Professional Documents

Culture Documents

Council Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.uk

Uploaded by

Steven HamiltonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Council Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.uk

Uploaded by

Steven HamiltonCopyright:

Available Formats

Council Tax 2019 to 2020

This leaflet forms part of your Council Tax Notice and should be read along with the information

contained in the notice.

Council Tax is applied across a range of bands from A to H, with all bands having a relationship with band D, known as the multiplier.

The Scottish Government changed the council tax multipliers for properties in Bands E to H from 1 April 2017.

In addition to the 3% increase in Council Tax charge, if your property is in Band E to H, your 2019/20 notice will reflect this change.

For more information on this change visit www.northlanarkshire.gov.uk/council-tax-bands

• WATER AND WASTE WATER CHARGES

The Scottish Water and Sewerage Charges have increased by 1.6%. For more information contact customer helpline on 0800 0778778 or visit their website

www.scottishwater.co.uk/unmeteredcharges

• THE BEST WAY TO PAY IS BY DIRECT DEBIT

If you opt to pay by Direct Debit you can pay over 10 or 12 months and can choose from five dates to assist with budgeting.

Set up a Direct Debit – Freephone 0800 163491.

For details of other methods of payment, see your Council Tax notice or visit www.northlanarkshire.gov.uk

• WHO IS RESPONSIBLE FOR PAYING COUNCIL TAX?

Council Tax is normally paid by the people who are living in the property. Civil partners, couples, joint owners or joint tenants are responsible, ‘jointly and

severally’, for making the payment. ‘Jointly and severally’ means that the amount on the bill is not split into shares and we can choose to collect the full

Council Tax charge from anyone legally responsible for it.

• HAVING PROBLEMS PAYING?

If you have missed any of your payments, please call us on 01698 403210 as soon as possible. Remember that if we do not know you are having

problems paying, we cannot help you. If you are experiencing financial difficulties or you would like information or advice on debt management, budget

planning or ethical lending help and assistance available at www.northlanarkshire.gov.uk/yourmoney

• DISCOUNTS

You may be entitled to a 25% Discount if you are the only adult in your home or there is another adult (18 years and over) who falls into certain disregarded

categories such as student/student nurse, apprentice/modern apprentice. More information on discount categories is available at

www.northlanarkshire.gov.uk/council-tax-discounts

• EMPTY PROPERTY DISCOUNTS

The discount is 10% or 50% where the property is not a liable person’s sole or main residence depending on the circumstances. However, if the property is

continuously empty for more than 12 months, it may be subject to an increased levy of 100% Council Tax charge. More information is available at

www.northlanarkshire.gov.uk/empty-property-discount

• DISABLED PERSONS REDUCTION

You can claim a Disabled Person’s Reduction if certain adaptations have been made to your home; or if extra rooms are needed for the disabled person’s

wellbeing. More information is available at www.northlanarkshire.gov.uk/disabled-persons-relief

• EXEMPTIONS

You may be exempt from paying Council Tax for six months if your home is empty and unfurnished. This also applies to other categories such as occupied

only by students; anyone under 18 years old; property occupied solely by people with severe mental impairment; where owner is deceased or resident in a

nursing home or hospital. More information on exemption categories is available at www.northlanarkshire.gov.uk/council-tax-exemptions

• APPEALS

You may have the right to appeal against your council tax banding. Such appeals are currently only possible in limited circumstances.

You can appeal online at https://www.saa.gov.uk/online-forms/council-tax-proposals/ or in writing to The Lanarkshire Joint Valuation Board, Phone

01698 476000 Email: assessor@lanarkshire-vjb.gov.uk

You may also appeal if you are aggrieved at the actions of the Council in calculating or collecting your council tax. Write to:

Head of Financial Solutions, PO Box 9060, Motherwell, ML1 1SH stating your grounds for appeal. If you are not satisfied with the response you do have

a further right of appeal to a Valuation Appeal Committee. Please contact your local council tax office for further information on the procedures you must

follow to submit a valid appeal. You must continue to pay your Council Tax until a decision on your appeal has been made.

