Professional Documents

Culture Documents

Provisional Certificate H404HHL0871998

Uploaded by

Prakash BattalaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Provisional Certificate H404HHL0871998

Uploaded by

Prakash BattalaCopyright:

Available Formats

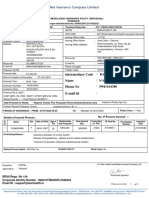

BAJAJ HOUSING FINANCE LIMITED

PROVISIONAL STATEMENT OF HOME LOAN FOR CLAIMING DEDUCTION UNDER SECTION 80(C) AND

24(B) OF THE INCOME TAX ACT, 1961 FOR THE PERIOD FROM 1/4/2022 to 31/3/2023

PRAKASH BATTALA

Agreement number: Date

NO 259 PRADEEPTHI NILAYAM 1C

H404HHL0871998 10-Jan-2023

CROSS 12TH MAIN PHASE 2 JUBILEE

ENGLISH HIGH SCHOOL NRI LAYOUT

BANGALORE Loan sanctioned amount:

KARNATAKA 560016

INDIA

PRAKASH.BATTALA@GMAIL.COM

8919577546 9,068,625.00

To whomsoever it may concern

This is to certify that PRAKASH BATTALA (Loan Account Number - H404HHL0871998) has/have been granted

a Housing Loan of Rs. 9,068,625.00 in respect of the following property.

Address: Under Construction Property Bearing No. 1, 8th B

Cross Road, Phase 2, NRI Layout, Kalkere Village

Applicant PRAKASH BATTALA

K R Puram, Bangalore

KARNATAKA

BANGALORE

Co-Applicant P DEEPTHI CHAITHANYA 560016

The above loan is repayable in Equated Monthly Installments (EMIs) comprising of the principal and the interest.

The breakup of this amount into Principal and Interest is as follows:

Payable from 1/4/2022 to 31/3/2023

Principal Rs. 551,583.00

Interest Rs. 309,822.00

Total Rs. 861,405.00

Notes:

- Interest is calculated on monthly rates. Principal repayments are credited at the end of each month.

- Interest and Principal figures are subject to change in case of partpayment/s and/or change in repayment schedule

Principal repayments through EMIs and/or Prepayments qualify for deduction under Section 80C,if the amounts are actually paid by 31/3/2023.

- Deduction under Section 80C can be claimed only if:

i. The repayment of the loan is made out of income chargeable to tax and

ii. The property for which the loan is taken is not transferred before the expiry of 5 years from the end of the financial year in which

the possession of such property is obtained.

- The PAN and Registered Office Address of BAJAJ HOUSING FINANCE LIMITED are as under:

a) Pan Number: AADCB6018P

b) Registered Office: Bajaj Auto Limited Complex, Mumbai- Pune Road, Akurdi- 411035.

These conditions have not been verified by BAJAJ HOUSING FINANCE LIMITED.

- Interest payable on the loan (including Pre-EMI Interest, if any) is allowed as a deduction under Section 24(b).

This statement being provisional in nature requires no authorization from BAJAJ HOUSING FINANCE LIMITED.

Note: This is system generated letter and hence does not require any signature.

BAJAJ HOUSING FINANCE LIMITED.

You might also like

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- Provisional Fy 20-21Document1 pageProvisional Fy 20-21Kedar YadavNo ratings yet

- Provisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernDocument1 pageProvisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernVenkateshNo ratings yet

- ProvisionalInterestCertificate H403HHL0576456Document1 pageProvisionalInterestCertificate H403HHL0576456AyazNo ratings yet

- HDFC 876Document1 pageHDFC 876Xen Operation DPHNo ratings yet

- IT Certificate 608466263Document1 pageIT Certificate 608466263Selvakumaran GNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- (Cin) L65190mh2004goi148838Document2 pages(Cin) L65190mh2004goi148838Kantesh KudapaliNo ratings yet

- IT CertificateDocument2 pagesIT CertificatePrashant TiwariNo ratings yet

- Star HealthDocument1 pageStar HealthpalanivelNo ratings yet

- LIC Housing Finance LTDDocument1 pageLIC Housing Finance LTDanand7602No ratings yet

- Ogl To CTC 28jul3Document1 pageOgl To CTC 28jul3Omkar DasNo ratings yet

- Loan Details: TWO - Wheeler Sandhya Automotives, KURNOOLDocument1 pageLoan Details: TWO - Wheeler Sandhya Automotives, KURNOOLmohammed rafiNo ratings yet

- IntCertEduLoanProvisional10 01 2022Document1 pageIntCertEduLoanProvisional10 01 2022ajay chaudharyNo ratings yet

- Policy CertificateDocument5 pagesPolicy CertificateRahulpatel25No ratings yet

- 524243536624287Document1 page524243536624287support marenNo ratings yet

- DS Policy Schedule 11230207673409 V1.0Document4 pagesDS Policy Schedule 11230207673409 V1.0Rajesh KsmNo ratings yet

- DHLF - Loan Sanction LetterDocument2 pagesDHLF - Loan Sanction LetterRaju BhaiNo ratings yet

