Professional Documents

Culture Documents

Pajak PT Pma

Pajak PT Pma

Uploaded by

Hi LocallyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pajak PT Pma

Pajak PT Pma

Uploaded by

Hi LocallyCopyright:

Available Formats

Tax reporting Tax reporting

Tax Tax

Company turnover below 4.8M Company turnover above 4.8M

Monthly Tax Report Monthly Tax Report

Pph 25 * Pph 25 *

Not subject to VAT 0 Value Added Tax (VAT) 10%

Pph 23 (When Using Services) 2% Pph 23 (When Using Services) 2%

Pph 22 (Import tax) 2,5% Pph 22 (Import tax) 2,5%

Pph 21 (If there are employees with a Pph 21 (If there are employees with a

** **

salary> 5 million) salary> 5 million)

Annual Report Tax Annual Report Tax

Annual Tax Return *** Annual Tax Return ***

Note:

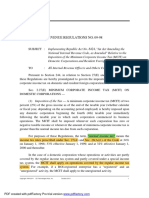

For income below 4.8M pph 25 can be replaced by final Pph 4(2) at a rate of 0.5%, but if the

taxpayer uses Pph Final, the import tax fee for Pph 22 cannot be accumulated as a deduction in the

annual report.

* Calculation of Pph 25 (Tax Credit)

The classification of the PPh 25 rates that apply to business entities is based on their gross turnover

rate, namely as follows:

1. If the gross income is less than IDR 4.8 billion, the tax rate is 1% times the gross income (gross

turnover).

2. If the income is more than IDR 4.8 billion to IDR 50 billion, the calculation is 0.25 - (0.6 billion

/ gross income) x PKP

3. If more than IDR 50 billion, the calculation is 25% x PKP

** Calculation of Pph 21 (For companies that have employees)

Based on PMK No. 101 / PMK. 010/2016, taxpayers will not be subject to income tax if the

taxpayer's income is equal to or not more than Rp. 54,000,000 in one year.

1. Income up to Rp.50,000,000 per year is subject to a tax rate of 5%.

2. Income of IDR 50,000,000 up to IDR 250,000,000 per year is subject to a tax rate of 15%.

3. Income from IDR 250,000,000 to IDR 500,000,000 per year is subject to a rate of 25%.

4. Income above IDR 500,000,000 per year is subject to a tax rate of 30%.

** Annual SPT calculation

Accumulated total tax credit of Pph 25 and Pph 22 (Import tax)

Tax Reporting Fee

After PKP

Before PKP

(Revenue above 4.8M)

Monthly Tax Report Monthly Tax Report

Rp. 2.500.000,- s/d Rp. 5.000.000,-

Rp. 1.500.000,-

(Depending on the level of difficulty)

Annual Report Tax Annual Report Tax

Rp. 3.000.000,- Minimum Rp. 5000.000,-

You might also like

- Staff Analysis of The 2023-2024 Executive BudgetDocument212 pagesStaff Analysis of The 2023-2024 Executive BudgetNew York SenateNo ratings yet

- Amended Legal ComplaintDocument37 pagesAmended Legal ComplaintZachary HansenNo ratings yet

- Janine Business PlanDocument33 pagesJanine Business PlanMichael L. Dantis50% (2)

- Lambers BEC TextDocument384 pagesLambers BEC Textalik711698100% (2)

- PH Tax RMC No 19 2015 NoexpDocument1 pagePH Tax RMC No 19 2015 NoexpRodel Ryan YanaNo ratings yet

- TaxDocument19 pagesTaxjhevesNo ratings yet

- Chapter 9 Percentage TaxDocument25 pagesChapter 9 Percentage TaxTrisha Mae BoholNo ratings yet

- MCIT, IAET Handouts Oct 2019Document13 pagesMCIT, IAET Handouts Oct 2019Elsie GenovaNo ratings yet

- REVIEWER-NI-LOVE HeheDocument6 pagesREVIEWER-NI-LOVE HeheSteph GonzagaNo ratings yet

- Indonesian Tax Treatment For Foreign Drilling Companies FDCDocument4 pagesIndonesian Tax Treatment For Foreign Drilling Companies FDCJoko ArifiantoNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- Reviewer (Tax) : National Internal Revenue Taxes Computation For Mixed Income Earner Who Availed 8%Document7 pagesReviewer (Tax) : National Internal Revenue Taxes Computation For Mixed Income Earner Who Availed 8%LeeshNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Document41 pagesTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- 8% Income Tax OptionDocument14 pages8% Income Tax OptionZaaavnn VannnnnNo ratings yet

