Professional Documents

Culture Documents

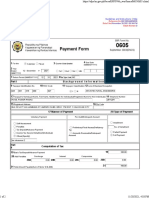

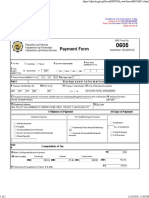

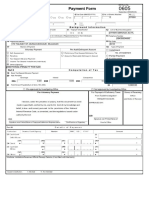

BIR Form No. 0605

Uploaded by

KC AtinonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form No. 0605

Uploaded by

KC AtinonCopyright:

Available Formats

Guidelines and Instructions

| Help

Reference No:292200048487056

Date Filed:June 28 2022 03:51 PM

Batch Number:0

PSOC: PSIC: 2320

BIR Form No.

Republika ng Pilipinas

0605

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas Payment Form September 2003(ENCS)

1 For the 3 Quarter Clear Quarter 4 Due Date 5 No. of Sheets Attached 6ATC

Calendar Fiscal (MM/DD/YYYY)

2 Year

Ended 12 - December 2022 1st 2nd 3rd 4th 06 30 2022 0 FP090

(MM/YYYY)

7 Return Period (MM/DD/YYYY) 06 30 2022 8Tax Type Code MC

Part I Background Information

9 Taxpayer Identification No. 10 RDO Code 11 Taxpayer Classification 12 Line of Business/Occupation

005 145 964 000 124 I N MANUFACTURE OF REFINED PETROLE

13 Taxpayer's Name(Last Name, First Name, Middle Name for Individuals)/(Registered Name for Non-Individuals)

14 Telephone Number

TOTAL PHILIPPINES CORPORATION 8490852

15 Registered Address 16 Zip Code

7/F 11TH CORPORATE CENTER, 11T CORNER TRIANGLE DRIVE, NORTH B FORT BONIFACIO TAGUIG CITY 1630

17 Manner of Payment 18 Type of Payment

Voluntary Payment Per Audit/Delinquent Account

Self-Assessment Installment

Penalties No. of Installment

Preliminary/Final Assess/Deficiency Tax

Tax Deposit/Advance Payment

Accounts Receivable/Delinquent Partial Payment

Income Tax Second Installment(Individual)

Account Full Payment

Others(Specify)

Part II Computation of Tax

19 Basic Tax/Deposit/Advance Payment 19 1,000.00

20 Add Penalties Surcharge Interest Compromise

20A 0.00 20B 0.00 20C 0.00 20D 0.00

21 1,000.00

21 Total Amount Payable(Sum of Items 19 & 20D)

Payment of Deficiency Taxes

For Voluntary Payment From Audit/Investigation

Delinquent Accounts

I declare, Under the penalties of perjury, that this document has been

made in good faith, verified by me, and to the best of my knowledge and

Pre-approved by Investigating Office

belief, is true and correct, pursuant to the provisions of the National

Internal Revenue Code, as amended, and the regulations issued under Not approved by Investigating Office

authority thereof.

Print Payment Details Proceed to Payment

[ BIR Main

| Tax Return Inquiry

|

User Menu

| Guidelines and Instructions

|

Help

]

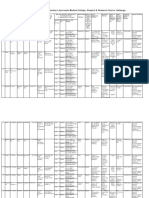

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 0605 2022 BIR Form NoDocument1 page0605 2022 BIR Form NoChristopher AbundoNo ratings yet

- (Filed) Akari Lighting 0605 Payment Form For Itr Fy 2020Document1 page(Filed) Akari Lighting 0605 Payment Form For Itr Fy 2020Gareth TiuNo ratings yet

- eFPS Home Efiling and Payment System PDFDocument2 pageseFPS Home Efiling and Payment System PDFruzell sedanoNo ratings yet

- BIR Form No. 0605 Payment FormDocument1 pageBIR Form No. 0605 Payment FormPAULA TVNo ratings yet

- BIR Form No. 0605 Payment FormDocument1 pageBIR Form No. 0605 Payment FormPAULA TVNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605rhea CabillanNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument1 pageEFPS Home - EFiling and Payment SystemIra MejiaNo ratings yet

- 2020 0605 Return MspaduaDocument1 page2020 0605 Return MspaduaEljoe VinluanNo ratings yet

- CSSM 0605 2023Document1 pageCSSM 0605 2023PAULA TVNo ratings yet

- Payment FormDocument4 pagesPayment FormRodel Rivera VelascoNo ratings yet

- BIR Form 0605 Payment FormDocument1 pageBIR Form 0605 Payment FormbertlaxinaNo ratings yet

- Bir Form No. 0605Document2 pagesBir Form No. 0605Ronald varrie Bautista50% (2)