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinNo ratings yet

- Policy Doc PDFDocument4 pagesPolicy Doc PDFGajen SinghNo ratings yet

- Provisional CertificateDocument1 pageProvisional CertificateNiklesh ChandakNo ratings yet

- Policy DocDocument6 pagesPolicy DocOmer Adelalamin AliNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- IT Certificate 664154430Document1 pageIT Certificate 664154430RajanNo ratings yet

- HDFC 1Document1 pageHDFC 1Vivekananda PenumarthiNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- Mercedes C250 RCDocument1 pageMercedes C250 RCKushal PatelNo ratings yet

- In Gov transport-RVCER-KA51MG3551Document1 pageIn Gov transport-RVCER-KA51MG3551RamabudihalNo ratings yet

- Higher Education Loans BoardDocument8 pagesHigher Education Loans BoardDON ONNYANGONo ratings yet

- Registered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Document1 pageRegistered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Khushi Jain100% (1)

- AC Bajaj Finance - 2Document2 pagesAC Bajaj Finance - 2prsnjt11No ratings yet

- Dear Munish SharmaDocument2 pagesDear Munish SharmaMunish SharmaNo ratings yet

- Manish Negi A1412020004 Interest Certificate 2015 16Document3 pagesManish Negi A1412020004 Interest Certificate 2015 16Ajinkya Bagade0% (1)

- Consolidated Premium Paid STMT 2020-2021 PDFDocument1 pageConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNo ratings yet

- View Certificate PDFDocument1 pageView Certificate PDFRama RaoNo ratings yet

- Registration Certificate of Vehicle: Issuing Authority: Madhubani, BiharDocument1 pageRegistration Certificate of Vehicle: Issuing Authority: Madhubani, Bihartabrez alamNo ratings yet

- Lic HFL PDFDocument1 pageLic HFL PDFSrinivasulu SambaNo ratings yet

- Sanction 4Document4 pagesSanction 4ParinithNo ratings yet

- 2018091800024Document3 pages2018091800024Gunjan ShahNo ratings yet

- Homeloancertificate - 38180652 DBFDBDocument1 pageHomeloancertificate - 38180652 DBFDBKRIS BARSAGADE100% (1)

- 1643730083633Document1 page1643730083633Saurabh ChoudharyNo ratings yet

- Sanction LetterDocument7 pagesSanction LetterPrimon KarmakarNo ratings yet

- Web It CertDocument1 pageWeb It CertSuppy PNo ratings yet

- Chandra496 - Provisional Interest CertificateDocument2 pagesChandra496 - Provisional Interest CertificateChandrasekhar Nandigam100% (1)

- View CertificateDocument1 pageView CertificateadiNo ratings yet

- Provisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernDocument2 pagesProvisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernKumar AbhisshekNo ratings yet

- Tata AIA Life Diamond Savings PlanDocument4 pagesTata AIA Life Diamond Savings Plansree db2No ratings yet

- Invoice - Dhanraj1992 APRIL-23 PDDocument1 pageInvoice - Dhanraj1992 APRIL-23 PDAinta GaurNo ratings yet

- Principal Amount Payable: Interest Amount Payable: Rs. 19,684.19 Rs. 1,435.81Document1 pagePrincipal Amount Payable: Interest Amount Payable: Rs. 19,684.19 Rs. 1,435.81Sarath KumarNo ratings yet

- Branch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest Certificatesudarsan kingNo ratings yet

- Welcome LetterDocument4 pagesWelcome LetterChetan ChoudharyNo ratings yet

- DS Policy Schedule 11230074563901 V1.0Document5 pagesDS Policy Schedule 11230074563901 V1.0Soorya ArunthavamNo ratings yet

- Bajaj Allianz Life InsuranceDocument1 pageBajaj Allianz Life InsuranceMirzaNo ratings yet

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- Axis Interest Certificate 2021 2022 1668998098463Document2 pagesAxis Interest Certificate 2021 2022 1668998098463Lovely PavaniNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)sarath potnuriNo ratings yet

- Happy Family Floater-2015 Policy Schedule: UIN: IRDAI/HLT/OIC/P-H/V.II/450/15-16Document4 pagesHappy Family Floater-2015 Policy Schedule: UIN: IRDAI/HLT/OIC/P-H/V.II/450/15-16Sanjay ShahNo ratings yet

- PHR051401998301-Final IT CertificateDocument2 pagesPHR051401998301-Final IT Certificateamjad.shaik0128No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- Professional Summary: Phone No: 9886577788 Email IdDocument3 pagesProfessional Summary: Phone No: 9886577788 Email IdPrakash BattalaNo ratings yet

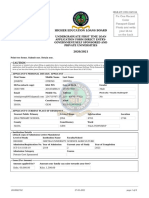

- Deepthi Medical Insurance 2022-2023Document1 pageDeepthi Medical Insurance 2022-2023Prakash BattalaNo ratings yet

- CC Certificate PrakashDocument1 pageCC Certificate PrakashPrakash BattalaNo ratings yet

- PRABHAVATHI Form26QBDocument2 pagesPRABHAVATHI Form26QBPrakash BattalaNo ratings yet

