Professional Documents

Culture Documents

CBDT Circular 8 of 2019 08.08.2019 - Monetary Ceiling

Uploaded by

Subramanyam SettyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBDT Circular 8 of 2019 08.08.2019 - Monetary Ceiling

Uploaded by

Subramanyam SettyCopyright:

Available Formats

8/7/2021 www.taxmann.

com

Header Header

CIRCULAR NO. 17/2019 [F.NO. 279/MISC.142/2007-ITJ(

FURTHER ENHANCEMENT OF MONETARY LIMITS FOR FILING OF APPEALS BY THE

DEPARTMENT BEFORE INCOME TAX APPELLATE TRIBUNAL, HIGH COURTS AND

SLPs/APPEALS BEFORE SUPREME COURT - AMENDMENT IN CIRCULAR NO. 3/2018,

DATED 11-7-2018 - MEASURES FOR REDUCING LITIGATION

CIRCULAR NO. 17/2019 [F.NO. 279/MISC.142/2007-ITJ(PT.)], DATED 8-8-2019

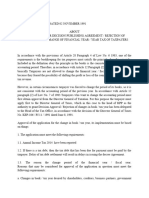

Reference is invited to the Circular No. 3 of 2018, dated 11-7-2018 (the Circular) of Central Board of Direct

Taxes (the Board) and its amendment dated 20th August, 2018 vide which monetary limits for filing of

income tax appeals by the Department before Income Tax Appellate Tribunal. High Courts and SLPs/appeals

before Supreme Court have been specified. Representation has also been received that an anomaly in the said

circular at para 5 may be removed.

2. As a step towards further management of litigation, it has been decided by the Board that monetary limits

for filing of appeals in income-tax cases be enhanced further through amendment in Para 3 of the Circular

mentioned above and accordingly, the table for monetary limits specified in Para 3 of the Circular shall read

as follows:

Sl. No. Appeals/SLPs in Income-tax matters Monetary Limit (Rs.)

1. Before Appellate Tribunal 50, 00,000

2. Before High Court 1,00.00.000

3. Before Supreme Court 2.00,00,000

3. Further, with a view to provide parity in filing of appeals in scenarios where separate order is passed by

higher appellate authorities for each assessment year vis-a-vis where composite order for more than one

assessment years is passed, para 5 of the circular is substituted by the following para:

"5. The Assessing Officer shall calculate the tax effect separately for every assessment year in respect of

the disputed issues in the case of every assessee. If in the case of an assessee. the disputed issues arise in

more than one assessment year, appeal can be filed in respect of such assessment year or years in which

the tax effect in respect of the disputed issues exceeds the monetary limit specified in para 3. No appeal

shall be filed in respect of an assessment year or years in which the tax effect is less than the monetary

limit specified in para 3. Further, even in the case of composite order of any High Court or appellate

authority which involves more than one assessment year and common issues in more than one assessment

year, no appeal shall be filed in respect of an assessment year or years in which the tax effect is less than

the monetary limit specified in para 3. In case where a composite order/ judgement involves more than

one assessee. each assessee shall be dealt with separately."

4. The said modifications shall come into effect from the date of issue of this Circular.

5. The same may be brought to the notice of all concerned.

6. This issues under section 268A of the Income-tax Act, 1961.

■■

1/1

You might also like

- PBCom vs. CIR, G.R. No. 112024, January 28, 1999Document10 pagesPBCom vs. CIR, G.R. No. 112024, January 28, 1999Machida Abraham100% (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Issues, Problems and Solutions in Tax Audit and Investigation (1-10-13)Document184 pagesIssues, Problems and Solutions in Tax Audit and Investigation (1-10-13)marygrace_apaitan100% (2)

- Income Tax Part 1 (Theory + MCQ)Document200 pagesIncome Tax Part 1 (Theory + MCQ)Neha SharmaNo ratings yet

- Cell Structure and Function Lesson PlanDocument6 pagesCell Structure and Function Lesson PlanSubramanyam Setty100% (1)

- Republic V Heirs of TiotioenDocument1 pageRepublic V Heirs of TiotioenGel Tolentino100% (1)

- Manual Book 1770 PDFDocument46 pagesManual Book 1770 PDFHafiedz SNo ratings yet

- People of The Philippines v. Tamani (G.R. Nos. L-22160 & L-22161)Document7 pagesPeople of The Philippines v. Tamani (G.R. Nos. L-22160 & L-22161)Ramon T. Conducto IINo ratings yet

- Pbcom Vs Cir 302 Scra 241Document11 pagesPbcom Vs Cir 302 Scra 241Ron LaurelNo ratings yet

