Professional Documents

Culture Documents

Manajemen Keuangan (Z-Akunt)

Uploaded by

hayin santosoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manajemen Keuangan (Z-Akunt)

Uploaded by

hayin santosoCopyright:

Available Formats

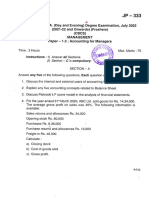

UNIVERSITAS HAYAM WURUK PERBANAS SURABAYA

MIDTERM TEST 2021/2022

SUBJECT : FINANCIAL MANAGEMENT (Accounting Class ZF)

DATE : Tuesday, November 2nd, 2021

DURATION : 120 MINUTES

Note: You may use a financial calculator to assist in solving the problem. But you must

present the steps or details of calculation in answering sheet. Otherwise, the mark will

be zero.

1. (20%). Mr. Dago is considering investing in ABC stock that has the following

distribution of possible one-year returns:

Economic Conditions Probability of Possible Return

Occurrence

Recession 0.10 -0.10

Below Normal 0.20 0.00

Normal 0.30 0.10

Above Normal 0.30 0.20

Boom (Peak) 0.10 0.30

Based on the above information, you are required to:

a. Calculate the expected return of the investment!

b. Calculate the risk (standard deviation) of the investment!

c. If Mr. Dago consider to add one more stock (say stock XYZ) in his portfolio that has

a negative correlation (say - 0,5) with stock ABC. Does this stock addition increase or

decrease the portfolio risk? Explain your argument!

2. (25%) PT. Rainbow is considering two mutually projects A and B below:

Year Project A Project B

(in million (in million Rp.)

Rp.)

0 -200 -200

1 30 50

2 50 50

3 70 50

4 40 50

5 30 50

You are required to:

a. Explain the different between independent projects and mutually exclusive project!

Give examples!

b. Calculate the Payback Period

c. Calculate Discounted payback period if discount rate 10%

d. NPV for the projects if discount rate 10%

e. IRR

f. Which projects would you choose?

3. (25%) Techno Network may upgrade its modem pool. It last upgraded 2 years ago, when

it spent Rp.115 million on equipment with an assumed life of 5 years (3 years remaining)

and an assumed salvage value of Rp.15 million for tax purpose. The firm uses straight line

depreciation. The old equipment can be sold today for Rp.80 million. A new modem pool

can be installed today for Rp.150 million. There will have a 3 years life and will be

depreciated to zero (no salvage value) using straight line. The new equipment will enable

the firm to increase sales by Rp.25 million per year and decrease operating cost by Rp.10

million per year. At the end of 3 years the new equipment will be worthless. Assume the

firm tax rate is 25%.

You are required to:

a. Explain the meaning of incremental cash flows in capital budgeting!

b. Calculate the Initial outlays (t0)

c. Calculate the Annual Operating Cash Flow (t1 – t3)

d. Calculate the Terminal value (t3)

4. (15%). Mr. Daddy is evaluating a stock for investment purpose. The stock has just paid a

dividend of Rp.40. The dividend is expected to grow at 10% constantly forever. The

appropriate discount rate (required rate of return) of this stock is 18%. Based on this

information:

a. Estimate the current market price of this stock!

b. If the stock is currently traded at Rp.600, will you buy this stock? Explain the

argument!

5. (15%). Mrs. Diana is a bond investor in the Indonesia Capital Market. She is considering

to buy a government retail bond. This bond has a nominal value of Rp.1.000.000,

maturity of 3 years, and a coupon rate of 9% paid monthly. The appropriate discount rate

for this bond is 10%. Based on this information:

a. Calculate the estimated bond price!

b. Explain the impact of a market interest rate increase on bond price!

You might also like

- Forces and MotionDocument22 pagesForces and MotiongamahimeNo ratings yet

- REYNOSO MBBA507 Final AssessmentDocument7 pagesREYNOSO MBBA507 Final AssessmentGianne Denise ReynosoNo ratings yet

- Ancient Indian ArchitectureDocument86 pagesAncient Indian ArchitectureRishika100% (2)

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- 1908 The Watchower and Herald of Christ's PresenceDocument193 pages1908 The Watchower and Herald of Christ's PresenceTimothy RichesNo ratings yet

- Workshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Document33 pagesWorkshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Ilie Viorel60% (5)

- The Entheogen Review׃ Vol. 16, No. 1 (2008)Document44 pagesThe Entheogen Review׃ Vol. 16, No. 1 (2008)HoorayFrisbeeHead100% (2)

- Case Presentation: Placenta Previa: Crissa Marie D. PinedaDocument42 pagesCase Presentation: Placenta Previa: Crissa Marie D. PinedaCrissa PinedaNo ratings yet