- BIR Form No. 0605Document2 pagesBIR Form No. 0605Ronald varrie BautistaNo ratings yet

- BIR Form No. 0605 2Document2 pagesBIR Form No. 0605 2Ronald varrie BautistaNo ratings yet

- BIR Form 0605 Payment Form InstructionsDocument2 pagesBIR Form 0605 Payment Form InstructionsRonald varrie BautistaNo ratings yet

- Mci REGDocument3 pagesMci REGPAULA TVNo ratings yet

- BIR Form No. 0605 (2022)Document1 pageBIR Form No. 0605 (2022)Nathan VeracruzNo ratings yet

- BIR Form No. 0605 (2021)Document1 pageBIR Form No. 0605 (2021)Nathan Veracruz100% (1)

- Nilda 1Document1 pageNilda 1Mary Lynn Sta PriscaNo ratings yet

- 2020 With PenaltiesDocument1 page2020 With PenaltiesKashato BabyNo ratings yet

- 0605 Version 1999Document3 pages0605 Version 1999Arlyn PisiaoNo ratings yet

- 0605 PDFDocument2 pages0605 PDFRob Villanueva100% (1)

- 0605Document2 pages0605Kath Rivera60% (42)

- 0605 PDFDocument2 pages0605 PDFeugene badere50% (2)

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene badereNo ratings yet

- BIR Payment Form ExplainedDocument2 pagesBIR Payment Form ExplainedElbert Natal100% (1)

- BIR Payment Form TitleDocument2 pagesBIR Payment Form Titleeugene badere50% (2)

- BIR Form 0605 - Annual Registration FeeDocument2 pagesBIR Form 0605 - Annual Registration FeeRonn Robby Rosales100% (3)

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022justgracelifeNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasLandsNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022CheRylNo ratings yet

- 0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022Document1 page0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022graceNo ratings yet

- Payment FormDocument2 pagesPayment FormDaryl Jay YubalNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasCeslhee AngelesNo ratings yet

- 0605Document3 pages0605iris virtudezNo ratings yet

- BIR Payment FormDocument1 pageBIR Payment FormJrryNo ratings yet

- 6J Store - WPDocument99 pages6J Store - WPAngelo LabiosNo ratings yet

- BIR Payment Form TitleDocument2 pagesBIR Payment Form TitleAngeline Mae Quintana GalayNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Troa BartonNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasAnonymous onBMYp9YNo ratings yet

- 1601C MarchDocument2 pages1601C Marchnaim indahiNo ratings yet

- BIR Payment FormDocument2 pagesBIR Payment FormFildehl JaniceNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022Danel Dave BarbucoNo ratings yet

- Registration FeeDocument1 pageRegistration FeeanakinNo ratings yet

- BIR Payment FormDocument2 pagesBIR Payment FormFratz LaraNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605crypto RN100% (1)

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasLimarOrravanNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas Internasromualdo sawayNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument4 pagesPayment Form: Kawanihan NG Rentas InternasMarinella Catahan MagalingNo ratings yet

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022pcrubin27No ratings yet

- 1601C FebruaryDocument2 pages1601C Februarynaim indahiNo ratings yet

- BIR Form 1601-C Monthly Remittance ReturnDocument2 pagesBIR Form 1601-C Monthly Remittance ReturnCeejay Pagdanganan RosalesNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnFrancis M. TabajondaNo ratings yet

- 0605 Version 1999Document2 pages0605 Version 1999radzNo ratings yet

- BIR Form 0605 Payment FormDocument2 pagesBIR Form 0605 Payment FormJasOn Evangelista100% (2)

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasAlverastine AnNo ratings yet

- Page 1 BirDocument1 pagePage 1 BirAce AbeciaNo ratings yet

- RMO 15-03.38433-2003-Policies - Guidelines - and - Procedures - in - The20210427-11-19opy9gDocument52 pagesRMO 15-03.38433-2003-Policies - Guidelines - and - Procedures - in - The20210427-11-19opy9gKC AtinonNo ratings yet

- RR 8 - 2022wwwDocument10 pagesRR 8 - 2022wwwKC AtinonNo ratings yet

- BIR RULING NO. 485-14.39461-2014-BIR - Ruling - No. - 485-1420210505-11-twf9g6Document8 pagesBIR RULING NO. 485-14.39461-2014-BIR - Ruling - No. - 485-1420210505-11-twf9g6KC AtinonNo ratings yet

- Remittance Form for Final Income TaxesDocument1 pageRemittance Form for Final Income TaxesDhaine PedeReNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022CheRylNo ratings yet

- Payment Form: Covered by A Letter NoticeDocument2 pagesPayment Form: Covered by A Letter NoticeNikholaiZartigaElveñaNo ratings yet

