Professional Documents

Culture Documents

Nanhi Pari Foundation 80g

Nanhi Pari Foundation 80g

Uploaded by

himanshi guptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nanhi Pari Foundation 80g

Nanhi Pari Foundation 80g

Uploaded by

himanshi guptaCopyright:

Available Formats

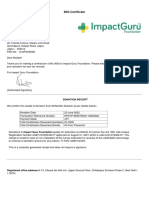

Donation Certificate Receipt under Section 80-G of the Income Tax Act, 1961

Receipt No: DA 07651 Date: 24th November 2022 Pan Number:

From:

Purpose of the Donations Details of the Payment Donation Amount

( INR )

Medical Help for children Transaction Number/Cheque/Cash

Payment ID –001439/HSBCBANK Rs : 40,000.00

In Words: Forty Thousand Rupees Only/-

Khan Mohammed

Azhar Founder- Nanhi

Pari

Nanhi Pari Foundation Pan Number – AACTN2961R

All donations made to Nanhi Pari Foundation, Registration No.: E/31874/Mumbai/2016

are exempt

From income tax under section 80-G of IT Act 1961 Vide Director of Income Tax

(Exemptions), Mumbai Letter No.CIT/(E)/80G/1732(2015-16)/2016-17 dated 06-09-

2016 & accordingly for A.Y.2019-20 ONWARDS, subject to following conditions refer

80G.

This certificate is valid for Tax Exemption in India only.

Nanhi Pari Foundation is a Girl Child Right Organization which works for Education, Health &

Nutrition for Girl Child, Other than this we work for early symptoms & Other Causes that are

responsible for Heart Disease, Cancer & Other major disease

To support us & find out more please visit www.nanhiparifoundationindia.org

Address Ranjit Studio, White House, Ground Floor, Between C & D Block,

Room No – 119, D.S.P. Road. Dadar East. Mumbai – 400014. Email Id – info@nanhiparifoundation.org Mobile

Number - 9664278673

You might also like

- All The Children: Donation ReceiptDocument2 pagesAll The Children: Donation Receiptsathish kumarNo ratings yet

- Form10BE - ALPNA VARMA - 2021 - AABTK6329H06221000050Document1 pageForm10BE - ALPNA VARMA - 2021 - AABTK6329H06221000050hemalatha aNo ratings yet

- Donatekart Foundation: Tax Exempt ReceiptDocument1 pageDonatekart Foundation: Tax Exempt ReceiptSunilSingh100% (1)

- Donation - Nov 2023 - 80GDocument1 pageDonation - Nov 2023 - 80Grohit.kedareNo ratings yet

- Received With Thanks ' 54,606.62 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 54,606.62 Through Payment Gateway Over The Internet FromDr Santosini BeheraNo ratings yet

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDocument5 pagesReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNo ratings yet

- Dengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateDocument1 pageDengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateAbhishek GoelNo ratings yet

- Fee Receipt 2nd QTRDocument1 pageFee Receipt 2nd QTRabhaskumar68No ratings yet

- Donation Receipt One Foundation (Paid)Document1 pageDonation Receipt One Foundation (Paid)shiva krishnaNo ratings yet

- Donatekart Foundation: Tax Exempt ReceiptDocument1 pageDonatekart Foundation: Tax Exempt ReceiptVishal GandhleNo ratings yet

- Maharogi Sewa Samiti, Warora: Acknowledgement of Donation Amount ReceivedDocument1 pageMaharogi Sewa Samiti, Warora: Acknowledgement of Donation Amount ReceivedKawljeet Singh KohliNo ratings yet

- Donation 80GDocument1 pageDonation 80Gmanoj kumarNo ratings yet

- LenskartDocument1 pageLenskartchirag shahNo ratings yet

- Received With Thanks From Mobile: The Sum of Rupees by Towards Donation For Cauvery Calling ProjectDocument1 pageReceived With Thanks From Mobile: The Sum of Rupees by Towards Donation For Cauvery Calling Projectsvka_3aNo ratings yet

- Bharatiya Janata Party Central Office 6A, Pandit Deendayal Upadhyaya Marg, New DelhiDocument1 pageBharatiya Janata Party Central Office 6A, Pandit Deendayal Upadhyaya Marg, New DelhiMadathukulam MuthukumarNo ratings yet

- 2016000000046344Document1 page2016000000046344Sanjay BhayaniNo ratings yet

- SaibabaDocument1 pageSaibabasameer5458100% (1)

- Preventive CheckupDocument1 pagePreventive CheckupRohan Desai0% (1)

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Received With Thanks ' 27,550.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 27,550.00 Through Payment Gateway Over The Internet FromPradeep ChinnamulagundNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation ReceiptAnshulNo ratings yet