- Vasuanand Bba ProjectDocument66 pagesVasuanand Bba ProjectMaster PrintersNo ratings yet

- University of Tennessee Religious ExemptionDocument3 pagesUniversity of Tennessee Religious ExemptionDonnaNo ratings yet

- FINAN204-21A - Tutorial 7 Week 10Document6 pagesFINAN204-21A - Tutorial 7 Week 10Danae YangNo ratings yet

- BcvTnl-BMAN30111 Exam Paper 2019-20Document7 pagesBcvTnl-BMAN30111 Exam Paper 2019-20ruoningzhu7No ratings yet

- Ugbs 202 Pasco (Lawrence Edinam)Document27 pagesUgbs 202 Pasco (Lawrence Edinam)Young SmartNo ratings yet

- Financial Management (Ba 3601) Assignment Spring 2020 - Bba 6 ADocument7 pagesFinancial Management (Ba 3601) Assignment Spring 2020 - Bba 6 ANoor Nabi ShaikhNo ratings yet

- Practice CorpDocument2 pagesPractice CorpShafiquer RahmanNo ratings yet

- Adv Issues in CapBud - Gr2 9-02 WipDocument24 pagesAdv Issues in CapBud - Gr2 9-02 WipHimanshu GuptaNo ratings yet

- FIN 440: Individual Assignment Total: 50Document12 pagesFIN 440: Individual Assignment Total: 50ImrAn KhAnNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceChhabilal KandelNo ratings yet

- Exam Practice SolutionsDocument11 pagesExam Practice Solutionssir bookkeeperNo ratings yet

- Economy Exam - .2016 Final MSCDocument3 pagesEconomy Exam - .2016 Final MSCabdullah 3mar abou reashaNo ratings yet

- Module-III Portfolio Risk & Return-1 ProblemDocument3 pagesModule-III Portfolio Risk & Return-1 Problemgaurav supadeNo ratings yet

- MainExam 2018 PDFDocument12 pagesMainExam 2018 PDFAnonymous hGNXxMNo ratings yet

- R21 Capital Budgeting Q Bank PDFDocument10 pagesR21 Capital Budgeting Q Bank PDFZidane KhanNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)asdsadsaNo ratings yet

- Corpuz, Aily-Bsbafm2-2-Final Practice ProblemDocument7 pagesCorpuz, Aily-Bsbafm2-2-Final Practice ProblemAily CorpuzNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementgundapola100% (2)

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- GradedDocument6 pagesGradedYagnik prajapatiNo ratings yet

- Exercise On CVP - CB PDFDocument3 pagesExercise On CVP - CB PDFqwertNo ratings yet

- Coursework-1 2013 Mba 680Document5 pagesCoursework-1 2013 Mba 680CarlosNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- ProblemsDocument2 pagesProblemsHuynh Thi Phuong ThuyNo ratings yet

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Treatment GP Graphs and HitsoDocument20 pagesTreatment GP Graphs and HitsodavidNo ratings yet

- Paper14 SolutionDocument15 pagesPaper14 Solutionharshrathore17579No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- 5-Handout Five - Capital Budgeting Techniques-Chapter ThirteenDocument12 pages5-Handout Five - Capital Budgeting Techniques-Chapter ThirteenSharique KhanNo ratings yet

- Cash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)Document10 pagesCash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)hardik100No ratings yet

- 2013 EXAM I Session1Document3 pages2013 EXAM I Session1mathieu652540No ratings yet

- Sample Final SolvedDocument9 pagesSample Final SolvedateiskaNo ratings yet

- BUS1AFB - Assignment 2 - Semester 1 2021 - FINALDocument4 pagesBUS1AFB - Assignment 2 - Semester 1 2021 - FINALChi NguyenNo ratings yet

- Corporate Answer 13 Ledt PDFDocument11 pagesCorporate Answer 13 Ledt PDFHope KnockNo ratings yet

- 2015-Spring-F18-CIA Revision Practice QuestionsDocument2 pages2015-Spring-F18-CIA Revision Practice QuestionsMayal AhmedNo ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementMiconNo ratings yet

- Managerial Finance - QUIZ#2Document6 pagesManagerial Finance - QUIZ#2Simranjeet KaurNo ratings yet

- 134 Accounting Managers FreshersDocument4 pages134 Accounting Managers Freshersdchandru271No ratings yet

- Financial Management V2 PDFDocument28 pagesFinancial Management V2 PDFNeeraj SinghNo ratings yet

- Tutorial Questions - Capital Budgeting 2023-1Document16 pagesTutorial Questions - Capital Budgeting 2023-1Richie Ric JuniorNo ratings yet