• AUDIT SCOTLAND NATIONAL FRAUD INITIATIVE

North Lanarkshire Council is participating in the Audit Scotland National Fraud Initiative, a data matching exercise which involves sharing data between

public and private sector bodies to prevent and detect fraud. Further information is available at www.northlanarkshire.gov.uk/national-fraud-initiative or the

Audit Scotland’s website (www.audit-scotland.gov.uk). For more information on how we process your data visit http://www.northlanarkshire.gov.uk/privacy

• COUNCIL TAX REDUCTION (CTR)

If you are a low earner, a pensioner, or on benefits, and are responsible for paying Council Tax, you may be entitled to claim CTR of up to 100%.

CTR will not cover Scottish Water’s charges. You can complete an application online at www.northlanarkshire.gov.uk/benefitcalculator.

If you wish to appeal your CTR assessment write to: Head of Financial Solutions, PO Box 9060, Motherwell, ML1 1SH

If you are still dissatisfied with your decision you can seek an independent ruling from the Council Tax Reduction Panel who will conduct a further review.

An application should be made directly to them by yourself or representative. Further Appeal Information is available via their website

http://counciltaxreductionreview.scotland.gov.uk/ or by telephoning 0141 302 5840.

• SPENDING ON OUR SERVICES

Council Tax Notice 2019-20– Analysis of Service Expenditure

2019-20 Net 2018-19 Net Change from Band D Council

Expenditure Expenditure 2018-19 Tax Equivalent

£’000 £’000 £’000 % £

Chief Executive 48,440 53,493 (5,052) (9.45)% 385

Enterprise & Communities 114,954 116,765 (1,811) (1.55)% 914

Education & Families 456,443 434,946 21,496 4.94% 3,628

Health & Social Care 148,689 139,569 9,120 6.53% 1,182

Joint Boards 12,403 12,237 166 1.36% 99

Totals 780,929 757,010 23,919 3.16%

Financed by:-

Government Grants 527,453 504,534

Non Domestic Rates 107,252 114,474

Use of Balances and Reserves 4,729 2,502

Total needed from Council Taxes 141,494 135,500

Band ‘D’ council tax 2019-20 1,164.87

Band ‘D’ council tax 2018-19 1,130.94

Scottish average band ‘D’ council tax for 2018-19 1,207.85

Council employees (full time equivalent)

2018-19 12,149

2019-20 estimate 12,106

decrease 43

Comparison of council expenditure proposals per household with Government provisions

Expenditure figures assumed by Government in Aggregate External Finance provisions (grant support) £4,876

Proposed spending by council on comparable basis £5,137

Revenue Budget 2019-20

North Lanarkshire Council set its net budget for 2019-20 at £780.929 million, of which £634.705 million (81%) is estimated to be funded by government

grants and non-domestic rates, £141.495 million from council tax, and £4.729 million from one-off Council balances.

The Band D council tax level will increase by 3% to £1,164.87, continuing the trend of a council tax rate below the Scottish average. With council tax levels

ranging from £776.58 (Band A) to £2,853.92 (Band H), your council tax helps fund a variety of much needed services to the community including: educating

children, supporting the most vulnerable members of our society, improving and maintaining our roads and local environment, and providing cultural, leisure

and recreation facilities.

In setting its 2019-2020 budget, the Council has continued its commitment to the Club 365 initiative, investing £1 million to provide free meals to pupils at

weekends and holidays. In addition the Council established a Community Investment Fund for capital investment in the communities.

As in previous years, the Council continues to face challenging financial times, with its 2019-2020 government grant showing a decrease of 1.7% on the

previous 2018-2019 grant level on a like for like basis, despite the Council facing significant cost pressures. Reflecting ring-fenced and directed funding an

overall increase of 2.5% in funding was received. However, the Council has set a balanced budget, which per the service expenditure table provided,

illustrates additional spend of £23.919 million compared to the 2018-2019 position.