- All The Children: Donation ReceiptDocument1 pageAll The Children: Donation ReceiptSYED AJEEZ0% (1)

- Receipt Under Section 80G of The Income Tax ActDocument1 pageReceipt Under Section 80G of The Income Tax ActdpfsopfopsfhopNo ratings yet

- Donation Detail Partner Ngo Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Donation Giveindia Retention TotalSelvamNo ratings yet

- Aspl Invoice 2019-20 Jan'20 To Mar'20Document20 pagesAspl Invoice 2019-20 Jan'20 To Mar'20Gurupada SahooNo ratings yet

- Medical Bill KhajaDocument2 pagesMedical Bill KhajaNagesh AdumullaNo ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- 15180125864942bTbD6sKH05uYfPT PDFDocument1 page15180125864942bTbD6sKH05uYfPT PDFHimanshu ChoukseyNo ratings yet

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- EDonation ReceiptDocument1 pageEDonation ReceiptSrinivasa GarlapatiNo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- Cons-0420925660 08082020170150Document1 pageCons-0420925660 08082020170150Ananya SharmaNo ratings yet

- LTA Bill Template 1 PDFDocument1 pageLTA Bill Template 1 PDF9816494828No ratings yet

- Donation Receipt: Details of DoneeDocument1 pageDonation Receipt: Details of DoneeNaveen BansalNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- Dream Runners FoundationDocument12 pagesDream Runners FoundationdpfsopfopsfhopNo ratings yet

- Ved Vignan Maha Vidya Peeth Receipt For Sai Shruthi Dated (28!07!2019)Document1 pageVed Vignan Maha Vidya Peeth Receipt For Sai Shruthi Dated (28!07!2019)Sai SankalpNo ratings yet

- Bill 12sep2023Document1 pageBill 12sep2023UR12ME148 PrafullaNo ratings yet

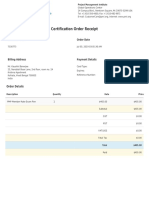

- Certificate Order ReceiptDocument1 pageCertificate Order ReceiptkaushikNo ratings yet

- Donor FormDocument1 pageDonor FormKalpesh MangeNo ratings yet

- Children Charitable Trust: Donation Acknowledgement ReceiptDocument1 pageChildren Charitable Trust: Donation Acknowledgement ReceiptRaghuraman SelvamaniNo ratings yet

- CGF - J0s352ep41Document1 pageCGF - J0s352ep41SIMRA KhanNo ratings yet

- Shri Mata Vaishno Devi Shrine BoardDocument1 pageShri Mata Vaishno Devi Shrine BoardDivine NatureNo ratings yet

- DonationDocument7 pagesDonationSwapnil ChodankarNo ratings yet

- Edonation DNI23010706231125Document1 pageEdonation DNI23010706231125Chintada Netaji PraneethNo ratings yet

- 80G CertificateTax ExemptionDocument56 pages80G CertificateTax ExemptionskunwerNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- Edonation DNI230628122189Document1 pageEdonation DNI230628122189Mohith ReddyNo ratings yet

- District E-Governance Society (RAJSAMAND) Duplicate ReceiptDocument1 pageDistrict E-Governance Society (RAJSAMAND) Duplicate Receiptvikrant paliwalNo ratings yet

- Holding Tax BIHARDocument2 pagesHolding Tax BIHARD-Sign Infotech SevicesNo ratings yet

- Pvss Dav Public School: ReceiptDocument1 pagePvss Dav Public School: ReceiptSanjeevNo ratings yet

- ADITYA Birla Elss 19-20Document2 pagesADITYA Birla Elss 19-20Rajgopal BalabhadruniNo ratings yet

- Health DocumentDocument2 pagesHealth Documentramki240No ratings yet

- Health InsuranceDocument1 pageHealth InsurancecagopalofficebackupNo ratings yet

- Isha Foundation: Bill of Supply / Fee Receipt TO: NoDocument1 pageIsha Foundation: Bill of Supply / Fee Receipt TO: NoMainak SamantaNo ratings yet

- Akanksha P Deshpande - 1451 PDFDocument1 pageAkanksha P Deshpande - 1451 PDFdpfsopfopsfhopNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- STRDocument62 pagesSTRhimanshi guptaNo ratings yet

- Literature Review:: Author Title of The Study Objectives, Outcome or Findings Gap IdentifiedDocument5 pagesLiterature Review:: Author Title of The Study Objectives, Outcome or Findings Gap Identifiedhimanshi guptaNo ratings yet

- WIFI Bill - MayDocument1 pageWIFI Bill - Mayhimanshi guptaNo ratings yet

- Excel 02Document1 pageExcel 02himanshi guptaNo ratings yet