- CTA Rules on Manila Double Taxation CaseDocument36 pagesCTA Rules on Manila Double Taxation CaseRiel BanggotNo ratings yet

- CTA Jurisdiction Over RTC Decision on Real Property Tax CaseDocument2 pagesCTA Jurisdiction Over RTC Decision on Real Property Tax CaseJuno Geronimo100% (1)

- RMC No 17-2018Document6 pagesRMC No 17-2018fatmaaleahNo ratings yet

- SERRANO VS SPS GUTTIEREZ DigestDocument1 pageSERRANO VS SPS GUTTIEREZ DigestJean Monique Oabel-TolentinoNo ratings yet

- IPL - Price v UNILAB: Philippine court upholds compulsory licensing of pharmaceutical patentDocument2 pagesIPL - Price v UNILAB: Philippine court upholds compulsory licensing of pharmaceutical patentMarioneMaeThiamNo ratings yet

- Doctrine of Judicial StabilityDocument17 pagesDoctrine of Judicial StabilityAlyssa Clarizze MalaluanNo ratings yet

- Circular 3 2018Document6 pagesCircular 3 2018sandeepNo ratings yet

- Circular No. 17-2019 - 2392019105619105Document2 pagesCircular No. 17-2019 - 2392019105619105sandeepNo ratings yet

- Income Tax 2 j2019Document50 pagesIncome Tax 2 j2019Avinash ShettyNo ratings yet

- Advanced Tax Law Supplement for Direct Tax and International TaxDocument50 pagesAdvanced Tax Law Supplement for Direct Tax and International TaxAvinash ShettyNo ratings yet

- Phil Bank Vs CIRDocument9 pagesPhil Bank Vs CIRCarol JacintoNo ratings yet

- RR 15-2007 PDFDocument4 pagesRR 15-2007 PDFnaldsdomingoNo ratings yet

- Pbcom Vs CirDocument10 pagesPbcom Vs CirRaven DizonNo ratings yet

- Indian Tax Circular Revises Monetary Limits for Adjudicating Show Cause NoticesDocument5 pagesIndian Tax Circular Revises Monetary Limits for Adjudicating Show Cause NoticesmonuNo ratings yet

- PHIL. BANK OF COMMUNICATIONS v. CIR, 302 SCRA 250Document15 pagesPHIL. BANK OF COMMUNICATIONS v. CIR, 302 SCRA 250Ronnie Garcia Del RosarioNo ratings yet

- Court Rules on Prescriptive Period for Tax Refund ClaimsDocument8 pagesCourt Rules on Prescriptive Period for Tax Refund ClaimsCol. McCoyNo ratings yet

- Court of Tax Appeals: en BaneDocument14 pagesCourt of Tax Appeals: en BaneAudrey DeguzmanNo ratings yet

- Handling BIR Tax Examination For COOPS EVR PDFDocument133 pagesHandling BIR Tax Examination For COOPS EVR PDFGracel Joy Galeno100% (1)

- PBCOM vs. CIR, G.R. No. 112024 January 28, 1999 (FULL CASE)Document9 pagesPBCOM vs. CIR, G.R. No. 112024 January 28, 1999 (FULL CASE)Sharliemagne B. BayanNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- Direct Tax Updates for June 2019 ExamDocument60 pagesDirect Tax Updates for June 2019 Examjanardhan CA,CSNo ratings yet

- Petitioner, vs. Respondents. JDocument33 pagesPetitioner, vs. Respondents. J유니스No ratings yet

- T Division: Republi The Philippines C AppealsDocument5 pagesT Division: Republi The Philippines C Appealsnia_artemis3414No ratings yet

- TLP Supplement DT Dec, 2019 - Old SyllabusDocument94 pagesTLP Supplement DT Dec, 2019 - Old Syllabusjanardhan CA,CSNo ratings yet

- Shell Petroleum Tax Ruling ModifiedDocument11 pagesShell Petroleum Tax Ruling ModifiedRJ MaligayaNo ratings yet

- 164-PBC v. CIR, January 28, 1999Document6 pages164-PBC v. CIR, January 28, 1999Jopan SJNo ratings yet

- Supreme CourtDocument9 pagesSupreme CourtaoramNo ratings yet

- CTA upholds denial of insurance firm's tax refund claimDocument8 pagesCTA upholds denial of insurance firm's tax refund claimAnathema DeviceNo ratings yet

- RR 13-2001 As Amended by RR 4-2012Document7 pagesRR 13-2001 As Amended by RR 4-2012Quinciano MorilloNo ratings yet