In setting its 2019-2020 revenue budget, the Council has therefore:

• Funded unavoidable cost pressures totalling £23.766 million in respect of employee costs, contractual obligations and strategic priorities;

• Approved base budget adjustments totalling £13.236 million to reflect efficiency measures undertaken, including staff restructures. These

base budget adjustments significantly reduced the potential budget gap and the consequent need for savings;

• Approved savings totalling £13.830 million, and service enhancements of £1.026 million

• Approved the use of £4.729 million of the balances it holds;

• Remained committed to protecting and providing vital services required by its community.

The number of posts within the Council is estimated to decrease by 43 (0.35%) to reflect the reconfiguration of services which result from the Council

approving service restructures and the 2019-20 savings package noted above.

You might also like

- Notice of Assessment 2020 03 12 18 58 03 155882Document4 pagesNotice of Assessment 2020 03 12 18 58 03 155882Dishantt GandhiNo ratings yet

- Council Tax Sample BilllDocument2 pagesCouncil Tax Sample BilllMaisa SantosNo ratings yet

- Notice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Document4 pagesNotice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Therese FadelNo ratings yet

- Bamboo Proposal PDFDocument7 pagesBamboo Proposal PDFCirilo Jr. Lagnason100% (1)

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax DocumentYerina Elizabeth Feliz PinedaNo ratings yet

- Mock 1Document14 pagesMock 1Simon YossefNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- CT 2018 FinalDocument19 pagesCT 2018 FinalminorblueNo ratings yet

- Council Tax LeafletDocument2 pagesCouncil Tax LeafletabaragbcNo ratings yet

- Council Tax Additional Info For WebDocument6 pagesCouncil Tax Additional Info For WebKomagalNo ratings yet

- 2019 Tax Year Assessment Ivolpe PDFDocument5 pages2019 Tax Year Assessment Ivolpe PDFLISA VOLPENo ratings yet

- Apac BFP 2015-16Document202 pagesApac BFP 2015-16derr barrNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 853056Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 853056api-676582318No ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- Nueva Vizcaya Executive Summary 2020Document11 pagesNueva Vizcaya Executive Summary 2020Emille MercadoNo ratings yet

- How Your Council Tax Bill Has Been Worked Out How Your Council Tax Bill Has Been Worked OutDocument2 pagesHow Your Council Tax Bill Has Been Worked Out How Your Council Tax Bill Has Been Worked Outmagurean.viorel18No ratings yet

- Non-Domestic Rates Bill 2018/19: Please Quote On All EnquiriesDocument4 pagesNon-Domestic Rates Bill 2018/19: Please Quote On All Enquiriesautos osmanNo ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax Documentjohnsonwto15No ratings yet

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Document4 pagesCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Notice of Assessment 2022 03 17 11 16 57 195191Document4 pagesNotice of Assessment 2022 03 17 11 16 57 195191api-676582318No ratings yet

- ACC 3013 - Revision Material - 201920Document34 pagesACC 3013 - Revision Material - 201920falnuaimi001No ratings yet

- Council Tax Demand Notice 2020/2021: :-U-Can) 82®Document2 pagesCouncil Tax Demand Notice 2020/2021: :-U-Can) 82®Amruta Lambat DaulatkarNo ratings yet

- 2019-2020 - VoteBFP - 755 - Jinja Municipal Council - Budget Framework PaperDocument18 pages2019-2020 - VoteBFP - 755 - Jinja Municipal Council - Budget Framework PaperJohn KimutaiNo ratings yet

- Fort Portal MC BFPDocument89 pagesFort Portal MC BFPTim KarmaNo ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax Documentjohnsonwto15No ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Budget SummaryDocument16 pagesBudget SummaryMichael FelthamNo ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Level 2 DifficultDocument4 pagesLevel 2 DifficultSamuel FerolinoNo ratings yet

- Finance Act 2021 - ACCA GlobalDocument56 pagesFinance Act 2021 - ACCA GlobalhfdghdhNo ratings yet