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimNo ratings yet

- International Tax Philippines Highlights 2021: Updated March 2021Document8 pagesInternational Tax Philippines Highlights 2021: Updated March 2021nomercykillingNo ratings yet

- TRAIN LAW - Individual Income TaxationDocument25 pagesTRAIN LAW - Individual Income TaxationJennilyn SantosNo ratings yet

- DTTL Tax Philippineshighlights 2020Document8 pagesDTTL Tax Philippineshighlights 2020Jayson CeriasNo ratings yet

- Gamilkissergail FNon PTDocument1 pageGamilkissergail FNon PTKisser Gail GamilNo ratings yet

- Tax Supplemental Reviewer - October 2019Document46 pagesTax Supplemental Reviewer - October 2019Daniel Anthony CabreraNo ratings yet

- Icpak PPT Minimum Tax PDFDocument20 pagesIcpak PPT Minimum Tax PDFREJAY89No ratings yet

- Train I.ppt - Vers. 10.21.2018Document103 pagesTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Module 6 - Income Tax On Corporations - Part 2Document5 pagesModule 6 - Income Tax On Corporations - Part 2Never Letting GoNo ratings yet

- Chapter 7: Introduction To Regular Income TaxDocument5 pagesChapter 7: Introduction To Regular Income TaxArna Kaira Kjell DiestraNo ratings yet

- M7 - P2 Corporate Income Taxation (15B) - Students'Document46 pagesM7 - P2 Corporate Income Taxation (15B) - Students'micaella pasionNo ratings yet

- First Tax Reform Plan: Restructuring Personal Tax Rates: Taxwise or OtherwiseDocument3 pagesFirst Tax Reform Plan: Restructuring Personal Tax Rates: Taxwise or Otherwisegrumpybear16No ratings yet

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- Individual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )Document12 pagesIndividual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )jimmatthamNo ratings yet

- Individual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )Document12 pagesIndividual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )jimmatthamNo ratings yet

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Train LawDocument25 pagesTrain LawMariel Mangalino BautistaNo ratings yet

- 1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Document24 pages1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Jordan Tagao ColcolNo ratings yet

- Vatable Transactions PDFDocument5 pagesVatable Transactions PDFJester LimNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Annual Income Information Form For General Professional PartnershipsDocument2 pagesAnnual Income Information Form For General Professional PartnershipsAlvin Dela CruzNo ratings yet

- Tax For CorpDocument28 pagesTax For CorpNiki DimaanoNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Chapter 7 Regular Income TaxationDocument4 pagesChapter 7 Regular Income TaxationMary Jane Pabroa100% (1)

- Minimum Corporate Income Tax 3Document5 pagesMinimum Corporate Income Tax 3NaikNo ratings yet

- 1997 Tax Code vs. TRAINDocument4 pages1997 Tax Code vs. TRAINCyrine CalagosNo ratings yet

- BIR ComputationsDocument10 pagesBIR Computationsbull jackNo ratings yet

- Module 07 Introduction To Regular Income Tax 3 2Document21 pagesModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNo ratings yet

- Minimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)Document57 pagesMinimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)kyleramosNo ratings yet

- Module 07 Introduction To Regular Income TaxDocument21 pagesModule 07 Introduction To Regular Income TaxJeon KookieNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- Corporate Income Taxes StudentsDocument6 pagesCorporate Income Taxes StudentsClazther MendezNo ratings yet

- Department of Accountancy Income Taxation - Quizzer Answer Key Case 1Document11 pagesDepartment of Accountancy Income Taxation - Quizzer Answer Key Case 1Dominic BulaclacNo ratings yet

- A Guide To Taxation in The PhilippinesDocument5 pagesA Guide To Taxation in The PhilippinesNathaniel MartinezNo ratings yet

- How To Compute Quarterly Income Tax ReturnDocument44 pagesHow To Compute Quarterly Income Tax ReturnMia Torres100% (1)

- Tax Accounting - DR Ahmed Sharaf - Lecture 1,2Document16 pagesTax Accounting - DR Ahmed Sharaf - Lecture 1,2Ahmed AdelNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoNo ratings yet

- TaXavvy Budget 2020 Part 1Document29 pagesTaXavvy Budget 2020 Part 1Anonymous gMgeQl1SndNo ratings yet

- Income Taxation Lecture Notes.6.TAX On CORPORATIONSDocument10 pagesIncome Taxation Lecture Notes.6.TAX On CORPORATIONSeinel dcNo ratings yet

- BIR ComputationsDocument10 pagesBIR Computationsbull jack100% (1)

