Professional Documents

Culture Documents

Fearnleys

Fearnleys

Uploaded by

SANDESH GHANDAT0 ratings0% found this document useful (0 votes)

11 views7 pagescf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views7 pagesFearnleys

Fearnleys

Uploaded by

SANDESH GHANDATcf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

Fearnleys Weekly Report

Printer version

C J

es

VLCC rates have continued to side in the week gone by. Numerous MEG/China “COA” movements have been

booked, with Chinese charterers taking care of business ahead of their holidays next week - leaving litle enquiry

cof note for third party owners to bite into. The market remains firmly mired in the WS20's for MEG/Eastbound

cargoes, ranging from the low end for the somewhat challenged units to the upper end for modern tonnage. The

Atlantic has fared somewhat better, with daily earings twice that available from the MEG, but it's a Hobson's

c’choice whether to lock in current rock bottom levels well into the new year. —TRE7RaR#2F (One meal won't make

a fat man).

(Suczmax)

‘Coming into this week Suezmax owners felt much more confident than the last couple of months. Activity in the

st have been very good for over a week, thinning out the front end of the position list. Only problem is that

might not be enough, The activity in the East it has prevented the stream of ballasters to West Arica,

1 Atlantic list to look slightly better as well, enly problem there is the cargo activity. North, Med/Black

Sea, USG and West Africa is stil rather quiet, but there are some positives going forward. Libya is up at 250k

bbls/day in production, which is a good start. Volumes in Wafr are expected ta slowly increase, and going forward

we can say that WS35 on TD20 Is the bottom for now.

(Game)

F Aframax owners trading in the North Sea/Baltic, even a relatively busy week with a decent amount of cargoes

was not enough to push the market up higher as the tonnage list was too long. Owners are showing some

resistance to fix current low levels, but again the volumes are not there to support them. Some delays in strategic

load and discharge port coupled with some bad weather could possibly play thelr role i

do not expect any dramatic change in the rates, Also in the Med/Bsea the low rate levels have rolled for another

week On a positive we have seen a fow more inquiries from Libya as a result of the force majeure being lifted in

some ports, however due to the unbalance of cargoes versus ships we do not foresee an imminent improvement

In the week to come.

the short term, but we

MEG/WEST (280 000) ws 175 ose

ws 280 208

MEG/Singapore (280 000) ws275 35

WAF/FEAST (260.000), ws 330 ov

WAF/USAC (130 000), ws 325 00

Sidi Kerir7W Me (135 000) ws 400 00>

NN. Afe/Euromed (80 000) wss7s 00

UKycont (80 000) ws 725 asm

‘aribs/Use (70 000) ws 525 2s

Vice (Modern) 365000 09

‘Suezmax (Medern) 215009 $5000

‘Aframax (Modern) 9000.0 09

VLCC fixed inal areas lst week 52 6m

VLCCS available in MEG next 30158 on

days

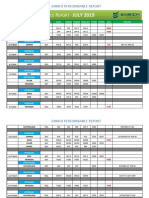

We see the market continuing its move upwards despite an expected quiet week with holidays in China, The Brazil

to China route with iron ore is the main driver where i's been a lot of activity with levels up 18% from last week.

However, in terms of increase the north Atlantic is the most impressive with the fronthaul rate being up 50% and

transatlantic up 68%. The Pacific is more stable, but still with good amount of activity is up 3%. For now, the

‘market seems very solid and with a thin available tonnage list for Brazil itis expected to see further near-term

Improvement.

‘The Panamax market has experienced a flat tendency in both hemispheres this week It has been slow activity and

With Chinese and Korean Holidays starting off today, we believe the activity will remain slow, TAs are yielding USD

tow 12k while fronthauls bss Continent delivery are being fixed in region of USD low 20k. The Pacific round

voyages are priced similar to the Atlantic rounds andl are being fixed in the low 12k

Positive sentiment across all borders for the Supramax market. Though @4 expect to be more volatile than usual,

spot market supporting firm sentiment going forward. The increased activity and stronger rates in the Pacific

pushed indexes further up, which helped to increase period activity for tonnage open in Far East. Imabari’ 63,

built 2019, open China med September was fixed USD 1100 bss 8-10 mos, Seasonal grain export from Black Sea

and Continent dominating Atlantic market. Rates from Continent to Far East fixing in low USD 20k pd. Scrap runs

to Med paying USD 17k pd. Clinker from Med to West Africa reported to fix USD 20,500 pd APS on a $5,000 dwt