- Cut Your Council Tax 2020Document4 pagesCut Your Council Tax 2020AlpamisNo ratings yet

- Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDocument2 pagesDate of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDaniel HollandsNo ratings yet

- Income Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Document5 pagesIncome Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Maria PatinoNo ratings yet

- Extct Bill 905431x 677697Document2 pagesExtct Bill 905431x 677697clinica.sante.resultsNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- Budget 2010 Highlights Income TaxDocument8 pagesBudget 2010 Highlights Income TaxparthsomaiyaNo ratings yet

- July 20 Grand Forks Bochenski Budget PowerpointDocument68 pagesJuly 20 Grand Forks Bochenski Budget PowerpointJoe BowenNo ratings yet

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDocument11 pagesAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNo ratings yet

- Solution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDocument14 pagesSolution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDevender SharmaNo ratings yet

- PalawanProv ES2019Document11 pagesPalawanProv ES2019Smile Laugh and Be InspiredNo ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- Guimbal Executive Summary 2019Document5 pagesGuimbal Executive Summary 2019AllynMae TurijaNo ratings yet

- Bel Air BudgetDocument15 pagesBel Air BudgetelizabethNo ratings yet

- Scenario - Taxation 2019 UNISA - Level 1 Test 4Document7 pagesScenario - Taxation 2019 UNISA - Level 1 Test 4Tyson RuvengoNo ratings yet

- 2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDocument8 pages2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDougNo ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- DocumentDocument3 pagesDocumentMaria Kathreena Andrea AdevaNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (34)

- Tax Reform Acceleration and InclusionDocument28 pagesTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreNo ratings yet

- Tax Data Card 30 June 2014Document9 pagesTax Data Card 30 June 2014api-300877373No ratings yet

- 11 Appendix J B 1st-31st March 2020 - 2Document2 pages11 Appendix J B 1st-31st March 2020 - 2Adita DayNo ratings yet

- F6 - IPRO - 2021 - Mock 1 - AnswersDocument16 pagesF6 - IPRO - 2021 - Mock 1 - AnswersHussein SeetalNo ratings yet

- TX - SUCCESSDocument113 pagesTX - SUCCESSBiKâSH JhâNo ratings yet

- F6uk 2011 Dec QDocument12 pagesF6uk 2011 Dec Qmosherif2011No ratings yet

- Update On Québec's Economic and Financial Situation - Fall 2019 - in BriefDocument8 pagesUpdate On Québec's Economic and Financial Situation - Fall 2019 - in BriefamyluftNo ratings yet

- Budget 2012 Update PresentationDocument27 pagesBudget 2012 Update Presentationsarah_bradshaw1576No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Electrician of Tomorrow 2023Document18 pagesElectrician of Tomorrow 2023Steven HamiltonNo ratings yet

- Warner Howard: The High Speed Low Energy Dryer FromDocument2 pagesWarner Howard: The High Speed Low Energy Dryer FromSteven HamiltonNo ratings yet

- Council Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.ukDocument2 pagesCouncil Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.ukSteven HamiltonNo ratings yet

- Dimmer Switch (2 Gang) : Instruction ManualDocument30 pagesDimmer Switch (2 Gang) : Instruction ManualSteven HamiltonNo ratings yet

- Technical Application Guide Optotronic Led Drivers For Indoor Applications GBDocument68 pagesTechnical Application Guide Optotronic Led Drivers For Indoor Applications GBSteven HamiltonNo ratings yet

- First Baby Shoes Foot Print Measure Sheet PDFDocument1 pageFirst Baby Shoes Foot Print Measure Sheet PDFSteven Hamilton100% (1)

- Product Information SheetDocument2 pagesProduct Information SheetArtyyxNo ratings yet

- User Manual: BES45101LMDocument32 pagesUser Manual: BES45101LMSteven HamiltonNo ratings yet

- Secretary of State Letter Construction IndustryDocument1 pageSecretary of State Letter Construction IndustrySteven HamiltonNo ratings yet