- Payment Form: Under Tax Compliance Verification Drive/Tax MappingDocument2 pagesPayment Form: Under Tax Compliance Verification Drive/Tax MappingtristanjohnmagrareNo ratings yet

- Job Creators For LeppertDocument4 pagesJob Creators For LeppertTom LeppertNo ratings yet

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocument1 pageRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationJames Salviejo PinedaNo ratings yet

- Toyota Production SystemDocument32 pagesToyota Production SystemWawang SukmoroNo ratings yet

- Major Fruitcrops Quarterly Bulletin, April - June 2019 Per PSADocument28 pagesMajor Fruitcrops Quarterly Bulletin, April - June 2019 Per PSAteodyNo ratings yet

- Confirmation Slip CAQ190151Document2 pagesConfirmation Slip CAQ190151MG SanchezNo ratings yet

- Cash Memo FormatDocument6 pagesCash Memo FormatPPP67% (3)

- Exploring The Effectiveness of LCR in IndiaDocument50 pagesExploring The Effectiveness of LCR in IndiaLee SmithNo ratings yet

- Pepsico Fast-Moving Consumer GoodsDocument3 pagesPepsico Fast-Moving Consumer GoodsRABIA MONGA-IBNo ratings yet

- Analysis of Impact of GST With Reference To Perspective of Small Business StakeholdersDocument12 pagesAnalysis of Impact of GST With Reference To Perspective of Small Business StakeholdersnaseeemNo ratings yet

- Nama AkunDocument4 pagesNama AkunAan SoloNo ratings yet

- TDS and TCS Rates for FY 2008-2009Document5 pagesTDS and TCS Rates for FY 2008-2009Naveen Kumar VNo ratings yet

- Organizational Design For Performance Excellence: Goutham MattaDocument11 pagesOrganizational Design For Performance Excellence: Goutham MattaZenon GouthamNo ratings yet

- Warehouse Donation Request 090214Document1 pageWarehouse Donation Request 090214butada basuraNo ratings yet

- Original Kalyani ReportDocument70 pagesOriginal Kalyani ReportRahul Yargattikar100% (1)

- Industrial Revolution PresentationDocument7 pagesIndustrial Revolution PresentationChaudhry BilAlNo ratings yet

- Student Handouts For BananaDocument8 pagesStudent Handouts For Bananaapi-271596792No ratings yet

- Modern Mining Company - Calcined Petroleum Coke Plant - FEED STAGEDocument5 pagesModern Mining Company - Calcined Petroleum Coke Plant - FEED STAGESameer AliNo ratings yet

- Shri Hingulambika Education Society's Ayurvedic Medical College, Hospital & Research Centre, GulbargaDocument6 pagesShri Hingulambika Education Society's Ayurvedic Medical College, Hospital & Research Centre, GulbargaSahal ShaikhNo ratings yet

- Hotel Invoice SummaryDocument4 pagesHotel Invoice SummarySubrata MondalNo ratings yet

- Practicum Sites 2017Document16 pagesPracticum Sites 2017Samantha SonNo ratings yet

- q4 Virtonomics ReportDocument9 pagesq4 Virtonomics Reportapi-410426030No ratings yet

- Historical Trends in Savings and Investment in PakistanDocument22 pagesHistorical Trends in Savings and Investment in PakistanAsad BumbiaNo ratings yet

- Growth of Labour Legislation in IndiaDocument4 pagesGrowth of Labour Legislation in Indiavisha07100% (7)

- Microeconomics Chapter: Consumer Choice TheoryDocument51 pagesMicroeconomics Chapter: Consumer Choice Theoryjokerightwegmail.com joke1233No ratings yet

- India's Rice Industry Outlook Remains Stable on Bumper ProductionDocument4 pagesIndia's Rice Industry Outlook Remains Stable on Bumper Productiongerabharat87No ratings yet

- Skjermbilde 2023-06-03 Kl. 19.25.41 (20 Files Merged)Document31 pagesSkjermbilde 2023-06-03 Kl. 19.25.41 (20 Files Merged)JohanneNo ratings yet

- High Rise Building Structures and TrendsDocument9 pagesHigh Rise Building Structures and Trendsshuyahsaras100% (2)

- MACROECONOMICSDocument4 pagesMACROECONOMICSHarshit BelwalNo ratings yet

- 1 - Developing Strategy For Geothermal Drilling in Indonesia - FinalDocument44 pages1 - Developing Strategy For Geothermal Drilling in Indonesia - Finalrora zaalaibihNo ratings yet

- 315310Document9 pages315310Kateryna TernovaNo ratings yet