USG market is firm with good demand and lack of fresh tonnage supply. ECSA stable and rates holding same level

from “last done” about USD 15k plus 550k GBB pd delivery Brazil for trip to Se Asia

&

(Gepesize WD/Day UEE/TEMD)

‘TCE Cont/Far East (180 DWT) sas.oae i994

*

Australia ser sor

PacificRV 23991 $58

(Panamax OS0/Day. Uso/Temed)

“Transatlantic RV si2270 $220

TE Contr East seas $260%

Tee Far EasCont S454 “20

Tce Far East RV siisae $2000

GED)

Atlantic AV sis3s2 502%

Pacific RV ses $94

‘TCE Cont/Far East 21.182 sma

(Cerrc wscrom)

Neweastlemax (208 000 dwt) 17250 $500

‘capesize (180 000 dwt) 15100 $800

Kamsarmax (82 000 dt) 12750 2808

Panamax (75000 dt) 11300 250%

Ultramax (64000 ct 11,900 250%

Supramax (58 000 dw) 800 $2504

Baltic Dry index (801) 969.148

(Wear by Bu)

USD per Day

je

EAST

4 handful of ships have been taken out this week in the mid usd 50s baltic range, but time being there seems to

be few requirements left for October load unless ships get delayed and miss their laycans later. The market is also

preparing for long holiday in China next week that will last until 8th Oct, Meanwhile we continue to see strong

activity on freight for US cargos and thus we do not expect the baltic to come off anytime soon, as Owners would

rather send their open shins back West unless able to program them at favorable rates in the Fast.

west

Things have slowed down to some extent in the West this week compared to a busy week of fixing in the US last

week. However, there are things going on, and although we have only seen one fixture done in the new fixing

window so far, a couple of ships are on subs, and another few are under discussion. We are still seeing interest on

freight for both October and November dates, and rate wise it seems levels in the new fixing window pretty much

carry on from the last

(Geerates)

(aero)

UGC (84 000 ebm) 1350000 $50,000

*

sc (60 000 eben) 800,000 09

MGC (38 000 ebm) 950,000 90>

HOY SR 20-22 000 ebm) 650,000 50>

HOY ETH (17-22 000 ebm) 709000 50>

ETH (8-12 000 ebm) 420.000 50>

'5R (6 500 ebm») 340,000 10000

*

COASTER Asia 280000 50>

‘COASTER Europe 150000 $09

(EG/FOE Prices - Propane (US0/Tenne))

FOB North Sea/ANS! $305, 50>

‘Saudi Arabia/cP 8375 S10

Mr Belview (US Gulf) S283 ee

Sonatrach/Bethioua $335 an

FOB North Sea/ANSI s321 90>

Saudi Arabia/cP $380 wn

MT Belview (US Gulf) $250 y

Sonatrach/Bethious $380 som

(crates)

Gate G5)

East of Suez 155-165 000 ebm $57,500 90>

West of Suer 155-165 000.cbm $60,000 09

1 Year T/C 155-160 000 cbm 47,000 90>

(Hewbuiting]

Carine)

Tankers stow Siow

Dry Bulkers| Sow sow

‘others Siow Slow

Gres)

vice 050 500

Suezmax 560 500

Aframax sass 500

Product sas $00

Neweastlemax sao $009

Kamsarmax 5265 300

Uttramax 245 $009

NGC (MEG (ebm s1e00 500

(Sate & Purchase]

os)

Capesize s3so 00>

Kamsarmax se20 $00>

Urtramax siss. 300%

capesize si95 500

Kamsarmax sis0 500

Uteramax sno s00>

vice 670 10d

Suezmax $450 “$108

‘framax / R2 360 500

MR 260 500

vice sass $054

Suezmax ssi0 $009

éramax / U2 8250 $00

me sis, 4054

usoney 10638 102

Usp/KRW 118965 5a

Usp/NoK, asr one

EUR/USD 18 ood

LIBOR USD (6 months) 023% 9.02%

NIBOR NOK (6 months) 037% oni

Brent Spot $42.00 soso

Singapore 380 CST seers 3003

Singapore Gaseil sno s20%

Rotterdam 380 CST segs $00

Rotterdam Gasoil s3220 s30%

g

All rates published in this report do not necessarily reflect actual transactions occurring in the market. Certain