- Strength & Conditioning Becoming Husker Tough: 2017-18 Nebraska Women'S BasketballDocument2 pagesStrength & Conditioning Becoming Husker Tough: 2017-18 Nebraska Women'S BasketballSteven HamiltonNo ratings yet

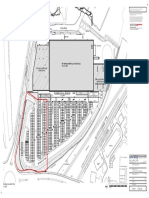

- Planning Statement: Ediston Properties LimitedDocument20 pagesPlanning Statement: Ediston Properties LimitedSteven HamiltonNo ratings yet

- Existing Location Plan 1:1250: G2737 AL (0) 102 ADocument1 pageExisting Location Plan 1:1250: G2737 AL (0) 102 ASteven HamiltonNo ratings yet

- CurrentRatings PDFDocument0 pagesCurrentRatings PDFVirajitha MaddumabandaraNo ratings yet

- North Lanarkshire Council Labour Group BUDGET MOTION 2020/21Document10 pagesNorth Lanarkshire Council Labour Group BUDGET MOTION 2020/21Steven HamiltonNo ratings yet

- 2017bin Sticker Glass Metal Plastic Reverse PDFDocument1 page2017bin Sticker Glass Metal Plastic Reverse PDFSteven HamiltonNo ratings yet

- Ask Ombudsman News: Q Q A ADocument20 pagesAsk Ombudsman News: Q Q A ASteven HamiltonNo ratings yet

- L22 Instructions v3Document5 pagesL22 Instructions v3Steven HamiltonNo ratings yet

- Electricity and Gas Statement: - EstimatedDocument2 pagesElectricity and Gas Statement: - EstimatedSteven HamiltonNo ratings yet

- wlp1 PDFDocument6 pageswlp1 PDFSubrat BaralNo ratings yet

- Mira Agile Thermostatic Mixer: Symptom: Cause RectificationDocument3 pagesMira Agile Thermostatic Mixer: Symptom: Cause RectificationSteven HamiltonNo ratings yet

- Secretary of State Letter Construction IndustryDocument1 pageSecretary of State Letter Construction IndustrySteven HamiltonNo ratings yet

- Dimmer Switch (2 Gang) : Instruction ManualDocument30 pagesDimmer Switch (2 Gang) : Instruction ManualSteven HamiltonNo ratings yet

- Centrifugal Recessed Bathroom Fan With Integral Filter: Features and BenefitsDocument1 pageCentrifugal Recessed Bathroom Fan With Integral Filter: Features and BenefitsSteven HamiltonNo ratings yet

- Lunchbox Ideas: Sandwich Ideas (Whole Meal Bread, Roll, Pitta Pocket, Wrap)Document2 pagesLunchbox Ideas: Sandwich Ideas (Whole Meal Bread, Roll, Pitta Pocket, Wrap)Steven HamiltonNo ratings yet

- Hand Dequervains Release Standard of Care PT BWHDocument12 pagesHand Dequervains Release Standard of Care PT BWHSteven HamiltonNo ratings yet

- Training For Approved Electrician Electrician Statement of ExperienceDocument5 pagesTraining For Approved Electrician Electrician Statement of ExperienceSteven HamiltonNo ratings yet

- How To Build Bigger ArmsDocument0 pagesHow To Build Bigger ArmsRaule DukeNo ratings yet

- CurrentRatings PDFDocument0 pagesCurrentRatings PDFVirajitha MaddumabandaraNo ratings yet

- North 4 SunDocument1 pageNorth 4 SunSteven HamiltonNo ratings yet

- Mo - Ola /0016: DSTL Procedure For ConductDocument21 pagesMo - Ola /0016: DSTL Procedure For ConductBren-RNo ratings yet

- Academic MBA LetterDocument2 pagesAcademic MBA LetterkothuwonNo ratings yet

- Assessing Speaking Skills: A: Workshop For Teacher Development Ben KnightDocument9 pagesAssessing Speaking Skills: A: Workshop For Teacher Development Ben KnightBello ChristoPerNo ratings yet