- Se 14 Tahun 1991Document3 pagesSe 14 Tahun 1991MADENo ratings yet

- 2022 PTD 1889Document4 pages2022 PTD 1889Your AdvocateNo ratings yet

- 2009 RMC 23-2009 LOA RevalidationDocument2 pages2009 RMC 23-2009 LOA Revalidationedong the greatNo ratings yet

- Supreme Court Ruling on Carry Forward of Unabsorbed Depreciation and Business LossesDocument15 pagesSupreme Court Ruling on Carry Forward of Unabsorbed Depreciation and Business LossesNomosvistasNo ratings yet

- Analysis of CBDT Circular On Condonation of Delay in Filing Refund Claim and Claim of Carry Forward of Losses - Taxguru - inDocument2 pagesAnalysis of CBDT Circular On Condonation of Delay in Filing Refund Claim and Claim of Carry Forward of Losses - Taxguru - inShyam Lal MandhyanNo ratings yet

- Court of X Pea S: Ta Ap LDocument16 pagesCourt of X Pea S: Ta Ap LMa. Stephanie Kate LabroNo ratings yet

- Application for Compounding OffencesDocument7 pagesApplication for Compounding OffencesKaRan K KHetaniNo ratings yet

- LeftMenu ChallanCorrectionMechanism 26082011Document3 pagesLeftMenu ChallanCorrectionMechanism 26082011Prasad MungekarNo ratings yet

- RMO No. 1-2024Document3 pagesRMO No. 1-2024Anostasia NemusNo ratings yet

- Composition Scheme For Sarafa and JewellersDocument6 pagesComposition Scheme For Sarafa and JewellersVirender ChaudharyNo ratings yet

- TLP Supplement DT June 2020-OSDocument105 pagesTLP Supplement DT June 2020-OSZamr GNo ratings yet

- Provision Related To Advance Payment of TaxDocument8 pagesProvision Related To Advance Payment of TaxBISHWAJIT DEBNATHNo ratings yet

- Service Tax Procedures: HapterDocument25 pagesService Tax Procedures: HaptertimirkantaNo ratings yet

- 5 Percentage CasesDocument42 pages5 Percentage CasesRichelle Grace LagguiNo ratings yet

- Court upholds VAT liability but clarifies interest computationDocument12 pagesCourt upholds VAT liability but clarifies interest computationEjieNo ratings yet

- Comment 01-05-2021Document22 pagesComment 01-05-2021Werner PfennigNo ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Siaya County Finance Bill SummaryDocument89 pagesSiaya County Finance Bill SummaryinyasiNo ratings yet

- No Appeals Against Orders of CESTAT, High Court, Supreme Court - CBEC - SIMPLE TAX INDIADocument38 pagesNo Appeals Against Orders of CESTAT, High Court, Supreme Court - CBEC - SIMPLE TAX INDIAphani raja kumarNo ratings yet

- BCCIDocument11 pagesBCCIanandsmehtaNo ratings yet

- Tax Refund Barred by Irrevocability RuleDocument9 pagesTax Refund Barred by Irrevocability Rulelili cruzNo ratings yet

- 2000 Revenue Regulations - The Lawphil ProjectDocument4 pages2000 Revenue Regulations - The Lawphil ProjectCherry ursuaNo ratings yet

- CBDT Circular 29.02.2016 - StayDocument1 pageCBDT Circular 29.02.2016 - StaySubramanyam SettyNo ratings yet

- ACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Document31 pagesACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Quinciano MorilloNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- RMO No. 59-2016Document6 pagesRMO No. 59-2016theo toaNo ratings yet

- PBCom VS. CIRDocument7 pagesPBCom VS. CIRGilbert YapNo ratings yet

- RMO No. 004-16Document10 pagesRMO No. 004-16cool_peachNo ratings yet

- RMO No. 4-2016Document3 pagesRMO No. 4-2016Cristelle Elaine ColleraNo ratings yet

- Amendments - Indirect Tax (Common) 2017Document6 pagesAmendments - Indirect Tax (Common) 2017Prateek SinghalNo ratings yet

- (2010) 133 TTJ 0482 - Gyan - Chand - Batra - 50C Deeming FictionDocument6 pages(2010) 133 TTJ 0482 - Gyan - Chand - Batra - 50C Deeming FictionSubramanyam SettyNo ratings yet

- (2011) 139 TTJ 0475 - Jeypore - Sugar - Company - LTD - Goodwill - DepreciationDocument11 pages(2011) 139 TTJ 0475 - Jeypore - Sugar - Company - LTD - Goodwill - DepreciationSubramanyam SettyNo ratings yet