- Prabhavathi ChallanDocument1 pagePrabhavathi ChallanPrakash BattalaNo ratings yet

- Prakash B Medical Insurance 22-23Document1 pagePrakash B Medical Insurance 22-23Prakash BattalaNo ratings yet

- Statement of Account H404HHL0889486Document2 pagesStatement of Account H404HHL0889486Prakash BattalaNo ratings yet

- Tax Proof Fy 20-21 Refno:751 Employee Code 1000452 Name Prakash Naidu Battala Department 35Ln Pan Ahlpn1901DDocument6 pagesTax Proof Fy 20-21 Refno:751 Employee Code 1000452 Name Prakash Naidu Battala Department 35Ln Pan Ahlpn1901DPrakash BattalaNo ratings yet

- Hi Prakash Battala,: Investor Name: Prakash Battala Email Phone PAN No BankDocument1 pageHi Prakash Battala,: Investor Name: Prakash Battala Email Phone PAN No BankPrakash BattalaNo ratings yet

- Life-Cycle Cost Analysis (LCCA) of Buildings: Jere RaunamaDocument14 pagesLife-Cycle Cost Analysis (LCCA) of Buildings: Jere RaunamatareqNo ratings yet

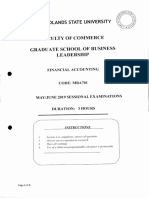

- Example of BookkepingDocument8 pagesExample of BookkepingMathew Visarra0% (1)

- Options Strategies PDFDocument66 pagesOptions Strategies PDFsrinivas_urv100% (3)

- 1 - Solution 2013Document10 pages1 - Solution 2013Yamer YusufNo ratings yet

- How To Decide Cut-Off Grade Based On Distribution of Ore GradeDocument5 pagesHow To Decide Cut-Off Grade Based On Distribution of Ore GradeG S RehanNo ratings yet

- Course DetailDocument3 pagesCourse DetailNajlaNo ratings yet

- Statcon DigestDocument1 pageStatcon DigestMaria JicaNo ratings yet

- File 261Document16 pagesFile 261Bharat Kumar PatelNo ratings yet

- Midterm Exam GovaccDocument3 pagesMidterm Exam GovaccEloisa JulieanneNo ratings yet

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- Accounting For Business Combination PART 1Document30 pagesAccounting For Business Combination PART 1Niki DimaanoNo ratings yet

- Partnership: Basic Considerations and Formation: Advance AccountingDocument53 pagesPartnership: Basic Considerations and Formation: Advance AccountingZyrah Mae Saez100% (1)

- Council Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.ukDocument2 pagesCouncil Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.ukSteven HamiltonNo ratings yet

- How Do Small Business Loans Work?Document3 pagesHow Do Small Business Loans Work?Soumyajit Das MazumdarNo ratings yet

- Mumbai Port Trust Land DevelopmentDocument69 pagesMumbai Port Trust Land DevelopmentAniruddh Kanade100% (2)

- Market Breadth BrochureDocument10 pagesMarket Breadth BrochureStevenTsaiNo ratings yet

- Mathoot Finanace ProjectsDocument32 pagesMathoot Finanace ProjectsMayank Jain NeerNo ratings yet

- InvocieDocument1 pageInvociepankajsabooNo ratings yet

- MBA731 Class Activity Question 2 CashflowDocument5 pagesMBA731 Class Activity Question 2 CashflowWisdom MandazaNo ratings yet

- SWOTDocument5 pagesSWOTAviraj KharadeNo ratings yet

- 2017 ADB Annual ReportDocument104 pages2017 ADB Annual ReportFuaad DodooNo ratings yet

- Final ITC Vs HULDocument15 pagesFinal ITC Vs HULpurvish13No ratings yet

- THE 10th INTERNATIONAL CONFERENCE ON ISLAMIC ECONOMICS AND FINANCE (ICIEF) Institutional Aspects of Economic, Monetary and Financial ReformsDocument21 pagesTHE 10th INTERNATIONAL CONFERENCE ON ISLAMIC ECONOMICS AND FINANCE (ICIEF) Institutional Aspects of Economic, Monetary and Financial ReformsKhairunnisa MusariNo ratings yet

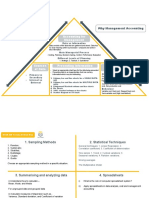

- FMA MindmapDocument6 pagesFMA MindmapJ.S. AlbertNo ratings yet

- CRLP (A) 17169 2014Document51 pagesCRLP (A) 17169 2014Akshay DhawanNo ratings yet

- Wallstreetjournal 20180531 TheWallStreetJournalDocument34 pagesWallstreetjournal 20180531 TheWallStreetJournalMadhav BhattaraiNo ratings yet

- FABM 2 NotesDocument4 pagesFABM 2 NotesShiny Natividad100% (1)

- Nyaradzo CVDocument3 pagesNyaradzo CVNyaradzo MachanyangwaNo ratings yet

- Introduction To Accounting For Construction ContractsDocument4 pagesIntroduction To Accounting For Construction ContractsJohn TomNo ratings yet

- Option Markets & ContractsDocument46 pagesOption Markets & Contractsroshanidharma100% (1)