- 4402 23 08 HW CAPM Alternatives WACCDocument4 pages4402 23 08 HW CAPM Alternatives WACCZack ZhangNo ratings yet

- Investment & Portfolio MGT AssignmentDocument2 pagesInvestment & Portfolio MGT AssignmentAgidew ShewalemiNo ratings yet

- FTCP Seminar 5 Answers (6) XSXSXSXDocument5 pagesFTCP Seminar 5 Answers (6) XSXSXSXLewis FergusonNo ratings yet

- Accounting Devoir Part BDocument2 pagesAccounting Devoir Part BAbdul HadiNo ratings yet

- Alllied Food ProductsDocument4 pagesAlllied Food ProductsHaznetta HowellNo ratings yet

- MBG-206 2019-20 09-12-2021Document4 pagesMBG-206 2019-20 09-12-2021senthil.jpin8830No ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Assignment#2Document3 pagesAssignment#2Wuhao KoNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- 6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenDocument17 pages6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenSharique KhanNo ratings yet

- UntitledDocument1 pageUntitledSaraswathy ArunachalamNo ratings yet

- Finance Past PaperDocument6 pagesFinance Past PaperNikki ZhuNo ratings yet

- Finance Exam Jan - 2017Document9 pagesFinance Exam Jan - 2017mrdirriminNo ratings yet

- UntitledDocument25 pagesUntitledAyesha AlliNo ratings yet

- Sample Final ExamDocument7 pagesSample Final Examanony88No ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- ALVAREZ, John Edriane A - Experiment No. 1Document7 pagesALVAREZ, John Edriane A - Experiment No. 1John Edriane AlvarezNo ratings yet

- Introduction To Public Policy: Course DescriptionDocument15 pagesIntroduction To Public Policy: Course DescriptionJericko Perez AvilaNo ratings yet

- Statistics II Week 6 HomeworkDocument3 pagesStatistics II Week 6 Homeworkteacher.theacestudNo ratings yet

- British Food Journal: Article InformationDocument8 pagesBritish Food Journal: Article InformationanisaNo ratings yet

- Bourbon Explorer 500 Series Commercial LeafletDocument6 pagesBourbon Explorer 500 Series Commercial LeafletDaniel ZhangNo ratings yet

- NN IP Guidebook To Alternative CreditDocument140 pagesNN IP Guidebook To Alternative CreditBernardNo ratings yet

- Phys172 S20 Lab07 FinalDocument8 pagesPhys172 S20 Lab07 FinalZhuowen YaoNo ratings yet

- Jisicom - Smart System of Fast Internet Access Development Using Backbone Network MethodDocument9 pagesJisicom - Smart System of Fast Internet Access Development Using Backbone Network MethodVerdi YasinNo ratings yet

- Noli and El FiliDocument2 pagesNoli and El FiliGeramei Vallarta TejadaNo ratings yet

- Service Oriented Architecture - Course Notes PDFDocument93 pagesService Oriented Architecture - Course Notes PDFRoberto Luna OsorioNo ratings yet

- The Dedicated - A Biography of NiveditaDocument384 pagesThe Dedicated - A Biography of NiveditaEstudante da Vedanta100% (2)

- Washback Effect in Teaching English As An International LanguageDocument13 pagesWashback Effect in Teaching English As An International LanguageUyenuyen DangNo ratings yet

- Grammar - File12 C ROMERO VIDALDocument3 pagesGrammar - File12 C ROMERO VIDALYuy Oré Pianto50% (2)

- RK20 Power Flow SparseDocument33 pagesRK20 Power Flow Sparsejohn smithNo ratings yet

- STP280 - 24Vd - UL (H4 Connector) - AZDocument2 pagesSTP280 - 24Vd - UL (H4 Connector) - AZkiranpandey87No ratings yet

- Dans Swing Trade StrategyDocument3 pagesDans Swing Trade StrategyDimitrios OuzounisNo ratings yet

- QP English Viii 201920Document14 pagesQP English Viii 201920Srijan ChaudharyNo ratings yet

- Srijana BahadurDocument13 pagesSrijana Bahadurkhadija khanNo ratings yet

- Control Grupos Electrogenos LobatoDocument20 pagesControl Grupos Electrogenos LobatoEdwin Santiago Villegas AuquesNo ratings yet

- Unidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFDocument24 pagesUnidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFpedropruebaNo ratings yet

- General Office Administration Level 1 (CVQ) PDFDocument129 pagesGeneral Office Administration Level 1 (CVQ) PDFddmarshall2838No ratings yet

- Formal Language and Automata TheoryDocument18 pagesFormal Language and Automata TheoryAyan DuttaNo ratings yet