- (2011) 331 ITR 0192 Hindustan Coca Cola Beverages (P) LTDDocument13 pages(2011) 331 ITR 0192 Hindustan Coca Cola Beverages (P) LTDSubramanyam SettyNo ratings yet

- (2008) 305 ITR 0227 (SC) ACIT Vs Saurashtra Kutch Stock Exchange LTD - 254 (2) Jurisdictional HC DecisionDocument11 pages(2008) 305 ITR 0227 (SC) ACIT Vs Saurashtra Kutch Stock Exchange LTD - 254 (2) Jurisdictional HC DecisionSubramanyam SettyNo ratings yet

- (2010) 128 TTJ 0596 The AP Paper Mills LTDDocument17 pages(2010) 128 TTJ 0596 The AP Paper Mills LTDSubramanyam SettyNo ratings yet

- UntitledDocument3 pagesUntitledSubramanyam SettyNo ratings yet

- CBDT Circular 9 of 2014 dt.23.4.2014 - Amortization - BOTDocument1 pageCBDT Circular 9 of 2014 dt.23.4.2014 - Amortization - BOTSubramanyam SettyNo ratings yet

- 7CPC Revision 18012017Document12 pages7CPC Revision 18012017Subramanyam SettyNo ratings yet

- Gladiator - The Real StoryDocument5 pagesGladiator - The Real StorySubramanyam SettyNo ratings yet

- CBDT Circular 29.02.2016 - StayDocument1 pageCBDT Circular 29.02.2016 - StaySubramanyam SettyNo ratings yet

- HOO and DDODocument1 pageHOO and DDOSubramanyam SettyNo ratings yet

- History AncientDocument8 pagesHistory AncientSubramanyam SettyNo ratings yet

- Orissa HC Paradeep Port Trust - 2 (15) - ProspectiveDocument5 pagesOrissa HC Paradeep Port Trust - 2 (15) - ProspectiveSubramanyam SettyNo ratings yet

- CBDT Circular 10 - 16.12.2005 - 80IA PortDocument1 pageCBDT Circular 10 - 16.12.2005 - 80IA PortSubramanyam SettyNo ratings yet

- CBDT Circular 7 of 2016 - AOP Consortium TaxablilityDocument1 pageCBDT Circular 7 of 2016 - AOP Consortium TaxablilitySubramanyam SettyNo ratings yet

- CBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsDocument1 pageCBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsSubramanyam SettyNo ratings yet

- CBDT Circular 4 of 2010 dt.18.5.2010 - 80IADocument1 pageCBDT Circular 4 of 2010 dt.18.5.2010 - 80IASubramanyam SettyNo ratings yet

- Railway Booking GuideDocument47 pagesRailway Booking Guidemynareshk100% (6)

- WWW.TAXSCAN.IN - Simplifying Tax Laws - 2023 TAXSCAN (HC) 154Document10 pagesWWW.TAXSCAN.IN - Simplifying Tax Laws - 2023 TAXSCAN (HC) 154Subramanyam SettyNo ratings yet

- 56 - 4 - 09 - 03 - 21 Capital GainsDocument2 pages56 - 4 - 09 - 03 - 21 Capital GainsSubramanyam SettyNo ratings yet

- NPS FormsDocument20 pagesNPS FormsSubramanyam SettyNo ratings yet

- Subject:: of For ofDocument7 pagesSubject:: of For ofSubramanyam SettyNo ratings yet

- 13th ARC ReportDocument89 pages13th ARC ReportNimish RaghavNo ratings yet

- Black Seeds PrecautionsDocument3 pagesBlack Seeds PrecautionsSubramanyam SettyNo ratings yet

- Central Govt Pay Bill FormatDocument11 pagesCentral Govt Pay Bill FormatSubramanyam SettyNo ratings yet

- Central Govt Casual Leave RulesDocument15 pagesCentral Govt Casual Leave RulesSubramanyam SettyNo ratings yet

- 25 uses of kalonji oilDocument3 pages25 uses of kalonji oilSubramanyam SettyNo ratings yet

- Conviction Upheld for Murder with Treachery of Floro EstoniloDocument229 pagesConviction Upheld for Murder with Treachery of Floro EstoniloJohn MenesesNo ratings yet

- SAMELCO II Ordered to Reinstate Employee Dismissed for Power OutageDocument75 pagesSAMELCO II Ordered to Reinstate Employee Dismissed for Power OutageAnu ShreeNo ratings yet

