagesCHAPTER 8 - Financial Reporting and Management Reporting SystemsAngela Marie PenarandaNo ratings yet

- CHAPTER 4 - The Revenue CycleDocument14 pagesCHAPTER 4 - The Revenue CycleAngela Marie PenarandaNo ratings yet

- FranchiseDocument6 pagesFranchiseAngela Marie PenarandaNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationAngela Marie PenarandaNo ratings yet

- Franchise and LTCCDocument4 pagesFranchise and LTCCAngela Marie PenarandaNo ratings yet

- Chapter 3Document32 pagesChapter 3Angela Marie PenarandaNo ratings yet

- ITIL ProcessDocument18 pagesITIL ProcessmikeNo ratings yet

- Analisi Penerepan Manajemen Mutu Mall Trans CibuburDocument11 pagesAnalisi Penerepan Manajemen Mutu Mall Trans Cibuburjack macoNo ratings yet

- CHESBROUGH - Open Innovation - Researching A New ParadigmDocument2 pagesCHESBROUGH - Open Innovation - Researching A New ParadigmJoão Carlos Silvério Ferraz0% (1)

- The Effectiveness of ERP Implementation in Manufacturing Industries - MohdDocument28 pagesThe Effectiveness of ERP Implementation in Manufacturing Industries - MohdMaruan MuhammadNo ratings yet

- Supply Chain Management in SamsungDocument11 pagesSupply Chain Management in SamsungZia ShuvoNo ratings yet

- Master of Customs Administration - Centre For Customs and Excise StudiesDocument1 pageMaster of Customs Administration - Centre For Customs and Excise StudiesSyed SumamaNo ratings yet

- Balance Scorecard ReviewDocument72 pagesBalance Scorecard Reviewapi-3781744100% (1)

- Chapter 1 - Competition and Product StrategyDocument38 pagesChapter 1 - Competition and Product StrategyRonald Reagan AlonzoNo ratings yet

- Benchmarking at XeroxDocument3 pagesBenchmarking at XeroxTok DalangNo ratings yet

- Justice NelsonDocument3 pagesJustice NelsonAnonymous bDYlxVNo ratings yet

- Differences Between Managerial Accounting and Financial AccountingDocument2 pagesDifferences Between Managerial Accounting and Financial AccountingNishat_Gupta_5819No ratings yet

- BMW Brand in North America: Case StudyDocument8 pagesBMW Brand in North America: Case Studyaugustine_4u132No ratings yet

- Solution Manual For Strategic Management Theory and Practice 3rd Edition John A Parnell Isbn 10 142662882x Isbn 13 9781426628825Document37 pagesSolution Manual For Strategic Management Theory and Practice 3rd Edition John A Parnell Isbn 10 142662882x Isbn 13 9781426628825bowerybismarea2blrr100% (12)

- Order: L'agc I I 7Document7 pagesOrder: L'agc I I 7Ramana ReddyNo ratings yet

- Performance Management and Apprasial Lect 7Document64 pagesPerformance Management and Apprasial Lect 7imadNo ratings yet

- Full Download Leadership and Management in Police Organizations 1st Edition Giblin Test BankDocument35 pagesFull Download Leadership and Management in Police Organizations 1st Edition Giblin Test Bankresigner.nudicaul7k1p3No ratings yet

- Corporate Culture Change ManagementDocument18 pagesCorporate Culture Change ManagementNeil ThomasNo ratings yet

- Course Number/Code: AEC 54 Course Name/Title: Auditing and Assurance: Concepts and Application 1 Course DescriptionDocument1 pageCourse Number/Code: AEC 54 Course Name/Title: Auditing and Assurance: Concepts and Application 1 Course DescriptionnikkaNo ratings yet

- VP Director National Sales in Chicago IL Resume A. E. Joseph ShepleyDocument2 pagesVP Director National Sales in Chicago IL Resume A. E. Joseph ShepleyAEJosephShepleyNo ratings yet

- Solution Manual For Supervisory Management 10th Edition Donald C Mosley Don C Mosley JR Paul H Pietri 2Document20 pagesSolution Manual For Supervisory Management 10th Edition Donald C Mosley Don C Mosley JR Paul H Pietri 2David Bryant100% (39)

- Multivariate Analysis WorkshopDocument4 pagesMultivariate Analysis Workshopshankar_missionNo ratings yet

- Chapter 8Document14 pagesChapter 8Xela KimNo ratings yet

- Incoterms Use in Buyer-Seller Relationships A Mixed Methods StuDocument289 pagesIncoterms Use in Buyer-Seller Relationships A Mixed Methods StuqwertyNo ratings yet

- Example of Materials ManagementDocument178 pagesExample of Materials Managementhasfanizamhashim100% (1)