- OrderDocument7 pagesOrderAbhik PalNo ratings yet

- Integrated Jail Management System For The Bureau of CorrectionsDocument54 pagesIntegrated Jail Management System For The Bureau of CorrectionsShaira AsisNo ratings yet

- TL Laws Regulating TransportationDocument32 pagesTL Laws Regulating TransportationJohn Jordan Calebag100% (1)

- English Research PaperDocument12 pagesEnglish Research PaperJo NathanNo ratings yet

- M4 Lesson 1,2 & 3 - GENDER & SOCIETY (Sebuma)Document5 pagesM4 Lesson 1,2 & 3 - GENDER & SOCIETY (Sebuma)Recca MayNo ratings yet

- Boozy Badger: A Thread byDocument4 pagesBoozy Badger: A Thread bypatchofurrNo ratings yet

- Sana 01 Unit 9 Worksheet 1Document4 pagesSana 01 Unit 9 Worksheet 1api-604478591No ratings yet

- Pdo Hse PolicyDocument1 pagePdo Hse Policyabdel-rahman emaraNo ratings yet

- Electrical Panel Labeling Best PracticesDocument2 pagesElectrical Panel Labeling Best Practicessarge18No ratings yet

- Integrating Active Learning Approaches in Language Learning: Lesson 1Document12 pagesIntegrating Active Learning Approaches in Language Learning: Lesson 1Angela Rose Banastas100% (1)

- PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. EDGAR LAGMAY y ALARCON, Accused-AppellantDocument1 pagePEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. EDGAR LAGMAY y ALARCON, Accused-AppellantNoelle Therese Gotidoc VedadNo ratings yet

- 3rd Summative Test English 5 2nd GradingDocument2 pages3rd Summative Test English 5 2nd GradingPey PolonNo ratings yet

- Validation Procedure: 1. PurposeDocument7 pagesValidation Procedure: 1. PurposeAbhishek Kumar Singh100% (1)

- The Impact of Language Ideologies On Schools PDFDocument9 pagesThe Impact of Language Ideologies On Schools PDFSergio Yepes PorrasNo ratings yet

- ILO. Decente Work 1999 PDFDocument88 pagesILO. Decente Work 1999 PDFAna Luiza GamaNo ratings yet

- I. Flowchart To Preparing, Delivering, Evaluating SpeechesDocument3 pagesI. Flowchart To Preparing, Delivering, Evaluating SpeechesIsse NvrroNo ratings yet

- Industry 4.0. DelloiteDocument32 pagesIndustry 4.0. Delloitemihai.banicaNo ratings yet

- AA - BackListDocument48 pagesAA - BackListArtdataNo ratings yet

- Asking For Bequests 3-5-13Document4 pagesAsking For Bequests 3-5-13John SeminoleNo ratings yet

- Theories On Language Learning - Vygotsky, Piaget, & Habit FormationDocument30 pagesTheories On Language Learning - Vygotsky, Piaget, & Habit FormationShofia NafisahNo ratings yet

- Design of Matter PDFDocument4 pagesDesign of Matter PDFabcdefNo ratings yet

- URC Investment PortfolioDocument3 pagesURC Investment PortfolioJanne May Villero100% (1)

- Synopsis of Dissertation Topic-PragyaDocument8 pagesSynopsis of Dissertation Topic-PragyaMadhvendra Pati Tripathi0% (1)

- Recognizing Achievement: RCM Guide To ExaminationsDocument4 pagesRecognizing Achievement: RCM Guide To ExaminationsJhi HiNo ratings yet

- Definition of MOOC - Loosely Defined As Online Courses Aimed at Large-Scale Interaction, Were SeenDocument6 pagesDefinition of MOOC - Loosely Defined As Online Courses Aimed at Large-Scale Interaction, Were SeenRajkumarNo ratings yet

- DECENA Case Digest People V SisonDocument2 pagesDECENA Case Digest People V SisonEli DecenaNo ratings yet