- Taxation SlideDocument26 pagesTaxation SlidePei Jia WahNo ratings yet

- Self-Employed And/ or Professionals (Sep) : Lesson 5Document2 pagesSelf-Employed And/ or Professionals (Sep) : Lesson 5Ash PadillaNo ratings yet

- MODULE TAX 1 MCIT March 242020Document6 pagesMODULE TAX 1 MCIT March 242020Rene LopezNo ratings yet

- New Tax ReformDocument4 pagesNew Tax ReformEDISON SAGUIRERNo ratings yet

- Tax StructureDocument23 pagesTax StructureAsif Rasool ChannaNo ratings yet

- Ammendments Made by Finance Bill 2068 in All ActsDocument14 pagesAmmendments Made by Finance Bill 2068 in All ActsNiraj ShresthaNo ratings yet

- BF4013 Revision Questions Set 2Document2 pagesBF4013 Revision Questions Set 2shazlina_liNo ratings yet

- Personal and Family Traits of Marwadi EntrepreneursDocument40 pagesPersonal and Family Traits of Marwadi EntrepreneursVinit MathurNo ratings yet

- Estimate Calling Script 2023 Financial YearDocument4 pagesEstimate Calling Script 2023 Financial Yearapril jean ondoyNo ratings yet

- 1344938487binder2Document34 pages1344938487binder2CoolerAdsNo ratings yet

- Principles of Accounts Def.Document1 pagePrinciples of Accounts Def.Samra SaeedNo ratings yet

- Rolling Mill OrissaDocument19 pagesRolling Mill OrissakxenggNo ratings yet

- Public Fiscal Administration TestDocument7 pagesPublic Fiscal Administration TestApril Dominguez-Benzon100% (2)

- 146-Republic v. IAC, 196 SCRA 335Document4 pages146-Republic v. IAC, 196 SCRA 335Jopan SJNo ratings yet

- Sample WillDocument4 pagesSample WillReynaldo ZavalaNo ratings yet

- FY 2011 BudgetDocument218 pagesFY 2011 BudgetBhupendra RawalNo ratings yet

- Co-Op Rural Bank of Davao V Ferrer-CallejaDocument7 pagesCo-Op Rural Bank of Davao V Ferrer-CallejaAngelo0% (1)

- CN Daily 0400029533 0400170316-B-VDocument2 pagesCN Daily 0400029533 0400170316-B-Vcreazy_monyetNo ratings yet

- Assignment 5Document4 pagesAssignment 5Syeda Umyma FaizNo ratings yet

- Laba Rugi Standar SetahunDocument1 pageLaba Rugi Standar SetahunlavmeilaNo ratings yet

- Hizon Notes - Social LegislationDocument27 pagesHizon Notes - Social Legislationdnel13No ratings yet

- Mukesh P. Shah: Chartered AccountantsDocument31 pagesMukesh P. Shah: Chartered AccountantsPorusSinghNo ratings yet

- 02 Charging Section GST Part 1Document18 pages02 Charging Section GST Part 1Debjit RahaNo ratings yet

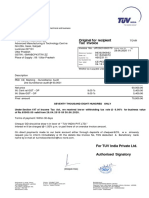

- Original For Recipient Tax Invoice: (Deepak Das)Document1 pageOriginal For Recipient Tax Invoice: (Deepak Das)Deepak DasNo ratings yet

- MyGlamm Invoice 1690200044-11Document1 pageMyGlamm Invoice 1690200044-11SbkNo ratings yet

- Definition of CorporationDocument10 pagesDefinition of CorporationSheena RodriguezNo ratings yet

- Procurement of Hexagonal Drill Rod 22 M.M. Dia X 1800 M.M. Length As Per NIT Specification.Document28 pagesProcurement of Hexagonal Drill Rod 22 M.M. Dia X 1800 M.M. Length As Per NIT Specification.sharang shankerNo ratings yet

- Direct and Indirect TaxesDocument14 pagesDirect and Indirect Taxeskratika singhNo ratings yet

- Exempt Sales - NotesDocument28 pagesExempt Sales - NotesSunny DaeNo ratings yet

- Sinha Electricals & Motor Rewinding:, Phone: 9300991234 M/S Cash M/S CashDocument2 pagesSinha Electricals & Motor Rewinding:, Phone: 9300991234 M/S Cash M/S CashToran SahuNo ratings yet

- Job - RFQ-017 - Video DocumentaryDocument25 pagesJob - RFQ-017 - Video DocumentaryFaizanSulNo ratings yet

- Customs LawDocument8 pagesCustoms LawBiswajit Dutta100% (1)