- G.R. No. 248652 - PEOPLE OF THE Philippines, Plaintiff-Appellee, V. Antonio M. Talaue, Accused-AppellantDocument23 pagesG.R. No. 248652 - PEOPLE OF THE Philippines, Plaintiff-Appellee, V. Antonio M. Talaue, Accused-AppellantBetter UnnamedNo ratings yet

- M S Bhagwandas B Ramchandani Vs British Airways On 29 July 2022Document5 pagesM S Bhagwandas B Ramchandani Vs British Airways On 29 July 2022HardeepNo ratings yet

- Supreme Court upholds ruling that respondents are owners of disputed land parcelDocument5 pagesSupreme Court upholds ruling that respondents are owners of disputed land parcelbbbmmm123No ratings yet

- Court rejects appeal extension over lack of evidenceDocument8 pagesCourt rejects appeal extension over lack of evidenceZaminNo ratings yet

- Department of Labor: 99 108Document5 pagesDepartment of Labor: 99 108USA_DepartmentOfLaborNo ratings yet

- Tanzania court upholds conviction of poachersDocument16 pagesTanzania court upholds conviction of poachersMambo JoshuaNo ratings yet

- Pirani v. Slack Technologies, Inc., Et Al.Document19 pagesPirani v. Slack Technologies, Inc., Et Al.Cato InstituteNo ratings yet

- Rizal Commercial Banking Corporation vs. Commissioner of Internal Revenue G.R. No. 168498. April 24, 2007Document2 pagesRizal Commercial Banking Corporation vs. Commissioner of Internal Revenue G.R. No. 168498. April 24, 2007Hazel RoxasNo ratings yet

- Plaintiff/Appellee, Dist - Ct.No. CR 08-68-GF-SEH v. CT - Apps.No. 09-30052 GORDON RAY MANN, JR.Document42 pagesPlaintiff/Appellee, Dist - Ct.No. CR 08-68-GF-SEH v. CT - Apps.No. 09-30052 GORDON RAY MANN, JR.Truth Press MediaNo ratings yet

- Civil Causelist 10th October 2023Document6 pagesCivil Causelist 10th October 2023Khuzo LusansoNo ratings yet

- JM Dominguez V LiclicanDocument11 pagesJM Dominguez V LiclicanLorille LeonesNo ratings yet

- United Transportation Union v. City of Albuquerque, 10th Cir. (2011)Document11 pagesUnited Transportation Union v. City of Albuquerque, 10th Cir. (2011)Scribd Government DocsNo ratings yet

- United States v. Perry Moseanko, Mary Moseanko Agnes Moseanko First National Bank in Minot, a Corporation Norwest Bank Minot National Association, a Corporation Trinity Hospital, 16 F.3d 1229, 1st Cir. (1994)Document3 pagesUnited States v. Perry Moseanko, Mary Moseanko Agnes Moseanko First National Bank in Minot, a Corporation Norwest Bank Minot National Association, a Corporation Trinity Hospital, 16 F.3d 1229, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Bartolome vs. Republic, 916 SCRA 409, August 28, 2019Document20 pagesBartolome vs. Republic, 916 SCRA 409, August 28, 2019j0d3No ratings yet

- Third Division G.R. NO. 150157, January 25, 2007: Supreme Court of The PhilippinesDocument18 pagesThird Division G.R. NO. 150157, January 25, 2007: Supreme Court of The PhilippinesMarieNo ratings yet

- 12-Flores v. Comelec G.R. No. 89604 April 20, 1990Document6 pages12-Flores v. Comelec G.R. No. 89604 April 20, 1990Jopan SJNo ratings yet

- Intro To Law - Hanna Balbona Jd-1C 1. Tanada vs. Tuvera G.R. No. L-63915 April 24, 1985Document5 pagesIntro To Law - Hanna Balbona Jd-1C 1. Tanada vs. Tuvera G.R. No. L-63915 April 24, 1985Justin IsidoroNo ratings yet

- Larry Marshak v. Gino Tonetti, 813 F.2d 13, 1st Cir. (1987)Document12 pagesLarry Marshak v. Gino Tonetti, 813 F.2d 13, 1st Cir. (1987)Scribd Government DocsNo ratings yet

- Not PrecedentialDocument8 pagesNot PrecedentialScribd Government DocsNo ratings yet

- Not PrecedentialDocument5 pagesNot PrecedentialScribd Government DocsNo ratings yet

- REMREV - CRIMPRO RULE 120 Judgment People Vs AsisDocument2 pagesREMREV - CRIMPRO RULE 120 Judgment People Vs AsisAgatha Bernice MacalaladNo ratings yet