‘estimates may be based on prevailing market conditions, In some circumstances, rates for certain vessel tyes are

based on theoretical assumptions of premium or discount for particular vessel versus other vessel types,

Disesimer

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 201703310604010923275DatasourcesforpricecalculationNov14 March 15Document3 pages201703310604010923275DatasourcesforpricecalculationNov14 March 15SANDESH GHANDATNo ratings yet

- Govt Link20Document2 pagesGovt Link20SANDESH GHANDATNo ratings yet

- Govt Link17Document1 pageGovt Link17SANDESH GHANDATNo ratings yet

- Govt Link21Document14 pagesGovt Link21SANDESH GHANDATNo ratings yet

- Govt Link12Document1 pageGovt Link12SANDESH GHANDATNo ratings yet

- Govt Link14Document5 pagesGovt Link14SANDESH GHANDATNo ratings yet

- Govt Link19Document12 pagesGovt Link19SANDESH GHANDATNo ratings yet

- Govt Link16Document4 pagesGovt Link16SANDESH GHANDATNo ratings yet

- Govt Link15Document3 pagesGovt Link15SANDESH GHANDATNo ratings yet

- Govt Link18Document7 pagesGovt Link18SANDESH GHANDATNo ratings yet

- Monthly Performance Report MAR 2018Document9 pagesMonthly Performance Report MAR 2018SANDESH GHANDATNo ratings yet

- Govt Link13Document8 pagesGovt Link13SANDESH GHANDATNo ratings yet

- Monthly Performance Report JULY 2019Document5 pagesMonthly Performance Report JULY 2019SANDESH GHANDATNo ratings yet

- Monthly Performance Report JUNE 2019Document5 pagesMonthly Performance Report JUNE 2019SANDESH GHANDATNo ratings yet

- Monthly Performance Report JUNE 2018Document9 pagesMonthly Performance Report JUNE 2018SANDESH GHANDATNo ratings yet

- Monthly Performance Report JAN 2019Document7 pagesMonthly Performance Report JAN 2019SANDESH GHANDATNo ratings yet

- Monthly Performance Report JULY 2018Document9 pagesMonthly Performance Report JULY 2018SANDESH GHANDATNo ratings yet

- MaritimeReporter 2022 05Document68 pagesMaritimeReporter 2022 05SANDESH GHANDATNo ratings yet

- Monthly Performance Report FEB 2019Document8 pagesMonthly Performance Report FEB 2019SANDESH GHANDATNo ratings yet

- Monthly Performance Report JAN 2018Document8 pagesMonthly Performance Report JAN 2018SANDESH GHANDATNo ratings yet

- Monthly Performance Report FEB 2018Document10 pagesMonthly Performance Report FEB 2018SANDESH GHANDATNo ratings yet

- FearnleysDocument7 pagesFearnleysSANDESH GHANDATNo ratings yet

- FearnleysDocument7 pagesFearnleysSANDESH GHANDATNo ratings yet

- FearnleysDocument7 pagesFearnleysSANDESH GHANDATNo ratings yet

- FearnleysDocument7 pagesFearnleysSANDESH GHANDATNo ratings yet

- MaritimeReporter 2022 06Document68 pagesMaritimeReporter 2022 06SANDESH GHANDATNo ratings yet

- AddDocument1 pageAddSANDESH GHANDATNo ratings yet

- Addendum - 4 To RFP No ONGC RFP BOKARO-01 Published On 21.06 .2022Document1 pageAddendum - 4 To RFP No ONGC RFP BOKARO-01 Published On 21.06 .2022SANDESH GHANDATNo ratings yet

- Authorisation LetterDocument1 pageAuthorisation LetterSANDESH GHANDATNo ratings yet

- MaritimeReporter 2022 04Document68 pagesMaritimeReporter 2022 04SANDESH GHANDATNo ratings yet